Market Overview

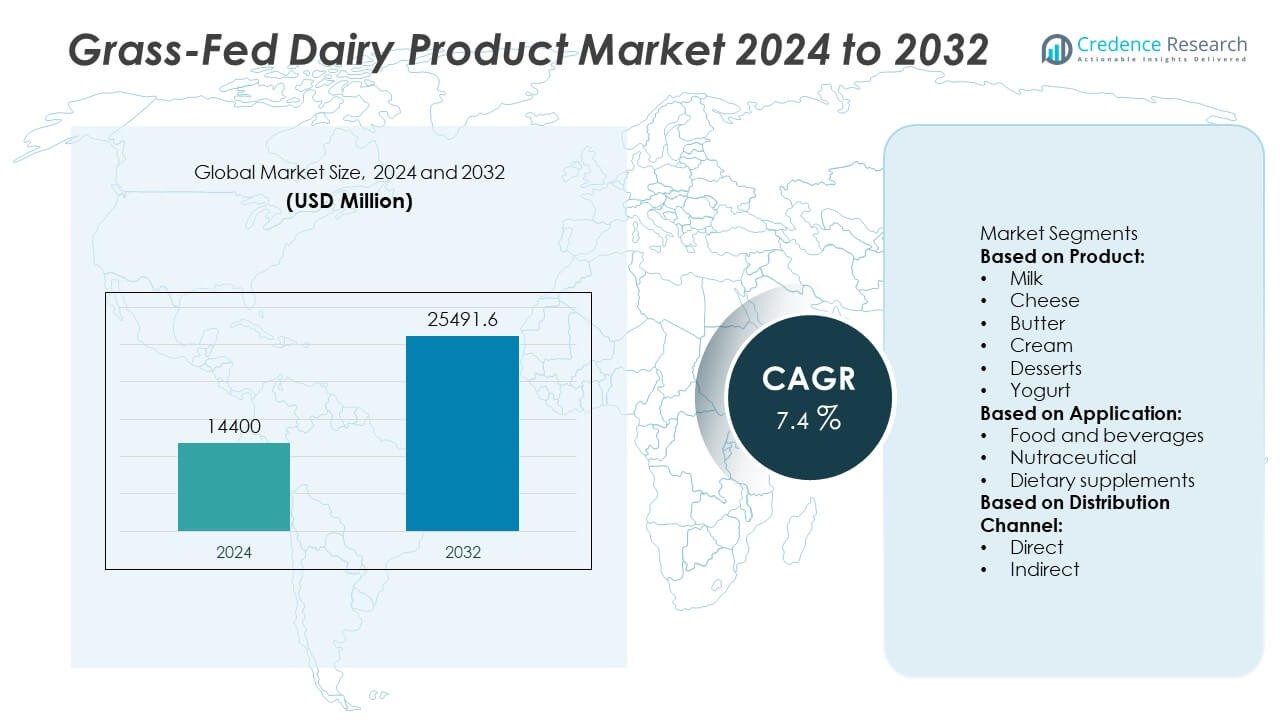

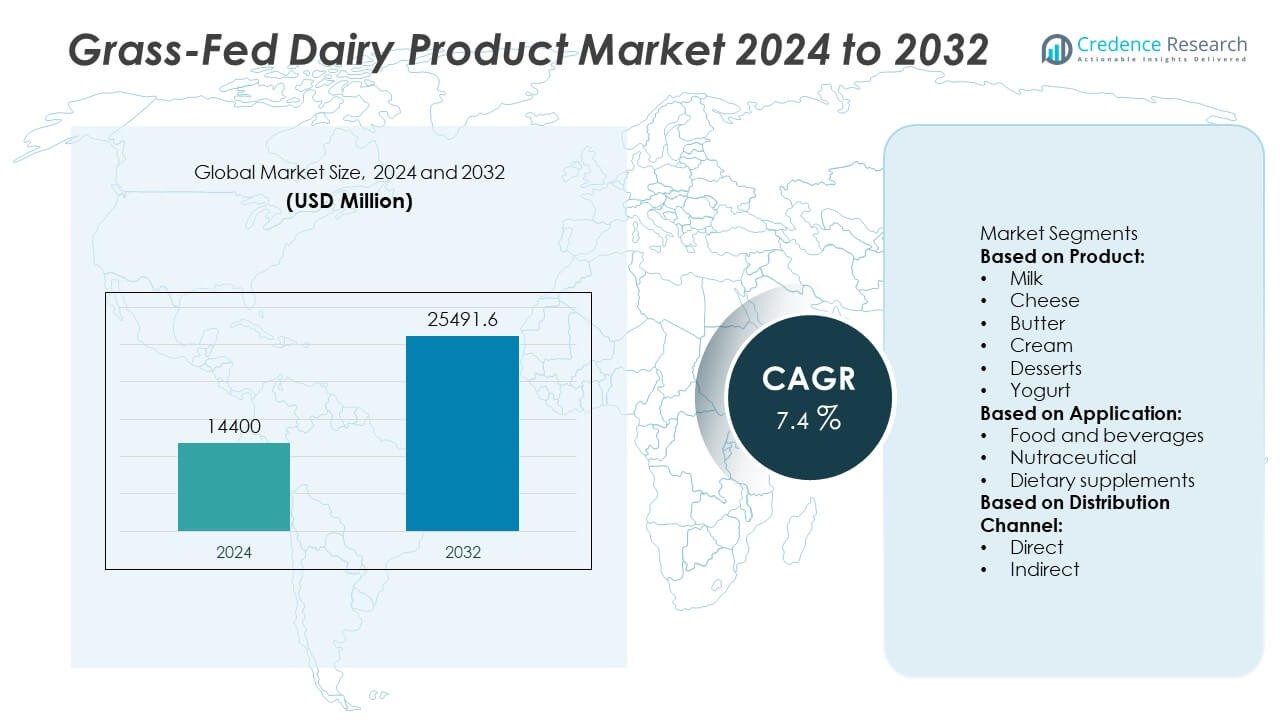

The Grass-Fed Dairy Product Market size was valued at USD 14,400 million in 2024 and is anticipated to reach USD 25,491.6 million by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Grass-Fed Dairy Product Market Size 2024 |

USD 14,400 Million |

| Grass-Fed Dairy Product Market, CAGR |

7.4% |

| Grass-Fed Dairy Product Market Size 2032 |

USD 25,491.6 Million |

The Grass-Fed Dairy Product Market advances through rising consumer demand for natural, nutrient-rich food products that promote health and wellness. Growing awareness of the higher omega-3 fatty acid and antioxidant content in grass-fed milk and its derivatives drives preference over conventional dairy.

The Grass-Fed Dairy Product Market shows strong growth across North America, Europe, Asia-Pacific, and Latin America, supported by increasing consumer awareness of health benefits and sustainability. North America leads with widespread adoption of grass-fed milk, yogurt, and butter, supported by robust organic certification frameworks and growing retail penetration. Europe emphasizes sustainability and ethical sourcing, with brands highlighting traceability and farm-to-table practices. Asia-Pacific gains traction as urban consumers shift toward premium dairy options, while Latin America expands gradually through rising production in Argentina and Mexico. Leading players such as Organic Valley, Maple Hill Creamery, and Straus Family Creamery in the United States focus on organic certification and product innovation. European companies including Arla Foods, Danone, and Müller Group emphasize sustainability and global distribution networks. Fonterra in New Zealand and Parag Milk Foods in India strengthen market growth through expanding product portfolios and regional distribution strategies tailored to evolving consumer demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Grass-Fed Dairy Product Market was valued at USD 14,400 million in 2024 and is expected to reach USD 25,491.6 million by 2032, growing at a CAGR of 7.4% during the forecast period.

- Growing health awareness and demand for natural nutrition drive market adoption, with consumers preferring grass-fed milk, butter, and yogurt for their higher omega-3 content and better nutritional value.

- Rising preference for clean-label and sustainable products shapes the market, as brands highlight ethical sourcing, transparency, and environmentally responsible dairy farming practices.

- Competition intensifies with key players such as Organic Valley, Maple Hill Creamery, Arla Foods, Danone, and Fonterra expanding product portfolios and strengthening distribution networks.

- High production costs and seasonal dependence of grass-fed dairy farming limit scalability, posing challenges for producers in meeting consistent supply and pricing stability.

- North America leads growth due to advanced certification standards and consumer demand for premium dairy, while Europe follows with a strong focus on sustainability and traceability in supply chains.

- Asia-Pacific and Latin America emerge as fast-growing regions, supported by rising urban consumption, expanding middle-class populations, and the increasing availability of premium dairy products in retail and e-commerce channels.

Market Drivers

Rising Demand for Natural and Nutrient-Rich Food Products

The Grass-Fed Dairy Product Market expands with rising consumer demand for natural and nutrient-dense food choices. Consumers increasingly value dairy products sourced from grass-fed cows due to their higher omega-3 fatty acids, conjugated linoleic acid, and antioxidant levels. It gains preference among health-conscious buyers seeking clean-label and minimally processed products. The nutritional advantage strengthens its position in premium food categories across both developed and emerging markets. Retailers dedicate more shelf space to grass-fed dairy items to capture this expanding consumer base. This shift in dietary awareness continues to drive consistent adoption worldwide.

- For instance, Organic Valley (USA) reported that its grass-fed milk contains 62% more omega-3 fatty acids compared to conventional milk, a nutritional advantage highlighted in its 2024 product portfolio expansion covering over 200 retail chains across North America.

Growing Focus on Sustainable and Ethical Farming Practices

Sustainability remains a critical driver supporting the growth of the Grass-Fed Dairy Product Market. Consumers associate grass-fed production with improved animal welfare, lower carbon footprints, and regenerative farming methods. It benefits from rising awareness of eco-friendly agricultural practices that align with ethical consumption trends. Farmers promoting grass-based systems highlight reduced dependence on grain and external feed inputs, which enhances sustainability. Brands emphasize certifications and transparent sourcing to build consumer trust. The alignment of ethical farming with consumer purchasing patterns reinforces long-term growth.

- For instance, Straus Family Creamery (USA) implemented a methane reduction initiative in June 2025 that converted 85% of methane emissions from manure into organic fertilizer through a bioreactor system, reinforcing the role of grass-based dairy in climate-resilient farming.

Expansion of Premium and Functional Dairy Categories

The market benefits from the expansion of premium and functional dairy categories targeting wellness-driven consumers. Grass-fed milk, cheese, butter, and yogurt align with demand for high-quality, nutrient-rich products positioned in the premium segment. It attracts urban buyers willing to pay higher prices for perceived quality and authenticity. Functional dairy applications such as protein-rich drinks and fortified yogurts incorporate grass-fed ingredients for added health value. The versatility across retail and foodservice channels supports continuous growth in this category. This rising premiumization cements the role of grass-fed dairy as a preferred alternative.

Increasing Penetration of E-Commerce and Direct-to-Consumer Channels

E-commerce platforms strengthen the accessibility of grass-fed dairy products, supporting their growth across diverse consumer groups. Online retailers expand product variety and enable brands to reach wider audiences with subscription-based services. It benefits from traceability features that highlight origin, certifications, and production practices, which enhance consumer confidence. Direct-to-consumer channels allow smaller producers to establish strong niche markets with loyal customer bases. Urbanization and busy lifestyles fuel demand for convenient home delivery options, further expanding online sales. This structural shift in distribution continues to accelerate market adoption.

Market Trends

Rising Consumer Shift Toward Clean-Label and Transparency

The Grass-Fed Dairy Product Market reflects strong momentum from the global clean-label movement. Consumers increasingly demand full transparency on sourcing, animal diet, and farming practices. It benefits from certifications such as organic, non-GMO, and grass-fed verified labels that strengthen product credibility. Brands highlight traceability through packaging and digital tools that allow buyers to track product origin. Retailers support this trend by creating dedicated shelves for clean-label and certified products. This focus on transparency strengthens long-term consumer loyalty.

- For instance, Danone Canada invested CAD 9 million in June 2025 to upgrade its Boucherville plant and produce Oikos yogurt cups with 30% recycled PET (rPET) content, reinforcing transparency and sustainability initiatives.

Expansion of Plant-Based and Hybrid Dairy Alternatives

Hybrid dairy innovation emerges as a growing trend in the Grass-Fed Dairy Product Market. Companies experiment with blending grass-fed dairy with plant-based ingredients to cater to flexitarian consumers. It enables brands to target health-focused buyers who value both sustainability and nutrition. The trend creates new product lines, including hybrid yogurts, protein drinks, and spreads. Retailers adopt these innovations to diversify offerings for evolving dietary preferences. This hybridization reflects the ongoing convergence of traditional dairy and plant-based demand.

- For instance, Arla Foods Ingredients launched its Nutrilac® ProteinBoost range in September 2024—a patented microparticulated whey protein solution—and introduced products like 10% protein ice cream, non-fat high‑protein drinking yogurt, and 12% protein spoonable yoghurt to showcase how high-protein content can blend with taste and texture.

Increasing Adoption of Functional and Fortified Dairy Products

The rise of functional foods drives innovation in grass-fed dairy, fueling product differentiation. Producers fortify grass-fed milk and yogurt with probiotics, vitamins, and minerals to meet wellness-driven demand. It strengthens the role of grass-fed products in supporting immunity, digestion, and energy management. Functional butter and protein-enriched dairy beverages gain traction among athletes and active consumers. The integration of functional attributes positions grass-fed dairy as more than a premium product. This aligns with consumer expectations for value-added nutrition.

Growing Influence of Digital Platforms and Direct Marketing

Digital platforms play an increasingly important role in shaping consumer awareness of grass-fed dairy products. Brands use online campaigns to highlight nutritional benefits, certifications, and ethical sourcing. It benefits from influencer marketing and digital storytelling that build trust and authenticity. Subscription services and direct-to-consumer models expand brand reach in urban markets. Retailers leverage e-commerce to diversify sales beyond traditional brick-and-mortar stores. This digital expansion enhances accessibility and sustains momentum for grass-fed dairy adoption.

Market Challenges Analysis

Higher Production Costs and Limited Supply Chain Efficiency

The Grass-Fed Dairy Product Market faces challenges linked to higher production costs and complex supply chain requirements. Grass-fed dairy farming demands larger grazing land, longer feeding cycles, and careful pasture management, which increases operational expenses. It often struggles with limited scalability compared to conventional dairy, restricting supply in high-demand regions. Seasonal variations in grass availability affect milk yield consistency, impacting production stability. Distribution networks also face hurdles in ensuring freshness across long distances. These constraints make grass-fed dairy less competitive on price, creating barriers to broader adoption.

Regulatory Variations and Consumer Misconceptions

Diverse regulatory frameworks across countries pose a challenge for standardizing grass-fed labeling and certification. The Grass Fed Dairy Product Market encounters difficulties when consumers face confusion over claims such as “grass-fed,” “organic,” and “free-range.” It risks weakening consumer trust if standards remain inconsistent across regions. Smaller producers face financial burdens in securing multiple certifications, limiting their market reach. Import-export barriers, including tariff regulations and compliance requirements, complicate global expansion for grass-fed dairy suppliers. Misconceptions around nutritional differences compared to conventional dairy further add to the challenge, requiring ongoing consumer education and transparency.

Market Opportunities

Rising Demand for Premium and Nutrient-Rich Dairy Products

The Grass-Fed Dairy Product Market holds strong opportunities in the rising demand for premium, nutrient-dense dairy products. Consumers increasingly seek milk, cheese, and yogurt with higher omega-3 fatty acids, beta-carotene, and conjugated linoleic acid (CLA), which grass-fed products naturally provide. It benefits from the health-driven shift toward functional foods that support immunity and wellness. Growing urban middle-class populations with higher disposable incomes are willing to pay premium prices for grass-fed offerings. Retailers expand dedicated sections for natural and specialty dairy products, making them more visible to consumers. E-commerce platforms further enable broader access, extending the reach of grass-fed dairy across new demographics.

Expansion Across Plant-Based and Hybrid Product Categories

Innovation in hybrid food categories presents growth opportunities for the Grass-Fed Dairy Product Market. Brands explore blending grass-fed dairy with plant-based alternatives to appeal to flexitarian consumers. It aligns with sustainability narratives, as grass-fed farming practices promote better soil health and lower environmental impact compared to intensive conventional systems. Restaurants and cafes incorporate grass-fed butter, cream, and milk into premium menus, boosting visibility among health-conscious diners. Export potential remains strong in Asia-Pacific and Middle Eastern markets, where demand for Western-style premium dairy continues to rise. Collaborations with health-focused brands create room for value-added products that strengthen consumer loyalty.

Market Segmentation Analysis:

By Product

The Grass-Fed Dairy Product Market segments by product into milk, cheese, butter, cream, desserts, and yogurt. Milk holds a strong share as the most consumed dairy item, driven by household and foodservice demand. Cheese continues to expand with its use in ready-to-eat meals, bakery, and restaurant menus, supported by its premium positioning. Butter attracts health-conscious consumers seeking natural fats with higher omega-3 and CLA levels. Cream supports bakery and dessert categories, creating demand from both commercial and household users. Yogurt shows rapid growth, fueled by probiotic benefits and rising adoption in breakfast and snacking habits. It reflects broad consumer acceptance across both traditional and premium categories.

- For instance, Organic Valley (USA) reported in January 2025 that its Grassmilk Yogurt line surpassed 50 million cups sold since launch, with each cup containing milk from 100% grass-fed cows, highlighting consumer preference for clean-label and nutrient-rich options.

By Application

Applications extend across food and beverages, nutraceutical, and dietary supplements. Food and beverages dominate usage, where grass-fed milk, butter, and cheese enhance taste, texture, and health perception. Nutraceutical manufacturers integrate grass-fed dairy proteins and fats into fortified products designed to support immunity, muscle recovery, and cardiovascular health. Dietary supplements incorporate grass-fed whey and casein powders, marketed as clean-label, protein-rich, and sustainable alternatives to conventional dairy. Expanding product launches in these categories strengthen industry adoption. It demonstrates the versatile integration of grass-fed dairy into multiple consumer-facing sectors.

- For instance, Fonterra Co-operative Group (New Zealand) announced in October 2024 that it scaled its NZMP Grass-Fed Whey Protein Isolate production capacity to 35,000 metric tons annually, supplying nutraceutical and supplement brands globally with certified grass-fed proteins.

By Distribution Channel

Distribution channels divide into direct and indirect. Direct sales, including farm-to-consumer models and specialized retailers, gain momentum through digital platforms and subscription-based delivery services. Consumers seeking traceable and sustainable sources prefer this channel for authenticity and freshness. Indirect channels, led by supermarkets, specialty stores, and online marketplaces, dominate large-scale distribution and provide wider accessibility to grass-fed dairy. Retail expansion across urban and semi-urban markets drives stronger reach and visibility for premium dairy products. It highlights a balanced structure where both direct and indirect channels support market growth and consumer adoption.

Segments:

Based on Product:

- Milk

- Cheese

- Butter

- Cream

- Desserts

- Yogurt

Based on Application:

- Food and beverages

- Nutraceutical

- Dietary supplements

Based on Distribution Channel:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest market share at 35%, driven by strong consumer demand for natural and clean-label products. The region’s focus on health, wellness, and sustainable agriculture supports the growth of grass-fed dairy. The United States leads consumption due to established organic dairy brands and a growing base of health-conscious consumers. Canada follows closely, with expanding retail presence for premium dairy categories. Distribution through supermarkets, natural food stores, and direct farm-to-consumer models accelerates accessibility. It benefits further from regulatory frameworks promoting clean production and animal welfare, reinforcing consumer trust in certified grass-fed labels.

Europe

Europe accounts for 30% of the Grass-Fed Dairy Product Market, supported by its long-standing tradition of organic farming and animal welfare practices. Countries such as Germany, France, and the Netherlands lead adoption with robust dairy processing industries and high awareness of sustainable consumption. The United Kingdom also shows strong demand for premium dairy products, particularly in cheese, yogurt, and butter categories. Consumers value authenticity, driving demand for certifications such as EU Organic and grass-fed labels. Distribution through specialty stores, supermarkets, and online platforms remains dominant. It highlights Europe’s role as a major hub for sustainable dairy innovation.

Asia-Pacific

Asia-Pacific captures 20% of the market, reflecting growing demand for premium and health-oriented dairy products. Rising disposable incomes and expanding urban populations in China, India, and Japan drive adoption of grass-fed dairy categories. Foodservice expansion, especially in premium bakery and café chains, contributes to rising consumption of grass-fed butter, cream, and milk. Australia and New Zealand further strengthen supply, leveraging advanced dairy farming systems and large-scale exports. Online platforms and modern retail formats improve accessibility in emerging economies. It positions Asia-Pacific as a fast-growing market with strong long-term potential.

Latin America

Latin America holds 8% of the Grass-Fed Dairy Product Market, with growth led by Brazil, Argentina, and Chile. The region benefits from abundant pasturelands that support natural and sustainable cattle grazing practices. Demand for grass-fed milk, cheese, and butter grows as consumers shift toward healthier and more natural diets. Export opportunities also rise, with Latin American suppliers catering to North American and European demand. Retail expansion and e-commerce penetration provide greater access to premium dairy categories. It demonstrates steady growth potential, supported by favorable agricultural conditions and rising consumer awareness.

Middle East & Africa

The Middle East & Africa represent 7% of the global market, showing gradual growth in grass-fed dairy adoption. Premiumization trends and rising health-conscious consumer groups in countries such as the UAE, Saudi Arabia, and South Africa support the category. Imports remain a key driver, with international brands dominating availability in supermarkets and specialty stores. Local producers explore niche opportunities, especially in organic milk and yogurt. The region’s growing urban middle class contributes to increased spending on premium dairy products. It reflects steady progress, though challenges in pricing and accessibility continue to limit broader penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Müller Group (Germany)

- Veronica Milk (Argentina)

- Straus Family Creamery (USA)

- Arla Foods (Denmark)

- Fonterra Co-operative Group (New Zealand)

- Danone (France)

- Lala Group (Mexico)

- Maple Hill Creamery (USA)

- Organic Valley (USA)

- Parag Milk Foods (India)

Competitive Analysis

The Grass-Fed Dairy Product Market is defined by the presence of established global and regional players that compete on product quality, sustainability, and distribution reach. Leading companies such as Organic Valley, Maple Hill Creamery, Straus Family Creamery, Arla Foods, Müller Group, Danone, Fonterra Co-operative Group, Parag Milk Foods, Lala Group, and Veronica Milk shape the competitive environment through innovation and brand positioning. These players emphasize grass-fed certifications, premium nutritional profiles, and eco-friendly sourcing to strengthen consumer trust. Organic Valley and Maple Hill Creamery dominate the U.S. market with wide retail penetration and diversified product ranges in milk, cheese, and yogurt. Arla Foods and Danone lead in Europe with strong commitments to traceability and sustainable farming initiatives, while Fonterra expands in Asia-Pacific with grass-fed milk powders and ingredients catering to global demand. Emerging companies such as Parag Milk Foods in India and Lala Group in Mexico leverage growing regional health awareness and domestic supply chains to gain competitive advantage. Competition remains intense as established players invest in marketing, partnerships, and product diversification to capture rising demand for clean-label and ethically produced dairy products. The market reflects a strong balance between multinational corporations with global reach and local producers addressing regional preferences.

Recent Developments

- In June 2025, Müller launched a programme under its “Müller Advantage” platform to stabilize organic milk production in the UK.

- In June 2025, Straus Family Creamery completed a successful pilot of a methane-to-value solution in collaboration with Windfall Bio, which converted over 85% of methane from manure into organic fertilizer using a nature-based bioreactor.

- In May 2025, Arla Foods Ingredients signed a distribution agreement with Alchemy Agencies to serve the performance nutrition market in Australia, New Zealand, and the Pacific Islands, covering high-protein whey, casein, and milk ingredient ranges

Market Concentration & Characteristics

The Grass-Fed Dairy Product Market shows moderate to high concentration, led by multinational corporations and regional cooperatives that hold strong influence over supply, distribution, and branding. It features companies such as Organic Valley, Arla Foods, Danone, Müller Group, and Fonterra, which leverage advanced processing facilities, sustainability initiatives, and wide retail networks to secure competitive positions. Smaller players like Maple Hill Creamery, Straus Family Creamery, and Veronica Milk strengthen local presence with premium niche offerings focused on authenticity and traceability. The market reflects characteristics of premiumization, where consumers associate grass-fed dairy with higher nutritional quality, animal welfare, and environmental responsibility. It benefits from vertical integration strategies, where large firms manage farm operations, milk collection, and product processing to ensure consistency in quality standards. The sector shows regional variations, with North America and Europe emphasizing certification-driven trust, while Asia-Pacific and Latin America expand through rising consumer awareness and income growth. It demonstrates resilience through diversification of product portfolios, including milk, yogurt, cheese, and butter, supported by growing demand in health-conscious and sustainable food segments.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for grass-fed dairy will rise as consumers prioritize natural, nutrient-rich food options.

- Expansion of product lines such as yogurt, cheese, butter, and desserts will strengthen market reach.

- Companies will invest in sustainable farming practices to appeal to environmentally conscious buyers.

- E-commerce and direct-to-consumer platforms will boost accessibility of premium dairy products.

- Certifications like organic and grass-fed labels will gain importance in driving consumer trust.

- Innovations in packaging will extend shelf life and improve convenience for global shipments.

- Partnerships between farmers and cooperatives will secure consistent supply and pricing stability.

- Asia-Pacific will see accelerated growth due to rising awareness of clean-label and premium products.

- Functional dairy applications in nutraceuticals and dietary supplements will create new opportunities.

- Technology integration in supply chains will enhance transparency and traceability for end consumers.