Market Overview

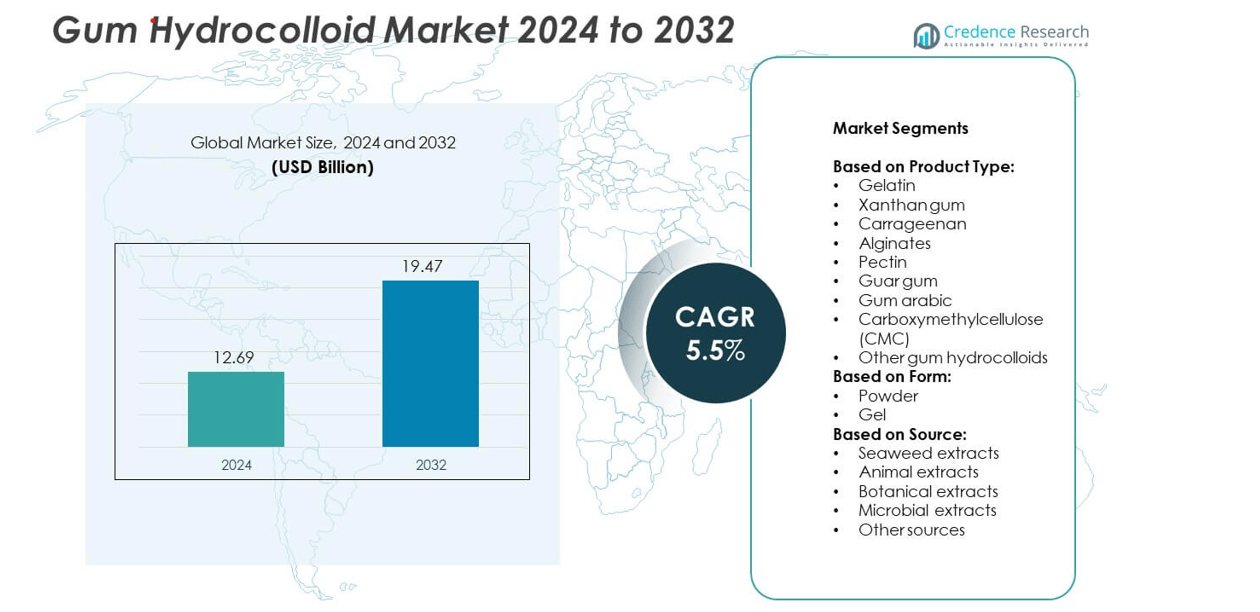

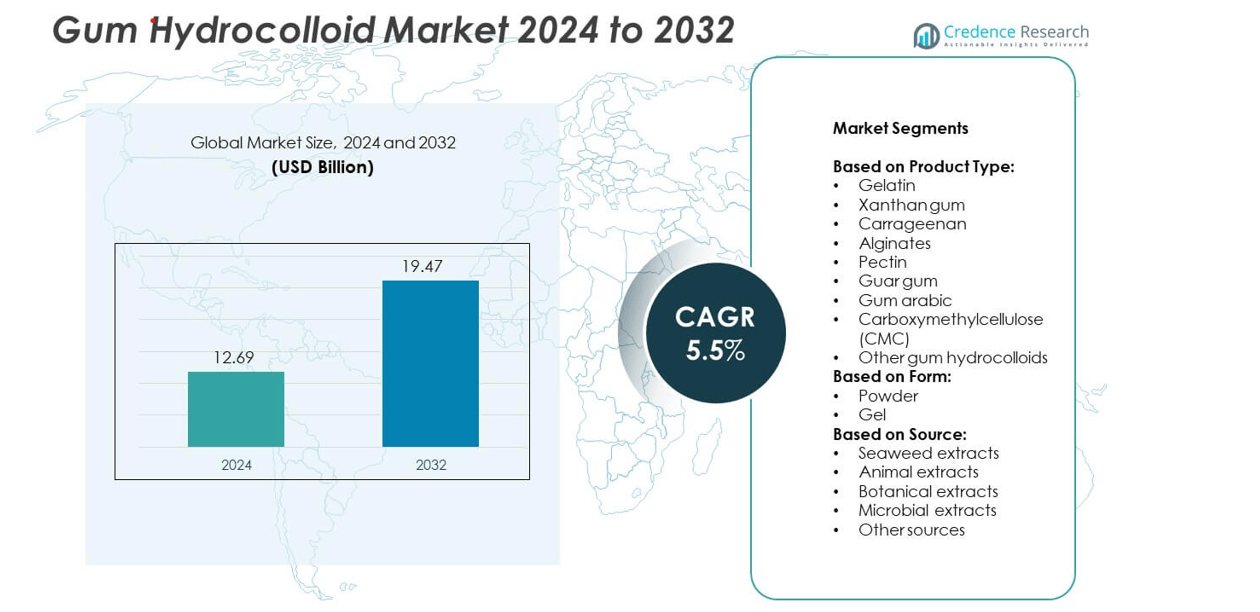

The Gum Hydrocolloid Market size was valued at USD 12.69 Billion in 2024 and is projected to reach USD 19.47 Billion by 2032, growing at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gum Hydrocolloid Market Size 2024 |

USD 12.69 Billion |

| Gum Hydrocolloid Market, CAGR |

5.5% |

| Gum Hydrocolloid Market Size 2032 |

USD 19.47 Billion |

The Gum Hydrocolloid market grows with rising demand from food, pharmaceutical, nutraceutical, and cosmetic industries. It supports clean-label and plant-based product trends through natural stabilizers, thickeners, and gelling agents. Expanding use in functional foods and dietary supplements strengthens its role in health-focused categories. Advanced processing technologies enhance solubility, stability, and texture, improving performance across applications. Sustainability initiatives in sourcing and eco-friendly manufacturing shape long-term industry direction. Together, these drivers and trends establish gum hydrocolloids as essential ingredients in global markets.

North America leads with strong demand from food, pharmaceutical, and personal care industries, while Europe emphasizes clean-label and sustainable sourcing. Asia Pacific emerges as the fastest-growing region, supported by urbanization, rising processed food consumption, and abundant raw material supply. Latin America and the Middle East & Africa show steady growth driven by expanding food and healthcare sectors. Key players such as Cargill, Kerry Group, DuPont, and Tate & Lyle drive innovation, sustainability practices, and strategic partnerships across regional markets.

Market Insights

- The Gum Hydrocolloid market was valued at USD 12.69 Billion in 2024 and is projected to reach USD 19.47 Billion by 2032, growing at a CAGR of 5.5%.

- Rising demand from food and beverage industries strengthens market growth, driven by the need for stabilizers, thickeners, and clean-label ingredients in bakery, confectionery, dairy, and beverages.

- Trends highlight growing adoption in nutraceuticals, pharmaceuticals, and personal care products where gum hydrocolloids provide solubility, controlled release, and stability for health-oriented and eco-friendly formulations.

- Competitive intensity is shaped by global leaders focusing on R&D, sustainable sourcing, and strategic partnerships to strengthen portfolios, with smaller regional firms competing in niche product categories.

- Restraints include volatile raw material supply, price fluctuations, and regulatory challenges related to labeling and quality standards that increase operational costs for producers and limit smaller entrants.

- North America leads with high adoption in food and healthcare, Europe emphasizes sustainable and clean-label solutions, Asia Pacific grows rapidly with expanding food industries and raw material supply, while Latin America and the Middle East & Africa show steady but emerging opportunities.

- Long-term prospects remain strong with innovation in processing technologies, consumer preference for plant-based ingredients, and sustainability-focused practices reinforcing gum hydrocolloids as essential across multiple industries

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Food and Beverage Industry Driving Consistent Adoption

The food and beverage industry remains the largest consumer of gum hydrocolloids, using them for texture, stability, and shelf-life improvement. Bakery, confectionery, dairy, and beverages benefit from its gelling, emulsifying, and thickening properties. Clean-label and natural ingredient trends further push demand for plant-derived and seaweed-based hydrocolloids. Growing preference for gluten-free and reduced-fat formulations supports wider applications. Manufacturers introduce product lines with enhanced stability under varying temperatures and pH levels. This growth strengthens the role of gum hydrocolloids in processed and convenience foods.

- For instance, Ingredion is a leading global ingredient solutions provider that continuously expands its texture solutions portfolio, including gum hydrocolloids, to serve its customers. The company operates in more than 120 countries

Expanding Pharmaceutical and Nutraceutical Applications Creating New Growth Opportunities

The pharmaceutical and nutraceutical industries use gum hydrocolloids in drug delivery systems, capsules, and dietary supplements. It offers controlled release properties, film-forming capability, and improved solubility for active ingredients. Demand for plant-based excipients rises with growing consumer preference for natural formulations. Rising health awareness increases supplement intake, supporting stronger demand for functional excipients. Companies explore hydrocolloids for wound care dressings, oral care, and nutraceutical gummies. The industry’s focus on innovation creates steady growth avenues for the Gum Hydrocolloid market.

- For instance, BASF Care Creations offers Verdessence™ Xanthan, a vegan-compatible xanthan gum made from 100% renewable feedstock, as part of its Verdessence™ biopolymer line. This ingredient, which was formerly known as Rheocare® XGN, was integrated under the Verdessence™ trademark in March 2022.

Personal Care and Cosmetics Industry Driving Diversification of End-Use Applications

Cosmetic and personal care products increasingly use gum hydrocolloids for thickening, stabilizing, and moisturizing purposes. It finds application in lotions, creams, shampoos, and gels to improve product consistency. The industry’s push toward sustainable, bio-based, and safe ingredients supports greater adoption. Rising consumer focus on natural skincare products enhances demand for hydrocolloids sourced from guar, xanthan, and seaweed. Manufacturers develop multifunctional ingredients combining texture, stability, and eco-friendly benefits. This demand shift diversifies revenue streams for gum hydrocolloid producers across global markets.

Growth in Processed Foods and Convenience Products Supporting Long-Term Expansion

Global demand for ready-to-eat and packaged foods drives higher consumption of hydrocolloids for product stability. It ensures consistent quality across frozen, canned, and microwaveable meals. Emerging economies experience rapid urbanization and lifestyle changes that fuel packaged food growth. Food producers adopt gum hydrocolloids to meet rising consumer expectations for taste, shelf life, and nutritional quality. Increasing retail and e-commerce distribution boosts accessibility of processed foods. This dynamic reinforces strong long-term growth prospects for the Gum Hydrocolloid market across regions.

Market Trends

Shift Toward Clean-Label and Plant-Based Ingredients Influencing Product Development

Consumers prefer natural, plant-based, and minimally processed ingredients, creating strong momentum for hydrocolloids derived from guar, xanthan, and seaweed. Food companies reformulate products to meet clean-label expectations without compromising texture or stability. It encourages wider exploration of botanical sources and sustainable cultivation methods. Brands emphasize transparency in sourcing and labeling to build consumer trust. This transition aligns with global dietary trends toward health-conscious and ethical consumption. The Gum Hydrocolloid market benefits significantly from these shifts.

- For instance, In 2022, Ashland announced a significant production capacity increase for its Benecel™ cellulose ethers at its facility in Doel, Belgium, by more than 50 percent, with the expansion completed in 2023 to meet growing market demand. Specific product grades are available with documented properties, such as Benecel™ E4M HPMC, which has a Brookfield viscosity of 2,700–5,040 cP (at a 2% aqueous solution) and a particle size of 170–250 micrometers

Rising Focus on Functional Foods and Nutraceuticals Supporting Broader Utilization

Functional foods and dietary supplements adopt hydrocolloids for controlled release, binding, and solubility. Growing consumer awareness of gut health, immunity, and nutrition accelerates product innovation. It supports applications in fortified beverages, protein bars, and nutraceutical gummies. The rising popularity of wellness-focused diets expands opportunities for specialized hydrocolloid blends. Pharmaceutical and nutraceutical firms invest in R&D to enhance performance and compatibility with active ingredients. This trend positions gum hydrocolloids as critical components in health-oriented product portfolios.

- For instance, On November 15, 2024, Tate & Lyle officially completed its acquisition of CP Kelco, combining their operations into a single leading global specialty food and beverage ingredients business. This combination means CP Kelco is no longer a separate entity and its employees and facilities have been integrated into Tate & Lyle. Following the acquisition, Tate & Lyle’s global talent base expanded to more than 5,000 employees working in around 75 locations across 38 countries, serving customers in more than 120 countries

Technological Advancements in Food Processing Driving Efficiency and Innovation

Advancements in food processing equipment and formulations increase the scope for hydrocolloids. It enables better emulsification, gelling, and stabilization across diverse product categories. Companies integrate hydrocolloids with advanced processing techniques to achieve improved textures and shelf-life consistency. Modern manufacturing systems allow precise customization of viscosity and solubility. This adaptability helps meet growing demand for convenience foods and beverages with high functional quality. The Gum Hydrocolloid market continues to expand with these innovations.

Sustainability and Eco-Friendly Practices Reshaping Industry Supply Chains

Producers adopt sustainable harvesting and environmentally responsible practices to align with global climate goals. It drives stronger demand for hydrocolloids sourced from renewable raw materials like seaweed. Manufacturers invest in supply chain traceability to assure ethical sourcing. Partnerships with local communities support sustainable guar and seaweed farming initiatives. Eco-certifications and green manufacturing methods strengthen competitive advantage. These sustainability-driven trends reshape long-term strategies within the Gum Hydrocolloid market.

Market Challenges Analysis

Volatile Raw Material Supply and Price Fluctuations Impacting Industry Stability

The Gum Hydrocolloid market faces challenges from unstable raw material availability and rising input costs. Dependence on agricultural and marine sources like guar beans and seaweed exposes producers to climate risks and seasonal variations. It leads to inconsistent pricing and supply chain disruptions, affecting manufacturers and end-users alike. Currency fluctuations in key producing countries add further pressure on global trade margins. Producers struggle to balance demand with sustainable sourcing practices under these conditions. This volatility creates uncertainty for long-term planning and capacity expansion across the industry.

Intense Competition and Regulatory Pressures Limiting Growth Opportunities

The industry experiences intense competition among established multinational firms and regional players, pushing price sensitivity across markets. It challenges companies to maintain profitability while investing in product innovation and sustainable practices. Strict regulatory frameworks for food, pharmaceuticals, and cosmetics increase compliance costs and lengthen approval timelines. Variations in international standards for labeling, safety, and quality complicate market entry strategies. Smaller firms find it difficult to compete with global leaders under these conditions. These competitive and regulatory hurdles pose significant barriers to growth in the Gum Hydrocolloid market.

Market Opportunities

Expanding Role in Functional and Health-Oriented Product Categories Driving Future Demand

The Gum Hydrocolloid market gains strong opportunities from rising demand for functional foods, nutraceuticals, and dietary supplements. Hydrocolloids enhance solubility, control release, and improve stability of active ingredients in fortified products. It supports innovation in protein beverages, fiber-rich foods, and wellness-focused snacks. Growing consumer interest in gut health and natural formulations creates wider application potential. Pharmaceutical and nutraceutical companies explore hydrocolloids for controlled delivery systems and advanced excipients. These trends open consistent revenue streams across health-driven product categories.

Sustainable Sourcing and Eco-Friendly Manufacturing Creating Competitive Advantage

Sustainability-focused practices offer new opportunities for producers to differentiate their product portfolios. It encourages investment in renewable sources such as seaweed farming and community-based guar cultivation. Traceability systems and eco-certifications enhance brand credibility among environmentally conscious buyers. Manufacturers adopting low-carbon processes and clean-label solutions strengthen their market position. Partnerships with food, cosmetic, and pharmaceutical industries seeking green ingredients expand growth potential. These sustainability-driven strategies highlight long-term opportunities for innovation and value creation in the Gum Hydrocolloid market.

Market Segmentation Analysis:

By Product Type:

Gelatin, xanthan gum, and carrageenan dominate usage due to their strong functional benefits in food, pharmaceutical, and cosmetic industries. Gelatin holds a significant role in confectionery, capsules, and dairy applications, supported by its gelling and stabilizing properties. Xanthan gum continues to expand in bakery and beverage sectors with its superior thickening performance, while carrageenan remains vital in dairy and meat products. Alginates and pectin strengthen their presence in clean-label formulations, offering natural stability and texture enhancement. Guar gum, gum arabic, and carboxymethylcellulose (CMC) serve diverse uses in pharmaceuticals, beverages, and processed foods. The Gum Hydrocolloid market benefits from this broad product mix, which ensures adaptability across multiple industries.

- For instance, In February 2020, Jungbunzlauer expanded its xanthan gum production at its Pernhofen, Austria, facility, which was operational in the first quarter of that year. Subsequently, in September 2024, the company broke ground on a new $200 million biogum manufacturing plant in Port Colborne, Ontario, which is confirmed to be the first of its kind in Canada. This project was supported by a C$4.8 million grant from the Invest Ontario Fund. The new plant’s first phase is expected to be operational by spring 2026, creating up to 50 new jobs

By Form:

Powder leads the segment due to its ease of storage, transportation, and extended shelf life. Powder formulations provide precise dosage control, making them preferred in industrial food processing, nutraceuticals, and cosmetics. It offers better solubility in water-based systems and ensures consistent product performance. Gel forms, while smaller in share, address niche applications in personal care and specialty food products. Their direct-use convenience supports adoption in ready-to-use formulations. This segmentation by form reflects growing demand for versatile product delivery methods tailored to industry needs.

- For instance, Gelita officially launched CONFIXX®, a fast-setting gelatin for starch-free gummies, in March 2023. The company has a significant global presence, operating numerous production plants and offices across different continents. According to Gelita’s 2024 information, its network includes over 22 production sites

By Source:

Seaweed extracts, including carrageenan and alginates, represent a major share due to their renewable origin and broad application in food and pharmaceuticals. Animal extracts, primarily gelatin, maintain strong demand in confectionery, dairy, and healthcare applications. Botanical extracts such as guar and gum arabic align with natural and plant-based trends. Microbial extracts, including xanthan gum, show rapid adoption with expanding use in processed foods and nutraceuticals. Other sources continue to serve specialized applications across niche industries. It highlights how diversified sourcing strategies enhance market resilience and meet evolving regulatory and consumer requirements across regions.

Segments:

Based on Product Type:

- Gelatin

- Xanthan gum

- Carrageenan

- Alginates

- Pectin

- Guar gum

- Gum arabic

- Carboxymethylcellulose (CMC)

- Other gum hydrocolloids

Based on Form:

Based on Source:

- Seaweed extracts

- Animal extracts

- Botanical extracts

- Microbial extracts

- Other sources

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32% share of the Gum Hydrocolloid market, making it one of the leading regions globally. The region benefits from strong demand in processed food categories such as bakery, confectionery, and dairy products, supported by a well-developed food industry and high consumer preference for convenience products. It sees steady uptake in pharmaceuticals, where gum hydrocolloids serve as excipients and drug delivery agents. It also records significant adoption in personal care, with hydrocolloids used in skincare formulations and oral care products. Regulatory emphasis on clean-label products further drives sourcing of natural hydrocolloids such as guar gum, pectin, and carrageenan. The presence of established players, advanced R&D facilities, and high investment in product innovation support steady growth across the region. North America’s leadership reflects its role in setting global trends for clean-label and functional food formulations.

Europe

Europe holds a 27% market share, driven by its robust food and beverage industry and strong regulatory framework supporting clean-label and natural products. The region maintains high demand for pectin, carrageenan, and alginates due to their use in dairy, confectionery, and beverage products. It also places significant emphasis on bio-based and sustainable sourcing, with European consumers strongly favoring plant-based and seaweed-derived hydrocolloids. Pharmaceutical and nutraceutical industries in Germany, France, and the United Kingdom expand usage through controlled-release systems and dietary supplements. It also benefits from cosmetic and personal care applications, where hydrocolloids add stability and texture to formulations. Europe’s market structure is shaped by both multinational corporations and local producers offering specialized products. The region continues to lead advancements in eco-friendly and traceable sourcing within the Gum Hydrocolloid market.

Asia Pacific

Asia Pacific contributes 29% share, reflecting its position as the fastest-growing region for gum hydrocolloids. Rapid urbanization and dietary shifts in China, India, and Southeast Asia fuel strong demand for processed foods, beverages, and confectionery. It drives high adoption of guar gum, xanthan gum, and carrageenan across multiple industries. Pharmaceutical and nutraceutical markets expand with rising health awareness and growing middle-class populations. It also benefits from large-scale raw material supply, particularly guar from India and seaweed from coastal countries, creating a strong supply base for global trade. Increasing focus on natural, plant-based products aligns with consumer preferences across emerging economies. Asia Pacific continues to represent a growth hub for both domestic and international producers, strengthening its importance in the Gum Hydrocolloid market.

Latin America

Latin America accounts for 7% of the market, with demand driven primarily by food and beverage applications in Brazil, Mexico, and Argentina. The region relies heavily on guar gum and carrageenan for dairy, confectionery, and beverage stability. It experiences rising interest in nutraceutical and cosmetic products that integrate natural hydrocolloids. Local production capabilities for seaweed and botanical sources support regional supply chains. It also shows potential in pharmaceuticals, with increasing healthcare investments expanding demand for excipients. Latin America’s smaller but growing market benefits from both local consumption and export opportunities for hydrocolloids. The region continues to present expansion potential with its increasing processed food demand and emerging interest in wellness products.

Middle East and Africa

The Middle East and Africa represent 5% of the Gum Hydrocolloid market, supported by steady demand in food, beverage, and pharmaceutical sectors. Gulf countries drive growth through investments in processed foods and imported nutraceuticals. Africa contributes with expanding urban centers and rising packaged food consumption. It also records demand from personal care and cosmetics industries in markets such as South Africa and the United Arab Emirates. Limited domestic production capacity creates reliance on imports of guar gum, xanthan gum, and carrageenan. The region sees opportunities in sustainable sourcing and partnerships with global suppliers. Market development is supported by economic diversification strategies and rising consumer interest in health-oriented products across both Middle Eastern and African economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kerry Group

- DuPont

- Ingredion Incorporated

- Ashland Global Holdings

- Cargill, Incorporated

- CP Kelco

- Royal DSM

- Archer Daniels Midland Company (ADM)

- Tate & Lyle PLC

- FMC Corporation

Competitive Analysis

Competitive landscape in the Gum Hydrocolloid market features Kerry Group, DuPont, Ingredion Incorporated, Ashland Global Holdings, Cargill, Incorporated, CP Kelco, Royal DSM, Archer Daniels Midland Company (ADM), Tate & Lyle PLC, and FMC Corporation. These companies compete on innovation, product quality, and sourcing strategies to strengthen their global presence. They focus on expanding clean-label and plant-based hydrocolloids that align with evolving consumer demand for natural and sustainable ingredients. It allows them to serve diverse industries including food, pharmaceuticals, nutraceuticals, and cosmetics. Strategic investments in R&D drive advancements in functionality, solubility, and application performance across multiple product categories. Supply chain resilience and sustainable sourcing practices remain priorities, particularly with rising environmental concerns and raw material volatility. These companies also adopt mergers, acquisitions, and partnerships to expand their portfolios and strengthen regional reach. Strong emphasis on customer collaboration ensures tailored solutions that address specific industry needs and regulatory requirements. Competitive intensity continues to rise with regional players entering specialized markets, pushing established firms to reinforce differentiation through eco-friendly practices and advanced formulations. Overall, innovation, sustainability, and global scale define the strategies that sustain leadership in the Gum Hydrocolloid market.

Recent Developments

- In 2024, Tate & Lyle completed its acquisition of CP Kelco, bringing pectins, speciality gums, and nature-based ingredients into its global portfolio and expanding its leadership in mouthfeel and fortification.

- In 2023, Ingredion also launched new clean-label texturizers derived from citrus peels, FIBERTEX™ CF 502 and FIBERTEX™ CF 102, in the U.S..

- In 2022, Kerry Group made a significant development in the gum hydrocolloid market by expanding its gum acacia portfolio with new Acacia FD products

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for clean-label and natural ingredients.

- Food and beverage applications will continue to dominate global consumption.

- Nutraceutical and pharmaceutical industries will drive new product innovations.

- Sustainable sourcing practices will become a critical competitive factor.

- Emerging economies will offer strong growth opportunities for producers.

- Cosmetic and personal care adoption will increase through bio-based formulations.

- Advanced processing technologies will improve product performance and stability.

- Supply chain resilience will remain vital due to raw material fluctuations.

- Strategic partnerships will strengthen presence across multiple industries.

- Consumer focus on health and wellness will shape long-term demand.