Market Overview

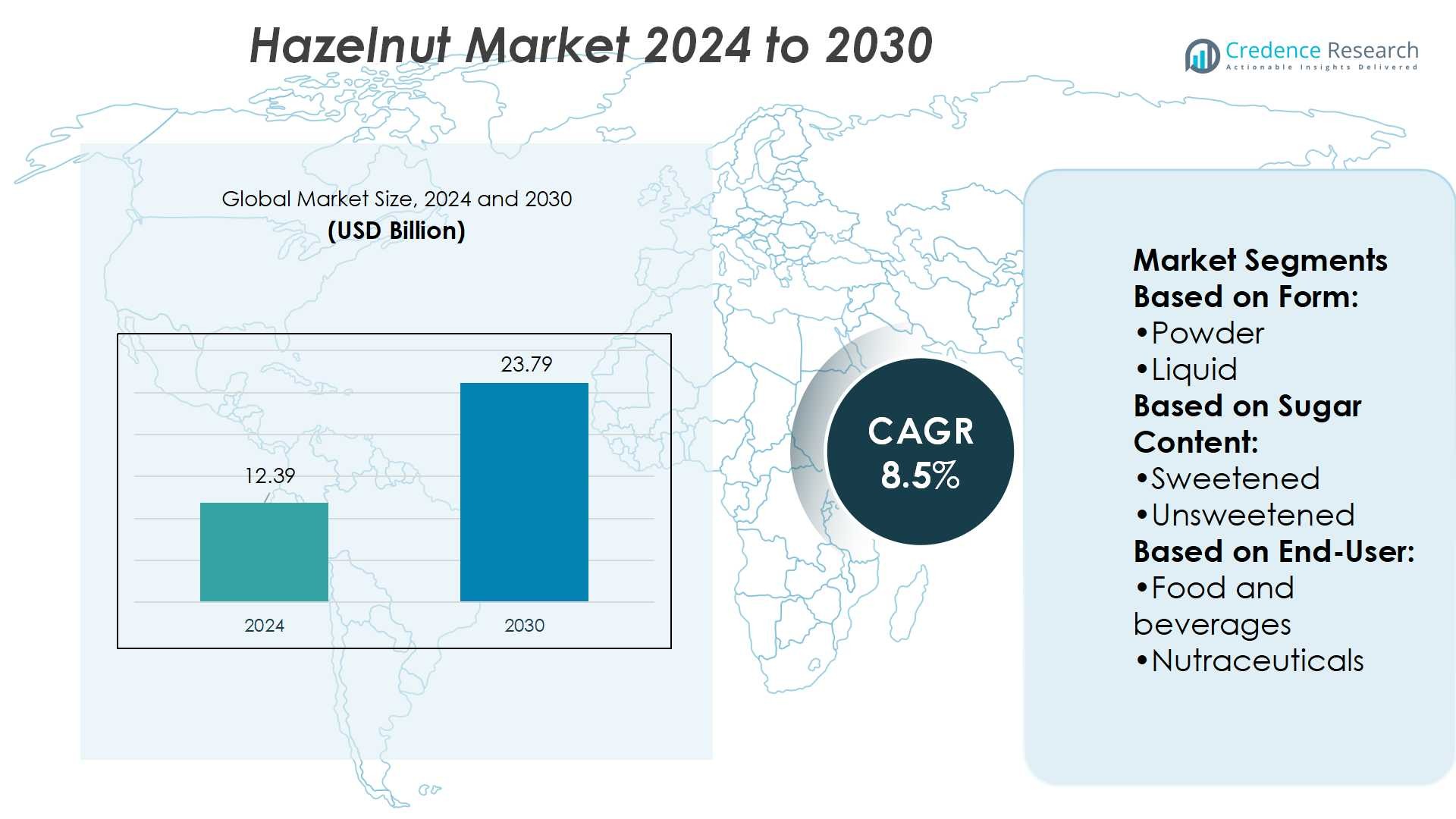

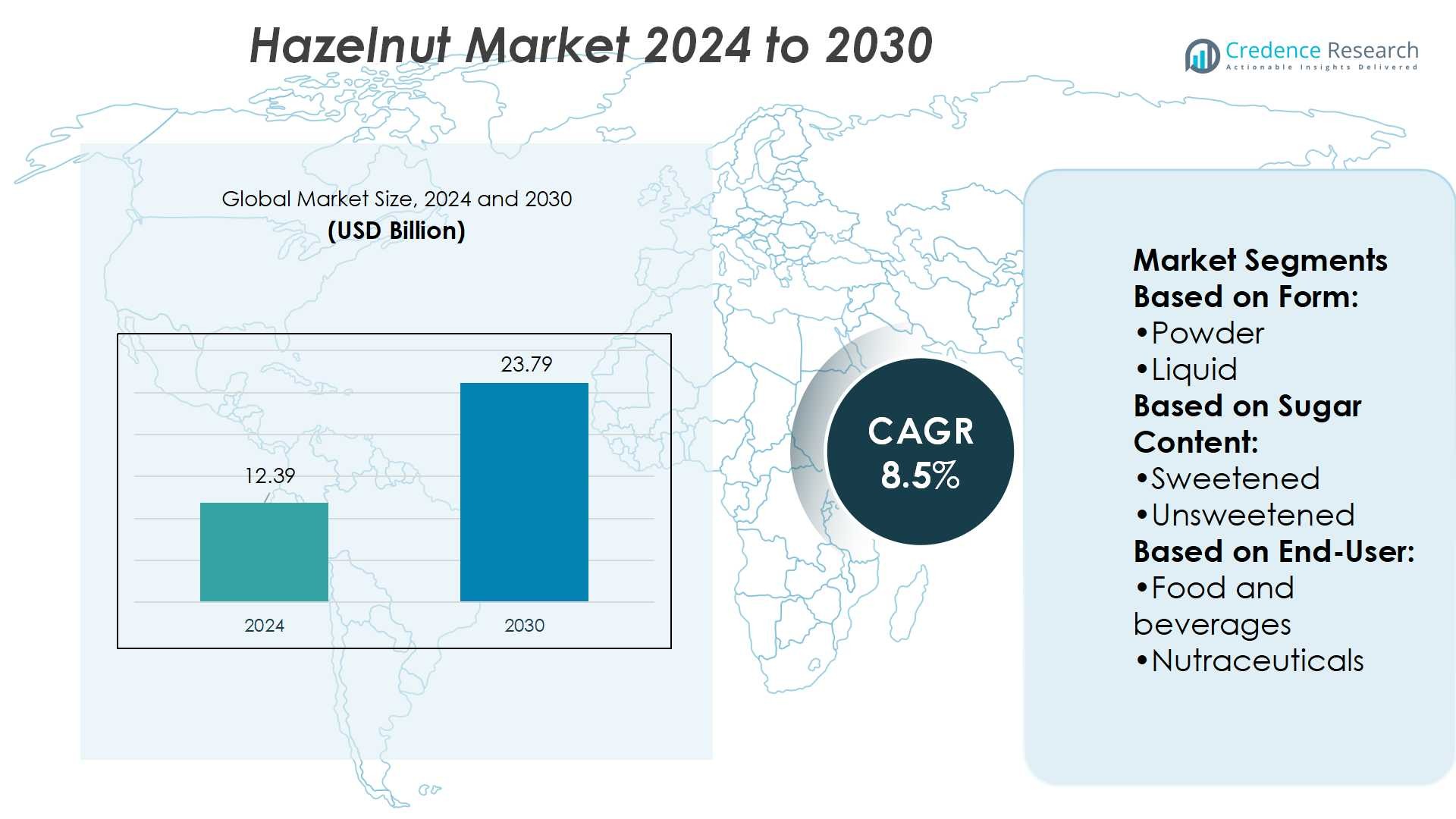

Hazelnut Market size was valued at USD 12.39 billion in 2024 and is anticipated to reach USD 23.79 billion by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hazelnut Market Size 2024 |

USD 12.39 Billion |

| Hazelnut Market, CAGR |

8.5% |

| Hazelnut Market Size 2032 |

USD 23.79 Billion |

The Hazelnut Market grows steadily, driven by rising demand for plant-based foods, premium confectionery, and dairy alternatives. Health-conscious consumers value hazelnuts for their nutrient-rich profile, supporting adoption in functional snacks and beverages. Advancements in processing technologies improve efficiency, quality, and scalability across applications. Sustainability programs and transparent sourcing enhance consumer trust and brand loyalty. Market trends highlight strong traction in vegan-friendly categories, growing interest in unsweetened and clean-label products, and expanding applications in nutraceuticals and personal care. It benefits from e-commerce growth and increasing consumption in emerging economies, strengthening global demand and long-term market opportunities.

The Hazelnut Market shows strong geographical presence, with Europe holding the largest share supported by major producers like Turkey and Italy, while North America and Asia-Pacific record rising demand from dairy alternatives, confectionery, and premium snacks. Latin America and the Middle East & Africa contribute modestly but show emerging potential through urban consumption. Key players include WhiteWave Foods, Blue Diamond Growers, SunOpta Inc., Hain Celestial Group, Daiya Foods Inc., and Galaxy Nutritional Foods Inc., each focusing on innovation and sustainability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Hazelnut Market size was valued at USD 12.39 billion in 2024 and is expected to reach USD 23.79 billion by 2032, growing at a CAGR of 8.5%.

- Rising demand for plant-based foods, premium confectionery, and dairy alternatives drives steady market growth.

- Health-conscious consumers prefer hazelnuts for their nutrient-rich profile, supporting functional snacks and beverages.

- Sustainability programs and transparent sourcing practices strengthen consumer trust and brand positioning.

- Competition intensifies with key players focusing on innovation, clean-label products, and eco-friendly strategies.

- Supply chain risks, climate change, and reliance on Turkey remain major restraints for stability.

- Europe leads with the largest share, while North America and Asia-Pacific record strong growth, and Latin America with Middle East & Africa show emerging potential.

Market Drivers

Rising Demand for Plant-Based and Nutrient-Rich Ingredients

The Hazelnut Market benefits from strong consumer interest in healthier diets and plant-based options. Hazelnuts provide protein, fiber, and antioxidants that align with wellness trends. Food manufacturers use them in snacks, spreads, and dairy alternatives, responding to demand for clean-label products. Growth in vegan and flexitarian populations increases their adoption in functional foods. Global awareness of nut-based diets supports wider consumption patterns. It strengthens the market position across both developed and emerging regions.

- For instance, a study using FT-NIR and electronic nose technology achieved R² values between 0.918 and 0.951 when predicting protein content and moisture in roasted hazelnuts, enabling cleaner label control.

Expanding Applications Across Confectionery, Bakery, and Beverages

The Hazelnut Market gains momentum from diverse applications in chocolates, cakes, and flavored drinks. Leading confectionery brands rely heavily on hazelnuts for premium product lines. Demand for nut-based spreads continues to expand, supported by consistent household consumption. Beverage producers explore hazelnut-based milk alternatives, offering dairy-free solutions with strong appeal. High versatility in flavor and texture supports innovation across product portfolios. It reinforces the role of hazelnuts as a value-added ingredient in mainstream and specialty foods.

- For instance, Harvesting machines in Turkish hazelnut orchards achieved kernel productivity between 124.83 kg/h and 1,322.08 kg/h, depending on orchard yield and ground conditions.

Technological Improvements in Processing and Supply Chain Efficiency

The Hazelnut Market advances through improvements in shelling, roasting, and packaging technologies. These innovations ensure better quality, reduced waste, and extended shelf life. Process automation enhances consistency and supports large-scale commercial applications. Improved cold storage and controlled atmosphere facilities secure freshness during transportation. Supply chain digitization reduces delays and strengthens traceability from farms to processors. It enables producers to maintain premium standards while meeting strict regulatory requirements.

Rising Production in Key Growing Regions and Export Growth

The Hazelnut Market experiences steady support from leading producing countries such as Turkey, Italy, and the United States. Expanding cultivation areas and government-backed farming programs sustain long-term supply. Export demand rises from Asia-Pacific and North America, where consumption grows sharply. Producers benefit from favorable trade agreements that ease market access and boost competitiveness. Rising adoption in emerging economies supports broader distribution networks and new retail channels. It creates strong momentum for sustained market expansion worldwide.

Market Trends

Growing Popularity of Premium and Specialty Food Products

The Hazelnut Market reflects strong traction from premium chocolates, artisan spreads, and gourmet bakery items. Global brands emphasize hazelnuts to create distinct flavor profiles in luxury lines. Consumers link hazelnuts with indulgence, supporting their presence in high-end segments. Rising disposable incomes in urban areas strengthen demand for specialty nut-based products. Retailers highlight origin-based labeling to reinforce authenticity and quality. It drives consumer loyalty and supports higher price realization for premium products.

- For instance, Bulk Storage Capacity the Salida, California facility added a 58,000-square-foot Bulk 8 Warehouse, giving an additional 50 million pounds of in-house bulk almond storage capacity.

Rising Interest in Dairy Alternatives and Plant-Based Beverages

The Hazelnut Market expands through the development of hazelnut-based milk, coffee creamers, and flavored drinks. Plant-based diets push demand for lactose-free, nut-derived beverages. Manufacturers invest in product launches that cater to health-conscious buyers seeking alternatives. Cafés and quick-service restaurants promote hazelnut-based options in hot and cold beverages. Strong consumer preference for natural, allergen-friendly choices accelerates product acceptance. It widens market presence across both retail and foodservice channels.

- For instance, The International Delight brand (under WhiteWave, now Danone) launched a coffee creamer line called Simply Pure in three flavors: vanilla, caramel, and hazelnut. A 1-tablespoon serving of the Simply Pure Hazelnut creamer contains 30 calories, 1 gram of fat, and 5 grams of sugar.

Increasing Focus on Sustainability and Ethical Sourcing Practices

The Hazelnut Market demonstrates a clear shift toward sustainable farming and transparent sourcing. Companies invest in programs that promote fair trade and farmer welfare. Demand for traceable supply chains grows with consumer concerns about environmental impact. Certification labels, such as organic and fair trade, influence purchasing decisions. Global food producers commit to reducing carbon footprints by supporting sustainable nut cultivation. It ensures long-term supply resilience while enhancing brand reputation.

Advancements in Processing and Product Innovation

The Hazelnut Market benefits from technological progress in roasting, paste production, and flavor enhancement. Process innovations improve consistency, reduce waste, and increase scalability. Companies experiment with new formats such as protein bars, snack packs, and fortified spreads. Flavored hazelnut products, including savory coatings and unique blends, capture consumer attention. Integration of digital tools in processing ensures better traceability and efficiency. It enables producers to meet evolving consumer preferences with speed and accuracy.

Market Challenges Analysis

Vulnerability to Supply Fluctuations and Climatic Risks

The Hazelnut Market faces challenges from unpredictable weather conditions and climate change. Frost, drought, and pests threaten crop yields in major producing countries. Supply shortages lead to volatile prices, affecting manufacturers and end-users. Heavy reliance on Turkey, which dominates global production, increases market exposure to regional risks. Export restrictions and geopolitical tensions further complicate trade flows. It places pressure on processors and retailers to secure stable long-term contracts.

Rising Competition, Allergies, and Regulatory Pressures

The Hazelnut Market encounters strong competition from other nuts such as almonds and cashews. Consumer health concerns over nut allergies limit wider adoption in some regions. Regulatory standards on labeling, pesticide use, and sustainability demand higher compliance costs. Small-scale growers struggle to meet strict certifications required by international buyers. Price-sensitive consumers often shift to cheaper alternatives when hazelnut costs rise. It forces producers and brands to balance innovation with affordability and compliance.

Market Opportunities

Expansion into Functional Foods and Health-Oriented Segments

The Hazelnut Market presents opportunities through rising demand for functional and fortified foods. Hazelnuts provide essential nutrients, healthy fats, and antioxidants that align with wellness-focused consumption. Food manufacturers can integrate hazelnuts into protein bars, nutritional supplements, and meal replacements. Growing awareness of heart health and plant-based diets strengthens their appeal among health-conscious buyers. Premium snack formats and ready-to-eat products create new growth avenues. It enables producers to capture higher margins in evolving nutrition-driven categories.

Growth Potential in Emerging Economies and Value-Added Applications

The Hazelnut Market benefits from rising consumption in Asia-Pacific, Latin America, and the Middle East. Expanding retail networks and e-commerce platforms improve access to hazelnut-based products in these regions. Opportunities exist in value-added applications, including flavored spreads, dairy alternatives, and confectionery. Investments in sustainable sourcing and traceability programs enhance consumer trust in new markets. Foodservice operators explore hazelnut-based offerings to meet rising demand for premium taste experiences. It strengthens long-term growth prospects by diversifying demand beyond traditional markets.

Market Segmentation Analysis:

By Form

The Hazelnut Market demonstrates significant demand across powder and liquid forms. Hazelnut powder finds strong adoption in bakery, confectionery, and snack products due to its rich flavor and ease of blending. Food manufacturers rely on powder for consistent quality in chocolates, spreads, and dairy alternatives. Liquid forms such as hazelnut oil and extracts hold strong potential in both culinary and personal care applications. They deliver natural flavor and nutritional benefits, supporting their use in gourmet foods and premium cosmetic formulations. It positions both forms as essential contributors to growth, with powder holding a larger market share and liquid expanding through value-added segments.

- For instance, Hain Celestial opened a new Innovation Experience Center with 2,200 square feet of working kitchen space. The Innovation Experience Center is split into two dedicated areas: one for technical R&D (product development) and another for sensory/consumer immersive exploration.

By Sugar Content

The Hazelnut Market reflects growing variety across sweetened and unsweetened offerings. Sweetened hazelnut-based products dominate the confectionery and spread categories, appealing to consumers seeking indulgent taste. Chocolates, pralines, and dessert toppings continue to rely heavily on this segment. Unsweetened variants gain traction among health-conscious buyers and food manufacturers targeting clean-label formulations. Nutritional snack bars, dairy-free beverages, and functional foods increasingly incorporate unsweetened hazelnut forms. It highlights an important balance, where sweetened maintains traditional demand while unsweetened builds new opportunities in wellness-oriented categories.

- For instance, Azerstar is a major hazelnut processor and exporter in Azerbaijan, with an export volume of more than 4,000 tons of finished products per year. The exact volume processed in any given year, and the percentage of that volume that is exported, are not publicly disclosed.

By End-User

The Hazelnut Market benefits from diverse adoption across food and beverages, nutraceuticals, pharmaceuticals, and personal care. Food and beverages remain the leading segment, with strong utilization in chocolates, bakery goods, spreads, and dairy alternatives. Nutraceuticals adopt hazelnuts for their antioxidant and nutrient profile, supporting dietary supplements and functional food innovation. Pharmaceuticals explore applications in formulations that use hazelnut oil as a carrier and wellness-enhancing ingredient. Personal care brands integrate hazelnut oil in skin creams, hair products, and cosmetics due to its moisturizing and antioxidant properties. It underscores the versatility of hazelnuts across both edible and non-edible sectors, supporting long-term demand across industries.

Segments:

Based on Form:

Based on Sugar Content:

Based on End-User:

- Food and beverages

- Nutraceuticals

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis

North America

North America accounts for 18% of the global Hazelnut Market in 2024. The United States drives regional growth with Oregon as the hub of cultivation. Strong demand comes from chocolates, snacks, and dairy alternatives. Imports from Turkey and Italy supplement domestic production to meet rising demand. Plant-based beverages and premium nut-based spreads expand consumer choices. Investments in mechanization and traceability strengthen supply efficiency. It positions North America as both a strong consumer base and a secondary producer.

Europe

Europe dominates the Hazelnut Market with a 64% share in 2024, the largest globally. Turkey remains the leading producer, supported by Italy and Spain. Germany and Italy represent the highest levels of consumption within the region. Premium confectionery and bakery industries rely heavily on hazelnuts for product innovation. Sustainability programs and origin-based labeling enhance consumer trust. It maintains leadership through strong production, established brands, and export capacity.

Asia-Pacific

Asia-Pacific holds 10% market share in 2024 but shows the fastest growth potential. China, India, and South Korea lead rising demand for nut-based snacks and beverages. Imports dominate supply as regional production remains limited. Growing urban populations and shifting dietary habits support higher consumption. E-commerce channels and modern retail strengthen accessibility of hazelnut-based products. It is expected to expand its share significantly in the forecast period.

Latin America

Latin America contributes 2.2% of global market share in 2024. Brazil drives most of the demand in confectionery and bakery applications. Limited local production constrains wider growth potential. Rising middle-class incomes create opportunities for premium hazelnut products. Supply chain improvements may enhance regional competitiveness in the coming years. It remains a small but promising market for future investment.

Middle East & Africa

Middle East & Africa account for 5.8% of the Hazelnut Market in 2024. Turkey anchors the region as a global leader in production, while Iran and Egypt also support supply. Consumption grows in Gulf countries through imports of premium chocolates and snacks. Rising health awareness increases preference for nut-based foods. Domestic farming initiatives expand availability in select African nations. It continues to evolve as an important supplementary market with growing demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fine Japan Co. Ltd.

- SunOpta Inc.

- Galaxy Nutritional Foods, Inc.

- Nature’s Choice B.V.

- VitaHazelnut Australia Products Pty. Ltd.

- Blue Diamond Growers

- Whitewave Foods

- Daiya Foods Inc.

- Tofutti Brands Inc.

- Hain Celestial Group

Competitive Analysis

The Hazelnut Market players including WhiteWave Foods, Blue Diamond Growers, Daiya Foods Inc., Tofutti Brands Inc., SunOpta Inc., Fine Japan Co. Ltd., Hain Celestial Group, Galaxy Nutritional Foods Inc., Nature’s Choice B.V., and VitaHazelnut Australia Products Pty. Ltd. The Hazelnut Market demonstrates strong competition driven by innovation, sustainability, and consumer health trends. Companies focus on expanding product portfolios in plant-based beverages, premium confectionery, and nutraceutical applications. Rising demand for dairy alternatives and functional foods pushes manufacturers to invest in advanced processing, clean-label certifications, and transparent sourcing programs. Market leaders emphasize differentiation through premium quality, origin-based labeling, and eco-friendly production practices. E-commerce and global retail channels further intensify competition by widening consumer access to hazelnut-based products. It creates a dynamic landscape where continuous innovation and sustainability commitments shape long-term growth and brand positioning.

Recent Developments

- In April 2025, Saba, a plant-based beverages company, has expanded its product line with the launch of its own Hazelnut Milk. The new milk is creamy, full of flavor, and 100% plant-based, appealing to those seeking a dairy alternative with a rich and smooth texture.

- In November 2024, Ferrero invested to Oregon State University and Rutgers University to advance hazelnut research in disease resistance and sustainable farming. The investment support Ferrero long-term strategy to expand hazelnut cultivation in North America and reduce reliance on Turkish supply.

- In February 2024, Chosen Foods introduced a chocolate hazelnut spread made with 100% pure avocado oil and 40% less sugar than leading brands, targeting health-conscious consumers.

- In September 2023, Hazelicious has introduced its new hazelnut milk in two varieties: lightly sweetened and unsweetened. According to the brand, both varieties are made from premium hazelnuts sourced from small family farms, emphasizing sustainability, and are now available in convenient 1L cartons for direct-to-consumer purchase across various retail channels.

Report Coverage

The research report offers an in-depth analysis based on Form, Sugar Content, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Hazelnut Market will expand with rising demand for plant-based and functional foods.

- Sustainable sourcing programs will strengthen supply chain transparency and consumer trust.

- Growth in dairy alternatives will drive wider use of hazelnuts in beverages and spreads.

- Premium confectionery and bakery products will remain core drivers of demand.

- Investments in advanced processing will enhance product quality and reduce waste.

- Emerging economies will create new opportunities through rising urban consumption.

- E-commerce platforms will accelerate global access to hazelnut-based products.

- Nutraceutical and personal care applications will diversify the market landscape.

- Climate resilience strategies will shape long-term production stability.

- Innovation in flavor profiles and value-added formats will expand consumer adoption.