Market Overview:

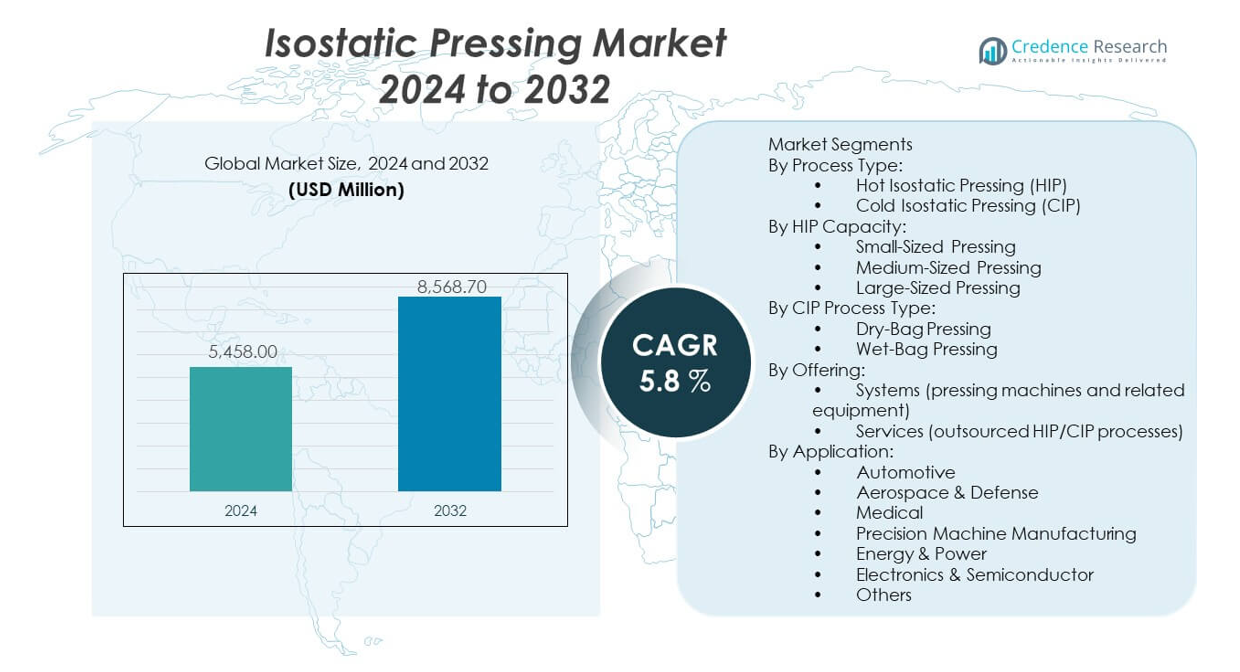

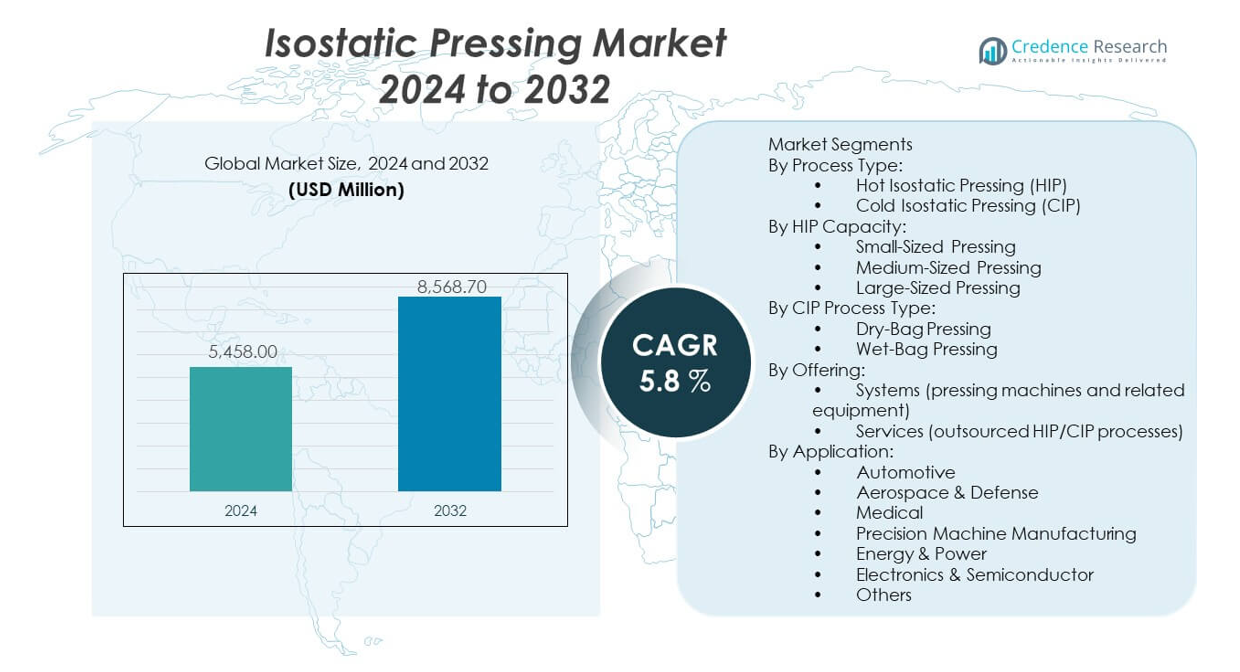

The Isostatic Pressing market is projected to grow from USD 5,458 million in 2024 to an estimated USD 8,568.7 million by 2032, with a compound annual growth rate (CAGR) of 5.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Isostatic Pressing Market Size 2024 |

USD 5,458 million |

| Isostatic Pressing Market, CAGR |

5.8% |

| Isostatic Pressing Market Size 2032 |

SD 8,568.7 million |

The isostatic pressing market is gaining traction due to the increasing demand for high-performance components in sectors such as aerospace, automotive, medical, and energy. It supports the densification of advanced ceramics and metal parts, improving mechanical strength and reliability. The technology also facilitates the production of complex geometries and defect-free parts, aligning with evolving precision manufacturing trends. Growing adoption of additive manufacturing and the integration of hot isostatic pressing (HIP) for post-processing further bolster its market relevance.

Regionally, North America and Europe lead the isostatic pressing market due to their strong presence in aerospace, defense, and advanced manufacturing industries. The United States, Germany, and the United Kingdom are key contributors, leveraging technological capabilities and robust R&D investment. Asia-Pacific is emerging as a high-growth region, driven by expanding industrial infrastructure, rising demand for precision components, and increasing adoption of advanced metal forming technologies in China, Japan, and South Korea. These dynamics reflect a broadening global footprint and increased cross-regional technology transfer.

Market Insights:

- The isostatic pressing market was valued at USD 5,458 million in 2024 and is projected to reach USD 8,568.7 million by 2032, registering a CAGR of 5.8% during the forecast period (2024–2032).

- Strong demand from aerospace, medical, and energy sectors is driving the adoption of isostatic pressing for producing high-strength, defect-free components.

- Increasing integration of hot and cold isostatic pressing in additive manufacturing processes boosts material performance and product reliability.

- High capital investment and operational costs continue to limit technology adoption, particularly among small and medium-scale enterprises.

- Technical complexities and limited compatibility with certain powder materials pose challenges in widespread industrial application.

- North America and Europe lead the market due to established manufacturing infrastructure and advanced R&D capabilities.

- Asia-Pacific is witnessing the fastest growth, supported by rapid industrialization, localized production initiatives, and growing demand in China, Japan, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for High-Performance Materials Across Industrial Sectors:

The isostatic pressing market is driven by the growing need for high-performance materials in aerospace, defense, and automotive industries. These sectors require components with enhanced mechanical strength, uniformity, and precision. Isostatic pressing ensures superior density and eliminates internal voids in complex parts. It supports lightweight component production, which aligns with fuel efficiency and emission goals. Medical and energy industries also increasingly use this technology for advanced implants and turbine blades. The method enables consistent results in hard-to-machine materials, making it suitable for high-spec applications. Its ability to produce net-shape or near-net-shape parts enhances productivity. This has positioned isostatic pressing as a core technique in advanced manufacturing.

- For instance, Bodycote plc has used hot isostatic pressing (HIP) to improve metal part densities up to 99.99% for aerospace turbine components, ensuring critical reliability in flight operations.

Adoption of Advanced Manufacturing and Precision Engineering Techniques:

Industries worldwide are integrating isostatic pressing into their workflows to meet tighter tolerances and stricter specifications. It allows consolidation of multiple manufacturing steps into one, minimizing material waste and reducing the need for secondary operations. Additive manufacturing, especially metal 3D printing, benefits significantly from post-processing through hot isostatic pressing (HIP). It enhances the structural integrity of printed parts and ensures defect-free output. Demand from satellite, turbine, and orthopedic device manufacturers remains strong. Countries investing in localized defense and aerospace programs are adopting HIP for mission-critical components. Isostatic pressing also supports customization and scalability. This flexibility drives its adoption in both prototyping and volume production.

- For instance, Quintus Technologies AB supplied HIP systems that allowed customers like Siemens to achieve 100% densification of 3D-printed parts for gas turbines, significantly reducing defect rates and post-machining requirements.

Growing Emphasis on Quality Control and Material Reliability:

Manufacturers continue to prioritize consistency and repeatability in critical applications. Isostatic pressing offers the ability to produce isotropic parts, eliminating variations in mechanical properties across sections. The technology is crucial for applications requiring uniform stress distribution, such as structural aerospace components or pressure vessels. Its capability to densify complex shapes without compromising internal quality reduces product rejection rates. In sectors with strict certification requirements, like medical and defense, it ensures compliance. The process also improves fatigue resistance and overall part life. Manufacturers are investing in in-house isostatic systems to enhance control over the final product. This push for reliability strengthens demand for isostatic pressing systems globally.

Expansion of Clean Energy and Advanced Ceramics Industries:

The shift toward renewable and nuclear energy is accelerating the use of isostatic pressing in the production of fuel pellets and structural components. It is essential for shaping ceramic and refractory parts used in high-temperature environments. Applications in solar, fusion, and hydrogen technologies further expand its reach. The market benefits from rising R&D in ceramic matrix composites and ultra-high-temperature materials. Manufacturers rely on isostatic pressing to meet the performance requirements of next-generation energy systems. Its compatibility with both metal and ceramic powders supports multi-material processing. This versatility makes it a preferred method in evolving energy technologies. The market gains from continued innovation in advanced material solutions.

Market Trends:

Integration of Automation and Digital Control in Isostatic Pressing Systems:

The isostatic pressing market is experiencing increased automation and digital integration to improve efficiency and process control. Advanced systems now feature programmable logic controllers (PLCs) and real-time monitoring tools. These innovations help operators maintain consistent pressure and temperature parameters. Automation reduces cycle times and labor dependency, enhancing throughput in high-volume production. Remote diagnostics and predictive maintenance features are being incorporated to minimize downtime. Smart interface technologies also simplify operator training and reduce the learning curve. Digital twins and simulation tools are emerging to optimize pressing parameters before production. This shift reflects the broader trend of smart manufacturing adoption across industries.

- For instance, Kobe Steel, Ltd. introduced automated HIP lines with digital monitoring, achieving up to 15% reduction in cycle time and offering predictive maintenance that decreased unplanned downtime by over 20% in customer installations.

Growing Use of Cold Isostatic Pressing (CIP) in Powder Metallurgy:

Cold isostatic pressing is gaining popularity for its role in shaping complex geometries from powdered materials without heat application. It supports near-net shape forming with minimal material wastage. The technique enables the production of large, uniform green compacts used in ceramics, tool steels, and PM parts. CIP facilitates better control over porosity and grain structure, making it suitable for high-performance applications. It is also preferred in the production of metal filters, sintered components, and specialty parts. Equipment manufacturers are offering modular systems to suit varied part sizes and shapes. This flexibility broadens its appeal across small and mid-scale producers. The trend underlines a shift toward energy-efficient, low-cost forming methods.

- For instance, DORST Technologies has delivered modular CIP presses enabling ceramic part producers to form green bodies with porosity below 2% across large batch runs, supporting the production of high-purity semiconductor components.

Collaborative R&D and Expansion of Industry-Academia Partnerships:

The isostatic pressing market is witnessing a surge in collaborative research projects aimed at developing new materials and processes. Universities, research institutes, and manufacturers are working together to improve powder formulations and sintering techniques. Joint ventures focus on applications in space materials, high-entropy alloys, and functional ceramics. Public funding and government-backed innovation programs are accelerating experimentation and commercialization cycles. These partnerships facilitate faster validation of isostatic processes in emerging fields like biomedical implants and nuclear containment. Industry players are also investing in academic centers for pilot production and prototyping. These collaborative efforts ensure continued technical evolution and market relevance.

Customization and On-Demand Pressing Services Gain Popularity:

Demand for flexible and customized pressing services is rising among small and mid-sized enterprises. Service providers are offering contract-based isostatic pressing operations with fast turnaround times. These services help manufacturers avoid large capital investments in in-house equipment. The trend supports low-to-medium batch production in sectors like jewellery, precision tools, and aerospace components. It allows customers to access advanced pressing technology without long-term infrastructure commitments. Portable or skid-mounted systems are also entering the market to support decentralized production. Growth of these services aligns with the broader shift toward on-demand and agile manufacturing. The trend is strengthening the role of service-based models in the supply chain.

Market Challenges Analysis:

High Capital Investment and Maintenance Costs Limit Accessibility:

The isostatic pressing market faces challenges due to the substantial upfront investment required for high-pressure equipment and supporting infrastructure. Small and medium-sized enterprises find it difficult to justify the cost, especially for limited production volumes. Installation of HIP and CIP systems demands specialized layouts, safety controls, and power requirements. Ongoing operational costs such as utilities, periodic servicing, and consumables add to the burden. Operators also require advanced training to manage cycle parameters and safety measures. These costs restrict the market’s penetration in price-sensitive industries. Manufacturers hesitate to adopt the technology unless return on investment is clearly demonstrated. The financial barrier affects market scalability in developing regions.

Technical Constraints and Limited Compatibility With Certain Materials:

The isostatic pressing market also encounters limitations related to material selection and process adaptation. Not all materials respond optimally to isostatic compaction, especially those with irregular particle sizes or reactive compositions. The need for pre-processing, such as granulation and binder addition, increases complexity. Sintering requirements vary based on the material’s thermal behavior, which influences final part quality. Large components may experience non-uniform densification if not managed properly. Dimensional tolerances may require post-processing despite the net-shape advantage. These technical constraints can affect consistency in critical applications. Addressing them requires precise control and deep process understanding. This reduces flexibility and increases dependency on expert operators.

Market Opportunities:

Rising Application of Isostatic Pressing in Medical and Dental Sectors:

The isostatic pressing market offers growth opportunities in medical and dental applications, where precision and biocompatibility are vital. Manufacturers use HIP to enhance strength and surface finish in orthopedic implants, prosthetics, and dental crowns. These sectors demand materials with zero porosity and high fatigue resistance. Isostatic pressing meets these criteria while supporting scalable and repeatable manufacturing. Expanding healthcare infrastructure and aging populations in both developed and emerging economies create strong demand for high-quality medical components. This demand opens a lucrative growth channel for the market.

Expansion in Emerging Economies and Localized Manufacturing:

Emerging economies are focusing on domestic production of critical components in defense, energy, and industrial sectors. Governments in Asia-Pacific, Latin America, and the Middle East are investing in advanced manufacturing capabilities. Isostatic pressing supports this shift by enabling high-spec part production locally. It reduces dependence on imports and aligns with national strategies for industrial self-reliance. Increasing access to funding and training resources is improving adoption rates. The market stands to benefit from this regional expansion and localization trend.

Market Segmentation Analysis:

By Process Type

The isostatic pressing market is categorized into Hot Isostatic Pressing (HIP) and Cold Isostatic Pressing (CIP). HIP uses high temperature and pressure simultaneously to densify materials, eliminate internal porosity, and improve mechanical properties, making it ideal for critical applications in aerospace and medical sectors. CIP, on the other hand, operates at room temperature and is commonly used to shape powdered materials into uniform green bodies before sintering, supporting applications in powder metallurgy and ceramics.

- For instance, American Isostatic Presses, Inc. has provided CIP equipment for tungsten carbide tooling manufacturers, allowing for uniform compacts that meet tight standards—enabling defect rates under 1% in tooling production.

By HIP Capacity

Based on HIP capacity, the market is segmented into small-sized, medium-sized, and large-sized pressing systems. Small-sized HIP systems are suitable for laboratory research and prototyping. Medium-sized systems serve industries such as aerospace, energy, and medical devices, where precision and structural integrity are crucial. Large-sized HIP systems cater to heavy industrial components and high-volume production needs, particularly in power generation and defense applications.

- For instance, EPSI supplied a large-capacity HIP system to a leading power device manufacturer, enabling pressing of parts up to 1 meter in diameter for high-voltage insulator applications.

By CIP Process Type

The market is further divided into dry-bag pressing and wet-bag pressing under the CIP process type. Dry-bag pressing involves reusable elastomer molds that allow high efficiency and repeatability, ideal for large-scale manufacturing. Wet-bag pressing offers greater design flexibility and is suitable for smaller batches or intricate part geometries, especially where mold changes are frequent or complex.

By Offering

In terms of offering, the isostatic pressing market includes systems and services. Systems consist of pressing machines, high-pressure vessels, and automation equipment used in internal operations. Services refer to outsourced HIP/CIP processing provided by third-party specialists, catering to manufacturers who prefer contract processing over capital investment in equipment.

By Application

End-use industries driving demand in this market include automotive, aerospace & defense, medical, precision machine manufacturing, energy & power, and electronics & semiconductor, along with other sectors. These industries rely on isostatic pressing for producing dense, high-strength, defect-free parts used in mission-critical components such as implants, turbines, structural aerospace parts, and high-precision mechanical tools.

Segmentation:

By Process Type:

- Hot Isostatic Pressing (HIP)

- Cold Isostatic Pressing (CIP)

By HIP Capacity:

- Small-Sized Pressing

- Medium-Sized Pressing

- Large-Sized Pressing

By CIP Process Type:

- Dry-Bag Pressing

- Wet-Bag Pressing

By Offering:

- Systems (pressing machines and related equipment)

- Services (outsourced HIP/CIP processes)

By Application:

- Automotive

- Aerospace & Defense

- Medical

- Precision Machine Manufacturing

- Energy & Power

- Electronics & Semiconductor

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe Lead with Strong Industrial Base

North America holds the largest share in the isostatic pressing market, accounting for 32.4% of the global revenue. The region benefits from advanced aerospace, defense, and medical industries that rely on high-precision, high-strength components. The presence of established players such as Kennametal Inc., Pressure Technology Inc., and American Isostatic Presses drives strong adoption across sectors. The United States leads regional demand due to its robust R&D environment and emphasis on domestic manufacturing of mission-critical parts. Europe follows with a 27.8% share, supported by strong industrial engineering and automotive sectors. Countries like Germany, the UK, and France invest in precision manufacturing and collaborate actively in aerospace and energy research.

Asia-Pacific Emerges as Fastest-Growing Regional Market

Asia-Pacific holds a 25.6% share of the isostatic pressing market and exhibits the highest growth rate during the forecast period. China, Japan, and India dominate the regional landscape due to rapid industrialization, infrastructure development, and localized manufacturing incentives. Government support for aerospace and energy self-sufficiency fuels demand for HIP and CIP equipment. Major producers in China and Japan are investing in expanding domestic capabilities and serving export markets. The region’s booming semiconductor, electronics, and medical device sectors further strengthen the demand for precision pressing technologies. Asia-Pacific’s manufacturing scale and rising technological adoption enhance its position as a growth engine for the global market.

LATAM and MEA Show Gradual Uptake in Niche Applications

Latin America and the Middle East & Africa (MEA) collectively account for 14.2% of the isostatic pressing market, with Latin America holding 8.1% and MEA capturing 6.1%. These regions are gradually adopting isostatic pressing in energy, mining, and industrial applications. Brazil and Mexico are emerging markets in Latin America, leveraging CIP systems for powder metallurgy and specialty components. In MEA, countries like Saudi Arabia and the UAE are exploring HIP applications in energy infrastructure and high-performance materials. Infrastructure development and rising interest in domestic manufacturing are contributing to a steady but smaller market presence. Limited local expertise and high equipment costs currently moderate adoption compared to other regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Kobe Steel, Ltd. (Japan)

- Bodycote plc (UK)

- Kennametal Inc. (US)

- Nikkiso Co., Ltd. (Japan)

- DORST Technologies GmbH & Co. KG (Germany)

- American Isostatic Presses, Inc. (US)

- Engineered Pressure Systems, Inc. (EPSI, US)

- Pressure Technology, Inc. (US)

- Shanxi Golden Kaiyuan Co., Ltd. (China)

- Fluitron, Inc. (US)

- Kittyhawk Products (US)

- Höganäs AB (Sweden)

- GKN Powder Metallurgy

- Quintus Technologies AB

- MTI Corporation

Competitive Analysis:

The isostatic pressing market features a moderately consolidated competitive landscape, with key players focusing on technological innovation, global expansion, and strategic collaborations. Companies such as Kobe Steel, Bodycote plc, Kennametal Inc., and Quintus Technologies AB lead the market by offering specialized HIP and CIP systems tailored for high-spec applications. These players invest heavily in R&D to enhance equipment performance, reduce cycle time, and improve process automation. The market also includes several regional manufacturers and service providers that serve niche applications or localized demand. Competition centers on system reliability, pressure capacity, energy efficiency, and customer-specific customization. The isostatic pressing market continues to evolve through digital integration and hybrid manufacturing solutions.

Recent Developments:

- In June 2025, Kobe Steel, Ltd. announced a major investment in expanding its plant at Kobelco Industrial Machinery India (KIMI). This expansion includes the installation of new production facilities for non-standard compressors, aiming to diversify Kobe Steel’s production bases, strengthen its position in India and neighboring regions, and support market growth related to future energy transitions. The investment is scheduled for completion in fiscal 2027 and also involved establishing the Kobelco Machinery Global Capability Center in Chennai earlier in January 2025 to focus on R&D for tire and rubber machinery and non-standard compressors.

- In May 2025, Kennametal Inc. made a strategic investment in Toolpath Labs, a leading developer of AI-powered CAM (computer-aided manufacturing) software. This partnership is designed to advance Kennametal’s digital innovation, expanding its portfolio to deliver enhanced intelligent machining solutions to manufacturing customers worldwide.

- In August 2024, Nikkiso Co., Ltd. announced the doubling of its manufacturing capacity at its Wurzen, Germany facility. This initiative supports the group’s growth in cryogenic pump assembly, heat exchangers, and hydrogen fueling skids, strengthening Nikkiso’s clean energy and hydrogen technology offering in Europe. Full completion is targeted for the first half of 2025, with operations powered by renewable solar energy.

Market Concentration & Characteristics:

The isostatic pressing market shows a medium-to-high level of concentration, with a few global players controlling significant market share in systems manufacturing and service provision. It features high entry barriers due to the capital-intensive nature of HIP and CIP equipment, technical complexities, and strict safety regulations. The market is characterized by long equipment lifecycles, customer-specific system configurations, and a rising preference for integrated automation. Demand clusters around industries requiring material precision and structural performance, such as aerospace, energy, and medical devices. Service-based models are growing, especially among small-to-medium enterprises lacking in-house infrastructure.

Report Coverage:

The research report offers an in-depth analysis based on Process Type, HIP Capacity, CIP Process Type, Offering, Application/End-Use Industry, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for defect-free, high-density components will continue driving adoption in aerospace, medical, and energy sectors.

- Integration with additive manufacturing will expand, making HIP a standard post-processing step for 3D-printed parts.

- Advancements in automation and real-time process control will enhance productivity and quality assurance.

- Increased focus on lightweight materials in automotive and defense will push adoption of CIP and HIP technologies.

- Asia-Pacific is expected to dominate future growth due to industrialization and localization of critical manufacturing.

- Service-based models will rise as SMEs outsource HIP/CIP processes to avoid capital-intensive setups.

- Emerging applications in semiconductors, hydrogen storage, and advanced ceramics will unlock new opportunities.

- R&D investment will focus on material compatibility, energy efficiency, and hybrid processing systems.

- Regulatory alignment and safety standardization will shape technology implementation across regions.

- Market competition will intensify as regional players expand capabilities and new entrants target niche solutions.