Market Overview:

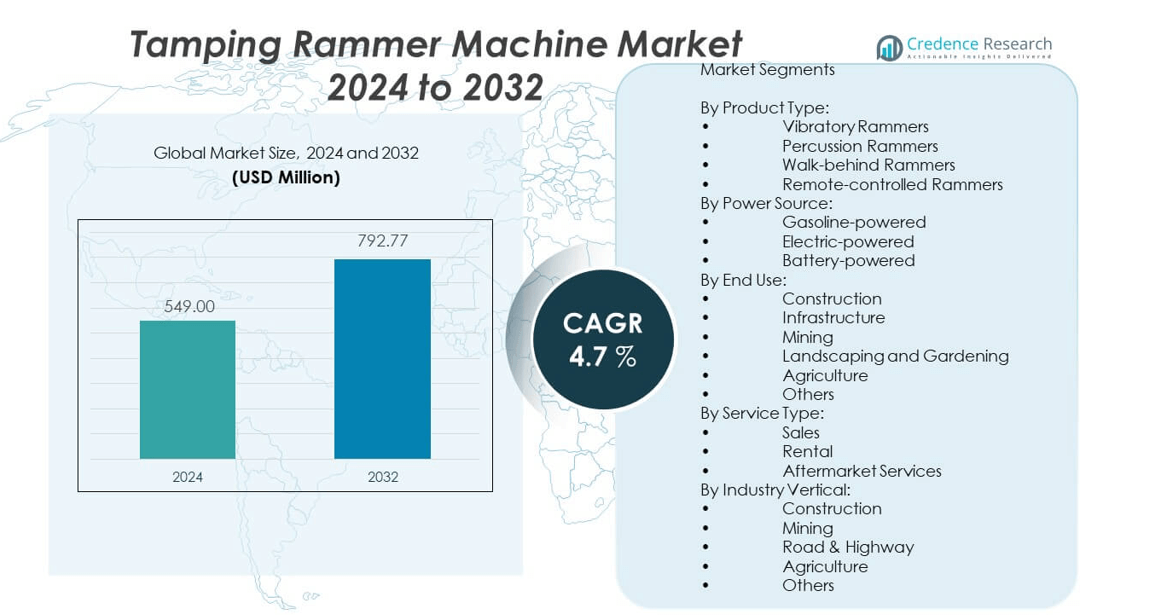

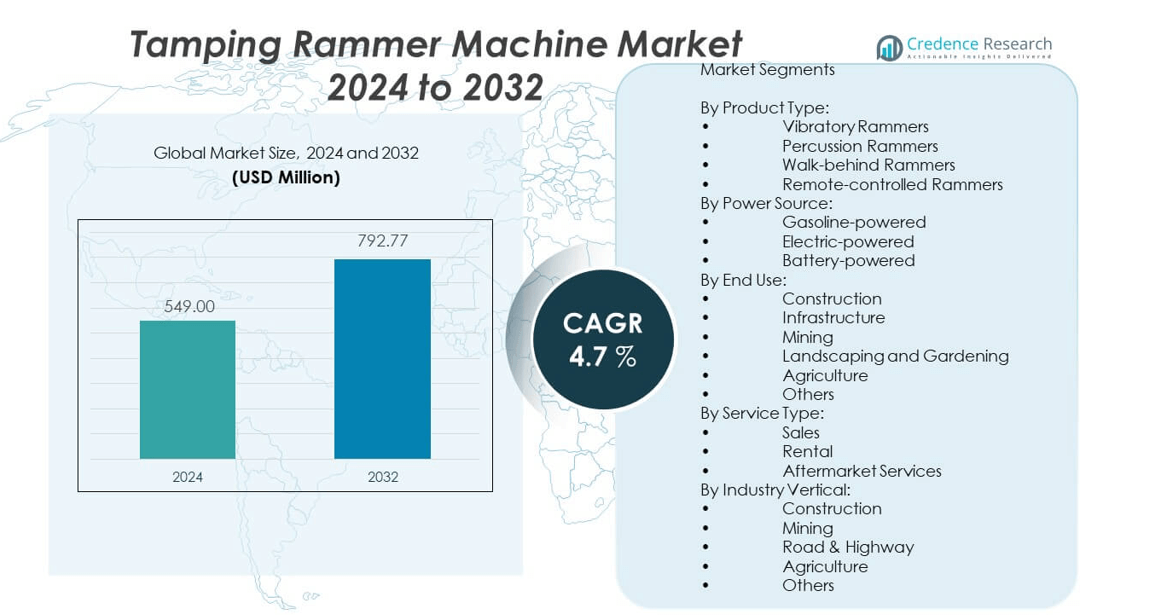

The Tamping rammer machine market is projected to grow from USD 549 million in 2024 to an estimated USD 792.77 million by 2032, registering a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Tamping rammer machine market Size 2024 |

USD 549 million |

| Tamping rammer machine market, CAGR |

4.7% |

| Tamping rammer machine market Size 2032 |

USD 792.77 million |

Strong urbanization, rapid infrastructure development, and the need for high-performance compaction equipment are driving market growth. Contractors are adopting tamping rammers for their portability, precision, and ability to compact cohesive soils in tight spaces, which enhances operational efficiency. Innovations in engine performance, reduced emissions, and noise reduction are increasing adoption, particularly in regions with strict environmental regulations. Manufacturers are also integrating ergonomic designs and digital monitoring features to appeal to both developed and developing markets.

Asia-Pacific leads the tamping rammer machine market, supported by large-scale urban projects, road construction initiatives, and rising public infrastructure investments, especially in China and India. North America and Europe follow, driven by stringent standards on compaction quality and a focus on worker safety and equipment efficiency. Emerging markets in Latin America and the Middle East & Africa are showing steady growth due to expanding construction activities and government efforts to improve transportation and utilities infrastructure. Demand in these regions is also bolstered by increasing equipment rentals and the growing presence of global OEMs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The tamping rammer machine market was valued at USD 549 million in 2024 and is projected to reach USD 792.77 million by 2032, growing at a CAGR of 4.7% during the forecast period.

- Growing infrastructure development and road construction projects globally are driving strong demand for compact and efficient soil compaction equipment.

- Rising focus on mechanization among small and mid-sized contractors is accelerating the shift from manual tools to powered rammers.

- High upfront costs of advanced models and limited access to financing options in developing regions are restraining wider adoption.

- Availability of low-cost aftermarket alternatives in price-sensitive markets can undermine OEM sales and affect long-term brand value.

- North America held the largest market share in 2024, supported by established infrastructure networks, rental fleet expansion, and strong OEM presence.

- Asia Pacific is expected to witness the fastest growth due to urbanization, infrastructure investment, and increasing adoption of battery-powered rammers.

Market Drivers:

Accelerating Urban Infrastructure Projects in Emerging Economies Fuel Demand for Compact Soil Compaction Solutions:

The tamping rammer machine market is expanding due to increasing investment in urban infrastructure, particularly in emerging economies. Governments in Asia-Pacific and Africa are prioritizing the development of roads, housing, and utilities, creating demand for effective soil compaction tools. Tamping rammers offer high precision in compacting confined areas, which supports their adoption in urban projects. Municipal corporations and contractors prefer these machines for utility trenches, footpaths, and foundation repairs. The market benefits from the growing need for reliable and portable equipment. Infrastructure financing by public and private stakeholders strengthens equipment sales. Vendors are witnessing higher procurement in rural development schemes. Public works departments are deploying tamping rammers to support infrastructure rollouts in hard-to-access areas. The market responds positively to increased infrastructure commitments.

- For instance, Ammann Group’s eATR 68 electric tamping rammer, launched in 2025, weighs 154 lbs and delivers a compaction force of 3,035 lbf with a working width of 280 mm, providing zero-emission and precise compaction suited for tight urban spaces and environmentally sensitive zones.

Surging Construction Activities in the Residential and Commercial Sectors Drive Product Uptake:

The tamping rammer machine market receives strong support from growing residential and commercial construction worldwide. Expanding real estate markets in Southeast Asia, the Middle East, and South America require reliable ground preparation tools. Builders prefer tamping rammers for small-scale, high-precision tasks such as compacting base layers for walls, pavements, and walkways. These machines are especially useful in restricted spaces where larger rollers cannot operate. Their mobility, ease of use, and efficiency enhance productivity on-site. New housing developments and commercial complexes drive repeated demand. The post-pandemic recovery in real estate boosts construction starts, indirectly benefiting the market. It aligns with increased investments in smart cities and sustainable buildings. The consistent demand from building contractors ensures stable equipment sales.

- For instance, Wacker Neuson’s gasoline-powered rammers equipped with 4-stroke engines include models known for durable operations in confined construction sites, offering vibration reduction technology that improves operator comfort during prolonged compaction tasks.

Government Focus on Road Modernization and Public Utility Expansion Supports Market Growth:

The tamping rammer machine market thrives under policy-driven infrastructure programs focusing on rural and urban connectivity. Governments are upgrading road networks, laying utility pipelines, and enhancing sanitation infrastructure, all of which require precision compaction tools. Tamping rammers are effective for backfilling trenches and preparing subgrade layers for roads and utilities. National and regional agencies prefer them for their reliability and cost-efficiency. Demand increases during the early stages of infrastructure projects where manual compaction is inefficient. Utility installation projects such as water lines and gas pipelines also create repetitive demand. Civil engineering contractors deploy tamping rammers for continuous compaction needs. Public procurement tenders include these machines for routine use. The equipment’s utility across multiple project types supports broad adoption.

Shift Toward Mechanization in Construction Drives Adoption Across Small Contractors:

The tamping rammer machine market benefits from the growing shift from manual labor to mechanized tools among small and mid-sized contractors. As labor shortages rise and efficiency pressures increase, companies seek compact machines to perform repetitive tasks. Tamping rammers replace hand tools in many applications such as trench backfilling and patch repairs. Their affordability, low maintenance, and high ROI appeal to smaller firms. Distributors are expanding outreach to rental companies and small businesses. Mechanization improves safety and ensures compaction consistency, which is essential for project durability. Awareness campaigns by OEMs and construction bodies improve adoption rates. Contractors value these machines for their flexibility and operational simplicity. The shift aligns with broader digital and mechanical transformation in construction.

Market Trends:

Integration of Hybrid and Low-Emission Engines Aligns with Global Sustainability Regulations:

The tamping rammer machine market is witnessing a shift toward hybrid and low-emission models in response to stricter environmental regulations. Manufacturers are integrating engines that meet Tier 4 and EU Stage V emission norms. These machines minimize harmful exhaust output while maintaining power output, making them ideal for urban job sites. Noise reduction is also a key feature being prioritized. Battery-assisted tamping rammers are emerging for indoor or noise-sensitive environments. Equipment buyers in Europe and North America demand greener alternatives to traditional engines. Rental fleets are upgrading to meet compliance requirements. These trends increase the appeal of eco-friendly tamping rammers in competitive bids. The market adapts to stricter legislation and green building practices.

- For instance, Ammann’s eAPR 20/40 electric-drive reversible plate compactor, delivering a compaction force of 20 kN—the equivalent of its petrol counterpart—features noise-reducing ergonomics and long battery life for zero-emission operations compliant with EU Stage V standards.

Rising Adoption of Rental and Leasing Models Expands Product Accessibility to Wider User Base:

The tamping rammer machine market is responding to growing demand from equipment rental businesses. Construction firms increasingly prefer short-term leasing to reduce upfront capital expenditure. Rental companies invest in compact and durable rammers that can withstand repeated use. OEMs are offering extended warranties and service packages to support rental operations. The rise of shared equipment platforms increases machine circulation among contractors. Small firms and seasonal projects benefit from the affordability of rentals. Rental penetration is particularly high in Latin America and Southeast Asia. This trend allows market players to reach new customer segments without direct selling. Equipment lifespan optimization and return on asset value become key considerations.

- For instance, major OEMs like Ammann provide extensive after-sales service and technician support globally to ensure high uptime and quick maintenance for their electric rammers, which are designed for intensive rental use with built-in robustness and ease of servicing.

Development of Ergonomic and Vibration-Controlled Machines Enhances Operator Safety:

The tamping rammer machine market is embracing ergonomic innovations that prioritize user safety and comfort. Prolonged exposure to vibration and repetitive motion can cause operator fatigue or injury. Manufacturers are redesigning handles, control levers, and shock absorption systems to reduce strain. Anti-vibration systems are being standardized across models. These advancements improve compliance with occupational health standards. Enhanced safety features attract contractors focused on long-term workforce wellbeing. Feedback from field users informs continuous product improvements. Training programs and safety certification now include best practices for using such ergonomically designed equipment. The shift supports worker retention and reduces insurance liabilities on job sites.

Product Line Expansion Through Digital Monitoring and Smart Control Systems Gains Momentum:

The tamping rammer machine market is evolving with the integration of digital control features and monitoring systems. Advanced models now include diagnostics, fuel tracking, and machine usage data. These features help contractors manage equipment utilization and schedule maintenance proactively. Fleet managers value real-time alerts for performance anomalies. Manufacturers are embedding IoT-based modules to capture operational metrics. The trend supports predictive maintenance and reduces downtime. Digital dashboards and mobile apps are also being introduced. Remote monitoring aligns with broader digital construction trends. Smart rammers are gaining traction in large-scale infrastructure projects with strict compliance protocols.

Market Challenges Analysis:

High Initial Equipment Cost and Limited Budget of Small Contractors Restrict Adoption:

The tamping rammer machine market faces obstacles due to the high upfront cost of new machines. Small contractors, especially in developing economies, operate under tight budgets and prioritize immediate project needs over capital investments. Many rely on manual tools or second-hand equipment, delaying technology adoption. New machines with advanced features are often unaffordable to these segments. Financing options and government subsidies are limited or inaccessible. This challenge hinders market penetration in rural construction markets. OEMs must develop cost-effective models to address pricing sensitivities. The disparity between large-scale projects and small-scale operations contributes to uneven demand distribution. Affordability remains a key barrier in low-income regions.

Inconsistent After-Sales Support and Maintenance Infrastructure Reduces Product Lifecycle Value:

The tamping rammer machine market suffers in regions lacking robust service and parts infrastructure. Timely maintenance is critical to preserve machine efficiency and safety. However, many developing markets face challenges in accessing certified service centers and spare parts. Equipment downtime increases when users cannot procure necessary components locally. Lack of skilled technicians for diagnostics and repairs also affects reliability. These issues reduce user confidence, particularly among new buyers. OEMs and distributors must invest in expanding service networks. Without consistent support, even technically advanced models fail to gain traction. Maintenance-related delays can impact project schedules and damage brand reputation.

Market Opportunities:

Expansion of Smart Cities and Urban Redevelopment Programs Drives Long-Term Market Growth:

The tamping rammer machine market has a strong opportunity in upcoming smart city and urban renewal projects worldwide. Governments are investing in transportation corridors, underground utility grids, and compact residential layouts. These projects require extensive trenching, backfilling, and foundation work in confined urban spaces. Tamping rammers offer the versatility and mobility essential for such tasks. Urban development timelines span multiple years, supporting recurring demand. OEMs can align product portfolios with evolving urban engineering requirements. Collaborations with urban contractors and public bodies will boost adoption rates. Continuous infrastructure updates in modern cities keep the market demand active.

Rising Popularity of Compact Construction Equipment Among Rental Fleets Opens New Sales Channels:

The tamping rammer machine market can grow by targeting the expanding rental equipment ecosystem. Compact, high-utilization machines like tamping rammers fit well into rental business models. These machines offer high turnover, minimal maintenance, and fast ROI for rental companies. OEMs can partner with rental operators to ensure wide geographic coverage. Strong rental demand supports recurring orders and promotes brand visibility. Product bundling with other light equipment improves customer value. Offering training and maintenance packages can further strengthen OEM-rental relationships. The rental-focused strategy opens consistent revenue streams in both mature and emerging markets.

Market Segmentation Analysis:

By Product Type

The tamping rammer machine market features vibratory rammers as the most widely adopted product, offering strong performance for cohesive soil compaction. Percussion rammers are selected for high-impact applications, especially in confined areas. Walk-behind rammers are preferred for their operator control and maneuverability on smaller job sites. Remote-controlled rammers are gradually entering the market, driven by demand for safer operations in hazardous or sensitive environments.

- For instance, Ammann’s standard electric eATR 68 rammer has a percussion rate of 11 Hz and stroke height of 65 mm, delivering a centrifugal force of 11.5 kN, close to comparable petrol rammer models, combining performance with environmental benefits.

By Power Source

Gasoline-powered tamping rammers lead the market due to their reliability in outdoor construction and infrastructure applications. Electric-powered models are used in environments with emissions restrictions or power accessibility. Battery-powered variants are gaining interest, particularly in regions with stricter emission standards and requirements for quieter operations, making them ideal for indoor or urban use.

- For instance, Ammann offers electric tamping rammers powered by Honda GXE 2.0 electric drives with nominal speeds of 3600 rpm, delivering 2.4 HP power output, designed specifically for zero-emission operation in urban job sites with limited access to power sources.

By End Use/Application

Construction and infrastructure dominate the end-use segmentation, accounting for the majority of machine deployment due to ongoing urbanization and utility installations. Mining applications demand compact, rugged machines for underground or remote site use. Landscaping, agriculture, and other specialized sectors represent smaller but steadily growing areas with targeted use cases.

By Service Type

The sales segment continues to drive core revenue, while the rental segment expands rapidly, supported by budget-conscious contractors and short-term project requirements. Aftermarket services play a vital role in maintaining equipment performance and extending product life, reinforcing user retention and brand loyalty.

By Sourcing Type

OEMs lead in market share due to quality assurance, certified support, and availability of newer technologies. Aftermarket sourcing is prominent in developing regions, where affordability and accessibility drive procurement decisions, especially among small contractors.

By Application/Material Compaction

Soil compaction is the primary application across most industries, followed by asphalt compaction for road repairs and patchwork. Granular material compaction serves construction and landscaping needs, particularly in drainage, sub-base, and foundation preparations.

By Industry Vertical

The construction sector is the largest vertical, consistently requiring compactors for foundational and trench work. Road and highway projects fuel steady demand through infrastructure upgrades and maintenance. Mining and agriculture represent developing segments, utilizing tamping rammers for terrain preparation and light civil tasks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Product Type:

- Vibratory Rammers

- Percussion Rammers

- Walk-behind Rammers

- Remote-controlled Rammers

By Power Source:

- Gasoline-powered

- Electric-powered

- Battery-powered

By End Use:

- Construction

- Infrastructure

- Mining

- Landscaping and Gardening

- Agriculture

- Others

By Service Type:

- Sales

- Rental

- Aftermarket Services

By Industry Vertical:

- Construction

- Mining

- Road & Highway

- Agriculture

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Robust Infrastructure Investments

North America holds the largest share of the tamping rammer machine market, contributing approximately 37% of the global revenue. The region benefits from continuous infrastructure upgrades, utility repair programs, and the expansion of rental equipment businesses. The United States drives most of the demand due to active road maintenance and construction activities. Canada supports market growth with increasing investments in urban development and public works. Advanced technologies and stringent safety regulations push contractors to adopt reliable, emission-compliant rammers. OEMs have established strong distribution and service networks across the region. It remains the most mature market with consistent product innovation and adoption.

Europe Maintains Strong Market Presence with 29% Share

Europe accounts for nearly 29% of the global tamping rammer machine market, with key contributors including Germany, the United Kingdom, and France. The region emphasizes sustainable construction practices and modernized infrastructure, creating steady demand for compactors. Germany leads in both production and usage due to its strong engineering base and civil infrastructure projects. The UK and France focus on urban regeneration and public transport upgrades. Regulatory frameworks around emissions and occupational safety drive demand for electric and low-vibration equipment. The presence of established European manufacturers supports regional equipment preferences. It remains a technology-driven market with high emphasis on quality and compliance.

Asia Pacific Shows Highest Growth Potential at 24% Share

Asia Pacific holds approximately 24% of the tamping rammer machine market and shows the fastest growth among all regions. Rapid urbanization and government-backed infrastructure development in China, India, and Southeast Asia fuel strong demand. Large-scale projects such as roadways, water pipelines, and affordable housing require versatile compaction equipment. The adoption of battery-powered and affordable machines is rising due to cost sensitivity and regulatory pressure in urban zones. Domestic manufacturers and global OEMs are expanding their presence to capture growing opportunities. It is emerging as a highly competitive region with increasing demand from both organized and informal construction sectors.

Key Player Analysis:

- Ammann Group

- Atlas Copco

- Belle Group

- Bomag GmbH (Fayat Group)

- Caterpillar Inc.

- Chicago Pneumatic

- Doosan Corporation

- Husqvarna Group

- JCB

- MBW Inc.

- Mikasa Sangyo Co., Ltd.

- Wacker Neuson

- Weber MT

- Enarco (ENAR)

- Hitachi Construction Machinery

- Multiquip Inc.

Competitive Analysis:

The tamping rammer machine market features a mix of global OEMs and regional manufacturers, competing on performance, durability, emission compliance, and pricing. Key players such as Wacker Neuson, Mikasa Sangyo, Bomag GmbH, Ammann Group, and Multiquip Inc. dominate with wide product portfolios and established service networks. It experiences steady competition in emerging markets where cost and maintenance play critical roles in buying decisions. Companies are focusing on innovation, particularly around electric and battery-powered models, to address evolving regulatory and operational needs. Partnerships with rental providers and expansion in developing regions strengthen market penetration. Aftermarket services and product customization are critical differentiators. The tamping rammer machine market continues to evolve as firms respond to shifting demand from infrastructure and urban construction sectors.

Recent Developments:

- In July 2025, Ammann showcased new compaction machines at RecyclingAktiv & TiefbauLive (RATL) in Karlsruhe, including updated electric tamping rammers like the eATR 68, which offers improved speed, torque control, and zero emissions. They also introduced attachment compactors with self-locking worm gear technology.

- In March 2024, Wacker Neuson launched an updated battery-powered tamping rammer featuring reduced vibration levels and extended runtime, targeting urban and indoor construction sites.

- In November 2023, Mikasa Sangyo Co., Ltd. introduced a new line of low-emission rammers designed for compliance with EU Stage V and Tier 4 Final regulations.

Market Concentration & Characteristics:

The tamping rammer machine market is moderately concentrated, with a few global players accounting for a significant share of total sales. It shows characteristics of both mature and emerging markets, depending on regional infrastructure investment and mechanization levels. Product differentiation focuses on performance, engine efficiency, emission levels, and ergonomic design. The market is driven by the growing shift from manual to mechanized compaction and the rising demand for compact, durable, and mobile solutions. Service capability and distributor presence strongly influence brand loyalty and repeat purchases.

Report Coverage:

The research report offers an in-depth analysis based on product type, power source, end use, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Battery-powered tamping rammers will gain strong traction in urban and indoor construction sites.

- Manufacturers will increase investment in low-emission and noise-reducing technologies.

- Rental and leasing demand will continue to grow, especially in cost-sensitive markets.

- Asia Pacific will emerge as a key growth region driven by rapid urbanization and infrastructure projects.

- Integration of remote diagnostics and telematics will improve equipment lifecycle management.

- Market players will expand aftermarket service offerings to retain customers.

- Compact and ergonomic designs will drive adoption among small contractors.

- Product innovation will focus on compliance with stricter environmental and safety standards.

- Strategic collaborations between OEMs and distributors will enhance market access.

- Digital platforms will support sales, rentals, and maintenance scheduling globally.