Market Overview

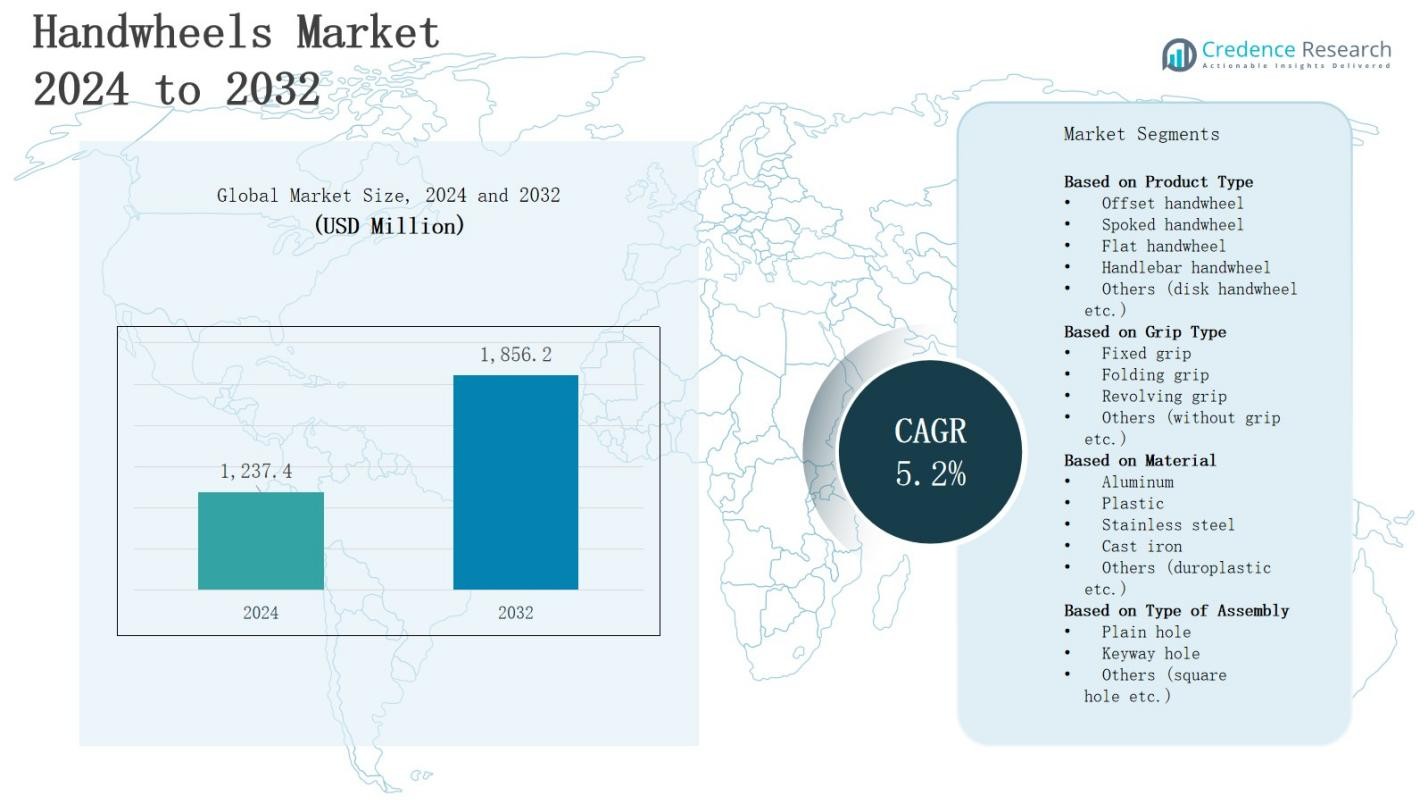

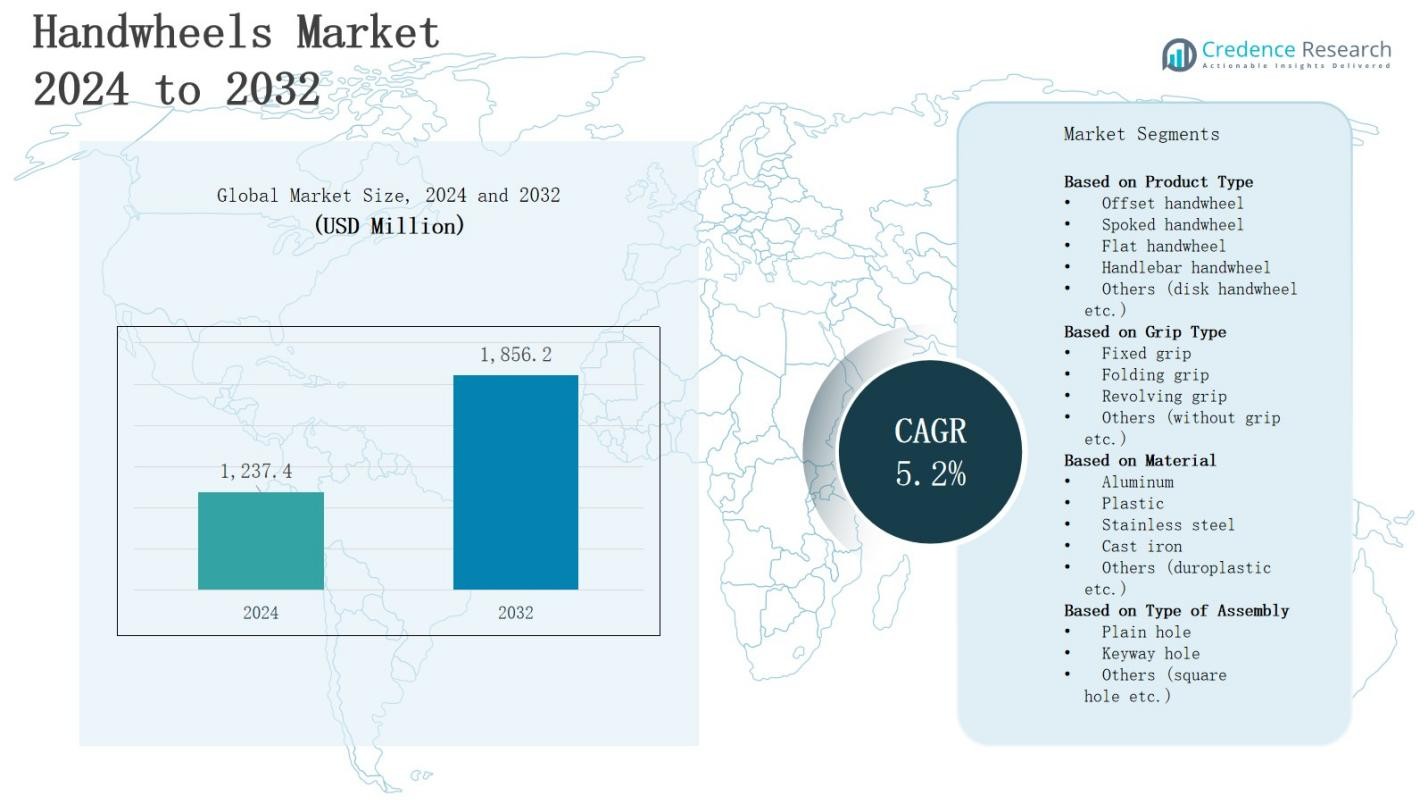

The handwheels market is projected to grow from USD 1,237.4 million in 2024 to USD 1,856.2 million by 2032, registering a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Handwheels Market Size 2024 |

USD 1,237.4 Million |

| Handwheels Market, CAGR |

5.2% |

| Handwheels Market Size 2032 |

USD 1,856.2 Million |

Market growth in the handwheels sector is driven by rising demand across manufacturing, machinery, and industrial equipment due to their reliability, ease of operation, and low maintenance requirements. Increasing automation in production facilities is boosting the need for ergonomic and precision control components. Advancements in materials, such as high-strength plastics and stainless steel, enhance durability and performance in harsh environments. Trends include the adoption of customizable and lightweight designs, integration with safety features, and growing use in sectors like food processing, packaging, and medical devices. Expanding industrialization in emerging economies further strengthens market adoption and global growth potential.

The handwheels market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each contributing to global demand through diverse industrial applications. Asia-Pacific leads with strong manufacturing growth, followed by North America and Europe with advanced industrial bases. Latin America sees rising adoption in food processing and packaging, while the Middle East & Africa benefit from oil, gas, and construction sectors. Key players include Elesa, Misumi, Alpha Engineering, OneMonroe, Norelem, Igus, KIPP, Jergens, Dandong Foundry, Imao Corporation, Carr Lane, and Erwin Halder.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The handwheels market is projected to grow from USD 1,237.4 million in 2024 to USD 1,856.2 million by 2032, registering a CAGR of 5.2% during the forecast period.

- Rising demand in manufacturing, automotive, packaging, and industrial machinery sectors drives market growth due to reliability, ease of operation, and low maintenance.

- Advancements in materials such as high-strength plastics, stainless steel, and corrosion-resistant alloys enhance durability, hygiene, and performance in harsh environments.

- Ergonomic and customizable designs with adjustable diameters, textured grips, and safety features boost adoption across industrial and commercial applications.

- Asia-Pacific leads with 38% market share, followed by North America at 24%, Europe at 22%, Latin America at 9%, and the Middle East & Africa at 7%.

- Market challenges include competition from automated control systems and volatility in raw material prices affecting production costs and supply stability.

- Key players include Elesa, Misumi, Alpha Engineering, OneMonroe, Norelem, Igus, KIPP, Jergens, Dandong Foundry, Imao Corporation, Carr Lane, and Erwin Halder.

Market Drivers

Rising Demand Across Industrial and Manufacturing Applications

The handwheels market is experiencing strong demand due to their widespread use in manufacturing machinery, valves, and equipment requiring manual control. It offers operators reliable functionality in environments where precision adjustments are critical. Industrial growth in automotive, packaging, and metalworking sectors continues to boost consumption. Manufacturers prefer handwheels for their simple operation, minimal maintenance, and cost-effectiveness. The expansion of industrial facilities worldwide further accelerates product adoption in diverse operational settings.

- For instance, Strahman Group engineered handwheel extensions to address difficult-to-access 16” and 18” gate valves in an industrial plant, improving operator safety and ease of use by allowing operation through railing without bending dangerously.

Advancements in Material Technology and Product Durability

Material innovations are a significant driver for the handwheels market, with manufacturers adopting high-strength plastics, stainless steel, and corrosion-resistant alloys. It enables handwheels to perform effectively in harsh industrial environments, including high-humidity and chemical-exposure conditions. Enhanced durability extends product life cycles, reducing replacement costs for end-users. Lightweight yet robust materials improve operator comfort and control. Industries with strict hygiene standards, such as food and pharmaceuticals, increasingly prefer these improved designs for safety and compliance.

- For instance, JW Winco produces three-spoked handwheels made from high-strength reinforced phenolic plastic and steel hub bushings, resistant to solvents, oils, and grease, ensuring reliable use in harsh environments.

Growing Preference for Ergonomic and Customizable Designs

The demand for ergonomic handwheel designs is increasing as operators seek reduced fatigue during repetitive tasks. It encourages manufacturers to focus on user-friendly shapes, textured grips, and smooth rotational performance. Customizable options, including adjustable diameters and handle positions, allow integration into specialized machinery. This flexibility benefits sectors like medical devices, precision engineering, and laboratory equipment. The rising emphasis on operator safety and comfort drives continued adoption across industrial and commercial applications.

Expansion of Emerging Markets and Industrialization

Rapid industrialization in Asia-Pacific, Latin America, and parts of Eastern Europe fuels growth in the handwheels market. It benefits from increasing infrastructure investment, manufacturing capacity expansion, and machinery modernization programs. Local manufacturers are also enhancing product availability and affordability. Government-backed industrial development initiatives create new procurement opportunities. As new industries emerge in these regions, the demand for dependable manual control mechanisms grows, supporting long-term market expansion and product innovation.

Market Trends

Integration of Modern Manufacturing Technologies in Production

The handwheels market is witnessing a shift toward precision manufacturing methods such as CNC machining and advanced molding techniques. It allows producers to achieve tighter tolerances, improved surface finishes, and consistent quality across batches. Automation in production lines supports higher output without compromising standards. Manufacturers are also leveraging computer-aided design for optimized ergonomics and structural strength. This technological integration reduces defects, enhances customization capabilities, and shortens lead times for diverse industry requirements.

- For instance, Bosch Rexroth produces handwheels with highly precise CNC-machined aluminum components, achieving tight tolerances and durable finishes essential for their industrial automation products.

Rising Adoption of Lightweight and Corrosion-Resistant Materials

The growing preference for lightweight materials like reinforced plastics and aluminum alloys is shaping product innovation. It ensures improved handling, reduced operator fatigue, and suitability for portable equipment. Corrosion-resistant metals such as stainless steel expand application potential in marine, chemical, and food industries. The combination of durability and reduced weight is driving replacement of traditional heavy-metal designs. Manufacturers continue to invest in research to enhance material performance while meeting regulatory compliance and industry safety standards.

- For instance, Boeing employs titanium alloys in aerospace components due to their exceptional strength-to-weight ratio and resistance to corrosive environments, particularly in engines and airframes, enabling longer service life and fuel efficiency.

Customization and Aesthetic Appeal in Industrial Components

Demand for customizable handwheel designs with varied colors, finishes, and grip types is increasing across industrial sectors. It enables companies to align equipment appearance with branding or ergonomic preferences. Industries with high-precision needs, such as medical devices and laboratory equipment, value design flexibility to fit unique operational requirements. Enhanced aesthetics also improve user experience in semi-public machinery environments. This trend supports premium product segments while encouraging differentiation among competitive manufacturers.

Growing Focus on Safety and Operator Comfort

The emphasis on workplace safety standards is influencing handwheel design and functionality. It drives manufacturers to introduce non-slip grips, smooth edges, and safety-coated surfaces to prevent operator injury. Ergonomically shaped handles reduce strain during repetitive use. Compliance with occupational safety guidelines encourages adoption in regulated industries. The integration of safety and comfort features into standard products strengthens customer trust and expands usage across sectors where manual control remains essential for precision operations.

Market Challenges Analysis

Rising Competition from Automated Control Systems

The handwheels market faces pressure from the increasing adoption of automated and motorized control systems in industrial machinery. It limits demand in sectors prioritizing high-speed operations and reduced manual intervention. Automated alternatives offer faster adjustment capabilities and integration with digital monitoring systems, appealing to advanced manufacturing setups. The shift toward Industry 4.0 further accelerates automation investment, reducing reliance on manual controls. To remain competitive, manufacturers must highlight the durability, cost-effectiveness, and precision advantages of handwheels in specific applications.

Fluctuations in Raw Material Prices and Supply Chain Constraints

Volatility in the prices of metals, alloys, and engineering plastics impacts production costs for the handwheels market. It challenges manufacturers in maintaining stable pricing while ensuring consistent quality. Supply chain disruptions, such as delays in material sourcing and transportation bottlenecks, hinder timely deliveries. These issues are intensified during periods of global trade instability or regional manufacturing slowdowns. Companies must adopt strategic sourcing, diversify suppliers, and improve inventory management to mitigate these challenges and sustain market presence.

Market Opportunities

Expansion in Emerging Industrial and Manufacturing Sectors

The handwheels market holds significant growth potential in rapidly industrializing regions such as Asia-Pacific, Latin America, and parts of Africa. It benefits from rising investments in manufacturing, infrastructure development, and machinery modernization programs. Growing small- and medium-scale enterprises in these regions create demand for affordable yet durable manual control components. Sectors like food processing, packaging, and metal fabrication present untapped opportunities. Strategic partnerships with regional distributors and localized production facilities can help manufacturers capture expanding customer bases.

Innovation in Ergonomic and Application-Specific Designs

Product innovation offers strong opportunities for market expansion, particularly through ergonomic and application-tailored designs. It allows manufacturers to cater to specialized needs in industries such as medical devices, marine equipment, and laboratory instrumentation. Integrating features like non-slip grips, adjustable diameters, and quick-release mechanisms enhances user comfort and efficiency. Eco-friendly materials and advanced coatings can attract environmentally conscious buyers. Leveraging customization and premium design options enables manufacturers to differentiate offerings and strengthen market positioning.

Market Segmentation Analysis:

By Product Type

The handwheels market is segmented into offset handwheel, spoked handwheel, flat handwheel, handlebar handwheel, and others such as disk handwheels. Offset and spoked variants dominate industrial machinery applications due to their strength and ease of control. Flat handwheels are favored in compact equipment where space efficiency is critical. Handlebar designs cater to applications requiring higher torque and grip control. Demand for specialized disk handwheels grows in precision engineering and niche mechanical systems.

- For instance, MasterMover, a provider of industrial handling solutions, supports manufacturers like Terex Omagh and Toyota Motor Manufacturing with specialized equipment integrating ergonomic hand control solutions to improve safety and efficiency in heavy equipment handling.

By Grip Type

Grip types include fixed grip, folding grip, revolving grip, and others such as models without grips. Fixed grips remain the most widely adopted due to their durability and consistent performance in heavy-duty environments. Folding grips offer space-saving benefits, particularly in portable or adjustable machinery. Revolving grips enhance operator comfort during repetitive motion. Gripless designs find applications in compact or aesthetic-focused equipment, appealing to sectors requiring minimalistic and sleek component integration.

- For instance, POMA’s Unifix fixed-grip chairlift demonstrates exceptional durability with up to 30,000 hours of operation without disassembly, making it reliable for heavy-duty environments like ski resorts.

By Material

Material segmentation covers aluminum, plastic, stainless steel, cast iron, and others such as duroplastic. Aluminum is valued for its lightweight strength and corrosion resistance, making it suitable for portable equipment. Plastic options are gaining traction for cost-effectiveness and chemical resistance in non-heavy-duty applications. Stainless steel remains preferred in food, pharmaceutical, and marine sectors for hygiene and durability. Cast iron continues to serve heavy industrial uses due to its robustness, while duroplastic offers enhanced dimensional stability and insulation properties.

Segments:

Based on Product Type

- Offset handwheel

- Spoked handwheel

- Flat handwheel

- Handlebar handwheel

- Others (disk handwheel etc.)

Based on Grip Type

- Fixed grip

- Folding grip

- Revolving grip

- Others (without grip etc.)

Based on Material

- Aluminum

- Plastic

- Stainless steel

- Cast iron

- Others (duroplastic etc.)

Based on Type of Assembly

- Plain hole

- Keyway hole

- Others (square hole etc.)

Based on End Use Industry

- Automotive

- Oil & gas

- Food & beverage

- Manufacturing industry

- Construction

- Others (pharmaceuticals etc.)

Based on Distribution Channel

- Direct sales

- Indirect sales

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 24% of the handwheels market, driven by strong demand in manufacturing, automotive, and industrial machinery sectors. It benefits from advanced production facilities and a focus on ergonomic, high-precision components. The presence of established manufacturers and steady investment in equipment modernization supports regional growth. Adoption in food processing and pharmaceutical industries remains high due to stringent safety standards. Expanding renewable energy and marine applications further contribute to market expansion. The region continues to prioritize product innovation and compliance with regulatory requirements.

Europe

Europe holds 22% of the handwheels market, supported by robust industrial infrastructure and a mature machinery manufacturing base. It benefits from high adoption in automotive, marine, and packaging equipment applications. Demand is driven by strict quality standards and the use of advanced materials like stainless steel and aluminum. The region’s focus on energy-efficient and safe machinery boosts product upgrades. It also experiences strong growth in medical device and laboratory equipment manufacturing. Expansion in Eastern Europe’s industrial sector adds to overall market development.

Asia-Pacific

Asia-Pacific dominates with 38% share of the handwheels market, led by rapid industrialization and manufacturing growth in China, India, and Southeast Asia. It benefits from large-scale infrastructure projects and rising investments in machinery production. Growing small- and medium-scale manufacturing units increase demand for cost-effective manual control solutions. Local production capabilities and competitive pricing strengthen the region’s export potential. Adoption is also expanding in agriculture, textile, and construction equipment manufacturing. Continuous capacity expansion and technology upgrades sustain market leadership.

Latin America

Latin America represents 9% of the handwheels market, with demand concentrated in Brazil, Mexico, and Argentina. It benefits from growing food processing, mining, and packaging industries. Rising investment in manufacturing and infrastructure projects boosts equipment procurement. Local manufacturing capabilities are expanding, although high import dependency still influences pricing. The adoption of corrosion-resistant materials is increasing in marine and chemical applications. The region’s industrial modernization initiatives continue to create opportunities for premium product segments.

Middle East & Africa

The Middle East & Africa holds 7% of the handwheels market, driven by demand in oil and gas, marine, and construction sectors. It benefits from ongoing infrastructure projects and industrial diversification programs. Heavy-duty applications in mining and manufacturing support product usage. The region increasingly adopts stainless steel and cast iron variants for durability in harsh environments. Growing investment in manufacturing hubs in GCC countries and South Africa is supporting regional expansion. It remains a developing but promising market segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Elesa

- Misumi

- Alpha Engineering

- OneMonroe

- Norelem

- Igus

- KIPP

- Jergens

- Dandong Foundry

- Imao Corporation

- Carr Lane

- Erwin Halder

Competitive Analysis

The handwheels market is characterized by a mix of global manufacturers and specialized regional suppliers competing through product quality, customization, and material innovation. It is driven by demand from diverse sectors such as manufacturing, packaging, marine, and medical equipment. Leading players including Elesa, Misumi, Alpha Engineering, OneMonroe, Norelem, Igus, KIPP, Jergens, Dandong Foundry, Imao Corporation, Carr Lane, and Erwin Halder focus on expanding portfolios with ergonomic designs, corrosion-resistant materials, and application-specific variants. Companies leverage CNC machining, advanced molding, and precision engineering to improve durability and performance. Strategic initiatives include partnerships with distributors, entry into emerging markets, and investment in automation to enhance production efficiency. Competitive differentiation is often achieved through offering multiple grip types, lightweight materials, and compliance with safety standards. Regional players strengthen their presence by offering cost-effective solutions tailored to local industrial needs, while global brands target high-value segments through premium products. Continuous innovation, strong supply chains, and customer-focused customization remain essential for sustaining leadership in this market.

Recent Developments

- In 2025, igus introduced its drygear worm gear series, featuring versions with handwheel integration, ball bearings, and slewing ring bearings—ensuring user-friendly operation and precise component positioning.

- In April 2024, Misumi, a trusted supplier of industrial automation and automotive components, announced the launch of its D-JIT Supported by over 400 suppliers worldwide, the platform will deliver real-time inventory and production data, with additional global partners expanding its coverage.

- In July 2025, Valworx unveiled a new line of pneumatic/manual combination actuators equipped with integrated handwheels. These units support pneumatic, manual, or stroke‑limited operations and offer compact installation with ISO5211 compatibility.

Market Concentration & Characteristics

The handwheels market exhibits moderate concentration, with a mix of global leaders and regional manufacturers competing through product quality, customization, and sector-specific expertise. It is characterized by steady demand from industries such as manufacturing, automotive, packaging, marine, and medical equipment. Key players focus on innovation in ergonomic designs, lightweight materials, and corrosion-resistant finishes to meet diverse operational needs. Regional suppliers strengthen market presence by offering cost-effective solutions tailored to local industries, while global brands target premium segments with advanced features. The market benefits from stable replacement demand, wide product applicability, and strong integration into industrial machinery supply chains. Competitive differentiation often depends on manufacturing precision, compliance with industry standards, and the ability to deliver customized solutions for specialized applications.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Grip Type, Material, Type of Assembly, End-Use Industry, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will increase as emerging economies continue rapid industrialization and expand manufacturing infrastructure.

- Manufacturers will prioritize ergonomic handwheel designs to enhance operator comfort and reduce workplace fatigue.

- Adoption of corrosion-resistant, lightweight materials will grow to meet performance and durability requirements.

- Customization options will drive competitiveness, enabling tailored solutions for specialized industrial applications and machinery.

- Usage in food processing and pharmaceutical sectors will expand due to strict hygiene regulations.

- Replacement demand will sustain growth as industries modernize machinery and upgrade manual control systems.

- Integration of enhanced safety features will shape product innovation and influence buyer purchasing decisions.

- Regional manufacturers will strengthen market share by offering cost-effective and locally optimized solutions.

- Global brands will capture premium segments through advanced materials and high-precision manufacturing capabilities.

- Supply chain efficiency improvements will help mitigate risks from raw material cost fluctuations and shortages.