Market overview

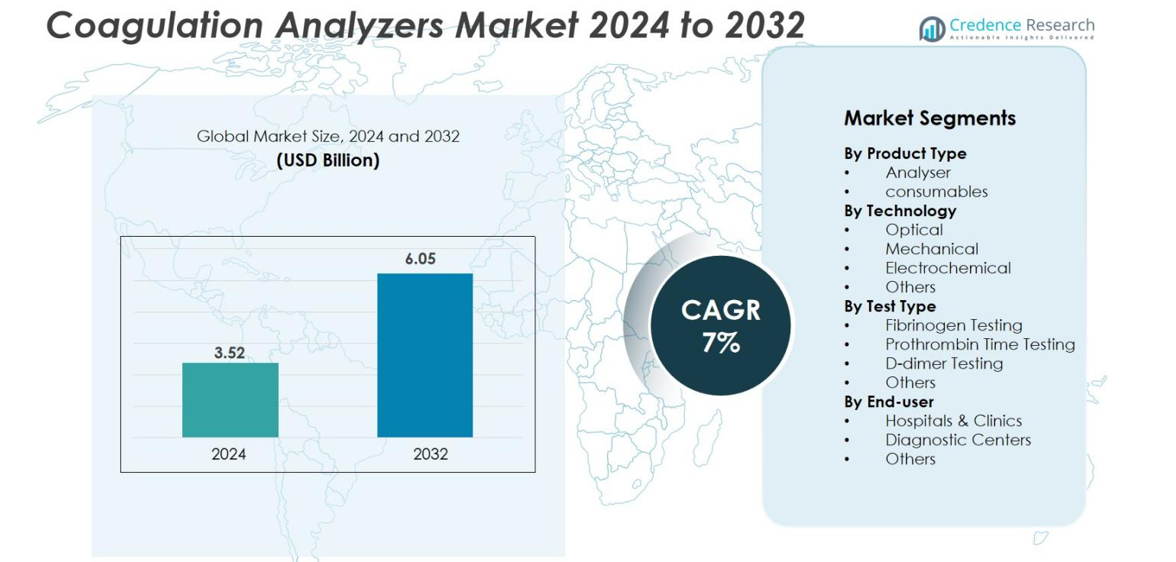

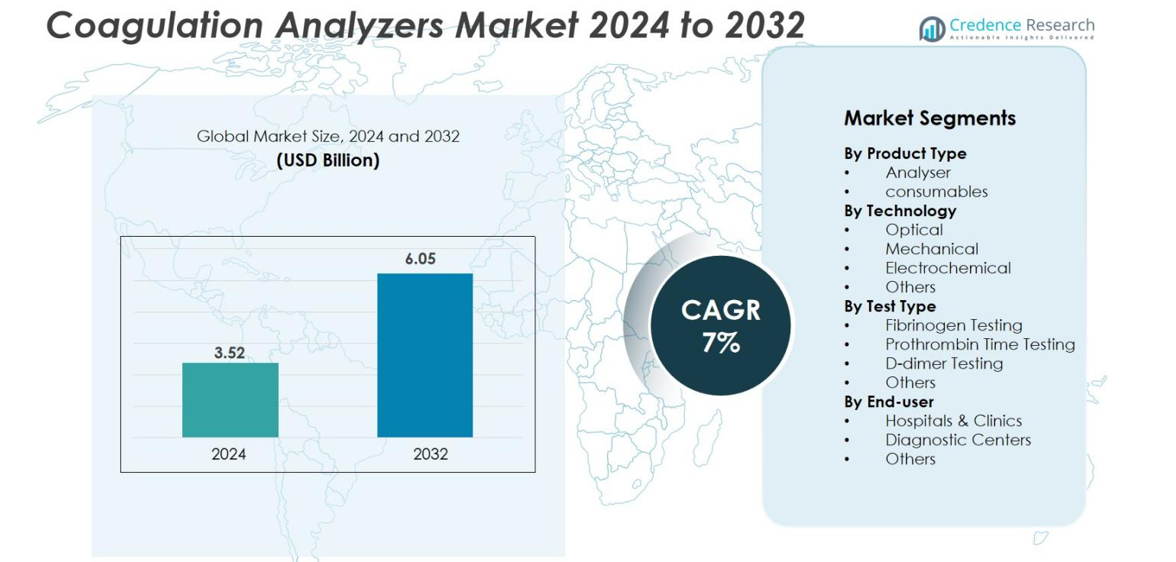

The Coagulation Analyzers market size was valued at USD 3.52 billion in 2024 and is anticipated to reach USD 6.05 billion by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coagulation Analyzers Market Size 2024 |

USD 3.52 billion |

| Coagulation Analyzers Market, CAGR |

7% |

| Coagulation Analyzers Market Size 2032 |

USD 6.05 billion |

The coagulation analyzers market sees strong competitive presence from key players such as Abbott Laboratories, Roche Diagnostics (F. Hoffmann‑La Roche Ltd.), HORIBA Ltd., Mindray Bio‑Medical Electronics Co., Ltd., and Randox Laboratories Ltd.. These firms command leadership through advanced technology portfolios, global distribution networks and strong reagent ecosystems. Regionally, North America leads with a share of approximately 42.7% in 2024, driven by high healthcare spending, prevalence of coagulation disorders, and strong laboratory infrastructure. The Asia Pacific region follows as a fast‑growing opportunity zone, and Europe holds the second largest share globally.

Market Insights

- The Coagulation Analyzers market was valued at USD 3.52 billion in 2024 and is projected to reach USD 6.05 billion by 2032, growing at a CAGR of 7% during the forecast period.

- Key drivers include the rising prevalence of coagulation disorders, increasing healthcare access in emerging markets, and technological advancements in testing platforms.

- Key trends show a growing adoption of point-of-care testing and integration of AI in coagulation testing, enhancing accuracy and speed.

- The competitive landscape is dominated by companies like Abbott Laboratories, Roche Diagnostics, and Siemens Healthineers, which hold significant market shares, with North America leading at 42.7% of the global market share in 2024.

- Regional growth is robust in Asia Pacific, driven by increased healthcare spending, while challenges include high costs and regulatory hurdles in certain regions, limiting faster adoption in price-sensitive markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Type

The Coagulation Analyzers market is segmented into analyzers and consumables. The analyzer segment holds the largest market share, accounting for approximately 65% in 2024. This dominance is driven by the increasing demand for accurate and rapid testing capabilities in hospitals and diagnostic centers. Consumables, including reagents and test kits, also show steady growth as they are crucial for continuous use in coagulation testing. The rise in chronic diseases like cardiovascular disorders fuels the demand for both analyzers and consumables, ensuring a sustainable market for these products.

- For instance, the Autobio Ci-310 automated coagulation analyzer supports up to 300 tests per hour using advanced four-wavelength optical technology, making it ideal for medium to high-volume laboratories.

By Technology

The technology segment in the Coagulation Analyzers market includes optical, mechanical, electrochemical, and others. Optical technology leads the market, with an estimated market share of 45%. This is due to its high accuracy and non-invasive nature, making it suitable for point-of-care testing. Electrochemical and mechanical technologies follow, offering benefits like ease of integration and cost-effectiveness, respectively. As healthcare systems prioritize precision, optical coagulation analyzers are expected to continue leading the market, driven by advancements in optical sensors and diagnostic tools.

- For instance, Abbott’s Sekisui CP3000 system uses optical detection combined with automation to offer accurate and rapid coagulation testing, enhancing lab efficiency through standardized sample management.

By Test Type

The test type segment comprises fibrinogen testing, prothrombin time testing, D-dimer testing, and others. Prothrombin time testing holds the largest market share, approximately 40%, due to its frequent use in routine blood coagulation diagnostics. Fibrinogen testing and D-dimer testing are also gaining traction, driven by their importance in monitoring clotting disorders such as hemophilia and deep vein thrombosis. The increased prevalence of these conditions and the need for early detection contribute to the growing demand for these specific test types across healthcare facilities globally.

Key Growth Drivers

Increasing Prevalence of Coagulation Disorders

The rising prevalence of coagulation disorders such as hemophilia, deep vein thrombosis, and cardiovascular diseases is a major growth driver for the Coagulation Analyzers market. As these conditions require frequent monitoring of blood clotting profiles, healthcare systems globally are investing in advanced coagulation testing solutions. According to recent statistics, cardiovascular diseases alone account for a significant portion of global mortality, heightening the need for regular coagulation testing. Moreover, the increasing awareness and early diagnosis of such conditions have led to the growing adoption of coagulation analyzers in hospitals, diagnostic centers, and clinics.

- For instance, Deep vein thrombosis incidence in orthopedic patients can range from 40% to 60% without anticoagulation therapy, underlining the need for frequent coagulation monitoring.

Technological Advancements in Coagulation Testing

Technological innovations in coagulation testing are transforming the Coagulation Analyzers market. The adoption of advanced technologies such as optical, electrochemical, and mechanical methods for blood coagulation testing is driving the growth of the market. Optical coagulation analyzers, in particular, are gaining popularity due to their accuracy, ease of use, and non-invasive nature. These advancements allow for faster, more precise testing, significantly improving patient outcomes. Additionally, miniaturization and the development of point-of-care testing devices are broadening the market’s scope, particularly in remote and underdeveloped regions.

- For instance, Miniaturization efforts are exemplified by the development of the mHemoRetractoMeter (mHRM), a small, low-cost device that measures clot retraction forces in real time using minute blood samples, showing promise for point-of-care testing especially in resource-limited settings.

Growing Demand for Point-of-Care Testing

The increasing demand for point-of-care (POC) testing in healthcare is fueling the growth of the Coagulation Analyzers market. With an increasing focus on delivering faster and more accurate results at the patient’s location, POC testing devices are becoming integral in clinical settings, including emergency departments, outpatient clinics, and home care environments. These devices offer immediate results, minimizing delays in treatment decisions, which is especially critical in coagulation disorders. The need for quick diagnoses in critical care situations is a significant driver, pushing healthcare providers to adopt portable and easy-to-use coagulation analyzers.

Key Trends & Opportunities

Integration of Artificial Intelligence in Coagulation Testing

One of the emerging trends in the Coagulation Analyzers market is the integration of artificial intelligence (AI) and machine learning (ML) into coagulation testing systems. These technologies are enhancing the diagnostic accuracy and efficiency of analyzers, enabling better interpretation of complex coagulation profiles. AI algorithms can analyze large sets of data to identify patterns that may be overlooked by manual interpretation. This results in faster and more accurate diagnoses, particularly in the case of rare or complex coagulation disorders. Moreover, AI-powered coagulation analyzers can predict patient responses to treatments, providing a personalized approach to healthcare.

- For instance, AI models developed by researchers have achieved up to 97% accuracy in identifying clotted blood specimens, reducing the risk of erroneous test results.

Expansion of Home-based Coagulation Monitoring

There is a growing opportunity in the expansion of home-based coagulation monitoring. With advancements in miniaturized testing devices, patients can now monitor their coagulation status at home, especially those with chronic conditions like anticoagulation therapy. The ability to test at home offers convenience and reduces the need for frequent hospital visits, enhancing patient compliance and treatment outcomes. This trend aligns with the broader shift toward remote patient monitoring, allowing for continuous health tracking without the need for in-person visits. As more patients take control of their health from home, the demand for at-home coagulation analyzers will increase. Healthcare providers are also benefiting from this trend by improving care efficiency and reducing hospital congestion.

- For instance, Roche Diagnostics’ CoaguChek system allows patients to accurately self-test their International Normalized Ratio (INR) from home, improving treatment adherence while maintaining results comparable to laboratory standards and reducing frequent clinic visits.

Key Challenges

High Cost of Advanced Coagulation Analyzers

A major challenge faced by the Coagulation Analyzers market is the high cost of advanced analyzers and testing devices. While technological innovations, such as optical and electrochemical systems, have significantly improved the accuracy and efficiency of coagulation testing, the initial investment required for these devices is substantial. For many healthcare facilities, particularly in developing regions, the high upfront cost of these machines can be a barrier to adoption. Additionally, maintenance and consumables for these systems can add to the long-term expenses. This presents a challenge for hospitals, diagnostic centers, and other healthcare providers who may have limited budgets but still require advanced testing equipment.

Regulatory and Compliance Issues

The Coagulation Analyzers market faces challenges related to regulatory and compliance issues, particularly in regions with stringent healthcare regulations. The approval and certification process for new coagulation testing devices can be lengthy and costly, delaying the introduction of innovative products to the market. In addition, manufacturers must ensure that their products comply with varying regulatory requirements across different countries, which can be complex and time-consuming. Non-compliance with regulatory standards can result in product recalls, fines, or delays in market access, impacting both revenue and brand reputation. As the market grows and diversifies, navigating the complex regulatory landscape remains a critical challenge for manufacturers and distributors aiming for global reach.

Regional Analysis

North America

In 2024, North America led the coagulation analyzers market with a share of 42.7%. The region’s dominance is driven by a strong presence of advanced healthcare systems, high incidence of cardiovascular and bleeding disorders, and rapid adoption of sophisticated coagulation testing platforms. High healthcare expenditures and frequent use of anticoagulation therapies further propel growth. Continued investment in diagnostics and laboratory automation is expected to sustain North America’s leading position over the forecast period.

Europe

Europe holds the second-largest regional share in the coagulation analyzers market, with an approximate share of 28.3%. Growth in Europe is supported by well-established healthcare infrastructure, rising awareness of blood clotting disorders, and increasing investments in diagnostic technologies. Additional factors such as favorable reimbursement frameworks and regulatory support for advanced diagnostics contribute to steady demand in both hospital and outpatient settings across major European countries.

Asia Pacific

The Asia Pacific region is the fastest-growing market for coagulation analyzers, projected to register strong growth with a share of 18.5% in 2024. Growth is driven by the increasing prevalence of cardiovascular and thrombotic disorders, rising geriatric populations, and improving healthcare infrastructure in countries like China, India, and Japan. Government initiatives and expanding diagnostic capacity support the uptake of coagulation testing devices, positioning the region as a key opportunity for market expansion.

Latin America

Latin America accounts for a smaller share of the global coagulation analyzers market, 6.5%, but presents meaningful growth potential. Factors such as increasing healthcare access, a growing incidence of bleeding/clotting disorders, and rising diagnostic awareness are supporting market expansion. However, adoption is still constrained by limited budgets, infrastructure gaps, and slower uptake of high-end diagnostic platforms compared to more developed regions.

Middle East & Africa

The Middle East & Africa region holds a modest share of 4.0% of the global coagulation analyzers market. However, there is considerable room for growth, driven by improving healthcare infrastructure, rising chronic disease burden, and increased governmental focus on diagnostics. Challenges such as limited laboratory capacity, higher cost sensitivity, and slower technology adoption may temper growth relative to more mature markets.

Market Segmentations

By Product Type

By Technology

- Optical

- Mechanical

- Electrochemical

- Others

By Test Type

- Fibrinogen Testing

- Prothrombin Time Testing

- D-dimer Testing

- Others

By End-user

- Hospitals & Clinics

- Diagnostic Centers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the global coagulation analyzers market features a concentrated structure with key players holding substantial influence. Leading companies such as F. Hoffmann‑La Roche Ltd., Siemens Healthineers AG, Abbott Laboratories, Danaher Corporation (via Beckman Coulter), Sysmex Corporation and HORIBA Ltd. dominate the market through broad product portfolios, strong installed bases, and global distribution networks. These firms emphasise innovation—including automation, connectivity, and reagent/method advancement—to differentiate offerings and capture market share. Strategic initiatives such as mergers, acquisitions, joint ventures and geographic expansion further strengthen positions. Mid‑sized players such as Werfen Group and Diagnostic Stago SAS compete by targeting niche segments, increasing agility and regional focus. Overall, competitive pressure remains high, with performance tied to R&D investment, service networks and the ability to address cost‑sensitive markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DiaSys

- Roche

- RANDOX

- HemoSonics

- iLine

- Abbott

- mindray

- HELENA LABORATORIES

- HORIBA

- Erba Mannheim

Recent Developments

- In April 2025, Sysmex Corporation commenced operations at its new production facility in India, establishing the Group’s first site capable of manufacturing both diagnostic reagents and instruments.

- In September 2024, Sysmex Corporation launched the HISCL™ HIT IgG Assay Kit in Japan, designed to detect IgG antibodies against complexes formed between platelet factor 4 and heparin.

- In February 2024, Hoffmann–La Roche Ltd. introduced three new coagulation tests to support monitoring of oral Factor Xa inhibitors, including apixaban, edoxaban, and others.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Test Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is poised to expand significantly, supported by growing global demand for coagulation monitoring driven by aging populations and increased chronic disease prevalence.

- Adoption of point‑of‑care coagulation analyzers will accelerate as healthcare systems focus on value‑based care and rapid diagnostics at the patient bedside.

- Consumables including reagents and test kits will continue to represent a large share of revenue, with frequent usage fostering recurring business for manufacturers.

- Optical technology will sustain dominance in the technology segment, while electrochemical and viscoelastic technologies will gain traction by offering faster results and improved sensitivity.

- Hospitals and diagnostic centers will remain primary end‑users, yet diagnostic labs in emerging markets will capture rising share as infrastructure expands.

- The Asia‑Pacific region will outperform other geographies in growth rate, while North America will retain the largest share due to mature healthcare systems.

- Integrating artificial intelligence and connectivity into analyzers will create opportunities for predictive diagnostics and workflow optimization.

- Partnerships and mergers between technology firms and reagent‑suppliers will intensify as players seek comprehensive solutions and stronger market positioning.

- Cost pressures and regulatory complexity will drive innovation toward compact, lower‑cost systems suited for decentralized settings and resource‑limited regions.

- Manufacturers that deliver modular, scalable platforms capable of supporting multiple coagulation tests will lead the market by offering breadth and flexibility.