Market Overview

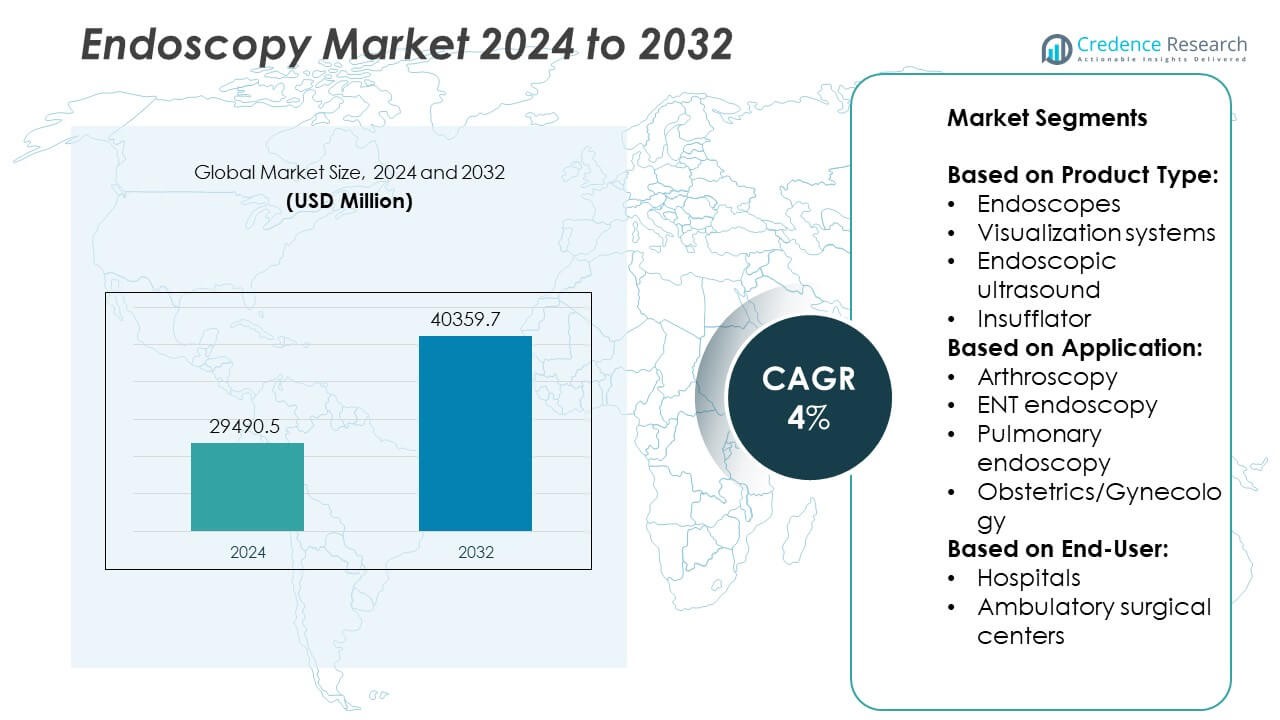

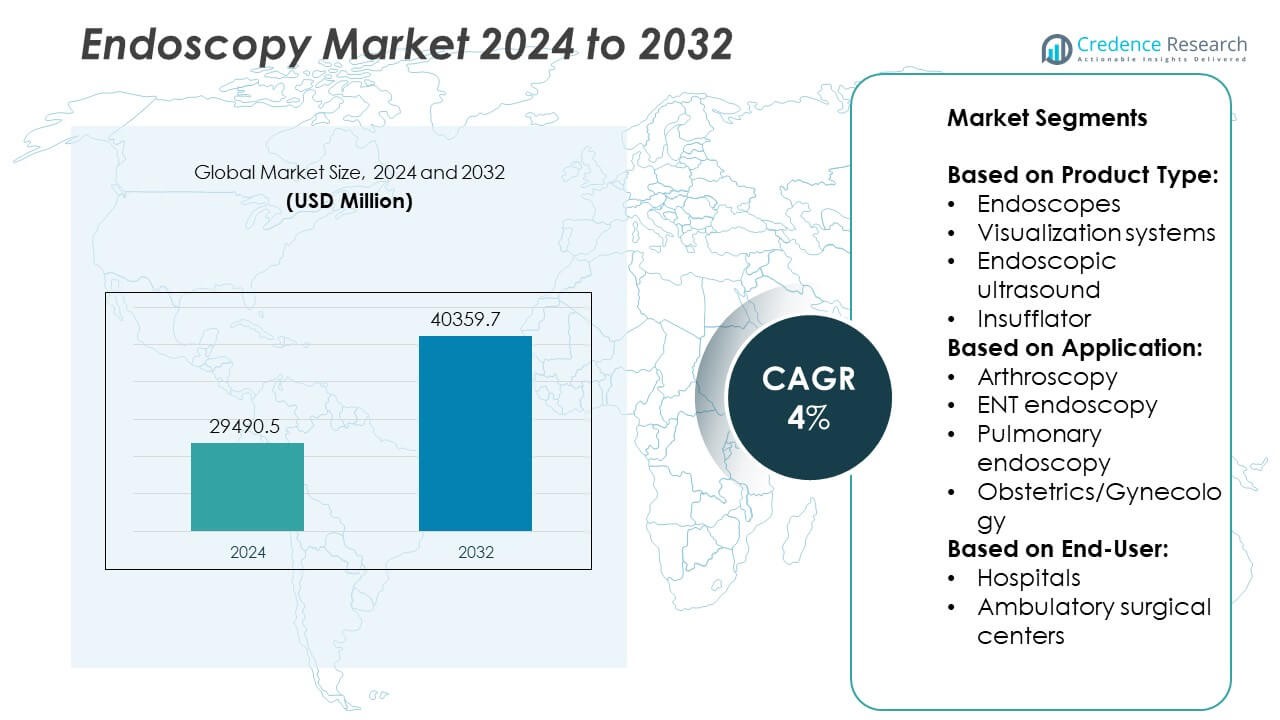

The Endoscopy Market size was valued at USD 29,490.5 million in 2024 and is anticipated to reach USD 40,359.7 million by 2032, growing at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Endoscopy Market Size 2024 |

USD 29,490.5 Million |

| Endoscopy Market, CAGR |

4% |

| Endoscopy Market Size 2032 |

USD 40,359.7 Million |

The Endoscopy market experiences strong growth driven by technological advancements such as high-definition imaging and disposable endoscopes that improve diagnostic accuracy and patient safety. Rising prevalence of chronic diseases and an expanding geriatric population increase demand for minimally invasive diagnostic and therapeutic procedures. Growing awareness of preventive healthcare and government initiatives promoting early disease detection further boost market adoption. Trends include rapid integration of artificial intelligence to enhance real-time diagnostics and the expansion of telemedicine platforms, which extend specialist access to remote areas. Together, these factors accelerate innovation and broaden the market’s clinical applications worldwide.

The Endoscopy market demonstrates strong presence across North America, Europe, and Asia-Pacific, driven by advanced healthcare infrastructure and growing demand for minimally invasive procedures. North America leads with significant adoption of cutting-edge technologies, while Asia-Pacific shows rapid growth due to improving healthcare access and increasing chronic disease prevalence. Key players shaping the market include Olympus, KARL STORZ, Johnson & Johnson, and Boston Scientific.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Endoscopy market was valued at USD 29,490.5 million in 2024 and is projected to reach USD 40,359.7 million by 2032, growing at a CAGR of 4% during the forecast period.

- Technological advancements such as high-definition imaging and disposable endoscopes drive market growth by improving diagnostic accuracy and patient safety.

- Increasing prevalence of chronic diseases and expanding geriatric populations fuel demand for minimally invasive diagnostic and therapeutic procedures.

- Integration of artificial intelligence and telemedicine platforms enhances real-time diagnostics and expands access to specialized care in remote regions.

- The market faces challenges from high equipment costs and strict regulatory requirements, which slow adoption in price-sensitive and developing markets.

- North America and Europe dominate due to advanced healthcare infrastructure and favorable reimbursement policies, while Asia-Pacific shows rapid growth with improving healthcare facilities.

- Major players like Olympus, KARL STORZ, Johnson & Johnson, and Boston Scientific invest heavily in R&D to introduce innovative products and strengthen their global market position.

Market Drivers

Key Factors Driving Growth in the Endoscopy Market Include Technological Advancements and Rising Prevalence of Chronic Diseases

Technological advancements in endoscopic equipment have significantly propelled market growth. Innovations such as high-definition imaging, flexible endoscopes, and disposable devices improve diagnostic accuracy and patient safety. These enhancements facilitate minimally invasive procedures, reducing recovery time and hospital stays. Increasing prevalence of chronic diseases like gastrointestinal disorders, cancer, and respiratory conditions creates a strong demand for early diagnosis and treatment through endoscopy. Hospitals and diagnostic centers prioritize investment in advanced endoscopic tools to meet clinical needs and improve patient outcomes.

- For instance, Medtronic’s AI-enabled endoscopy platform processes over 2000 images per procedure, assisting clinicians in identifying subtle mucosal changes and reducing miss rates during colorectal cancer screenings.

Expanding Geriatric Population and Growing Awareness of Preventive Healthcare Boost Market Demand

The growing geriatric population worldwide drives demand for endoscopic procedures since older adults face higher risks of conditions that require minimally invasive diagnosis. Increased health awareness among patients and healthcare providers encourages regular screenings and early interventions. Governments and private organizations promote preventive healthcare programs that include endoscopic examinations for cancer screening and other chronic diseases. The rising acceptance of outpatient procedures due to shorter recovery times and cost efficiency also contributes to greater utilization of endoscopy services.

- For instance, Olympus launched its EVIS X1 endoscopy system featuring enhanced image processing at 60 frames per second, improving lesion detection and enabling real-time diagnostics.

Rising Investments in Healthcare Infrastructure and Favourable Reimbursement Policies Stimulate Market Expansion

Many countries have increased healthcare spending and expanded infrastructure, leading to enhanced availability of endoscopic services. Improved access to modern medical facilities allows more patients to benefit from endoscopic diagnostics and treatments. Insurance providers and government bodies offer favourable reimbursement policies that reduce out-of-pocket expenses for patients. This financial support encourages healthcare providers to adopt advanced endoscopic technologies and increase procedure volumes. It also helps in overcoming cost barriers that previously limited widespread adoption of endoscopy.

Increasing Integration of Artificial Intelligence and Digital Technologies in Endoscopic Procedures

The integration of artificial intelligence (AI) and digital technologies enhances the capabilities of endoscopy systems. AI-powered image analysis aids clinicians in detecting abnormalities with higher precision and speed. Digital documentation and telemedicine platforms improve data management and remote consultation opportunities. These advancements improve diagnostic confidence and streamline workflow efficiency in healthcare settings. The market benefits from continuous innovation that supports better clinical decision-making and patient care through endoscopic methods.

Market Trends

Rapid Adoption of Minimally Invasive Procedures and Patient-Centric Technologies in the Endoscopy Market

The growing preference for minimally invasive procedures drives significant trends within the endoscopy market. These procedures reduce patient discomfort and shorten recovery periods, leading to higher acceptance rates among both patients and healthcare providers. Endoscopic technologies continue to evolve with enhanced imaging capabilities and improved maneuverability, enabling more precise diagnostics and interventions. Healthcare facilities focus on integrating patient-centric devices that ensure safety and improve clinical outcomes. The shift toward outpatient care settings also fuels demand for portable and user-friendly endoscopic equipment. It reflects broader efforts to optimize healthcare delivery and reduce overall treatment costs.

- For instance, Ambu’s single-use bronchoscope models have been utilized in over 1 million procedures, demonstrating significant adoption due to their ease of use and infection control benefits.

Expansion of Disposable and Single-Use Endoscopes to Address Infection Control Challenges

Infection control remains a critical concern in healthcare, influencing endoscopy market trends toward disposable and single-use devices. These devices reduce cross-contamination risks, enhance procedural safety, and minimize the need for complex sterilization processes. Hospitals increasingly adopt single-use endoscopes to comply with stringent hygiene protocols and reduce hospital-acquired infections. Manufacturers invest in developing cost-effective disposable solutions without compromising device performance. It also supports faster procedure turnover and operational efficiency in high-volume clinical settings. The growing regulatory focus on patient safety accelerates acceptance of these disposable technologies worldwide.

- For instance, Karl Storz offers a telemedicine platform that supports real-time video streaming and remote procedure assistance, connecting over 500 healthcare facilities worldwide.

Integration of Advanced Imaging Technologies and Artificial Intelligence for Enhanced Diagnostic Accuracy

Advanced imaging technologies such as high-definition cameras, narrow-band imaging, and 3D visualization gain traction in the endoscopy market. These tools improve lesion detection, characterization, and treatment planning. Artificial intelligence integration further refines diagnostic precision by assisting in real-time anomaly recognition and risk assessment. Such innovations reduce human error and enhance clinical decision-making during endoscopic procedures. Hospitals and clinics prioritize investments in these technologies to improve patient outcomes and streamline workflows. It marks a transition toward smarter, data-driven healthcare practices in endoscopy.

Growing Adoption of Telemedicine and Remote Consultation Platforms to Expand Access to Endoscopic Services

Telemedicine and remote consultation platforms increasingly complement traditional endoscopic services. These digital tools enable specialists to provide real-time guidance and second opinions during procedures, improving diagnostic accuracy. Remote access facilitates care delivery in underserved or rural areas where specialist availability remains limited. It supports collaborative healthcare models and enhances patient management across different locations. The endoscopy market benefits from these advancements by expanding its reach and optimizing resource utilization. Continued digital transformation within healthcare systems drives further integration of tele-endoscopy solutions.

Market Challenges Analysis

High Costs and Complex Regulatory Requirements Limit Growth Potential in the Endoscopy Market

The high costs associated with advanced endoscopic equipment and procedures present a significant challenge to market expansion. Healthcare providers in developing regions often face budget constraints that restrict acquisition of cutting-edge devices. The complexity of manufacturing and maintaining sophisticated endoscopy systems adds to overall expenses. Strict regulatory requirements and lengthy approval processes further delay product launches and increase compliance costs for manufacturers. These factors create barriers to entry for smaller companies and slow adoption rates in price-sensitive markets. It forces providers to balance cost efficiency with the need for high-quality diagnostic tools. Overcoming these financial and regulatory hurdles remains critical for sustained market growth.

Shortage of Skilled Professionals and Limited Awareness Impact Adoption of Endoscopic Procedures

The shortage of trained endoscopy specialists limits the availability and accessibility of these procedures in many regions. Training programs require time and resources, and insufficient skilled personnel restrict the volume of endoscopic diagnostics and treatments. Limited awareness about the benefits of early detection through endoscopy affects patient demand and screening rates. Healthcare facilities may hesitate to invest heavily in endoscopic technologies without a skilled workforce to operate them efficiently. It also challenges efforts to integrate advanced procedures into routine clinical practice. Bridging the gap in education and raising awareness about endoscopic applications are essential to unlock the full potential of the market.

Market Opportunities

Expanding Demand for Early Disease Detection and Minimally Invasive Treatment Options Offers Significant Opportunities in the Endoscopy Market

The growing emphasis on early diagnosis of chronic diseases creates substantial opportunities for the endoscopy market. Increasing incidence of gastrointestinal disorders, cancer, and respiratory illnesses drives demand for reliable and less invasive diagnostic tools. Healthcare providers focus on integrating endoscopic procedures to enable timely interventions and improve patient outcomes. Rising patient preference for minimally invasive treatments with shorter recovery times supports broader adoption of endoscopy technologies. It encourages manufacturers to innovate devices that enhance procedural efficiency and patient comfort. Expansion of screening programs and preventive healthcare initiatives further boosts market potential worldwide.

Emerging Markets and Technological Innovations Provide New Avenues for Market Expansion

Emerging economies present a promising landscape for endoscopy market growth due to improving healthcare infrastructure and rising healthcare expenditure. Increased government initiatives to enhance medical facilities and accessibility create favorable conditions for endoscopy adoption. Technological innovations such as artificial intelligence, disposable endoscopes, and tele-endoscopy open new frontiers in diagnostics and patient care. These advancements enable more accurate detection, reduce infection risks, and extend specialized services to remote areas. It positions the market to capitalize on unmet clinical needs and growing demand in underserved regions. Continuous investment in research and development will drive sustained expansion and competitive advantage.

Market Segmentation Analysis:

By Product Type:

Endoscopes hold a dominant position due to their essential role in performing minimally invasive diagnostic and therapeutic procedures. Visualization systems complement endoscopes by providing high-definition imaging, enabling accurate diagnosis and treatment planning. Endoscopic ultrasound devices combine endoscopy with ultrasound imaging, enhancing capabilities for detecting and staging cancers and other internal abnormalities. Insufflators play a critical role by maintaining adequate cavity inflation during procedures, ensuring better visibility and maneuverability for clinicians. Each product type addresses specific clinical needs, driving demand based on technological sophistication and procedure complexity.

- For instance, Medtronic’s GI Genius system provides real-time lesion detection during colonoscopies by analyzing more than 50 video frames per second, significantly improving diagnostic accuracy.

By Application:

Arthroscopy leads the segment due to its widespread use in diagnosing and treating joint disorders, particularly in orthopedics and sports medicine. ENT endoscopy covers procedures related to ear, nose, and throat conditions, benefiting from advancements in flexible and high-resolution scopes. Pulmonary endoscopy supports diagnosis and intervention in respiratory diseases, an area witnessing growth due to rising respiratory illness prevalence. Obstetrics and gynecology applications include minimally invasive procedures for women’s health, enhancing patient outcomes with reduced recovery times. The endoscopy market benefits from the expanding range of clinical applications that improve disease management across multiple specialties.

- For instance, Olympus’s Narrow Band Imaging (NBI) technology enhances mucosal visualization by using specific light wavelengths, enabling detection of vascular patterns with over 90% accuracy in differentiating cancerous tissues.

By End-User:

Hospitals represent the largest segment given their comprehensive medical facilities and capacity to perform complex endoscopic procedures. Hospitals invest heavily in state-of-the-art endoscopy equipment to support a broad spectrum of diagnostic and surgical interventions. Ambulatory surgical centers (ASCs) show rapid growth due to their focus on outpatient care and cost-effective procedure delivery. ASCs increasingly adopt endoscopy technologies for procedures that do not require extended hospital stays, responding to patient preferences for convenience and shorter recovery. It highlights a shift toward decentralized healthcare delivery models, promoting broader accessibility of endoscopic services.

Segments:

Based on Product Type:

- Endoscopes

- Visualization systems

- Endoscopic ultrasound

- Insufflator

Based on Application:

- Arthroscopy

- ENT endoscopy

- Pulmonary endoscopy

- Obstetrics/Gynecology

Based on End-User:

- Hospitals

- Ambulatory surgical centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the endoscopy market, accounting for about 38% of the global revenue. This dominance stems from the region’s advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and substantial investment in research and development. The presence of major medical device manufacturers and key market players in the U.S. and Canada further strengthens its leadership position. Increasing prevalence of chronic diseases, such as gastrointestinal and respiratory disorders, drives strong demand for diagnostic and therapeutic endoscopic procedures. Well-established reimbursement policies and growing patient awareness about minimally invasive techniques contribute to widespread utilization. Hospitals and ambulatory surgical centers in this region continuously upgrade their equipment to improve clinical outcomes and patient experiences.

Europe

Europe captures close to 28% of the global endoscopy market, making it the second-largest regional segment. The region benefits from sophisticated healthcare systems and favorable government initiatives promoting early disease detection and minimally invasive surgeries. Countries such as Germany, the UK, and France lead adoption with robust healthcare infrastructure and widespread availability of advanced endoscopic devices. Growing geriatric populations and rising incidence of chronic diseases add to the increasing demand for endoscopy procedures. European healthcare providers actively invest in high-definition imaging and disposable endoscopes to enhance patient safety and procedural efficiency. Market growth is also supported by increasing outpatient procedures performed in ambulatory surgical centers across several countries.

Asia-Pacific

The Asia-Pacific region holds an estimated 22% share in the endoscopy market, driven by improving healthcare infrastructure, rising healthcare expenditure, and expanding access to advanced medical technologies. Countries like China, India, Japan, and South Korea contribute significantly to this growth. Rising awareness about preventive healthcare and increasing prevalence of lifestyle-related diseases fuel demand for endoscopic diagnostics and treatments. The region experiences a growing number of ambulatory surgical centers, making minimally invasive procedures more accessible to a broader population. Additionally, government initiatives aimed at modernizing healthcare facilities and expanding insurance coverage create a favorable environment for market expansion. Manufacturers focus on cost-effective and innovative solutions tailored to the needs of this diverse market.

Latin America

Latin America accounts for around 7% of the global endoscopy market. The region faces challenges related to limited healthcare infrastructure and lower healthcare spending compared to developed regions. Despite this, increasing investments in healthcare modernization and growing private healthcare sectors contribute to gradual market growth. Countries like Brazil, Mexico, and Argentina lead the regional market due to expanding hospital networks and rising demand for minimally invasive diagnostic techniques. Patient awareness campaigns and government initiatives promoting early disease detection support the adoption of endoscopy technologies. There is also growing interest in portable and disposable endoscopic devices to address infection control concerns.

Middle East and Africa

The Middle East and Africa region holds approximately 5% of the global endoscopy market. Healthcare infrastructure development and increased government focus on improving medical services underpin market growth. The presence of rising chronic disease incidence and expanding private healthcare providers fuels demand for advanced diagnostic and therapeutic tools. Countries such as the UAE, Saudi Arabia, and South Africa show notable progress in adopting endoscopic technologies. Investments in training healthcare professionals and improving access to modern medical equipment further support market expansion. The market growth in this region remains gradual but shows promising potential due to ongoing healthcare reforms and rising patient demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson & Johnson

- KARL STORZ

- FUJIFILM

- Smith & Nephew

- Boston Scientific

- Medtronic

- RICHARD WOLF

- B Braun

- OLYMPUS

- COOK MEDICAL

- Stryker

- INTUITIVE

- CONMED

- HOYA

Competitive Analysis

Key players in the Endoscopy market include Olympus, KARL STORZ, Johnson & Johnson, Boston Scientific, Medtronic, FUJIFILM, and Smith & Nephew. These companies maintain strong market positions through continuous innovation, extensive product portfolios, and global distribution networks. They invest significantly in research and development to introduce advanced technologies such as high-definition imaging systems, disposable endoscopes, and AI-integrated devices that enhance diagnostic accuracy and procedural efficiency. Strategic collaborations, mergers, and acquisitions enable these players to expand their market reach and address emerging clinical needs. They also focus on improving patient safety and minimizing procedure times, which align with healthcare providers’ goals. Competitive pricing strategies and after-sales service excellence contribute to customer retention and brand loyalty in various regions. The growing demand for minimally invasive procedures pushes these companies to develop user-friendly, portable, and cost-effective solutions. Regulatory compliance and adapting to local market requirements remain key focus areas to facilitate product approvals and market entry. As new entrants attempt to disrupt the market, established players leverage their technological expertise and strong financial resources to sustain leadership. Overall, competitive dynamics revolve around innovation, market expansion, and strategic partnerships, positioning these companies at the forefront of the evolving endoscopy market landscape.

Recent Developments

- In January 2025, Karl Storz SE & Co. KG announced the strategic acquisition of its long-standing Swiss distributor, ANKLIN, to strengthen its direct sales presence in Switzerland.

- In August 2024, Ambu received CE mark approval for its new-generation duodenoscopy solutions, Ambu aBox 2 and Ambu aScope Duodeno 2, for ERCP procedures.

- In April 2024, Medtronic introduced ColonPRO™, the latest AI software for its GI Genius™ intelligent endoscopy system, aimed at improving patient care via AI integration.

Market Concentration & Characteristics

The Endoscopy market exhibits a moderately concentrated structure dominated by a few key players who control a significant portion of the global revenue. Leading companies possess strong technological expertise, extensive product portfolios, and established global distribution channels, which create high entry barriers for new entrants. It fosters intense competition focused on innovation, quality, and customer service. The market features continuous advancements in imaging technologies, disposable devices, and AI integration that differentiate players and drive competitive advantage. Healthcare providers prioritize reliable, efficient, and cost-effective solutions, influencing purchasing decisions and vendor selection. Regional variations in regulatory requirements and healthcare infrastructure also impact market dynamics and concentration. Smaller companies often specialize in niche applications or emerging technologies, contributing to market diversity but with limited scale. The balance between established multinationals and innovative smaller firms shapes the competitive landscape. It encourages collaboration, strategic partnerships, and acquisitions to expand product offerings and geographic presence. The market’s characteristic focus on technological innovation and quality performance sustains steady growth and evolving customer demands, maintaining a dynamic yet consolidated competitive environment.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Endoscopy market will continue to grow steadily driven by technological advancements.

- Minimally invasive procedures will gain greater adoption across medical specialties.

- Artificial intelligence integration will enhance diagnostic accuracy and procedural efficiency.

- Disposable and single-use endoscopes will see increased demand to improve infection control.

- Expansion of outpatient and ambulatory surgical centers will boost market growth.

- Emerging markets will offer significant opportunities due to improving healthcare infrastructure.

- Telemedicine and remote consultation will expand access to endoscopic services.

- Manufacturers will focus on developing portable and user-friendly devices.

- Increasing prevalence of chronic diseases will sustain demand for endoscopic diagnostics.

- Strategic partnerships and mergers will intensify competition and foster innovation.