Market Overview

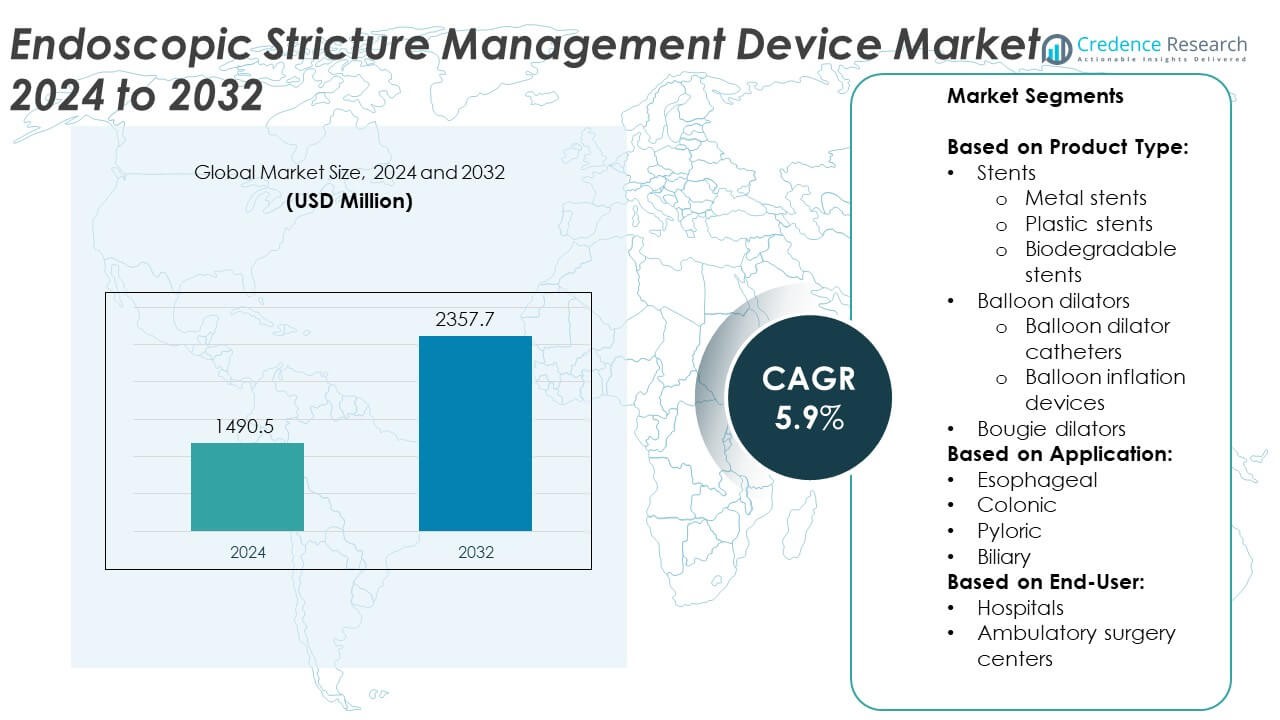

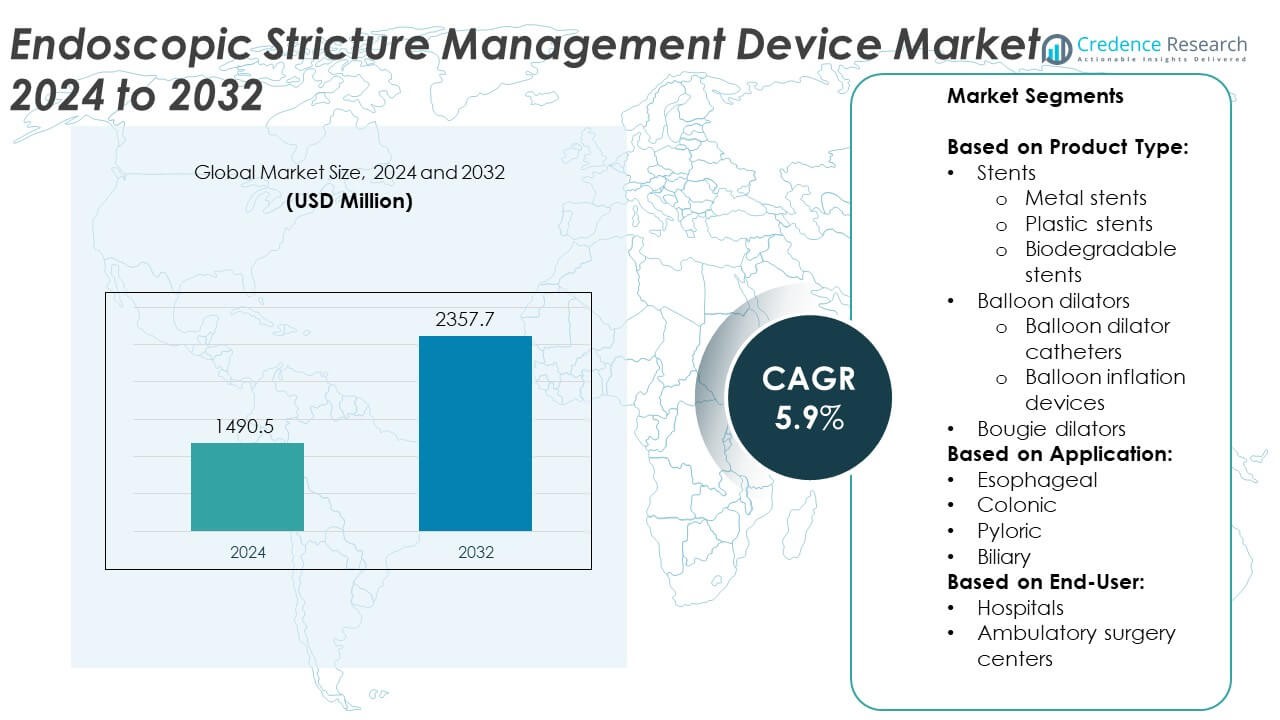

Endoscopic Stricture Management Device Market size was valued at USD 1490.5 million in 2024 and is anticipated to reach USD 2357.7 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Endoscopic Stricture Management Device Market Size 2024 |

USD 1490.5 Million |

| Endoscopic Stricture Management Device Market, CAGR |

5.9% |

| Endoscopic Stricture Management Device Market Size 2032 |

USD 2357.7 Million |

The Endoscopic Stricture Management Device market grows with rising adoption of minimally invasive procedures, increasing demand for patient safety, and expanding gastrointestinal and urological care volumes. Technological advancements enhance switch durability, insulation quality, and fail-safe mechanisms, ensuring reliable operation in high-frequency electrosurgical settings. Integration with smart endoscopy platforms supports real-time monitoring, predictive maintenance, and efficient asset management. Hospitals prefer compact, ergonomic designs that fit modern endoscopy suites while meeting international safety standards.

North America leads the Endoscopic Stricture Management Device market due to advanced healthcare infrastructure, high procedural volumes, and strong adoption of innovative endoscopic technologies. Europe follows with robust regulatory frameworks and increasing demand for minimally invasive gastrointestinal procedures. The Asia Pacific region shows rapid growth, driven by expanding healthcare access, rising patient awareness, and significant investments in medical technology. Key players shaping the market include Boston Scientific Corporation, Olympus Corporation, known for their high-performance, safety-focused devices. Other notable participants such as Merit Medical Systems and Pentax Medical contribute through product innovation and regional expansion strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Endoscopic Stricture Management Device market was valued at USD 1,490.5 million in 2024 and is projected to reach USD 2,357.7 million by 2032, growing at a CAGR of 5.9% during the forecast period.

- Demand is driven by the increasing adoption of minimally invasive endoscopic procedures in gastrointestinal and urological care, with hospitals and specialty clinics prioritizing devices that enhance patient safety and procedural efficiency.

- Market trends highlight a shift toward compact, ergonomic designs for modern endoscopy suites, integration of smart connectivity features, and advanced safety mechanisms that comply with stringent international standards.

- Competitive activity is shaped by major players such as Boston Scientific Corporation, Olympus Corporation, CONMED Corporation, and Merit Medical Systems, focusing on innovation, durability, and expansion into high-growth regions.

- Challenges include high initial equipment costs, the need for specialized operator training, and compliance with varying regulatory requirements across regions, which can slow procurement cycles.

- Regional growth is prominent in North America due to technological leadership and procedural demand, Europe benefits from strong regulatory support, and Asia Pacific shows the fastest adoption rates supported by expanding healthcare infrastructure.

- The market’s outlook remains positive, fueled by aging populations with higher stricture incidence, increasing healthcare investments, and the ongoing push toward user-friendly, long-life medical devices that optimize operational performance and reduce costs in clinical settings.

Market Drivers

Increasing Adoption of Minimally Invasive Endoscopic Procedures

The Endoscopic Stricture Management Device market benefits from the global shift toward minimally invasive treatments in gastrointestinal and urological care. Healthcare providers prefer devices that enable safe electrical disconnection without disrupting procedure flow. Demand grows in hospitals and specialty clinics seeking to enhance patient safety and reduce procedural risks. It supports efficient power management in devices such as balloon dilators, stents, and electrosurgical tools. Advances in ergonomic designs and compact form factors make integration into endoscopy systems easier. Rising patient awareness of quicker recovery and reduced complications further strengthens market demand.

- For instance, Olympus Corporation’s ESG-300 electrosurgical system incorporates advanced safety disconnect features, enabling seamless power cut-off within 0.05 seconds during endoscopic interventions.

Advancements in Device Safety Features and Reliability Standards

Stringent safety regulations and technological innovation drive improvements in performance. The Endoscopic Stricture Management Device Disconnect Switch market sees consistent upgrades in insulation, load capacity, and contact materials to prevent malfunctions. It ensures reliable operation under high-frequency electrosurgical environments. Manufacturers develop switches capable of sustaining thousands of operational cycles without performance degradation. Integration with automatic fail-safe mechanisms prevents accidental device activation during sensitive procedures. Hospitals prioritize equipment that complies with international electrical safety standards, boosting demand for certified devices.

- For instance, CONMED Corporation’s Beamer CE200 incorporates a disconnect mechanism rated for over 50,000 activation cycles, meeting IEC 60601-1 standards for medical electrical equipment safety.

Growing Demand from Aging Populations with Higher Stricture Incidence

An expanding elderly population increases the prevalence of gastrointestinal strictures, raising procedural volumes globally. The Endoscopic Stricture Management Device market benefits from higher device utilization in gastroenterology departments. It ensures safe power control during multiple interventions in a single patient case. Surge in demand for repeat procedures in chronic cases drives procurement of reliable, long-life switches. Healthcare facilities invest in equipment that supports both diagnostic and therapeutic interventions. The aging demographic trend sustains a consistent need for advanced endoscopic solutions.

Integration with Smart Endoscopic Platforms for Enhanced Efficiency

Integration with IoT-enabled endoscopy systems improves operational control and monitoring. The Endoscopic Stricture Management Device market aligns with digital platforms that track device usage and performance in real time. It supports predictive maintenance, reducing downtime and enhancing service life. Manufacturers introduce models with programmable settings to match various procedural requirements. Data integration allows technicians to evaluate switch performance and schedule timely replacements. Hospitals adopting smart endoscopy suites favor devices that combine safety, efficiency, and data-driven insights.

Market Trends

Adoption of Ergonomic and Space-Saving Designs for Modern Endoscopy Suites

The Endoscopic Stricture Management Device market is witnessing a shift toward compact and ergonomically designed units. Manufacturers focus on creating switches that fit seamlessly into limited workspace environments while maintaining high electrical performance. It supports smoother handling for surgeons and technicians during complex endoscopic interventions. Enhanced portability and reduced footprint improve integration into mobile endoscopy carts. Devices with intuitive layouts allow faster training and adoption in busy clinical settings. The trend reflects a broader move toward user-centric medical device engineering.

- For instance, Boston Scientific Resolution 360 platform integrates a high-durability disconnect unit designed for over 40,000 operations, ensuring long-term reliability in gastroenterology suites with high patient turnover.

Integration of Advanced Safety Mechanisms and Fail-Safe Technologies

Manufacturers are incorporating multi-layered safety features to reduce the risk of accidental power activation. The Endoscopic Stricture Management Device market benefits from switches with automatic shut-off capabilities and high-precision contact mechanisms. It ensures consistent reliability even in high-frequency electrosurgical environments. The use of high-grade insulating materials further improves operator and patient safety. Devices with visible status indicators enable quick verification of operational readiness. The emphasis on safety aligns with regulatory standards and growing institutional procurement requirements.

- For instance, Pentax Medical DISCOVERY AI platform integrates switch status monitoring, logging over 1,000 procedural cycles per month for predictive maintenance alerts.

Incorporation of Smart Connectivity and Digital Monitoring Features

Integration with connected endoscopic platforms is becoming a prominent trend. The Endoscopic Stricture Management Device market is seeing devices equipped with data logging, usage tracking, and diagnostic alerts. It allows healthcare providers to monitor switch performance remotely and schedule timely maintenance. The connectivity supports efficient asset management in large hospital networks. Manufacturers invest in developing compatible interfaces with leading endoscopic equipment brands. This alignment with smart healthcare infrastructure enhances device value and operational efficiency.

Rising Preference for Durable and Long-Life Components

Durability has become a key selection criterion for medical facilities aiming to reduce replacement cycles. The Endoscopic Stricture Management Device market is experiencing demand for switches capable of enduring thousands of activation cycles without failure. It drives the use of reinforced contact points and corrosion-resistant materials. Extended service life reduces operational costs and improves procedural reliability. Manufacturers highlight durability metrics as a core feature in marketing and procurement discussions. The focus on longevity supports sustainable equipment investment strategies in healthcare systems.

Market Challenges Analysis

High Cost of Advanced Disconnect Switches Limiting Broader Adoption

The Endoscopic Stricture Management Device market faces challenges due to the high cost of technologically advanced models. Premium designs with enhanced safety features, smart connectivity, and durable materials often exceed the budget of smaller healthcare facilities. It creates a gap in adoption between large hospitals and smaller clinics, especially in cost-sensitive regions. Procurement delays occur when institutions require extended approval processes for capital equipment. Price competition among manufacturers remains limited, as strict compliance with safety and quality standards keeps production costs elevated. Balancing innovation with affordability remains a critical market hurdle.

Complex Integration and Maintenance Requirements in Clinical Settings

Integrating new disconnect switch models into existing endoscopic systems can present operational difficulties. The Endoscopic Stricture Management Device market encounters compatibility issues when devices are paired with older endoscopy platforms. It may require custom adapters or software updates, leading to extended installation timelines. Routine maintenance demands skilled technicians, which can strain resources in smaller hospitals. Unexpected downtime during repairs impacts procedural schedules and patient throughput. Overcoming integration complexity is essential to improving user experience and expanding market reach.

Market Opportunities

Expansion Potential in Emerging Healthcare Markets

The Endoscopic Stricture Management Device market holds strong growth potential in emerging economies with expanding healthcare infrastructure. Rising investments in hospital modernization create opportunities for advanced endoscopic equipment adoption. It supports improved procedural safety in regions experiencing an increase in gastrointestinal disorder cases. Government initiatives to upgrade public healthcare facilities further stimulate demand. Local distributors partnering with global manufacturers can enhance accessibility and reduce procurement lead times. Targeting these high-growth regions allows suppliers to diversify revenue streams and build long-term market presence.

Innovation in Smart and Customizable Disconnect Switch Solutions

Technological advancements in medical devices open opportunities for product differentiation. The Endoscopic Stricture Management Device market can benefit from developing models with programmable settings, real-time monitoring, and modular designs. It enables hospitals to tailor device performance to specific procedural requirements. Integration with AI-powered analytics platforms can add predictive maintenance capabilities, extending service life and reliability. Offering customizable solutions can strengthen relationships with healthcare providers seeking tailored operational benefits. These innovations position manufacturers to capture market share through value-added features and specialized designs.

Market Segmentation Analysis:

By Product Type:

The Endoscopic Stricture Management Device market covers a range of product categories that support stricture treatment procedures. Stents remain a primary segment, with metal stents offering durability and effective lumen patency in long-term cases, plastic stents providing cost-effective temporary solutions, and biodegradable stents eliminating the need for removal. It enhances procedural efficiency by ensuring safe device disconnection during stent placement. Balloon dilators represent another significant segment, comprising balloon dilator catheters for precise stricture expansion and balloon inflation devices that deliver controlled pressure. Bougie dilators retain importance in facilities where gradual dilation is preferred, offering versatility across various anatomical locations. Each product type demands disconnect switches that meet high electrical safety standards and integrate seamlessly with supporting equipment.

- For instance, Taewoong Medical’s Niti-S biliary stent series is compatible with electrosurgical disconnect units rated for over 45,000 activation cycles, ensuring high durability in complex long-duration cases.

By Application:

Applications span esophageal, colonic, pyloric, and biliary strictures, each with distinct clinical requirements. The Endoscopic Stricture Management Device market supports safe power control during delicate esophageal procedures, where precision and minimal tissue trauma are critical. It plays a vital role in colonic interventions requiring flexible handling and robust safety to manage complex anatomies. Pyloric stricture treatments benefit from devices enabling stable performance under prolonged procedural durations. In biliary applications, high reliability is essential due to the narrow and sensitive treatment area, making electrical safety a top priority. Tailoring disconnect switch specifications to these varied applications strengthens their clinical value and adoption.

- For instance, Pentax Medical’s EG29-i10 endoscope platform incorporates a dedicated disconnect switch module rated for 52,000 activation cycles, providing stable electrical safety performance during prolonged pyloric and biliary stricture procedures.

By End-User:

Hospitals remain the largest end-user segment, driven by high patient volumes, advanced endoscopic infrastructure, and specialist availability. The Endoscopic Stricture Management Device market serves hospitals that prioritize devices offering reliability during frequent and diverse procedures. It also caters to ambulatory surgery centers, which seek compact, easy-to-integrate solutions that support efficient turnaround times. Growing demand for minimally invasive treatments in outpatient settings increases adoption in this segment. Both end-user categories value devices that meet regulatory safety standards and deliver consistent performance across multiple procedural types. Manufacturers targeting these segments with tailored features and competitive service support can expand their market presence effectively.

Segments:

Based on Product Type:

- Metal stents

- Plastic stents

- Biodegradable stents

- Balloon dilator catheters

- Balloon inflation devices

Based on Application:

- Esophageal

- Colonic

- Pyloric

- Biliary

Based on End-User:

- Hospitals

- Ambulatory surgery centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

34% share reflects high procedure volumes in the United States and Canada, strong reimbursement frameworks, and rapid adoption of safety-focused components in endoscopy suites. The Endoscopic Stricture Management Device market benefits from hospital consolidation that standardizes capital procurement and service contracts. It gains momentum from GI centers that prioritize fast turnarounds and strict electrical safety compliance. Vendors compete on reliability metrics, cycle life, and integration with electrosurgical platforms. Health systems value compatible accessories that reduce changeover time between stenting and dilation. Ongoing upgrades in ambulatory centers sustain replacement demand and keep utilization rates elevated across major networks.

Europe

28% share stems from mature endoscopy ecosystems in Germany, France, the Nordics, Italy, Spain, and the UK, supported by robust clinical guidelines and accreditation regimes. The Endoscopic Stricture Management Device Switch market advances through tenders that weigh lifecycle costs and documented safety outcomes. It sees steady uptake in university hospitals that run complex esophageal and biliary programs. Vendors focus on compact footprints that fit modular towers and carts in space-constrained rooms. Cross-border purchasing groups push interoperable designs and traceable maintenance logs. Regulatory alignment encourages devices with clear visual status cues and standardized connectors for rapid verification before energy delivery.

Asia Pacific

27% share reflects accelerating GI procedure growth in China, Japan, South Korea, India, and Australia, with public and private providers expanding capacity. The Endoscopic Stricture Management Device market gains from new-build endoscopy units that specify modern power-control hardware from day one. It benefits from training-led rollouts that stress safe switching during balloon dilation and stent deployment. Local distributors emphasize fast service response and ready spares to limit downtime. Hospitals favor rugged devices that endure high daily case loads. Tiered product lines that balance price and durability help broaden access without sacrificing core safety features.

Latin America

6% share is supported by leading centers in Brazil, Mexico, Colombia, Chile, and Argentina that invest in GI services and day-surgery models. The Endoscopic Stricture Management Device market progresses where procurement teams prioritize dependable, easy-to-clean housings and stable connectors. It advances through partnerships that bundle switches with dilation sets and stent systems. Hospitals seek clear labeling, tactile feedback, and straightforward checks before activation. It often requires vendor training to standardize setup protocols and reduce human error. Financing options and multi-year service terms improve adoption across mixed public–private ecosystems.

Middle East & Africa

5% share arises from focused investments in referral hospitals and specialty clinics across GCC markets and select African hubs. The Endoscopic Stricture Management Device market expands with turnkey endoscopy suites that mandate verified insulation, high load ratings, and repeatable performance. It benefits from procurement that values IP-rated enclosures and corrosion resistance in hot, humid environments. Clinical teams request devices with unambiguous on–off states and audible or visual confirmations. Serviceability and simple preventive maintenance checklists matter to sustain uptime. Training programs tied to GI expansion initiatives reinforce safe power control during stenting and dilation workflows.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Merit Medical Systems

- Micro-Tech (Nanjing) Co., Ltd

- Olympus Corporation

- Taewoong Medical Co., Ltd.

- CONMED Corporation

- Medi-Globe GmbH

- PanMed Us

- Steris plc (Diagmed Healthcare)

- HOBBS MEDICAL, INC.

- Cook Medical Inc.

- Boston Scientific Corporation

- Becton, Dickinson and Company

Competitive Analysis

The Endoscopic Stricture Management Device market features strong competition among leading companies, including Boston Scientific Corporation, Olympus Corporation, CONMED Corporation, Merit Medical Systems, and Pentax Medical. These players compete on technological innovation, product reliability, and global distribution capabilities. Companies focus on enhancing safety features, such as advanced insulation, automatic shut-off mechanisms, and high-cycle durability, to meet evolving clinical and regulatory demands. Product development strategies emphasize compact and ergonomic designs that integrate seamlessly with modern endoscopy platforms. Manufacturers actively invest in R&D to incorporate smart connectivity and predictive maintenance capabilities, aligning with the growing adoption of digital healthcare solutions. Strategic partnerships with healthcare providers, expansion into emerging markets, and portfolio diversification strengthen competitive positioning. Pricing strategies remain competitive, with differentiation achieved through performance, durability, and ease of integration. Continuous regulatory compliance, adherence to international safety standards, and post-sales service quality play a critical role in sustaining market leadership. The competitive landscape is further influenced by regional expansion efforts, with companies establishing localized manufacturing, training, and support facilities to improve market reach and responsiveness to end-user needs.

Recent Developments

- In January 2024 regarding Merit Medical’s endoscopic stricture device relates to the advancement and promotion of their fully covered, laser-cut esophageal stent technology for precise placement with minimal migration risk.

- In 2022, Medi-Globe GmbH announced to expand in China by inaugurating a new branch in Beijing. As an integral component of its global expansion strategy, the company seeks to enhance support for its trading partners and clinical customers in China.

- In 2022, Boston Scientific announced to enter into a definitive agreement with Synergy Innovation Co., Ltd. to acquire majority stakes of M.I.Tech Co., Ltd, Korean manufacturer and distributor of HANAROSTENT technology, a non-vascular, self-expanding metal stents.

Market Concentration & Characteristics

The Endoscopic Stricture Management Device market exhibits a moderately concentrated structure, with a limited number of global manufacturers holding significant influence through established brands, advanced technology portfolios, and extensive distribution networks. It is characterized by high entry barriers due to stringent regulatory requirements, specialized production capabilities, and the need for proven clinical performance. Competition centers on innovation, with leading companies investing in safety enhancements, ergonomic designs, and integration with digital healthcare systems. The market demonstrates strong demand for products that combine durability, operational efficiency, and compliance with international safety standards. Procurement decisions in hospitals and specialty clinics often prioritize proven reliability, long service life, and compatibility with existing endoscopy platforms. Continuous product differentiation, strategic partnerships, and regional expansion strategies shape competitive dynamics. It benefits from rising procedural volumes in gastrointestinal and urological care, supported by an aging population and growing preference for minimally invasive interventions. The market’s evolution reflects a balance between established multinational players and emerging manufacturers that target niche applications or cost-sensitive segments.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with increasing adoption of minimally invasive procedures in gastrointestinal and urological care.

- Technological innovation will focus on integrating smart connectivity and predictive maintenance features.

- Ergonomic and space-saving designs will gain preference in modern endoscopy suites.

- Safety standards will drive the development of advanced fail-safe and automatic shut-off mechanisms.

- Aging populations with higher stricture incidence will sustain procedural demand globally.

- Durability and long operational life will remain critical selection criteria for healthcare facilities.

- Emerging markets will experience accelerated adoption due to expanding healthcare infrastructure.

- Strategic partnerships between manufacturers and healthcare providers will strengthen market reach.

- Regulatory compliance and adherence to international safety certifications will remain a key competitive factor.

- Integration with AI-powered endoscopy platforms will enhance operational efficiency and device value.