Market Overview

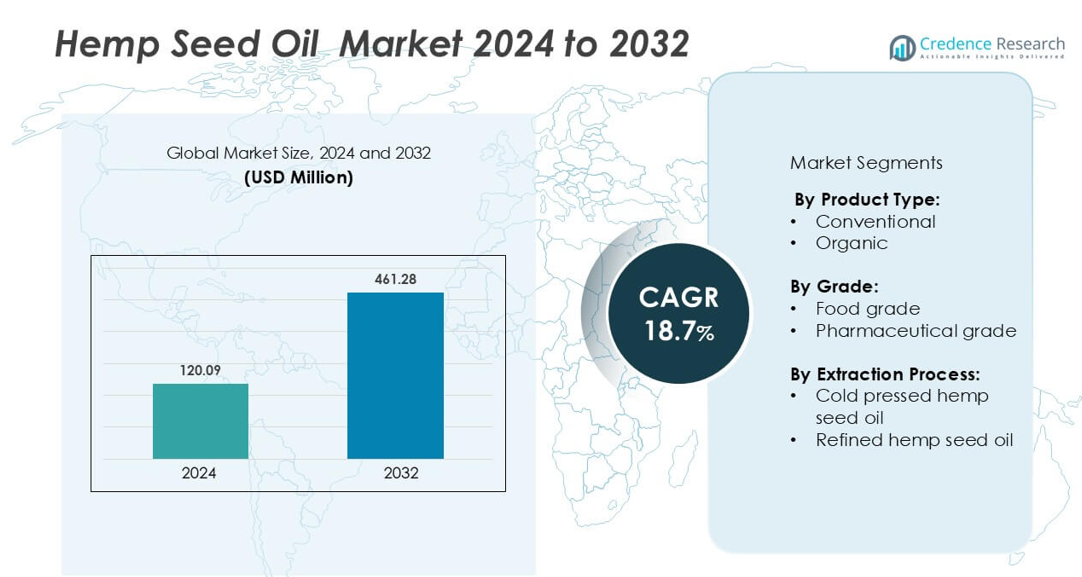

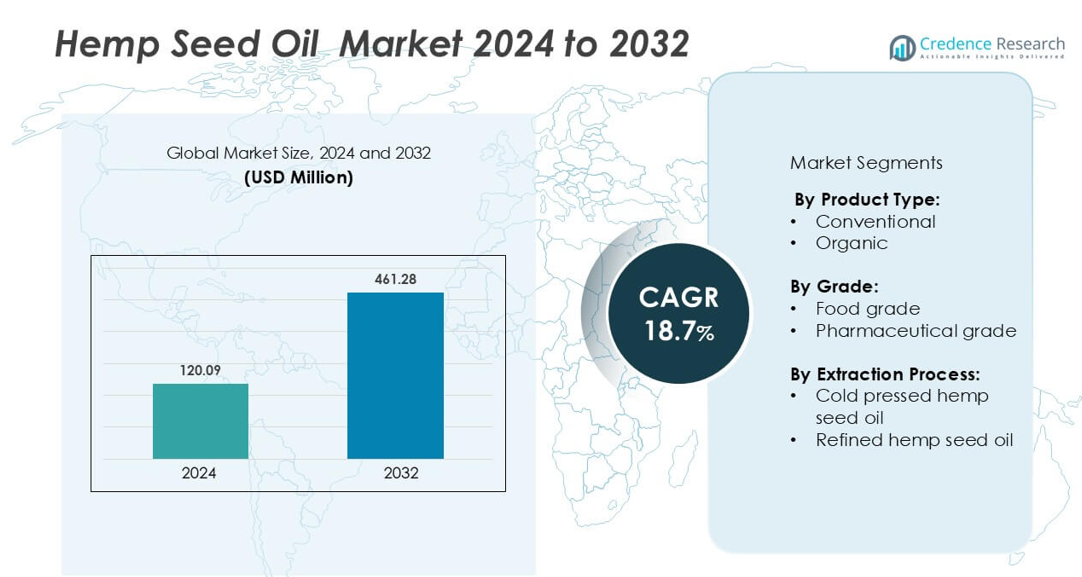

Hemp seed oil market size was valued USD 120.09 million in 2024 and is anticipated to reach USD 461.28 million by 2032, at a CAGR of 18.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hemp Seed Oil Market Size 2024 |

USD 120.09 million |

| Hemp Seed Oil Market, CAGR |

18.7% |

| Hemp Seed Oil Market Size 2032 |

USD 461.28 million |

The global hemp seed oil market is highly competitive, driven by key players emphasizing product innovation, quality, and supply chain integration. Leading companies include Manitoba Harvest (Canada), Hemp Oil Canada Inc. (Canada), Canah International (Romania), Hempflax BV (Netherlands), BAFA neu GmbH (Germany), Liaoning Qiaopai Biotech Co., Ltd. (China), North American Hemp & Grain Co. (Canada), Yunnan HuaFang Industrial Hemp Co. Ltd. (China), GFR Ingredients Inc. (Canada), and Naturally Splendid Enterprises Ltd. (Canada). These companies focus on cold-pressed and certified organic oils, vertical integration, and private-label solutions to strengthen their market presence. Regionally, the Asia-Pacific market leads globally, capturing approximately 25% of the total market share, supported by large-scale production, rising health-conscious consumer demand, and expanding use in dietary supplements, cosmetics, and personal care products. Strategic investments in product development and regional expansion remain critical for maintaining competitive advantage.

Market Insights

- The global hemp seed oil market was valued at approximately USD 120.09 million in 2024 and is projected to grow at a CAGR of 8.3%.

- Rising consumer preference for plant-based, natural, and organic products is driving demand across dietary, cosmetic, and nutraceutical applications.

- Key trends include increased use of cold-pressed and certified organic oils, incorporation into functional foods, skincare, and haircare products, and growth of online retail channels.

- The market is highly competitive, with major players such as Manitoba Harvest, Hemp Oil Canada Inc., Canah International, Hempflax BV, BAFA neu GmbH, Liaoning Qiaopai Biotech, North American Hemp & Grain Co., Yunnan HuaFang Industrial Hemp, GFR Ingredients, and Naturally Splendid Enterprises focusing on product innovation, private-label supply, and vertical integration.

- Regionally, Asia-Pacific leads with 25% market share, followed by North America and Europe; oil segment dominates the product portfolio, accounting for over 60% of the market due to high usage in food, cosmetics, and supplements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The conventional hemp seed oil segment holds the dominant market share, accounting for over 70% of global revenue. Its widespread availability, cost-effectiveness, and established consumer base in food, cosmetics, and nutraceutical applications drive this dominance. Conventional production methods enable large-scale output and consistent quality, supporting its preference among manufacturers. However, the organic segment is witnessing rapid growth due to rising consumer awareness of clean-label and chemical-free products. The expansion of organic-certified farming practices further enhances its adoption, especially in developed markets emphasizing sustainability and health-conscious consumption.

- For instance, in 2021, HempFlax announced a €3 million investment to increase its hemp fiber processing capacity from 3 to 6 tonnes per hour. A capacity of 6 tonnes per hour(16 hours a day) is approximately 35,000 tonnes annually.

By Grade:

The food-grade segment leads the hemp seed oil market, representing the largest share due to its extensive use in functional foods, dietary supplements, and plant-based products. Increasing demand for omega-rich edible oils and the trend toward vegan and heart-healthy diets reinforce its growth. The food-grade category benefits from expanding applications in salad dressings, protein powders, and bakery products. In contrast, the pharmaceutical-grade segment, though smaller, is gaining momentum with the growing use of hemp oil in therapeutic formulations, skincare treatments, and anti-inflammatory products targeting wellness-focused consumers.

- For instance, Nutiva, a prominentS.-based organic food company, has integrated hemp seed oil into its product line, offering cold-pressed, unrefined hemp oil as a nutritious addition to various food items.

By Extraction Process:

Cold-pressed hemp seed oil dominates the market, capturing the largest share owing to its superior nutritional profile and minimal processing. This method preserves essential fatty acids, antioxidants, and natural flavor, appealing strongly to consumers seeking unrefined and nutrient-dense oils. The surge in demand for premium and organic health products further boosts this segment’s growth. Refined hemp seed oil, while less prevalent, remains relevant in cosmetic and industrial formulations where extended shelf life and neutral aroma are prioritized, supporting moderate yet steady demand across diverse end-use industries.

Key Growth Drivers

Rising Demand for Plant-Based and Functional Foods

The global shift toward plant-based nutrition is a significant growth catalyst for the hemp seed oil market. Consumers increasingly seek natural and nutrient-dense alternatives to traditional cooking oils and animal-based supplements. Hemp seed oil, rich in omega-3 and omega-6 fatty acids, vitamins, and antioxidants, aligns well with this demand. Its incorporation into functional foods, beverages, and dietary supplements has surged as health-conscious consumers prioritize products supporting cardiovascular and immune health. Additionally, the growing vegan population and clean-label product trends amplify its adoption. Food manufacturers are leveraging hemp seed oil’s nutritional advantages to develop innovative offerings, enhancing the product’s visibility across mainstream retail and e-commerce channels.

- For instance, Nutiva’s cold-pressed, unrefined Organic Hemp Seed Oil is marketed for its ideal 3:1 omega-6 to omega-3 ratio and is available in 16 oz, 24 oz, and 1-gallon sizes, catering to various consumer needs.

Expanding Applications in Personal Care and Cosmetics

The increasing integration of hemp seed oil in skincare, haircare, and cosmetic formulations is a key market driver. Its anti-inflammatory, moisturizing, and antioxidant properties make it highly effective in addressing dryness, acne, and aging concerns. The clean beauty movement and preference for naturally derived ingredients have further accelerated demand. Cosmetic manufacturers are capitalizing on hemp seed oil’s versatility by using it in serums, lotions, soaps, and shampoos. Moreover, the oil’s ability to support skin barrier function and promote hydration resonates with consumers seeking gentle, plant-based products. Regulatory acceptance and innovation in cosmetic-grade hemp formulations continue to expand its market footprint, particularly across North America and Europe, where demand for sustainable beauty products remains strong.

- For instance, Hemp seed oil is beneficial for skin barrier function due to its high concentration of essential fatty acids and linoleic acid.

Legalization and Regulatory Support for Hemp Cultivation

The global legalization of industrial hemp cultivation has unlocked significant opportunities for hemp seed oil producers. Governments across several regions, including North America, Europe, and parts of Asia-Pacific, have revised regulations to allow hemp farming under strict THC content limits. This legal clarity has encouraged investment in hemp processing facilities, improved supply chain integration, and reduced sourcing constraints. The expansion of licensed cultivation also ensures consistent raw material availability, supporting large-scale production. As a result, hemp seed oil manufacturers can focus on product standardization, export expansion, and innovation. Furthermore, government-backed research initiatives promoting hemp’s economic and environmental benefits, such as soil regeneration and carbon sequestration, strengthen its position as a sustainable agricultural commodity.

Key Trend & Opportunity

Innovation in Extraction and Refinement Technologies

Advancements in cold-pressing and CO₂ extraction technologies present substantial opportunities for improving hemp seed oil quality and yield. These modern techniques preserve bioactive compounds, enhance purity, and ensure better shelf stability, enabling producers to cater to premium consumer segments. Companies are increasingly investing in process optimization to reduce oxidation and improve nutritional retention, giving them a competitive edge. Furthermore, technological innovations support the development of tailored oil profiles for specific applications—such as cosmetic-grade or nutraceutical-grade oils—broadening their market scope. As clean-label and minimally processed products gain traction, technology-driven differentiation is becoming a decisive factor in maintaining market leadership and expanding global trade potential.

- For instance, A flow rate of 15.7 kg/min (942 kg/hour or approximately 1000 L/hour for liquid CO₂) is a plausible figure for a high-end industrial system.

Expansion in Pharmaceutical and Therapeutic Applications

The growing exploration of hemp seed oil’s medicinal properties is creating new growth avenues in the pharmaceutical sector. Rich in essential fatty acids and bioactive compounds, hemp oil demonstrates potential benefits in managing inflammation, anxiety, and metabolic disorders. Ongoing clinical studies and consumer acceptance of natural therapeutics are driving its inclusion in formulations for chronic pain relief, dermatological care, and cardiovascular health. Pharmaceutical companies are partnering with hemp producers to standardize formulations and ensure regulatory compliance, particularly in emerging nutraceutical markets. As healthcare consumers increasingly favor plant-based, preventive health solutions, hemp seed oil is well-positioned to capture significant market share in the therapeutic and wellness categories.

- For instance, a clinical trial involving 90 patients with knee osteoarthritis found that daily topical application of hemp seed oil led to greater improvements in Visual Analog Scale (VAS) pain scores and Western Ontario and McMaster Universities Osteoarthritis Index (WOMAC) parameters compared to placebo.

Key Challenge

Regulatory Inconsistencies and Trade Restrictions

Despite widespread legalization, regulatory inconsistencies across countries pose significant challenges to the hemp seed oil market. Differences in THC content thresholds, labeling standards, and import/export regulations complicate international trade and product registration. Some regions maintain restrictive policies due to the association between hemp and cannabis, limiting market penetration. These fragmented legal frameworks increase compliance costs and discourage smaller producers from entering global markets. Furthermore, delays in product approvals and lack of standardized testing protocols hinder quality assurance. Harmonizing regulations and improving transparency within the global hemp supply chain remain critical to unlocking the full commercial potential of hemp seed oil.

Limited Consumer Awareness and Misconceptions

Persistent misconceptions linking hemp seed oil to psychoactive cannabis products hinder its widespread acceptance. Many consumers remain unaware that hemp seed oil contains negligible THC and offers significant nutritional benefits. This confusion, coupled with limited education on product safety and usage, restricts demand growth, especially in emerging markets. Inadequate marketing and inconsistent branding across regions exacerbate the issue, making consumers hesitant to adopt hemp-based products. Overcoming this challenge requires coordinated efforts by industry stakeholders through public education campaigns, transparent labeling, and endorsement by health professionals. Increasing awareness of hemp seed oil’s health and sustainability advantages will be essential for long-term market expansion.

Regional Analysis

North America

North America dominates the global hemp seed oil market, accounting for over 35% of total revenue. The United States leads regional growth due to the legalization of industrial hemp cultivation under the 2018 Farm Bill and rising consumer demand for natural and plant-based products. Expanding applications in food, cosmetics, and nutraceuticals further support market expansion. Canada’s strong hemp farming infrastructure and government support for sustainable agriculture enhance regional supply capabilities. Growing awareness of hemp’s nutritional benefits and increasing investments in research and product innovation continue to strengthen North America’s market position.

Europe

Europe holds a significant share of approximately 30% of the global hemp seed oil market, driven by increasing consumer preference for organic and sustainable products. Countries such as Germany, France, and the Netherlands lead production and consumption, supported by favorable regulations on hemp cultivation. The region’s advanced food processing and cosmetic industries actively integrate hemp seed oil into functional foods, skincare, and supplements. Stringent quality standards and growing interest in plant-based nutrition fuel consistent demand. Additionally, the European Union’s emphasis on eco-friendly sourcing and circular economy principles reinforces market growth across key member states.

Asia-Pacific

The Asia-Pacific region captures nearly 25% of the global hemp seed oil market and exhibits the fastest growth rate. China remains a dominant producer, leveraging large-scale cultivation and cost-efficient processing. Japan, South Korea, and Australia show increasing demand for hemp seed oil in personal care, health supplements, and functional foods. Rapid urbanization, expanding middle-class populations, and rising health awareness drive consumption growth. Supportive government policies in countries like India and Thailand are encouraging local hemp cultivation and product innovation. The region’s expanding manufacturing base and export potential further position it as a critical growth hub.

Latin America

Latin America accounts for around 6% of the global hemp seed oil market, with growth led by emerging markets such as Brazil, Chile, and Mexico. Evolving regulatory frameworks and increasing acceptance of hemp-based products are fostering regional development. Rising disposable incomes and a shift toward natural wellness products contribute to growing consumer interest. Local producers are gradually expanding cultivation and refining capabilities to meet domestic and export demand. However, limited technical expertise and inconsistent regulations currently restrict large-scale commercialization, though ongoing policy reforms are expected to create favorable market conditions in the coming years.

Middle East & Africa

The Middle East and Africa region holds a smaller but expanding share of roughly 4% in the global hemp seed oil market. Growth is supported by increasing awareness of hemp’s nutritional and cosmetic benefits, particularly in countries such as South Africa and the United Arab Emirates. Rising demand for natural skincare and dietary products among urban consumers drives modest market penetration. However, limited local production and restrictive regulations on hemp cultivation constrain supply. As regional governments reassess hemp policies and promote sustainable agriculture, new opportunities are emerging for investment and import-led market expansion.

Market Segmentations

By Product Type

By Grade

- Food grade

- Pharmaceutical grade

By Extraction Process

- Cold pressed hemp seed oil

- Refined hemp seed oil

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The global hemp seed oil market is characterized by intense competition among established and emerging players focused on expanding product portfolios and geographical reach. Key companies driving market growth include Nutiva Inc., Manitoba Harvest Hemp Foods, Hempco Food and Fiber Inc., Canopy Growth Corporation, and Sky Organics. These players emphasize product innovation, sustainable sourcing, and strategic partnerships to strengthen market presence. North America dominates the global hemp seed oil market, accounting for approximately 38% of total revenue, driven by high consumer awareness, a well-established regulatory framework, and increasing demand for plant-based products. Europe follows closely, supported by growing use in cosmetics and nutraceuticals, while the Asia-Pacific region exhibits significant potential due to rising health-conscious populations and favorable agricultural conditions. Competitive strategies primarily focus on organic certification, supply chain optimization, and e-commerce expansion to enhance global visibility and profitability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Naturally Splendid Enterprises Ltd. (Pitt Meadows, Canada)

- Hempflax BV (Oude Pekela, Netherlands)

- Manitoba Harvest (Winnipeg, Canada)

- Liaoning Qiaopai Biotech Co., Ltd. (Jinzhou, China)

- North American Hemp & Grain Co. (Vancouver, Canada)

- Canah International (Salonta, Romania)

- GFR Ingredients Inc. (Alberta, Canada)

- Hemp Oil Canada Inc. (Manitoba, Canada)

- Yunnan HuaFang Industrial Hemp Co. Ltd. (Kunming, China)

- BAFA neu GmbH (Malsch, Germany)

Recent Developments

- In July 2023, Elixinol announced a partnership with Living Harvest to enhance its sustainability efforts, focusing on organic hemp seed cultivation, which reflects the market’s shift towards eco-friendly practices. The growth in this sector is evidenced by the valuation increase of companies, with Green Roads reporting a 30% rise in revenue in Q1 2023. Additionally, major happenings include Hemp Foods Australia’s expansion into European markets in March 2022, responding to the increasing demand for hemp-based product.

- In August 2022, BioLife Sciences Inc., a prominent innovator in healthcare, beauty, and food & beverage technologies, introduced a product line of consumer products infused with cannabinoids to increase strengthen its product portfolio in hemp-based food products.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Grade, Extraction process and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for hemp seed oil is expected to grow steadily due to increasing health-conscious consumer behavior.

- Expansion in the cosmetic and personal care industry will drive adoption of hemp seed oil in skincare and haircare products.

- Manufacturers are likely to focus on organic and cold-pressed product variants to meet premium segment demand.

- E-commerce and online retail channels will play a significant role in market penetration and brand visibility.

- Companies will pursue strategic partnerships and acquisitions to strengthen supply chains and global presence.

- Product diversification into functional foods and dietary supplements will create new revenue streams.

- Regulatory support for hemp cultivation in key regions will facilitate market expansion.

- Asia-Pacific and North America will continue to dominate due to large production bases and consumer awareness.

- Technological advancements in extraction and processing will improve product quality and efficiency.

- Sustainability and traceability initiatives will become critical factors in consumer purchasing decisions.