Market Overview:

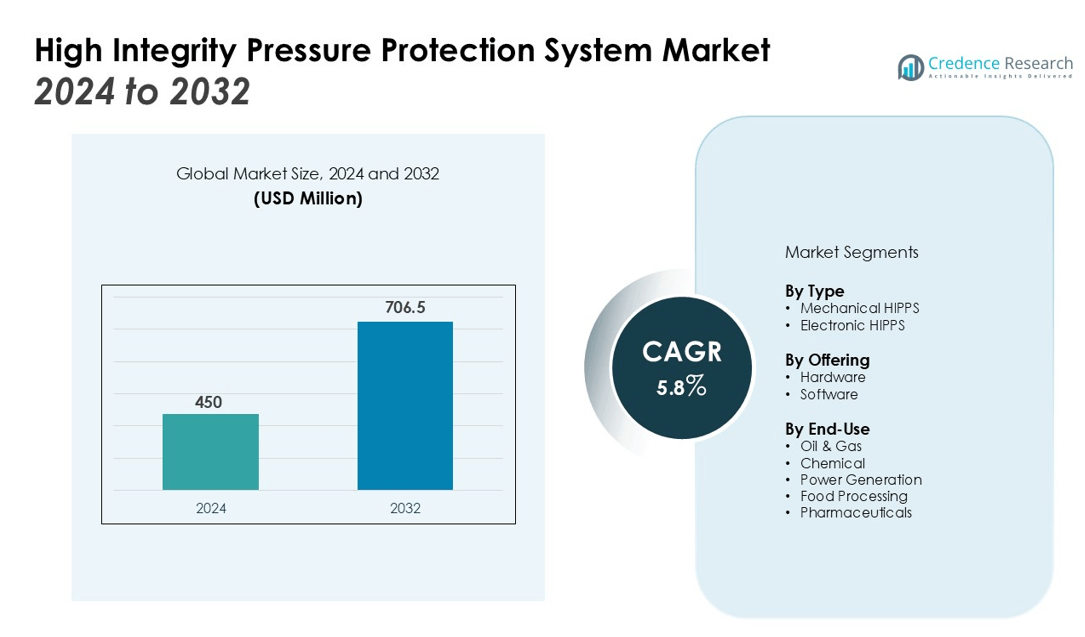

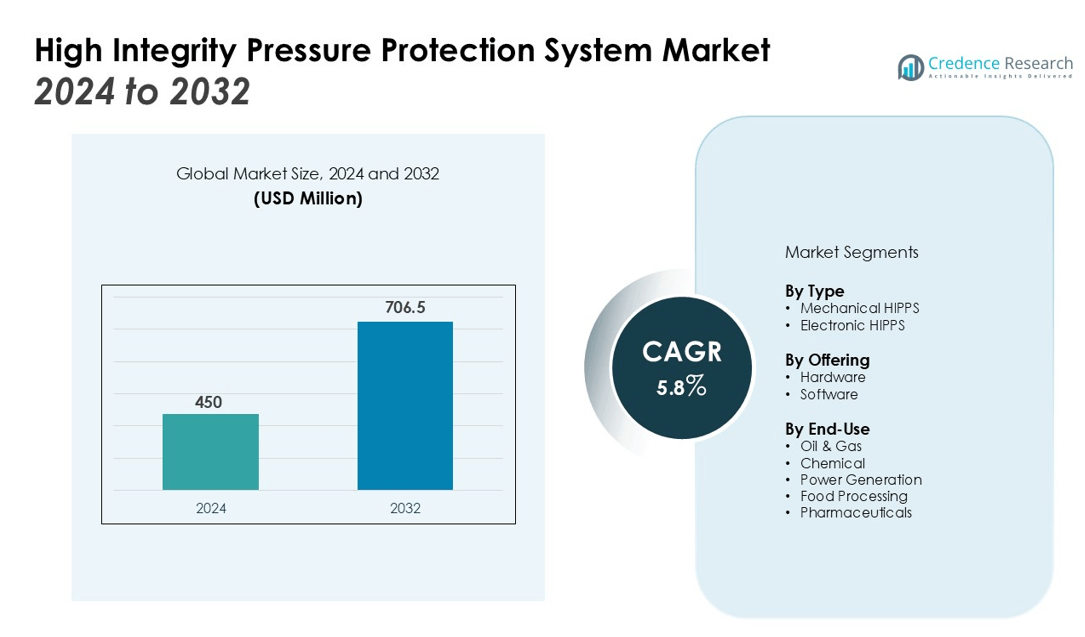

The High Integrity Pressure Protection System Market size was valued at USD 450 million in 2024 and is anticipated to reach USD 706.5 million by 2032, at a CAGR of 5.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Integrity Pressure Protection System Market Size 2024 |

USD 450 million |

| High Integrity Pressure Protection System Market, CAGR |

5.8% |

| High Integrity Pressure Protection System Market Size 2032 |

USD 706.5 million |

Key drivers of the HIPPS market include rising industrial safety concerns, stringent regulatory standards, and the growing adoption of automation and control systems in high-risk industries. The demand for HIPPS is driven by its ability to prevent overpressure scenarios that could lead to catastrophic failures, making it an essential system in hazardous environments. Additionally, the growing focus on minimizing operational downtime and enhancing safety in industries like oil & gas, chemicals, and energy has accelerated the adoption of these systems. Furthermore, the rising trend of smart factory initiatives and Industry 4.0 is further propelling the demand for advanced pressure protection systems.

Regionally, North America and Europe dominate the HIPPS market, owing to the mature industrial infrastructure and stringent safety regulations. However, the Asia-Pacific region is expected to witness the highest growth due to rapid industrialization, especially in countries like China and India, and increasing investments in infrastructure development. This shift towards automation and advanced safety systems in the region is expected to drive market growth significantly.

Market Insights:

- The High Integrity Pressure Protection System (HIPPS) market is valued at USD 450 million and is expected to reach USD 706.5 million by 2032, growing at a CAGR of 5.8%.

- Rising industrial safety concerns in high-risk sectors like oil & gas and chemicals drive the demand for HIPPS to prevent catastrophic failures.

- Stringent regulatory standards are pushing industries to adopt HIPPS, ensuring compliance and protecting personnel and facilities from overpressure incidents.

- The adoption of automation and control systems in industrial setups increases the need for HIPPS, providing real-time monitoring and enhanced protection.

- HIPPS systems help minimize operational downtime in sectors like oil & gas and chemicals, ensuring continuous operations and reducing equipment damage.

- The Asia-Pacific region is poised for significant growth, capturing 30% of the market share due to rapid industrialization and infrastructure development.

- North America and Europe continue to dominate the market, holding 35% and 28% shares respectively, due to their mature infrastructure and strict safety regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Industrial Safety Systems

The increasing focus on industrial safety across high-risk sectors is a key driver for the High Integrity Pressure Protection System (HIPPS) market. Industrial accidents, especially in sectors like oil & gas, chemical processing, and power generation, can result in catastrophic consequences. HIPPS provides a critical safety layer, preventing overpressure situations that may lead to equipment failure or hazardous incidents. As industries prioritize worker safety and environmental protection, the adoption of such systems is becoming more widespread. HIPPS plays an essential role in ensuring safe operations and minimizing the risk of damage to both assets and personnel.

Stringent Regulatory Standards and Compliance Requirements

Stringent regulatory standards for industrial safety are further driving the demand for HIPPS in various sectors. Regulatory bodies worldwide have implemented increasingly stringent rules to safeguard workers, facilities, and the environment from potential accidents. These regulations, particularly in high-risk industries, mandate the use of advanced safety measures such as HIPPS to prevent overpressure scenarios. Compliance with safety standards not only protects human life and the environment but also helps businesses avoid costly penalties, making HIPPS adoption essential to meet these requirements.

- For instance, Emerson released valve assemblies in October 2021 that are SIL 3 certified per IEC 61508 standards, providing reliable overpressure protection and meeting rigorous safety compliance for oil and gas industries.

Advancements in Automation and Control Systems

Automation and advanced control systems are accelerating the demand for HIPPS. Modern industrial setups are increasingly automated, leading to more complex systems and a higher need for robust safety measures. The integration of HIPPS within these automated systems provides real-time pressure monitoring and instant reaction to abnormal pressure levels, ensuring immediate protection. The growth of smart factory concepts and Industry 4.0 initiatives further enhances the adoption of HIPPS as part of automated safety solutions in critical environments.

- For instance, Yokogawa’s ProSafe-SLS system, designed for SIL 3 and 4 levels, integrates with control systems to provide the highest safety performance without software dependencies, improving system reliability in complex automated plants.

Focus on Minimizing Operational Downtime and Reducing Costs

Minimizing operational downtime is another significant factor driving the adoption of HIPPS. In industries like oil & gas, chemicals, and energy, equipment failure due to overpressure can lead to lengthy and costly shutdowns. HIPPS prevents such failures by providing proactive protection, thereby reducing unscheduled downtime. By maintaining system integrity and preventing catastrophic damage, HIPPS ensures the smooth, continuous operation of industrial processes, contributing to overall cost savings and improved operational efficiency.

Market Trends:

Increased Integration with Smart Factory Systems and Industry 4.0

The High Integrity Pressure Protection System (HIPPS) market is experiencing a growing trend towards integration with smart factory systems and Industry 4.0 technologies. As industries embrace automation, data exchange, and advanced control systems, the demand for intelligent pressure protection systems has increased. HIPPS is becoming an integral part of the overall safety and automation framework in industries like oil and gas, chemical processing, and power generation. It enables real-time monitoring and control, allowing for predictive maintenance and immediate responses to abnormal pressure levels. The growing trend of Industry 4.0 and smart factory adoption is accelerating the implementation of HIPPS, ensuring that safety protocols are seamlessly incorporated into automated processes, thereby enhancing both operational efficiency and safety standards.

- For instance, Emerson’s HIPPS solution is designed to shut down final elements within 2 to 3 seconds in overpressure events, significantly reducing the need for manual inspections and lowering operational downtime in oil and gas plants.

Growing Demand for Eco-friendly and Sustainable Solutions

Sustainability is an emerging trend driving the HIPPS market, with industries increasingly focusing on environmentally friendly and energy-efficient solutions. As companies prioritize reducing their environmental footprint, there is a rising need for systems that not only improve safety but also contribute to energy savings and operational efficiency. HIPPS helps prevent system failures that can lead to energy wastage and environmental damage, supporting industries in achieving sustainability goals. The growing emphasis on corporate social responsibility and environmental regulations is pushing companies to adopt more eco-friendly technologies. As a result, the demand for pressure protection systems that combine safety, efficiency, and sustainability is likely to increase in the coming years.

- For instance, Yokogawa Electric Corporation has successfully deployed over 20 subsea HIPPS installations, including in the North Sea’s Kristin field, delivering systems capable of operating at pressures as high as 13,000 psi while ensuring safety and reducing environmental risks.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

One of the significant challenges in the High Integrity Pressure Protection System (HIPPS) market is the high initial investment and ongoing maintenance costs. The installation of HIPPS in industrial setups requires significant capital expenditure, which may deter smaller companies from adopting these systems. The complexity of the system and the need for specialized maintenance further contribute to the operational costs. Continuous calibration, testing, and replacement of components add to the financial burden, making it challenging for some businesses to justify the investment despite the long-term benefits of enhanced safety and reduced downtime.

Integration Challenges with Legacy Systems

Integrating HIPPS with legacy industrial systems poses another challenge in the market. Many industries continue to rely on outdated infrastructure, which may not support the advanced capabilities of modern pressure protection systems. Retrofitting these systems to work with older equipment can be technically complex and costly. The lack of standardization across different industrial sectors further complicates the integration process, as companies may face compatibility issues. Despite the increasing need for HIPPS in high-risk industries, these integration challenges can delay adoption and hinder the widespread implementation of the technology.

Market Opportunities:

Expansion of Industrial Applications and Emerging Markets

The High Integrity Pressure Protection System (HIPPS) market presents significant opportunities through the expansion of industrial applications, particularly in emerging markets. Industries such as renewable energy, pharmaceuticals, and food processing are increasingly adopting HIPPS to enhance operational safety and meet regulatory requirements. With the ongoing industrialization in regions like Asia-Pacific and Latin America, there is a growing demand for safety solutions in new infrastructure projects. The rapid expansion of these markets provides an opportunity for HIPPS providers to offer their solutions to a broader range of industries, facilitating further growth in the market.

Advancements in Technology and Customization Options

Technological advancements present another key opportunity for the HIPPS market. As industries seek more tailored safety solutions, the demand for customizable HIPPS systems is increasing. Advances in IoT, artificial intelligence, and data analytics are enabling the development of smarter and more efficient systems that offer predictive maintenance, real-time monitoring, and automated pressure control. These innovations enhance the value proposition of HIPPS, making it a more attractive investment for industries looking to optimize safety and operational performance. The integration of these technologies will drive further growth and open new avenues for HIPPS adoption in diverse industrial sectors.

Market Segmentation Analysis:

By Type

The High Integrity Pressure Protection System Market is segmented into mechanical and electronic HIPPS. Mechanical systems dominate the market due to their proven reliability in harsh environments, ensuring robust protection. Electronic systems are gaining traction, driven by advancements in automation and control, offering enhanced efficiency, real-time monitoring, and data-driven safety management.

- For instance, Emerson’s mechanical HIPPS uses dual valve isolation with redundant hydraulic systems and a safety instrumented system logic solver achieving SIL 3 certification with a Probability of Failure on Demand (PFD) of 2.94E-04, providing robust fail-safe operation in critical process environments.

By Offering

The market is divided into hardware and software offerings. Hardware, which includes components like sensors, valves, and actuators, holds the larger share due to its critical role in the functionality of HIPPS. Software solutions are growing rapidly as industries increasingly integrate automation and IoT technologies, providing advanced capabilities like predictive maintenance, real-time monitoring, and system optimization for enhanced operational safety.

- For instance, ABB’s Ability Genix™ predictive maintenance software uses AI-driven analytics enabling early fault detection and reducing unplanned downtime by identifying anomalies accurately.

By End-Use

The oil and gas industry leads the market, as HIPPS is essential for preventing overpressure incidents in both upstream and downstream operations. The chemical and power generation sectors also represent significant portions of the market, as they rely on HIPPS systems to ensure safety and regulatory compliance. Additionally, industries such as food processing and pharmaceuticals are increasingly adopting HIPPS solutions to strengthen safety protocols and meet stringent operational standards.

Segmentations:

By Type

- Mechanical HIPPS

- Electronic HIPPS

By Offering

By End-Use

- Oil & Gas

- Chemical

- Power Generation

- Food Processing

- Pharmaceuticals

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Mature Industrial Infrastructure and Strict Regulations

North America holds a 35% share of the High Integrity Pressure Protection System (HIPPS) market. The region’s well-established industrial infrastructure and stringent safety regulations make it a key adopter of HIPPS solutions. Countries like the United States and Canada dominate industries such as oil and gas, chemicals, and power generation, where HIPPS systems are critical. Regulatory bodies like OSHA and the EPA enforce strict standards that compel businesses to implement advanced safety measures. These regulations significantly drive the demand for pressure protection systems to ensure compliance and minimize the risk of accidents.

Europe: Regulatory Focus and High Safety Standards

Europe accounts for 28% of the HIPPS market share, driven by a robust regulatory framework and strong safety culture. The region places a high emphasis on energy efficiency and environmental protection, which boosts the demand for HIPPS solutions, particularly in sectors like chemicals, manufacturing, and energy. Key countries such as Germany, France, and the UK are investing heavily in industrial safety solutions, with a focus on oil and gas operations. The continuous push for regulatory compliance in environmental and safety standards further accelerates the adoption of HIPPS across the continent.

Asia-Pacific: Rapid Industrialization and Growing Infrastructure Development

Asia-Pacific captures 30% of the HIPPS market share, experiencing the highest growth due to rapid industrialization and significant infrastructure investments. Countries like China and India are expanding their industrial sectors, especially in oil, gas, and energy production, fueling the need for advanced safety systems. The growing focus on automation and smart factories enhances the integration of HIPPS solutions. Increased industrial safety awareness and the need for compliance with global safety standards are further driving the market’s growth in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- L&T Valves Limited. (LARSEN & TOUBRO LIMITED)

- Ringo Válvulas (Samson AG group)

- Siemens

- IMI

- Rockwell Automation

- Schneider Electric

- Yokogawa Electric Corporation

- Maverick Valves (MV Nederland BV)

- Ampo

- ABB

- Baker Hughes Company

- Emerson Electric Co.

- Mokveld Valves B.V.

Competitive Analysis:

The High Integrity Pressure Protection System Market is competitive, with major players like Emerson Electric Co., Honeywell International Inc., and Schneider Electric leading through technological innovation and extensive industry expertise. These companies offer comprehensive HIPPS solutions, particularly for oil & gas, chemicals, and power generation sectors. Smaller regional players are also emerging, providing cost-effective, customized solutions to cater to specific industrial needs. As the demand for automation and smart technologies grows, key players are integrating IoT, AI, and real-time monitoring capabilities into their offerings, enhancing system efficiency and operational safety. This continuous innovation and the focus on advanced functionalities allow companies to maintain a competitive edge in the market.

Recent Developments:

- In January 2025, Siemens announced that JetZero selected the Siemens Xcelerator Platform to develop a new blended-wing aircraft.

- In May 2025, Siemens launched Depot 360 Home in the United States to simplify the management of electric vehicle fleets.

- In June 2025, Rockwell Automation launched OptixEdge, an edge gateway solution that enables faster decision-making by processing data at the machine level.

Report Coverage:

The research report offers an in-depth analysis based on Type, Offering, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for High Integrity Pressure Protection Systems (HIPPS) will continue to rise as industrial sectors prioritize safety and regulatory compliance.

- Increased adoption of automation and smart factory systems will drive the integration of HIPPS into advanced industrial processes.

- The oil and gas sector will remain a key market driver, with HIPPS systems critical in preventing overpressure incidents.

- Rapid industrialization in emerging markets, particularly in Asia-Pacific, will create new growth opportunities for HIPPS providers.

- Advancements in IoT, AI, and data analytics will lead to smarter, more efficient HIPPS solutions with real-time monitoring and predictive maintenance capabilities.

- Growing regulatory pressures will push industries to implement more robust safety systems to avoid penalties and protect both workers and the environment.

- The chemical and power generation industries will continue to drive demand for HIPPS to prevent operational disruptions and ensure continuous production.

- Increasing awareness of the importance of system reliability and uptime in high-risk industries will further boost HIPPS adoption.

- Companies will focus on reducing the cost of HIPPS solutions through innovations in technology and manufacturing processes, making them more accessible to smaller enterprises.

- As sustainability becomes a priority, the integration of HIPPS in environmentally conscious industries will see increased demand for energy-efficient and eco-friendly solutions.