Market overview

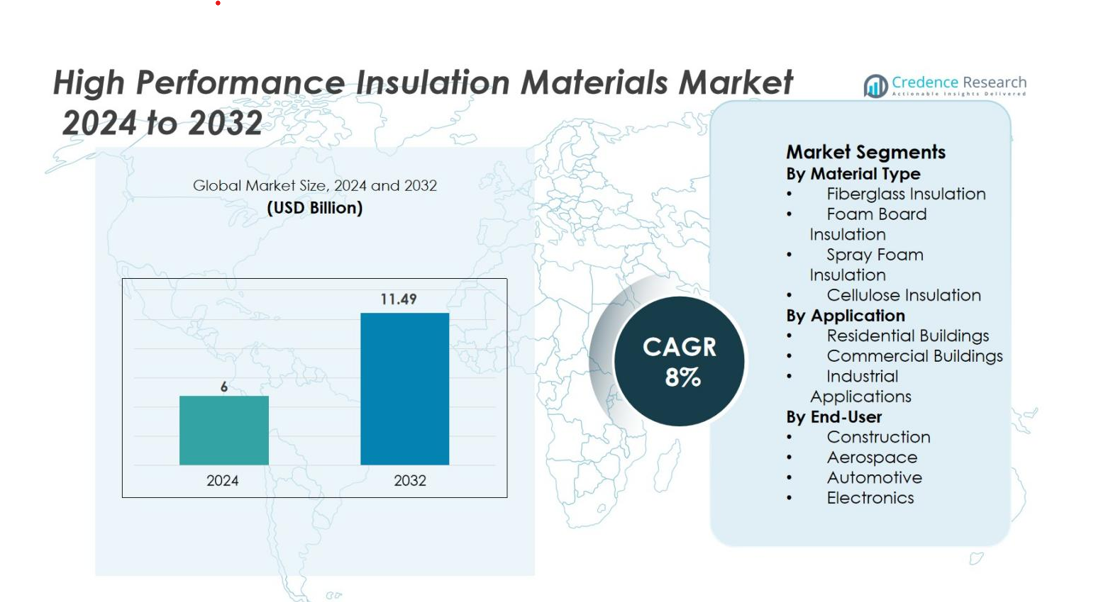

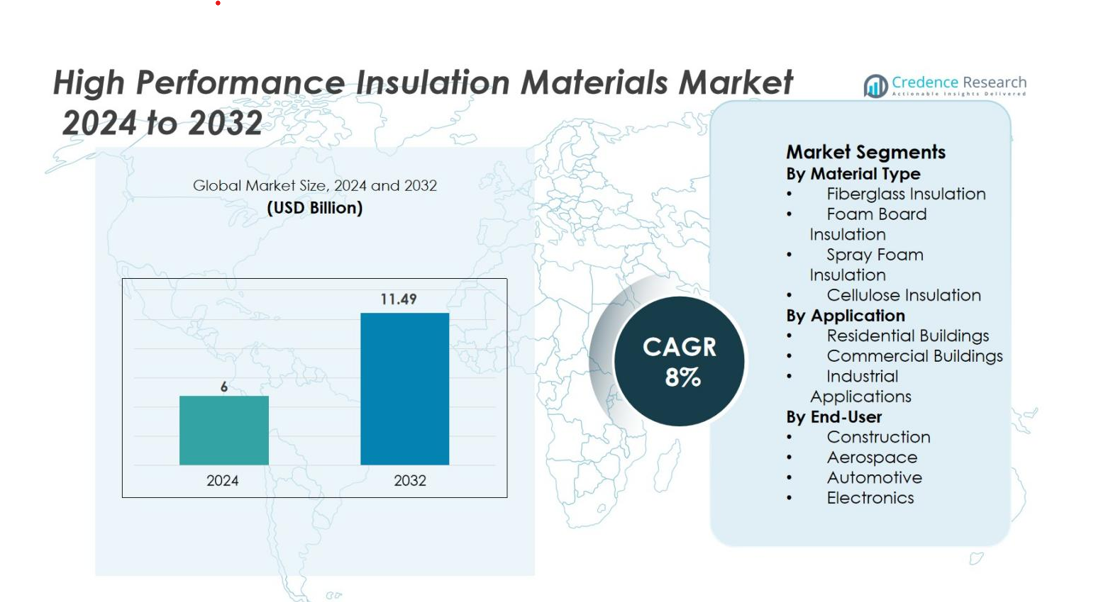

The High-Performance Insulation Materials market was valued at USD 6 billion in 2024 and is anticipated to reach USD 11.49 billion by 2032, growing at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High-Performance Insulation Materials Market Size 2024 |

USD 6 billion |

| High-Performance Insulation Materials Market, CAGR |

8% |

| High-Performance Insulation Materials Market Size 2032 |

USD 11.49 billion |

The High-Performance Insulation Materials market is driven by notable global players such as Owens Corning, Armacell International S.A., Saint‑Gobain S.A., Rockwool International A/S, Johns Manville Corporation, Evonik Industries AG, Thermablok Inc., Aerogel Technologies, LLC, Recticel Group and Sekisui Chemical Co., Ltd.. These companies benefit from broad geographic footprints, vertical integration and strong R&D capabilities, which help them maintain a competitive edge. Regionally, the Asia‑Pacific region captures the largest share of the global market — approximately 42% — due to rapid urbanization, infrastructure build‑out and heightened demand for energy‑efficient buildings and industrial facilities.

Market Insights

- The High-Performance Insulation Materials market was valued at USD 6 billion in 2024 and is expected to reach USD 11.49 billion by 2032, growing at a CAGR of 8% during the forecast period.

- The primary drivers for market growth include the increasing demand for energy-efficient buildings, stricter building codes, and rising construction activities, particularly in the residential and commercial sectors.

- Key trends include growing sustainability efforts, adoption of green building certifications, and advancements in insulation technologies, such as aerogels and spray foam.

- The market is highly competitive, with major players like Owens Corning, Saint-Gobain, Rockwool, and Johns Manville leading. These companies focus on product innovation, strategic partnerships, and regional expansion to maintain market share.

- The Asia-Pacific region leads the market with approximately 42% share, followed by North America at 35%. Fiberglass insulation dominates the market, holding the largest share within material types.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Material Type

The High-Performance Insulation Materials market is segmented into four primary material types: Fiberglass Insulation, Foam Board Insulation, Spray Foam Insulation, and Cellulose Insulation. Among these, Fiberglass Insulation dominates the market with the largest share, driven by its cost-effectiveness, excellent thermal performance, and wide range of applications in both residential and commercial sectors. Fiberglass insulation accounts for 40% of the total market share. The growing demand for energy-efficient solutions in construction and the rising focus on sustainability are key drivers of fiberglass insulation’s market leadership.

- For instance, Owens Corning’s PINK Next Gen Fiberglas insulation offers R-values ranging from 11 to 49, catering to various thicknesses and providing proven thermal control and sound dampening, with long-term stability that prevents settling within wall cavities.

By Application

The application segment of the High-Performance Insulation Materials market is categorized into Residential Buildings, Commercial Buildings, and Industrial Applications. Residential Buildings hold the largest market share, accounting for 45% of the segment. This dominance is attributed to the increasing demand for energy-efficient homes and government regulations promoting green building standards. Additionally, the growing trend of sustainable living and the desire for reduced energy costs continue to propel the demand for high-performance insulation in residential construction.

- For instance, the use of cellulose insulation made from recycled paper in eco-friendly homes aligns with green building trends by reducing energy bills and carbon footprints through its high R-value and sustainability benefits.

By End-User

The High-Performance Insulation Materials market is also segmented by end-user into Construction, Aerospace, Automotive, and Electronics. The Construction sector holds the largest share, estimated at 50%, due to the continuous growth in residential and commercial building projects. The need for energy-efficient buildings, government mandates on building codes, and the shift toward sustainable construction practices are significant factors contributing to the dominance of the construction sector. Additionally, the increasing emphasis on noise reduction and thermal insulation in modern buildings supports this growth.

Key Growth Drivers

Rising Demand for Energy Efficiency

The growing global emphasis on energy efficiency in buildings and industrial applications is a significant driver for the High-Performance Insulation Materials market. As governments worldwide enforce stricter energy standards and regulations, the demand for materials that reduce energy consumption and enhance thermal performance continues to increase. Energy-efficient insulation helps minimize heat loss, reduces carbon footprints, and lowers energy bills, making it a critical element in both new construction and renovation projects. The surge in consumer awareness about environmental impact and rising utility costs further accelerates this trend.

- For instance, Kenya’s New National Building Code 2024, active since March 2025, includes stringent energy performance standards improving building resource efficiency and sustainability, setting an example for emerging economies.

Construction Sector Expansion

The rapid growth of the construction sector, particularly in emerging economies, is a pivotal driver of the High-Performance Insulation Materials market. Increased infrastructure development, coupled with rising urbanization, has led to a higher demand for residential, commercial, and industrial buildings that prioritize energy efficiency and sustainability. In developed markets, building codes and regulations are becoming more stringent, promoting the use of high-performance insulation materials in new construction and renovation projects. Additionally, the trend towards eco-friendly, energy-efficient buildings has spurred the adoption of advanced insulation solutions.

- For instance, the US and Europe increasingly mandate insulation compliance with codes such as ASHRAE 90.1 and the EU’s Energy Performance of Buildings Directive, ensuring thermal resistance and fire safety, which fuels high-performance insulation adoption in new construction and retrofitting projects.

Technological Advancements in Insulation Materials

Technological advancements in insulation materials play a crucial role in the market’s growth by offering more efficient, durable, and environmentally friendly options. Innovations such as aerogels, vacuum insulation panels, and spray foam insulation have improved the performance of insulation materials, providing superior thermal and acoustic insulation while maintaining a lightweight and easy-to-install profile. These advancements not only enhance energy efficiency but also contribute to the development of sustainable and green building practices. The growing focus on reducing the environmental impact of construction materials further boosts the demand for high-performance insulation solutions.

Key Trends & Opportunities

Sustainability and Green Building Practices

Sustainability remains one of the leading trends in the High-Performance Insulation Materials market. The shift toward green building practices, driven by environmental concerns and regulations, is significantly impacting the demand for advanced insulation materials. Eco-friendly and sustainable insulation solutions, such as cellulose and recycled fiberglass, are gaining popularity due to their minimal environmental impact and excellent thermal efficiency. Additionally, with the growing adoption of LEED (Leadership in Energy and Environmental Design) certifications and other green building standards, the need for materials that contribute to energy conservation and environmental sustainability has surged.

- For instance, Owens Corning’s EcoTouch® insulation uses recycled glass and a proprietary, bio-based binder called PureFiber® Technology, lowering its ecological footprint while maintaining high thermal performance.

Increased Demand in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, present significant opportunities for growth in the High-Performance Insulation Materials market. As industrialization and urbanization accelerate in these regions, the demand for modern, energy-efficient construction is rising. The increasing adoption of international building codes, along with government incentives aimed at reducing energy consumption, is driving the need for high-performance insulation materials. Additionally, a growing middle class and rising disposable incomes are leading to higher standards of living, with consumers increasingly seeking energy-efficient homes and buildings.

- For instance, Kingspan Group PLC is notable for its Kooltherm and Therma rigid insulation boards, which are gaining traction in Asia-Pacific markets due to superior thermal resistance and alignment with carbon-neutral building goals.

Key Challenges

High Material and Production Costs

One of the key challenges facing the High-Performance Insulation Materials market is the high material and production costs associated with advanced insulation solutions. Materials such as aerogels, vacuum insulation panels, and spray foam insulation tend to be more expensive than traditional insulation options, which can limit their widespread adoption, especially in cost-sensitive markets. While these materials offer superior thermal and acoustic performance, the upfront cost can be a barrier for some residential and commercial projects, particularly in emerging markets where cost constraints are more prevalent.

Competition from Traditional Insulation Materials

The High-Performance Insulation Materials market faces significant competition from traditional insulation materials like fiberglass, cellulose, and foam boards, which have been in the market for decades. These materials are well-established, cost-effective, and widely available, making it challenging for newer, more advanced insulation products to gain market share. While advanced insulation solutions offer superior performance, many end-users still opt for traditional materials due to their lower cost and familiarity. To overcome this challenge, manufacturers of high-performance insulation materials must focus on educating consumers about the long-term benefits, including energy savings, durability, and environmental impact, to encourage the shift toward newer and more efficient insulation solutions.

Regional Analysis

Asia-Pacific

The Asia-Pacific region leads the high-performance insulation materials market with 42% of global revenue, driven by rapid urbanization, booming infrastructure investment, and strong growth in residential construction across China, India, and Southeast Asia. Governments in the region are increasingly enforcing energy-efficiency standards and retrofitting older buildings, which is fueling demand for advanced insulation. The industrial sector’s expansion particularly in electronics manufacturing and cold-storage facilities further supports uptake. Rising awareness of sustainability and lower cost barriers compared to Western markets are additional growth enablers in this high-momentum region.

North America

In North America, the high-performance insulation materials market accounts for 35% of global revenues, driven by strict building codes, government incentive programs, and a strong focus on retrofit opportunities in residential and commercial real estate. Energy-efficiency regulations mandate high-performance insulation usage in new construction and renovations. Manufacturers in the U.S. and Canada are investing in new insulation technologies to meet demand for enhanced thermal and acoustic performance. The mature market environment, combined with demand for sustainability upgrades, positions North America as a key region for premium insulation materials.

Europe

Europe contributes 25% of the global high-performance insulation materials market, supported by longstanding energy-efficiency targets, comprehensive building-performance legislation, and significant renovation programs across the UK, Germany, and France. Regulatory frameworks such as the EU Energy Performance of Buildings Directive push for higher insulation standards in both new and existing buildings. The commercial and industrial segments hold strong potential thanks to increased retrofitting of older buildings for thermal and acoustic efficiency. Market maturity means growth is more incremental, but demand remains steady for high-quality insulation materials that support green-building certification.

Market Segmentations

By Material Type

- Fiberglass Insulation

- Foam Board Insulation

- Spray Foam Insulation

- Cellulose Insulation

By Application

- Residential Buildings

- Commercial Buildings

- Industrial Applications

By End-User

- Construction

- Aerospace

- Automotive

- Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the High-Performance Insulation Materials market reflects a fragmented structure marked by robust activity among established global players. Companies such as Owens Corning, Saint‑Gobain, Rockwool International A/S, Johns Manville Corporation, Armacell International S.A. and Evonik Industries AG dominate the market through extensive geographic reach, broad product portfolios, and strong brand recognition. These firms invest heavily in research and development to enhance thermal and acoustic performance, lightweight solutions, and sustainable insulation materials. Consolidation through acquisitions, partnerships and technology licensing further strengthens their competitive positions and enables rapid entry into emerging markets. Meanwhile, a large number of regional and niche manufacturers continue to vie for market share by offering specialized materials tailored to localized applications and cost‑sensitive segments, intensifying competitive pressure across product types and end‑use industries

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Foli Aerogel partnered with Aerogel Technologies, LLC to launch “Foli Aerogel Adhesive Tape”, an ultra-thin flexible insulation solution aimed at EVs, aerospace and cold-chain logistics.

- In July 2024, Kingspan Group and LONGi Green Energy Technology Co., Ltd. established a strategic partnership to integrate high-performance insulation materials with solar building technologies.

- In December 2023, The ROCKWOOL Group entered into an agreement to acquire Boerner Insulation Sp. z o.o. (Poland) to strengthen its presence in Europe.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is poised to grow steadily as energy‑efficiency regulations tighten globally, prompting widespread uptake of high‑performance insulation materials.

- Emerging markets will open up significant opportunity as rapid urbanisation drives new construction of residential, commercial and industrial buildings.

- The push for sustainability will accelerate development of bio‑based and recycled insulation materials, enabling manufacturers to tap into green‑building certification demand.

- Technological innovation in nanomaterials and vacuum insulation panels will enhance thermal performance and reduce material thickness, supporting retrofit projects in space‑constrained applications.

- Smart insulation systems integrated with sensors and IoT will gain traction, enabling real‑time monitoring of thermal efficiency and contributing to building automation strategies.

- Cross‑industry application beyond construction such as in automotive, aerospace and electronics will expand market scope by requiring lightweight, high‑insulation solutions.

- Regional expansion into Asia‑Pacific and MEA will advance as governments support infrastructure development and energy‑saving standards in new‑build and refurbishment markets.

- Premium product segments will continue to grow faster than commoditised offerings, driven by higher performance requirements and willingness to invest in long‑term savings.

- Supply‑chain optimisation and cost‑reductions in advanced insulation manufacturing will make these materials more accessible to mid‑market and retrofit segments.

- Competitive pressure will increase as both global and regional players seek to differentiate via material innovation, strategic partnerships and geographic footprint extension.