Market Overview

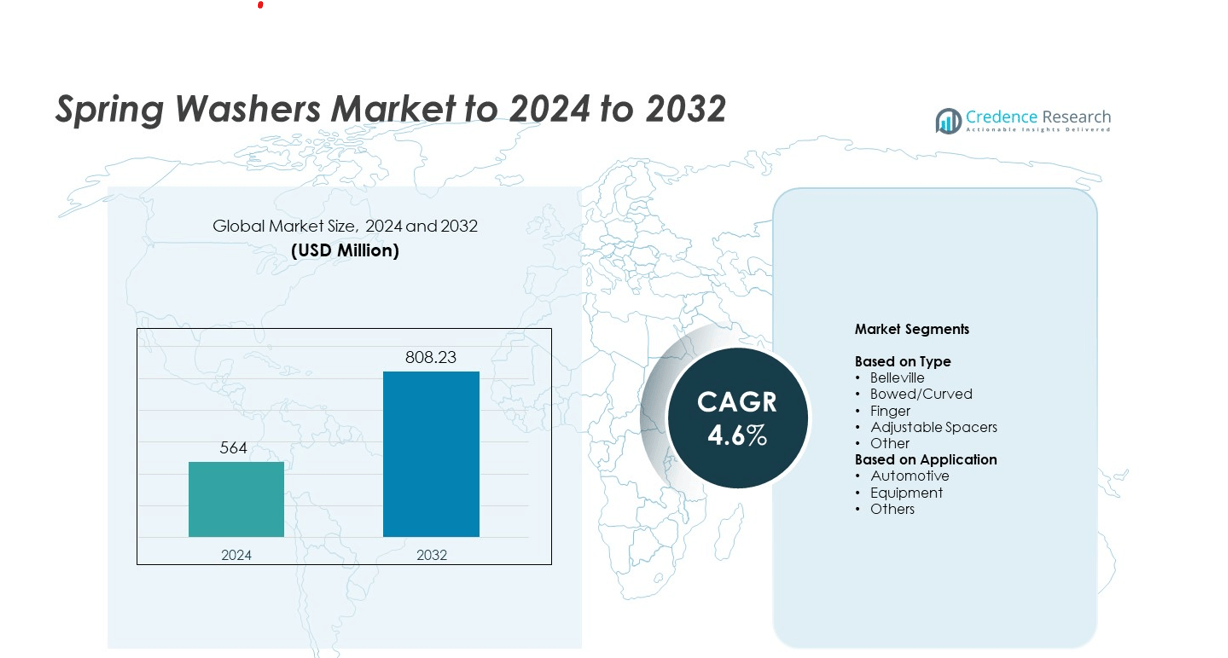

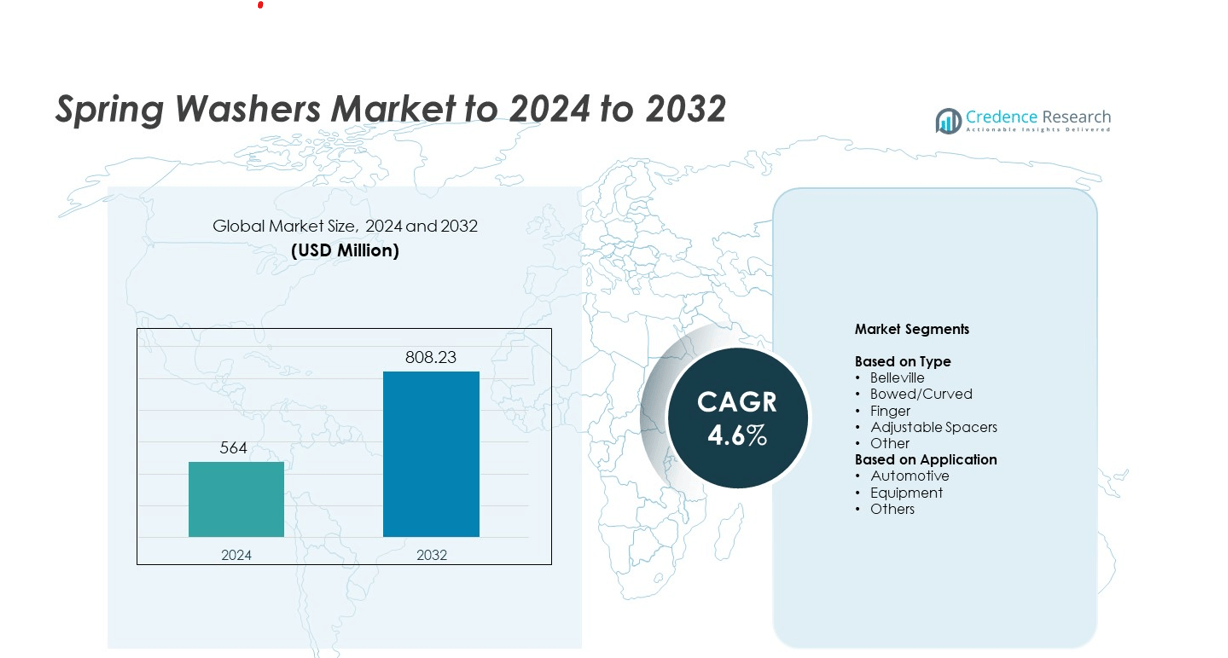

Spring Washers Market size was valued USD 564 Million in 2024 and is anticipated to reach USD 808.23 Million by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spring Washers Market Size 2024 |

USD 564 Million |

| Spring Washers Market, CAGR |

4.6% |

| Spring Washers Market Size 2032 |

USD 808.23 Million |

The Spring Washers Market includes key players such as Bombardier Recreational Products, Accurate Mfd Products, Yamaha, Nord-Lock, Polaris, Foreverbolt, Alpina, Rotor Clip, Crazy Mountain, BRP, Arctic Cat, and Micro Plastics, each contributing to product innovation and wider industry adoption. North America leads the market with about 32% share, driven by strong automotive and equipment manufacturing activity. Europe follows with roughly 28% share supported by strict engineering standards and advanced machinery production. Asia Pacific holds about 30% share due to large-scale industrial growth and expanding automotive output, while Latin America and the Middle East and Africa account for smaller but steady shares as machinery upgrades and construction activities rise.

Market Insights

- The Spring Washers Market was valued at USD 564 Million in 2024 and is projected to reach USD 808.23 Million by 2032, growing at a CAGR of 4.6%.

- Market growth is driven by rising use in automotive fastening systems, wider adoption in industrial machinery, and increasing demand for durable and high-tension assembly components.

- Key trends include the shift toward lightweight and high-strength washer designs, rising precision manufacturing needs, and growing use of spring washers in automated assembly lines.

- Competition intensifies as manufacturers improve material quality, expand customized washer portfolios, and strengthen global distribution to serve automotive, equipment, and construction applications.

- North America leads with about 32% share, followed by Europe at nearly 28% and Asia Pacific at about 30%, while automotive holds around 48% share and Belleville types lead the product segment with about 42% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Belleville washers lead this segment with about 42% share in 2024. Demand stays strong because these conical washers deliver high load capacity, compact design, and precise tension control for heavy-duty assemblies. Industries rely on Belleville designs to maintain joint integrity under vibration, thermal shifts, and dynamic loads. Bowed or curved washers grow as manufacturers use them for flexible preload support in light machinery. Finger types see adoption in rotating systems where smooth torque transmission matters, while adjustable spacers and other forms serve niche uses that require fine height correction or layered stacking.

- For instance, SPIROL International produces Series DS Belleville-style (disc) springs following the DIN EN 16983 (formerly DIN 2093) standard, which offers a wide range of load/deflection characteristics

By Application

Automotive dominates this segment with nearly 48% share in 2024. Automakers adopt spring washers to secure fasteners exposed to shock, heat, and constant vibration in chassis, braking, and powertrain systems. The rising use of lightweight components and high-performance assemblies pushes demand for reliable tension-maintaining washers. Equipment applications expand in industrial machinery and construction tools where stable load distribution supports longer service life. Other uses include electronics and small devices that need compact fastener stability without adding excess mass.

- For instance, Schnorr GmbH notes in its product literature that its DIN 6796 load washers conform to the standard, which specifies they are designed for high-strength bolts (grades 8.8-12.9) and offer optimum compensation for setting in the joint.

Key Growth Drivers

Rising Use in Automotive Fastening Systems

Automotive makers rely on spring washers to keep joints stable under heat, shock, and vibration. Demand rises as new vehicles use more compact parts that need steady tension to avoid loosening. Growth also comes from electric vehicles, which place higher stress on mounting points due to battery weight and torque. This wider use in fasteners makes automotive adoption a major growth driver across global production lines.

- For instance, the Würth Group, which includes specialized companies like Arnold Umformtechnik focusing on connecting technology for the automotive industry, achieved total sales of over €20.4 billion in the 2023 fiscal year, a 2.4 % increase over the previous year.

Expansion of Industrial Machinery and Equipment

Industrial machines need fasteners that stay secure during long duty cycles and heavy loads. Spring washers support this need by offering strong preload control and better load distribution. As industries expand automation and upgrade older systems, buyers pick washers that reduce downtime and lower maintenance risk. This strong industrial push makes machinery growth a key driver for the market.

- For instance, Springmasters supplies DIN 2093 disc springs with outside diameters ranging from 6.0 mm to 250.0 mm, allowing engineers to match washer sizes to both small and very large industrial machinery connections.

Increasing Focus on Durable Assembly Solutions

Manufacturers seek components that support longer product life and reduce field failures. Spring washers help maintain tight joints in harsh settings such as pressure changes, vibration, and repeated motion. Rising quality standards and global safety rules also push companies to use tension-holding hardware. This rising focus on durability and performance stands as a key market driver.

Key Trends and Opportunities

Shift Toward Lightweight and High-Strength Designs

Producers explore new alloys and refined shapes to create lighter washers with higher load ratings. Growing demand for compact assemblies in automotive, equipment, and electronics encourages suppliers to design thin yet strong variants. These upgraded materials help improve energy efficiency and reduce part fatigue. This shift toward advanced lightweight designs forms a major trend and opportunity.

- For instance, the SPIROL Disc Spring Design Guideprovides charts and formulas for engineers to calculate the estimated fatigue life of specific springs, such as the DIN EN 16983 Series B 50 x 25.4 x 2 disc spring operating between a 15% and 75% deflection range.

Growth of Precision Manufacturing and Customized Washers

Buyers now request washers that match exact preload, thickness, and deflection needs. Precision machining and automated forming systems help suppliers deliver consistent, high-tolerance parts. Demand grows in sectors where accurate tension control improves system reliability. The expansion of custom and application-specific washers creates a strong opportunity for specialized manufacturers.

- For instance, Keller + Kalmbachsupplies a wide range of DIN 2093 disc springs with precisely defined dimensions that conform to tight-tolerance engineered assembly requirements.

Adoption of Automated Assembly Lines

Automated lines need fasteners that fit smoothly into high-speed processes. Spring washers designed for clean feeding and stable stacking gain traction. As more factories automate production, these optimized washers reduce rejection rates and improve throughput. Automation growth creates a clear opportunity for suppliers offering assembly-friendly designs.

Key Challenges

Fluctuating Raw Material Prices

Spring washer production depends on steel grades and specialty alloys that face constant price swings. These shifts raise production costs and squeeze margins for small suppliers. Companies struggle to balance quality and cost during volatile periods. This ongoing material instability stands as a major challenge for the market.

Competition from Alternative Fastening Solutions

Some systems now use locking nuts, thread adhesives, or integrated fastening designs that reduce the need for washers. These alternatives gain attention in sectors focused on fewer parts and faster assembly. As designs evolve, spring washers must prove higher value to remain standard in critical joints. This rise of competing solutions remains a key market challenge.

Regional Analysis

North America

North America holds about 32% share in the Spring Washers Market in 2024. The region benefits from strong automotive production, advanced equipment manufacturing, and strict quality standards that support steady demand. Industries such as construction machinery, aerospace components, and energy infrastructure rely on washers that maintain tension under vibration and thermal stress. The United States leads due to large-scale industrial activity and high adoption of precision fastening systems. Canada adds demand through machinery exports and mining equipment needs. Ongoing upgrades in production facilities and higher reliability requirements strengthen long-term growth across the region.

Europe

Europe accounts for nearly 28% share in the Spring Washers Market in 2024. The region maintains strong demand driven by large automotive fleets, advanced engineering standards, and strong industrial machinery production. Germany, France, and Italy support steady growth due to high reliance on durable fastening components in transport systems and heavy equipment. Strict safety rules encourage the use of tension-maintaining washers in high-load assemblies. The region’s strong focus on lightweight components further increases demand for precision-formed washers. Continued innovation in manufacturing lines and growth in electric mobility support stable long-term expansion.

Asia Pacific

Asia Pacific leads many production activities but holds about 30% share in the Spring Washers Market in 2024. Rapid industrial expansion, large automotive manufacturing hubs, and rising machinery exports support strong washer consumption. China drives demand with large equipment factories and wider use of automated assembly lines. India and Southeast Asia add growth due to infrastructure development and expansion of light machinery sectors. Manufacturers in this region focus on affordable but durable fastening components. Rising investment in electric vehicles and consumer electronics further enhances adoption of high-strength spring washer designs.

Latin America

Latin America represents around 6% share in the Spring Washers Market in 2024. Demand grows steadily due to the expansion of automotive servicing networks, mining equipment use, and moderate industrial development. Brazil leads with strong machinery manufacturing and wider application of tension-maintaining fasteners in heavy equipment. Mexico adds demand through automotive component production and assembly operations. Growth remains moderate but stable as industries upgrade older machines to improve reliability and reduce downtime. Expanding construction activity and transport equipment markets contribute to ongoing washer consumption across the region.

Middle East and Africa

Middle East and Africa hold about 4% share in the Spring Washers Market in 2024. The region sees demand from oil and gas operations, mining machinery, and heavy construction equipment that rely on stable fastening under high vibration and pressure. Gulf countries support washer use in industrial projects and large-scale infrastructure. Africa adds growth through mining machinery and transport equipment upgrades. Adoption remains gradual but increases as industries improve maintenance standards and depend more on reliable fastening solutions. Rising investment in manufacturing and logistics equipment contributes to steady long-term market development.

Market Segmentations:

By Type

- Belleville

- Bowed/Curved

- Finger

- Adjustable Spacers

- Other

By Application

- Automotive

- Equipment

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Spring Washers Market features leading companies such as Bombardier Recreational Products, Accurate Mfd Products, Yamaha, Nord-Lock, Polaris, Foreverbolt, Alpina, Rotor Clip, Crazy Mountain, BRP, Arctic Cat, and Micro Plastics in a highly competitive environment. The market includes global manufacturers focusing on durable fastening solutions supported by strong engineering capabilities, wide product portfolios, and consistent material quality. Many firms invest in advanced forming technologies to improve load retention, fatigue strength, and dimensional accuracy. Competition intensifies as suppliers expand distribution networks and adopt automated production lines to meet rising precision requirements. Companies strengthen market presence by offering customized washers designed for specific load, tension, and vibration conditions across automotive, machinery, construction, and equipment sectors. Producers also broaden their reach in emerging markets where industrial expansion drives new demand. Rising focus on performance reliability, lightweight engineering, and high-strength alloys continues to shape competitive strategies across the sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Arctic Cat resumed production of snowmobiles and side-by-side vehicles, indicating a focus on advanced component manufacturing including spring washers in their production lines.

- In 2025, Polaris introduced improved suspension systems featuring longer torsion springs with redesigned mounting points for enhanced performance on their 2026 RMK and INDY XCR models.

- In 2025, Rotor Clip continued to innovate with nested wave springs for high static load applications and introduced customized wave spring solutions tailored to exact specifications, improving force accuracy and simplifying assembly processes.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as industries use more durable fastening solutions.

- Automotive production and electric vehicle expansion will raise long-term washer demand.

- Industrial machinery upgrades will increase the need for preload-stable washer designs.

- Adoption of lightweight and high-strength materials will support advanced washer development.

- Automation in factories will boost demand for washers suited for high-speed assembly lines.

- Precision manufacturing will push suppliers to offer tighter tolerances and custom designs.

- Construction and infrastructure projects will increase washer use in heavy-load applications.

- Global safety standards will drive the adoption of reliable tension-holding assemblies.

- Emerging markets will see faster growth as machinery and transport systems expand.

- Competition will shift toward improved performance washers that replace older designs.