Market Overview

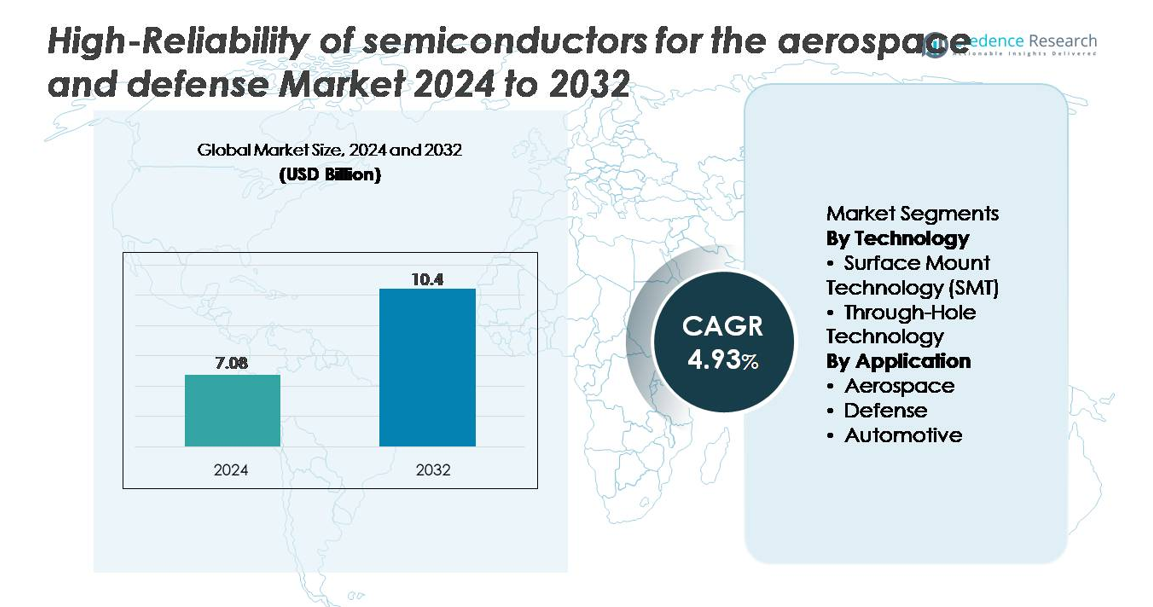

The global high-reliability semiconductors for aerospace and defense market was valued at USD 7.08 billion in 2024 and is projected to reach USD 10.40 billion by 2032, reflecting a CAGR of 4.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High-Reliability Of Semiconductors For The Aerospace And Defense Market Size 2024 |

USD 7.08 billion |

| High-Reliability Of Semiconductors For The Aerospace And Defense Market, CAGR |

4.93% |

| High-Reliability Of Semiconductors For The Aerospace And Defense Market Size 2032 |

USD 10.40 billion |

The high-reliability semiconductors for aerospace and defense market is shaped by a strong group of specialized manufacturers, including Skyworks Inc., Teledyne Technologies Inc., SEMICOA, Vishay Intertechnology, Digitron Semiconductors, Texas Instruments Incorporated, Semtech Corporation, Microsemi, Infineon Technologies AG, and Time Technology Ltd. These players compete through portfolios of radiation-hardened processors, wide-bandgap power devices, precision analog ICs, and high-frequency RF components engineered for extreme aerospace and defense environments. North America leads the market with approximately 38% share, supported by advanced defense modernization programs, strong domestic semiconductor capabilities, and the presence of major aerospace OEMs. This leadership reinforces regional demand for long-life, mission-critical semiconductor solutions.

Market Insights

- The high-reliability semiconductors for aerospace and defense market was valued at USD 7.08 billion in 2024 and is expected to reach USD 10.40 billion by 2032, growing at a CAGR of 4.93% during the forecast period.

- Market growth is driven by rising investments in advanced radar systems, electronic warfare platforms, secure communication electronics, and satellite missions requiring radiation-hardened processors, wide-temperature power devices, and high-frequency RF components.

- Key trends include increasing adoption of GaN and SiC wide-bandgap semiconductors, miniaturized packaging, and mission-grade chip architectures supporting autonomous defense systems, AI-enabled ISR platforms, and high-density avionics electronics.

- The competitive landscape features players such as Skyworks, Teledyne Technologies, SEMICOA, Texas Instruments, Semtech, Microsemi, Vishay, Infineon, Digitron Semiconductors, and Time Technology, all expanding qualified MIL-STD and space-grade product portfolios.

- Regionally, North America leads with ~38% share, followed by Europe at ~28% and Asia-Pacific at ~24%; technologically, SMT dominates the segment, while defense applications hold the highest share driven by mission-critical electronics demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology (Surface Mount Technology, Through-Hole Technology)

Surface Mount Technology (SMT) accounts for the dominant market share due to its ability to support miniaturized, lightweight, and high-density circuit designs required in modern aerospace and defense systems. SMT components provide superior vibration resistance, thermal stability, and high-frequency performance, enabling their widespread adoption in radar electronics, mission computers, secure communication devices, and satellite payloads. The growing integration of radiation-tolerant microprocessors, RF MMICs, and power management ICs further strengthens SMT’s lead. Through-hole technology remains relevant for high-power connectors and modules exposed to mechanical stress, but its usage is gradually shrinking as defense platforms hift toward compact architectures.

- For instance, Microchip’s RT PolarFire® radiation-tolerant FPGA family includes devices with up to 481,000 logic elements, enabling high-density compute architectures for space systems.

By Application (Aerospace, Defense, Automotive)

The Defense segment leads the market, driven by strong demand for high-reliability semiconductors in electronic warfare systems, missile guidance units, avionics-grade processors, and secure communication hardware. These systems require components tested to stringent MIL-STD standards, prioritizing radiation hardness, thermal resilience, and mission-duration reliability. Aerospace applications follow closely, supported by the expansion of satellite constellations and cockpit modernization programs demanding robust flight-control, navigation, and propulsion electronics. The automotive segment, although smaller, increasingly integrates high-reliability semiconductors for ruggedized ADAS controllers and safety-critical modules, but its share remains secondary to aerospace and defense due to lower qualification requirements.

- For instance, BAE Systems’ RAD5545 radiation-hardened processor delivers 5.6 GFLOPS while operating reliably across extreme thermal and radiation conditions, making it a core component in next-generation defense computing platforms.

KEY GROWTH DRIVERS

Rising Demand for Mission-Critical Electronics Across Aerospace and Defense Platforms

The rapid modernization of aerospace and defense systems significantly increases demand for high-reliability semiconductors capable of performing under extreme operating conditions. Defense programs increasingly rely on advanced electronics for electronic warfare, secure communication networks, radar systems, missile guidance units, and unmanned platforms. These applications require semiconductors engineered for radiation tolerance, high-temperature operation, vibration resistance, and long mission durability. The shift toward autonomous combat systems, high-bandwidth sensors, and network-centric warfare further elevates the need for rugged, radiation-hardened microprocessors, power devices, and RF components. Likewise, aerospace programs including next-generation avionics, space payloads, propulsion control, and satellite constellations depend heavily on high-reliability components qualified to stringent standards such as MIL-PRF-38535 and MIL-STD-883. As mission complexity and data processing requirements advance, semiconductor manufacturers face strong incentives to design specialized chips such as hardened FPGAs, wide-bandgap power devices, and secure communication ICs that guarantee uninterrupted performance throughout critical operations.

- For instance, Microchip’s RT PolarFire® radiation-tolerant FPGA family offers up to 481,000 logic elements and uses SEU-immune flash architecture, enabling reliable compute workloads in space systems.

Expansion of Space Missions, Satellite Programs, and High-Altitude Defense Systems

The global acceleration of space exploration, commercial satellite deployment, and orbital defense initiatives is a major driver of high-reliability semiconductor demand. Low Earth Orbit (LEO) constellations for broadband communication, Earth observation, and military reconnaissance require radiation-hardened processors, RF transceivers, power management ICs, and memory devices capable of withstanding cosmic radiation and extreme thermal swings. Government agencies and private space companies increasingly source components qualified for long-duration missions, boosting adoption of hardened ASICs, SiC-based power devices, and advanced MMICs. Defense-related high-altitude platforms such as hypersonic vehicles, early-warning radar systems, and strategic missile defense interceptors also rely on semiconductors that deliver precise performance under high thermal and aerodynamic stress. As satellite networks escalate in complexity and mission cycles lengthen, aerospace primes demand longer component lifecycles, higher fault tolerance, and guaranteed reliability, prompting chip manufacturers to expand radiation-hardening processes, wafer-level screening, and environmental stress testing capabilities.

- · For instance, CAES’s GR740 radiation-hardened quad-core LEON4 processor delivers up to 1.4 GIPS and is qualified for operation beyond 100 krad (Si), making it a flight-proven computing platform for satellite payload controllers, deep-space missions, and advanced avionics systems.

Increased Adoption of Wide-Bandgap Semiconductors for High-Power and High-Temperature Defense Applications

Defense and aerospace programs increasingly adopt wide-bandgap materials primarily silicon carbide (SiC) and gallium nitride (GaN) to enhance power density, efficiency, and resilience in harsh environments. GaN RF devices offer superior performance for radar, electronic warfare, and secure communication systems, supporting high-frequency, high-power operation with exceptional thermal stability. SiC MOSFETs and diodes are widely deployed in power systems for aircraft actuators, satellite power conditioning units, and missile power modules due to their ability to function at temperatures exceeding 200°C. This shift enables more compact, efficient, and durable subsystems, allowing defense platforms to reduce weight while improving mission performance. With governments prioritizing high-energy radar, directed-energy weapons, and more electrified aircraft architectures, demand for wide-bandgap semiconductors continues to surge. Manufacturers are responding by expanding epitaxy capacity, enhancing wafer quality, and developing space-qualified and MIL-certified wide-bandgap device portfolios.

Key Trends and Opportunities:

Transition Toward Miniaturized, High-Density, and Secure Electronics Architectures

A leading trend is the industry’s rapid transition toward miniaturized, high-density electronic architectures capable of supporting the growing complexity of aerospace and defense systems. Platforms now require more processing power, higher bandwidth sensors, and advanced communication modules in smaller, lighter footprints. This boosts demand for 3DIC packaging, multi-chip modules, chiplet-based architectures, and radiation-hardened SoCs that consolidate multiple functionalities into a single package. Cyber-secure semiconductor design has also emerged as a critical opportunity, with increasing emphasis on encrypted hardware, secure boot, and tamper-resistant architectures to protect mission-critical information. Manufacturers investing in integrated packaging technologies, RF-system-in-package solutions, and high-density memory architectures benefit from strong adoption across avionics, ISR platforms, UAVs, and satellite systems. As missions require more functionality in compact volumes, the opportunity for next-generation microelectronics with enhanced thermal performance and reliability continues to expand.

- For instance, Intel’s Stratix® 10 MX FPGA integrates HBM2 memory delivering up to 512 GB/s bandwidth and uses EMIB 2.5D packaging to support high-throughput signal processing workloads required in defense-grade sensor fusion and electronic warfare test environments.

Growing Opportunity in Multi-Domain Operations, AI-Driven Defense Systems, and Autonomous Platforms

The emergence of multi-domain operations and AI-enhanced defense systems boosts demand for high-performance semiconductors capable of supporting real-time data processing, situational awareness, and autonomous decision-making. Modern ISR sensors, battlefield networks, and unmanned platforms require advanced processors, high-speed memory, AI accelerators, and ruggedized edge-computing devices. Autonomous drones, robotic defense systems, and hypersonic platforms rely on chips with high thermal tolerance, fast switching speeds, and rugged design. Semiconductor manufacturers that develop AI-optimized, radiation-tolerant compute architectures such as hardened GPUs, neural accelerators, and FPGA-based AI modules gain a strong advantage. As defense agencies integrate AI into mission systems, opportunities expand for providers capable of delivering secure, deterministic, real-time hardware that maintains performance integrity under extreme aerospace and battlefield conditions.

- For instance, NVIDIA’s Jetson AGX Orin module delivers up to 275 TOPS of AI performance within a configurable 15–60 W power budget, supporting edge-AI workloads such as real-time object detection and multi-sensor fusion in autonomous robots and unmanned systems.

Key Challenges

Stringent Qualification Standards and Long Validation Cycles

One of the most significant challenges in this market is the highly stringent qualification and certification process required for aerospace and defense semiconductors. Components must comply with standards such as MIL-PRF-38535, MIL-PRF-19500, DO-254, and ECSS-Q-ST specifications, requiring extended testing cycles that include radiation exposure, thermal shock, burn-in testing, and long-term reliability assessments. These long validation cycles delay product deployment and increase development costs, limiting the speed at which new semiconductor technologies can enter the market. Manufacturers also face challenges maintaining long-term availability of specialized components, as defense platforms require supply continuity for 20+ years. Balancing innovation with rigorous certification remains a core structural constraint, intensifying pressure on vendors to sustain specialized fabrication, screening, and quality assurance processes.

Supply Chain Vulnerabilities and Challenges with Specialized Material Availability

The aerospace and defense semiconductor sector faces significant supply chain constraints due to its reliance on specialized materials, long-lead-time components, and highly secure manufacturing environments. Radiation-hardened wafers, wide-bandgap substrates, hermetic packaging materials, and high-precision testing equipment often come from a limited supplier base, increasing vulnerability to geopolitical disruptions and export-control regulations. Maintaining a secure and traceable supply chain is critical, and compliance with ITAR, EAR, and defense procurement rules further complicates sourcing. The long lifecycle requirements of military platforms also require extended support for legacy components, which strains foundries as they transition to advanced nodes. These structural bottlenecks create persistent challenges in balancing supply reliability with technological advancement.

Regional Analysis

North America

North America dominates the market with approximately 38% share, driven by strong defense spending, rapid modernization of military electronics, and extensive space program investments. The U.S. Department of Defense and NASA generate continuous demand for radiation-hardened processors, high-reliability power devices, and secure communication semiconductors. Major aerospace primes such as Lockheed Martin, Northrop Grumman, and Raytheon prioritize long-life, mission-critical components that must comply with stringent MIL-STD qualifications. Additionally, the region’s advanced semiconductor ecosystem and domestic manufacturing capabilities support ongoing adoption of rugged, temperature-resilient chips across defense, avionics, and satellite platforms.

Europe

Europe accounts for roughly 28% of the global market, driven by robust aerospace activity, defense modernization programs, and expanding satellite infrastructure led by ESA and national space agencies. The region emphasizes radiation-tolerant microelectronics, high-frequency RF devices, and wide-bandgap power semiconductors for avionics, missile defense, and space missions. Countries such as France, Germany, and the U.K. invest heavily in secure communication systems, ISR platforms, and high-altitude defense systems, all of which rely on high-reliability chips. Strong regulatory frameworks and long qualification cycles further reinforce demand for rugged, precision-engineered semiconductor components.

Asia-Pacific

Asia-Pacific holds approximately 24% market share, supported by rising defense budgets, growing satellite deployment initiatives, and rapid expansion of aerospace manufacturing hubs. China, India, Japan, and South Korea increasingly prioritize indigenous development of radiation-hardened processors, wide-bandgap power devices, and secure radar electronics for military and space programs. The region also benefits from a strong semiconductor fabrication ecosystem, enabling cost-efficient production and localized supply chains. As nations accelerate modernization of air-defense systems, unmanned platforms, and high-performance avionics, demand for high-reliability semiconductors with enhanced thermal, vibration, and radiation resistance continues to grow.

Middle East & Africa

The Middle East & Africa region represents around 6% of the global market, driven primarily by defense procurement, modernization of air-defense networks, and niche investments in satellite communication infrastructure. Gulf nations continue to upgrade radar, surveillance, and missile systems, creating steady demand for ruggedized microelectronics designed for high-temperature and high-dust environments. Although domestic semiconductor manufacturing remains limited, reliance on imported high-reliability components from global suppliers drives consistent growth. Africa’s participation remains modest, driven by smaller aerospace programs and selective defense acquisitions requiring mission-critical semiconductor hardware.

Latin America

Latin America captures roughly 4% market share, with growth fueled by incremental modernization of defense communication networks, radar systems, and government aerospace initiatives. Brazil leads regional demand due to its expanding satellite programs, domestic aircraft manufacturing, and participation in international defense collaborations. The region primarily imports high-reliability semiconductors certified for rugged environmental conditions, supporting avionics upgrades, surveillance systems, and secure communication platforms. Despite moderate market size, increasing interest in space observation missions and homeland security technologies is expected to sustain demand for durable, mission-grade semiconductor devices.

Market Segmentations:

By Technology

- Surface Mount Technology (SMT)

- Through-Hole Technology

By Application

- Aerospace

- Defense

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape is defined by a concentrated group of semiconductor manufacturers specializing in radiation-hardened, wide-temperature-range, and mission-grade microelectronics for aerospace and defense platforms. Key players including Microchip Technology, BAE Systems, Infineon Technologies, Teledyne e2v, Honeywell Aerospace, Texas Instruments, and STMicroelectronics focus on expanding portfolios of rad-hard processors, GaN RF amplifiers, SiC power devices, secure communication ICs, and high-density memory solutions. These companies maintain strong customer relationships with defense primes and space agencies by offering long product lifecycles, MIL-STD-compliant qualification processes, and robust supply-chain assurance. Strategic investments prioritize wafer-level radiation hardening, hermetic packaging, extended environmental testing, and high-reliability screening to ensure component readiness for space, avionics, and missile platforms. Partnerships with aerospace OEMs, government labs, and satellite manufacturers strengthen collaborative innovation, while advancements in GaN, SiC, and chiplet-based architectures intensify competition among suppliers seeking leadership in next-generation mission-critical electronics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Skyworks Inc.

- Teledyne Technologies Inc.

- SEMICOA

- Vishay Intertechnology, Inc.

- Digitron Semiconductors

- Texas Instruments Incorporated

- Semtech Corporation

- Microsemi

- Infineon Technologies AG

- Time Technology Ltd.

Recent Developments

- In October 2025, Skyworks announced a definitive agreement to merge with Qorvo in a cash-and-stock deal, creating a US$22 billion RF, analog, and mixed-signal leader. The combined company aims to strengthen U.S. manufacturing and broaden its reach in markets including defense and aerospace RF front-ends and power solutions.

- In October 2025, Vishay introduced the DLA 04051 series vPolyTan™ polymer surface-mount chip capacitors, approved to new DLA 04051 military specs and designed for aerospace, military and space (AMS) markets. These high-reliability capacitors feature ultra-low ESR (down to 25 mΩ), making them suitable for mission-critical power rails and RF systems in harsh environments.

- In November 2024, Teledyne agreed to acquire select aerospace and defense electronics businesses from Excelitas Technologies (Qioptiq Optical Systems and Advanced Electronic Systems) for US$710 million in cash, expanding its portfolio of high-reliability electronic and optical subsystems for defense, space and aerospace platforms.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for radiation-hardened processors, RF devices, and wide-bandgap power semiconductors will rise as next-generation space missions and defense platforms require higher performance and durability.

- Adoption of GaN and SiC technologies will accelerate to support high-power radar, hypersonic systems, and advanced avionics with superior thermal and switching efficiency.

- Miniaturized and multi-chip packaging architectures will gain traction to meet the need for compact, lightweight, and high-density military and aerospace electronics.

- AI-driven and autonomous defense systems will increase the requirement for rugged, high-speed computing hardware capable of real-time processing in harsh environments.

- Satellite constellations and military communication networks will drive stronger demand for secure, high-frequency semiconductor solutions.

- Long-term component lifecycle support will become more critical as aerospace and defense programs extend mission durations.

- Supply-chain security and domestic semiconductor manufacturing will strengthen due to rising geopolitical concerns.

- Environmental and reliability testing requirements will grow more stringent to ensure operational safety in extreme conditions.

- Investments in chiplet-based designs and heterogeneous integration will expand to boost system performance for mission-critical applications.

- Collaboration between semiconductor suppliers, defense primes, and space agencies will intensify to accelerate innovation and qualification of next-generation high-reliability components.