Market Overview

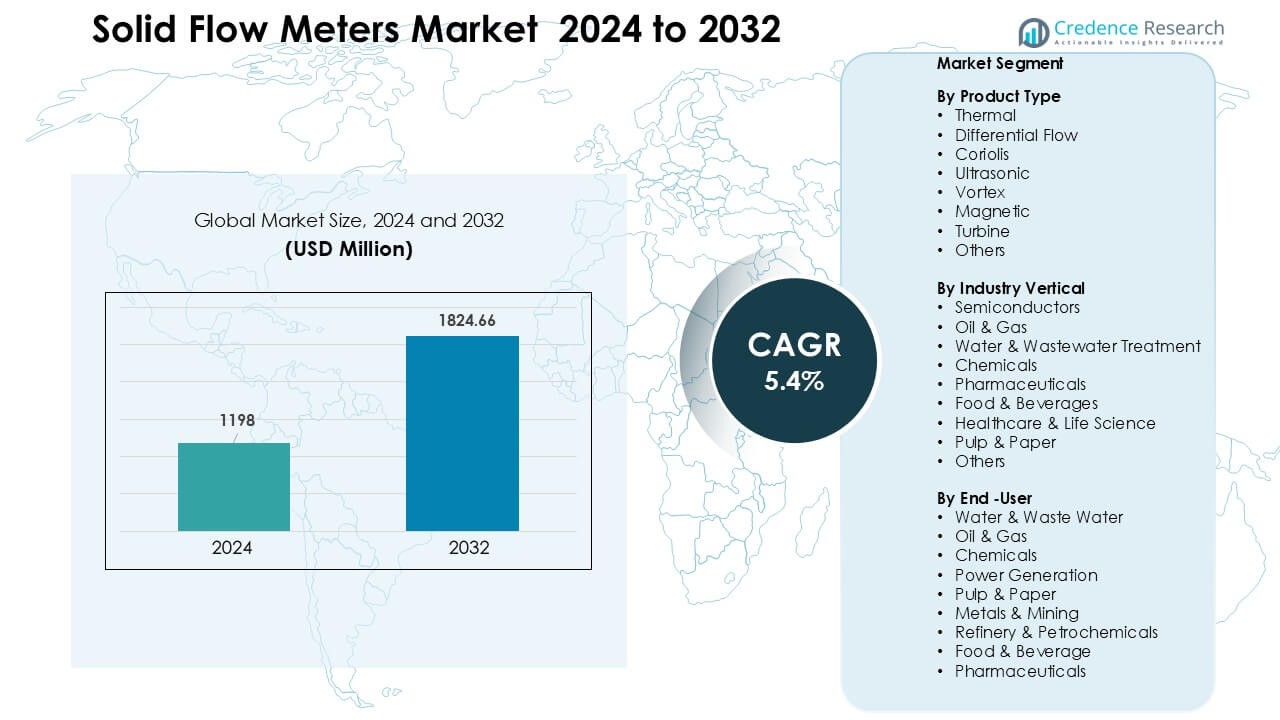

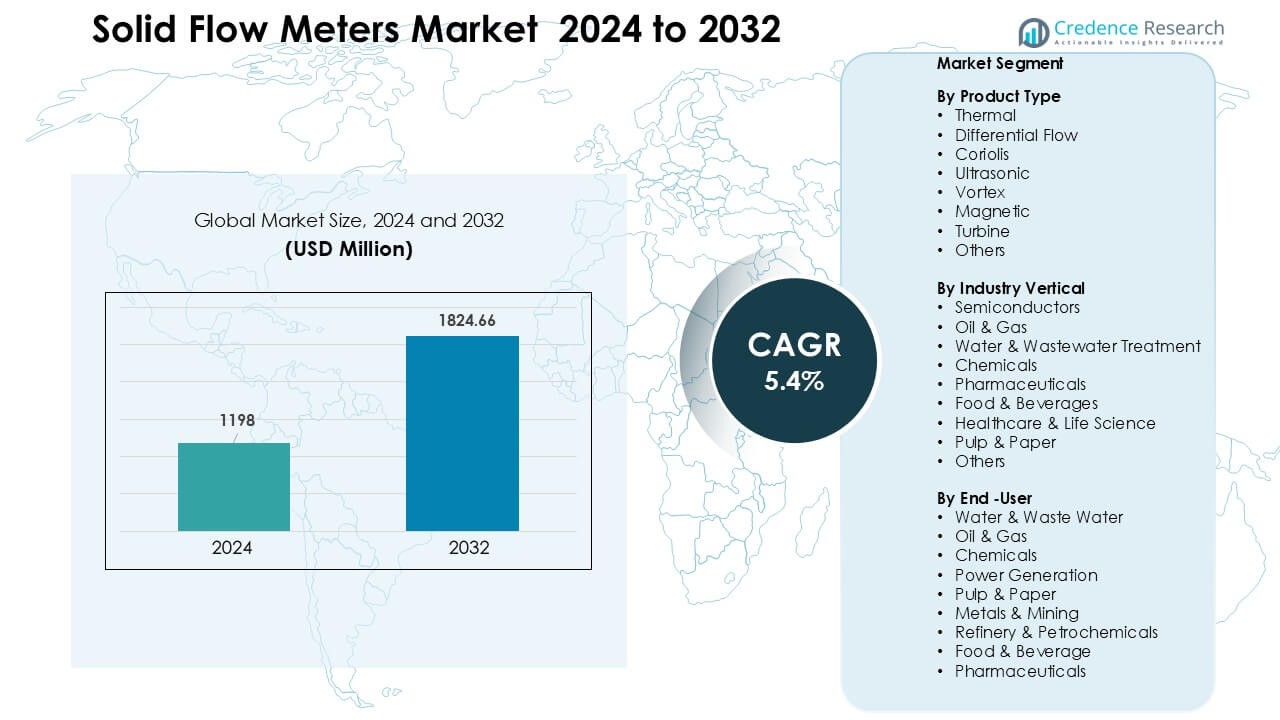

Solid Flow Meters Market was valued at USD 1198 million in 2024 and is anticipated to reach USD 1824.66 million by 2032, growing at a CAGR of 5.4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solid Flow Meters Market Size 2024 |

USD 1198 Million |

| Solid Flow Meters Market, CAGR |

5.4 % |

| Solid Flow Meters Market Size 2032 |

USD 1824.66 Million |

The solid flow meters market is shaped by leading companies such as Honeywell International Inc., Bronkhorst, Hitachi High-Tech Corporation, Christian Bürkert GmbH & Co. KG, Endress+Hauser Group, Dwyer Instruments, ABB Ltd., Azbil Corporation, Emerson Electric Co., and Keyence Corporation. These players compete through advanced sensing technologies, strong calibration capabilities, and expanded digital monitoring features that support accurate measurement of powders, granules, and abrasive solids. They focus on durability, automation-ready designs, and industry-specific solutions for chemicals, wastewater, mining, and semiconductors. **North America emerged as the leading region in 2024 with a 32% share, supported by high automation adoption and major investments in wastewater treatment and manufacturing modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The solid flow meters market reached USD 1198 million in 2024 and is projected to hit USD 1824.66 million by 2032, growing at a 5.4% CAGR during the forecast period.

- Demand rises due to stronger automation in chemicals, wastewater, mining, and food processing, with thermal meters holding the largest 32% share because of their stability in dense-phase conveying.

- Key trends include wider use of IoT-enabled meters, predictive maintenance tools, and high-precision technologies for semiconductor and specialty chemical operations.

- Competition remains strong among Honeywell, Emerson, ABB, Endress+Hauser, Keyence, Azbil, Bürkert, Bronkhorst, Dwyer Instruments, and Hitachi High-Tech, as companies expand digital capabilities and application-specific designs.

- North America leads with 32% share, followed by Europe at 27%, while Asia Pacific grows fastest at 29%, supported by rising industrialization and expansion of wastewater and semiconductor facilities.

Market Segmentation Analysis:

By Product Type

Thermal solid flow meters dominated this segment in 2024 with about 32% share, driven by strong use in bulk powder handling and dust-laden gas lines across manufacturing plants. Industries preferred thermal designs because they offer stable measurement for low-velocity solids and support easy installation without major pipe changes. Coriolis and ultrasonic meters gained steady traction as plants shifted toward high-accuracy systems for chemical and food processing lines, but thermal units stayed ahead due to lower ownership cost and wider suitability for dense‐phase conveying operations.

- For instance, Sino‑Inst supplies a powder solids flow meter used in cement plants to continuously monitor cement flow in pneumatic conveying pipelines enabling real‑time flow measurement of powders and dust in gas‑solid two‑phase flows.

By Industry Vertical

Semiconductors led this segment in 2024 with nearly 28% share, supported by rising adoption of solid-material metering in wafer fabrication, slurry distribution, and abrasive particle flow monitoring. Chip manufacturers used advanced flow meters to maintain tight process control, reduce wastage, and meet purity needs in fabrication plants across Asia and North America. Oil & gas, chemicals, and pharmaceuticals recorded healthy gains as each sector expanded automated dosing and blending systems, yet semiconductors remained ahead due to rapid fab capacity additions and higher precision demand.

- For instance, SONOTEC supplies clamp‑on ultrasonic flow meters such as the SEMIFLOW® CO.65, which deliver non‑contact liquid flow measurement up to 400 L/min with an accuracy of ±1% enabling precise slurry mixing and chemical distribution in wet‑process modules of semiconductor fabs.

By End-User

Water & wastewater emerged as the leading end-user group in 2024 with about 26% share, driven by rising investments in sludge handling, grit measurement, and solid-laden stream monitoring across municipal plants. Utilities adopted solid flow meters to enhance treatment efficiency and meet tighter regulatory standards on plant performance. Oil & gas, chemicals, and power generation followed with steady uptake, but water & wastewater-maintained leadership because cities expanded capacity, upgraded old systems, and used continuous flow tracking to reduce treatment disruption and improve operational reliability.

Key Growth Drivers

Rising Automation in Process Industries

Growing automation across manufacturing, chemicals, and power generation drives strong adoption of solid flow meters. Plants rely on continuous material flow measurement to support real-time monitoring, reduce manual handling, and boost production accuracy. Automated conveying lines, pneumatic transport, and dosing systems need reliable meters to track powders, granules, and abrasive solids under varying pressure and temperature conditions. This demand grows further as industries replace older mechanical devices with digital, self-diagnostic, and low-maintenance meters. Adoption also increases in food, cement, and metals processing, where automated bulk material movement enhances throughput and cuts operational losses.

- For instance, Newton Weighing offers a Solid Impact Flow Meter that produces an electrical signal from the force exerted by solid materials hitting a sensing plate — this system is compatible with industrial automation protocols such as Modbus, Profibus or Ethernet, enabling direct integration with PLC or SCADA for continuous, real‑time flow data.

Expansion of Wastewater and Sludge Treatment Facilities

The expansion of municipal and industrial wastewater plants boosts demand for solid flow meters, particularly those designed for sludge, grit, and particulate-laden streams. Utilities upgrade legacy treatment systems to comply with tighter discharge norms and support rising urban population needs. Plants require accurate flow monitoring to optimize aeration, reduce sediment buildup, and ensure consistent sludge dewatering performance. Solid flow meters help operators improve plant efficiency, reduce downtime, and maintain regulatory compliance. Their ability to handle harsh, corrosive, and variable-density solids makes them essential in large-scale treatment modernization efforts globally.

- For instance, several treatment plants have opted for clamp‑on ultrasonic or electromagnetic meters (instead of mechanical/moving‑part devices) to measure influent, effluent, and sludge flow lines. These designs avoid clogging or fouling in abrasive or sediment‑heavy wastewater, require minimal maintenance, and remain durable under fluctuating flow conditions.

Increased Use of High-Precision Measurement in Semiconductor and Chemical Processing

The semiconductor and chemical industries drive demand for advanced solid flow meters due to rising production of microelectronics, specialty chemicals, and high-purity materials. These sectors require precise flow control of abrasive powders, catalysts, and slurry mixtures during sensitive manufacturing steps. Flow stability directly impacts yield, efficiency, and product consistency, leading manufacturers to adopt Coriolis, ultrasonic, and thermal meters with self-calibration and high repeatability. As chip fabs expand across Asia and North America, and chemical plants scale specialty production, need for accurate solid flow measurement strengthens, supported by digital monitoring and predictive maintenance tools.

Key Trend & Opportunity

Integration of IoT-Enabled and Smart Metering Systems

Smart solid flow meters with IoT connectivity create major opportunities for predictive maintenance, remote diagnostics, and advanced process optimization. Industries increasingly adopt meters that link with SCADA, PLCs, and cloud platforms to enable continuous health monitoring and data-driven control. This shift supports proactive fault detection, reduces downtime, and enhances accuracy in harsh operating environments. Manufacturers add wireless modules, self-learning algorithms, and edge-processing capabilities to improve performance in bulk handling, cement, mining, and food processing lines. Growing digital budgets across industries further accelerate adoption.

- For instance, smart‑meter platforms described by Flowtech Measuring Instruments Pvt. Ltd. include SCADA/PLC integration plus cloud connectivity enabling flow, pressure, and temperature data to be logged and analyzed in real-time, with alerts when flow deviates beyond programmed thresholds.

Rising Adoption in Renewable Energy and Biomass Facilities

Growth of renewable energy projects, such as biomass plants and waste-to-energy units, increases demand for solid flow meters that track fuel feed rates and combustion input consistency. These facilities rely on precise measurement of wood chips, agricultural residues, and municipal waste solids to optimize combustion efficiency and emissions control. Flow meter makers see strong opportunity as governments promote cleaner energy and expand waste processing infrastructure. Advanced meters designed for irregular particle sizes and wet biomass strengthen market potential in Europe, Asia, and North America.

- For instance, Dynascales markets its Dynaflow solid flow meters, specifically designed for biomass industry applications, to measure bulk solids such as wood chips, pellets, and sawdust on conveyor belts or chutes enabling reliable throughput monitoring in biomass-fuel supply lines.

Key Challenge

Measurement Errors in Abrasive and High-Moisture Solids

A major challenge is maintaining accuracy when measuring abrasive, sticky, or high-moisture solids that create clogging, buildup, or wear. Dense materials such as cement, clinker, wet sludge, and mineral ores reduce sensor life and distort readings, especially in harsh industrial settings. Frequent recalibration raises maintenance cost and disrupts production. Although advanced designs improve durability, many plants still struggle with performance consistency due to variable particle size, temperature swings, and pipeline vibration. These factors limit adoption in older facilities with legacy conveying systems.

High Installation and Integration Costs for Digital Metering Systems

Integration of modern solid flow meters into existing plants often requires significant structural changes, control-system upgrades, and skilled technical support. Digital and high-precision designs come with higher upfront cost, limiting adoption in small and mid-scale facilities. Operators also face compatibility issues with older PLCs and SCADA networks, increasing integration complexity. Limited technician availability, calibration expertise, and downtime concerns further slow modernization efforts. As industries weigh cost against benefits, adoption can lag in cost-sensitive markets despite clear efficiency advantages.

Regional Analysis

North America

North America held about 32% share of the Solid Flow Meters Market in 2024, supported by strong demand from wastewater treatment, chemicals, and food processing industries. The U.S. led regional growth as municipalities upgraded sludge-handling systems and manufacturers adopted high-precision meters for automated production lines. Adoption rose further due to strict environmental monitoring standards and rising investments in bulk-material handling in mining and power generation. Canada expanded its use of advanced digital meters across pulp and paper plants, helping the region maintain steady demand for accuracy-focused and low-maintenance metering solutions.

Europe

Europe accounted for nearly 27% share in 2024, driven by strong industrial automation across Germany, France, Italy, and the U.K. The region saw growing use of solid flow meters in pharmaceuticals, specialty chemicals, and advanced food processing. Strict EU environmental and efficiency regulations pushed utilities to upgrade flow-monitoring equipment in wastewater treatment plants. Demand increased further in cement, steel, and biomass facilities that required reliable metering under abrasive conditions. Eastern Europe contributed additional growth as new manufacturing sites adopted modern conveying and process-control systems.

Asia Pacific

Asia Pacific dominated several end-use categories and held roughly 29% share of the market in 2024, supported by rapid industrialization across China, India, Japan, and South Korea. Semiconductor fabrication, chemicals manufacturing, and large-scale wastewater facilities drove strong adoption of precision meters. China and India expanded bulk handling systems in cement, mining, and power sectors, boosting demand for durable and easy-to-maintain solutions. Growing investment in food processing and pharmaceuticals further pushed uptake. The region remained the fastest-growing due to expanding manufacturing bases and increasing use of IoT-enabled measurement devices.

Latin America

Latin America captured around 7% share in 2024, driven by rising demand from mining, cement, and oil & gas operations across Brazil, Mexico, Chile, and Argentina. Flow meters gained traction in wastewater upgrades, where cities invested in improved sludge monitoring and treatment efficiency. Brazil led adoption through expansion in chemicals, pulp & paper, and biomass-energy projects. Mining-intensive countries such as Chile increased use of solid flow measurement to reduce material losses and enhance plant supervision. The region showed gradual but stable growth due to rising industrial modernization.

Middle East & Africa

The Middle East & Africa region held nearly 5% share in 2024, supported by oil & gas, refining, and petrochemical facilities adopting solid flow meters for catalyst and particulate flow tracking. Gulf countries expanded wastewater and desalination infrastructure, boosting demand for meters suited for sludge and high-solids applications. South Africa and Morocco recorded increased adoption in mining and cement plants that required durable, abrasion-resistant solutions. Ongoing industrial projects and modernization of process plants continued to lift demand, though overall growth remained moderate due to budget constraints in several developing economies.

Market Segmentations:

By Product Type

- Thermal

- Differential Flow

- Coriolis

- Ultrasonic

- Vortex

- Magnetic

- Turbine

- Others

By Industry Vertical

- Semiconductors

- Oil & Gas

- Water & Wastewater Treatment

- Chemicals

- Pharmaceuticals

- Food & Beverages

- Healthcare & Life Science

- Pulp & Paper

- Others

By End -User

- Water & Waste Water

- Oil & Gas

- Chemicals

- Power Generation

- Pulp & Paper

- Metals & Mining

- Refinery & Petrochemicals

- Food & Beverage

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the solid flow meters market is shaped by leading companies such as Honeywell International Inc., Bronkhorst, Hitachi High-Tech Corporation, Christian Bürkert GmbH & Co. KG, Endress+Hauser Group, Dwyer Instruments, LLC, ABB Ltd., Azbil Corporation, Emerson Electric Co., and Keyence Corporation. These companies compete through advanced sensor technology, durable meter designs, and strong digital integration capabilities that support real-time monitoring in harsh industrial environments. Vendors focus on improving accuracy for abrasive, high-moisture, and variable-density solids, while expanding portfolios across thermal, Coriolis, ultrasonic, and magnetic flow systems. Growth strategies include partnerships with automation firms, expansion of calibration services, and development of IoT-enabled meters that reduce downtime and enhance operational reliability. Strong global distribution networks and industry-specific customization help key players maintain a competitive edge across water treatment, chemicals, mining, food processing, and semiconductor applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Honeywell International Inc.

- Bronkhorst

- Hitachi High-Tech Corporation

- Christian Bürkert GmbH & Co. KG

- Endress+Hauser Group

- Dwyer Instruments, LLC

- ABB Ltd.

- Azbil Corporation

- Emerson Electric Co.

- Keyence Corporation

Recent Developments

- In June 2025, Hitachi High-Tech announced a collaboration agreement with Chulalongkorn University (Thailand) focused on sustainable industry and academic development part of broader activity in measurement/analysis and digital solutions. This is corporate/technology collaboration rather than a product launch of a solids flowmeter.

- In April 2025, Emerson introduced the Flexim FLUXUS / PIOX 731 series: a set of clamp-on ultrasonic flow meters offering non-intrusive measurement for liquids and gases, useful where process disruption must be avoided.

- In December 2024, Honeywell introduced a new liquid flow sensing platform aimed at improving dosing accuracy for liquid medications (press release). This is a notable recent product development in Honeywell’s flow-sensing portfolio, though it targets liquids rather than bulk-solids flow.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Industry Vertical, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Solid flow meters will see rising adoption as industries automate bulk-material handling.

- Demand will grow in wastewater plants as cities expand sludge and grit monitoring systems.

- Semiconductor fabs will drive need for high-precision metering to support advanced manufacturing.

- IoT-enabled meters will gain traction as plants shift toward predictive maintenance.

- Mining and cement industries will adopt more durable meters to manage abrasive solids.

- Food and beverage facilities will invest in hygienic and contamination-resistant flow technologies.

- Biomass and waste-to-energy plants will create new opportunities for solids-fuel measurement.

- Digital calibration and remote diagnostics will reduce downtime and boost operational efficiency.

- Manufacturers will expand smart, low-maintenance designs to replace older mechanical systems.

- Asia Pacific will remain the fastest-growing region due to rapid industrial expansion.