Market Overview:

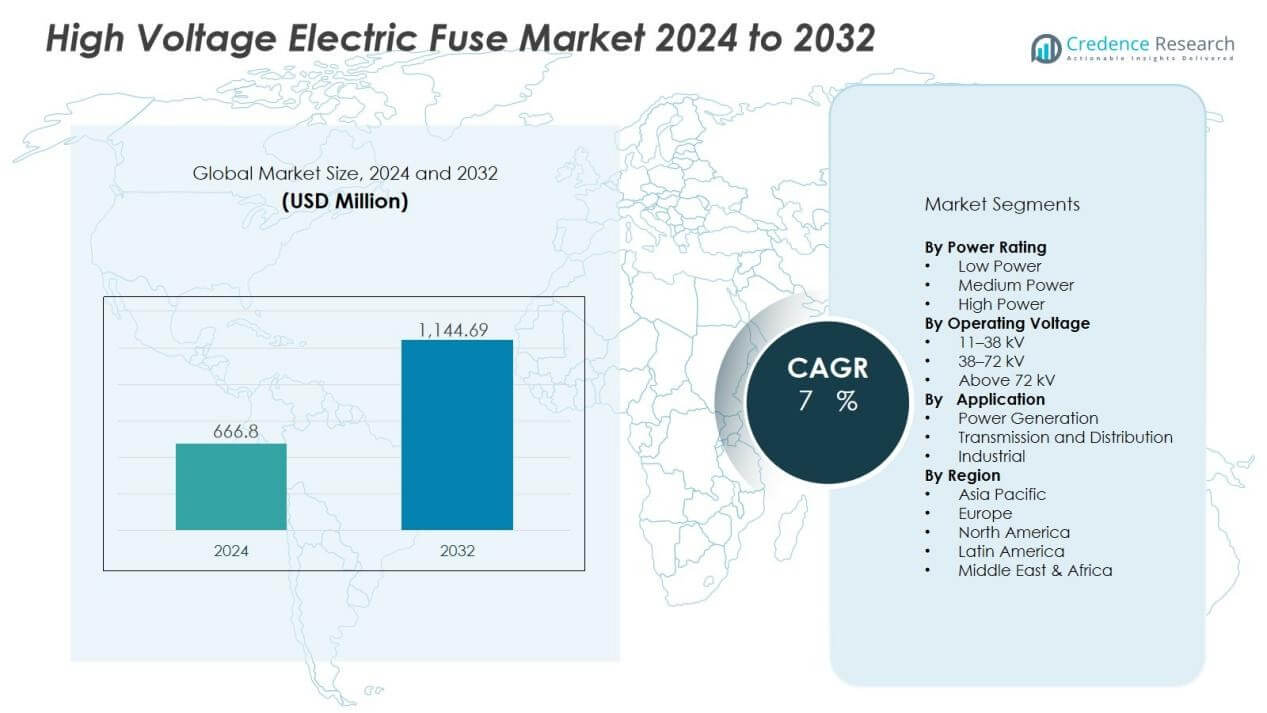

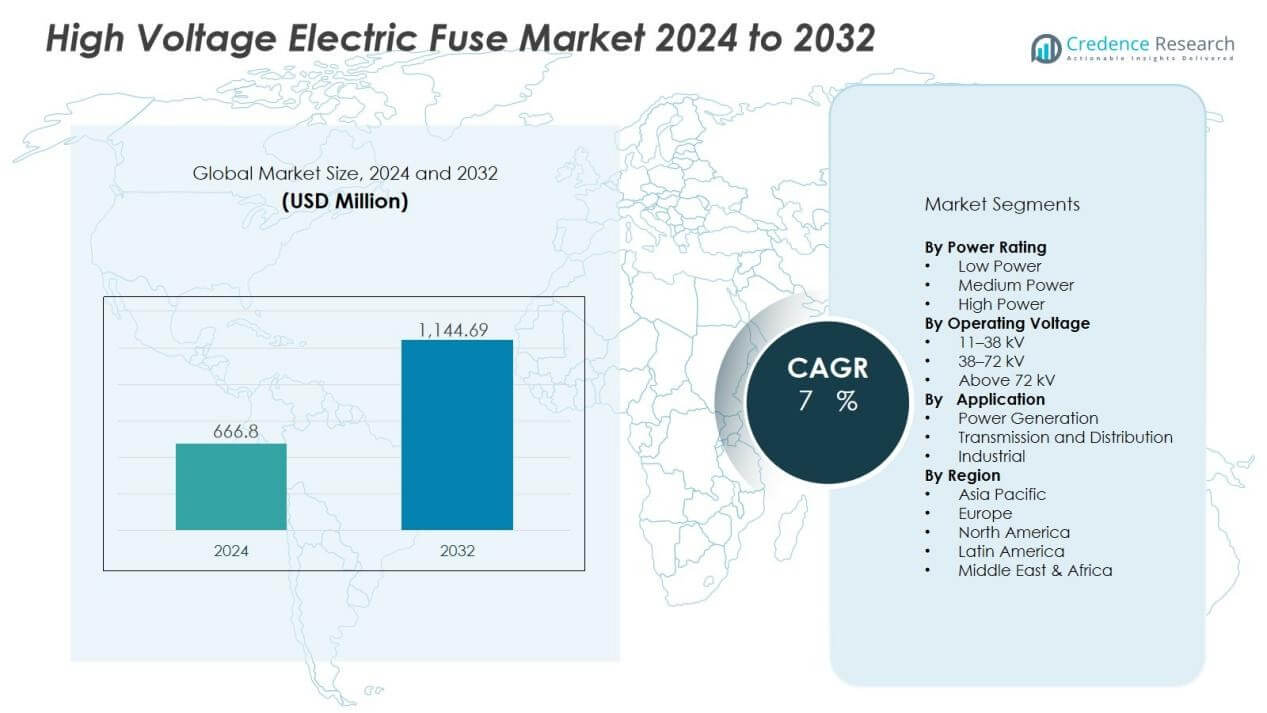

The high voltage electric fuse market size was valued at USD 666.8 million in 2024 and is anticipated to reach USD 1,144.69 million by 2032, at a CAGR of 7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Electric Fuse Market Size 2024 |

USD 666.8 Million |

| High Voltage Electric Fuse Market, CAGR |

7% |

| High Voltage Electric Fuse Market Size 2032 |

USD 1,144.69 Million |

Market expansion is driven by several factors, including the growing integration of renewable energy, rising electricity consumption, and stringent regulatory frameworks ensuring grid safety. Industrial operators are adopting advanced fuses for fault protection, operational reliability, and system efficiency. The replacement of aging infrastructure in developed economies, coupled with investments in smart grid and automation technologies, is further accelerating demand.

Regionally, North America and Europe maintain significant market shares due to early adoption of advanced grid technologies, strict safety standards, and high renewable energy penetration. Asia-Pacific is forecasted to grow at the fastest pace, supported by rapid industrialization, urbanization, and government-backed energy transition programs in countries like China and India. Meanwhile, Latin America and the Middle East & Africa are emerging as promising regions, driven by infrastructure development and rising investments in power transmission and distribution projects.

Market Insights:

- The high voltage electric fuse market was valued at USD 666.8 million in 2024 and is projected to reach USD 1,144.69 million by 2032, growing at a CAGR of 7%.

- Rising demand for grid safety and reliability is driving adoption as utilities and industries prioritize preventing equipment failures and reducing outage risks.

- Integration of renewable energy sources such as solar, wind, and hydro plants boosts demand for advanced fuses capable of handling fluctuating power loads.

- Replacement of aging infrastructure in developed economies is creating steady demand for modern fuse solutions that extend operational life and reduce maintenance costs.

- Growing industrialization and smart grid investments in emerging regions support the need for high-capacity fault protection systems in expanding urban and industrial networks.

- High replacement costs and shorter fuse lifecycles compared to circuit breakers remain a challenge, impacting cost efficiency for large-scale operations.

- North America held 29% market share in 2024, Europe accounted for 27%, and Asia-Pacific led with 31% share, while Latin America and the Middle East & Africa represented 7% and 6% respectively, supported by infrastructure growth and renewable energy investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Grid Safety and Reliability:

The high voltage electric fuse market benefits from growing attention to grid reliability and safety standards. Utilities and industrial operators prioritize fuses to prevent equipment failures and reduce outage risks. Regulatory bodies enforce strict compliance measures that strengthen adoption. It ensures stable and secure electricity supply across high-voltage networks, making fuses a critical component of transmission systems.

- For instance, in October 2024, the U.S. Department of Energy launched a $1.5 billion investment covering four major transmission projects, resulting in nearly 1,000 miles of new transmission lines and an increase of 7,100 MW of grid capacity—demonstrating how grid modernization is fundamental to strengthening power infrastructure

Increasing Integration of Renewable Energy Sources:

The market gains momentum from the expanding integration of renewable power generation. Solar, wind, and hydroelectric plants require advanced protection systems to handle fluctuations in power flow. High voltage electric fuses provide reliable fault protection for renewable energy infrastructure. It supports sustainable energy initiatives while reducing downtime risks in power distribution.

- For Instance, The Fécamp Offshore Wind Farm in France, with a capacity of 497 MW, became fully operational in May 2024. Siemens Gamesa Renewable Energy supplied the 71 wind turbines, each with a capacity of 7 MW.

Replacement of Aging Infrastructure in Developed Economies:

A significant driver comes from the replacement of outdated electrical systems in North America and Europe. Many countries are modernizing grids that rely on older components prone to failure. The high voltage electric fuse market responds with advanced solutions that extend operational life and enhance performance. It helps utilities lower maintenance costs and increase long-term system reliability.

Growing Industrialization and Smart Grid Investments in Emerging Regions:

Emerging economies contribute to market growth through industrial expansion and infrastructure projects. Rapid urbanization in Asia-Pacific and the Middle East drives large-scale electricity demand. Governments and private players invest in smart grid technologies that require efficient protection systems. The high voltage electric fuse market benefits by offering solutions tailored to high-capacity industrial applications and modern grid networks.

Market Trends:

Advancements in Fuse Technology and Smart Grid Integration:

The high voltage electric fuse market is witnessing strong demand for innovative designs that improve efficiency and durability. Manufacturers are focusing on compact, lightweight, and environmentally resistant fuses to support modern infrastructure. Smart grid adoption fuels interest in intelligent protection systems that enable real-time monitoring and predictive maintenance. It creates opportunities for fuses embedded with digital features that enhance operational visibility. Integration of IoT and AI technologies further transforms fuse performance, making them suitable for next-generation power networks. Rising investments in automation and energy-efficient solutions accelerate the adoption of such advanced fuse systems.

- For Instance, Mersen announced the launch of its new MDC Series DC Distribution Fuses, which included a 1,000 VDC model.

Growing Emphasis on Renewable Energy and Sustainable Solutions:

The transition toward renewable energy continues to shape market developments across multiple regions. Wind farms, solar plants, and hydroelectric facilities require fault protection tailored to fluctuating power loads. The high voltage electric fuse market is evolving with eco-friendly materials and designs that align with global sustainability goals. It supports renewable infrastructure by ensuring long-term operational stability and reduced downtime. Manufacturers are investing in recyclable and low-impact fuse materials to meet environmental standards. Demand is further influenced by global initiatives promoting decarbonization and electrification, pushing fuses to play a vital role in sustainable grid modernization.

- For instance, ABB’s CMF 7.2 kV/160 A current-limiting backup fuse features a sealed outdoor design and measures 442 mm in length by 87 mm in diameter, ensuring reliable short-circuit protection in renewable installations.

Market Challenges Analysis:

High Replacement Costs and Limited Lifecycle Performance:

The high voltage electric fuse market faces challenges from high replacement costs and shorter lifecycles compared to alternative protective devices. Utilities and industries often prefer circuit breakers, which offer reusability and longer service life. It creates hesitation among buyers who seek cost-efficient solutions for large-scale networks. Frequent replacement of fuses adds to operational expenses, especially in regions with limited budgets for grid modernization. The need for skilled labor to install and maintain fuses further increases the total cost of ownership. This cost-related challenge can slow adoption in both mature and emerging markets.

Supply Chain Disruptions and Raw Material Constraints:

Global supply chain disruptions also hinder steady growth in this sector. The high voltage electric fuse market relies on materials like metals, ceramics, and composites, which are vulnerable to price volatility. It puts pressure on manufacturers to balance production costs and maintain competitive pricing. Trade restrictions and logistical delays further affect the availability of raw materials. Smaller players struggle to secure stable supply lines, limiting their ability to compete with global brands. These uncertainties in supply and cost fluctuations remain a key barrier to consistent market expansion.

Market Opportunities:

Expansion of Renewable Energy and Smart Grid Projects:

The high voltage electric fuse market has strong opportunities driven by the global shift toward renewable power. Solar farms, wind projects, and hydroelectric facilities require advanced fuses to handle variable load conditions. It creates steady demand for reliable fault protection devices across new installations. Smart grid investments in developed and emerging regions further enhance opportunities for fuse adoption. Digitalization of power networks requires protection systems that integrate with monitoring and control technologies. Manufacturers that innovate in smart, durable, and eco-friendly fuses are well-positioned to capture this growth.

Rising Infrastructure Development in Emerging Economies:

Infrastructure expansion in Asia-Pacific, Latin America, and the Middle East is fueling fresh opportunities. The high voltage electric fuse market benefits from rapid urbanization, industrialization, and government-backed electrification projects. It supports growing electricity demand across residential, commercial, and industrial sectors. Grid modernization efforts in these regions require scalable and cost-effective protection solutions. International players are exploring partnerships and local production to meet regional needs. This expansion into emerging markets creates a promising path for long-term revenue growth.

Market Segmentation Analysis:

By Power Rating:

The high voltage electric fuse market is segmented into low, medium, and high-power ratings. Low and medium-power fuses are widely used in industrial and commercial networks due to their cost-effectiveness and reliable protection. It supports distribution systems where moderate load management is critical. High-power fuses hold significant adoption in large-scale utilities and renewable energy plants. Their ability to handle heavy fault currents ensures system stability in demanding environments.

- For instance, in May 2025, Littelfuse introduced the Nano² 415 SMD Series Fuse supporting a 1,500 A interrupting rating at 277 V, setting a record for low-voltage surface-mount fuses that enhances surge handling in industrial electronics

By Operating Voltage:

Segmentation by operating voltage includes fuses for 11–38 kV, 38–72 kV, and above 72 kV applications. The 11–38 kV range dominates due to widespread deployment in distribution networks and industrial operations. It is preferred for balancing cost and performance in mid-range voltage applications. The 38–72 kV segment is gaining traction with infrastructure modernization and smart grid investments. Above 72 kV fuses cater to specialized high-capacity projects such as transmission lines and renewable energy integration.

- For instance, Schneider Electric SM6 fuse-switch combination units are rated for 630 A and can withstand 16 kA for one second. Other units within the broader SM6 range, such as busbars and circuit breakers, offer higher configurations, achieving ratings of 1,250 A and 25 kA for one second.

By Application:

Applications include power generation, transmission and distribution, and industrial sectors. Transmission and distribution hold the largest share, supported by grid upgrades and electrification initiatives worldwide. It ensures operational safety by providing critical fault protection in networks. Power generation uses fuses to secure renewable and conventional plants from overload risks. Industrial applications are expanding with rising automation, requiring efficient fuse systems for machinery and facility protection.

Segmentations:

By Power Rating:

- Low Power

- Medium Power

- High Power

By Operating Voltage:

- 11–38 kV

- 38–72 kV

- Above 72 kV

By Application:

- Power Generation

- Transmission and Distribution

- Industrial

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America and Europe:

North America held 29% market share in 2024, while Europe accounted for 27%. The high voltage electric fuse market in these regions benefits from strict regulatory standards and advanced grid infrastructure. It is further supported by the early adoption of smart grid technologies and large-scale renewable energy projects. Governments prioritize energy transition, which increases demand for reliable protection systems. Strong investments in modernization of transmission networks drive steady adoption across utilities and industries. Established manufacturers in these regions also maintain a competitive edge through innovation and strong distribution networks.

Asia-Pacific:

Asia-Pacific captured 31% market share in 2024 and is forecasted to expand at the fastest pace. The high voltage electric fuse market here is driven by rapid urbanization, industrial expansion, and rising electricity demand. It is strengthened by government-backed renewable energy programs in China, India, and Southeast Asia. Countries are investing heavily in infrastructure projects, creating a large requirement for fault protection devices. Strong manufacturing bases and expanding export capacity further support growth. The region’s energy transition initiatives are expected to sustain long-term market expansion.

Latin America and Middle East & Africa:

Latin America accounted for 7% market share in 2024, while the Middle East & Africa stood at 6%. The high voltage electric fuse market in these regions benefits from ongoing infrastructure development and grid expansion projects. It is driven by industrialization, rising electrification programs, and investments in renewable energy. Governments are working on strengthening energy security, which boosts demand for reliable fuse systems. International players view these regions as promising due to favorable policies and growing energy demand. Partnerships and local production strategies are expected to improve accessibility and accelerate adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Littelfuse, Inc.

- Toshiba Corporation

- ABB

- Mitsubishi Electric

- General Fuse

- Chint Group

- OEZ

- Siemens

- GE Grid Solutions

- Schneider Electric

- Eaton Corporation

- LS Group

- Nisshin Electric Holdings

- Cooper Bussmann

- Mersen

Competitive Analysis:

The high voltage electric fuse market is highly competitive with global and regional players driving innovation and expansion. Key companies include Toshiba Corporation, ABB, Mitsubishi Electric, General Fuse, Chint Group, OEZ, Siemens, GE Grid Solutions, Schneider Electric, and Eaton Corporation. It is characterized by strong emphasis on safety standards, advanced designs, and energy-efficient solutions. Leading players invest in R&D to enhance product reliability and support smart grid integration. Partnerships and strategic acquisitions are common to strengthen market presence and expand regional reach. Companies also focus on eco-friendly materials and cost-effective designs to meet regulatory and customer demands. Competition is further shaped by the ability to deliver tailored solutions for renewable energy projects, transmission networks, and industrial applications.

Recent Developments:

- In May 2025, ABB Ltd. announced its acquisition of BrightLoop, a French power electronics innovator, expanding its off-highway vehicle and marine electrification business.

- In May 2025, Littelfuse introduced the Nano²® 415 SMD Series Fuse, the industry’s first surface-mount fuse with a 1500 A interrupting rating at 277 V, aimed at compact and high-voltage applications.

Report Coverage:

The research report offers an in-depth analysis based on Power Rating, Operating Voltage, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The high voltage electric fuse market will witness strong demand from expanding renewable energy projects.

- It will see steady adoption as governments enforce stricter safety and reliability standards in grid infrastructure.

- Utilities will increase investments in smart grid technologies, boosting the need for advanced fuse solutions.

- Manufacturers will focus on eco-friendly materials and designs to align with global sustainability goals.

- It will benefit from modernization programs in developed economies that require replacement of aging components.

- Asia-Pacific will continue to drive significant growth due to rapid industrialization and large-scale electrification.

- Collaborations between global and regional players will expand product availability in emerging markets.

- It will experience growing competition from circuit breakers, yet niche applications will sustain fuse demand.

- Technological advancements in monitoring and predictive maintenance will enhance the role of smart fuses.

- Expansion of industrial infrastructure in Latin America and the Middle East will create new opportunities.