Market Overview:

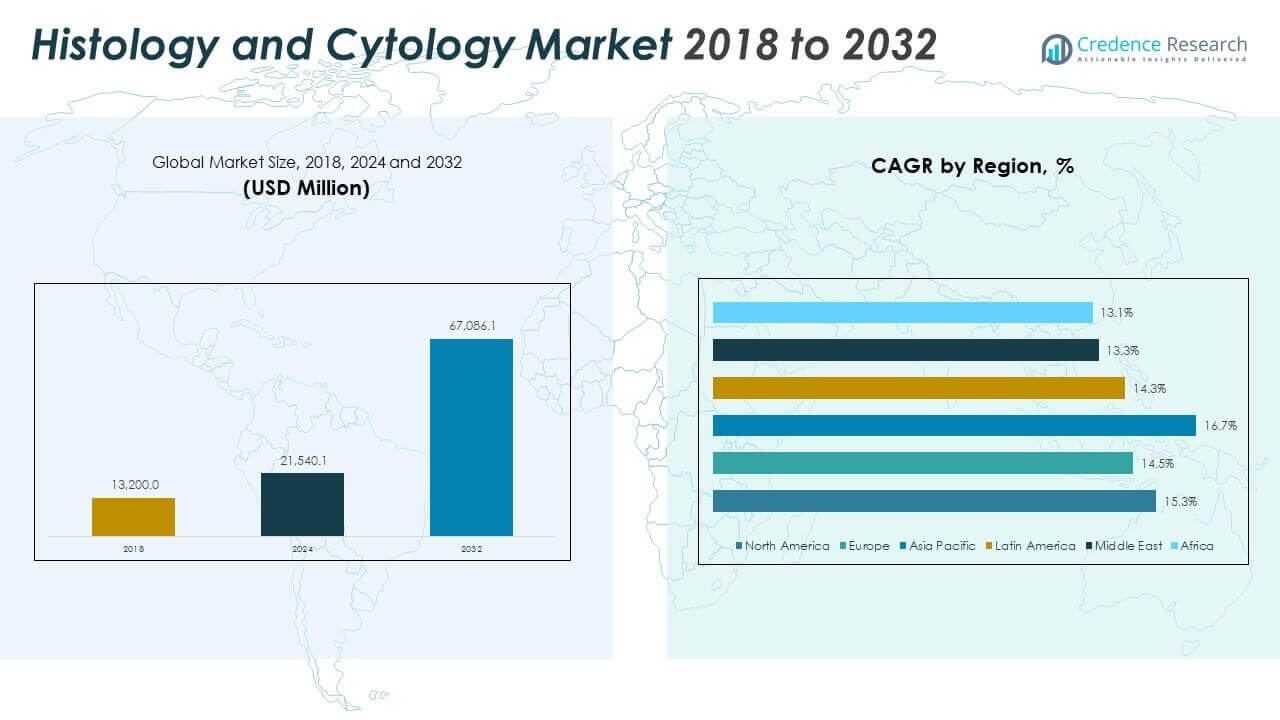

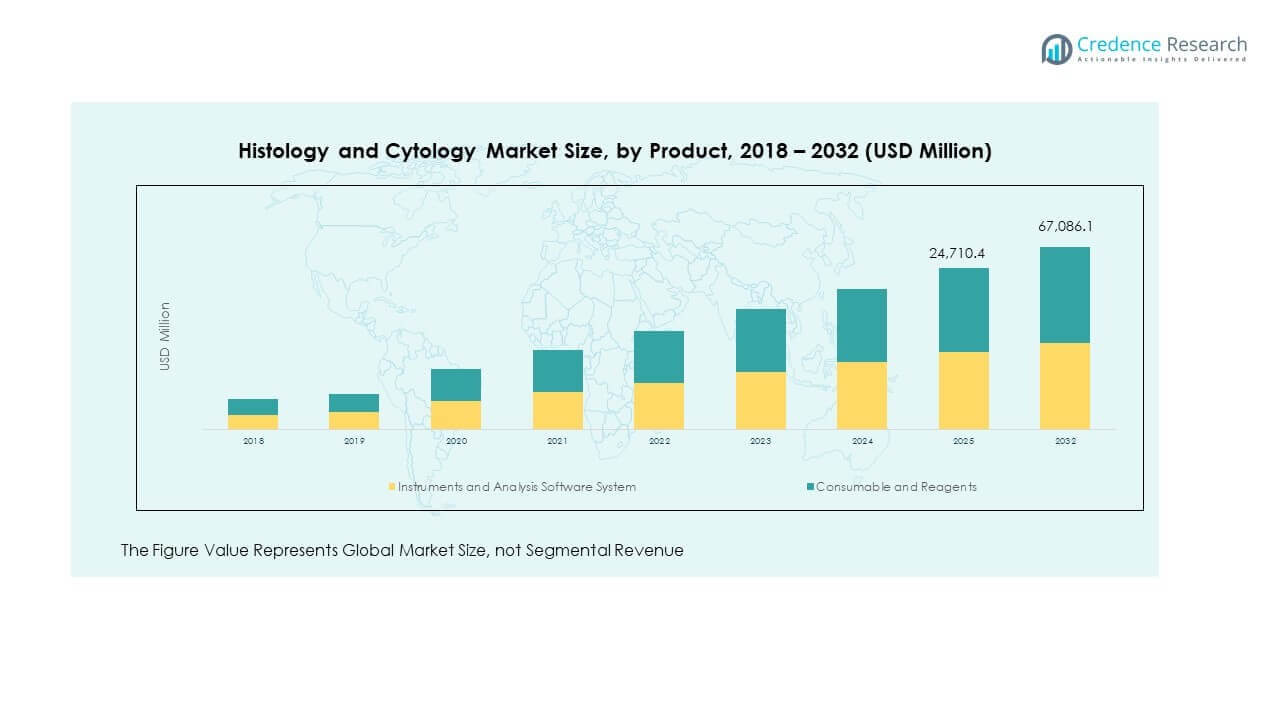

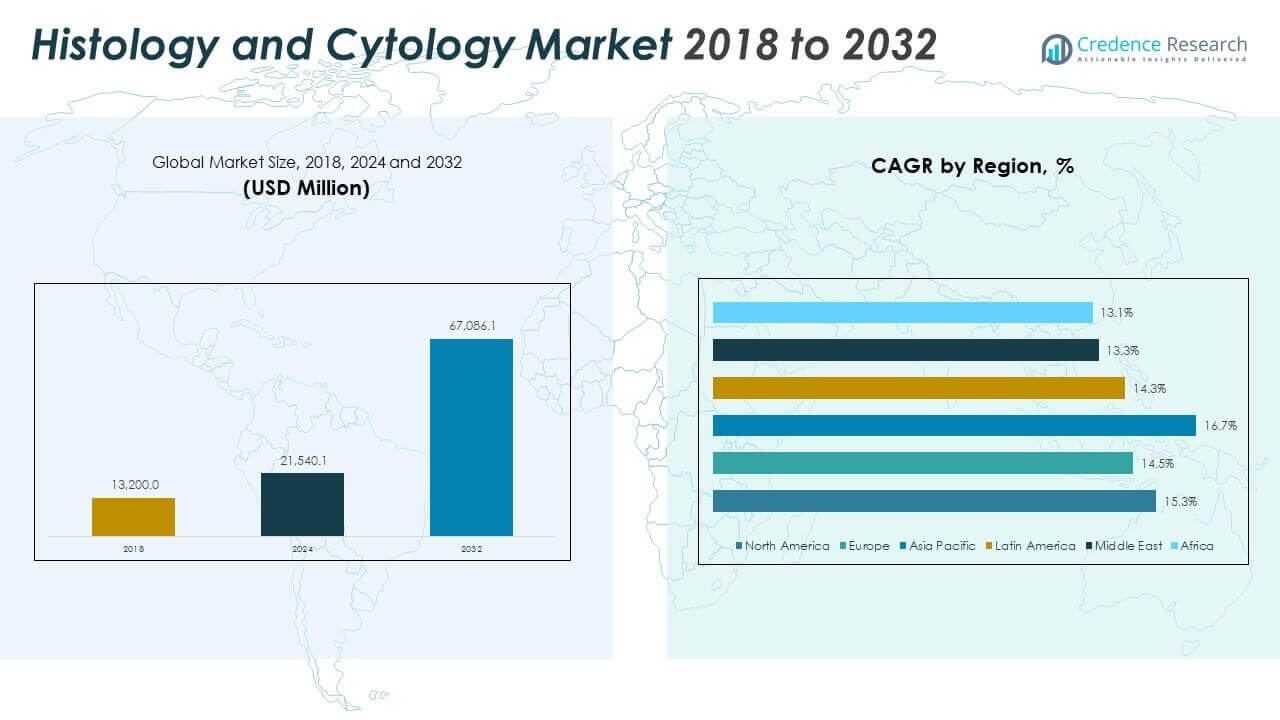

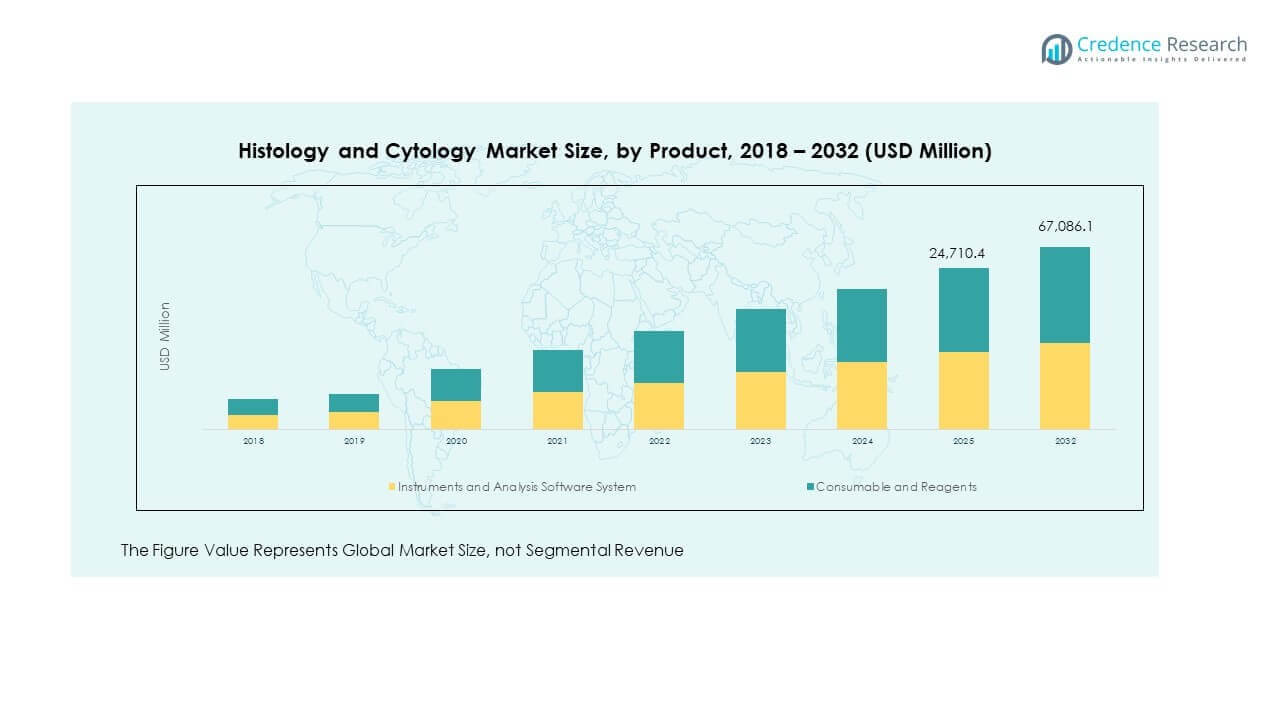

The Histology and Cytology Market size was valued at USD 13,200.0 million in 2018 to USD 21,540.1 million in 2024 and is anticipated to reach USD 67,086.1 million by 2032, at a CAGR of 15.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Histology and Cytology Market Size 2024 |

USD 21,540.1 Million |

| Histology and Cytology Market, CAGR |

15.3% |

| Histology and Cytology Market Size 2032 |

USD 67,086.1 Million |

The market is driven by rising cancer incidence, increasing demand for early disease detection, and advancements in diagnostic technologies. Growing use of cytology in cervical cancer screening and histopathology for tumor diagnosis are fueling adoption. Supportive government initiatives, rising healthcare expenditure, and integration of automation in laboratories are improving diagnostic efficiency, driving market growth across hospitals, diagnostic centers, and research institutions worldwide.

North America leads the market due to advanced healthcare infrastructure, higher cancer prevalence, and strong investment in R&D. Europe follows, driven by established screening programs and adoption of advanced diagnostic systems. Asia-Pacific is emerging as a high-growth region, supported by rising healthcare awareness, expanding medical infrastructure, and increasing demand for cost-effective cancer diagnostic solutions, particularly in countries like China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Histology and Cytology Market was valued at USD 13,200.0 million in 2018, reached USD 21,540.1 million in 2024, and is projected to hit USD 67,086.1 million by 2032, growing at a CAGR of 15.3%.

- North America (38%), Europe (25%), and Asia Pacific (25%) held the top three regional shares in 2024, driven by advanced screening programs, strong R&D, and expanding healthcare infrastructure.

- Asia Pacific is the fastest-growing region with a 25% share in 2024, supported by increasing cancer prevalence, rising healthcare spending, and broader diagnostic access.

- Consumables and reagents contributed the largest portion of market revenue in 2024, accounting for about 65% of total share, reflecting recurring demand.

- Instruments and analysis software systems represented nearly 35% of the market in 2024, driven by adoption of digital pathology and automated solutions.

Market Drivers

Rising Cancer Prevalence and Growing Need for Early Diagnostic Interventions

The growing incidence of cancer worldwide remains a critical driver for market expansion. Healthcare systems emphasize early detection to improve patient survival rates. The Histology and Cytology Market addresses this need with reliable diagnostic methods. Cytology techniques help detect cervical, lung, and bladder cancers at earlier stages. Histology offers deeper analysis for identifying malignant tissue structures. Governments support cancer screening initiatives that create higher demand for pathology services. Insurance coverage improvements increase patient access to testing. Strong awareness campaigns encourage wider adoption of diagnostic programs.

- For example, in a 2024 trial at Sun Yat-sen Memorial Hospital, an AI-based system enhanced cytopathologists’ ability to detect high-grade cervical lesions. A prospective assessment showed 94.6% sensitivity, 89.0% specificity, and 89.2% accuracy for the system, which also provided a 13.3% sensitivity gain when assisting cytopathologists.

Technological Advancements Supporting Diagnostic Accuracy and Efficiency

Rapid developments in imaging and automation improve accuracy across laboratory practices. Automated sample preparation systems reduce human error and improve consistency. Digital pathology enables real-time sharing of results across healthcare networks. The Histology and Cytology Market benefits from advanced staining techniques that highlight abnormal cells more clearly. Innovations such as AI-assisted image analysis enhance precision in cancer detection. Laboratories implement advanced equipment to shorten turnaround times. Hospitals adopt digital workflows to integrate data seamlessly with electronic health records. These advancements collectively improve outcomes for patients and providers.

Expanding Healthcare Expenditure and Improved Access to Laboratory Services

Rising healthcare budgets in both developed and emerging nations fuel growth. Governments allocate funds toward expanding diagnostic infrastructure and cancer care programs. The Histology and Cytology Market benefits from this investment by securing wider penetration across clinical facilities. Rural and semi-urban regions gain improved access to pathology services. Hospitals expand diagnostic labs to address growing patient volumes. Private diagnostic companies establish new centers in untapped areas. Public-private partnerships strengthen testing capacities at regional levels. These investments ensure broader coverage for large populations.

- For example, a 2025 Nature Communications study in China developed a deep-learning model for liquid-based cytology slides using data from more than 17,000 women across multiple hospitals. The system improved diagnostic performance and efficiency for cervical cancer screening and was validated in both community and hospital settings. The research demonstrated its potential to extend advanced screening access to underserved populations.

Growing Emphasis on Personalized Medicine and Targeted Cancer Treatments

The demand for personalized medicine is shaping diagnostic services. Oncologists require precise tissue profiling to guide treatment decisions. The Histology and Cytology Market supports personalized therapies through accurate cellular and tissue-level insights. Pathology reports influence drug selection and dosage adjustments. Patients benefit from reduced side effects and improved treatment responses. Biopharmaceutical firms collaborate with diagnostic providers for companion testing services. Tissue and cytology analysis become essential in oncology research and clinical trials. This focus on individualized treatment strengthens the role of diagnostic testing.

Market Trends

Expansion of Digital Pathology and Remote Diagnostic Solutions

Digital pathology adoption is accelerating across clinical and research environments. Pathologists analyze samples on digital platforms rather than traditional microscopes. The Histology and Cytology Market witnesses greater demand for telepathology services. Remote diagnosis enables healthcare access in underserved areas. Cloud-based platforms allow faster collaboration between labs and hospitals. AI-based solutions further enhance efficiency of digital workflows. Vendors expand digital imaging offerings to meet this shift. Health systems invest in integrated systems that support faster turnaround and broader access.

- For example, in October 2024, HistoWiz launched its advanced FFPE Block Management Solution within the upgraded PathologyMap 2.0 platform. This enhancement offers researchers 24/7 digital access to paraffin-embedded sample inventories, automated block retrieval, and integration with slide digitization workflows, enabling faster turnaround and seamless remote consultations for clinical and research pathology teams.

Rising Collaborations Between Diagnostic Providers and Pharmaceutical Companies

Strategic partnerships support innovation in diagnostics and treatment development. Pharmaceutical firms require reliable pathology support for clinical trials. The Histology and Cytology Market gains importance in drug development pipelines. Cytology testing validates efficacy and safety of oncology therapies. Histology confirms molecular and tissue-level treatment effects. Joint ventures create advanced diagnostic assays for companion therapeutics. Partnerships improve regulatory approval timelines for novel drugs. These collaborations ensure diagnostics remain integral to modern medicine.

Adoption of AI and Machine Learning in Cellular Analysis

Artificial intelligence tools enhance accuracy in image recognition and disease classification. Machine learning algorithms support faster identification of abnormal cells. The Histology and Cytology Market integrates these technologies to improve diagnostic precision. Automated systems reduce workloads for pathologists while improving reporting quality. Startups and established firms develop AI-powered pathology solutions. Hospitals invest in machine learning platforms to handle growing diagnostic volumes. Research facilities validate AI models for clinical application. These advancements accelerate integration of technology into everyday pathology.

- For example, in February 2024, Hologic received U.S. FDA clearance for its Genius Digital Diagnostics System, the first FDA-cleared digital cytology platform that integrates artificial intelligence with high-resolution imaging for cervical cancer screening. Validated studies showed the system reduced false negatives for high-grade lesions by 28% and improved laboratory efficiency, supporting remote slide review and adoption in U.S. pathology labs.

Integration of Advanced Biomarkers and Molecular Testing in Clinical Practice

Biomarker-driven testing is gaining traction in oncology diagnostics. Cytology and histology complement molecular assays for deeper insights. The Histology and Cytology Market supports precision medicine initiatives with biomarker validation. Clinicians combine cellular analysis with genomic data to improve accuracy. Laboratories expand service portfolios to include biomarker detection methods. Molecular profiling guides treatment decisions across diverse cancers. Healthcare providers adopt integrated workflows to optimize patient management. This trend elevates the role of pathology in comprehensive care.

Market Challenges Analysis

High Costs of Advanced Diagnostic Equipment and Operational Constraints

Advanced diagnostic systems require significant capital investment from healthcare providers. Many hospitals struggle with the financial burden of upgrading laboratory infrastructure. The Histology and Cytology Market faces challenges from limited budgets in low-income regions. Smaller diagnostic centers lack access to modern digital pathology platforms. Operational costs for maintaining and calibrating equipment remain high. Shortages of skilled technicians further limit adoption of complex systems. Rural hospitals experience difficulties in sustaining advanced testing capabilities. These financial and operational barriers slow broader adoption.

Regulatory Hurdles and Shortage of Trained Pathology Professionals

The regulatory framework for diagnostic approvals remains complex and time-consuming. Delays in approvals impact the adoption of new testing methods. The Histology and Cytology Market also struggles with shortages of skilled pathologists worldwide. Training programs fail to meet rising global demand. Developing countries face a significant gap in laboratory professionals. Uneven workforce distribution creates delays in diagnosis across many regions. Hospitals depend heavily on centralized labs, extending turnaround times. This imbalance between demand and capacity hinders efficiency in service delivery.

Market Opportunities

Expanding Role of Diagnostic Testing in Emerging Economies

Emerging economies represent promising growth potential for diagnostic service providers. Healthcare reforms expand infrastructure and create demand for advanced pathology services. The Histology and Cytology Market benefits from rising awareness of early cancer detection. Governments focus on developing diagnostic networks in semi-urban and rural regions. Growing middle-class populations drive healthcare spending on preventive testing. International diagnostic firms establish regional labs to serve growing populations. Telepathology provides access in areas with limited specialists. This expansion offers new opportunities for global vendors.

Rising Integration of Digital and Molecular Tools for Next-Generation Pathology

The combination of digital platforms and molecular tools creates strong opportunities. Hospitals integrate cellular analysis with genomic data for advanced precision care. The Histology and Cytology Market leverages molecular diagnostics for personalized therapies. AI-powered platforms deliver faster interpretation of pathology images. Vendors develop hybrid solutions that combine digital imaging and biomarker testing. These technologies improve clinical outcomes through better diagnostic accuracy. Research partnerships support innovation in molecular pathology services. The convergence of these tools will reshape the diagnostic landscape.

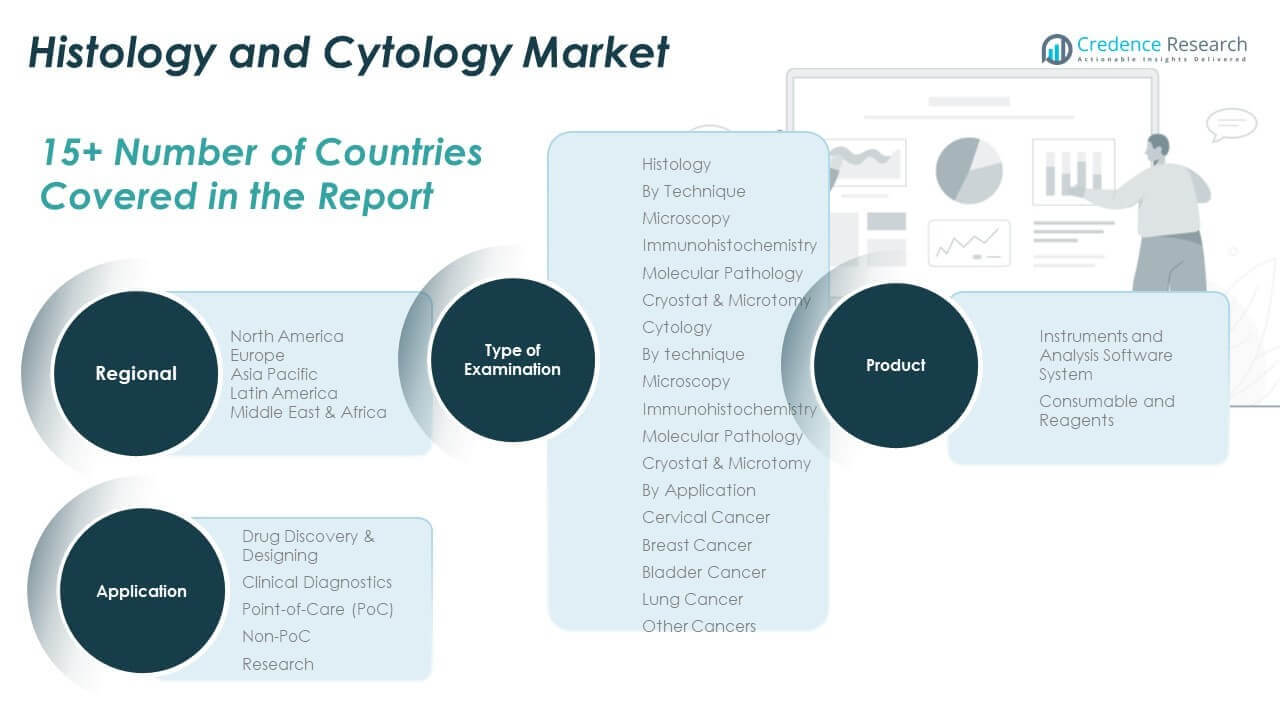

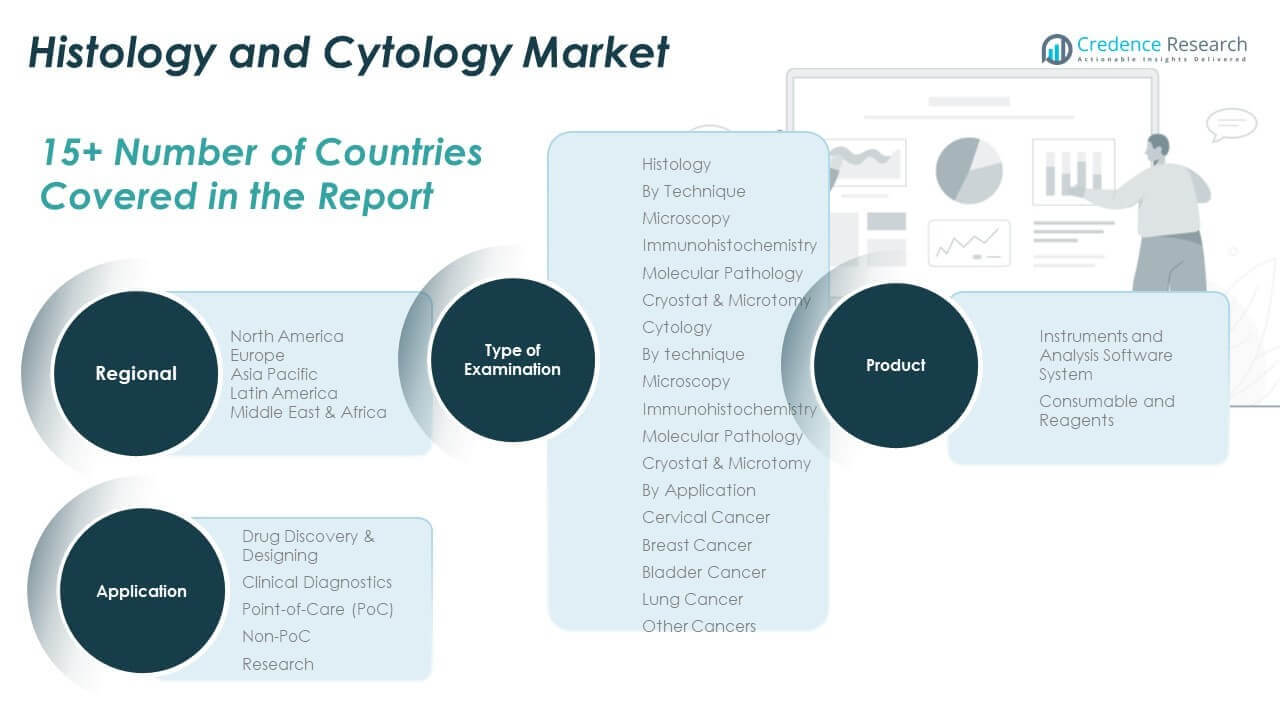

Market Segmentation Analysis:

By type of examination, the Histology and Cytology Market demonstrates strong segmentation across examination types, applications, and products. Within examination, histology techniques such as microscopy, immunohistochemistry, molecular pathology, and cryostat & microtomy form the foundation of tissue-based analysis, offering deeper insights into disease mechanisms. Cytology techniques mirror these methods but provide a focus on cellular-level diagnostics, enhancing early detection. The application of cytology in cervical, breast, bladder, and lung cancer remains central, with broader usage in identifying other cancers that require precise cellular evaluation. This breadth underlines the value of examination-based segmentation in addressing diverse clinical needs.

- For example, in January 2025, Roche received U.S. FDA 510(k) clearance for its VENTANA Kappa and Lambda Dual ISH mRNA Probe Cocktail assay. This first-of-its-kind in-situ hybridization (ISH) test enables pathologists to assess over 60 B-cell lymphoma subtypes and plasma cell neoplasms on a single tissue slide. It improves diagnostic certainty by differentiating malignant B-cell processes from reactive responses and reduces repeat biopsies and follow-up tests.

By application, drug discovery and designing continues to command attention, with researchers using advanced histology and cytology platforms to support targeted therapies. Clinical diagnostics remain a dominant segment, with rising cancer incidence fueling testing volumes. Point-of-care (PoC) applications improve accessibility in decentralized healthcare environments, while non-PoC settings support large-scale laboratory analysis. Research institutions utilize these tools for innovation, reinforcing the importance of flexible diagnostic solutions.

- For example, HistoWiz’s PathologyMap 2.0 platform is utilized by more than 500 organizations and has over 7,000 active users worldwide. The platform supports drug discovery and histopathology research, offering AI-powered analysis of tissue slides to improve research efficiency.

By product, the Histology and Cytology Market also shows clear product segmentation, where instruments and analysis software systems strengthen laboratory efficiency, while consumables and reagents drive recurring revenue streams. Together, these segments provide a comprehensive framework supporting growth, technology adoption, and clinical advancement.

Segmentation:

By Type of Examination

- Histology – By Technique:

- Microscopy

- Immunohistochemistry

- Molecular Pathology

- Cryostat & Microtomy.

- Cytology – By Technique:

- Microscopy

- Immunohistochemistry

- Molecular Pathology

- Cryostat & Microtomy.

- Cytology – By Application:

- Cervical Cancer

- Breast Cancer

- Bladder Cancer

- Lung Cancer

- Other Cancers.

By Application

- Drug Discovery & Designing

- Clinical Diagnostics

- Point-of-Care (PoC)

- Non-PoC

- Research

By Product

- Instruments and Analysis Software System

- Consumable and Reagents

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Histology and Cytology Market size was valued at USD 5,068.8 million in 2018 to USD 8,176.5 million in 2024 and is anticipated to reach USD 25,427.5 million by 2032, at a CAGR of 15.3% during the forecast period. North America accounts for 38% of the global market share in 2024. Strong healthcare infrastructure, early adoption of advanced diagnostic technologies, and well-established cancer screening programs drive regional growth. The U.S. dominates with extensive investments in pathology labs and digital solutions. Canada and Mexico also contribute through expanding healthcare access and rising cancer awareness. The Histology and Cytology Market benefits from collaborations between diagnostic providers and pharmaceutical firms, supporting clinical trials and research. Government support for precision medicine initiatives strengthens adoption across hospitals and research centers. It continues to expand with strong R&D pipelines and higher patient awareness across the region.

Europe

The Europe Histology and Cytology Market size was valued at USD 3,498.0 million in 2018 to USD 5,487.8 million in 2024 and is anticipated to reach USD 16,151.2 million by 2032, at a CAGR of 14.5% during the forecast period. Europe represents 25% of the global market share in 2024. Countries such as Germany, the UK, and France lead with advanced screening infrastructure and rising emphasis on personalized medicine. The Histology and Cytology Market in Europe grows with strong regulatory frameworks promoting early cancer detection. Eastern European nations show increasing demand through healthcare reforms and higher investments in diagnostic services. Regional adoption of digital pathology and molecular tools strengthens diagnostic precision. Research-driven collaborations between universities and diagnostic firms support innovation. Europe maintains steady momentum due to strong healthcare standards and structured national screening programs.

Asia Pacific

The Asia Pacific Histology and Cytology Market size was valued at USD 3,181.2 million in 2018 to USD 5,424.8 million in 2024 and is anticipated to reach USD 18,611.8 million by 2032, at a CAGR of 16.7% during the forecast period. Asia Pacific captures 25% of the global market share in 2024. China, Japan, and India lead regional adoption, supported by growing healthcare investments and a large patient base. The Histology and Cytology Market in Asia Pacific benefits from increasing awareness of cancer screening and broader access to diagnostic services. Expanding pharmaceutical R&D across the region creates stronger demand for histology and cytology techniques. Emerging economies are upgrading laboratory infrastructure with digital and molecular solutions. Rising healthcare expenditure among middle-class populations enhances diagnostic accessibility. The region continues to be the fastest-growing hub due to a favorable regulatory landscape and rising clinical research activity.

Latin America

The Latin America Histology and Cytology Market size was valued at USD 818.4 million in 2018 to USD 1,322.3 million in 2024 and is anticipated to reach USD 3,815.9 million by 2032, at a CAGR of 14.3% during the forecast period. Latin America holds 6% of the global market share in 2024. Brazil and Argentina represent the largest markets due to better cancer screening programs and infrastructure improvements. The Histology and Cytology Market in Latin America expands with rising government funding for public health services. Multinational diagnostic firms establish partnerships to increase market presence. Access to diagnostic services improves with the expansion of private laboratories. Growth is supported by regional medical tourism and rising awareness campaigns for early cancer detection. Market expansion continues with steady adoption of digital tools and laboratory automation.

Middle East

The Middle East Histology and Cytology Market size was valued at USD 381.5 million in 2018 to USD 570.7 million in 2024 and is anticipated to reach USD 1,543.3 million by 2032, at a CAGR of 13.3% during the forecast period. The Middle East accounts for 2% of the global market share in 2024. GCC countries lead the regional market with strong investments in modern healthcare infrastructure. The Histology and Cytology Market benefits from rising demand for advanced cancer diagnostics in Saudi Arabia and the UAE. Israel demonstrates growth with high adoption of molecular and digital pathology technologies. Turkey shows strong potential with expanding healthcare reforms. Regional governments support oncology care through policy-driven investments. Market growth is reinforced by private sector involvement in advanced diagnostic services.

Africa

The Africa Histology and Cytology Market size was valued at USD 252.1 million in 2018 to USD 558.0 million in 2024 and is anticipated to reach USD 1,536.5 million by 2032, at a CAGR of 13.1% during the forecast period. Africa represents 2% of the global market share in 2024. South Africa leads adoption with better diagnostic infrastructure and oncology research facilities. The Histology and Cytology Market in Africa expands with gradual improvements in healthcare funding and infrastructure. Egypt shows demand growth through public health initiatives in cancer screening. Other African nations remain at early stages but demonstrate rising awareness of cancer detection. International aid programs support pathology training and diagnostic development. Limited laboratory networks challenge accessibility, yet regional collaborations continue to improve testing availability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Histology and Cytology Market is characterized by strong competition among global diagnostic leaders and regional players. Key companies such as Hologic, Abbott, Becton, Dickinson and Company, F. Hoffmann-La Roche, Merck KGaA, Thermo Fisher Scientific, Danaher, Sysmex Corporation, Trivitron Healthcare, and Koninklijke Philips N.V. dominate with advanced product portfolios and established distribution networks. It emphasizes innovation in instruments, software, and consumables to address rising demand for accurate and rapid diagnostics. Mergers, acquisitions, and collaborations remain core strategies to expand market presence and strengthen technology platforms. Companies focus on integrating digital pathology, AI-enabled analysis, and molecular solutions to enhance diagnostic precision. Strong investment in R&D supports the launch of advanced reagents and imaging systems. Regional players increase competition by offering cost-effective products tailored to emerging markets. Competitive intensity continues to grow as firms expand into high-potential geographies and align product development with personalized medicine trends.

Recent Developments:

- In May 2025, Philips, a global leader in health technology, and Histolab, a prominent provider of histology solutions, announced a strategic partnership to expand digital pathology solutions across Sweden, Norway, Finland, and Denmark. Under this collaboration, Histolab has become the official reseller for Philips Digital Pathology Solutions in the Nordics, combining Philips’ advanced scanning technology with Histolab’s regional expertise, aimed at improving diagnostic accuracy and workflow efficiency in pathology labs across these countries.

- In March 2025, Epredia received FDA 510(k) clearance for its E1000 Dx Digital Pathology Solution, which is an automated whole-slide imaging system. Capable of processing up to 1,500 tissue samples per day, this product offers improved laboratory efficiency and diagnostic capabilities within histology and cytology applications.

- In February 2025, Thermo Fisher Scientific agreed to acquire Solventum’s Purification & Filtration business for $4.1 billion. This acquisition is significant as it deepens Thermo Fisher’s integration into life sciences, particularly pathology, by expanding its consumables offering for laboratories involved in histology and cytology testing.

- In January 2025, Roche received FDA clearance for the VENTANA Kappa and Lambda Dual ISH mRNA Probe Cocktail. This advanced reagent enables diagnoses of over 60 B-cell lymphoma subtypes on a single slide, streamlining and expanding the clinical utility for pathology labs engaged in histology and cytology diagnostics.

Report Coverage:

The research report offers an in-depth analysis based on Type of Examination, Product and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for early cancer detection will accelerate adoption of advanced histology and cytology techniques.

- Growing integration of AI and digital pathology platforms will improve diagnostic accuracy and efficiency.

- Expanding use of molecular pathology will strengthen personalized treatment pathways and targeted therapies.

- Increasing collaborations between pharmaceutical firms and diagnostic providers will drive innovation in clinical trials.

- Strong government support for cancer screening programs will boost market penetration in developed and emerging regions.

- Expanding laboratory automation and imaging technologies will reduce turnaround times and enhance workflows.

- Rising healthcare expenditure in developing economies will support broader access to diagnostic services.

- Ongoing product innovations in reagents, consumables, and imaging systems will create sustainable revenue streams.

- Growing adoption of point-of-care diagnostic solutions will extend access to underserved areas.

- Expanding global research investments in oncology will continue to drive the relevance of advanced pathology.