Market Overview

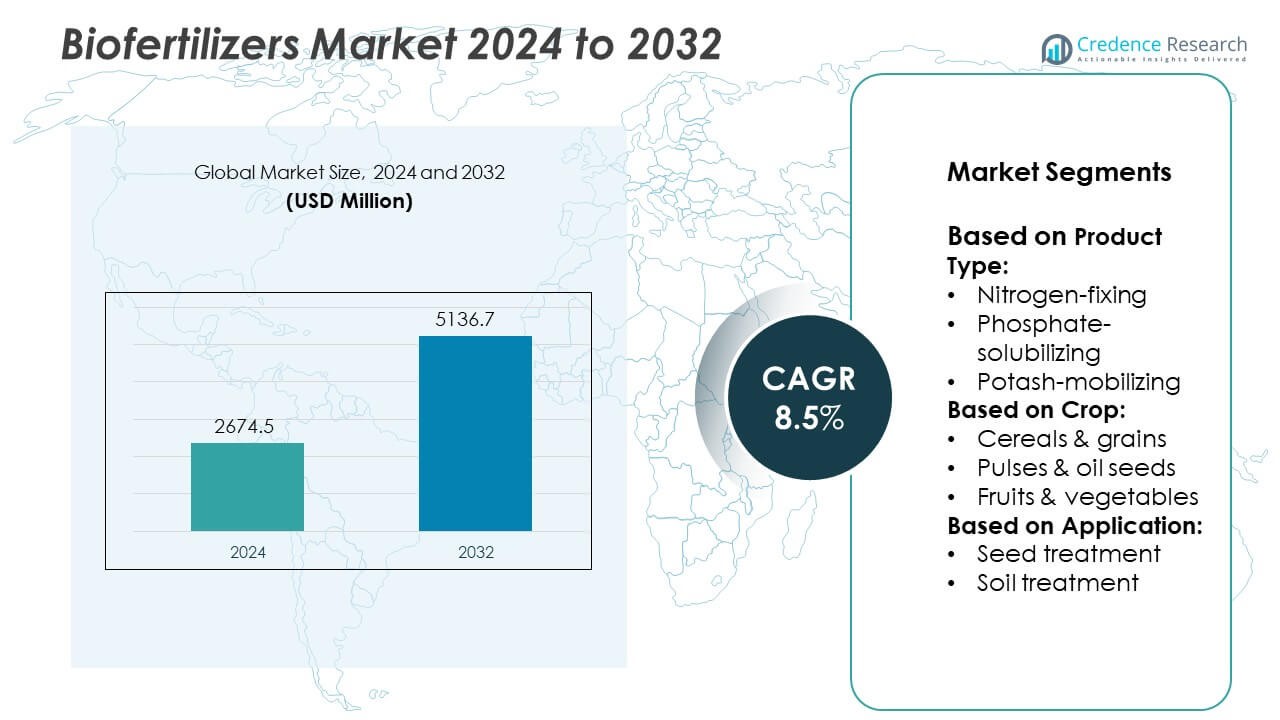

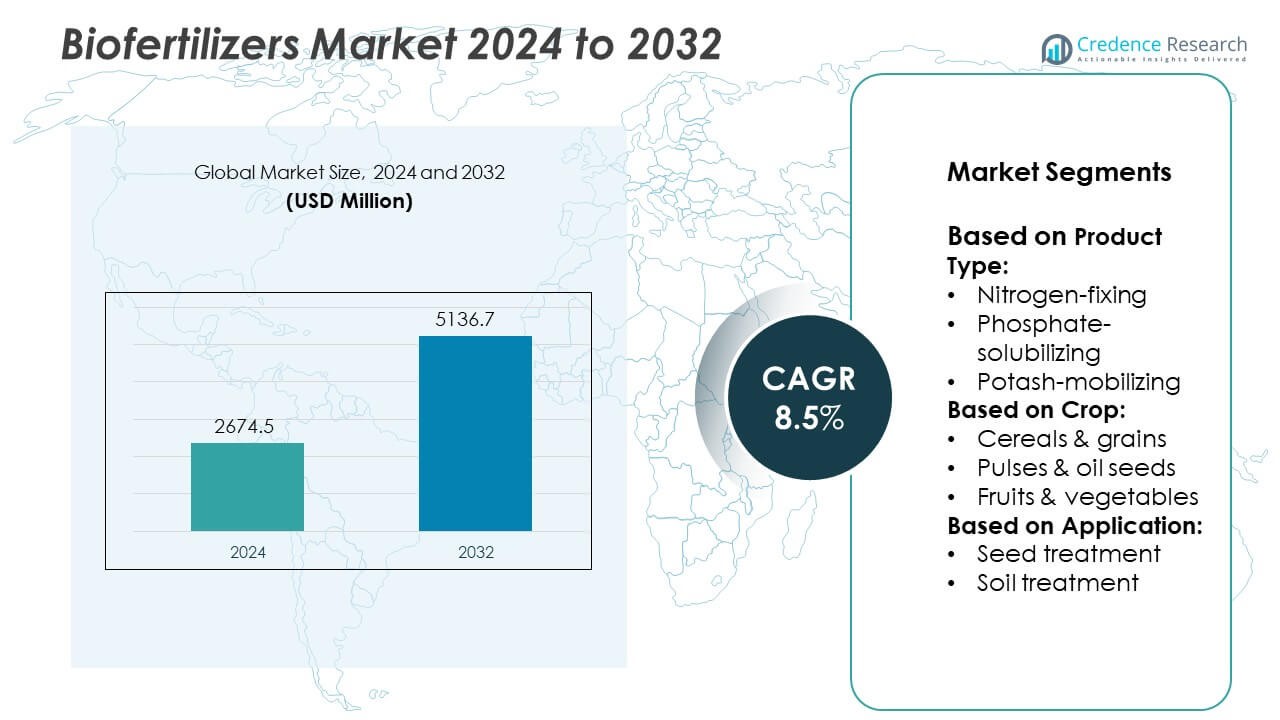

The Biofertilizers Market size was valued at USD 2674.5 million in 2024 and is anticipated to reach USD 5136.7 million by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biofertilizers Market Size 2024 |

USD 2674.5 Million |

| Biofertilizers Market, CAGR |

8.5% |

| Biofertilizers Market Size 2032 |

USD 5136.7 Million |

The biofertilizers market grows through rising demand for sustainable agriculture, driven by the need to reduce chemical fertilizer dependency and improve soil health. Government incentives, organic farming expansion, and increasing awareness of microbial solutions strengthen adoption. Technological advancements in multi-strain and liquid formulations enhance efficiency and crop compatibility. Integration with precision agriculture tools enables targeted application, improving yields and reducing wastage. Growing consumer preference for chemical-free produce fuels demand across cereals, pulses, and horticulture.

The biofertilizers market has a strong presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with Asia Pacific leading growth due to extensive agricultural activities and supportive government policies. Europe demonstrates high adoption driven by stringent environmental regulations and demand for organic produce, while North America benefits from advanced farming technologies and sustainability initiatives. Key players shaping the industry include Gujarat State Fertilizers & Chemicals Limited, Lallemand Inc., Kimitec Group, and Madras Fertilizers Limited, all focusing on innovation, region-specific formulations, and strategic partnerships to expand market reach and improve product performance globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The biofertilizers market was valued at USD 2674.5 million in 2024 and is projected to reach USD 5136.7 million by 2032, growing at a CAGR of 8.5% during the forecast period.

- Growing demand for sustainable agriculture and reduced reliance on chemical fertilizers is driving adoption, supported by government incentives and organic farming expansion.

- Advancements in multi-strain, liquid, and region-specific microbial formulations are enhancing efficiency, shelf life, and compatibility with diverse crops and soil types.

- Competition is shaped by both global and regional players such as Gujarat State Fertilizers & Chemicals Limited, Lallemand Inc., and Kimitec Group, focusing on R&D, partnerships, and product innovation.

- Limited farmer awareness, technical knowledge gaps, and short shelf life of microbial products remain key restraints, particularly in developing agricultural economies.

- Asia Pacific leads growth due to extensive farming activities, strong policy support, and local manufacturing; Europe and North America follow with high adoption in organic and precision farming.

- Latin America and the Middle East & Africa are emerging growth regions, driven by the need for soil restoration, sustainable crop production, and export-focused agricultural practices.

Market Drivers

Rising Global Focus on Sustainable Agricultural Practices

The shift toward eco-friendly farming methods drives strong adoption of biofertilizers. Farmers and agribusinesses seek alternatives to chemical fertilizers that preserve soil health and reduce environmental impact. Governments promote sustainable agriculture through subsidies and training programs, encouraging wider usage of microbial-based inputs. It benefits from rising consumer demand for organically grown produce, which requires compliance with strict organic standards. International organizations highlight soil biodiversity protection as a critical goal, aligning with biofertilizer adoption. This alignment between policy, environmental priorities, and consumer demand continues to strengthen its market position.

- For instance, airtight packaging that reduces oxygen below 1% by volume can extend shelf life 2 to 6 fold compared to non‑oxygen‑reduced formulations.

Increasing Awareness of Soil Health and Microbial Diversity

Soil degradation from excessive chemical input use creates a pressing need for restorative solutions. Biofertilizers improve nutrient availability and restore microbial balance, ensuring better crop resilience. Research institutions and agri-tech firms invest in advanced microbial strains that deliver higher efficiency under diverse climatic conditions. Farmers recognize that maintaining soil health directly impacts crop yield and profitability. It gains traction in regions where soil nutrient depletion has reached critical levels, particularly in intensive farming zones. Educational campaigns by agricultural extension services accelerate understanding of biofertilizer benefits among rural farming communities.

- For instance, adding protectants like trehalose in liquid inoculants has enabled Bradyrhizobium survival for more than 180 days at room temperature.

Government Support Through Policies and Subsidy Frameworks

Policy interventions play a pivotal role in driving biofertilizer adoption rates. Many countries offer tax incentives, certification support, and distribution assistance to encourage farmers to transition from chemical fertilizers. It benefits from regulatory frameworks that limit synthetic fertilizer use, creating demand for biological alternatives. National agricultural development programs integrate biofertilizers into crop management packages. Public-private partnerships promote innovation and local production capacity, reducing reliance on imports. Strong policy backing ensures steady demand growth across both emerging and developed economies.

Technological Advancements in Microbial Formulation and Application Methods

Continuous innovation in formulation techniques improves biofertilizer stability, shelf life, and application efficiency. Modern encapsulation technologies protect microbial viability under extreme storage and field conditions. It achieves broader adoption through compatibility with mechanized farming and precision agriculture systems. Companies develop liquid and carrier-based formulations that suit diverse crops and soil types. Research breakthroughs expand the range of target crops beyond traditional cereals and legumes. These technological improvements enhance farmer confidence, leading to higher repeat adoption rates.

Market Trends

Growing Integration with Precision Agriculture Technologies

The adoption of precision agriculture tools supports the targeted application of biofertilizers. GPS-guided equipment and variable rate technology enable precise dosage, reducing wastage and improving crop outcomes. It gains traction in advanced farming regions where digital agriculture is standard practice. Integration with soil mapping and real-time nutrient monitoring enhances efficiency. Farmers leverage data-driven decisions to optimize microbial input use across different field zones. This trend strengthens biofertilizer performance consistency and supports scalability for large-scale farms.

- For instance, national programs in some countries now include on‑field training that reaches 1000 of farmers annually, accelerating uptake of biofertilizer use.

Expansion of Liquid and Multi-Strain Formulations

Manufacturers focus on liquid biofertilizers and multi-strain microbial blends to increase efficiency across diverse soil and crop types. Liquid formulations offer longer shelf life and ease of application through drip irrigation systems. It benefits from the ability to combine nitrogen-fixing, phosphate-solubilizing, and potassium-mobilizing microorganisms in one product. Such innovations improve nutrient uptake and reduce the need for multiple applications. Field trials demonstrate yield improvements in both high-value horticulture and staple crops. Demand for these advanced formulations is growing in both developed and emerging agricultural markets.

- For instance, lyophilized (freeze-dried) formulations retain 80–95 % viability for more than 5 years when stored at below ‑80 °C.

Rising Demand from Organic and Regenerative Farming Sectors

Organic and regenerative farming practices continue to expand, creating higher demand for biofertilizers. Certified organic growers prefer microbial inputs that meet international organic certification requirements. It finds strong alignment with regenerative agriculture’s focus on soil restoration and biodiversity enhancement. Increased consumer interest in chemical-free produce supports this demand surge. Food retailers and processors encourage sustainable sourcing by partnering with growers using biofertilizers. This trend strengthens the role of biofertilizers in global sustainable food supply chains.

Increased Focus on Region-Specific Strain Development

Research and development efforts increasingly prioritize microbial strains tailored to local soil and climatic conditions. Region-specific solutions improve crop compatibility and resilience under environmental stress. It benefits from collaborations between universities, research institutes, and private sector innovators. Customized strains address nutrient deficiencies unique to certain geographies, enhancing adoption rates. Such localized development reduces farmer risk and improves return on investment. This approach positions biofertilizers as a viable alternative to synthetic inputs in diverse agricultural regions.

Market Challenges Analysis

Limited Farmer Awareness and Technical Knowledge

A major challenge for the biofertilizers market is the lack of adequate awareness among farmers about proper application methods and expected results. Many growers remain unfamiliar with microbial-based solutions and their benefits compared to chemical fertilizers. It faces adoption barriers in rural areas where training and extension services are limited. Misapplication or incorrect storage often reduces product effectiveness, leading to skepticism. Seasonal labor shortages and low mechanization rates in developing regions further restrict correct usage. Building farmer trust requires consistent demonstration of results through field trials and educational programs.

Short Shelf Life and Storage Sensitivity of Microbial Products

Biofertilizers contain living microorganisms that require specific storage and handling conditions to maintain viability. High temperatures, moisture fluctuations, and exposure to direct sunlight can degrade product quality before application. It encounters distribution challenges in regions lacking cold chain infrastructure or reliable warehousing. The relatively short shelf life compared to synthetic fertilizers adds logistical complexity for suppliers. Retailers and distributors may hesitate to stock large quantities due to spoilage risk. Overcoming this constraint requires innovation in formulation technology and stronger supply chain management systems.

Market Opportunities

Expanding Role in Climate-Smart and Sustainable Farming Practices

The biofertilizers market has significant growth potential through its alignment with climate-smart agriculture initiatives. Governments and international organizations promote practices that reduce greenhouse gas emissions and enhance soil carbon sequestration. It offers a viable alternative to synthetic fertilizers, helping farmers meet sustainability targets while maintaining yields. Adoption is set to rise in regions implementing carbon credit schemes for environmentally friendly farming methods. Partnerships between agritech firms and sustainability-driven food brands create new commercial channels. These collaborations enhance market visibility and accelerate large-scale adoption.

Untapped Potential in Emerging Agricultural Economies

Rapidly expanding agricultural sectors in Asia, Africa, and Latin America present strong growth prospects for biofertilizers. Rising population and food demand in these regions encourage investment in higher-yield, sustainable inputs. It can benefit from growing government incentives aimed at improving soil health and reducing dependency on chemical imports. Local manufacturing and region-specific product development will lower costs and improve accessibility for smallholder farmers. Distribution networks integrated with rural cooperatives can extend market reach effectively. These opportunities position biofertilizers as a key input in the modernization of farming systems worldwide.

Market Segmentation Analysis:

By Product Type:

Nitrogen-fixing biofertilizers hold a dominant share due to their ability to enhance atmospheric nitrogen fixation and improve crop yields sustainably. These products, often based on Rhizobium, Azotobacter, and Azospirillum strains, are widely adopted for leguminous crops and cereals. Phosphate-solubilizing biofertilizers address the challenge of phosphorus unavailability in soil by converting insoluble forms into plant-accessible nutrients, increasing root development and productivity. Potash-mobilizing variants improve potassium uptake, enhancing plant strength and resistance to environmental stress. It benefits from the growing demand for balanced nutrient management in both high-value and staple crops. Manufacturers continue to invest in multi-functional formulations that combine these categories for comprehensive nutrient support.

- For instance, research shows that a selected Azospirillum brasilense strain reached approximately 5 × 10⁸ CFU per milliliter in liquid form, ensuring high potency and uniform application distribution.

By Crop:

Cereals and grains represent the largest user segment due to their extensive cultivation area and the high nutrient demand of staple crops like wheat, rice, and maize. Pulses and oil seeds, including soybean, groundnut, and sunflower, see strong adoption of nitrogen-fixing products to improve protein content and oil yield. Fruits and vegetables drive growth in the premium agricultural segment, where biofertilizers enhance quality, shelf life, and nutrient density. It gains traction in horticulture due to rising consumer preference for chemical-free produce. Region-specific formulations targeting horticultural crops have shown significant market acceptance. This crop-based diversification ensures stable demand across varied agricultural cycles.

- For instance, a commercial biofertilizer used on tomato seedlings maintained viable Bacillus subtilis populations of around 1 × 10⁷ CFU per gram of dry carrier after 90 days of ambient storage.

By Application:

Seed treatment remains a preferred method for ensuring early-stage plant vigor and efficient microbial colonization. It requires minimal application quantity and ensures targeted delivery of beneficial microorganisms directly to germinating seeds. Soil treatment dominates in large-scale farming operations, where uniform distribution across fields supports root zone nutrient enrichment. This method is favored for high-nutrient-demand crops and in soils with significant nutrient depletion. Integration of soil treatment with mechanized application systems improves efficiency and adoption rates. The dual benefits of yield improvement and long-term soil health restoration make both seed and soil treatments integral to the biofertilizers market.

Segments:

Based on Product Type:

- Nitrogen-fixing

- Phosphate-solubilizing

- Potash-mobilizing

Based on Crop:

- Cereals & grains

- Pulses & oil seeds

- Fruits & vegetables

Based on Application:

- Seed treatment

- Soil treatment

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 24% of the global biofertilizers market, driven by advanced agricultural practices, strong regulatory support, and a rapidly expanding organic farming sector. The United States leads the region with high adoption rates in large-scale farming operations, supported by precision agriculture technologies. Canada also contributes significantly due to growing demand for organic cereals, grains, and horticultural crops. It benefits from favorable policies such as organic certification programs and sustainable agriculture incentives. Well-established supply chains, advanced research institutions, and collaborations between universities and biotech firms further strengthen regional growth. The adoption of biofertilizers in both conventional and greenhouse farming is expanding, reflecting the region’s emphasis on environmental sustainability and soil conservation.

Europe

Europe holds 21% of the global market, with adoption strongly influenced by strict environmental regulations and the European Union’s Common Agricultural Policy (CAP). Countries such as Germany, France, Italy, and Spain are prominent markets, supported by high awareness of soil health and biodiversity. It gains momentum from widespread consumer demand for organic produce and pesticide-free food products. The region also benefits from a robust network of cooperatives and farmer associations that promote biofertilizer usage. Investment in research to develop microbial strains suited for colder climates ensures consistent product performance across diverse geographies. The integration of biofertilizers into regenerative farming models further positions Europe as a leader in sustainable agricultural solutions.

Asia Pacific

Asia Pacific dominates with 38% of the global biofertilizers market, driven by the vast agricultural base and increasing government initiatives promoting eco-friendly inputs. India and China are the largest contributors, supported by extensive cultivation of cereals, grains, pulses, and oil seeds. It benefits from programs such as subsidies, farmer training, and awareness campaigns aimed at reducing chemical fertilizer dependency. Japan, Australia, and Southeast Asian countries are also witnessing growing adoption in high-value horticulture and organic farming. The region’s strong presence of local biofertilizer manufacturers enhances affordability and accessibility, especially for smallholder farmers. Rising population and food demand further strengthen market expansion, making Asia Pacific a key growth hub.

Latin America

Latin America represents 10% of the global market, supported by its strong agricultural export sector and increasing adoption of sustainable farming practices. Brazil leads the region, driven by large-scale soybean, sugarcane, and maize cultivation. Argentina, Chile, and Mexico also demonstrate rising usage, particularly in fruits, vegetables, and export-oriented crops. It benefits from regional policies promoting soil conservation and long-term productivity enhancement. Partnerships between local producers and international agricultural companies improve technological transfer and product innovation. Growing awareness among farmers about the economic and environmental benefits of microbial inputs supports steady market growth across the region.

Middle East & Africa

The Middle East & Africa holds 7% of the global market, with adoption led by South Africa, Egypt, and Gulf countries focusing on sustainable agriculture in arid climates. Limited arable land and soil nutrient depletion drive the demand for biofertilizers to improve productivity without harming the environment. It benefits from projects funded by government and international organizations to promote organic farming and reduce import dependency. Adoption is growing in horticulture, greenhouse farming, and high-value crops for export. Water-efficient application methods combined with microbial inputs help address the region’s resource constraints. While the market share is smaller compared to other regions, growth potential remains high due to increasing investments in agricultural modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jay Enterprises

- Madras Fertilizers Limited

- Gizatec

- Ajay Bio-Tech (India) Ltd.

- Lallemand Inc.

- Chema Industries

- Kimitec Group

- Gujarat State Fertilizers & Chemicals Limited

- Agri Life

- Cairochem

Competitive Analysis

The leading players in the biofertilizers market include Gujarat State Fertilizers & Chemicals Limited, Lallemand Inc., Kimitec Group, and Madras Fertilizers Limited. These companies compete through innovation in microbial formulations, expansion of product portfolios, and strategic partnerships with agricultural cooperatives and distributors. They focus on developing multi-strain and liquid biofertilizers that enhance nutrient uptake efficiency and perform well under diverse climatic conditions. Strong investment in research enables the creation of region-specific strains, improving adoption rates in varied geographies. Distribution network optimization remains a priority to ensure timely product delivery and maintain microbial viability. Marketing strategies emphasize farmer education, field demonstrations, and technical support to build trust and encourage repeat usage. The competitive landscape is further shaped by increasing collaborations with government programs promoting sustainable farming. Companies are also strengthening sustainability credentials by aligning product development with environmental standards and certification requirements. By balancing technological advancements with market expansion strategies, these players position themselves to capture demand from both traditional farming sectors and high-value organic agriculture. The competitive intensity is expected to rise as more entrants focus on innovation and as global demand for eco-friendly agricultural inputs continues to grow.

Recent Developments

- In 2025, MFL introduced biofertilizers under the brand name VIJAY BIO aimed at maintaining soil health and fertility. This product launch focuses on eco-friendly biofertilizers as part of MFL s sustainable agriculture initiatives.

- In May 2024, Fresh Del Monte partnered to produce biofertilizers using fruit residues. A new biofertilizer plant is located near Del Monte Kenya Ltd., a subsidiary of Fresh Del Monte. This facility will utilize residues from the company’s pineapple cannery to create a range of biofertilizers for internal use and potential sale to other growers in Kenya and neighboring East African countries.

- In 2024, Jay Enterprises is mentioned as expanding operations beyond domestic markets to tap into emerging opportunities globally, including adapting products for specific crop and soil needs for enhanced competitiveness.

Market Concentration & Characteristics

The Biofertilizers market shows moderate concentration, with competition shaped by a mix of global leaders and regional producers focused on specific crop and soil requirements. It benefits from strong demand across diverse agricultural sectors, with key players investing in advanced microbial strains, liquid formulations, and region-specific product lines to enhance efficiency and adoption. It operates in a regulatory landscape that supports sustainable agriculture, with policies encouraging reduced chemical fertilizer use and promotion of organic farming practices. Product differentiation relies on formulation stability, crop compatibility, and integration with precision farming systems. It experiences steady entry of new participants leveraging biotechnology advancements, while established companies strengthen market position through strategic partnerships, distribution network expansion, and farmer outreach programs. The market’s growth potential is reinforced by rising consumer demand for chemical-free produce, sustained government support, and ongoing innovation in application techniques. It remains highly dynamic, with regional dominance influenced by agricultural scale, policy frameworks, and environmental priorities.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Crop, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of biofertilizers will increase due to growing demand for sustainable farming practices.

- Technological advancements will improve microbial strain efficiency and product stability.

- Government incentives will continue to promote organic farming and reduce chemical fertilizer usage.

- Integration with precision agriculture tools will enhance targeted application and yield optimization.

- Expansion of liquid and multi-strain formulations will boost compatibility with diverse crops.

- Consumer preference for chemical-free produce will drive higher demand across multiple crop categories.

- Strategic partnerships will strengthen distribution networks in emerging and developed markets.

- Climate change concerns will push farmers toward eco-friendly soil enhancement solutions.

- Research in biofertilizer blends will improve nutrient uptake and crop resilience.

- Regional market growth will be influenced by agricultural scale, policies, and environmental regulations.