Market Overview

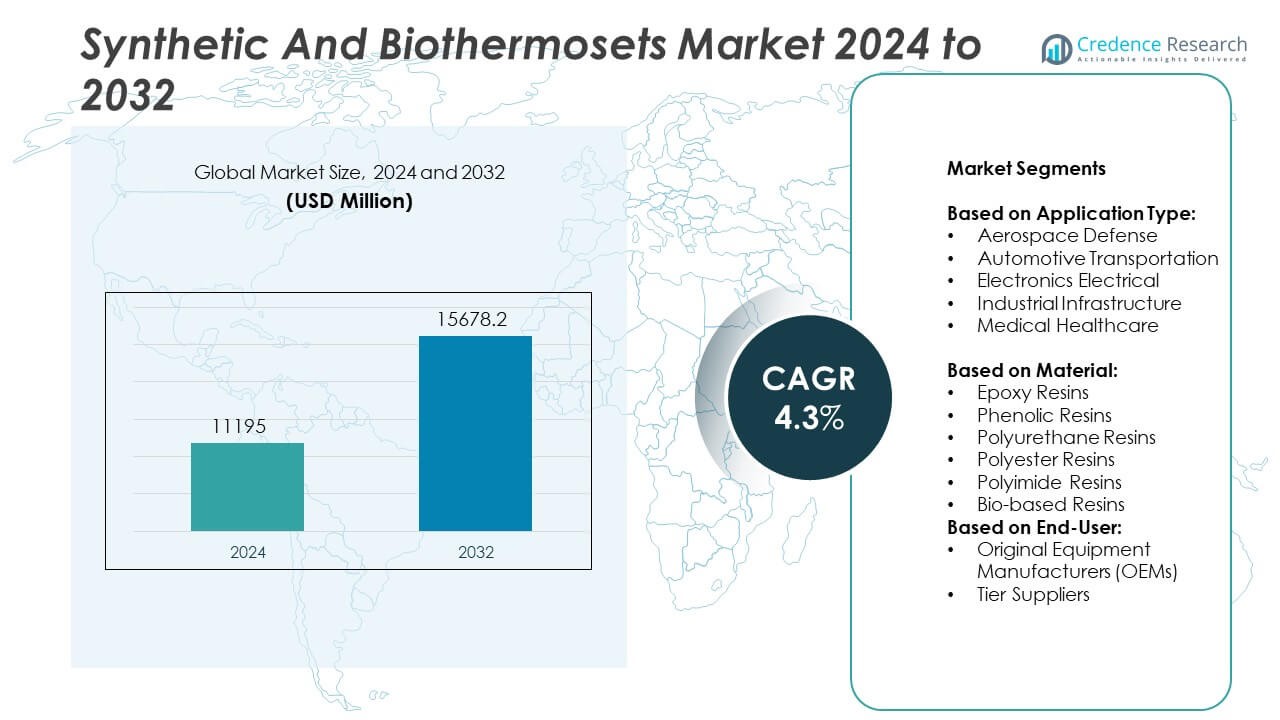

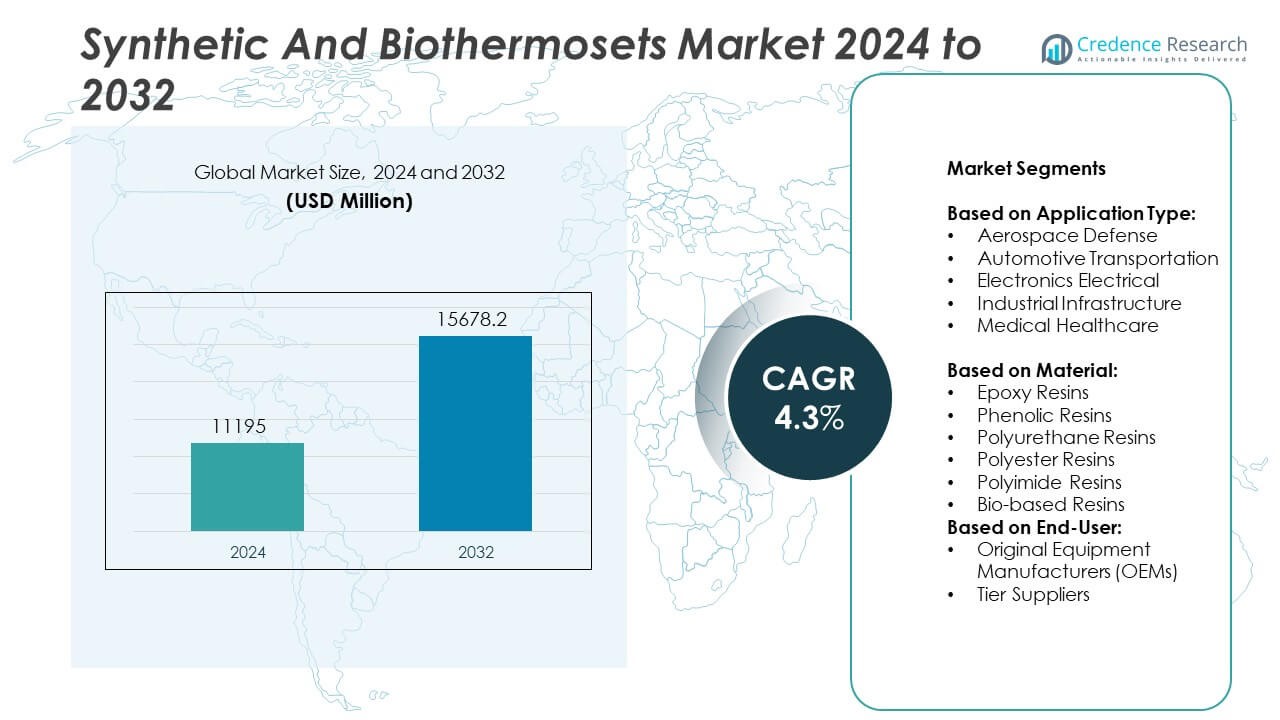

The Synthetic and Bio thermosets Market size was valued at USD 11,195 million in 2024 and is anticipated to reach USD 15,678.2 million by 2032, growing at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Synthetic and Bio thermosets Market Size 2024 |

USD 11,195 Million |

| Synthetic and Bio thermosets Market, CAGR |

4.3% |

| Synthetic and Bio thermosets Market Size 2032 |

USD 15,678.2 Million |

The Synthetic and Bio thermosets market is driven by rising demand from automotive, aerospace, and construction industries that require high-performance, lightweight, and heat-resistant materials. Manufacturers prioritize thermosets for their structural strength, durability, and ability to meet stringent emission and safety standards. Increasing focus on sustainability fuels interest in bio-based thermosets, supported by regulatory pressure and shifting consumer preferences.

The Synthetic and Bio thermosets market sees strong demand across Asia Pacific, North America, and Europe due to industrial growth and sustainability goals. Asia Pacific leads in production, while North America and Europe focus on innovation and high-performance applications. Key players include BASF, Huntsman, Dow Chemicals, and DSM, who drive market growth through advanced resin technologies, global supply networks, and investments in bio-based and high-strength material solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Synthetic and Bio thermosets market was valued at USD 11,195 million in 2024 and is expected to reach USD 15,678.2 million by 2032, growing at a CAGR of 4.3% during the forecast period.

- Strong demand from automotive, aerospace, and construction industries is driving the market, with thermosets preferred for their durability, thermal stability, and lightweight properties.

- A key trend shaping the market is the rising adoption of bio-based thermosets, supported by regulatory pressure and industry-wide focus on sustainability.

- Innovation in resin formulations, smart materials, and advanced processing technologies continues to expand the applications of thermosets in electronics, renewable energy, and healthcare sectors.

- Competitive dynamics feature key players such as BASF, Huntsman, Dow Chemicals, and DSM, who invest heavily in R&D, global supply networks, and sustainable product lines to maintain market presence.

- High production costs, limited recycling options, and technical challenges in scaling bio-based formulations act as restraints to broader market penetration.

- Asia Pacific leads the global market due to strong manufacturing activity and demand across key industries, while North America and Europe focus on high-performance and eco-friendly solutions.

Market Drivers

Rising Demand from Automotive and Aerospace Sectors Enhances Market Expansion

The Synthetic and Bio thermosets market benefits significantly from the increasing demand in automotive and aerospace industries. These sectors prioritize lightweight, durable, and heat-resistant materials to improve fuel efficiency and safety. Thermoset resins meet these performance standards, making them preferred choices in structural components and interior applications. Automakers adopt these materials to comply with stringent emission regulations and to reduce vehicle weight. Aerospace manufacturers rely on them for high-strength and low-weight solutions in aircraft interiors and structural parts. This expanding application base drives the overall demand for thermosets across both industries.

- For instance, automotive seating manufacturers use approximately 20–30 pounds of polyurethane foam per vehicle seat to achieve lightweight, durable cushioning.

Construction and Infrastructure Development Stimulates Material Consumption

Rapid infrastructure growth across developing regions supports the Synthetic and Bio thermosets market. Construction projects require advanced composites and adhesives with high chemical resistance and thermal stability. Thermoset polymers provide excellent durability, making them suitable for coatings, flooring, and insulation materials. Government-led infrastructure initiatives in Asia Pacific, the Middle East, and Latin America continue to boost demand. Increased focus on sustainable building materials also promotes the use of bio-based thermosets. It contributes to reduced lifecycle costs and improved environmental performance in the construction sector.

- For instance, Global carbon dioxide emissions from fossil fuels and industry totaled 37.01 billion metric tons (GtCO₂).

Growing Focus on Sustainability Drives Interest in Bio-Based Thermosets

The global shift toward environmentally responsible materials strengthens demand for bio-based thermosets. Industries seek alternatives to conventional synthetic materials due to stricter environmental regulations and corporate sustainability goals. Bio-based thermosets, derived from renewable sources, offer reduced carbon footprints and lower toxicity levels. Their adoption increases in consumer goods, packaging, and electronics where green credentials hold strategic value. The Synthetic and Bio thermosets market aligns with these sustainability trends, encouraging R&D investments in new bio-resin formulations. It helps manufacturers meet both performance and environmental standards.

Technological Advancements Improve Performance and Application Versatility

Continued innovation in formulation and processing enhances the appeal of thermoset materials. Manufacturers develop advanced curing techniques and resin systems to meet diverse industry requirements. These improvements result in faster processing times, greater structural integrity, and expanded usage in complex applications. The Synthetic and Bio thermosets market evolves alongside these technological trends, attracting interest from sectors like electronics, wind energy, and marine. It supports better customization and cost efficiency, improving competitiveness across end-user industries. Such advancements maintain strong growth momentum and broaden market adoption.

Market Trends

Increased Integration of Bio-Based Thermosets in Industrial Applications

Manufacturers are gradually integrating bio-based thermosets into mainstream industrial applications due to their environmental and performance advantages. These materials offer comparable thermal stability, chemical resistance, and mechanical strength to traditional synthetic resins. Industries such as automotive, electronics, and consumer goods now adopt them to meet sustainability targets and regulatory compliance. The Synthetic and Bio thermosets market reflects this trend through growing R&D investments and product launches centered on renewable feedstocks. It supports reduced reliance on petrochemical inputs while maintaining application versatility. This shift signals a long-term move toward more sustainable material choices.

- For instance, the SKZ Plastics Center, in partnership with Süd-West-Chemie GmbH and Baumgarten Automotive Technics GmbH, is developing new injection-moldable thermoset compounds. These compounds will contain a high proportion of bio-based ingredients, aiming for at least 950 grams per kilogram of compound. Additionally, they are working on optimized formulations using 700 grams of renewable raw material per kilogram for technical applications.

Adoption of Thermosets in Lightweight and High-Performance Components

Demand for lightweight and high-strength materials continues to influence market trends across aerospace, defense, and automotive sectors. Thermosets offer the mechanical stability and heat resistance necessary for load-bearing and structural applications. Their ability to retain properties under extreme conditions supports growing use in composite parts and high-performance assemblies. The Synthetic and Bio thermosets market captures this demand by offering advanced resin formulations tailored for critical engineering needs. It enables better weight-to-strength ratios without compromising durability. This trend strengthens the position of thermosets in next-generation mobility and transportation solutions.

- For instance, Sikorsky achieved a had a maximum gross weight of 46,000 lb (20,865 kg), including 20,000 lb (9,072 kg) in the payload in the CH‑53E helicopter’s gear housing by incorporating composite materials.

Shift Toward Smart and Functionalized Thermoset Materials

Technological advancements have enabled the development of smart thermosets with enhanced electrical, thermal, and mechanical properties. These materials support emerging applications in electronics, telecommunications, and energy systems. Functionalized thermosets with embedded sensors or conductivity features enable new use cases in printed circuit boards, sensors, and encapsulants. The Synthetic and Bio thermosets market evolves alongside these innovations by offering specialized products for high-tech sectors. It addresses the demand for multifunctional materials that combine structural and sensing capabilities. This trend reflects the ongoing convergence of materials science and digital technology.

Focus on Circular Economy and End-of-Life Material Solutions

Industry stakeholders increasingly prioritize recyclability, energy efficiency, and reduced waste across the thermoset product lifecycle. While traditional thermosets pose challenges in recycling, new research focuses on reversible cross-linking and degradable formulations. These innovations support compliance with circular economy goals and strengthen environmental responsibility. The Synthetic and Bio thermosets market responds to these expectations through collaborations with universities and start-ups focused on material reusability. It explores alternatives to incineration or landfill disposal for cured thermosets. This trend demonstrates the market’s proactive approach to long-term sustainability.

Market Challenges Analysis

Recycling Limitations and End-of-Life Management Remain Major Obstacles

Thermoset polymers face inherent recycling challenges due to their irreversible cross-linked structure, which prevents remelting and reshaping. This limitation creates significant waste management concerns, especially in large-scale industries such as automotive, aerospace, and construction. Existing disposal methods, including incineration and landfilling, raise environmental and regulatory issues. The Synthetic and Bio thermosets market must address the lack of efficient, scalable recycling technologies to meet evolving sustainability standards. It also faces pressure from environmental agencies and end users demanding greener alternatives with circular lifecycle potential. These barriers continue to restrict broader adoption despite performance advantages.

High Production Costs and Technical Complexities Impact Market Penetration

Manufacturing thermosets, particularly bio-based variants, involves complex formulations and expensive raw materials, which drive up overall production costs. Advanced curing processes and specialized equipment further add to operational expenses, limiting accessibility for small- and medium-sized manufacturers. Inconsistent raw material supply, especially for bio-based feedstocks, creates supply chain uncertainties. The Synthetic and Bio thermosets market struggles to balance performance and cost-efficiency in highly competitive end-use industries. It must overcome pricing barriers to expand presence across price-sensitive sectors such as packaging or consumer goods. These financial and technical constraints challenge the pace of innovation and scalability.

Market Opportunities

Expansion into Emerging Markets and Untapped Industrial Sectors

Rapid industrialization in emerging economies offers strong growth prospects for thermoset manufacturers. Infrastructure development, rising automotive production, and growing demand for durable materials across Asia Pacific, Latin America, and Africa open new application areas. The Synthetic and Bio thermosets market can benefit from strategic partnerships and local production facilities to serve regional needs efficiently. It can also tap into expanding sectors such as renewable energy and consumer electronics, where high-performance and long-lasting materials are essential. Supportive government policies and investment incentives in these regions create favorable conditions for market entry. These opportunities support long-term growth through market diversification and regional footprint expansion.

Innovation in Bio-Based Formulations and Circular Material Design

Advancements in bio-based resin chemistry present a valuable opportunity to develop sustainable alternatives to conventional thermosets. Manufacturers can capitalize on growing demand for low-carbon, non-toxic materials by investing in R&D for plant-derived or waste-based feedstocks. The Synthetic and Bio thermosets market stands to gain from developing resins with improved end-of-life recyclability or biodegradability, aligning with global circular economy goals. It can also explore new product designs that enable disassembly or reprocessing, offering added value to environmentally conscious industries. Collaboration with research institutions and start-ups can accelerate innovation cycles and commercialization. These developments position the market to lead the transition toward sustainable material solutions.

Market Segmentation Analysis:

By Application Type:

With aerospace and defense emerging as a key segment due to the need for lightweight, high-performance materials that offer thermal stability and structural integrity. Automotive and transportation also generate strong demand, driven by emission control standards and the push for lighter vehicles. Electronics and electrical applications benefit from thermosets’ excellent insulation and flame resistance properties, especially in circuit boards and encapsulants. Industrial and infrastructure projects use these materials for corrosion-resistant coatings, adhesives, and structural components. The medical and healthcare segment adopts thermosets in diagnostic devices and medical housing materials requiring chemical resistance and hygiene compliance.

- For instance, Hexcel Corporation supplies epoxy-based composite materials for Boeing’s 787 Dreamliner, contributing to a 20% weight reduction compared to traditional aluminum designs, improving fuel efficiency and structural integrity.

By Material:

Epoxy resins dominate the market due to their mechanical strength, electrical insulation, and chemical resistance. They remain a preferred choice across aerospace, electronics, and industrial applications. Phenolic resins follow closely, valued for their flame retardance and thermal stability, particularly in automotive and construction. Polyurethane and polyester resins support flexible applications, with polyurethane used in foams and sealants, while polyester offers cost-effective solutions in fiberglass composites. Polyimide resins cater to niche markets requiring extreme temperature resistance. Bio-based resins are gaining traction with growing interest in sustainable alternatives and support ongoing market evolution. The Synthetic and Bio thermosets market adapts to these material demands by expanding portfolios that meet both performance and environmental criteria.

- For instance, Huntsman Corporation developed ARALDITE® LY 3585 epoxy resin used in aerospace structures, which demonstrates a tensile strength of 85 MPa and elongation at break of 5.5%, meeting rigorous aviation standards.

By End-User:

Original Equipment Manufacturers (OEMs) hold a dominant share, as they integrate thermoset materials directly into finished products across automotive, aerospace, and electronics sectors. OEMs influence demand through innovation and quality standards. Tier suppliers, while smaller in volume, play a critical role in the value chain by providing intermediate components and specialized parts. It relies on coordination between OEMs and suppliers to ensure consistent supply, technical compliance, and material innovation. Both segments contribute to a robust and responsive market ecosystem.

Segments:

Based on Application Type:

- Aerospace Defense

- Automotive Transportation

- Electronics Electrical

- Industrial Infrastructure

- Medical Healthcare

Based on Material:

- Epoxy Resins

- Phenolic Resins

- Polyurethane Resins

- Polyester Resins

- Polyimide Resins

- Bio-based Resins

Based on End-User:

- Original Equipment Manufacturers (OEMs)

- Tier Suppliers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America held a significant share of the Synthetic and Bio thermosets market, accounting for approximately 28.5% of the global revenue in 2024. The region benefits from a mature industrial base and strong demand from key sectors such as aerospace, automotive, and electrical manufacturing. The United States drives most of the regional growth, supported by consistent investment in defense and aviation, where thermosets are critical due to their strength-to-weight ratio and durability. Major OEMs and tier suppliers operating in the U.S. and Canada continue to invest in advanced composites, pushing demand for high-performance thermoset resins. The presence of major producers and robust R&D facilities supports continuous innovation in formulations, particularly in epoxy and polyurethane resins. Strict regulatory standards also influence the shift toward bio-based thermosets, encouraging sustainable material development across the value chain.

Europe

Europe accounted for 25.2% of the global market share in 2024, driven by well-established automotive and construction sectors across Germany, France, Italy, and the UK. The region exhibits growing interest in environmentally sustainable solutions, prompting increased use of bio-based thermosets, especially in construction and packaging. Strong compliance with REACH and other environmental regulations accelerates the transition to low-emission and recyclable materials. Industrial infrastructure projects across the EU further contribute to the demand for corrosion-resistant thermoset composites. Innovation in green building materials and expansion of EV manufacturing support resin demand, particularly epoxy and polyester types. Europe’s circular economy directives encourage manufacturers to focus on end-of-life solutions, influencing product development strategies in the Synthetic and Bio thermosets market.

Asia Pacific

Asia Pacific led the global market with the largest share of 33.1% in 2024, fueled by rapid industrialization and infrastructure development across China, India, Japan, and Southeast Asian nations. The region’s dominant position stems from its large manufacturing base, lower production costs, and growing domestic consumption in automotive, electronics, and consumer goods. China and India, in particular, are expanding thermoset resin production to meet domestic and export demand. Government initiatives promoting electric mobility and renewable energy support the adoption of thermoset-based composites. Bio-based resin production is also emerging in response to sustainability concerns and changing policy frameworks. The Synthetic and Bio thermosets market in Asia Pacific continues to grow as both local players and multinational companies expand operations to meet rising regional needs.

Latin America

Latin America contributed around 7.4% of the global market share in 2024, supported by moderate demand in construction, automotive, and energy sectors. Brazil and Mexico serve as regional hubs due to their manufacturing capabilities and expanding industrial base. Although growth is slower than in Asia, increasing awareness of durable and heat-resistant materials drives gradual adoption. The shift toward modernizing infrastructure and the entry of global automotive brands enhance resin consumption. Challenges include economic fluctuations and limited R&D investment, which may delay adoption of advanced bio-based alternatives. Still, regional growth potential remains strong over the forecast period.

The Middle East and Africa

The Middle East and Africa (MEA) region represented 5.8% of the global market share in 2024, with demand primarily driven by infrastructure and energy projects. Countries like the UAE, Saudi Arabia, and South Africa invest in high-end construction, utilities, and renewable energy initiatives that require thermoset-based components. Although thermoset application is still developing in some sectors, government-led diversification strategies support industrial growth. High temperatures and harsh environmental conditions make thermosets ideal for coatings, pipelines, and insulation. The Synthetic and Bio thermosets market in MEA is expected to expand gradually, with increasing interest in sustainable materials and capacity-building through joint ventures and technology transfer.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lanxess

- Ashland

- 3M

- DSM

- Huntsman

- Sika AG

- AOC Resins

- DuPont

- Dow Chemicals

- BASF

- Freudenberg Performance Materials

Competitive Analysis

The Synthetic and Bio thermosets market features strong competition among leading players including BASF, Huntsman, Dow Chemicals, DSM, Ashland, DuPont, Sika AG, and AOC Resins. These companies compete by offering a wide range of thermoset resins tailored to the specific needs of industries such as automotive, aerospace, construction, and electronics. They invest heavily in research and development to enhance product performance, improve thermal resistance, and reduce environmental impact. Continuous innovation in bio-based alternatives and advanced composite solutions helps these players maintain relevance in sustainability-driven markets. Strategic partnerships, mergers, and capacity expansions are commonly used to strengthen their global footprint and secure raw material supply chains. Many players operate dedicated application development centers to support clients with technical assistance and custom formulations. The competitive landscape remains dynamic, with new product launches targeting high-growth sectors such as electric vehicles and renewable energy. Price competitiveness, product quality, and global distribution capabilities remain key factors shaping market leadership.

Recent Developments

- In May 2025, Lanxess exhibited at Chemspec Europe for the first time with six business units, including its subsidiary Saltigo. This participation signals their active presence and engagement in specialty chemicals and polymers markets, including thermoset-related segments.

- In April 2025, Huntsman announced at LIGNA 2025 the launch of two new bio-based I-BOND® resins (I-BOND® PB BIO 1025 and I-BOND® OSB BIO 1025) for composite wood products.

- In SEP 2023, BASF expanded its bio-based monomers portfolio by launching 2-Octyl Acrylate (2-OA).

Market Concentration & Characteristics

The Synthetic and Bio thermosets market is moderately concentrated, with a mix of global chemical giants and specialized resin manufacturers dominating the competitive landscape. A few key players control a significant portion of the global supply, leveraging their technological expertise, large-scale production capabilities, and established customer relationships. It reflects a strong focus on product quality, performance consistency, and regulatory compliance. The market is characterized by high entry barriers due to complex production processes, capital-intensive manufacturing, and stringent material standards in end-use industries. Innovation plays a critical role, with companies investing in research to develop bio-based alternatives and advanced resin systems that meet evolving industrial demands. Customer preferences for lightweight, durable, and sustainable materials influence product development and differentiation. The market also shows regional fragmentation, where local suppliers serve niche applications, particularly in Asia Pacific and Latin America. It continues to evolve as manufacturers respond to environmental pressures, cost challenges, and shifting application needs.

Report Coverage

The research report offers an in-depth analysis based on Application Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily due to rising demand from automotive, aerospace, and construction sectors.

- Bio-based thermosets will gain traction as industries shift toward sustainable and low-emission materials.

- Technological advancements in resin formulations will enhance product performance and expand application areas.

- Asia Pacific will remain the dominant region due to strong industrial growth and increasing domestic consumption.

- Manufacturers will invest more in R&D to develop recyclable and environmentally friendly thermoset solutions.

- Electronics and electrical applications will see higher adoption of thermosets for insulation and thermal management.

- Strategic collaborations and acquisitions will help companies strengthen their global presence and product portfolios.

- Regulatory frameworks will push manufacturers to prioritize safer, low-VOC, and sustainable materials.

- High-performance thermosets will see increased use in electric vehicles and renewable energy systems.

- Supply chain optimization and raw material innovation will become key to maintaining cost competitiveness.