Market Overview

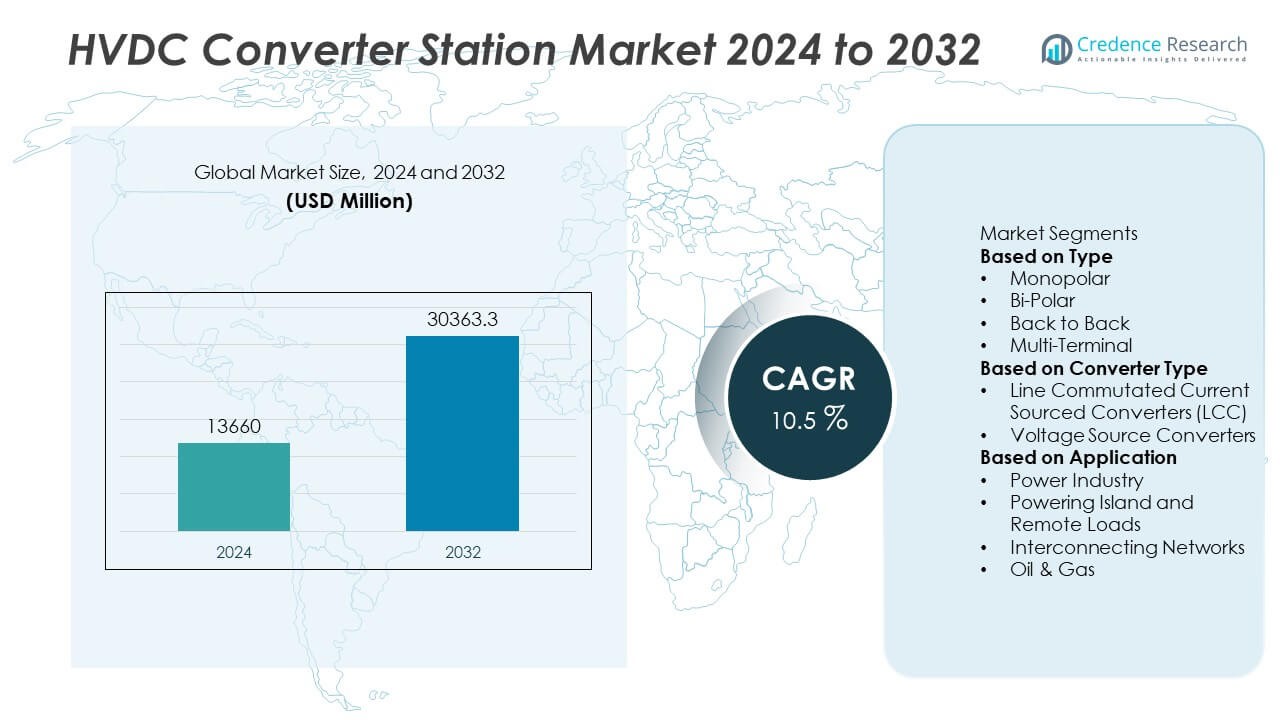

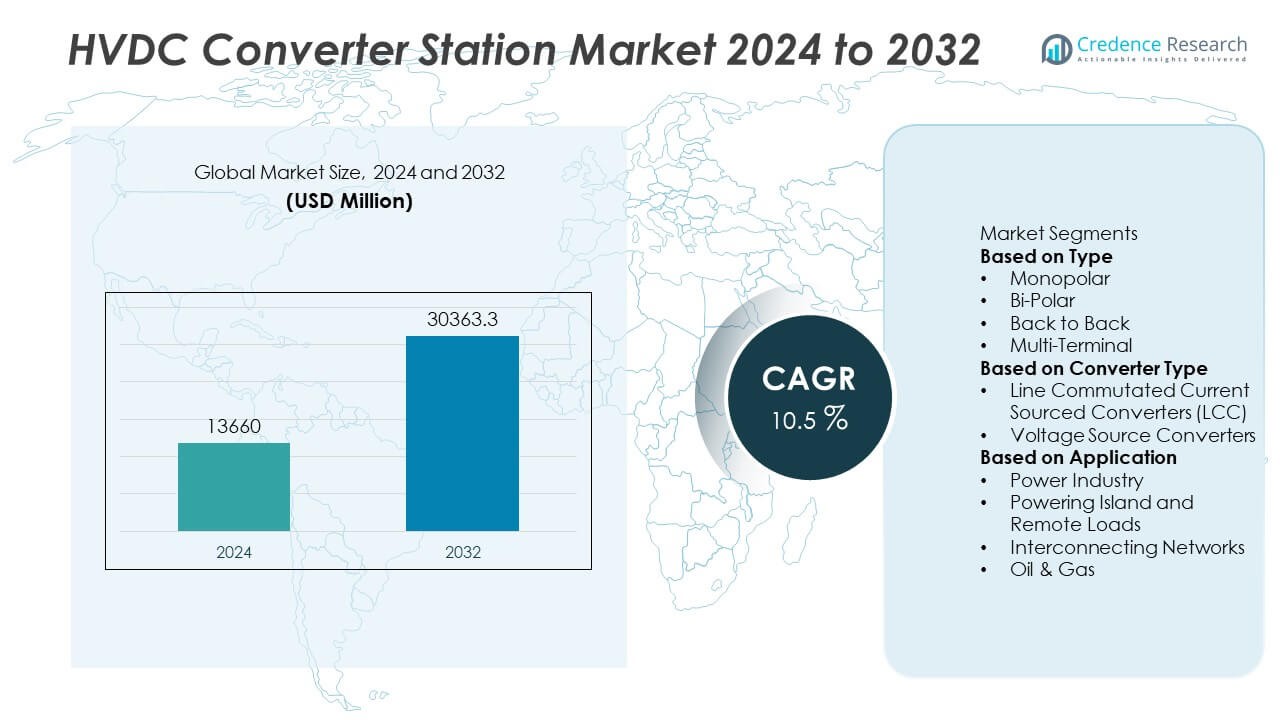

The HVDC Converter Station Market was valued at USD 13,660 million in 2024 and is projected to reach USD 30,363.3 million by 2032, expanding at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| HVDC Converter Station Market Size 2024 |

USD 13,660 Million |

| HVDC Converter Station Market, CAGR |

10.5% |

| HVDC Converter Station Market Size 2032 |

USD 30,363.3 Million |

The HVDC Converter Station Market grows on the strength of rising renewable energy integration, cross-border interconnections, and grid modernization initiatives. Governments invest in long-distance transmission projects to connect offshore wind, solar, and hydro resources with demand centers, ensuring efficiency and stability.

The HVDC Converter Station Market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with each region advancing projects that strengthen energy security and renewable integration. North America focuses on grid modernization and cross-border interconnections between the U.S. and Canada, while Europe leads in offshore wind development and subsea interconnectors that link multiple nations. Asia-Pacific expands rapidly with large-scale adoption of ultra-high-voltage direct current technology in China and growing renewable integration in India. Latin America invests in hydro-based HVDC projects, and the Middle East & Africa emphasize solar-driven interconnections and regional electricity trade. Key players shaping this market include ABB Ltd., known for advanced HVDC technologies; Siemens AG, driving innovation in voltage source converters; General Electric, offering large-scale grid solutions; and Hitachi Ltd., expanding capabilities in smart transmission infrastructure. Their strategies define the competitive dynamics of the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights

- The HVDC Converter Station Market was valued at USD 13,660 million in 2024 and is projected to reach USD 30,363.3 million by 2032, growing at a CAGR of 10.5% during the forecast period.

- The market expands with rising demand for renewable energy integration, where HVDC systems enable efficient long-distance transmission of wind, solar, and hydroelectric power.

- Offshore wind expansion, adoption of voltage source converter (VSC) technology, and digitalization of power infrastructure define major trends shaping growth.

- Leading players such as ABB Ltd., Siemens AG, General Electric, Hitachi Ltd., and Mitsubishi Electric compete by investing in advanced converter technologies, cross-border projects, and smart grid integration.

- High capital investment requirements, lengthy project approvals, and technical complexities in grid synchronization act as restraints that limit wider adoption, especially in emerging economies.

- North America emphasizes grid modernization and U.S.–Canada interconnections, Europe leads with offshore wind projects and subsea links, Asia-Pacific grows rapidly with UHVDC corridors in China and renewable integration in India, Latin America strengthens hydro-based transmission, while the Middle East & Africa focus on solar-driven interconnectors and regional electricity trade.

- The market reflects long-term opportunities through government-backed decarbonization initiatives, growing cross-border power trade, and increasing adoption of smart grids supported by automation and predictive analytics.

Market Drivers

Rising Integration of Renewable Energy into Transmission Networks

The HVDC Converter Station Market gains momentum from the global shift toward renewable energy generation. Large-scale solar and wind farms are often located far from demand centers, requiring efficient long-distance transmission. HVDC systems enable minimal power loss over extended corridors, supporting grid stability and renewable integration. Governments in Europe, China, and the United States invest heavily in offshore wind projects that rely on converter stations to transport electricity to mainland grids. It ensures consistent supply from variable renewable sources while reducing reliance on fossil fuels. The growing urgency to decarbonize energy systems strengthens the market’s expansion.

- For instance, Siemens Energy delivered the DolWin6 HVDC converter station in Germany in 2023, connecting 900 MW of offshore wind capacity from the North Sea to the onshore grid, supplying electricity to nearly one million households.

Growing Need for Cross-Border Power Exchange and Grid Interconnection

Global electricity trade stimulates demand for advanced transmission infrastructure, where HVDC converter stations play a vital role. Cross-border interconnections between regions such as Europe and North Africa, or China and Southeast Asia, depend on HVDC links for reliable transfer. It supports energy security by enabling countries to share surplus power during peak and off-peak cycles. Converter stations ensure frequency stability between asynchronous grids, allowing large-scale international energy cooperation. Expanding regional energy markets, supported by multilateral agreements, boost investments in new HVDC corridors. The demand for secure and efficient interconnections continues to rise with increasing energy globalization.

- For instance, ABB commissioned the 1,000 MW Skagerrak 4 HVDC interconnection between Norway and Denmark, enabling efficient cross-border electricity exchange and stabilizing Nordic and European grids with a link spanning 240 km.

Modernization of Aging Power Infrastructure and Demand for Grid Reliability

The aging transmission infrastructure in developed economies drives adoption of HVDC systems for improved performance. Many existing AC networks face congestion, high losses, and limited ability to handle growing renewable input. It provides a cost-effective solution by upgrading capacity without replacing entire networks. Converter stations strengthen reliability by mitigating blackouts and enabling real-time power flow control. Urbanization and industrialization demand consistent electricity supply, pushing utilities to invest in modernized grid solutions. The market benefits from rising focus on efficiency, resilience, and long-term asset management.

Technological Advancements and Declining Project Costs

Advancements in converter technology, such as voltage source converters (VSC), improve efficiency and reduce system footprint. Modern VSC stations operate with flexible control, enabling integration into weak and isolated grids. It lowers installation time, reduces maintenance needs, and enhances system adaptability for complex environments. Declining project costs from modular designs and improved components attract utilities and governments toward HVDC projects. Ongoing research in insulation, semiconductors, and automation ensures continuous improvement in system reliability. These innovations encourage wider adoption of converter stations across both developed and emerging markets.

Market Trends

Expansion of Offshore Wind Energy Driving New Transmission Corridors

The HVDC Converter Station Market reflects strong alignment with the rapid growth of offshore wind projects across Europe, China, and North America. Offshore farms are located far from urban demand centers, requiring efficient long-distance transmission supported by HVDC technology. Converter stations provide reliable delivery of electricity with minimal losses, ensuring stable integration of renewable output. It strengthens the role of HVDC as a core enabler of green energy targets set by governments. Countries continue to allocate funds toward subsea interconnections that link offshore generation to mainland grids. This expansion sets a long-term foundation for steady market growth.

- For instance, HVDC Light® technology will enable Dogger Bank Wind Farm to support UK’s clean electricity demand, powering six million UK homes., installing a converter system of transmitting 1,200 MW from offshore wind farms located 130 km from the coast, to power approximately two million homes.

Increasing Adoption of Voltage Source Converter (VSC) Technology

VSC-based systems are emerging as a dominant trend due to their compact design and operational flexibility. Unlike traditional line-commutated converters, VSC stations enable black-start capability, supporting weak grids and remote applications. It enhances system reliability by allowing independent control of active and reactive power. The smaller footprint reduces land use, which appeals to projects in urban and environmentally sensitive areas. Manufacturers focus on improving VSC modules to deliver higher efficiency and scalability for complex networks. The market witnesses consistent investment in VSC innovation to address evolving grid challenges.

- For instance, Siemens Energy deployed the DolWin6 VSC HVDC station in Germany in 2023, using ±320 kV technology with a transmission capacity of 900 MW, marking a significant step in offshore wind integration into continental grids.

Growing Focus on Interregional and Cross-Border Energy Trade

International energy cooperation accelerates the construction of HVDC interconnectors between nations. Converter stations enable asynchronous grids to exchange electricity securely and flexibly across vast distances. It creates opportunities for countries to balance renewable fluctuations by importing or exporting surplus energy. Projects linking Europe with North Africa, and China with neighboring regions, highlight this trend. Policymakers promote cross-border corridors to strengthen energy security and support competitive electricity markets. The push for interregional trade places converter stations at the center of future transmission strategies.

Rising Emphasis on Digitalization and Smart Grid Integration

Integration of digital technologies into HVDC infrastructure is reshaping project execution and operation. Advanced monitoring systems, predictive analytics, and automation enhance real-time control of converter performance. It reduces downtime, lowers maintenance costs, and increases operational safety. Smart grid initiatives prioritize flexible power flow management, where converter stations act as key enablers. Utilities deploy digital twins and AI-based systems to simulate and optimize HVDC projects before implementation. The trend toward digital transformation improves project efficiency and long-term reliability, reinforcing the market’s growth trajectory.

Market Challenges Analysis

High Capital Investment and Complex Project Execution

The HVDC Converter Station Market faces significant challenges from the high upfront investment required for development. Large-scale projects demand billions in capital expenditure, which often delays approvals and financing, particularly in emerging economies. It also involves complex engineering, procurement, and construction processes that extend project timelines. Land acquisition, permitting, and stakeholder negotiations add layers of difficulty, creating uncertainty for investors and utilities. The scale and cost of infrastructure deter smaller market players from entering, leaving projects concentrated among a few global leaders. These financial and logistical hurdles remain a major barrier to widespread adoption.

Technical Constraints and Skilled Workforce Shortage

Operational complexities present another challenge, especially in the integration of HVDC systems with existing AC grids. Converter stations must maintain frequency stability and seamless synchronization, which requires advanced design and control expertise. It is further complicated by the limited availability of a highly skilled workforce capable of managing installation and maintenance. Developing economies struggle to meet the technical standards required for HVDC reliability, slowing deployment. Frequent upgrades in semiconductor and converter technologies demand continuous training, which increases operational costs for utilities. These constraints create bottlenecks that hinder faster market expansion despite rising demand for transmission efficiency.

Market Opportunities

Expanding Renewable Energy Projects Creating Strong Growth Potential

The HVDC Converter Station Market benefits from the accelerating deployment of renewable energy projects worldwide. Large-scale wind and solar farms require efficient transmission systems to deliver electricity over long distances with minimal losses. Converter stations provide the backbone for integrating variable renewable output into national and regional grids. It enables countries to meet carbon reduction targets while ensuring grid stability. Growing investments in offshore wind farms in Europe, North America, and Asia-Pacific strengthen opportunities for converter station developers. This trend positions HVDC infrastructure as a critical enabler of the global clean energy transition.

Rising Demand for Smart Grids and Cross-Border Interconnections

Global focus on smart grid development and interregional energy trade presents significant opportunities for converter station adoption. Utilities and governments invest in digitalized transmission systems that optimize power flow and enhance real-time grid monitoring. It facilitates reliable cross-border electricity exchange, supporting energy security and competitive electricity markets. Initiatives to link Europe with North Africa, or China with neighboring regions, highlight the expanding scope of interconnectors. Growing urbanization and industrialization also drive demand for resilient power infrastructure, where HVDC systems deliver unmatched efficiency. These opportunities encourage long-term growth across both developed and emerging markets.

Market Segmentation Analysis:

By Type

The HVDC Converter Station Market segments by type into line-commutated converters (LCC) and voltage source converters (VSC). LCC technology dominates traditional long-distance transmission, particularly in projects exceeding 1,000 km, where efficiency and bulk power handling are critical. It remains widely adopted for interregional and cross-border connections, supported by decades of proven reliability. VSC stations, however, gain traction in offshore wind integration and urban grid applications due to their compact design and operational flexibility. Their ability to support weak grids and provide black-start capability drives strong adoption in renewable-heavy networks. The balance between LCC and VSC reflects the dual demand for both legacy systems and modern, adaptable solutions.

- For instance, The HVDC line between Changji and Guquan will be operated by State Grid Corporation (SGCC), a Chinese grid operator. The connection is expected to begin operation in 2019.

By Converter Type

Converter stations deploy monopolar, bipolar, and back-to-back configurations based on project needs. Bipolar systems hold strong preference for bulk transmission, as they provide redundancy and reduce transmission losses significantly. It supports large-scale interconnections such as those linking hydroelectric projects to urban centers. Monopolar systems are applied in cost-sensitive projects where partial capacity is sufficient. Back-to-back stations gain importance in linking asynchronous grids within shorter distances, especially at regional borders. Growing investment in flexible converter designs creates opportunities for broader deployment across diverse geographies.

- For instance, ABB implemented a 500 MW back-to-back HVDC station in Caprivi Link, Namibia, in 2010, enabling secure and stable power exchange between Namibia and Zambia through a 950 km corridor that integrates regional electricity trade in Southern Africa.

By Application

Applications span power generation, interconnection, and industrial demand. Renewable energy integration represents the fastest-growing area, with converter stations enabling the transport of offshore wind and large-scale solar output to consumption hubs. It strengthens energy transition goals by supporting stable and reliable renewable integration. Interconnection projects, both domestic and cross-border, rely heavily on HVDC technology to ensure secure and efficient power trade. Industrial applications, including steel and chemical plants, adopt converter stations to stabilize grid interaction and meet high energy demand. The versatility across these applications positions HVDC systems as essential infrastructure in future energy planning.

Segments:

Based on Type

- Monopolar

- Bi-Polar

- Back to Back

- Multi-Terminal

Based on Converter Type

- Line Commutated Current Sourced Converters (LCC)

- Voltage Source Converters

Based on Application

- Power Industry

- Powering Island and Remote Loads

- Interconnecting Networks

- Oil & Gas

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 27% of the HVDC Converter Station Market, supported by strong investments in grid modernization and renewable energy integration. The United States leads the region with extensive development of long-distance transmission corridors to connect wind and solar resources from the Midwest and Southwest to major demand centers. Canada contributes with hydroelectric power exports, which rely heavily on HVDC infrastructure to deliver electricity to U.S. markets efficiently. It benefits from supportive regulatory frameworks and federal funding programs that prioritize grid reliability and carbon reduction goals. Ongoing projects such as the SOO Green HVDC Link and Champlain Hudson Power Express illustrate the region’s focus on cross-border and interregional connectivity. Growing demand for stable electricity supply and decarbonization strengthens the regional outlook.

Europe

Europe represents 30% of the HVDC Converter Station Market, making it the largest regional share. The continent demonstrates leadership in renewable energy integration, especially through offshore wind projects in the North Sea and Baltic Sea. Countries such as Germany, the United Kingdom, and Denmark invest heavily in subsea interconnections to link offshore generation with mainland grids. It also leads in cross-border energy trade, with interconnectors linking nations such as Norway, France, and the Netherlands to stabilize supply across the continent. The European Union’s Green Deal and climate neutrality goals accelerate funding for large-scale HVDC corridors. With multiple projects underway, Europe maintains a strong pipeline that reinforces its dominance in converter station deployment.

Asia-Pacific

Asia-Pacific holds 28% of the HVDC Converter Station Market, driven by China’s extensive adoption of ultra-high-voltage direct current (UHVDC) technology. China alone operates some of the world’s largest HVDC projects, transmitting electricity from remote hydro, wind, and solar plants to densely populated eastern provinces. India follows with ambitious plans to expand renewable generation and strengthen grid reliability through HVDC systems. It also supports energy security in Southeast Asian nations that adopt cross-border HVDC interconnections to balance supply and demand. Rapid industrialization and urbanization increase electricity consumption, further driving investment in transmission infrastructure. The scale of planned projects makes Asia-Pacific one of the fastest-growing markets.

Latin America

Latin America contributes 8% of the HVDC Converter Station Market, supported by large hydroelectric resources and growing renewable development. Brazil stands out with significant investments in HVDC corridors that connect hydro plants in the Amazon to coastal urban centers. Chile and Argentina also explore HVDC deployment to stabilize power supply in remote mining and industrial regions. It benefits from international partnerships that bring expertise and financing for advanced transmission projects. Expanding regional interconnections create opportunities for efficient electricity trade between neighboring countries. The region’s growing demand for grid reliability and energy access sustains steady investment in converter technology.

Middle East & Africa

The Middle East & Africa accounts for 7% of the HVDC Converter Station Market, with growing interest in renewable energy and cross-border connectivity. The Middle East invests in HVDC systems to integrate large-scale solar projects, particularly in Saudi Arabia and the United Arab Emirates. Africa’s development initiatives focus on interregional interconnectors that enable electricity trade between resource-rich and demand-heavy nations. It also strengthens access to reliable electricity in regions where AC transmission infrastructure remains underdeveloped. Projects such as the Egypt-Saudi Arabia interconnector highlight the region’s commitment to HVDC technology. Although adoption remains gradual, the long-term potential is significant due to abundant renewable resources and government-backed infrastructure programs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG (Germany)

- Hitachi Ltd. (Japan)

- Crompton Greaves Ltd. (India)

- General Electric (U.S.)

- Toshiba Corporation (Japan)

- ABB Ltd. (Switzerland)

- Nissin Electric Co Ltd. (Japan)

- Bharat Heavy Electricals Ltd. (India)

- Alstom (France)

- Mitsubishi Electric Corporation (Japan)

Competitive Analysis

The competitive landscape of the HVDC Converter Station Market is defined by a group of global leaders that focus on technological innovation, strategic collaborations, and large-scale project execution. ABB Ltd., Siemens AG, General Electric, Hitachi Ltd., Mitsubishi Electric Corporation, Toshiba Corporation, Alstom, Bharat Heavy Electricals Ltd., Crompton Greaves Ltd., and Nissin Electric Co. Ltd. dominate the market with their expertise in advanced converter technologies and integrated grid solutions. ABB and Siemens lead with extensive portfolios in both line-commutated and voltage source converter systems, positioning themselves in offshore wind and interregional transmission projects. General Electric leverages its global presence and digital grid solutions to expand its footprint, while Hitachi Ltd. and Mitsubishi Electric invest in smart grid capabilities and high-efficiency components to strengthen their positions in Asia-Pacific. Toshiba and Alstom contribute through specialized project execution and cross-border interconnections, whereas Bharat Heavy Electricals and Crompton Greaves drive adoption in India with cost-competitive solutions. Nissin Electric focuses on niche technologies, particularly in Japan, addressing local demand for compact and efficient converter systems. Collectively, these players shape the industry by prioritizing research, strategic partnerships, and capacity expansion to meet rising demand for renewable integration and global energy interconnections.

Recent Developments

- In July 2025, National Grid and SP Energy Networks selected Siemens Energy as the preferred bidder to construct two High Voltage Direct Current (HVDC) converter stations for the £2.5 billion Eastern Green Link 4 (EGL4) project, a 530km subsea electricity superhighway connecting Fife, Scotland, to West Norfolk, England.

- In December 2024, GE Vernova, via its JV KAPES, won a major contract from KEPCO to deliver an LCC-based 500 kV HVDC system for South Korea’s Donghaean 2–Seoul EP2 project.

- In July 2024, GE Vernova entered an R&D agreement with four German TSOs to develop multi-terminal HVDC technology and a 525 kV DC circuit breaker, targeting implementation by 2029.

Market Concentration & Characteristics

The HVDC Converter Station Market demonstrates a concentrated structure dominated by a limited number of multinational companies with strong technological expertise and global project execution capabilities. Leading firms such as ABB, Siemens, Hitachi, General Electric, and Mitsubishi Electric control a significant portion of high-value contracts, leveraging advanced converter technologies, long-standing partnerships with utilities, and international project experience. It is characterized by high entry barriers due to substantial capital requirements, complex engineering standards, and the need for specialized technical expertise. Project lifecycles are lengthy, often spanning several years from design to commissioning, which favors established players with financial strength and proven track records. The market also reflects strong reliance on government-backed energy transition initiatives, renewable integration policies, and cross-border interconnection projects. Competitive dynamics emphasize innovation in voltage source converters, digital monitoring solutions, and modular designs that reduce installation costs. The concentration of expertise within a few companies ensures technological leadership while leaving smaller regional players to focus on niche or cost-sensitive projects.

Report Coverage

The research report offers an in-depth analysis based on Type, Converter Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for HVDC converter stations will rise with large-scale renewable energy integration across global grids.

- Offshore wind projects will continue to drive investment in subsea HVDC interconnections.

- Voltage source converter technology will gain wider adoption due to flexibility and compact design.

- Cross-border energy trade will expand, creating new opportunities for interregional HVDC links.

- Digitalization and smart grid integration will enhance efficiency and reliability of converter stations.

- Governments will increase funding support for grid modernization and decarbonization initiatives.

- Asia-Pacific will emerge as the fastest-growing region due to ultra-high-voltage projects in China and India.

- Europe will maintain leadership in offshore wind and cross-border HVDC corridors.

- High capital costs will encourage partnerships and joint ventures among global players.

- Continuous innovation in semiconductors and insulation materials will improve performance and reduce project costs.