Market Overview

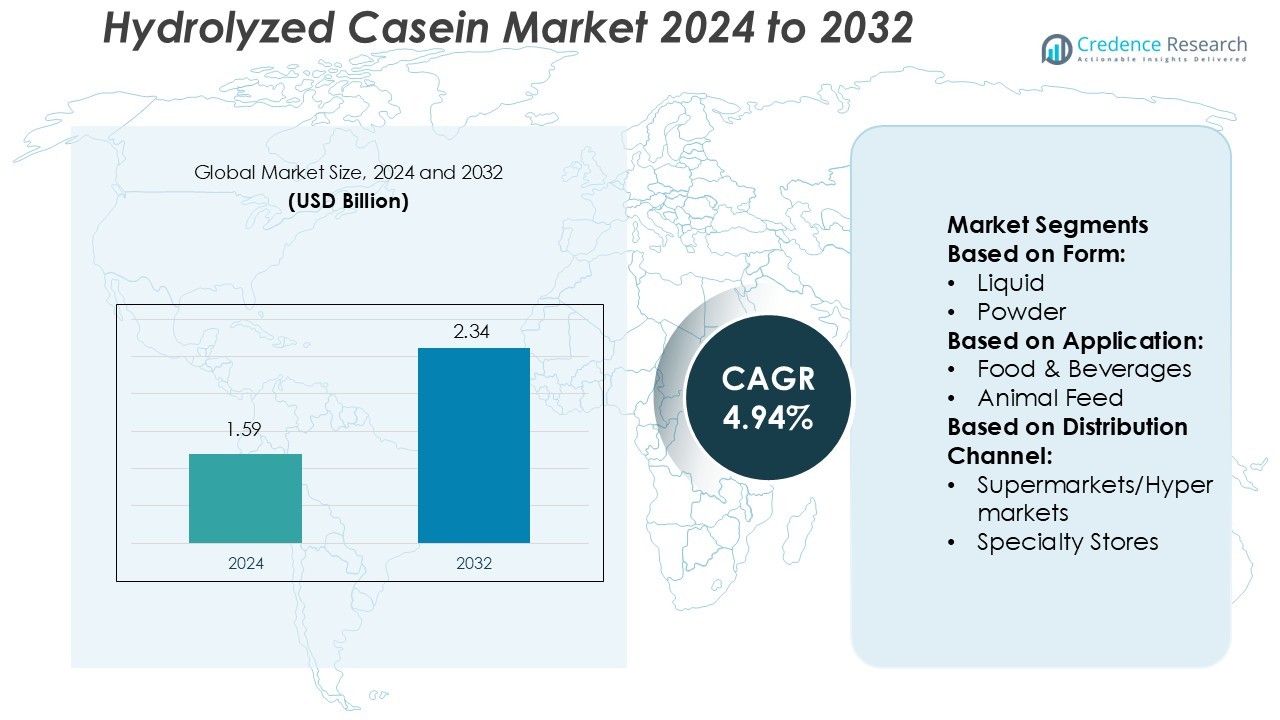

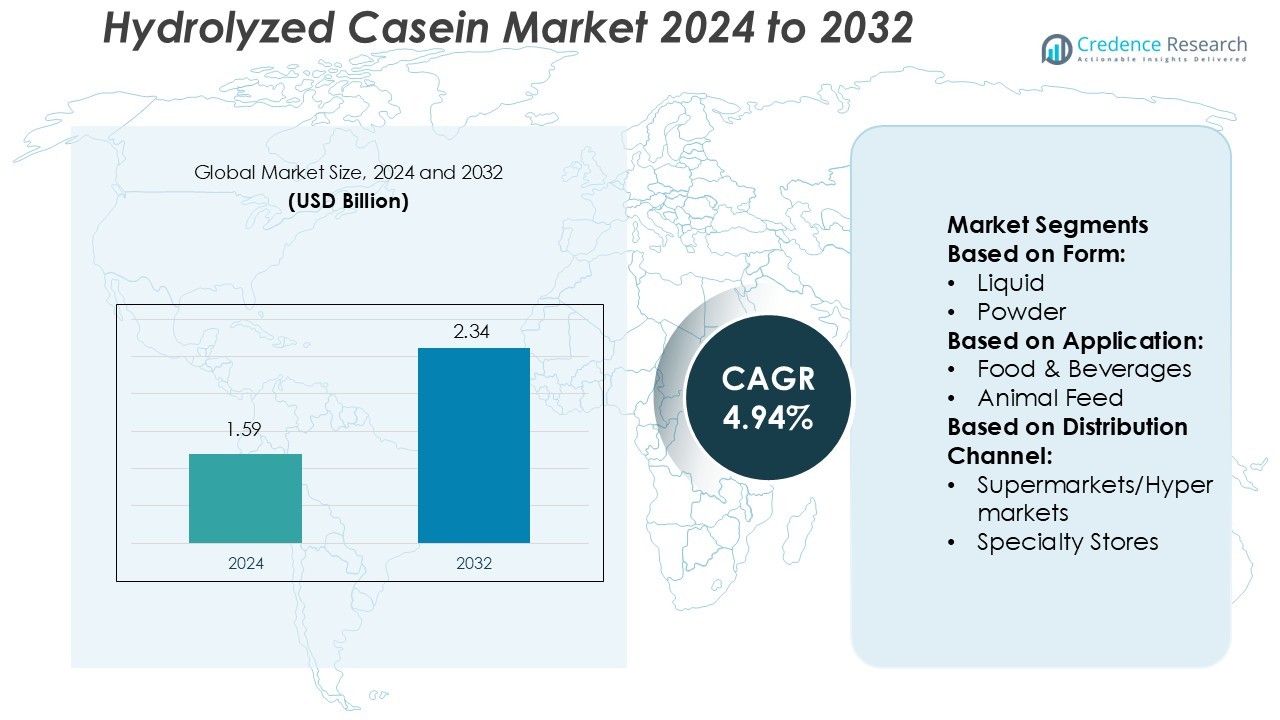

Hydrolyzed Casein Market size was valued USD 1.59 billion in 2024 and is anticipated to reach USD 2.34 billion by 2032, at a CAGR of 4.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydrolyzed Casein Market Size 2024 |

USD 1.59 Billion |

| Hydrolyzed Casein Market, CAGR |

4.94% |

| Hydrolyzed Casein Market Size 2032 |

USD 2.34 Billion |

The Hydrolyzed Casein Market is led by major players including Tate & Lyle, Ajinomoto Co., Inc., Griffith Foods, Kerry Group Plc., Cargill Inc., DSM, Roquette Frères, Titan Biotech, Aipu Food Industry, and ADM. These companies focus on technological innovation, product diversification, and strategic expansion to strengthen their global presence. North America dominates the market with a 33.2% share, driven by high consumption of protein-enriched foods, sports nutrition products, and infant formulas. Strong R&D investments, advanced dairy processing facilities, and established regulatory frameworks in the region support consistent market growth and competitive advantages for key participants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hydrolyzed Casein Market size was valued at USD 1.59 billion in 2024 and is projected to reach USD 2.34 billion by 2032, growing at a CAGR of 4.94%.

- Rising demand for functional and protein-rich foods, infant formulas, and dietary supplements is driving market growth across developed and emerging economies.

- Key trends include technological advancements in enzymatic hydrolysis and increasing applications in cosmetics and animal feed sectors.

- The market faces restraints from high production costs and stringent allergen labeling regulations, which limit small-scale manufacturers.

- North America dominates with a 33.2% regional share, followed by Europe and Asia-Pacific; the food and beverage segment holds the largest share due to strong demand for high-quality nutritional proteins.

Market Segmentation Analysis:

By Form

The powder segment dominates the Hydrolyzed Casein Market with a 63.4% share in 2024, driven by its longer shelf life, easy handling, and versatility in formulations. Powdered hydrolyzed casein offers superior solubility and stability, making it suitable for use in infant nutrition, sports supplements, and food processing. Manufacturers favor this form due to efficient transport and reduced spoilage risks. The liquid form, while used in specialized formulations like beverages and clinical nutrition, holds a smaller market share due to limited storage stability and higher logistics costs.

- For instance, Kerry Group Plc operates a Biotechnology Centre in Leipzig equipped with enzyme engineering and precision fermentation facilities. The site employs over 100 scientists, including 34 PhD specialists, who develop bioactive ingredients that enhance protein stability and solubility in powdered formulations, ensuring improved nutritional performance and formulation consistency.

By Application

The food and beverages segment leads the market with a 48.6% share in 2024, supported by rising demand for protein-enriched functional foods and dietary supplements. Hydrolyzed casein enhances texture, flavor stability, and digestibility in dairy, confectionery, and bakery products. Its rapid absorption benefits athletes and health-conscious consumers. The animal feed and cosmetics segments are growing as manufacturers use hydrolyzed casein in premium feed and skincare formulations. Increasing awareness of clean-label and high-protein diets continues to drive the food and beverage segment’s dominance.

- For instance, Cargill developed a proprietary natural-antioxidant blend under its Natural Flavors platform that extended the shelf life of ground beef by five days and already preserves 1.5 million pounds of product annually.

By Distribution Channel

Supermarkets and hypermarkets dominate the market with a 46.8% share in 2024, attributed to extensive consumer reach, wide product availability, and in-store promotions. These outlets allow customers to compare brands and purchase directly, strengthening sales for both retail and bulk buyers. Specialty stores focus on premium and nutraceutical-grade hydrolyzed casein products, while online retail is expanding rapidly due to growing e-commerce adoption. Digital platforms offering discounts, subscriptions, and home delivery are expected to boost the online channel’s market share in the coming years.

Key Growth Drivers

Rising Demand from the Food & Beverage Industry

The food and beverage sector is a major growth driver for the Hydrolyzed Casein Market. Manufacturers use hydrolyzed casein as a high-quality protein source in infant formulas, dietary supplements, and functional foods. Its easy digestibility and amino acid profile enhance nutritional value and consumer appeal. For instance, Arla Foods Ingredients expanded its protein ingredient line to meet increasing demand for hydrolyzed dairy-based proteins in infant nutrition and sports recovery formulations. The growing preference for clean-label, high-protein foods continues to drive this segment.

- For instance, Roquette Frères reports generating approximately 30 patents per year and employing over 300 R&D personnel globally to develop plant-based proteins and texturising systems.

Increasing Use in Animal Feed Applications

Animal feed producers are adopting hydrolyzed casein due to its superior digestibility and nutrient absorption rates. It enhances growth performance and immune response in livestock and aquaculture. Companies such as FrieslandCampina Ingredients supply hydrolyzed casein-based protein concentrates that improve feed conversion efficiency. This driver is reinforced by global trends toward sustainable and high-protein feed solutions. As livestock productivity and animal welfare standards rise, hydrolyzed casein’s nutritional properties make it a preferred protein source in specialized feed formulations.

- For instance, ISO versions mentioned in the original statement (ISO 22000–2005, ISO 13485:2003, and ISO 9001:2008) are outdated. Titan Biotech has upgraded its certifications to meet more recent standards.

Expanding Applications in Cosmetics and Personal Care

Hydrolyzed casein is gaining traction in the cosmetics industry for its moisturizing and conditioning effects. It is used in skin creams, shampoos, and hair conditioners for improved elasticity and hydration. For instance, BASF’s protein-based formulations incorporate hydrolyzed milk proteins to enhance product texture and skin compatibility. The shift toward natural and bio-based cosmetic ingredients supports wider adoption. With consumer interest in sustainable and functional personal care products growing, hydrolyzed casein offers strong value through its biocompatible and biodegradable profile.

Key Trends & Opportunities

Shift Toward Plant-Based Hydrolyzed Proteins

Manufacturers are exploring hybrid formulations that combine milk-based and plant-based proteins to appeal to vegan consumers. This trend aligns with the clean-label movement and sustainability goals. For example, Kerry Group’s R&D investments in enzymatic hydrolysis are expanding product lines with reduced allergenic potential. The growing market for lactose-free and plant-protein-enhanced blends presents significant opportunities for diversification and broader consumer reach within functional nutrition.

- For instance, WebAIM’s 2023–2024 Screen Reader User Survey collected responses from 1,539 participants and found that approximately 40.5% cited JAWS as their primary desktop or laptop screen reader, while 37.7% selected NVDA.

Innovation in Enzymatic Hydrolysis Technology

Technological advances in enzymatic hydrolysis improve yield, consistency, and flavor quality of hydrolyzed casein. For instance, DSM developed enzyme systems that deliver better peptide control and reduced bitterness, improving taste and application flexibility. Such innovations help manufacturers target high-value applications in sports nutrition and infant formula. Continued research into process optimization enhances scalability, cost efficiency, and product differentiation across end-use industries.

- For instance, ViewPlus Technologies has delivered over 10,000 embossers worldwide, empowering blind and low-vision learners with tactile graphics and braille access across educational and personal use contexts.

Key Challenges

High Production and Processing Costs

The production of hydrolyzed casein involves energy-intensive enzymatic processes that raise operational expenses. Maintaining product purity and flavor consistency adds to manufacturing costs. Smaller producers often struggle with capital requirements for advanced hydrolysis equipment. For example, continuous filtration and drying systems require significant investment to ensure product quality and compliance with food safety standards. These cost barriers limit market entry and constrain pricing flexibility for new entrants.

Stringent Regulatory and Allergen Compliance Issues

Regulatory frameworks governing protein labeling and allergen management present challenges for manufacturers. Hydrolyzed casein, being milk-derived, must meet strict labeling and allergen disclosure norms under FDA and EFSA guidelines. Companies such as Nestlé emphasize transparent labeling and controlled production to meet global standards. Non-compliance risks product recalls and reputational harm. Meeting evolving food safety and consumer transparency expectations increases compliance costs and operational complexity for producers.

Regional Analysis

North America

North America holds a 33.2% share of the Hydrolyzed Casein Market, driven by strong demand from the food and beverage and sports nutrition sectors. The U.S. leads with extensive adoption in infant formulas, dietary supplements, and protein-enriched snacks. Major companies such as Arla Foods Ingredients and Kerry Group maintain a strong presence through advanced dairy processing technologies. Growing consumer awareness of high-protein diets and lactose-free formulations supports continued market expansion. Regulatory standards set by the FDA further ensure product safety and encourage innovation in hydrolyzed milk-based proteins across diverse applications.

Europe

Europe accounts for 29.4% of the Hydrolyzed Casein Market, supported by a mature dairy industry and increasing applications in cosmetics and personal care. Countries such as Germany, France, and the Netherlands dominate regional output through established dairy cooperatives and ingredient manufacturers. The European Food Safety Authority (EFSA) enforces strict labeling and allergen standards, promoting high-quality formulations. Innovation in enzymatic hydrolysis technology and clean-label product development enhances market growth. Rising consumer demand for sustainable and bio-based protein ingredients strengthens Europe’s leadership in premium hydrolyzed casein production and application diversification.

Asia-Pacific

Asia-Pacific captures a 24.7% share of the Hydrolyzed Casein Market, emerging as the fastest-growing regional segment. Strong demand from the infant nutrition, animal feed, and cosmetic industries drives expansion. China, Japan, and India are major contributors, supported by rapid population growth and rising disposable incomes. Local dairy producers are increasingly partnering with global ingredient suppliers to meet quality standards. For instance, collaborations between Fonterra and regional food processors enhance supply chain efficiency. Growing health awareness and urbanization continue to boost consumption of functional, protein-enriched food and skincare products across the region.

Latin America

Latin America holds a 7.1% share of the Hydrolyzed Casein Market, with Brazil and Mexico as primary growth centers. The region benefits from an expanding dairy processing industry and rising demand for fortified foods and beverages. Government-backed nutrition programs encourage protein inclusion in daily diets. Local manufacturers are investing in enzymatic processing to improve yield and efficiency. Import dependence for advanced hydrolyzed ingredients remains a challenge, but partnerships with European and North American suppliers support steady growth. The increasing adoption of animal feed applications further reinforces market expansion within Latin America.

Middle East & Africa

The Middle East & Africa region represents a 5.6% share of the Hydrolyzed Casein Market, showing moderate yet consistent growth. Rising health consciousness and increasing investment in the food and personal care sectors drive regional demand. The UAE and South Africa are leading markets, supported by expanding dairy imports and product diversification. Manufacturers are targeting high-value applications in infant nutrition and skincare products to tap into premium consumer segments. Improved supply chain infrastructure and strategic distribution networks are helping bridge import gaps and strengthen market accessibility across the region.

Market Segmentations:

By Form:

By Application:

- Food & Beverages

- Animal Feed

By Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Hydrolyzed Casein Market is characterized by the active participation of key players such as Tate & Lyle, Ajinomoto Co., Inc., Griffith Foods, Kerry Group Plc., Cargill Inc., DSM, Roquette Frères, Titan Biotech, Aipu Food Industry, and ADM. The Hydrolyzed Casein Market is defined by continuous innovation and technological advancement. Manufacturers focus on improving enzymatic hydrolysis efficiency to enhance product quality, reduce bitterness, and optimize amino acid balance. Strategic partnerships and collaborations between dairy processors and biotechnology firms are driving product diversification across food, cosmetics, and feed applications. Companies are also investing in sustainability through low-emission production methods and renewable energy integration. Expanding global distribution networks and compliance with strict food safety regulations strengthen competitiveness. Continuous R&D investment supports market differentiation, ensuring consistent growth and adaptability to consumer trends.

Key Player Analysis

- Tate & Lyle

- Ajinomoto Co., Inc.

- Griffith Foods

- Kerry Group Plc.

- Cargill Inc.

- DSM

- Roquette Frères

- Titan Biotech

- Aipu Food Industry

- ADM

Recent Developments

- In June 2025, PRNewswire, Ajinomoto Health and Nutrition North America, Inc. (AHN), a global leader in amino acid manufacturing, celebrated the opening of its renovated Quality Control Laboratory. Ajinomoto Health and Nutrition North America, Inc. opened the USD 2.1 million quality control lab in Raleigh, NC.

- In May 2025, Darling Ingredients and Tessenderlo Group announced the formation of a new company named Nextida to meet market demand for collagen products. This is further expected to accelerate growth in the attractive collagen-based health, wellness, and nutrition sector.

- In April 2025, Rousselot announces the upcoming showcase of its new precision collagen peptide platform Nextida at Vitafoods Europe 2025. This innovation reinforces Rousselot’s strategic focus on targeted health benefits by introducing science-backed peptide compositions, beginning with Nextida GC, designed to support post-meal glucose management. The initiative is expected to strengthen and further expand Rousselot’s leadership.

- In December 2024, Lonza Capsules & Health Ingredients (CHI) implemented new manufacturing lines for hard gelatin capsules (HGCs) at its facilities in Rewari, India, and Suzhou, China. The expanded lines became operational in late 2024, with additional capacity planned for the third quarter of 2025.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Form, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for hydrolyzed casein will grow across infant nutrition and sports supplement applications.

- Technological advancements in enzymatic hydrolysis will enhance production efficiency and product quality.

- The shift toward clean-label and natural protein ingredients will drive new product development.

- Expanding applications in cosmetics and personal care will create additional growth opportunities.

- Rising consumer focus on digestive health will increase adoption of hydrolyzed protein-based foods.

- Strategic partnerships between dairy processors and biotech firms will strengthen innovation pipelines.

- Asia-Pacific will remain the fastest-growing region due to expanding food and feed industries.

- Sustainable manufacturing practices will gain importance in maintaining regulatory compliance.

- Increased investment in research and formulation will help manufacturers reduce allergen risks.

- Online retail and specialty nutrition channels will expand global access to hydrolyzed casein products.