Market Overview

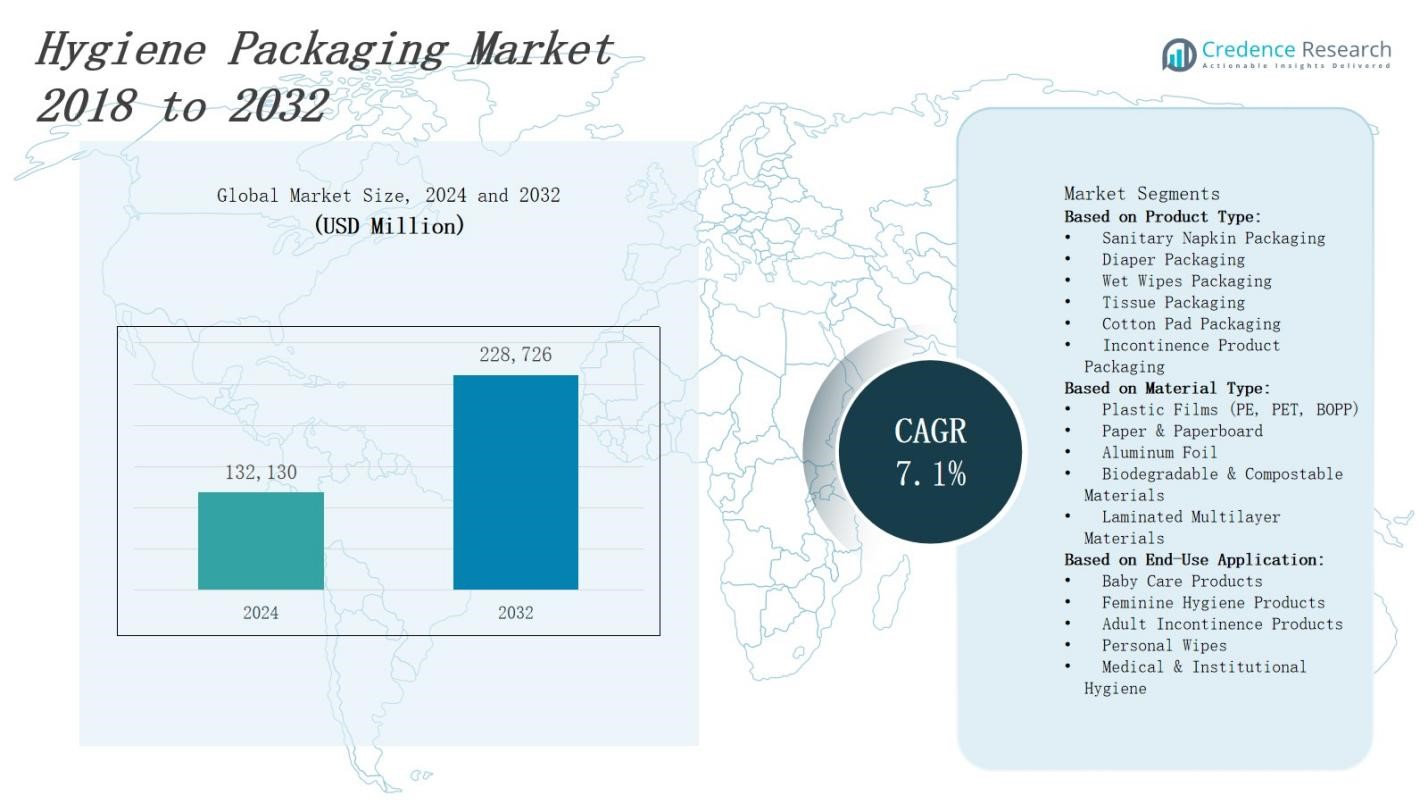

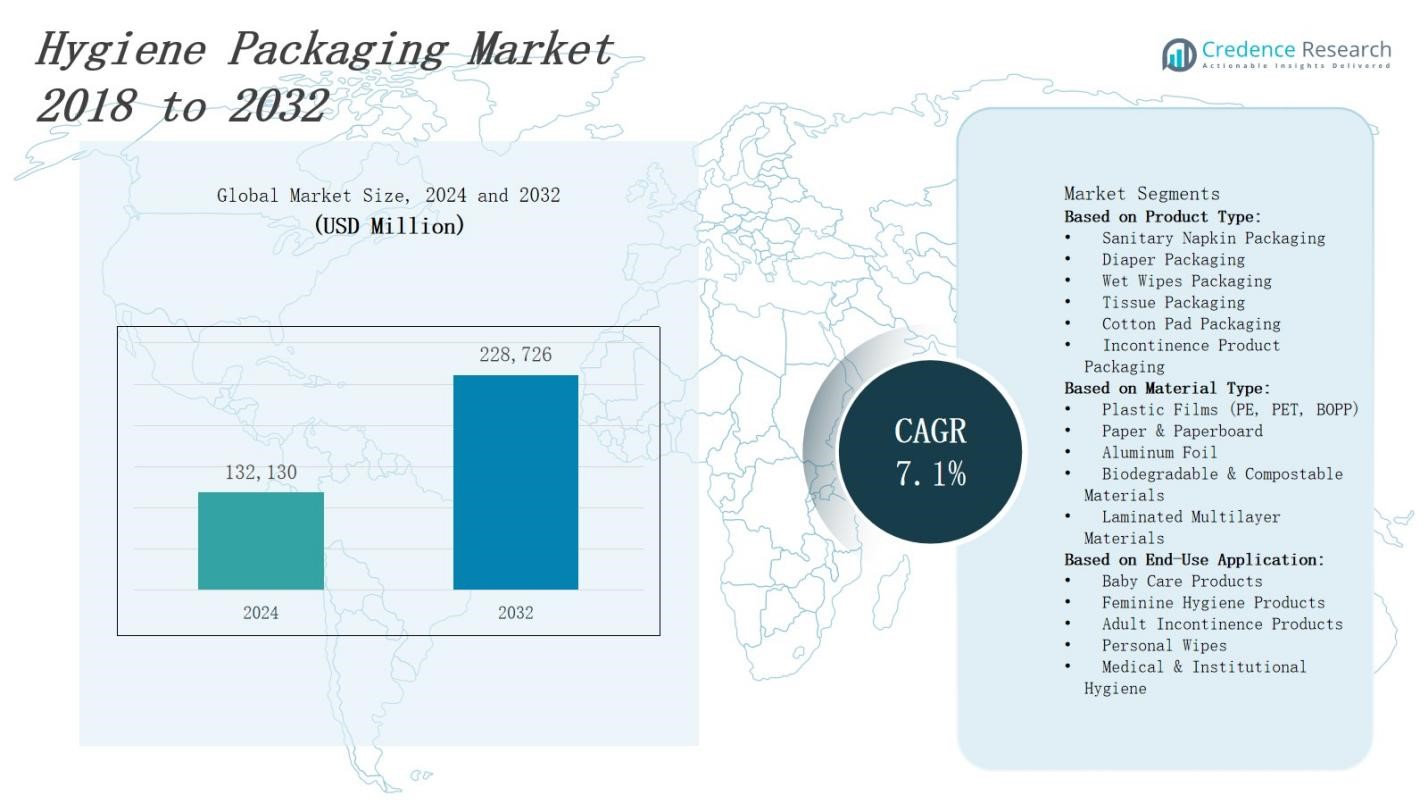

The Hygiene Packaging Market is projected to expand from USD 132,130 million in 2024 to USD 228,726 million by 2032 at a CAGR of 7.1%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hygiene Packaging Market Size 2024 |

USD 132,130 Million |

| Hygiene Packaging Market, CAGR |

7.1% |

| Hygiene Packaging Market Size 2032 |

USD 228,726 Million |

Rising consumer focus on health and hygiene drives demand for advanced hygiene packaging solutions that ensure product safety and extend shelf life. Stringent regulatory standards and growing awareness of pathogen transmission encourage manufacturers to adopt tamper-evident seals, antimicrobial coatings, and airtight materials. Sustainability concerns prompt shifts toward recyclable, bio-based substrates and lightweight designs that reduce waste and transportation costs. Digital printing and smart packaging technologies enable personalized labeling and real-time quality monitoring. Rapid growth of e-commerce channels fuels demand for durable, leak-proof formats. Collaboration between resin producers and converters accelerates innovation, while automation streamlines production and lowers overall operational expenses.

Asia Pacific commands the largest share in the hygiene packaging market, driven by low‑cost hubs in China and India. Europe follows with strict sustainability standards. North America leverages advanced logistics and e‑commerce growth. Latin America benefits from rising middle‑class demand, and Middle East & Africa experiences growth through healthcare investments. Major suppliers such as Kimberly‑Clark Corporation, RKW Group, Trioplast Group and Nitto Denko Corporation tailor solutions to regional needs. SILON s.r.o and Prochimir Technical Films focus on specialty films. It underscores the importance of local partnerships and innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The hygiene packaging market will grow from USD 132,130 million in 2024 to USD 228,726 million by 2032 at a CAGR of 7.1%.

- Public health awareness increases demand for tamper-evident seals, airtight wraps and antimicrobial coatings to safeguard products.

- Regulatory mandates require traceable systems and high-barrier materials to limit pathogen transmission.

- Eco‑concerns push brands to adopt recyclable, bio‑based substrates and lightweight structures that cut waste and transport costs.

- Digital printing and connected features enable personalized labels and real‑time quality checks.

- E‑commerce expansion drives demand for leak‑proof, durable formats that withstand transit stress.

- Asia Pacific holds 35% share, Europe 25%, North America 20%, Latin America 10% and Middle East & Africa 10%.

Market Drivers

Heightened Health and Safety Awareness

Rising public awareness of personal cleanliness drives demand for secure packaging that prevents contamination. The hygiene packaging market experiences growth due to consumer preference for tamper-evident features and robust barrier properties. It supports product integrity and ensures user confidence. Brands promote safety through sealed pouches, peel-off lids, and airtight wrappers. Manufacturers deploy advanced materials to shield products from moisture and microbes. Increased adoption of disposable hygiene items expands demand.

For istance, Drylock Technologies introduced the first paper packaging for baby diapers in Europe, developed with Mondi’s EcoWicketBag, a recyclable and biodegradable solution that protects product integrity while reducing environmental impact.

Strict Regulatory Compliance Requirements

Stringent government regulations enforce packaging protocols to limit pathogen spread in consumer goods. The hygiene packaging market benefits from mandates that require tamper-evidence and traceability features. It compels producers to integrate antimicrobial coatings and sanitized production lines. Compliance audits push companies to adopt closed-loop systems and certified materials. Firms invest in quality control labs to validate barrier performance. Regulatory pressure drives innovation in shelf-life extension and contamination control solutions.

For instance, INX International developed INXShield antimicrobial coatings for package printing that provide durable, broad-spectrum microbial protection on various substrates like paper, plastic, and metal, extending shelf life and reducing cross-contamination risks.

Sustainability and Eco‑Friendly Innovation

Environmental concerns influence packaging design toward biodegradable and recyclable alternatives. The hygiene packaging market shifts investments into bio-based resins and lightweight films. It reduces plastic waste and lowers carbon footprint in supply chains. Companies adopt mono-material structures to simplify recycling processes. Suppliers partner with material scientists to develop compostable coatings. Brands highlight eco-friendly credentials in marketing campaigns. Consumer demand for green products compels rapid adoption of sustainable solutions.

E‑Commerce and Supply Chain Adaptation

Rapid expansion of online retail transforms delivery demands for hygiene products. The hygiene packaging market develops durable, leak-proof solutions that resist transit stress. It maintains product integrity during warehouse sorting and last-mile shipping. Companies collaborate with carriers to validate packaging performance under pressure. Producers implement modular designs for efficient stacking. Consumer expectation for sealed, tamper-indicated parcels drives adoption of high-barrier materials.

Market Trends

Integration of Smart and Connected Packaging

Smart labels and sensor-enabled seals deliver real-time product data and quality assurance in the hygiene packaging market. It provides temperature, moisture and usage feedback to manufacturers and end users. Brands incorporate QR codes and NFC tags to verify authenticity and share usage tips. Mobile applications pair with packaging to guide consumers through proper disposal or refill processes. Industry alliances define interoperability standards. Insight from data analytics informs supply chain adjustments and recalls.

For instance, Hershey’s Holiday Kisses launched smart packaging with QR codes that offer transparency about ingredients and production processes, illustrating how packaging can communicate detailed product information beyond basic use.

Adoption of Sustainable and Compostable Materials

Regulators and consumers demand eco-friendly packaging in the hygiene packaging market. It drives shifts toward bio-based polymers, paperboard laminates and compostable films. Suppliers test new fiber blends that maintain barrier quality while simplifying end-of-life processing. Brands highlight certification labels to build trust. Recyclability targets shape material selection across product lines. Industry forums set performance benchmarks. Pilot programs validate circular supply models and measure environmental impact. R&D teams partner with startups on closed-loop collection systems.

For instance, skincare brand Naïf Natural Skincare has switched to using PaperWise packaging made from agricultural waste, which not only protects the product but also offers a luxurious look while being eco-friendly.

Customization and Personalization in Product Presentation

Dynamic printing techniques create tailored designs for diverse consumer groups in the hygiene packaging market. It delivers unique graphics, instructions and brand messages on single packages. Manufacturers implement variable data printing to adjust batch codes and usage information per region. Limited-edition collections drive brand loyalty and collectability. Packaging converters integrate lightweight structures that adapt to shape demands. Retailers test promotional sleeves that engage shoppers. User feedback informs future design iterations and color choices.

Automation and High‑Throughput Production Technologies

Industries deploy robotic lines and vision systems to boost output in the hygiene packaging market. It cuts manual errors and improves speed for seal integrity checks. Companies integrate modular machines that handle filling, capping and labeling in one cell. Real-time sensors optimize process parameters and flag anomalies. Maintenance teams use predictive algorithms to schedule service before failures. Training programs equip operators with digital skills. Operational dashboards display metrics to guide management decisions.

Market Challenges Analysis

Raw Material Shortages and Price Fluctuations

The hygiene packaging market encounters supply disruptions for key substrates such as resin, paperboard and barrier films. It drives cost increases that manufacturers pass to customers. Sudden demand spikes for sanitization products strain procurement networks. Firms struggle to secure alternative sources that meet quality requirements. Price uncertainty complicates budget planning and profit forecasting. Long lead times create inventory shortages and production delays.

Regulatory and Sustainability Compliance Hurdles

The hygiene packaging market confronts strict environmental laws that impose recycled content and chemical restrictions on packaging designs. It forces companies to redesign products that retain barrier performance. Certification processes demand extensive testing and documentation. Compliance teams allocate resources to monitor evolving standards across regions. Consumer scrutiny over recyclability intensifies brand reputation risks. Innovations to meet green targets require significant capital investment. Small-scale players struggle to fund research and certification procedures

Market Opportunities

Growth in Healthcare and E‑Commerce Channels

Healthcare providers demand sterile, tamper-evident formats for wound care and surgical supplies, driving expansion in the hygiene packaging market. Online retailers require durable, leak-proof parcels that preserve product integrity during transit. It supports direct-to-consumer models and subscription services for personal care items. Medical device firms seek antimicrobial substrates to extend shelf life and meet sterilization standards. Partnerships between converters and logistics providers streamline last-mile delivery of sensitive products. R&D teams develop high-barrier materials that reinforce trust and safety.

Innovation Through Sustainability and Smart Technologies

Regulatory bodies enforce recycled-content targets, creating openings for eco‑friendly substrates in the hygiene packaging market. It attracts consumer segments that prioritize compostable films and mono-material structures. Brands introduce refillable pouches and modular designs to cut plastic volume. Smart labels with built-in sensors report temperature excursions and tamper events. Companies harness data analytics to forecast demand and manage recalls with precision. Contract packagers invest in flexible lines to support emerging startups and limited-edition launches.

Market Segmentation Analysis:

By Product Type:

The hygiene packaging market divides into sanitary napkin packaging, diaper packaging, wet wipes packaging, tissue packaging, cotton pad packaging and incontinence product packaging. It addresses specific barrier and format requirements for each category. Manufacturers tailor film thickness and seal designs to match absorbency levels. Demand for sanitary napkin and diaper packaging remains high due to rising consumer hygiene awareness. Producers innovate pouch shapes and dispensers to enhance convenience. It supports brand differentiation and supply chain efficiency.

For instance, Niine Sanitary Napkins launched India’s first PLA-based biodegradable sanitary pads in 2023, featuring completely biodegradable packaging with over 90% of the pads decomposing within 175 days, which supports sustainability goals while maintaining product efficacy.

By Material Type:

The hygiene packaging market features plastic films (PE, PET, BOPP), paper & paperboard, aluminum foil, biodegradable & compostable materials and laminated multilayer materials. It applies plastic films for moisture resistance and print clarity. Paperboard solutions offer rigid protection for cotton pads and tissue packs. Aluminum foil provides oxygen barrier for medical wipes. Bio-based options meet sustainable goals, while multilayer laminates deliver balanced barrier and strength. Producers select substrates to balance cost, performance and environmental impact.

For instance, Berry Global Group produces multilayer co-extruded plastic films, such as polyethylene and polypropylene blends, that offer moisture resistance and print clarity for baby diapers and sanitary napkins packaging.

By End-Use Application:

The hygiene packaging market serves baby care products, feminine hygiene products, adult incontinence products, personal wipes and medical & institutional hygiene segments. It meets safety and sterility needs in medical areas through peelable, tamper-evident seals. Brands supply baby diaper packs with resealable closures. Feminine hygiene wraps require discreet, lightweight films. Personal wipes demand easy-open pouches with foil barriers. Incontinence packaging focuses on high-barrier multilayer films. Market players optimize designs to align with usage patterns and regulatory guidelines.

Segments:

Based on Product Type:

- Sanitary Napkin Packaging

- Diaper Packaging

- Wet Wipes Packaging

- Tissue Packaging

- Cotton Pad Packaging

- Incontinence Product Packaging

Based on Material Type:

- Plastic Films (PE, PET, BOPP)

- Paper & Paperboard

- Aluminum Foil

- Biodegradable & Compostable Materials

- Laminated Multilayer Materials

Based on End-Use Application:

- Baby Care Products

- Feminine Hygiene Products

- Adult Incontinence Products

- Personal Wipes

- Medical & Institutional Hygiene

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

Manufacturers deploy tamper‑evident closures to protect consumer goods. The hygiene packaging market uses advanced barrier films to block moisture and microbes. Online retail growth drives demand for puncture‑resistant pouches. Regulatory bodies enforce strict barrier performance tests. With market share at 20%, producers upgrade lines to boost throughput. It optimizes distribution networks to meet regional demand.

Europe

Eco‑focused legislation mandates recyclable substrates and limits mixed‑material films. The hygiene packaging market shifts to certified paperboard and mono‑material laminates. Funding incentives expand collection and processing infrastructure. Label approvals give consumers visible proof of sustainability. Companies with a market share of 25% introduce biodegradable coatings. It standardizes transparency marks to support consumer trust.

Asia Pacific

Rapid urban expansion propels hygiene product consumption across major cities. The hygiene packaging market leverages low‑cost hubs in India and China to cut production expenses. Retail network growth extends reach into suburban and rural areas. Collaborative ventures with resin suppliers secure material flow. Firms holding a market share of 35% optimize supply chains. It innovates sealed‑pack formats for on‑the‑go use.

Latin America

Rising middle‑income groups increase demand for personal hygiene items. The hygiene packaging market adapts stand‑up pouches and dispenser packs to local preferences. Producers collaborate with logistics partners to navigate infrastructure challenges. Government regulations impose recycled content targets. Firms with a market share of 10% develop resealable closures. It runs consumer education programs on disposal best practices.

Middle East & Africa

Healthcare investments and sanitation campaigns elevate packaging standards. The hygiene packaging market integrates antimicrobial lamination and peel‑open seals. Urbanization boosts demand for portable, single‑use formats. Partnerships with health agencies deliver hygiene kits to underserved areas. Companies commanding a market share of 10% modernize retail displays. It aligns packaging guidelines with regional cultural norms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Skymark Packaging International

- Kimberly‑Clark Corporation

- RKW Group

- Fatra A.S

- Nitto Denko Corporation

- SILON s.r.o

- Prochimir Technical Films

- Trioplast Group

- GCR Group

- PT Asia Pacific Fortuna Sari

- Napco National

- Schweitzer‑Mauduit International, Inc.

Competitive Analysis

The hygiene packaging market features intense rivalry among leading global and regional suppliers. Companies such as Kimberly‑Clark Corporation and Schweitzer‑Mauduit International leverage extensive R&D budgets to introduce high‑barrier films and antimicrobial coatings. RKW Group and Trioplast Group compete on cost‑effective production, while Nitto Denko Corporation differentiates through advanced printing and sensor integration. SILON s.r.o and Prochimir Technical Films target niche segments with bespoke materials, and PT Asia Pacific Fortuna Sari capitalizes on local manufacturing efficiencies. Skymark Packaging International and Napco National focus on flexible pouch formats that meet shifting consumer preferences. Fatra A.S pursues sustainable substrates to satisfy regulatory mandates and brand sustainability goals. It encourages partnerships with converters to accelerate product launches and expand distribution networks.

Recent Developments

- On May 9, 2025, SC Johnson launched its first refillable packaging system for Method and Mrs. Meyer’s Clean Day soaps in partnership with London Drugs.

- On April 8, 2025, Orange Packaging and Supplies introduced the Selpak Professional Recycled Series—eco‑friendly hygiene products in fully biodegradable wrapping—in the UK.

- On July 28, 2025, Nelipak® broke ground on a new healthcare packaging facility in Grecia, Alajuela, Costa Rica, expanding its capacity for sterile and medical-grade hygiene packaging.

- In November 2024, Berry Global Group, Inc. completed a merger between its Health, Hygiene and Specialties Global Nonwovens and Films business and Glatfelter Corporation, creating a new entity called Magnera Corporation.

Market Concentration & Characteristics

The hygiene packaging market exhibits moderate concentration, with major suppliers such as Kimberly‑Clark Corporation, RKW Group and Trioplast Group commanding significant production capacity and distribution networks. It features a blend of global giants and specialized niche players that focus on sustainable substrates or smart packaging solutions. High capital requirements for advanced machinery and rigorous regulatory certifications limit new entrants. Leading firms exploit scale advantages to negotiate raw material contracts and optimize logistics. Product differentiation through antimicrobial coatings, tamper‑evident features and personalized designs drives brand loyalty. Vertical integration gives few players control over upstream resin supply and downstream converting operations. It drives margin stability and supports scaling of packaging formats. Small and medium enterprises struggle to match cost structures and certification processes, prompting consolidation among regional producers. Price competition intensifies in mature markets, pushing players to seek efficiency gains through automated lines. It encourages adoption of digital quality inspection to reduce waste and reinforce market positions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material Type, End-Use Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Companies will expand adoption of compostable films to meet consumer sustainability demands.

- Producers will integrate sensor labels to monitor product conditions throughout the supply chain.

- Brands will launch refillable pouch formats to reduce single‑use plastic waste.

- Manufacturers will upgrade machinery with vision systems to ensure seal integrity.

- Suppliers will partner with material innovators to develop high‑barrier bio‑resins.

- Converters will streamline operations with modular production lines for faster changeovers.

- Retailers will feature branded hygiene kits that combine multiple product formats.

- Logistics providers will test packaging durability under extreme temperature conditions.

- Regulatory bodies will tighten standards for antimicrobial surface treatments.

- Industry consortia will standardize labeling protocols for greater consumer transparency.