Market Overview

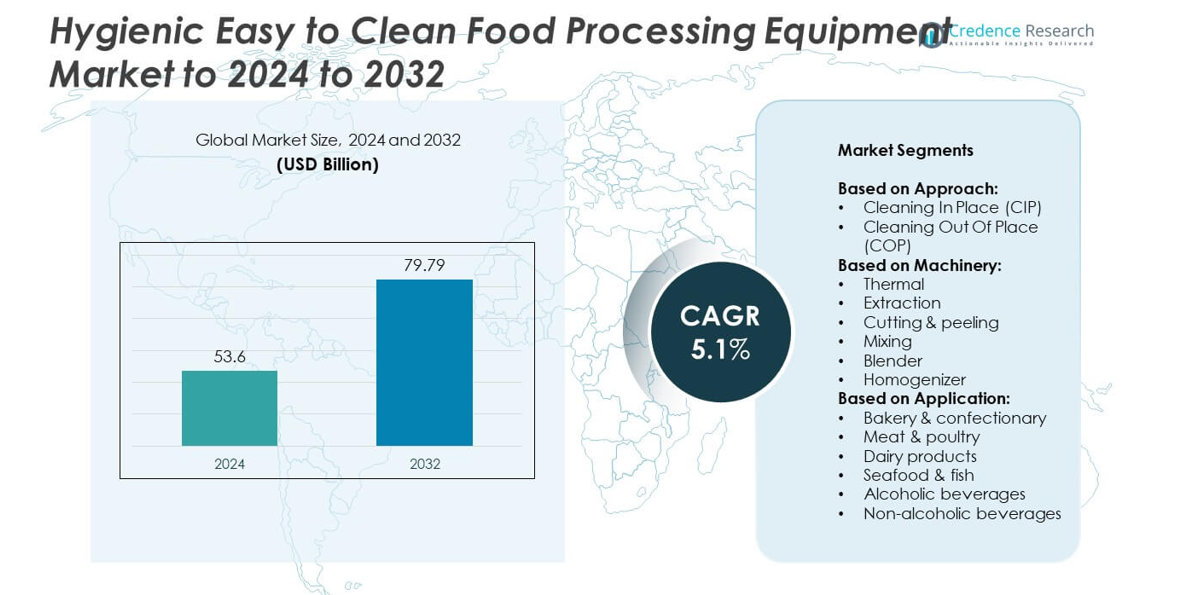

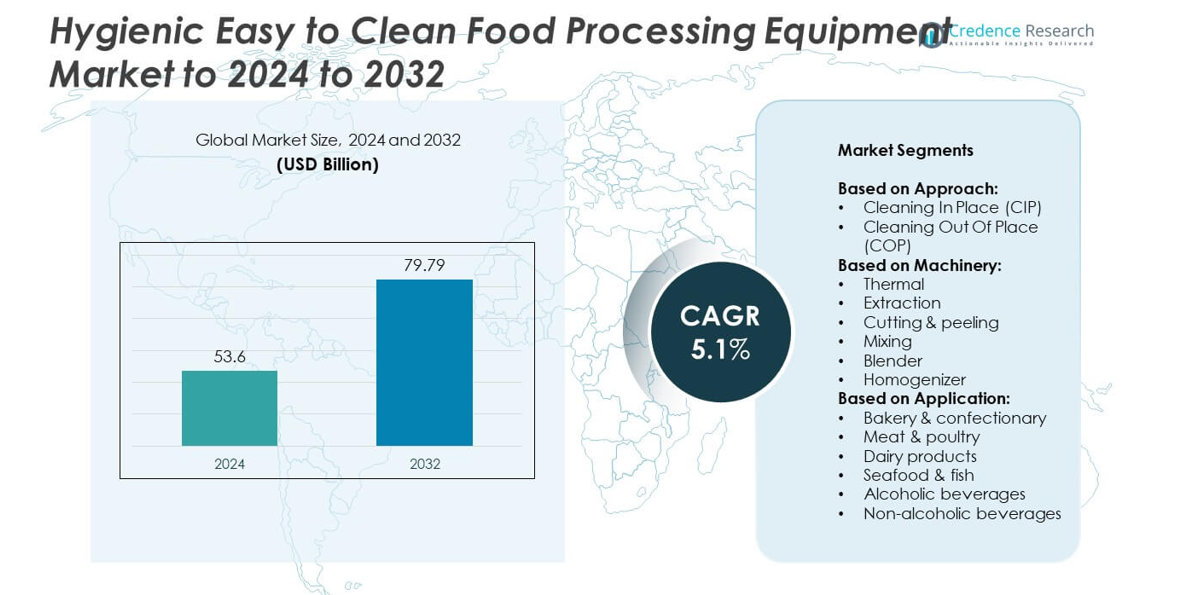

Hygienic Easy to Clean Food Processing Equipment Market size was valued at USD 53.6 Billion in 2024 and is anticipated to reach USD 79.79 Billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hygienic Easy to Clean Food Processing Equipment Market Size 2024 |

USD 53.6 Billion |

| Hygienic Easy to Clean Food Processing Equipment Market, CAGR |

5.1% |

| Hygienic Easy to Clean Food Processing Equipment Market Size 2032 |

USD 79.79 Billion |

The hygienic easy-to-clean food processing equipment market is driven by major players such as Nestlé, Heat and Control, Schneider Electric, Baker Perkins, Tna Solutions, Alfa Laval, FMC Technologies, Marel, JBT Corporation, Charles Lawrence International, Avery WeighTronix, Kraft Heinz, GEA Group, and Welbilt. These companies emphasize innovation in automation, CIP systems, and sustainable designs to meet stringent food safety regulations and rising consumer demand for processed foods. Regional dynamics show North America leading the market with a 32% share in 2024, supported by strong regulatory frameworks and high adoption across dairy, meat, and beverage sectors. Europe followed with 28%, driven by advanced manufacturing and sustainability initiatives, while Asia-Pacific, holding 25%, emerged as the fastest-growing region due to rapid industrialization and rising packaged food demand.

Market Insights

- The hygienic easy-to-clean food processing equipment market was valued at USD 53.6 billion in 2024 and is projected to reach USD 79.79 billion by 2032, growing at a CAGR of 5.1% during the forecast period.

- Rising demand for processed and packaged foods, along with stringent global food safety regulations, is fueling the adoption of CIP systems and advanced hygienic equipment across large-scale processing facilities.

- Market trends highlight increasing integration of automation, IoT-enabled cleaning systems, and sustainable designs that reduce water and energy usage while improving operational efficiency.

- The competitive landscape is shaped by global players focusing on product innovation, strategic partnerships, and compliance with hygiene standards, while smaller firms face challenges due to high initial investment costs.

- Regionally, North America led with 32% share in 2024, followed by Europe at 28% and Asia-Pacific at 25%, while the dairy sector dominated applications, holding nearly 30% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Approach

The Cleaning In Place (CIP) segment dominated the hygienic easy-to-clean food processing equipment market in 2024, holding over 60% share. Its leadership stems from reduced downtime, automation benefits, and compliance with stringent hygiene regulations in food safety. CIP systems allow processors to clean equipment without disassembly, saving labor and ensuring consistent sanitization. Their adoption is strong in large-scale dairy, beverage, and meat processing facilities where continuous operations are critical. Rising regulatory emphasis on HACCP standards and the need for operational efficiency continue to drive CIP’s expansion compared to Cleaning Out of Place (COP) systems.

- For instance, Ecolab’s CIP IQ at Umpqua Dairy cut manual review of 900 CIP charts monthly.

By Machinery

Thermal equipment accounted for the largest share of the machinery segment in 2024, representing around 35% of the market. This dominance is driven by widespread use in pasteurization, sterilization, and cooking applications, particularly in dairy and beverage sectors. Thermal systems ensure microbial safety while preserving product quality, aligning with food safety standards. Their easy-to-clean designs minimize contamination risk and support continuous production. Growth in dairy processing and ready-to-eat food demand further strengthens their position over extraction, cutting and peeling, mixing, blender, and homogenizer machinery. Rising demand for energy-efficient thermal systems also supports the segment’s expansion.

- For instance, Alfa Laval’s LKH hygienic pump handles up to 500 m³/h at 11 bar. It is offered in 13 sizes for CIP and product transfer.

By Application

The dairy products segment led the application category in 2024, capturing nearly 30% of the overall market. Its dominance is fueled by strict hygiene requirements in milk processing, cheese production, and yogurt manufacturing. Dairy operations depend on clean-in-place systems and hygienic machinery to prevent microbial growth and extend shelf life. Equipment with seamless surfaces and automated cleaning functions ensures compliance with FDA and EU dairy safety regulations. Rising global dairy consumption, particularly in emerging economies, and increasing investments in modern dairy processing plants sustain demand for hygienic equipment, keeping dairy ahead of bakery, meat, seafood, and beverage applications.

Market Overview

Stringent Food Safety Regulations

Strict global regulations on food hygiene remain a primary growth driver in this market. Authorities such as the FDA, EFSA, and regional health bodies enforce standards that require equipment to prevent contamination and maintain product safety. Hygienic equipment with smooth surfaces, minimal dead zones, and automated cleaning systems helps processors comply efficiently. Growing consumer awareness of foodborne illnesses further pushes manufacturers to adopt easy-to-clean designs. As regulatory frameworks tighten worldwide, demand for compliant processing equipment continues to rise, strengthening the market’s long-term outlook.

- For instance, JBT Corporation’s is a leading supplier of food processing equipment for shelf-stable food products, with more than 7,500 continuous rotary sterilizers in operation globally since 1921.

Rising Demand for Processed and Packaged Foods

The rapid increase in urbanization and changing lifestyles has boosted processed food consumption globally. Consumers demand ready-to-eat, dairy, bakery, and beverage products, which require large-scale hygienic production facilities. Easy-to-clean equipment supports faster changeovers, reduces downtime, and ensures safety in high-volume processing. The expanding convenience food sector, especially in Asia-Pacific, drives adoption of advanced machinery like CIP systems. With packaged food sales projected to grow steadily, food manufacturers continue to invest in hygienic processing equipment to maintain quality, safety, and production efficiency.

- For instance, Heat and Control is a leading manufacturer of snack processing lines, offering systems with quick-clean changeover features. Its global scale was underscored in 2023 with the opening of a new 33,134-square-meter facility in Mexico. The company also confirmed at that time that it operates 10 plants worldwide to support its customers.

Technological Advancements in Cleaning Systems

Advances in automation and smart cleaning technologies are transforming food processing operations. Integration of IoT-enabled sensors, automated CIP systems, and robotics allows real-time monitoring of cleanliness and reduces manual intervention. These innovations cut operational costs, extend equipment life, and improve efficiency by minimizing water and chemical usage. Companies are adopting sustainable cleaning solutions that align with ESG goals. As the industry shifts toward digitalized and eco-friendly processing, advanced hygienic equipment provides both operational efficiency and competitive advantage, making technology adoption a significant growth driver.

Key Trends & Opportunities

Shift Toward Sustainable Processing Solutions

Sustainability is a growing trend as food companies adopt eco-friendly cleaning systems to reduce resource consumption. Water-efficient CIP technologies and chemical-free cleaning agents are gaining traction in developed markets. Equipment designed for minimal environmental impact aligns with corporate ESG commitments and regulatory pressures. Manufacturers offering sustainable, hygienic equipment gain preference among food producers seeking cost savings and eco-compliance. This shift provides opportunities for equipment makers to differentiate through green innovations, creating strong demand across dairy, beverage, and meat processing sectors.

- For instance, Sani-Matic users cut clean times 20% and water use 50% after analytics-driven CIP tuning.

Expansion in Emerging Economies

Emerging markets in Asia-Pacific and Latin America present strong growth opportunities for hygienic processing equipment. Rising disposable incomes, urbanization, and demand for packaged foods drive investment in modern food production facilities. Governments in these regions promote food safety and export standards, encouraging adoption of advanced equipment. Dairy, meat, and beverage processors are expanding capacity to meet domestic and export needs. Equipment suppliers focusing on localized, cost-effective solutions gain significant market advantage. This expansion trend strengthens the market’s global footprint and long-term growth prospects.

- For instance, Watson-Marlow MasoSine pumps deliver up to 99,000 L/h at 15 bar, with Certa models using up to 50% less power than alternatives.

Key Challenges

High Initial Investment Costs

The high capital expenditure associated with advanced hygienic food processing equipment remains a key barrier. Small and medium-sized food processors, particularly in developing regions, face difficulty adopting CIP systems and automation due to budget constraints. While long-term cost savings from reduced downtime and compliance benefits are significant, upfront investments discourage rapid adoption. This challenge slows modernization efforts, limiting growth in price-sensitive markets where manual cleaning and low-cost alternatives remain common.

Complex Integration with Existing Facilities

Integrating advanced hygienic equipment into legacy food processing plants poses operational challenges. Many facilities were not designed to accommodate automated cleaning systems or high-grade hygienic machinery. Retrofitting requires redesigning production lines, leading to downtime and increased costs. The complexity of installation, workforce training, and compliance adjustments adds to adoption hurdles. Companies with older infrastructure delay investment, creating barriers to wider market penetration. This challenge particularly affects traditional processors in emerging economies seeking gradual modernization.

Regional Analysis

North America

North America accounted for 32% of the hygienic easy-to-clean food processing equipment market in 2024. The region benefits from strict FDA and USDA food safety regulations that push processors to adopt CIP-enabled and automation-driven machinery. Strong demand from the dairy, meat, and bakery sectors further accelerates adoption. Major investments in sustainable cleaning technologies and smart equipment by leading manufacturers enhance market growth. The U.S. dominates regional demand, supported by large-scale packaged food production and high consumer spending. Canada also contributes steadily, driven by expanding dairy and beverage industries. The market outlook remains positive with modernization trends.

Europe

Europe captured 28% of the market in 2024, led by countries such as Germany, France, and the UK. The region’s focus on sustainability and compliance with EFSA and HACCP regulations drives strong adoption of hygienic systems. Dairy and bakery sectors form the core demand base, with growing emphasis on automated cleaning and eco-friendly solutions. European food processors invest heavily in CIP technologies to meet stringent hygiene standards and reduce downtime. Demand is also strengthened by the region’s strong processed food exports. Continuous innovation and regulatory pressure will maintain Europe as a key contributor to global market growth.

Asia-Pacific

Asia-Pacific held 25% of the market share in 2024, making it the fastest-growing regional segment. Rising disposable incomes, urbanization, and expanding food production capacities fuel demand for hygienic equipment. Countries such as China, India, and Japan are driving investments in dairy, meat, and beverage processing facilities. Government initiatives to improve food safety standards accelerate adoption of advanced CIP and thermal machinery. Local players are partnering with global manufacturers to deliver cost-effective yet compliant equipment. Strong growth in packaged and ready-to-eat food consumption further enhances demand. The region is expected to continue gaining market share through 2032.

Latin America

Latin America represented 9% of the market in 2024, with Brazil and Mexico as key contributors. The region’s growing meat and poultry processing sector creates strong demand for easy-to-clean equipment. Rising exports to North America and Europe require compliance with international food safety standards, pushing manufacturers toward hygienic designs. However, high equipment costs limit adoption among smaller processors. Despite this, modernization efforts in dairy and beverage industries are gradually improving uptake. Expanding consumer demand for packaged foods further drives market growth. The region offers potential for steady expansion as regulatory frameworks tighten and investments rise.

Middle East & Africa

The Middle East & Africa accounted for 6% of the global market share in 2024. Demand is primarily driven by the growing dairy and beverage processing sectors in Gulf countries and South Africa. Investments in modern food production facilities and rising consumer awareness of hygiene standards are supporting gradual adoption. However, the region faces challenges such as limited infrastructure and high capital costs, restricting smaller processors. Export-oriented meat and seafood industries also push for compliance with international hygiene regulations. Though currently a smaller market, steady economic growth and regulatory improvements are expected to expand adoption rates.

Market Segmentations:

By Approach:

- Cleaning In Place (CIP)

- Cleaning Out Of Place (COP)

By Machinery:

- Thermal

- Extraction

- Cutting & peeling

- Mixing

- Blender

- Homogenizer

By Application:

- Bakery & confectionary

- Meat & poultry

- Dairy products

- Seafood & fish

- Alcoholic beverages

- Non-alcoholic beverages

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The hygienic easy-to-clean food processing equipment market is shaped by leading players such as Nestlé, Heat and Control, Schneider Electric, Baker Perkins, Tna Solutions, Alfa Laval, FMC Technologies, Marel, JBT Corporation, Charles Lawrence International, Avery WeighTronix, Kraft Heinz, GEA Group, Welbilt, and Tna. These companies focus on innovation in cleaning technologies, automation, and energy efficiency to meet evolving industry requirements. Their strategies include heavy investment in research and development, expansion of product portfolios, and alignment with global food safety regulations. Many are enhancing their offerings with digital monitoring, IoT-enabled systems, and eco-friendly solutions to improve operational efficiency and sustainability. Strategic partnerships, mergers, and acquisitions strengthen market positioning and enable access to new geographies. The competitive landscape remains dynamic, with both global giants and regional players contributing to technological advancements. Continuous innovation, compliance with stringent hygiene standards, and sustainability commitments are central to maintaining competitive advantage in this growing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nestlé

- Heat and Control

- Schneider Electric

- Baker Perkins

- Tna Solutions

- Alfa Laval

- FMC Technologies

- Marel

- JBT Corporation

- Charles Lawrence International

- Avery WeighTronix

- Kraft Heinz

- GEA Group

- Welbilt

- Tna

- Heat and Control

Recent Developments

- In 2024, GEA presented new valve technology, which significantly minimizes areas where food product can pool. This design is reported to reduce potential contamination areas by approximately 96%, thereby improving Cleaning-in-Place (CIP) efficiency and further reducing microbiological risk in dairy and food processing.

- In 2024, Heat and Control released its Symphony On-Machine and In-Kitchen Seasoning Systems at PACKEXPO International.

- In 2024, Tna emphasized optimizing the entire production process. Their tna intelli-flav® OMS 5.1 seasoning system ensured consistent and precise seasoning coverage. The precision of this system minimizes overspray and raw material waste, contributing to a cleaner, more efficient line and simplifying the necessary cleaning protocols.

Report Coverage

The research report offers an in-depth analysis based on Approach, Machinery, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing focus on food safety compliance.

- Adoption of automated CIP systems will increase across large-scale processing facilities.

- Dairy and beverage sectors will continue to drive the highest demand.

- Asia-Pacific will emerge as the fastest-growing regional market.

- Sustainability goals will push demand for water- and energy-efficient equipment.

- Integration of IoT and smart monitoring will enhance equipment performance.

- High upfront costs will remain a barrier for small and medium processors.

- Emerging economies will attract investments in modern food processing facilities.

- Regulatory tightening will accelerate replacement of outdated equipment.

- Partnerships between global and regional manufacturers will strengthen market penetration.