Market Overview

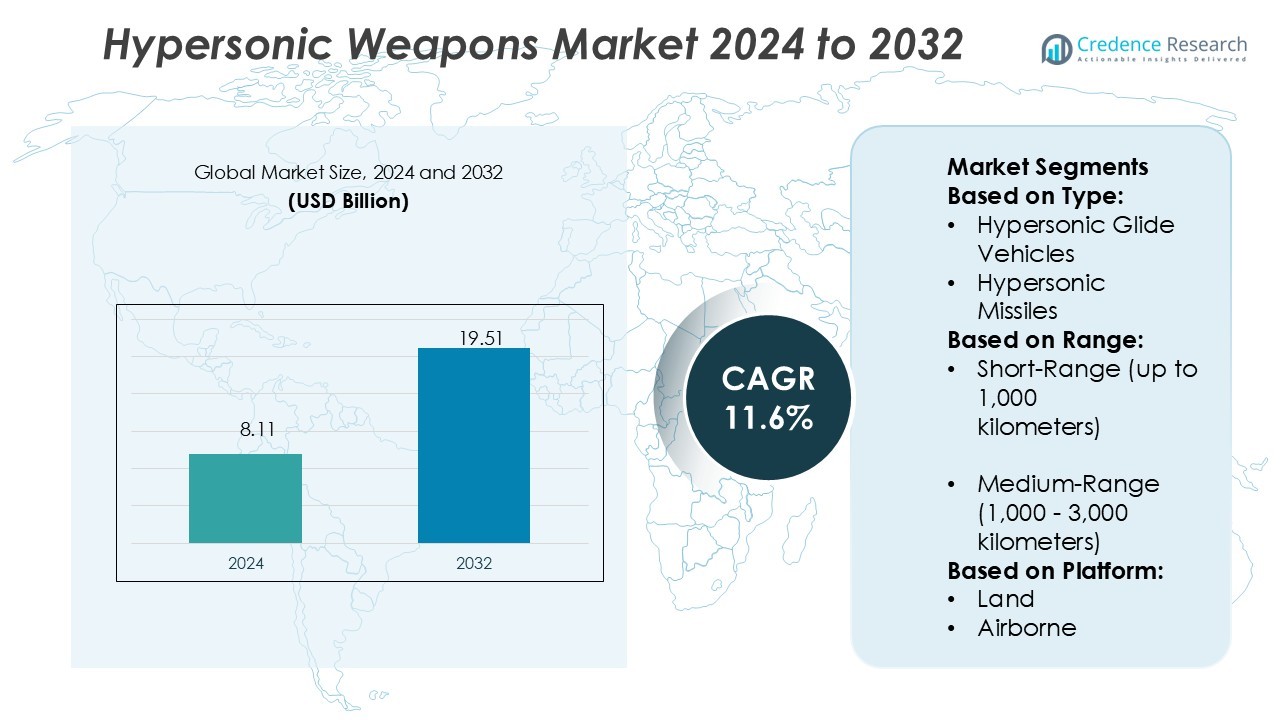

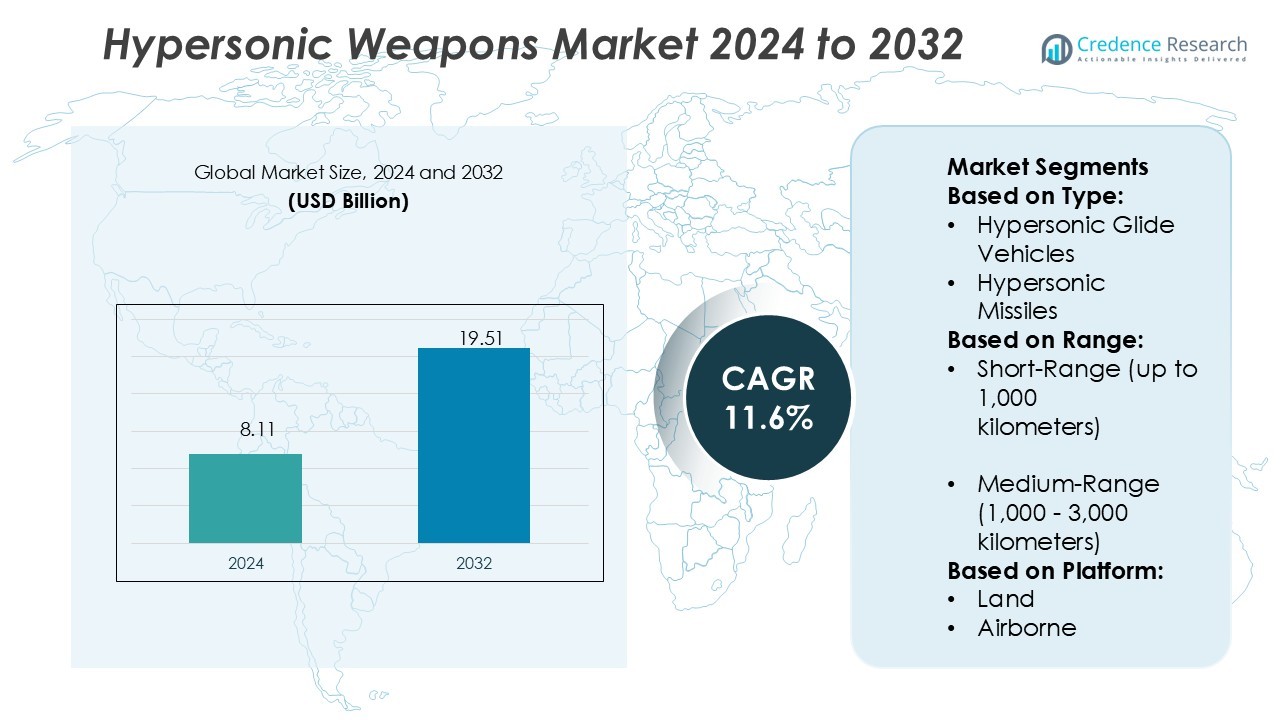

Hypersonic Weapons Market size was valued USD 8.11 billion in 2024 and is anticipated to reach USD 19.51 billion by 2032, at a CAGR of 11.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hypersonic Weapons Market Size 2024 |

USD 8.11 Billion |

| Hypersonic Weapons Market, CAGR |

11.6% |

| Hypersonic Weapons Market Size 2032 |

USD 19.51 Billion |

The hypersonic weapons market is shaped by top players including Lockheed Martin Corporation, Northrop Grumman, RTX, BAE Systems, Thales Group, Leonardo S.p.A., AIRBUS, L3Harris Technologies, Inc., NXP Semiconductors, Infineon Technologies AG, Robert Bosch GmbH, Aerojet Rocketdyne Holdings Inc., General Dynamics Corporation, The Boeing Company, BrahMos Aerospace Pvt. Ltd., Denel Dynamics, J.S.C. Tactical Missiles Corporation, and Raytheon Technologies. These companies drive innovation in propulsion, guidance, and thermal protection systems to enhance strike capabilities. North America leads the global market with a 38% share, supported by extensive U.S. defense programs and strong government funding. The region’s dominance is reinforced by advanced R&D infrastructure, strategic defense contracts, and continuous technological innovation, positioning it as the primary hub for hypersonic weapons development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The hypersonic weapons market size was USD 8.11 billion in 2024 and is expected to reach USD 19.51 billion by 2032, growing at a CAGR of 11.6%.

- Rising defense modernization programs and advancements in propulsion and thermal protection technologies are driving strong demand for hypersonic systems across major military powers.

- Integration into multi-domain operations, including land, airborne, and naval platforms, reflects a growing trend, with airborne systems holding the largest segment share due to rapid deployment capabilities.

- High development and deployment costs, along with technical complexity, remain key restraints, limiting widespread adoption to nations with significant defense budgets and advanced R&D capacity.

- North America leads the market with a 38% regional share, supported by extensive U.S. defense initiatives, while Asia-Pacific accounts for 30% and emerges as the fastest-growing region due to strategic programs in China, India, and Japan, reinforcing the global competitive landscape dominated by leading defense contractors and technology firms.

Market Segmentation Analysis:

By Type

In the hypersonic weapons market, hypersonic glide vehicles hold the dominant share at 57%. Their ability to maneuver at high speeds while evading missile defense systems drives their adoption. These vehicles offer longer range, higher survivability, and precision strike capabilities compared to hypersonic missiles. Defense modernization programs in the U.S., Russia, and China emphasize glide vehicle development due to their strategic deterrence value. Hypersonic missiles continue to gain traction in tactical roles, but glide vehicles remain the preferred choice for long-range, high-impact operations, strengthening their market leadership.

- For instance, Airbus advances digital twin integration across its platforms: over 12,000 aircraft are connected via the Skywise platform, enabling real-time sensor data streaming to virtual models for predictive maintenance.

By Range

The long-range segment leads the market with a 49% share, supported by growing strategic defense initiatives. Nations prioritize weapons capable of traveling above 3,000 kilometers to ensure deterrence and reach critical targets. Investments in advanced propulsion systems and thermal protection technologies enhance long-range system efficiency. Geopolitical tensions and great power competition further accelerate demand for intercontinental capabilities. While medium-range systems gain traction for regional conflicts, the long-range category dominates due to its ability to reinforce military superiority and strategic reach, making it the most vital range classification in the hypersonic market.

- For instance, RTX’s Pratt & Whitney business, in collaboration with Collins Aerospace, completed a rated-power test of a 1 MW electric motor in its hybrid-electric demonstrator.

By Platform

Airborne platforms account for the largest market share at 46%, driven by flexibility and rapid deployment. Fighter jets and bombers equipped with hypersonic weapons can launch strikes across wide operational zones. Programs such as the U.S. Air Force’s AGM-183 ARRW and Russia’s Kinzhal missile highlight investment in air-launched hypersonics. The airborne segment benefits from reduced infrastructure dependency and faster deployment timelines compared to land or naval systems. While naval platforms are expanding with integration on submarines and destroyers, airborne platforms dominate due to their proven adaptability, strong funding, and integration with existing air combat systems.

Key Growth Drivers

Rising Defense Modernization Programs

Global defense modernization is a major driver for the hypersonic weapons market. Nations such as the U.S., China, and Russia are heavily investing in next-generation strike capabilities. Governments seek to strengthen deterrence strategies by deploying advanced hypersonic systems capable of penetrating missile defenses. Large defense budgets and multi-billion-dollar R&D programs enhance hypersonic development. The race for technological superiority in long-range precision strike weapons ensures consistent funding and accelerates deployment timelines, positioning hypersonic weapons as a critical element of modern military power projection.

- For instance, Infineon became the first semiconductor firm to develop 300-millimeter GaN (gallium nitride) power wafers inside its high-volume manufacturing lines, pushing power density and efficiency forward.

Geopolitical Tensions and Strategic Rivalries

Escalating geopolitical tensions and military rivalries drive hypersonic weapons demand. Border conflicts, territorial disputes, and competition for global dominance push nations to adopt faster and more evasive weapons. Hypersonics provide unmatched speed and maneuverability, giving military forces a tactical advantage in both deterrence and combat. Strategic competitors are prioritizing hypersonic deployment to counter adversaries and maintain superiority. As regional conflicts intensify, countries across Asia-Pacific, North America, and Europe accelerate procurement, ensuring hypersonics remain a priority investment in national defense strategies.

- For instance, BAE Systems announced a sixteen-fold increase in 155 mm artillery shell production capacity using a continuous flow processing method for explosives and propellants. ([Business Insider].

Advancements in Propulsion and Materials Technology

Technological progress in propulsion systems and advanced materials supports market expansion. Scramjet engines and novel thermal protection materials enable sustained flight at Mach 5+ speeds. These advancements enhance reliability, reduce vulnerability, and extend operational range for hypersonic systems. Defense contractors are collaborating with aerospace firms to integrate cutting-edge composites and heat-resistant alloys into designs. Continuous innovation improves cost-effectiveness and performance, making hypersonic weapons more feasible for large-scale deployment. Technology breakthroughs strengthen competitiveness and ensure that governments maintain long-term investments in these next-generation strike capabilities.

Key Trends & Opportunities

Integration with Multi-Domain Operations

A key trend is the integration of hypersonic weapons into multi-domain warfare strategies. Defense forces are aligning hypersonic programs with air, land, sea, and space platforms to enhance mission flexibility. This creates opportunities for joint-force applications and seamless interoperability across military branches. Naval integration on submarines and destroyers, alongside air-launched platforms, expands operational use. Such cross-domain deployment strengthens deterrence and broadens defense strategies, making hypersonic weapons a central feature in future battle doctrines.

- For instance, Northrop’s Stand-in Attack Weapon (SiAW) has been delivered to the U.S. Air Force for testing. The high-speed missile is engineered to fit inside F-35 internal weapons bays and is intended to complement multi-domain strike strategies by engaging rapidly relocatable targets within enemy anti-access/area-denial environments.

Growing Defense Collaborations and Alliances

International collaborations in hypersonic research present opportunities for market growth. NATO members, Japan, India, and Australia are pursuing joint programs with established defense powers. These partnerships allow cost-sharing, knowledge exchange, and faster development timelines. For example, U.S. and Australian collaboration under the SCIFiRE program highlights joint hypersonic testing. Expanding alliances not only enhance technological expertise but also drive adoption beyond traditional military powers. This cooperative approach strengthens collective security, ensuring broader global demand for hypersonic systems.

- For instance, NXP introduced LDMOS transistors that deliver 1,500 W peak RF output power (MMRF1317H) between 1,030–1,090 MHz, enabling high-power radar and IFF systems.

Key Challenges

High Development and Deployment Costs

The hypersonic weapons market faces challenges due to high R&D and production costs. Advanced propulsion systems, specialized materials, and extensive testing require billions in investment. Many developing countries find it difficult to allocate sufficient defense budgets for hypersonic programs. Even established powers struggle with balancing costs against competing defense priorities. These financial barriers limit widespread adoption, restricting participation to a few nations with substantial resources. The high costs of deployment and maintenance may delay large-scale procurement.

Technical Complexity and Safety Concerns

Developing hypersonic weapons involves extreme technical complexity, creating significant challenges for manufacturers. Sustaining stable flight at Mach 5+ speeds requires advanced thermal management, precision guidance, and robust propulsion systems. Failures during testing can lead to major financial losses and program delays. Safety concerns surrounding heat-resistant materials and integration with existing platforms further complicate adoption. The complexity of ensuring operational reliability under extreme conditions makes development a high-risk endeavor. These hurdles slow commercialization and prolong timelines for global deployment.

Regional Analysis

North America

North America leads the hypersonic weapons market with a 38% share, driven by extensive U.S. defense programs. The region invests heavily in R&D, supported by agencies such as DARPA and the U.S. Department of Defense. Programs like the AGM-183 ARRW and the Hypersonic Conventional Strike Weapon highlight strong funding commitments. Rising competition with China and Russia further accelerates development. The presence of major defense contractors, advanced aerospace infrastructure, and significant government budgets ensures continuous innovation. North America’s focus on long-range deterrence and rapid deployment capabilities secures its dominant position in the global hypersonic market.

Europe

Europe holds a 22% share of the hypersonic weapons market, supported by NATO-led initiatives and domestic programs. France, Germany, and the U.K. invest in indigenous systems while strengthening collaboration with allies to counter growing global threats. The European Union emphasizes joint research to close capability gaps with the U.S., Russia, and China. Programs focusing on air-launched and land-based systems are gaining traction. Defense industrial bases across Europe benefit from technological partnerships, ensuring steady progress. Regional demand is driven by strategic deterrence requirements, defense modernization, and rising security concerns due to geopolitical instability.

Asia-Pacific

Asia-Pacific accounts for 30% of the global market, emerging as the fastest-growing region. China dominates with advanced hypersonic missile programs like DF-17, while India and Japan expand indigenous development. Regional investments are fueled by escalating territorial disputes, maritime tensions, and strategic rivalries. Governments prioritize hypersonic weapons for both tactical and long-range operations. Collaboration with global defense firms enhances local innovation. Expanding aerospace and defense budgets, particularly in China and India, support large-scale adoption. Asia-Pacific’s rapid industrialization, technological advancement, and heightened security environment make it a critical growth hub in the global hypersonic weapons market.

Latin America

Latin America captures a 4% share, with slow but steady progress in defense modernization. Brazil leads regional initiatives, focusing on advanced aerospace technologies and potential hypersonic research collaborations. Budgetary constraints and competing social priorities limit large-scale adoption across most countries. However, interest in hypersonic weapons is rising as regional governments seek to modernize missile capabilities and enhance deterrence. Partnerships with global defense firms are key to accessing technology. Although Latin America’s role remains small compared to major markets, gradual investments and collaborative programs may support future regional growth in the hypersonic weapons sector.

Middle East & Africa

The Middle East & Africa region holds a 6% share, with growing interest in advanced defense systems. Nations such as Saudi Arabia, Israel, and the UAE are exploring hypersonic technologies to strengthen deterrence. Rising regional conflicts and security challenges drive procurement efforts. However, dependence on imports and partnerships with Western defense contractors limits indigenous development. Investments focus primarily on missile defense integration and future-oriented strike capabilities. Africa remains a minor contributor due to limited budgets. The region’s market growth is shaped by rising security threats, modernization needs, and collaborations with leading defense suppliers.

Market Segmentations:

By Type:

- Hypersonic Glide Vehicles

- Hypersonic Missiles

By Range:

- Short-Range (up to 1,000 kilometers)

- Medium-Range (1,000 – 3,000 kilometers)

By Platform:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The hypersonic weapons market is shaped by leading players such as Leonardo S.p.A., Robert Bosch GmbH, AIRBUS, RTX, Thales Group, L3Harris Technologies, Inc., Infineon Technologies AG, BAE Systems, Northrop Grumman, and NXP Semiconductors. The hypersonic weapons market is highly competitive, driven by rapid advancements in propulsion, guidance, and materials technologies. Companies are focusing on high-speed strike systems capable of penetrating advanced missile defense networks. Significant investments in R&D and testing programs aim to enhance speed, maneuverability, and precision while ensuring operational reliability. Defense contractors prioritize long-range deterrence capabilities and integration across land, air, and naval platforms. Strategic collaborations, government-funded programs, and international partnerships are central to strengthening market presence. The competitive environment is defined by technological innovation, defense alliances, and growing demand for next-generation weapons, fueling steady market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Leonardo S.p.A.

- Robert Bosch GmbH

- AIRBUS

- RTX

- Thales Group

- L3Harris Technologies, Inc.

- Infineon Technologies AG

- BAE Systems

- Northrop Grumman

- NXP Semiconductors

Recent Developments

- In May 2025, Scopic acquired ZoomRadar, a provider of real-time weather data and radar visualization tools. The acquisition aims to enhance ZoomRadar’s platform using Scopic’s expertise in AI and cloud technologies. This move strengthens Scopic’s position in delivering advanced weather intelligence solutions across various industries.

- In January 2025, Arbe partnered with NVIDIA to integrate its high-resolution MIMO radar with NVIDIA’s DRIVE AGX platform. The collaboration enables real-time free-space mapping and detection of small obstacles under all conditions. This joint solution aims to advance safety and performance in ADAS and autonomous driving systems.

- In March 2024 Castelion, a startup aiming to develop hypersonic weapons for the Pentagon, announced that it has conducted its first system test. This marks a significant step as a growing number of smaller hypersonic arms manufacturers challenge large defense contractors with more cost-effective and rapidly produced products, according to Reuters.

- In March 2024, US tests hypersonic missile in Pacific as it aims to keep up with China and Russia. B-52 crews take part in hypersonic weapon familiarization to China that Washington remains competitive in this advanced weapons arena, where Beijing is often perceived to have an advantage.

Report Coverage

The research report offers an in-depth analysis based on Type, Range, Platform and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Hypersonic weapons will gain wider adoption as nations prioritize long-range deterrence.

- Advancements in propulsion will improve speed, range, and maneuverability of future systems.

- Integration with multi-domain operations will expand deployment across land, air, and naval platforms.

- Defense collaborations will accelerate technology sharing and shorten development cycles.

- Miniaturization of electronics will enhance precision guidance and strike accuracy.

- Stronger thermal protection materials will support extended hypersonic flight endurance.

- Rising geopolitical tensions will drive continuous investments in hypersonic programs.

- Testing and simulation capabilities will advance to reduce risks and costs.

- Demand for air-launched systems will grow due to rapid deployment flexibility.

- International regulatory discussions may emerge to address security and arms control.