Market Overview:

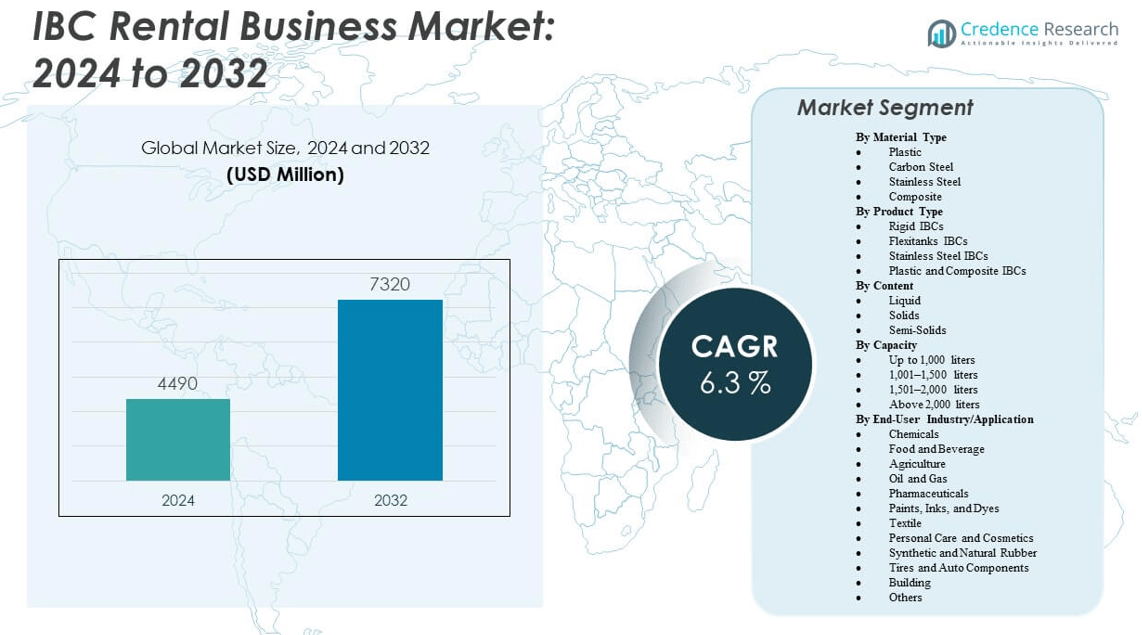

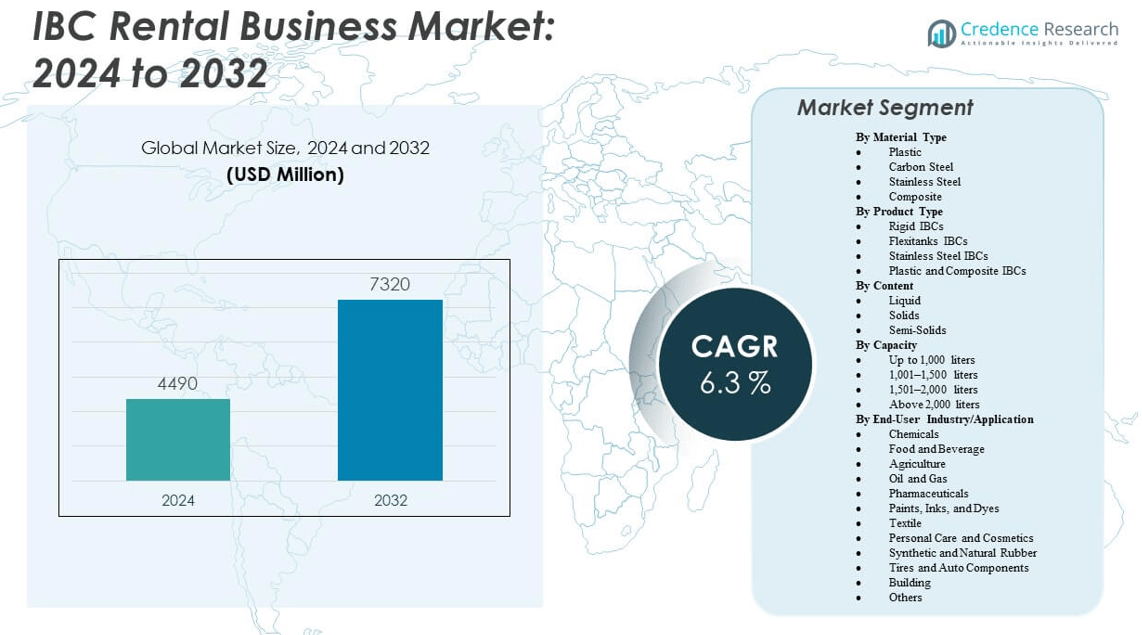

The IBC Rental Business Market is projected to grow from USD 4,490 million in 2024 to an estimated USD 7,320 million by 2032, with a compound annual growth rate (CAGR) of 6.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| IBC Rental Business Market Size 2024 |

USD 4,490 million |

| IBC Rental Business Market, CAGR |

6.3% |

| IBC Rental Business Market Size 2032 |

USD 7,320 million |

This market is experiencing robust growth due to the increasing demand for cost-effective, flexible, and sustainable packaging solutions across industries such as chemicals, food and beverage, pharmaceuticals, and oil and gas. Companies are shifting toward rental services to reduce capital expenditure and avoid maintenance burdens associated with container ownership. The rising awareness of environmental sustainability, coupled with stricter regulations around reusable packaging and hazardous goods transportation, is further accelerating the adoption of IBC rentals. Continuous innovations in IBC tracking, cleaning, and reverse logistics are also strengthening market confidence among users.

Geographically, North America and Europe are leading the IBC rental business market, supported by their mature logistics infrastructure, well-regulated industrial frameworks, and high awareness of sustainable practices. The United States, Germany, and the UK show strong adoption across manufacturing and chemical sectors. Meanwhile, Asia-Pacific is emerging as a key growth region, driven by industrial expansion and export activity in countries like China, India, and Southeast Asian nations. Rapid urbanization, growing industrial output, and increased cross-border trade have created favorable conditions for rental-based IBC deployment across the region.

Market Insights:

- The IBC Rental Business Market was valued at USD 4,490 million in 2024 and is projected to reach USD 7,320 million by 2032, growing at a CAGR of 6.3%.

- Demand is rising due to industries seeking cost-effective and flexible packaging solutions that eliminate ownership burdens.

- The push toward sustainability and circular economy models is encouraging the adoption of reusable IBC systems across various sectors.

- High upfront investment required to establish rental infrastructure and cleaning facilities acts as a barrier for new entrants.

- Regulatory differences across regions complicate cross-border operations, especially for food-grade and hazardous material compliance.

- North America leads the market with 35% share, followed by Europe at 30%, driven by mature industries and strong sustainability mandates.

- Asia-Pacific is emerging as the fastest-growing region due to expanding manufacturing, trade activity, and demand for scalable logistics solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Focus on Cost Efficiency and Asset-Light Models in Industrial Supply Chains

Industries are increasingly shifting toward rental-based packaging to reduce upfront capital investments and maintenance costs. The IBC Rental Business Market benefits from this trend, with businesses preferring asset-light models for operational agility. Renting eliminates the need for long-term storage, cleaning, and compliance overheads, especially for companies operating in multiple geographies. This model also supports lean inventory strategies by reducing container idling time. Logistics providers find it easier to scale operations without owning large fleets of containers. The IBC Rental Business Market gains traction in sectors where temporary usage patterns dominate. The flexibility of rentals aligns well with seasonal or project-based demand surges. It offers a predictable cost structure and avoids hidden costs of container damage or underutilization.

Expansion of Global Trade and Cross-Border Transportation Regulations

The rising complexity of international trade logistics has strengthened the need for standardized, compliant, and trackable containers. The IBC Rental Business Market meets these requirements by offering UN-certified and ISO-compliant IBCs that ease regulatory navigation. With growing scrutiny on the movement of hazardous and food-grade materials, rental providers offer containers with regular inspection and traceability. This compliance assurance is critical for sectors like chemicals, pharmaceuticals, and food processing. It reduces the liability risk for clients while enhancing their brand reputation. The ability to provide documented cleaning histories and safety certifications adds to market value. Cross-border trade continues to accelerate, especially in Asia-Pacific and Europe. This drives greater demand for agile and regulation-ready IBC rental solutions.

- For example, SCHÄFER Container Systems offers UN-certified and ISO-compliant stainless steel IBCs, approved for hazardous materials and international transport. These containers meet global regulations such as ADR and are widely used by exporters in the chemical and pharmaceutical sectors for cross-border logistics.

Emphasis on Sustainability and Reusable Packaging Systems

Sustainability has become a key decision driver in industrial procurement, encouraging the adoption of circular economy models. The IBC Rental Business Market supports this shift by enabling packaging reuse, minimizing waste generation, and reducing CO₂ emissions. Renting IBCs reduces single-use packaging and supports a closed-loop supply chain. Manufacturers and distributors are aligning with ESG goals and prefer vendors with strong sustainability credentials. Rental providers ensure containers are refurbished, cleaned, and reused under controlled conditions. This eco-centric model appeals to multinational corporations subject to environmental reporting obligations. The demand for greener logistics solutions continues to grow across chemicals, food, and oil & gas sectors. The rental ecosystem is now positioned as a sustainable logistics enabler.

- For example, CHEP, a global leader in pooled packaging solutions, promotes a circular model where reusable IBCs are maintained, cleaned, and redeployed across supply chains to reduce waste and carbon emissions. The company supports sustainability goals through life cycle assessments and collaborative programs that replace single-use containers with shared, trackable alternatives.

Adoption of Smart Technologies for IBC Fleet Management and Tracking

Digital transformation in logistics has opened doors for smart tracking and remote monitoring of rented containers. The IBC Rental Business Market has embraced RFID, GPS, and IoT-based solutions to offer real-time visibility of container location, condition, and usage. These technologies enable predictive maintenance and theft reduction. Clients benefit from improved asset utilization, data-driven decision-making, and reduced turnaround times. Rental providers can optimize container flows and reduce underperformance through data analytics. This tech-enabled efficiency builds trust among customers with high-value or sensitive cargo. It also supports automated compliance tracking and seamless integration with warehouse management systems. The IBC Rental Business Market gains a competitive edge by integrating smart logistics capabilities into its offerings.

Market Trends:

Shift Toward Customization and Application-Specific Container Solutions

Clients are seeking IBCs tailored to specific product needs, including temperature-sensitive goods or corrosive chemicals. The IBC Rental Business Market is responding by offering container variants with application-specific features such as insulation, corrosion resistance, or food-grade certification. Rental providers now segment their fleets based on vertical use cases. This allows better targeting of industries like pharmaceuticals, specialty chemicals, and dairy. Customization improves container performance and enhances product safety during transit. It also ensures regulatory compliance for different material classes. This trend has led to collaborative product development between rental firms and end-users. The market is gradually shifting from one-size-fits-all to fit-for-purpose rental models.

- For instance, SCHÄFER Container Systems manufactures heatable IBCs with insulation and integrated heating capabilities up to 120°C, ideal for food, chemical, and pharmaceutical applications. UCON IBC offers stainless steel containers rated for up to 260°C, with optional thermal insulation for extreme conditions. Hoover Ferguson supplies food-grade IBCs featuring sanitary ferrule fittings, weld finishes, and contamination-resistant liners tailored for regulated sectors.

Expansion of Rental Services into Emerging Economies and Industrial Clusters

The IBC Rental Business Market is witnessing strong expansion into rapidly industrializing regions like Southeast Asia, Latin America, and Eastern Europe. These markets present growing demand for affordable and scalable bulk packaging solutions. Rental providers are establishing service hubs in key export and industrial zones. This decentralization reduces delivery time and enhances service efficiency. Manufacturers in emerging economies prefer rentals to avoid capital lock-in. Governments in these regions are investing in export infrastructure, indirectly supporting rental demand. The availability of localized support and cleaning facilities is improving customer confidence. These developments position rentals as an enabler of industrial growth in cost-sensitive economies.

Integration of Circular Economy Principles in Rental Contract Structures

Circularity is not just about reuse—it also reflects in how contracts and service models are structured. The IBC Rental Business Market is evolving to offer closed-loop systems where providers take full responsibility for cleaning, inspection, and reconditioning. Contractual models now include performance guarantees, lifecycle tracking, and end-of-life recycling commitments. This aligns with clients’ sustainability KPIs. Rental firms are also engaging in take-back programs to ensure circularity. These models provide transparency into environmental impact and offer reporting dashboards. Clients use this data to meet their internal ESG goals. This evolving trend turns IBC rentals into a strategic sustainability solution, not just a logistics utility.

Growing Collaboration Between IBC Rental Firms and Third-Party Logistics Providers (3PLs)

To increase service coverage and scalability, IBC rental companies are partnering with logistics providers and supply chain integrators. The IBC Rental Business Market leverages these partnerships to offer bundled services that include warehousing, tracking, and reverse logistics. Such collaboration improves asset utilization across broader transport networks. It also enables better container pooling and reduces repositioning costs. Clients benefit from unified invoicing and service accountability. These alliances also facilitate expansion into new geographies without heavy capital investment. Rental firms can now operate more flexibly, scaling up or down based on regional demand. This collaborative trend enhances service speed, reliability, and cross-border capabilities.

- For instance, market leader Goodpack partners with global logistics networks to provide pooled metal IBC rental solutions, integrating tracking with transport and warehousing on a unified digital dashboard. Hoover Ferguson reports leveraging these collaborations to offer predictive fleet repositioning, consolidated invoicing, and cross-border supply assurance without fixed asset investments

Market Challenges Analysis:

Complexities in Reverse Logistics and Cleaning Infrastructure Across Geographies

Reverse logistics remains one of the major hurdles in the IBC Rental Business Market, particularly in regions lacking established infrastructure. Returning used containers for cleaning and redeployment demands coordination, cost efficiency, and compliance with local regulations. It often leads to delays and increased turnaround times, especially in remote or developing markets. Cleaning standards also vary by country, complicating quality consistency. Establishing or outsourcing cleaning hubs increases overhead costs. If not managed efficiently, the delays impact asset availability and customer satisfaction. It also adds complexity when tracking hygiene history for food-grade or hazardous material containers. The IBC Rental Business Market must balance cost control with operational compliance in a geographically dispersed environment.

Regulatory Variability and Certification Requirements Across End-Use Industries

Each industry imposes its own regulatory requirements, making it difficult to standardize IBC rental solutions across sectors. The IBC Rental Business Market faces challenges meeting the unique compliance needs of industries such as pharmaceuticals, chemicals, and food processing. Certification needs, labeling formats, and transport laws often differ, even within the same region. Staying updated with changing laws and maintaining container readiness adds significant administrative burden. A lack of harmonized global standards hinders cross-border scalability. This regulatory fragmentation may slow adoption or create barriers to entry in highly controlled industries. It limits the ability of rental firms to offer universally applicable solutions across their global fleets.

Market Opportunities:

Expansion into Niche Applications and High-Value Product Segments

The IBC Rental Business Market has an opportunity to diversify into specialized application areas such as biotechnology, fine chemicals, and premium beverages. These sectors require precision-engineered containers with strict compliance and traceability. By offering tailored solutions with advanced features, rental providers can capture high-margin opportunities. Clients in these segments value hygienic assurance, insulation, and contamination control. Targeting these industries increases rental frequency and lengthens contract durations. It also builds deeper client relationships through technical collaboration. This expansion into niche domains positions the rental model as a strategic service partner rather than a transactional provider.

Digital Transformation of Rental Services Through Platform-Based Offerings

The digitalization of rental services opens up new growth avenues by improving user experience and operational efficiency. The IBC Rental Business Market can benefit from deploying online platforms that allow booking, tracking, and billing in real time. These platforms enable clients to monitor fleet health, optimize usage, and automate returns. Integration with ERP and logistics systems makes rentals more transparent and responsive. Predictive analytics help in proactive maintenance and demand forecasting. Digital service portals enhance customer engagement and streamline contract management. This shift toward smart rental ecosystems builds a competitive edge and attracts digital-first industrial clients.

Market Segmentation Analysis:

The IBC Rental Business Market is segmented by material type, product type, content, capacity, and end-user industry.

By material, plastic and composite IBCs dominate due to their lightweight nature, corrosion resistance, and cost-effectiveness. Stainless steel and carbon steel IBCs are preferred in high-risk environments such as pharmaceuticals and hazardous chemicals due to their durability and compliance with safety standards.

By product type, rigid IBCs lead the market, favored for their reusability and robust design in handling bulk liquids. Flexitanks IBCs are gaining traction in the logistics of food-grade and non-hazardous liquids.

- For example, Greif offers its GCUBE IBC range, featuring sturdy galvanized steel cages and liquid capacities tailored to industry standards, designed for repeated reuse and compliance with sustainable circular economy processes. The GCUBE PCR IBC incorporates post-consumer resin to reduce carbon footprint, while the GCUBE Flex version delivers aseptic liners for food and pharmaceutical use—ensuring both hygiene and reconditioning efficiency in global supply chains.

By content, liquid handling forms the largest share, with IBC rentals widely used in chemical, beverage, and oil industries. Solids and semi-solids also contribute, especially in agriculture and construction.

By Capacity-wise, IBCs in the range of 1,001–1,500 liters are most in demand due to their optimal balance between volume and mobility.

- For instance, SCHÄFER Container Systems offers stainless steel IBCs in the 1,200 L range, designed with frames that support stacking and certified for sea and rail transport (UN 31A/Y and ADR/RID/IMDG compliant). These containers serve sectors such as chemicals, food, and pharmaceuticals where meeting regulatory and logistical requirements is critical.

By End-user industries such as chemicals, food and beverage, and oil and gas drive the bulk of market demand, while pharmaceuticals and personal care products show rising adoption for hygienic and traceable container solutions. The IBC Rental Business Market supports operational flexibility across all these segments.

Segmentation:

By Material Type

- Plastic

- Carbon Steel

- Stainless Steel

- Composite

By Product Type

- Rigid IBCs

- Flexitanks IBCs

- Stainless Steel IBCs

- Plastic and Composite IBCs

By Content

- Liquid

- Solids

- Semi-Solids

By Capacity

- Up to 1,000 liters

- 1,001–1,500 liters

- 1,501–2,000 liters

- Above 2,000 liters

By End-User Industry/Application

- Chemicals

- Food and Beverage

- Agriculture

- Oil and Gas

- Pharmaceuticals

- Paints, Inks, and Dyes

- Textile

- Personal Care and Cosmetics

- Synthetic and Natural Rubber

- Tires and Auto Components

- Building

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America leads the IBC Rental Business Market with a market share of 35%, driven by its well-established chemical, pharmaceutical, and food processing industries. The United States accounts for the largest portion, supported by advanced logistics infrastructure, regulatory compliance, and strong focus on sustainable packaging. The presence of major rental providers and high adoption of asset-light models further reinforce regional dominance. Canada also contributes to growth through increased industrial exports and demand for reusable containers. The region’s technological maturity enables efficient tracking and return systems. High awareness of ESG goals and supply chain optimization strategies continues to support market expansion.

Europe holds the second-largest share at 30%, characterized by robust regulatory frameworks and rising circular economy initiatives. Countries such as Germany, France, and the UK demonstrate widespread adoption across chemicals, automotive, and beverage industries. The region’s strict environmental laws promote the use of reusable and rental-based IBCs. EU regulations on packaging waste and safety compliance strengthen the rental model’s appeal. Service providers in Europe focus on container reconditioning, cleaning facilities, and real-time tracking, making the model viable across borders. It benefits from a mature network of logistics partners and supportive industrial policies.

Asia-Pacific accounts for 25% of the IBC Rental Business Market and is expected to grow at the fastest rate. The region’s growth is fueled by rapid industrialization, urbanization, and the expansion of manufacturing sectors in China, India, and Southeast Asia. Export-oriented economies and increasing cross-border trade volumes boost the demand for flexible and cost-effective container solutions. Rental models appeal to businesses in emerging markets that seek scalability without high capital expenditure. Market players are investing in regional hubs and cleaning stations to meet rising demand. With evolving infrastructure and regulatory support, Asia-Pacific presents high potential for long-term market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Brambles Ltd (CHEP)

- Goodpack Ltd

- Hoover Ferguson Group, Inc.

- SCHÜTZ Container Systems

- TPS Rental Systems Ltd

- Envirotainer AB

- HOYER GmbH

- Precision IBC, Inc.

- METANO IBC Services, Inc.

- Arlington Packaging (Rental) Limited

- Schoeller Allibert B.V.

- Thielmann

- Mauser Packaging Solutions

- Greif, Inc.

- Arena Products Inc.

Competitive Analysis:

The IBC Rental Business Market is highly competitive, with global and regional players focusing on service innovation, fleet expansion, and digital integration. Leading companies emphasize advanced tracking technologies, container customization, and sustainable cleaning solutions to gain an edge. Strategic partnerships with logistics providers and end-use industries enhance service reach and operational efficiency. Key players invest in expanding their geographic footprint through local hubs and reconditioning facilities to improve turnaround times. Mergers and acquisitions are common strategies to strengthen market share and broaden service portfolios. It continues to see strong competition from both established rental providers and new entrants targeting niche applications. Customer loyalty is driven by reliability, container quality, and cost-effective service models. Competitive intensity is expected to increase as demand for reusable and sustainable packaging grows across industries.

Recent Developments:

- In July 2025, the HOYER Group signed a contract with H2 MOBILITY to provide hydrogen logistics services for Germany’s largest operator of hydrogen refueling stations. This contract is in line with HOYER’s newly launched strategy, aiming to expand core markets and deliver advanced, sustainable logistics solutions through 2027.

- In February 2025, Brambles Ltd (CHEP) delivered its half-year results, highlighting operational excellence, network optimization, and enhanced customer experience driven by continued investments in innovation, pallet quality, and service. The company reported 4% sales revenue growth, with new digital solutions launched for commercial and proactive customer engagement optimization.

- In Aug 2024, SCHÜTZ Container Systems is completing construction of its largest North American facility—a $35 million, 371,000-sq-ft plant in Kenosha, Wisconsin, focused on IBC manufacturing. SCHÜTZ also secured approval to build two more plants in the area, expanding its local production of IBCs, drums, and steel components, with a combined property value near $100 million. These projects mark a significant growth in SCHÜTZ’s U.S. manufacturing capabilities.

Market Concentration & Characteristics:

The IBC Rental Business Market exhibits a moderate to high level of concentration, with a few global companies controlling significant market share. These players dominate due to extensive fleets, established infrastructure, and expertise in compliance management. It is characterized by high capital requirements for container acquisition, cleaning stations, and logistics support, which pose barriers to entry for smaller firms. Service quality, container durability, and adherence to regulatory standards are key differentiators among competitors. The market places strong emphasis on sustainability and circular economy principles, favoring companies with advanced reconditioning and tracking capabilities. Growth opportunities lie in specialized sectors where customization and reliable service are crucial.

Report Coverage:

The research report offers an in-depth analysis based on material type, product type, content, capacity, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The IBC Rental Business Market is expected to benefit from the accelerating shift toward circular economy models across global supply chains.

- Demand for outsourced container solutions will rise as manufacturers aim to reduce capital expenditure and operational complexity.

- Growth in the global chemical and pharmaceutical sectors will create steady demand for compliant, reusable IBC systems.

- Technological integration, including IoT and smart tracking, will enhance fleet visibility and customer service performance.

- Expansion of export activities in emerging economies will drive demand for scalable and standardized rental container services.

- Increasing regulatory pressure on single-use packaging will strengthen the market’s position in sustainable logistics.

- Rental providers will invest in regional cleaning and reconditioning hubs to improve container turnaround times and local responsiveness.

- Strategic collaborations between IBC rental firms and third-party logistics providers will expand service portfolios and operational reach.

- Market consolidation may intensify as larger players acquire niche providers to enter specialized application segments.

- Digital platforms offering real-time booking, tracking, and analytics will transform customer experience and operational efficiency.