Market Overview:

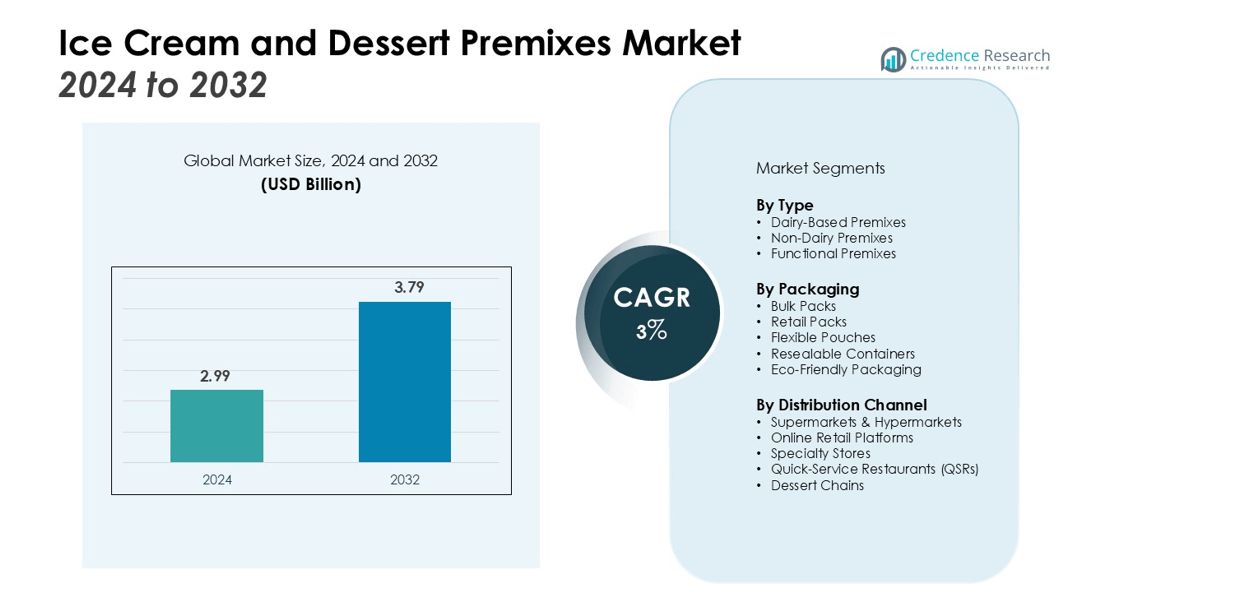

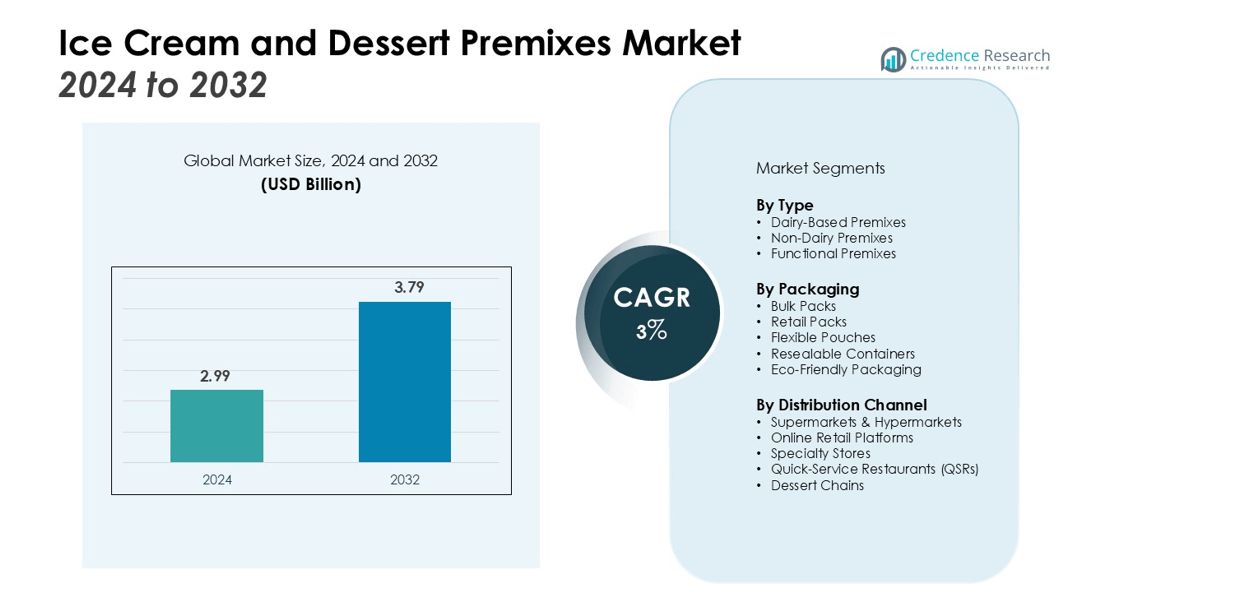

The Ice Cream and Dessert Premixes Market size was valued at USD 2.99 billion in 2024 and is anticipated to reach USD 3.79 billion by 2032, at a CAGR of 3 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ice Cream and Dessert Premixes Market Size 2024 |

USD 2.99 billion |

| Ice Cream and Dessert Premixes Market, CAGR |

3% |

| Ice Cream and Dessert Premixes Market Size 2032 |

USD 3.79 billion |

Key drivers of the market include increasing demand for premium ice cream and indulgent dessert products. Health-conscious consumers are further shaping product innovation, with manufacturers investing in plant-based, low-fat, and clean-label premixes. The expanding presence of quick-service restaurants (QSRs), dessert chains, and online delivery platforms continues to accelerate adoption, as premixes and stabilizers ensure consistency, extended shelf life, and operational efficiency across diverse sales channels. Growing collaborations between food manufacturers and ingredient suppliers are also boosting innovation and accelerating market penetration.

Regionally, North America holds the largest share of the Ice Cream and Dessert Premixes Market, supported by strong consumer demand for frozen desserts and ongoing product innovation. Europe follows, benefiting from strict food quality standards and growing preference for natural stabilizers. Asia-Pacific is projected to register the fastest growth, fueled by urbanization, rising disposable incomes, and expanding organized retail networks. Investments in cold chain infrastructure further strengthen market opportunities in developing economies. Rising consumer experimentation with global dessert flavors is also contributing to regional market expansion.

Market Insights:

- The Ice Cream and Dessert Premixes Market is projected to expand steadily, supported by a CAGR of 3%.

- Premium and indulgent dessert demand is driving growth, encouraging new product development and differentiation.

- Rising focus on plant-based, low-fat, and clean-label premixes aligns with health-conscious consumer preferences.

- Quick-service restaurants, dessert chains, and online platforms are accelerating adoption of standardized premixes.

- Fluctuating raw material costs and regulatory compliance remain key challenges for global manufacturers.

- North America leads with 38% share, Europe follows at 29%, while Asia-Pacific grows fastest at 24%.

- Cold chain infrastructure and digital retail expansion in emerging economies are creating significant opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Demand for Premium and Indulgent Desserts

The Ice Cream and Dessert Premixes Market is strongly driven by growing consumer preference for premium and indulgent products. Customers are seeking richer flavors, unique textures, and innovative recipes that deliver a superior experience. This demand encourages manufacturers to introduce high-quality premixes that cater to evolving tastes. It creates consistent opportunities for product differentiation and brand loyalty across global markets.

- For instance, Häagen-Dazs builds its premium reputation on a simple recipe, using only 5 ingredients for its classic vanilla ice cream: cream, milk, sugar, eggs, and vanilla.

Growing Focus on Health-Conscious and Clean-Label Products

Health awareness is reshaping the Ice Cream and Dessert Premixes Market, with consumers prioritizing low-fat, plant-based, and clean-label options. Manufacturers are reformulating premixes to exclude artificial additives while enhancing nutritional value. It drives the adoption of natural stabilizers and functional ingredients that appeal to a broader customer base. The shift aligns with regulatory trends emphasizing transparency in labeling and ingredient sourcing.

Expansion of Quick-Service Restaurants and Online Delivery Channels

The rapid expansion of QSRs, specialty dessert chains, and e-commerce platforms significantly supports market growth. The Ice Cream and Dessert Premixes Market benefits from premixes that provide operational efficiency, consistency, and ease of preparation for large-scale outlets. It allows businesses to maintain standardized product quality across multiple locations. The increasing reliance on online food delivery also boosts demand for ready-to-use solutions.

- For instance, the Taylor Company is a primary supplier of soft-serve machines for major QSR chains, with its equipment capable of dispensing over 100 cones per hour to meet high-volume demand.

Investments in Innovation and Cold Chain Infrastructure

Continuous investments in research and infrastructure are propelling the Ice Cream and Dessert Premixes Market forward. Companies are developing advanced stabilizers and tailored premix solutions to improve taste, shelf life, and performance. It ensures alignment with changing consumer expectations while supporting global distribution. Expanding cold chain infrastructure in emerging markets strengthens the supply network and enables year-round availability of high-quality products.

Market Trends:

Innovation in Plant-Based, Functional, and Clean-Label Formulations

The Ice Cream and Dessert Premixes Market is witnessing a clear shift toward plant-based, functional, and clean-label product innovations. Manufacturers are increasingly focusing on natural stabilizers, reduced sugar, and low-fat options to appeal to health-conscious consumers. It reflects the rising demand for dairy-free and vegan alternatives that align with global dietary preferences. Functional premixes enriched with probiotics, proteins, or added nutrients are gaining traction among consumers seeking indulgence without compromising wellness. Clean-label offerings also strengthen brand credibility, especially in regions with strict regulatory frameworks. This trend continues to shape competitive strategies, driving research and new product launches.

- For instance, Ben & Jerry’s has improved its non-dairy line by reformulating its 19 vegan ice cream flavors with a new sunflower butter base for a smoother texture.

Digital Integration and Expansion Across Global Retail Channels

Digitalization and retail transformation are reshaping growth opportunities in the Ice Cream and Dessert Premixes Market. The surge in e-commerce platforms and online delivery services is making premixes more accessible to a wider consumer base. It enables manufacturers to strengthen direct-to-consumer channels while expanding distribution in organized retail formats. Quick-service restaurants and dessert chains are also adopting premixes to maintain consistency and reduce operational complexities. International brands are collaborating with regional players to introduce innovative dessert flavors and formats tailored to local tastes. This integration of digital platforms and diversified retail channels is reinforcing global market penetration and accelerating consumer adoption.

- For instance, Nestlé is advancing its digital marketing by creating “digital twins” of its products for virtual use, with a goal to convert 10,000 products into these virtual models for streamlined content creation.

Market Challenges Analysis:

Fluctuating Raw Material Costs and Supply Chain Constraints

The Ice Cream and Dessert Premixes Market faces challenges due to fluctuating prices of dairy ingredients, stabilizers, and natural additives. Rising costs of high-quality raw materials create pressure on manufacturers to balance pricing and profitability. It becomes more complex when supply chain disruptions limit consistent access to essential inputs. Seasonal variations in milk supply and global trade restrictions further intensify volatility. Companies must invest in sourcing strategies and supplier diversification to reduce risk and maintain stability in production. These constraints influence product availability and hinder consistent growth across regions.

Regulatory Compliance and Shifting Consumer Preferences

Regulatory frameworks surrounding food safety, labeling, and permissible additives present another challenge in the Ice Cream and Dessert Premixes Market. Compliance with regional standards increases operational complexity for global manufacturers. It demands constant monitoring of formulation practices and ingredient sourcing to avoid non-compliance risks. At the same time, shifting consumer preferences toward clean-label and allergen-free products require frequent reformulation of existing premixes. This dual pressure of regulation and evolving demand increases R&D costs while slowing down product innovation cycles. Companies must strike a balance between compliance, consumer satisfaction, and operational efficiency to remain competitive.

Market Opportunities:

Expansion into Plant-Based, Functional, and Premium Segments

The Ice Cream and Dessert Premixes Market presents strong opportunities through the expansion of plant-based, functional, and premium product segments. Rising consumer preference for dairy-free, vegan, and low-sugar desserts creates space for innovative formulations. It enables manufacturers to introduce premixes with added health benefits such as probiotics, proteins, and natural fortification. Premiumization of desserts with unique flavors and high-quality ingredients further enhances brand positioning. The increasing willingness of consumers to pay for indulgence and wellness-oriented offerings supports sustainable growth. Companies investing in R&D and product differentiation can secure a competitive edge in this evolving segment.

Growth Potential in Emerging Economies and Digital Distribution

Rapid urbanization, rising disposable incomes, and expanding middle-class populations create growth opportunities in emerging economies. The Ice Cream and Dessert Premixes Market is set to benefit from the expansion of organized retail, QSR chains, and digital platforms in Asia-Pacific, Latin America, and the Middle East. It allows manufacturers to strengthen direct-to-consumer channels while diversifying regional portfolios. Cold chain infrastructure development further supports distribution and ensures product quality in warmer climates. The adoption of e-commerce platforms for frozen and ready-to-mix products enhances accessibility and consumer reach. Companies leveraging digital channels and regional partnerships can accelerate market penetration in high-growth regions.

Market Segmentation Analysis:

By Type

The Ice Cream and Dessert Premixes Market is segmented by type into dairy-based, non-dairy, and functional premixes. Dairy-based premixes continue to hold a strong share due to their widespread use in traditional ice cream and desserts. Non-dairy premixes are gaining traction with the rise of vegan and lactose-intolerant consumers. Functional premixes enriched with proteins, probiotics, and reduced-sugar formulations are creating new growth opportunities. It is driving manufacturers to expand offerings that meet both indulgence and health needs.

By Packaging

Packaging plays a vital role in market performance, with bulk packs dominating due to high demand from quick-service restaurants and dessert chains. Retail-sized packs are steadily growing with rising consumer adoption of at-home dessert preparation. Sustainable and eco-friendly packaging solutions are gaining importance as regulations and consumer expectations shift toward reducing environmental impact. Flexible pouches and resealable containers are also becoming popular for ease of use and longer shelf life. It supports efficiency for both commercial and household applications.

- For instance, Tetra Pak has developed the world’s highest capacity ice cream extrusion line, capable of producing up to 43,200 ice cream products per hour, enhancing production efficiency for large-scale manufacturers.

By Distribution Channel

Distribution in the Ice Cream and Dessert Premixes Market is largely driven by supermarkets and hypermarkets, which offer wide product visibility and accessibility. Online retail platforms are expanding rapidly, driven by growing consumer preference for convenience and doorstep delivery. Specialty stores and dessert chains also contribute significantly, especially in urban centers. It strengthens the multi-channel presence of brands, ensuring consistent availability across regions. Strategic partnerships with retailers and digital platforms are further enhancing consumer reach and adoption.

- For instance, New York-based premium mochi brand Mochidoki expanded its retail footprint by launching in 40 Amazon Fresh delivery regions, making its products available to a significantly larger customer base.

Segmentations:

By Type

- Dairy-Based Premixes

- Non-Dairy Premixes

- Functional Premixes

By Packaging

- Bulk Packs

- Retail Packs

- Flexible Pouches

- Resealable Containers

- Eco-Friendly Packaging

By Distribution Channel

- Supermarkets & Hypermarkets

- Online Retail Platforms

- Specialty Stores

- Quick-Service Restaurants (QSRs)

- Dessert Chains

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Strong Market Presence in North America

North America accounts for 38% of the Ice Cream and Dessert Premixes Market, leading globally. The region’s dominance is supported by strong consumer demand for frozen desserts and high purchasing power. It benefits from the presence of established quick-service restaurants, dessert chains, and organized retail networks. Innovation in clean-label and plant-based formulations further strengthens consumer adoption. Continuous investment in product development and marketing campaigns ensures sustained leadership in this region.

Steady Growth in Europe with Focus on Quality and Sustainability

Europe holds 29% of the Ice Cream and Dessert Premixes Market, maintaining a strong position. The region emphasizes clean-label formulations and compliance with strict food safety regulations. It also reflects rising demand for sustainable and environmentally friendly ingredient sourcing. Growth is reinforced by the expansion of specialty dessert chains and increased popularity of artisanal and premium offerings. European manufacturers are leveraging innovation in functional and reduced-sugar premixes to cater to health-conscious consumers while maintaining product authenticity.

Rapid Expansion Across Asia-Pacific and Emerging Economies

Asia-Pacific represents 24% of the Ice Cream and Dessert Premixes Market and is expected to grow fastest. Large populations in China, India, and Southeast Asia drive significant consumption potential. It benefits from growing penetration of organized retail, quick-service restaurants, and online delivery platforms. Investments in cold chain infrastructure and product distribution are expanding market accessibility. Emerging economies in Latin America and the Middle East also present new opportunities with digital platforms and modern retail formats supporting broader adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Glanbia Nutritionals

- Ashland Global Holdings

- Kerry Group

- Cargill

- Chemelco International

- DuPont Nutrition & Biosciences

- Nexira

- Fuerst Day Lawson

- Gum Technology

- Hindustan Gum

- Ingredion Incorporated

Competitive Analysis:

The Ice Cream and Dessert Premixes Market is characterized by strong competition among global and regional players focusing on product innovation, distribution expansion, and brand positioning. Leading companies are investing in research to develop plant-based, low-sugar, and clean-label premixes that meet evolving consumer preferences. It is driving advancements in functional ingredients, sustainable packaging, and extended shelf-life solutions. Strategic partnerships with quick-service restaurants, dessert chains, and e-commerce platforms are strengthening market reach and visibility. Regional players are leveraging local supply chains and flavor customization to enhance competitiveness against multinational brands. Continuous mergers, acquisitions, and product launches are shaping the industry landscape, with companies aiming to capture diverse consumer segments while improving operational efficiency.

Recent Developments:

- In July 2025, Cargill announced significant upgrades to its cocoa supply chain with the goal of reducing carbon emissions and eliminating waste in its operations stretching from West Africa to Europe.

- In August 2025, Glanbia Nutritionals highlighted the launch of ISOPURE Protein Water in Costco stores as part of its first-half 2025 update.

Report Coverage:

The research report offers an in-depth analysis based on Type, Packaging, Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Ice Cream and Dessert Premixes Market will expand with rising demand for premium and indulgent desserts.

- Plant-based and dairy-free premixes will gain stronger acceptance among health-conscious and vegan consumers.

- Functional premixes enriched with proteins, probiotics, and reduced sugar will shape new product launches.

- Clean-label and natural stabilizers will remain a priority to meet regulatory and consumer expectations.

- Quick-service restaurants and dessert chains will continue to drive bulk demand for standardized products.

- Online retail and e-commerce platforms will accelerate growth by improving accessibility and convenience.

- Sustainable and eco-friendly packaging innovations will become key differentiators for leading brands.

- Emerging economies in Asia-Pacific, Latin America, and the Middle East will present high growth opportunities.

- Cold chain infrastructure investments will strengthen supply networks and improve product availability worldwide.

- Strategic collaborations between global and regional players will enhance innovation and expand market penetration.