Market Overview

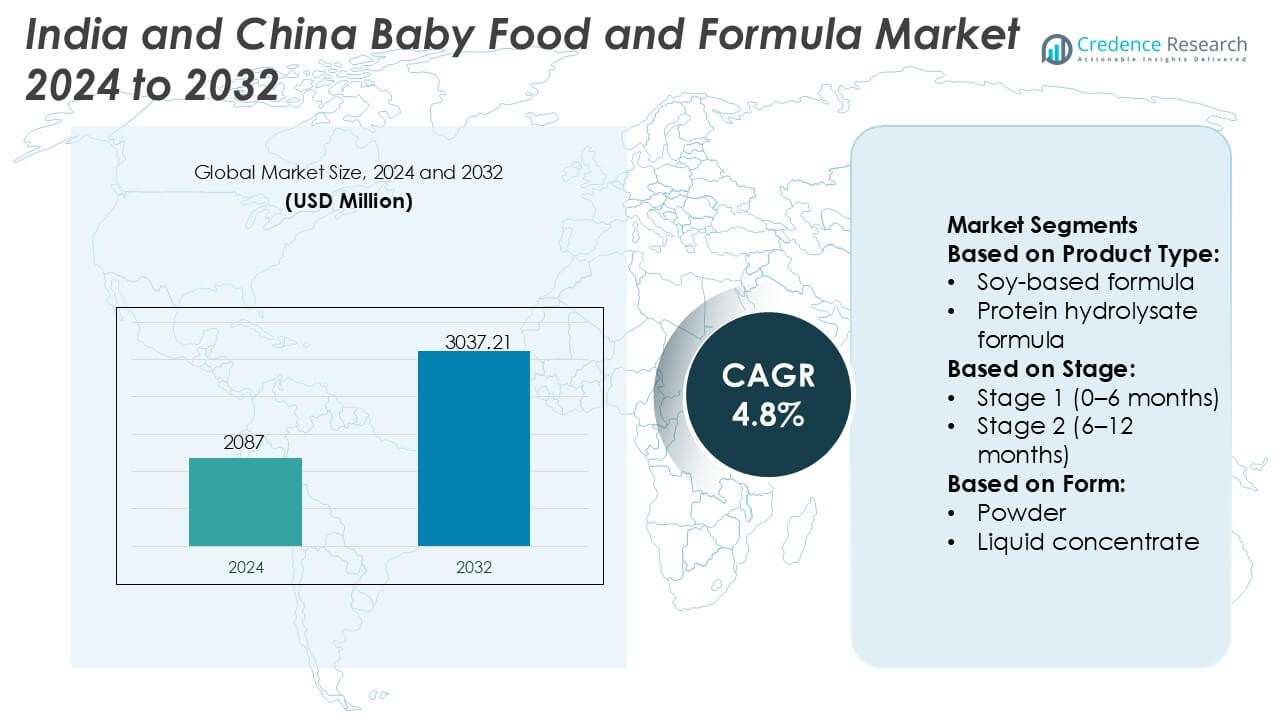

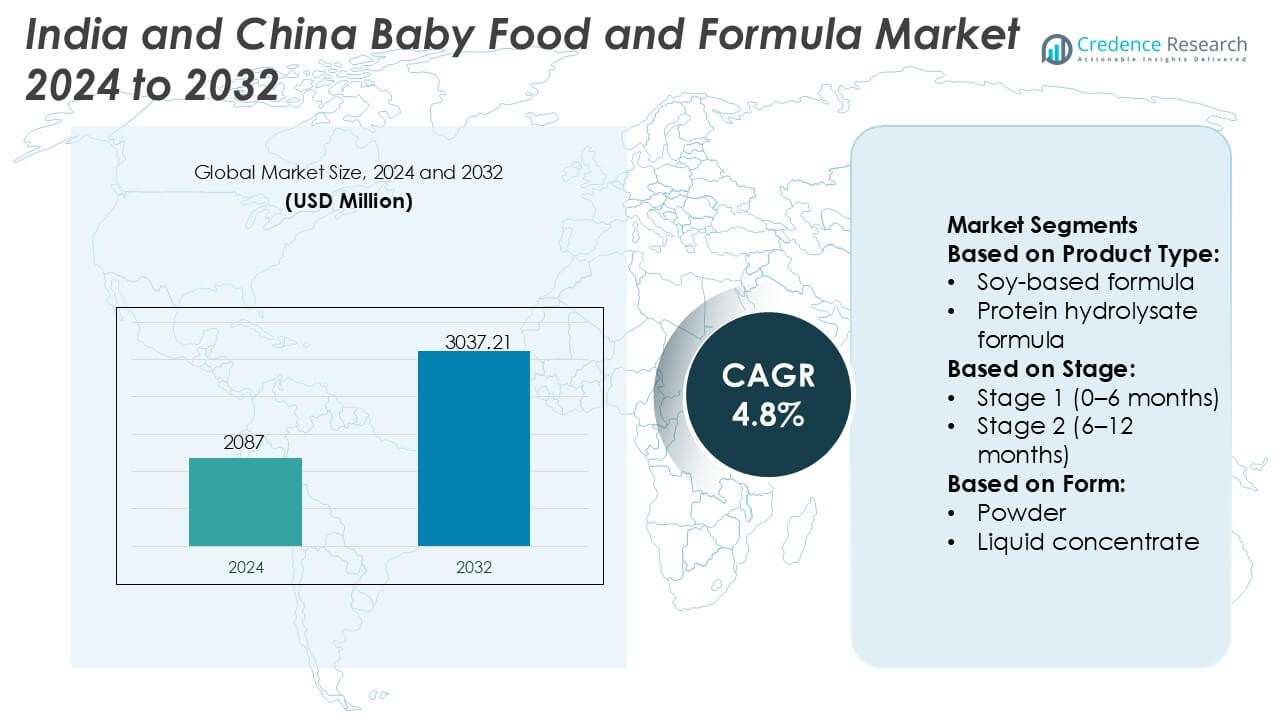

India and China Baby Food and Formula Market size was valued USD 2087 million in 2024 and is anticipated to reach USD 3037.21 million by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India and China Baby Food and Formula Market Size 2024 |

USD 2087 Million |

| India and China Baby Food and Formula Market, CAGR |

4.8% |

| India and China Baby Food and Formula Market Size 2032 |

USD 3037.21 Million |

The India and China Baby Food and Formula Market feature a mix of multinational and regional manufacturers that strengthen their competitive positions through expanded product portfolios, fortified formulations, and investments in localized production capabilities. Companies focus on enhancing nutritional density, improving supply-chain agility, and tailoring SKUs to evolving consumer preferences across urban and semi-urban areas. Innovation in organic, hypoallergenic, and stage-specific formulas supports broader market penetration, while digital retail channels accelerate brand reach among young parents. China stands as the leading region with an exact 58% market share, driven by higher per-capita spending, premiumization trends, and strong adoption of advanced infant nutrition products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 2087 million in 2024 and is projected to hit USD 3037.21 million by 2032, registering a 4.8% CAGR during the forecast period.

- Rising demand for fortified, organic, and stage-specific formulas drives adoption, supported by higher nutrition awareness and increased spending among young parents in both countries.

- Rapid growth of e-commerce, premiumization, and digital brand engagement shapes market trends, with consumers shifting toward specialty SKUs that offer improved digestibility and targeted nutrition.

- Competitive intensity strengthens as multinational and regional players expand localized production, but supply-chain constraints and price sensitivity in rural belts act as restraints for premium products.

- China leads the regional landscape with an exact 58% share, while follow-on milk formulas hold the dominant segment share, reflecting strong uptake among working parents seeking convenient and nutritionally balanced feeding solutions.

Market Segmentation Analysis:

By Product Type

Cow’s milk-based formula stands as the dominant product category, with standard cow’s milk formula holding an exact 42% market share across India and China. Its leadership stems from high pediatrician recommendation rates, wide retail availability, and strong consumer familiarity. Rising dual-income households and preference for nutritionally balanced alternatives strengthen demand. Specialty formulas such as lactose-free, anti-reflux, and amino acid-based variants gain traction among infants with medical sensitivities, while hydrolyzed and protein-modified formulas expand steadily due to increased diagnosis of early-life allergies and digestive intolerance.

- For instance, Bellamy’s Organic Infant Formula Stage 1 delivers approximately 1.4 g of protein, 7.8 mg of DHA, and 69 kcal per 100 mL of prepared feed, reflecting the company’s emphasis on certified organic, nutrient-rich formulations that meet stringent Australian food-safety and compositional standards.

By Stage

Within age-based nutrition stages, Stage 1 (0–6 months) remains the dominant sub-segment with an exact 38% market share, driven by high consumption frequency and medical guidance for early-life nutritional adequacy. Growth is reinforced by rising birth rates in select provinces of China and increasing institutional births in India that expose parents to professionally recommended feeding solutions. Stage 2 and Stage 3 formulas show accelerating uptake as parents shift toward fortified blends supporting immunity and brain development, while Stage 4 products see growing traction due to premium toddler nutrition positioning.

- For instance, Royal FrieslandCampina N.V.’s Friso Gold Stage 2 incorporates approximately 1.7 g of galacto-oligosaccharides (GOS) per 100 g of powder and includes approximately 120 mg of DHA per 100 g, reflecting the company’s investment in advanced nutrient structures designed to support gut health and early neurodevelopment.

By Form

Powdered formula dominates the form category, with an exact 64% market share, supported by affordability, long shelf life, and extensive SKU availability across both online and offline retail channels. Parents in India and China prefer powder formats for flexible portioning and cost-effective daily feeding. Liquid concentrate and ready-to-feed formats expand among urban consumers seeking convenience, especially in China’s tier-1 cities where time-compressed lifestyles raise demand for single-serve, sterile options. However, higher pricing and lower distribution penetration keep their adoption below powdered alternatives despite rising premiumization trends.

Key Growth Drivers

- Rising Urbanization and Growing Working-Parent Population

Urbanization in India and China accelerates the adoption of commercial baby food and formula as working parents seek convenient, nutritionally balanced feeding options. Expanding female workforce participation intensifies reliance on formula-supported feeding, particularly in nuclear households with limited caregiver assistance. Structured maternity programs in metros, wider daycare penetration, and improved maternal awareness shape stronger early-life nutrition choices. Expanding retail distribution and accessible e-commerce channels further support category growth, giving parents consistent access to certified, high-quality formula and packaged baby food solutions.

- For instance, Abbott’s Similac Pro-Advance incorporates 0.2 g/L of 2’-fucosyllactose (2’-FL HMO) and delivers approximately 0.076 mg of lutein per L in certain formulations, demonstrating the company’s application of bioactive components that support immune and visual development in infants.

- Strong Pediatrician Recommendation and Expanding Medical Nutrition Awareness

Pediatricians across India and China increasingly recommend scientifically formulated infant nutrition products, enhancing trust and accelerating category penetration. Awareness campaigns emphasizing balanced early-life nutrition influence parents to adopt standard and specialty formulas, particularly for infants with sensitivative digestive or allergic conditions. Hospitals and maternity clinics strengthen this shift by integrating nutritional counselling into postnatal programs. Growing acceptance of hydrolyzed, low-lactose, and fortified blends reflects rising confidence in clinically validated formulations that support immunity, cognitive development, and healthy growth during the first two years of life.

- For instance, Arla Foods amba’s Lacprodan® ALPHA-50 alpha-lactalbumin ingredient provides a minimum of 90% protein purity (of which 90% is alpha-lactalbumin) and generally offers a high content of essential amino acids like tryptophan and cysteine, evidencing the company’s advancement in infant-grade milk protein technology designed to meet strict medical nutrition standards.

- Premiumization and Shift Toward High-Quality, Clean-Label Nutrition

Consumers in both markets demonstrate stronger preference for premium, clean-label products, including organic, goat-milk-based, and specialty hypoallergenic formulas. Rising disposable incomes, especially in China’s urban clusters, reinforce willingness to pay more for high-quality ingredients, advanced formulations, and international brands. In India, aspirational buying behavior and influence from digital parenting communities accelerate adoption of fortified blends with DHA, probiotics, and immune-support nutrients. Companies capitalize on this shift by introducing value-added SKUs and transparent labeling that assure product safety, purity, and enhanced functional benefits.

Key Trends & Opportunities

- Expansion of E-Commerce and Direct-to-Consumer Nutrition Models

Digital platforms create significant growth opportunities in India and China, offering parents convenient access to authentic formula brands, auto-replenishment services, and personalized nutrition recommendations. Growing trust in online channels, driven by improved product authentication systems and influencer-led education, fuels rapid adoption of premium and specialty formulas. Subscription-based delivery models gain traction among urban parents seeking seamless availability. Enhanced digital visibility, targeted promotions, and curated product bundles strengthen cross-border consumption, particularly in China where imported infant nutrition brands maintain strong online demand.

- For instance, Nestlé’s NAN SupremePro formulation typically includes approximately 0.105 g/L (or 105 mg/L) of 2’-fucosyllactose (2’-FL HMO) and approximately 0.035 g/L (or 35 mg/L) of lacto-N-neotetraose (LNnT) in the prepared feed, demonstrating the company’s application of clinically researched oligosaccharides to support immunity and digestive health.

- Growing Demand for Specialty, Medical, and Condition-Specific Formulas

A notable trend involves rising adoption of specialty formulas addressing digestive sensitivities, lactose intolerance, and allergy management. Increased diagnosis of cow’s milk protein allergy and reflux conditions prompts parents to shift toward amino acid-based, hydrolyzed, and anti-reflux formulations. Healthcare providers increasingly integrate such products into tailored nutrition plans, expanding their clinical relevance. Manufacturers respond with innovation in protein hydrolysates, micronutrient-enriched blends, and gut-health additives. This trend creates high-value opportunities as parents prioritize medically aligned nutrition solutions for infants with specific dietary needs.

- For instance, Perrigo Company plc’s hypoallergenic infant formula incorporates 100% extensively hydrolyzed casein protein and provides 17 mg of DHA per 100 kcal (which is approximately 90 mg of DHA per 100 g of powder), underscoring its focus on clinically supported solutions for infants requiring specialized nutrition.

- Advancing R&D and Introduction of Bio-Optimized and Organic Formulas

Companies in India and China invest in R&D to develop bio-optimized formulas that mimic human milk composition more closely. Growth accelerates in areas such as human-milk oligosaccharide (HMO) inclusion, probiotic enrichment, and organic-certified ingredient sourcing. Goat milk and plant-based formulations emerge as high-potential segments, particularly among consumers seeking gentler digestion and natural nutrition. Increasing regulatory approvals for organic and clean-label formulations further enable new product launches. These innovations enhance premium product portfolios and widen addressable demand across middle- and upper-income households.

Key Challenges

- Regulatory Complexity and Strict Compliance Requirements

Both India and China enforce stringent safety, labeling, and formulation regulations for infant nutrition products, creating compliance burdens for global and local manufacturers. Frequent revisions in compositional standards, import documentation rules, and mandatory quality checks extend product approval timelines. Cross-border brands face additional scrutiny on ingredient origins and nutritional claims, tightening operational flexibility. These regulatory demands increase market entry costs and slow innovation cycles, limiting smaller firms’ competitiveness. Ensuring consistent compliance across manufacturing, packaging, and distribution remains a major industry challenge.

- Competition from Breastfeeding Promotion and Cultural Preferences

Strong government and healthcare-led breastfeeding advocacy programs restrict the promotional scope for infant formulas, especially in early-stage segments. Cultural preference for homemade baby foods in India further restrains adoption of packaged alternatives among budget-sensitive and traditional households. In China, improving maternity benefits enable prolonged breastfeeding periods, reducing reliance on Stage 1 formulas. Misinformation concerns and emotional biases toward natural feeding also hinder penetration. To sustain growth, brands must emphasize scientific credibility, safety assurance, and functional nutrition benefits while complying with restrictive marketing regulations.

Regional Analysis

North America

North America holds an exact 23% market share, supported by high purchasing power, strong healthcare guidance, and widespread availability of premium infant nutrition products. Parents increasingly adopt organic, hypoallergenic, and HMO-enriched formulas due to rising awareness of early-life nutritional optimization. The region benefits from stringent regulatory standards that reinforce trust in product quality and safety. Growth intensifies through expanding e-commerce channels and subscription-based replenishment models that appeal to convenience-focused households. Although birth rates remain low, elevated per-child spending and strong adoption of specialty formulas continue to sustain market expansion.

Europe

Europe accounts for an exact 20% market share, driven by strong consumer preference for clean-label, organic, and sustainably sourced baby food and formula products. Strict regulatory frameworks under EFSA reinforce product quality, encouraging adoption of formulas with advanced nutritional compositions, including goat-milk-based and lactose-free options. Demand concentrates in Western European countries where premiumization and brand loyalty remain high. Eastern Europe exhibits steady uptake fueled by improving retail access and rising incomes. Environmental concerns and traceability requirements further shape innovation, enabling manufacturers to introduce eco-friendly packaging and responsibly sourced ingredient portfolios.

Asia-Pacific

Asia-Pacific dominates the global landscape with an exact 38% market share, led by strong consumption in China, India, Japan, and Southeast Asia. Rapid urbanization, increasing female workforce participation, and rising awareness of pediatric nutrition accelerate formula adoption across diverse income groups. Premium and specialty formulas gain traction as parents prioritize digestive comfort, immunity support, and cognitive development. E-commerce ecosystems in China and Southeast Asia significantly enhance access to imported and organic brands. Despite varying affordability constraints across the region, sustained economic growth and expanding healthcare guidance continue to reinforce market leadership.

Latin America

Latin America holds an exact 10% market share, characterized by growing adoption of infant formulas in urban centers and rising awareness of balanced early-life nutrition. Brazil and Mexico drive regional demand, supported by expanding modern retail networks and improved access to fortified formulas. Economic fluctuations temper consumption in some markets, yet increasing focus on infant health supports the uptake of premium and specialty products. Government programs promoting maternal and child nutrition further influence purchasing behavior. The rise of digital retail and locally adapted product lines strengthens availability, helping brands penetrate price-sensitive consumer segments.

Middle East & Africa

The Middle East & Africa region accounts for an exact 9% market share, driven by rising birth rates, expanding healthcare infrastructure, and growing acceptance of commercial infant nutrition solutions. Gulf countries lead demand due to higher disposable incomes and preference for imported premium formulas, including organic and goat-milk-based variants. In Africa, urbanization strengthens adoption, though affordability challenges persist in rural markets. Pediatric advocacy for balanced nutrition fuels uptake of iron-fortified and hypoallergenic formulas. Increasing modernization of retail channels and e-commerce penetration enhances access, supporting gradual but consistent market expansion across diverse income groups.

Market Segmentations:

By Product Type:

- Soy-based formula

- Protein hydrolysate formula

By Stage:

- Stage 1 (0–6 months)

- Stage 2 (6–12 months)

By Form:

- Powder

- Liquid concentrate

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape in the India and China Baby Food and Formula Market players such as Bellamy’s Organic, Royal FrieslandCampina N.V., Abbott, Arla Foods amba, Nestle S.A., Perrigo Company plc, Reckitt Benckiser Group plc, Yili Group, Danone SA, and The Kraft Heinz Company. The India and China Baby Food and Formula Market is defined by rapid product innovation, strong regulatory oversight, and increasing consumer preference for premium nutritional solutions. Companies compete through advancements in clean-label formulations, organic certification, hypoallergenic blends, and HMO-enriched products designed to replicate human milk composition. Expanding digital commerce ecosystems, particularly in China, intensify competition as brands leverage online channels for wider reach, authentication features, and targeted engagement with young parents. In India, competitive dynamics center on affordability, retail penetration, and trust-building through medical endorsements. Across both countries, continuous reformulation, sustainability initiatives, and investment in traceability technologies drive differentiation and strengthen long-term market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bellamy’s Organic

- Royal FrieslandCampina N.V.

- Abbott

- Arla Foods amba

- Nestle S.A.

- Perrigo Company plc

- Reckitt Benckiser Group plc

- Yili Group

- Danone SA

- The Kraft Heinz Company

Recent Developments

- In April 2025, Bobbie launched its Organic Whole Milk Infant Formula, the first USDA Organic whole milk formula made in America, following three years of R&D to provide a cleaner, European-standard formula with whole milk fat for easier digestion, supporting brain and gut health with MFGM and DHA, without palm oil, soy, or synthetic additives, becoming the brand’s fourth offering and earning top honors from Expert Consumers.

- In February 2025, Iceland Foods, in partnership with the charity Feed, launched new on-shelf labels for infant formula in the UK, making it the first retailer to provide evidence-based info to clarify that all first infant formulas are nutritionally equivalent, regardless of brand or price, tackling stigma and high costs for parents.

- In January 2025, the U.S. Food and Drug Administration (FDA) announced its Long-Term National Strategy to Increase the Resiliency of the U.S. Infant Formula Market building on earlier efforts to prevent another crisis like the shortage. This strategy focuses on improving information sharing, strengthening supply chain integrity, preventing contamination, and encouraging new manufacturers to boost supply, ensuring a steady, safe, and diversified infant formula market for vulnerable families.

- In October 2024, Nestlé India announced the launch of 14 new Cerelac baby food variants without added refined sugar, a direct response to global scrutiny from reports by Public Eye and IBFAN accusing the company of selling higher-sugar versions in developing nations compared to Europe.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift further toward premium, organic, and clean-label formulas as parents prioritize safer and purer nutrition options.

- Demand for specialty formulas will rise as diagnosis of digestive sensitivities, allergies, and lactose intolerance becomes more common.

- Digital retail channels will strengthen their influence as e-commerce and subscription models expand across urban centers.

- Human-milk-mimicking formulations with HMOs, probiotics, and advanced bioactive components will gain stronger consumer adoption.

- Localized product development will accelerate to address regional dietary patterns and culturally preferred feeding practices.

- Hospital partnerships and pediatric endorsements will play a larger role in shaping brand credibility and product preference.

- Ready-to-feed and convenience-oriented formats will see greater uptake among time-pressed urban parents.

- Sustainability initiatives will push manufacturers toward eco-friendly packaging and responsibly sourced ingredients.

- Cross-border and imported formulas will continue gaining traction in China, supported by trust in stringent quality standards.

- Companies will intensify investments in traceability, digital authentication, and safety assurance to strengthen consumer confidence.