| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Ceramic Sanitary Ware Market Size 2024 |

USD 3812 million |

| India Ceramic Sanitary Ware Market, CAGR |

4.30% |

| India Ceramic Sanitary Ware Market Size 2032 |

USD 5338.5 million |

Market Overview:

The India Ceramic Sanitary Ware Market is projected to grow from USD 3812 million in 2024 to an estimated USD 5338.5 million by 2032, with a compound annual growth rate (CAGR) of 4.30% from 2024 to 2032.

Several factors are propelling the growth of the ceramic sanitary ware market in India. The government’s initiatives, such as the Swachh Bharat Abhiyan and the Pradhan Mantri Awas Yojana, have significantly improved sanitation infrastructure and boosted the construction of affordable housing, thereby increasing the demand for sanitary ware products. Additionally, the rise in disposable incomes has led consumers to invest in premium and aesthetically appealing bathroom fixtures. Technological advancements, including the development of water-saving sanitary ware products and antimicrobial coatings, are also attracting consumers seeking modern and hygienic solutions. Furthermore, the expansion of the hospitality and real estate sectors is contributing to the increased adoption of ceramic sanitary ware in commercial establishments.

Regionally, South India holds the largest revenue share in the ceramic sanitary ware market, accounting for 32.5% in 2025. This dominance is attributed to higher literacy rates, greater awareness of sanitation, and rapid urbanization in cities like Bangalore, Chennai, and Hyderabad. North India follows, driven by infrastructure development in cities such as Delhi, Chandigarh, and Jaipur, and accounts for 35% of the market share. West India, with key cities like Mumbai, Pune, and Ahmedabad, contributes 25% to the market, benefiting from industrial growth and a booming real estate sector. East India is expected to experience the fastest growth during the forecast period, owing to rising demand for sanitary ware products in infrastructure development

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The India Ceramic Sanitary Ware market is projected to grow from USD 3,812 million in 2024 to USD 5,338.5 million by 2032, registering a CAGR of 4.30%

- Government schemes like Swachh Bharat Abhiyan and PMAY are increasing sanitary ware installations across rural and urban areas.

- Rising disposable income and urbanization are pushing demand for premium, aesthetically designed ceramic fixtures.

- Expansion of residential, commercial, and hospitality real estate projects continues to drive large-scale product adoption.

- Innovations such as water-saving systems and antimicrobial coatings support eco-conscious consumer demand.

- Raw material price fluctuations and energy-intensive manufacturing processes affect production costs and margins.

- South India holds 32.5% of the market share, followed by North (30%), West (25%), and fast-growing East India at 12.5%.

Report scoope

This report segments the India Ceramic Sanitary Ware Market as follow

Market Drivers:

Government-Backed Sanitation Programs and Housing Initiatives Drive Demand Surge

The Indian government continues to support sanitation infrastructure through flagship initiatives such as Swachh Bharat Abhiyan and the Pradhan Mantri Awas Yojana. These programs have accelerated toilet construction and affordable housing development across urban and rural regions. The India Ceramic Sanitary Ware Market benefits directly from these schemes, which stimulate procurement of toilets, basins, and related products. Public-private partnerships have increased construction activity in underdeveloped zones, further expanding the scope for sanitary ware installations. Government mandates on toilet access in schools and workplaces continue to strengthen product penetration. It reinforces market demand by ensuring hygiene access is a national priority.

Growing Urbanization and Changing Consumer Preferences Encourage Upmarket Shift

Rapid urban growth across Tier I and Tier II cities has expanded the consumer base for modern sanitary ware. As homebuyers and developers aim to upgrade living standards, the India Ceramic Sanitary Ware Market sees increased preference for premium and designer fixtures. A growing middle-class population with rising income levels now prioritizes aesthetic appeal and durable quality in bathrooms. It supports the demand for ceramic products that offer functionality with modern finishes. Changing lifestyles have also shifted consumer expectations toward branded and feature-rich sanitary solutions. These shifts create opportunities for domestic and international manufacturers focused on high-value segments.

Rising Real Estate Development in Residential and Commercial Projects Boosts Product Adoption

The real estate sector plays a vital role in fueling sanitary ware consumption, with both residential and commercial projects incorporating modern bathroom infrastructure. Increased construction of hotels, offices, shopping complexes, and residential townships has contributed to steady product demand. The India Ceramic Sanitary Ware Market continues to grow with the expansion of luxury housing, where consumers demand premium ceramic installations. Real estate developers now prioritize high-quality sanitary fittings to enhance property value and appeal to buyers. It drives recurring procurement from the building and construction sector, sustaining long-term growth. Demand remains stable across metros and emerging cities alike.

- For instance, Roca India announced plans in 2023 to invest ₹200 crores to expand its manufacturing capacity, aiming to meet the growing demand from residential and commercial real estate projects. Demand remains stable across metros and emerging cities alike.

Technological Advancements and Environmental Awareness Promote Product Innovation

Consumer awareness around water conservation and hygiene has created demand for innovative sanitary solutions. Manufacturers now introduce ceramic products that feature dual-flush systems, waterless urinals, and anti-microbial surfaces. The India Ceramic Sanitary Ware Market responds to these demands by investing in R&D for durable and eco-conscious offerings. It allows companies to differentiate in a competitive market while meeting regulatory expectations. Integration of technology into ceramic designs improves utility without compromising style. These innovations attract urban consumers and institutional buyers focused on sustainability and cost-efficiency.

- For instance, Jaquar’s i-Flush system offers a touchless flushing experience using motion sensors, catering to the demand for hygienic and water-efficient bathroom solutions. These innovations attract urban consumers and institutional buyers focused on sustainability and cost-efficiency.

Market Trends:

Consumer Preference Shifts Toward Premium and Aesthetic Bathroom Solutions

The rising demand for stylish and customized bathroom interiors is reshaping consumer behavior. Buyers now prioritize ceramic sanitary ware that combines visual appeal with long-term durability. The India Ceramic Sanitary Ware Market is witnessing increased uptake of high-end washbasins, wall-mounted toilets, and digitally controlled bidets. It reflects a broader lifestyle shift where bathrooms are viewed as wellness zones rather than just utility spaces. Design-centric trends are driving the launch of new product lines with unique textures, finishes, and colors. Manufacturers are aligning offerings to meet evolving consumer expectations in both urban and semi-urban settings.

- For instance, Duravit India, in partnership with designer Philippe Starck, launched the SensoWash® Starck f series, featuring minimalist shower toilets with integrated technology such as remote/app operation, automatic cover opening, customizable seat heating, and adjustable shower flow.

Adoption of Smart and Touchless Sanitary Fixtures Gains Traction

Contactless and sensor-based sanitary solutions are gaining popularity in residential and commercial spaces. Users seek convenience, safety, and hygiene in high-traffic environments, which supports the uptake of motion-sensing faucets, automatic flushing systems, and intelligent toilets. The India Ceramic Sanitary Ware Market is embracing this trend by integrating smart features into traditional ceramic designs. It allows brands to differentiate products in an increasingly competitive space. The pandemic further accelerated interest in touch-free technologies, especially in hotels, malls, and public restrooms. This trend is expected to remain strong due to its alignment with health-conscious behavior.

- Somany Ceramics, for example, introduced a new line of Smart Sensing Sanitary and Toilet Products in April 2023, offering touchless operation, adjustable water pressure, and self-cleaning features.

Expansion of Organized Retail and E-Commerce Channels Enhances Market Visibility

Organized retail formats and digital platforms have expanded access to a wider range of sanitary ware products. Multi-brand showrooms, home improvement stores, and online portals now allow consumers to compare, select, and customize their purchases. The India Ceramic Sanitary Ware Market benefits from this shift by reaching new customer segments in Tier II and Tier III cities. It also enables brands to showcase innovative products, demonstrate usage, and improve service standards. Manufacturers are forming partnerships with retail chains and e-commerce platforms to optimize distribution. These channels are redefining how consumers interact with brands and make purchasing decisions.

Sustainability and Eco-Conscious Designs Emerge as Product Differentiators

Environmental concerns are influencing product development and consumer choices. Water-saving technology, recyclable materials, and energy-efficient production methods are becoming standard features. The India Ceramic Sanitary Ware Market is evolving to align with green building practices and eco-label certifications. It encourages manufacturers to create sustainable product lines without compromising performance. Builders and architects increasingly favor sanitary ware that meets LEED and GRIHA standards, reinforcing the focus on sustainability. This trend supports long-term market growth by aligning product innovation with environmental goals.

Market Challenges Analysis:

High Dependency on Raw Materials and Energy-Intensive Manufacturing Limits Cost Efficiency

Ceramic sanitary ware production relies heavily on raw materials such as clay, silica, feldspar, and kaolin, many of which face price volatility and supply disruptions. Energy costs form a significant portion of total manufacturing expenses, especially due to the high-temperature kiln operations required in the firing process. The India Ceramic Sanitary Ware Market faces margin pressures when input prices spike or when fuel and electricity costs surge. It becomes difficult for manufacturers, particularly small and mid-sized enterprises, to maintain competitive pricing while ensuring quality. Fluctuating raw material availability and the lack of domestic alternatives hinder supply chain stability. These issues impact production timelines and constrain scalability.

Fragmented Market Structure and Unorganized Sector Hinder Brand Consolidation

The presence of numerous regional players and a large unorganized sector creates intense price competition and dilutes brand value. Smaller manufacturers often operate with limited compliance standards, which affects consumer trust and product consistency. The India Ceramic Sanitary Ware Market experiences difficulty in achieving nationwide brand loyalty due to inconsistent product availability and service support. It restricts the growth of established players aiming to expand in untapped regions. Unorganized players offer low-cost alternatives that often undercut branded options without adhering to performance benchmarks. This fragmented landscape delays the formalization of distribution networks and challenges long-term market consolidation.

- For instance, “Hindware Home Innovation Limited highlighted in its 2023 annual report that over 35% of the sanitary ware market is estimated to be controlled by unorganized players, resulting in inconsistent product quality and after-sales service.” The India Ceramic Sanitary Ware Market experiences difficulty in achieving nationwide brand loyalty due to inconsistent product availability and service support.

Market Opportunities:

Urbanization in smaller cities has created a new wave of demand for modern sanitary ware solutions. Consumers in Tier II and Tier III cities now seek durable and aesthetically pleasing products that were once limited to metropolitan areas. The India Ceramic Sanitary Ware Market stands to benefit from this demographic shift and improved housing infrastructure. It enables companies to enter underserved markets through regional partnerships and localized product strategies. Builders and local governments are increasing investments in public sanitation facilities, driving demand from institutional buyers. This trend opens up volume-based growth opportunities across emerging urban zones.

India’s position as a manufacturing hub is strengthening due to the government’s Make in India initiative and favorable export policies. Domestic producers can capitalize on rising global demand for ceramic sanitary ware, particularly in the Middle East, Africa, and Southeast Asia. The India Ceramic Sanitary Ware Market can leverage cost advantages and skilled labor to increase exports. It creates scope for international collaborations and capacity expansion. Indian brands are gaining traction in global exhibitions, highlighting design innovation and quality. This momentum supports long-term competitiveness on international platforms.

Market Segmentation Analysis:

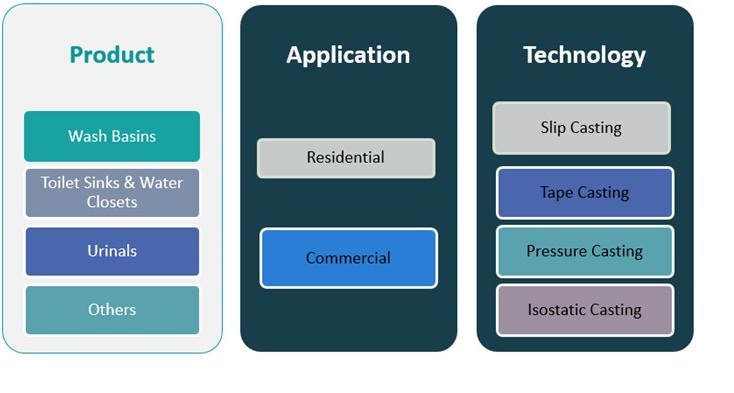

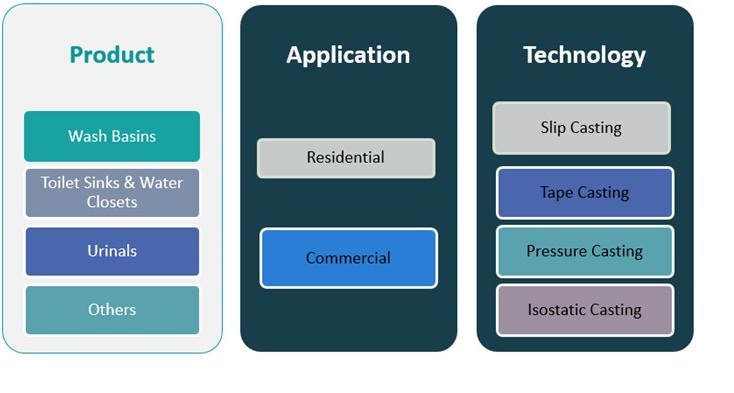

The India Ceramic Sanitary Ware Market is segmented into product, application, and technology categories, each contributing uniquely to its expansion.

By product, wash basins hold a major share due to their universal presence in residential and commercial spaces. Toilet sinks and water closets follow closely, supported by rising sanitation awareness and government initiatives. Urinals serve institutional and commercial requirements, while the “others” category includes bidets, cisterns, and accessories that support niche demands.

By application, the residential segment dominates due to rising homeownership, rapid urbanization, and consumer preference for modern bathroom fittings. It benefits from both mass housing schemes and premium real estate projects. The commercial segment, which includes hotels, malls, hospitals, and offices, is growing due to increased investments in infrastructure and public sanitation.

By technology, slip casting remains widely used due to its cost-effectiveness and adaptability. Pressure casting and isostatic casting are gaining traction for their ability to produce high-strength, precision-shaped products. Tape casting supports specific industrial applications where thin and uniform components are required.

Segmentation:

By Product Segment

- Wash Basins

- Toilet Sinks & Water Closets

- Urinals

- Others

By Application Segment

By Technology Segment

- Slip Casting

- Tape Casting

- Pressure Casting

- Isostatic Casting

Regional Analysis:

South India leads the India Ceramic Sanitary Ware Market with a market share of 32.5%, driven by rapid urbanization, strong infrastructure development, and a higher focus on hygiene across cities like Bangalore, Chennai, and Hyderabad. High literacy rates and increasing awareness of sanitation have led to early adoption of modern bathroom fixtures in both residential and institutional projects. Real estate growth and steady investments in hospitality and retail construction further support demand for ceramic sanitary ware. It allows brands to test and launch premium product lines in a receptive market. Government-backed smart city initiatives also contribute to increased installations in public and private spaces. The region remains a major consumption and manufacturing hub.

North India follows with a 30% market share, supported by construction activity across Delhi NCR, Chandigarh, and Jaipur. The region sees strong demand from luxury housing projects, commercial buildings, and institutional buyers seeking durable and visually appealing sanitary ware. The India Ceramic Sanitary Ware Market benefits from government housing schemes, real estate expansions, and infrastructure upgrades in this region. It enables suppliers to cater to a broad customer base that includes both mass-market and premium segments. Awareness campaigns under Swachh Bharat Abhiyan continue to drive installations in rural and peri-urban areas. The region also attracts international brands looking to establish retail footprints.

West India holds a 25% share, with cities like Mumbai, Pune, and Ahmedabad acting as commercial and industrial anchors. Growth in residential apartments, office complexes, and hospitality projects has boosted demand for ceramic sanitary ware products. It supports both high-end and affordable product segments, offering scope for tiered pricing strategies. The India Ceramic Sanitary Ware Market in this region also benefits from export activity through major ports, facilitating outbound shipments. Rising investments in urban infrastructure, coupled with consumer preference for branded products, further strengthen regional momentum. East India, though currently accounting for 12.5% of the market, shows high growth potential with improving construction activity and rising awareness of sanitation in emerging states.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Jaquar

- Hindustan Sanitaryware & Industries Limited

- Cera Sanitaryware Ltd

- RAK Ceramics

- Somany Ceramics Ltd.

Competitive Analysis:

The India Ceramic Sanitary Ware Market features a competitive landscape dominated by both domestic and international players. Leading companies include Cera Sanitaryware Ltd., Hindware Limited, Jaquar Group, Roca Bathroom Products Pvt. Ltd., and Parryware, which compete on product range, innovation, and distribution strength. It continues to evolve as players invest in advanced manufacturing, water-saving technologies, and design differentiation. Strategic partnerships with builders and retail chains help expand brand visibility across urban and semi-urban regions. International brands are strengthening presence through joint ventures and local production units. Intense price competition from unorganized sector players challenges premium segment growth but also pushes established firms to enhance value offerings. The market favors companies with strong after-sales service, wide product availability, and a clear sustainability focus.

Recent Developments:

- In April 2025, Jaquar entered into a partnership with Manoj Ceramics to launch an exclusive display centre in Ghatkopar, Mumbai. This collaboration, covering 500 sq. ft., allows Manoj Ceramics to present Jaquar’s premium sanitaryware and bathroom solutions alongside its own ceramic offerings, creating a comprehensive design destination for customers in a rapidly growing interior design market.

- In May 2025, Somany Ceramics inaugurated its flagship ‘Atelier’ showroom in Rajouri Garden, New Delhi. Spanning 5,500 sq. ft., the showroom is designed as an immersive experience center, showcasing the brand’s latest innovations in tiles and bathware, including premium collections like Coverstone slabs, Regalia, and the Italmarmi range. The space aims to set a new benchmark in customer experience for architects, designers, and end-users.

- In January 2024, Kohler launched its new PureWash Bidet seat in India, which features advanced voice activation technology. This innovative product aims to enhance user convenience and hygiene standards, reflecting Kohler’s ongoing commitment to smart sanitary solutions and the growing demand for technologically advanced bathroom fixtures in the Indian market.

Market Concentration & Characteristics:

The India Ceramic Sanitary Ware Market displays moderate to high market concentration, with a few large players accounting for a significant share of total sales. It is characterized by strong brand loyalty in urban centers and intense price sensitivity in rural and semi-urban regions. Product quality, design innovation, and dealer networks play a critical role in shaping consumer preferences. The market features a blend of organized and unorganized sectors, where established brands dominate high-value segments while smaller manufacturers cater to budget-conscious buyers. It shows seasonal demand fluctuations tied to construction cycles and housing project timelines. Competitive differentiation largely depends on product aesthetics, water efficiency, and service reliability.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application and Technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise steadily due to ongoing urbanization and housing expansion in Tier II and Tier III cities.

- Government infrastructure programs will continue to boost procurement for public sanitation facilities.

- Water-efficient and eco-friendly sanitary ware will gain market share amid rising environmental concerns.

- Growth in luxury residential and commercial real estate will drive demand for premium ceramic fixtures.

- E-commerce platforms and organized retail channels will expand product accessibility across regions.

- Technological integration in sanitary ware, including touchless and smart features, will see wider adoption.

- Domestic manufacturing capacity will increase under Make in India, reducing import reliance.

- Export potential will strengthen, especially to the Middle East, Africa, and Southeast Asia.

- Product innovation in design and hygiene performance will remain central to competitive strategies.

- Brand consolidation may accelerate as larger players expand into rural and semi-urban markets.