Market Overview

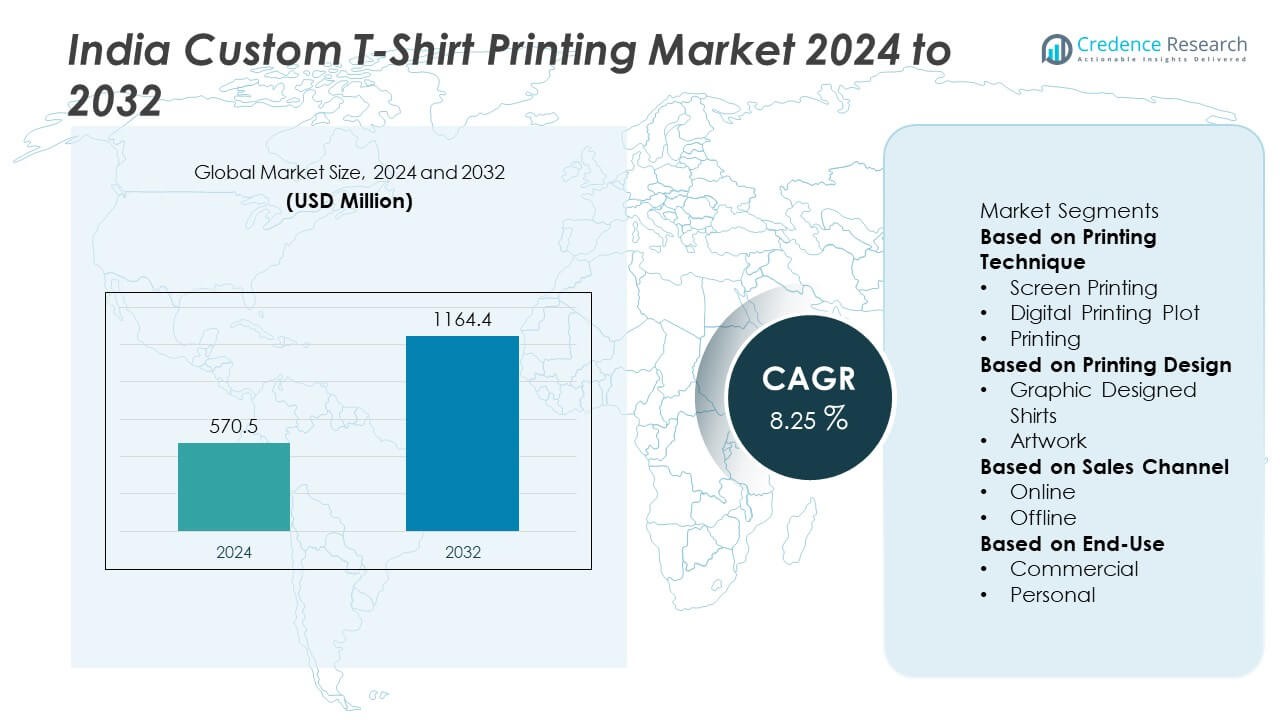

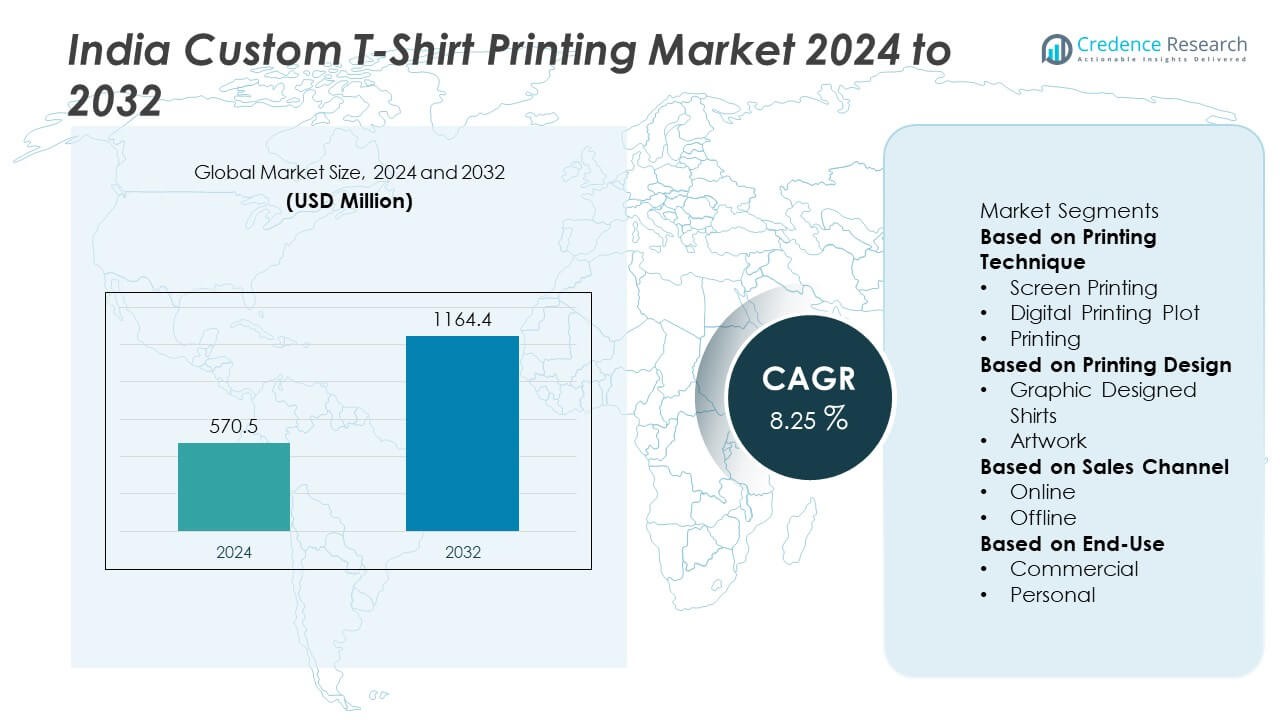

India Custom T-Shirt Printing Market was valued at USD 570.5 million in 2024 and is projected to reach USD 1,164.4 million by 2032, growing at a CAGR of 8.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Custom T-shirt Printing Market Size 2024 |

USD 570.5 Million |

| India Custom T-shirt Printing Market, CAGR |

8.25% |

| India Custom T-shirt Printing Market Size 2032 |

USD 1,164.4 Million |

The India Custom T-Shirt Printing Market grows on strong drivers such as rising youth preference for personalized apparel, expanding corporate branding activities, and increasing adoption of advanced printing techniques that enhance design precision and affordability.

The India Custom T-Shirt Printing Market demonstrates strong geographical presence across North, South, West, and East-Central regions, each contributing to demand through distinct consumer bases. Northern cities such as Delhi NCR and Chandigarh drive growth through youth communities and corporate branding needs, while South India benefits from the IT hubs of Bengaluru, Chennai, and Hyderabad that generate bulk corporate and institutional orders. Western states including Maharashtra and Gujarat combine fashion-oriented demand from Mumbai and Pune with textile production strengths in Surat and Ahmedabad. Eastern and Central regions, though emerging, show increasing adoption through educational institutions, community events, and cultural festivals. Prominent players shaping the market include Vistaprint India, known for its wide online customization platform; Be Young, catering to youth-driven fashion with creative prints; Spreadshirt India, leveraging global expertise to provide diverse design solutions; and Inkthreadable, which emphasizes eco-friendly and print-on-demand services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India Custom T-Shirt Printing Market was valued at USD 570.5 million in 2024 and is projected to reach USD 1,164.4 million by 2032, growing at a CAGR of 8.25% during the forecast period.

- The market benefits from increasing demand for personalized apparel, youth-driven fashion preferences, and the expansion of corporate branding initiatives across diverse industries.

- Key trends include the rise of on-demand printing platforms, adoption of eco-friendly fabrics and inks, and growing popularity of pop culture, sports, and event-driven designs.

- Competitive intensity is shaped by both organized players and local operators, with companies such as Vistaprint India, Be Young, Spreadshirt India, and Inkthreadable leveraging technology, product quality, and design variety to differentiate.

- Restraints emerge from high price sensitivity among consumers, operational inefficiencies faced by small-scale printers, and challenges related to supply chain disruptions and skilled labor shortages.

- Regional growth is supported by strong demand in North India led by metropolitan hubs, while South India benefits from IT and startup ecosystems, West India leverages textile supply strengths, and East-Central India represents a growing opportunity through educational and community events.

- The market is positioned as a dynamic segment within India’s fashion and promotional apparel landscape, driven by digital adoption, innovative design tools, and expanding accessibility through e-commerce platforms.

Market Drivers

Rising Influence of Fashion Personalization and Youth Culture

The India Custom T-Shirt Printing Market benefits strongly from rising consumer preference for personalized and statement-driven fashion. Young consumers adopt custom designs to reflect identity, social messages, and lifestyle choices. College students and urban millennials drive adoption through group events, clubs, and social movements. Social media amplifies visibility of unique apparel, boosting demand for customized prints. It supports experimentation with vibrant colors, graphic art, and pop-culture references. This trend elevates t-shirts from basic attire to expressive fashion pieces.

- For instance, Be Young reported selling over 1.2 million customized printed t-shirts across India in 2023, with 60% of orders driven by youth-centric graphic and pop-culture themes.

Expanding Corporate Branding and Promotional Activities

Corporate entities increase demand for printed t-shirts as tools for branding and workforce identity. It supports uniformity in promotional events, team activities, and retail staff presentation. Startups and SMEs use printed apparel to enhance visibility at trade fairs and exhibitions. Established companies adopt premium prints for employee engagement and loyalty campaigns. The cost-effectiveness of bulk custom printing encourages repeat corporate orders. This creates a steady business-to-business demand that strengthens overall market revenue.

- For instance, Underground Printing, a major custom‑apparel provider in the U.S., operates 30 locations across 13 states and prints an average of 10,000 t‑shirts per day from its production facility.

Technological Advancements in Printing Methods

Innovations in digital printing, screen printing, and direct-to-garment techniques enhance design accuracy and turnaround speed. It enables short-run printing at competitive costs, which appeals to small businesses and individual buyers. Improved inks and eco-friendly dyes provide vibrant, long-lasting prints, reducing environmental concerns. Automation in printing machinery reduces operational costs and boosts scalability. Integration of software-driven design tools simplifies order customization and processing. These advancements make printed t-shirts more accessible to both mass and niche markets.

Growth of E-Commerce and On-Demand Platforms

The rapid expansion of e-commerce strengthens market accessibility across urban and semi-urban India. It provides a direct platform for small printers, startups, and independent designers to reach large audiences. Online platforms offer customization interfaces that allow customers to upload designs or select templates. The rise of on-demand printing services reduces inventory costs and ensures timely delivery. Mobile-first consumers adopt these services for convenience and affordability. This digital transformation positions the market for accelerated growth across wider demographics.

Market Trends

Increasing Adoption of Sustainable Printing Practices

The India Custom T-Shirt Printing Market observes a strong shift toward eco-friendly materials and printing technologies. Consumers prefer organic cotton fabrics and water-based inks that reduce environmental impact. Printing companies invest in sustainable processes to align with green initiatives and evolving regulations. It creates opportunities for brands to position themselves as socially responsible. The focus on reducing chemical waste and energy consumption enhances brand trust. This trend appeals to environmentally conscious millennials and Gen Z buyers.

- For instance, Insight Print Communications implemented green printing technologies across two of its production lines in February 2025, cutting chemical usage by 300 kilograms per month.

Rise of On-Demand and Direct-to-Consumer Models

E-commerce platforms fuel demand for personalized prints through on-demand services. Customers design and order single pieces or small batches without minimum order requirements. It reduces inventory risks for businesses and caters to dynamic consumer preferences. Direct-to-consumer models allow independent designers to monetize creativity by selling online. Faster printing and delivery cycles encourage repeat purchases. This approach accelerates market penetration in both metro and non-metro regions.

- For instance, Printful® has fulfilled over 112 million items since 2013, illustrating the large-scale capacity of on‑demand fulfillment networks.

Growing Popularity of Pop Culture and Event-Based Designs

Entertainment, sports, and lifestyle events influence custom t-shirt demand across diverse audiences. It supports themed prints for concerts, sporting tournaments, and cultural festivals. Pop culture references from movies, OTT content, and gaming communities drive youth engagement. Limited edition event-based t-shirts create exclusivity and boost sales volumes. Social media collaborations amplify trends by promoting unique designs and fan-based collections. This trend strengthens the link between apparel and lifestyle experiences.

Integration of Advanced Printing Technologies and AI Tools

Technology adoption accelerates efficiency and customization in design creation. It includes digital design platforms, AI-powered visualization, and 3D printing simulations for prototypes. Direct-to-garment printing delivers high-definition outputs on varied fabrics. Integration with mobile applications enhances the customer experience by enabling real-time previews. AI-driven tools assist designers in automating layouts and scaling personalization. These advancements improve operational agility and attract both individual and corporate clients.

Market Challenges Analysis

High Competition and Price Sensitivity

The India Custom T-Shirt Printing Market faces intense competition from local printers, unorganized vendors, and online platforms offering low-cost services. It creates significant price pressure, limiting profit margins for established players. Small businesses often undercut prices to attract customers, leading to inconsistent quality in the market. Consumers display high price sensitivity, prioritizing affordability over premium designs or sustainable fabrics. This environment makes differentiation through branding, technology, and customer service essential. Companies must balance cost efficiency with quality to maintain long-term competitiveness.

Operational Inefficiencies and Supply Chain Constraints

Supply chain disruptions pose challenges for timely procurement of fabrics, inks, and printing equipment. It impacts order fulfillment cycles, particularly during peak demand seasons such as festivals or corporate events. Many small-scale operators lack advanced machinery, which limits scalability and efficiency. Maintenance costs for modern digital and direct-to-garment printing equipment remain high, creating barriers for new entrants. Skilled labor shortages in design and printing also affect output consistency. Addressing these constraints is critical to sustaining growth in a competitive environment.

Market Opportunities

Expansion Through E-Commerce and Regional Penetration

The India Custom T-Shirt Printing Market holds strong opportunity in the expansion of e-commerce platforms that connect small vendors with large customer bases. It enables printers to reach audiences beyond metropolitan areas and capture demand in tier-II and tier-III cities. Online marketplaces support startups and independent designers in scaling their offerings without heavy infrastructure investments. Increasing internet penetration and mobile-first shopping behavior create wider access for personalized apparel. Affordable logistics solutions further strengthen the reach of custom t-shirt businesses. This opportunity allows market players to diversify customer segments and improve brand visibility.

Growth Potential in Corporate and Event-Based Demand

Corporate branding and large-scale promotional events create a sustained opportunity for market expansion. It supports growing adoption of custom apparel in employee engagement, product launches, and community events. Educational institutions, sports leagues, and cultural festivals add recurring demand for bulk custom printing orders. Businesses can tap into premium segments by offering sustainable fabrics, quick turnaround, and advanced printing techniques. The rising focus on identity-based merchandise among fan groups, startups, and social communities further expands revenue streams. This segment provides long-term opportunities for players willing to align services with evolving client expectations.

Market Segmentation Analysis:

By Printing Technique

The India Custom T-Shirt Printing Market shows diversification across printing techniques including screen printing, digital printing, sublimation, and heat transfer. Screen printing remains dominant due to its cost-effectiveness and suitability for bulk orders. It delivers vibrant colors and durability, making it a preferred choice for corporate events and large-scale campaigns. Digital printing gains momentum by catering to short-run orders and high-resolution designs with quick turnaround times. Sublimation printing supports growing demand for all-over prints on polyester fabrics, while heat transfer techniques provide flexibility for customized logos and smaller batches. This segmentation highlights both traditional and modern techniques coexisting to meet varied consumer requirements.

- For instance, The Kornit Atlas MAX DTG (Direct-to-Garment) printer is indeed known for its high productivity, capable of printing up to 150 garments per hour. This high output is achieved with a single operator and is a key feature of the Kornit Atlas Max Plus system.

By Printing Design

Design segmentation emphasizes graphic-oriented, text-based, and artwork-focused prints. The India Custom T-Shirt Printing Market benefits from youth-driven demand for graphic t-shirts inspired by pop culture, sports, and social movements. It also supports personalized text prints that cater to individual expressions, college events, and social gatherings. Artwork-based designs attract niche audiences seeking unique, creative, and limited-edition apparel. Technology integration enables advanced design tools that allow consumers to visualize prints before purchase. Businesses align product offerings with evolving design trends to capture wider demographics. This segmentation ensures diverse design appeal across lifestyle and professional categories.

- For instance, Spreadshirt’s online customization platform reported over 35,000 new designs uploaded daily across its global portals in 2024, supported by its integrated AI-driven preview engine that allows customers to visualize prints in real time.

By Sales Channel

Sales channels include offline retail stores, company-owned outlets, and online platforms that dominate current market growth. Offline distribution continues to serve customers preferring physical inspection and immediate delivery. It remains relevant in regional markets where e-commerce penetration is limited. Online platforms demonstrate rapid expansion, offering user-friendly interfaces for customization and wider product variety. Startups and independent creators leverage digital platforms to access large consumer bases without significant overhead costs. On-demand models offered by e-commerce marketplaces attract tech-savvy buyers seeking convenience and affordability. This sales channel segmentation underlines how digital adoption reshapes customer interaction and market accessibility.

Segments:

Based on Printing Technique

- Screen Printing

- Digital Printing Plot

- Printing

Based on Printing Design

- Graphic Designed Shirts

- Artwork

Based on Sales Channel

Based on End-Use

Based on the Geography:

- North India

- South India

- West India

- East and Central India

Regional Analysis

North India

North India accounts for 32% share of the India Custom T-Shirt Printing Market, driven by high demand in metropolitan hubs such as Delhi NCR, Chandigarh, and Jaipur. The region benefits from a strong youth population, active college communities, and thriving corporate sectors that regularly adopt custom t-shirts for branding, events, and promotions. It also witnesses growing demand during festive seasons, weddings, and cultural programs, where printed apparel is used for group identity. The presence of multiple small and medium-scale printing units enhances competition while keeping prices affordable. Online platforms expand penetration across tier-II cities like Lucknow and Dehradun, where digital adoption is on the rise. North India maintains its leadership position through a combination of urban concentration and expanding semi-urban opportunities.

South India

South India captures 28% share of the market, supported by vibrant student communities, IT hubs, and startup ecosystems in Bengaluru, Chennai, and Hyderabad. It generates strong demand from corporate houses that use customized apparel for employee engagement and promotional campaigns. Universities and colleges across Karnataka, Tamil Nadu, and Kerala also drive bulk orders for events, cultural festivals, and youth-driven initiatives. The region has an established base of textile manufacturers, which supports cost-effective supply of raw materials and fabrics. Online custom t-shirt platforms see high adoption due to tech-savvy urban consumers and strong logistics infrastructure. South India demonstrates steady growth potential with its blend of corporate, institutional, and retail demand.

West India

West India holds 24% share of the India Custom T-Shirt Printing Market, with major contributions from Maharashtra and Gujarat. Mumbai and Pune serve as fashion-forward cities, fueling demand for personalized t-shirts tied to pop culture, sports, and lifestyle events. Corporate houses and media industries in Mumbai further strengthen market revenue through bulk promotional orders. Ahmedabad and Surat, as textile hubs, provide efficient fabric sourcing and support printing operators with competitive advantages. It also benefits from tourism and event-driven demand in Goa, where custom apparel is popular among groups and travelers. Online platforms and retail outlets complement regional demand by offering easy access to affordable customization services. West India continues to integrate fashion trends with industrial supply strengths to maintain its strong position.

East and Central India

East and Central India together contribute 16% share, marking them as emerging regions with untapped potential. Cities such as Kolkata, Bhubaneswar, Patna, and Raipur record rising demand from educational institutions, cultural organizations, and regional businesses. It experiences gradual growth in custom apparel adoption, driven by increasing internet penetration and expansion of online platforms. Limited presence of advanced printing infrastructure poses challenges, yet local operators cater to budget-conscious buyers with affordable services. The popularity of community-based events, festivals, and political campaigns creates recurring demand for bulk custom t-shirts. As logistics and e-commerce expand further into these regions, market penetration is expected to accelerate, improving the overall contribution of East and Central India in the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The India Custom T-Shirt Printing Market features strong competition from leading players including Vistaprint India, Spreadshirt India, Tshirt Studio, Shirtworks, Inkthreadable, Be Young, King Doodle, Printsome, Ginger Crush, and Tee Labs, each leveraging distinct strategies to capture market share. Vistaprint India dominates through its online customization platform and wide reach, while Spreadshirt India capitalizes on international expertise and scalable design offerings. Tshirt Studio and Shirtworks emphasize high-quality printing for niche and personalized orders, and Inkthreadable builds differentiation with eco-friendly, sustainable printing solutions. Be Young and King Doodle appeal to younger demographics with trendy, fashion-oriented designs, while Printsome strengthens its position in the corporate and promotional printing segment. Ginger Crush and Tee Labs expand competitiveness with fast delivery cycles and innovative customization tools, catering to startups and small-scale buyers. The overall market reflects high intensity, where pricing, technology adoption, design variety, and sustainability drive competitive advantages and long-term positioning.

Recent Developments

- In June 2025, Tee Labs announced its participation in Indexpo 2025 (South India’s leading industrial exhibition), signaling expanded industry engagement.

- In April 2025, Inkthreadable (again notable) also fulfilled over 250,000 print-on-demand orders for more than 5,000 businesses in the prior year.

- In June 2024, Inkthreadable underwent a pre-pack administration and was acquired by Hyper Merch-founded by Inkthreadable’s original founders, retaining 23 employees and continuing operations from its Blackburn facility.

Market Concentration & Characteristics

The India Custom T-Shirt Printing Market reflects moderate concentration with the presence of both organized players and a large base of unorganized local vendors. Leading companies such as Vistaprint India, Spreadshirt India, Be Young, Inkthreadable, and Ginger Crush maintain strong visibility through e-commerce platforms, advanced printing technologies, and brand partnerships. It also features a fragmented structure where regional operators and small-scale businesses serve localized demand at competitive prices, particularly in tier-II and tier-III cities. Market characteristics are defined by high demand volatility linked to fashion trends, seasonal events, and corporate promotions. It demonstrates strong adaptability to digital-first business models, enabling consumers to access on-demand printing with minimal order requirements. Sustainability initiatives, including the use of organic fabrics and water-based inks, are gaining traction, reflecting the evolving preference of younger consumers. Competitive pricing, design innovation, and quick delivery remain essential differentiators, reinforcing the dynamic and fast-moving nature of this market.

Report Coverage

The research report offers an in-depth analysis based on Printing Technique, Printing Design, Sales Channel, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing demand for personalized and statement-driven apparel.

- E-commerce platforms will strengthen reach across tier-II and tier-III cities.

- Digital printing and direct-to-garment techniques will gain higher adoption.

- Corporate branding and event-driven orders will continue to drive bulk demand.

- Sustainable fabrics and eco-friendly inks will become mainstream choices.

- Youth-driven fashion influenced by pop culture and sports will boost sales.

- On-demand printing models will reduce inventory costs for businesses.

- Regional players will expand operations with improved logistics support.

- AI-powered design tools and mobile apps will enhance customer experience.

- Competitive differentiation will rely on speed, design variety, and customization flexibility.