Market Overview:

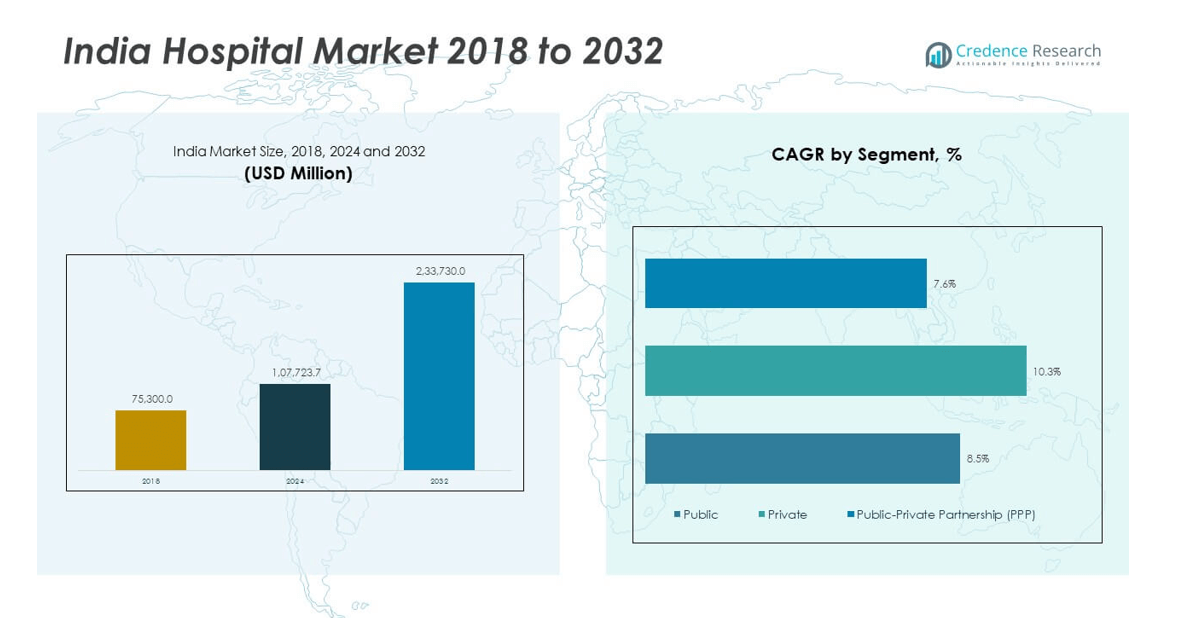

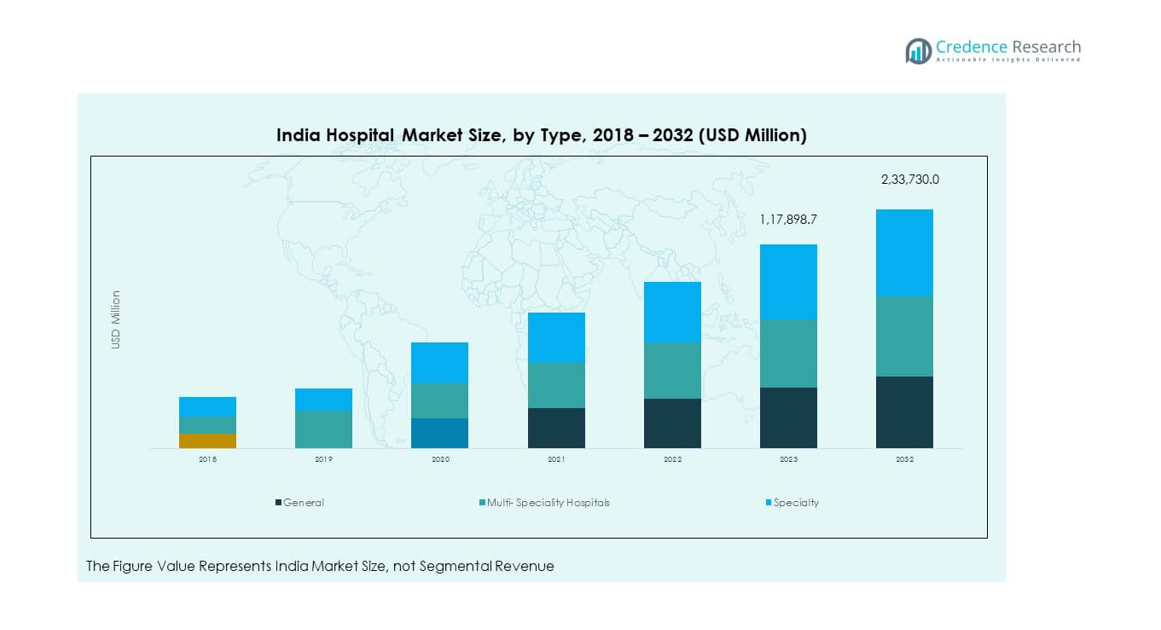

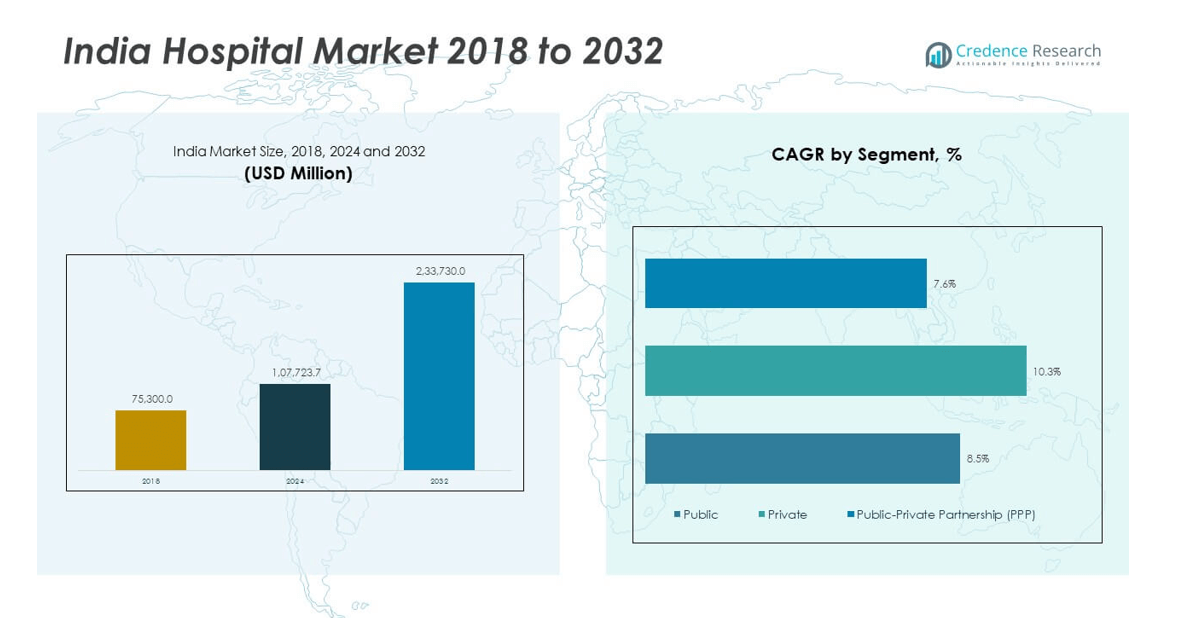

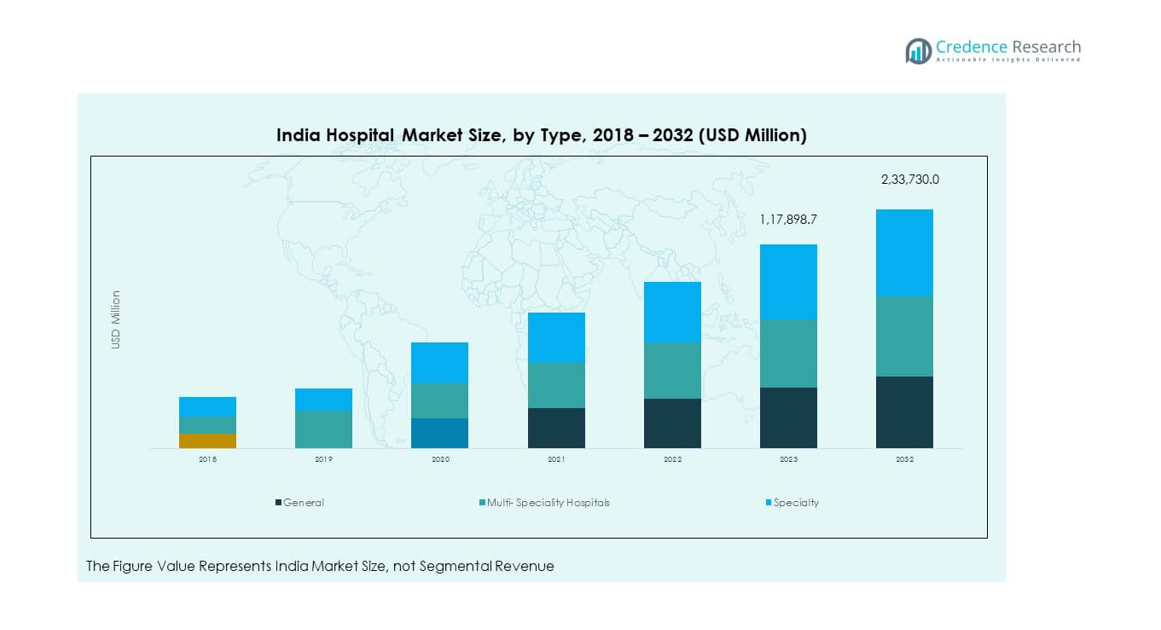

The India Hospital Market size was valued at USD 75,300.0 million in 2018 to in 2024 and is anticipated to reach USD 2,33,730.0 million by 2032, at a CAGR of 10.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Hospital Market Size 2024 |

USD 1,07,723.7 million |

| India Hospital Market, CAGR |

10.30% |

| India Hospital Market Size 2032 |

USD 2,33,730.0 million |

The market is driven by rising healthcare expenditure, growing population, and increased prevalence of chronic diseases, which demand advanced treatment facilities. Rapid urbanization, medical tourism growth, and government initiatives under schemes like Ayushman Bharat are enhancing hospital infrastructure and accessibility. Private sector investments in multispecialty and super-specialty hospitals, combined with the adoption of advanced medical technologies, are improving patient care standards. Additionally, the expansion of telemedicine and digital health services is further fueling the market’s growth potential across the country.

Regionally, Tier-1 cities such as Delhi, Mumbai, Bengaluru, and Chennai lead the market due to advanced infrastructure, high patient inflow, and concentration of top healthcare providers. Tier-2 and Tier-3 cities are emerging as fast-growing hubs, driven by government-funded projects and private sector expansion to meet rising healthcare demand. Rural areas are witnessing gradual improvements, supported by mobile health units and telehealth services that bridge accessibility gaps. This diverse regional growth pattern strengthens the overall market landscape in India.

Market Insights:

- The India Hospital Market was valued at USD 1,07,723.7 million in 2024 and is projected to reach USD 2,33,730.0 million by 2032, growing at a CAGR of 10.30% during the forecast period.

- Rising healthcare expenditure, increasing prevalence of chronic diseases, and expanding medical tourism are key factors driving market growth.

- Technological advancements such as AI-assisted diagnostics, robotic surgeries, and telemedicine platforms are enhancing service delivery and efficiency.

- Regulatory compliance requirements, high operational costs, and uneven distribution of healthcare infrastructure remain significant market restraints.

- South India leads the market due to advanced infrastructure, high concentration of multi-speciality hospitals, and strong medical tourism inflows.

- Northern and Western regions show strong growth momentum supported by urbanization, insurance penetration, and private sector investments.

- Eastern and Northeastern regions are emerging markets, benefiting from infrastructure upgrades, government initiatives, and cross-border patient inflows from neighboring countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Healthcare Expenditure and Expanding Infrastructure Investments:

The India Hospital Market benefits from consistent growth in healthcare expenditure from both public and private sectors. Government funding for hospital infrastructure under programs like Ayushman Bharat strengthens the availability of medical services across urban and rural areas. Large corporate hospital chains are investing in modern facilities, advanced diagnostic centers, and specialized treatment units to attract patients. It leverages rising insurance penetration, which reduces the financial burden on patients and promotes timely medical care. Public-private partnerships are driving the construction of multi-specialty hospitals in underserved regions. Increasing foreign direct investment in the healthcare sector supports infrastructure upgrades and expansion plans. Urban centers continue to lead in advanced hospital infrastructure, while rural areas gain from targeted government initiatives. This investment trend ensures wider access to quality healthcare and sustains market momentum.

- For instance, Apollo Hospitals, one of India’s largest hospital groups, is on track to add 4,370 beds over the next 3-4 years through acquisitions, construction of new hospitals, and expansion of existing facilities. The company has also announced plans to double its investment in artificial intelligence for medical diagnostics and hospital operations.

Growing Burden of Chronic and Lifestyle-Related Diseases:

The prevalence of chronic conditions such as diabetes, cardiovascular diseases, cancer, and respiratory disorders significantly fuels the India Hospital Market. It creates sustained demand for specialized treatment facilities, intensive care units, and advanced surgical procedures. Changing lifestyles, urban stress, and dietary patterns contribute to higher incidences of non-communicable diseases, especially in urban and semi-urban populations. Hospitals are expanding departments for oncology, cardiology, and nephrology to meet the growing patient load. Increased awareness of early diagnosis encourages more people to seek timely medical attention. Hospitals invest in advanced imaging, robotic surgeries, and minimally invasive procedures to improve treatment outcomes. The demand for preventive healthcare services also rises alongside curative care. This disease burden necessitates continuous expansion of hospital capacity and medical expertise.

- For instance, in response to the high prevalence of chronic diseases—such as cardiovascular diseases affecting 37% of those above age 75—leading hospital chains like Fortis Healthcare and Apollo have reported a 15-20% annual increase in robotic surgeries across specialties like cardiology and oncology.

Expansion of Medical Tourism and Specialized Healthcare Services:

India’s position as a leading medical tourism destination strengthens hospital revenues and service diversity. Patients from Southeast Asia, Africa, and the Middle East travel to India for cost-effective, high-quality medical care. The India Hospital Market capitalizes on advanced treatment capabilities, internationally accredited hospitals, and skilled medical professionals. Specialized services in orthopedics, cardiac surgery, cosmetic procedures, and organ transplants attract international patients. Hospitals invest in multilingual staff, concierge services, and international patient departments to enhance service experience. Favorable currency exchange rates and competitive pricing make India an appealing alternative to Western healthcare. The rise in international accreditations boosts trust and patient inflows. This segment’s growth reinforces the country’s global healthcare reputation.

Government Policies and Health Insurance Expansion:

Government initiatives such as the National Health Mission and public insurance schemes are increasing access to hospital services for low-income populations. The India Hospital Market benefits from Ayushman Bharat’s wide coverage, which enables millions to access secondary and tertiary care without financial strain. It supports the expansion of district hospitals and specialized units in public healthcare facilities. State-specific schemes complement national programs to improve regional healthcare infrastructure. Private hospitals see rising patient volumes through tie-ups with government insurance programs. Increased penetration of private health insurance policies also drives admissions in corporate hospitals. Policy reforms encouraging telemedicine integration expand hospital reach in rural areas. These policy measures create a favorable environment for sustained hospital growth.

Market Trends:

Integration of Digital Health Technologies and Smart Hospital Systems:

The India Hospital Market is witnessing a rapid shift toward digital transformation in hospital operations and patient care. Electronic medical records, AI-driven diagnostics, and cloud-based health data management systems are becoming standard in leading hospitals. It improves efficiency, reduces errors, and enables better patient monitoring. Telemedicine platforms and mobile health apps extend hospital services beyond physical boundaries, especially in rural and remote areas. Smart hospital systems incorporating IoT devices monitor patients in real time and provide predictive alerts for critical conditions. Virtual consultation services are gaining acceptance among urban and semi-urban populations. Digital payment solutions streamline billing processes, improving patient experience. This technological shift is reshaping the delivery and management of healthcare services across the nation.

- For instance, the Ayushman Bharat Digital Mission has facilitated the creation of over 730 million (73 crore) unique Ayushman Bharat Health Accounts (ABHA) as of January 2025 and established over 200,000 Ayushman Arogya Mandirs nationwide to enhance early diagnosis and treatment capacity.

Shift Toward Preventive Healthcare and Wellness-Oriented Hospital Services:

Hospitals in India are increasingly incorporating preventive healthcare services alongside curative treatments. The India Hospital Market reflects a rising demand for regular health check-up packages, lifestyle modification programs, and early screening initiatives. It aligns with growing public awareness of health management to avoid long-term complications. Wellness centers within hospitals offer nutrition counseling, physiotherapy, and stress management programs. Corporate wellness partnerships encourage employees to undergo periodic medical evaluations. Hospitals are developing integrated care pathways to monitor at-risk patients over extended periods. The trend reduces the long-term treatment burden on hospitals while improving population health outcomes. Preventive care adoption also strengthens hospital brand positioning as health partners rather than just treatment providers.

- For instance, corporate wellness providers like Loop Health offer unlimited primary healthcare and employee wellness sessions, supporting regular medical consultations and health monitoring for large organizations across India.

Growth of Day-Care Surgery and Minimally Invasive Procedures:

There is a notable increase in the demand for day-care surgeries and minimally invasive procedures across major hospitals. The India Hospital Market adapts to patient preference for shorter recovery times and lower hospitalization costs. It drives investment in advanced surgical equipment, robotic-assisted technologies, and specialized operating rooms. Procedures such as cataract removal, arthroscopy, laparoscopic surgeries, and cosmetic enhancements are increasingly performed on a same-day discharge basis. Insurance coverage for day-care procedures encourages more patients to choose these options. Hospitals focus on enhancing post-operative care and teleconsultation follow-ups. Reduced bed occupancy rates allow hospitals to optimize resources for critical and long-term care patients. This trend offers operational efficiency while meeting patient convenience expectations.

Rise of Corporate Hospital Networks and Franchising Models:

The India Hospital Market is experiencing consolidation through the expansion of corporate hospital chains and franchising models. Leading brands are acquiring regional hospitals to strengthen their presence across multiple states. It enables standardization of care protocols, centralized procurement, and brand recognition advantages. Franchising allows smaller hospitals to adopt established management systems and gain access to advanced technology. Large hospital groups are setting up multi-city specialty centers for cardiac, cancer, and orthopedic care. Expansion into Tier-2 and Tier-3 cities caters to rising middle-class healthcare demand. Cross-city integration improves referral networks and patient retention. This structural shift enhances competitiveness and operational scalability in the healthcare sector.

Market Challenges Analysis:

Infrastructural Gaps and Uneven Distribution of Healthcare Resources:

The India Hospital Market faces the challenge of uneven healthcare infrastructure distribution between urban and rural areas. Metropolitan cities have well-equipped multi-specialty hospitals, while rural regions struggle with basic facilities and specialist availability. It limits access to quality care for large segments of the population. Shortage of trained medical staff, especially in critical care and specialized fields, adds pressure to existing systems. Rural hospitals often lack advanced diagnostic equipment and ICU capacity, leading to delayed or inadequate treatment. High patient-to-bed ratios in government hospitals create overcrowding. Infrastructure development in remote areas is hindered by logistical challenges and lower profitability. Addressing these disparities requires sustained investment and coordinated public-private efforts.

Regulatory Compliance, Rising Costs, and Quality Standardization Issues:

Hospitals must comply with evolving regulatory requirements, which can be costly and resource-intensive. The India Hospital Market contends with increasing operational costs due to inflation in medical equipment, consumables, and skilled labor wages. It also faces the challenge of maintaining consistent quality standards across a diverse healthcare landscape. Smaller hospitals struggle to adopt advanced technology due to budget constraints. Accreditation processes, while improving service quality, demand significant time and financial investment. Price caps on medical devices and treatments can affect hospital margins. Balancing affordability with profitability remains a delicate challenge for both public and private sector hospitals.

Market Opportunities:

Expansion into Emerging Urban Centers and Semi-Urban Regions:

The India Hospital Market holds significant growth potential in Tier-2 and Tier-3 cities where healthcare demand is rising. Rapid urbanization in these regions is creating opportunities for setting up modern multi-specialty hospitals. It benefits from growing middle-class incomes and increased health insurance coverage. Private hospital chains are targeting these areas with smaller yet fully equipped facilities. Government incentives for infrastructure development in underserved areas support this expansion. Localized healthcare delivery reduces the need for patients to travel long distances for treatment. Hospitals entering these markets can establish strong community trust and long-term patient relationships.

Adoption of Specialized Care Segments and Niche Medical Services:

Demand for specialized healthcare services such as oncology, fertility treatment, organ transplantation, and advanced rehabilitation is expanding. The India Hospital Market can capture this segment through investment in high-tech equipment and expert medical teams. It allows hospitals to differentiate their offerings and attract patients from across regions. Growing awareness of advanced treatment options drives patients to seek specialized care even beyond their localities. Partnerships with global healthcare institutions can bring expertise and technology to Indian facilities. Specialized care services also enhance medical tourism appeal, creating multi-source revenue opportunities for hospitals.

Market Segmentation Analysis:

By Ownership Segment

The India Hospital Market is segmented into public, private, and public-private partnership (PPP) models. Public hospitals play a crucial role in delivering affordable care to large population groups, supported by government funding and national health programs. Private hospitals lead in advanced infrastructure, specialized treatments, and premium services, drawing both domestic and international patients. PPP models are expanding as they combine public sector accessibility with private sector efficiency, addressing gaps in underserved areas.

- For instance, Kasturba Medical College (KMC), Mangalore, has implemented a sustained public–private partnership (PPP) model since 1953, working in conjunction with Government Wenlock and Lady Goschen Hospitals to provide care and clinical training.

By Specialty Type

The market comprises general, multi-speciality, and specialty hospitals. General hospitals address a broad range of basic and emergency healthcare needs. Multi-speciality hospitals integrate various disciplines under one roof, enhancing patient convenience and retention. Specialty hospitals focus on specific medical areas such as oncology, cardiology, or orthopedics, offering expertise-driven care and attracting referral cases from across regions.

- For instance, specialty hospitals such as Medicover Cancer Institute in Hyderabad focus exclusively on oncology and are equipped for advanced therapies like immunotherapy, targeted therapy, and minimally invasive surgeries. Multi-specialty hospitals like Apollo in New Delhi offer comprehensive services across cardiology, nephrology, orthopedics, and neurology, and consistently manage high inpatient volumes—sometimes exceeding 11,000 inpatients annually for facilities like Fortis Malar Hospital in Chennai.

By Bed Capacity

Segments by bed capacity include up to 100 beds, 101–300 beds, 301–700 beds, and above 700 beds. Smaller hospitals often cater to local and rural populations. Mid-sized hospitals balance diversity in services with manageable operational costs. Larger hospitals, especially those above 700 beds, act as regional healthcare hubs, delivering advanced and critical care services with extensive resources.

By Type of Services

The market is divided into in-patient and out-patient services. In-patient services generate substantial revenue through prolonged stays and complex procedures. Out-patient services are expanding rapidly with the growth of preventive healthcare, diagnostics, and day-care surgeries, appealing to patients seeking cost-effective and time-efficient medical solutions.

Segmentation:

By Ownership Segment

- Public

- Private

- Public-Private Partnership (PPP)

By Specialty Type

- General

- Multi-Speciality Hospitals

- Specialty

By Bed Capacity

- Up to 100 Beds

- 101–300 Beds

- 301–700 Beds

- Above 700 Beds

By Type of Services

- In-patient Services

- Out-patient Services

Regional Analysis:

Dominance of North and South India in Hospital Infrastructure

The North and South regions account for the largest share of the India Hospital Market, contributing an estimated 42% of the total 2024 revenue. This dominance is driven by advanced infrastructure in states such as Delhi, Karnataka, Tamil Nadu, and Andhra Pradesh, along with the concentration of multi-specialty and super-specialty hospitals. It benefits from high patient inflow, medical tourism, and strong healthcare workforce availability. Urban hubs like Bengaluru, Chennai, and Hyderabad attract both domestic and international patients due to high-quality treatment at competitive costs. State health initiatives and private investments have boosted hospital capacity and technology adoption. These regions also lead in telemedicine integration, enabling wider outreach. Strong tertiary care facilities support specialized treatments, reinforcing their leadership in the national market.

Rising Growth Potential in Western India

Western India contributes about 28% to the India Hospital Market in 2024, with Maharashtra and Gujarat emerging as major growth engines. It benefits from significant urbanization, industrialization, and the presence of leading corporate hospital networks. Mumbai and Pune serve as medical hubs, attracting patients from surrounding states and abroad. The region shows strong demand for specialty services such as cardiac care, oncology, and orthopedics. Public-private partnerships and state-level health programs are improving healthcare access in semi-urban and rural areas. The growth of insurance penetration and expansion of private healthcare chains support market expansion. Increasing focus on preventive care and day-care surgeries is further enhancing service diversity in the region.

Emerging Opportunities in Eastern and Northeastern India

Eastern and Northeastern India collectively hold around 30% of the India Hospital Market in 2024, with West Bengal, Assam, and Odisha driving much of the growth. It is experiencing rapid improvement in healthcare infrastructure through government funding and private sector entry. Kolkata has positioned itself as the primary medical hub, offering both general and specialized care. The region attracts patients from neighboring countries like Bangladesh, Nepal, and Bhutan, expanding its medical tourism scope. Despite infrastructure challenges in rural areas, investment in mobile health units and telehealth platforms is closing accessibility gaps. Specialty hospitals and diagnostic centers are increasing in Tier-2 cities, broadening service coverage. This steady progress indicates a strong growth trajectory for the region over the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Apollo Hospitals Enterprise Limited

- Max Healthcare Institute Limited

- Fortis Healthcare Limited

- Narayana Health

- Aster DM Healthcare Limited

- Shalby Limited

- Medanta The Medicity Global Health Private Limited

- Tata Memorial Hospital

- All India Institute of Medical Sciences

- Kokilaben Dhirubhai Ambani Hospital and Medical Research Institute

Competitive Analysis:

The India Hospital Market is characterized by a mix of established hospital chains, specialty care institutions, and public sector facilities competing for market share. Leading private players such as Apollo Hospitals, Fortis Healthcare, and Max Healthcare leverage advanced medical technology, multi-speciality offerings, and strong brand presence to attract patients domestically and internationally. Public hospitals remain vital in serving mass populations with affordable care, supported by government funding. It is also witnessing the rise of PPP models that merge public reach with private efficiency. Competition is intensifying with investments in infrastructure, expansion into Tier-2 and Tier-3 cities, and the adoption of digital health solutions. Market leaders focus on quality accreditation, international partnerships, and diversified services to strengthen their positions.

Recent Developments:

- In August 2025, Apollo Hospitals reported a 42% year-on-year increase in consolidated net profit to ₹433 crore for Q1 FY26, driven by robust growth across its healthcare services, diagnostics, and digital health segments. Apollo also unveiled the Apollo Zen AI-powered preventive healthcare program and is on track to add four new facilities—totaling 500 beds—by the end of FY26, including new hospitals in Pune, Kolkata, Defence Colony (Delhi), and Bengaluru. Additionally, the company approved the demerger of its omnichannel pharmacy business into Apollo Health Tech to accelerate digital health expansion.

- On August 13, 2025, Max Healthcare announced a 17% increase in net profit to ₹345 crore for Q1 FY26, with consolidated revenue rising 27% year-on-year to ₹2,460 crore. Max commissioned a new 160-bed tower at its Mohali facility and initiated plans to lease a built-to-suit 130-bed hospital in Dehradun, scheduled for commissioning by 2028. The board reaffirmed its near-term strategy to double capacity to 9,500 beds by 2028, supported by brownfield and greenfield expansions.

- In July 2025, Fortis Healthcare completed the acquisition of Shrimann Superspecialty Hospital in Jalandhar, Punjab, adding 228 beds to its portfolio. The company reported a 16.6% year-on-year increase in consolidated revenue to ₹2,167 crore for Q1 FY26, with strong gains in oncology and robotic surgical procedures—robotic surgeries rose 75% year-on-year, radiation therapy 53%, and orthopaedic procedures 22%. Fortis also signed an operations and maintenance agreement with Gleneagles India, gaining operational oversight of 700 beds across five Gleneagles hospitals, primarily in metro cities.

Market Concentration & Characteristics:

The India Hospital Market demonstrates moderate to high concentration, with a few major corporate chains and government institutions holding significant market influence. It has a diverse mix of public, private, and PPP models, with competition varying by region and specialty. Large players dominate metropolitan areas, while smaller hospitals cater to local and rural communities. High barriers to entry exist due to capital intensity, regulatory compliance, and the need for specialized talent. Growth is supported by medical tourism, technology integration, and expanding insurance coverage.

Report Coverage:

The research report offers an in-depth analysis based on ownership, specialty type, bed capacity, and type of services. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of corporate hospital chains into Tier-2 and Tier-3 cities.

- Increased adoption of AI and digital health platforms in clinical workflows.

- Growth in specialized care segments such as oncology, cardiology, and orthopedics.

- Rising demand for preventive healthcare and wellness programs.

- Integration of telemedicine and remote patient monitoring for rural outreach.

- Continued investments in medical tourism infrastructure and services.

- Enhanced focus on accreditation and quality certifications for global recognition.

- Expansion of PPP models to bridge infrastructure gaps in underserved regions.

- Rising insurance penetration driving higher private hospital utilization.

- Adoption of sustainable and green hospital infrastructure designs.