| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Medical Tourism Market Size 2024 |

USD 8,185.65 Million |

| India Medical Tourism Market, CAGR |

16.18% |

| India Medical Tourism Market Size 2032 |

USD 27,177.71 Million |

Market Overview

India Medical Tourism Market size was valued at USD 8,185.65 million in 2024 and is anticipated to reach USD 27,177.71 million by 2032, at a CAGR of 16.18% during the forecast period (2024-2032).

India’s medical tourism market is experiencing significant growth, driven by cost-effective treatments, advanced medical infrastructure, and the availability of highly skilled healthcare professionals. The country’s reputation for high-quality yet affordable procedures, particularly in cardiology, oncology, orthopedics, and cosmetic surgery, attracts a large influx of international patients. Government initiatives such as the e-medical visa and investment in healthcare infrastructure further support market expansion. Additionally, the increasing prevalence of chronic diseases, rising healthcare costs in developed nations, and long waiting times for procedures abroad are compelling patients to seek treatment in India. Key trends include the integration of AI and telemedicine for remote consultations, partnerships between hospitals and travel agencies for seamless patient experiences, and the rise of wellness tourism combining traditional Ayurveda with modern medicine. The continued expansion of world-class hospitals and the growing adoption of digital health technologies are expected to sustain this upward trajectory in the coming years.

India’s medical tourism industry is driven by key geographical regions, each offering advanced healthcare infrastructure and specialized treatments. The northern region, including Delhi and Gurugram, is known for multi-specialty hospitals catering to international patients seeking cardiology, oncology, and neurology treatments. The western region, particularly Mumbai and Ahmedabad, attracts patients for complex procedures such as organ transplants and orthopedic surgeries. The southern region, with Chennai, Bengaluru, and Hyderabad as key hubs, leads in high-quality medical services, including advanced surgical procedures and holistic wellness treatments like Ayurveda. The eastern region, mainly Kolkata and Bhubaneswar, is growing as a preferred destination for patients from neighboring countries due to cost-effective treatments. Prominent players in India’s medical tourism sector include Fortis Healthcare, Apollo Hospitals, Medanta, Max Healthcare, Manipal Hospitals, Narayana Health, and Kokilaben Dhirubhai Ambani Hospital, which offer world-class healthcare services, internationally accredited facilities, and specialized treatment plans for global patients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India medical tourism market was valued at USD 8,185.65 million in 2024 and is projected to reach USD 27,177.71 million by 2032, growing at a CAGR of 16.18% during the forecast period.

- Rising healthcare costs in developed nations are driving international patients to India for affordable, high-quality medical treatments.

- Increased investments in advanced medical technologies and globally accredited hospitals are enhancing India’s appeal as a top medical tourism destination.

- Leading players such as Fortis Healthcare, Apollo Hospitals, Medanta, and Max Healthcare are expanding their international patient care services.

- Challenges such as visa processing delays, inconsistent healthcare standards, and ethical concerns hinder market growth.

- The southern region, particularly Chennai, Bengaluru, and Hyderabad, dominates the market due to superior infrastructure and wellness tourism integration.

- Government initiatives, including the “Heal in India” campaign, are promoting India as a global healthcare hub, attracting more medical tourists.

Report Scope

This report segments the India Medical Tourism Market as follows:

Market Drivers

Cost-Effective Medical Treatments

India’s medical tourism market is driven by the affordability of treatments compared to developed nations. The country offers advanced medical procedures at a fraction of the cost in countries like the U.S., the U.K., and Canada, making it a preferred destination for international patients. For instance, a heart bypass surgery in India costs approximately $5,000, compared to $144,000 in the U.S., as reported by the Medical Tourism Association. Even with travel and accommodation expenses, medical tourists often find the overall cost significantly lower than what they would pay in their home countries. The availability of high-quality care at competitive prices is particularly beneficial for patients requiring complex surgeries, including cardiac procedures, orthopedic treatments, and organ transplants. Additionally, many Indian hospitals offer fixed-price packages that cover treatment, hospitalization, and post-operative care, ensuring transparency and affordability. This cost advantage, combined with world-class medical expertise, continues to attract a growing number of international patients seeking quality healthcare solutions at reasonable rates.

Advanced Healthcare Infrastructure and Skilled Professionals

India has a well-established healthcare infrastructure, with internationally accredited hospitals equipped with state-of-the-art technology and highly skilled medical professionals. For instance, hospitals like Apollo Hospitals and Narayana Health hold accreditations from the Joint Commission International (JCI) and the National Accreditation Board for Hospitals & Healthcare Providers (NABH), ensuring adherence to global healthcare standards. The country is home to renowned specialists across various medical disciplines, including cardiology, oncology, neurology, and cosmetic surgery, who have trained and practiced in leading global institutions. The availability of multilingual healthcare staff further enhances the patient experience by ensuring effective communication and personalized care. Additionally, India’s growing network of specialty hospitals and research centers continues to advance medical innovation, offering cutting-edge treatments such as robotic surgeries, stem cell therapy, and advanced cancer care. These factors position India as a trusted destination for medical tourists seeking high-quality, specialized treatments.

Government Initiatives and Policy Support

The Indian government actively promotes medical tourism through various initiatives and policy measures aimed at facilitating seamless healthcare access for international patients. The introduction of e-medical visas and the expansion of visa-on-arrival facilities for citizens of select countries have streamlined travel procedures, making it easier for foreign patients to seek treatment in India. Additionally, the government has launched promotional campaigns showcasing India’s medical expertise, modern healthcare facilities, and traditional wellness treatments such as Ayurveda and yoga. Financial incentives and investments in healthcare infrastructure further strengthen the sector, ensuring that hospitals and medical centers continue to offer world-class services. The establishment of dedicated medical tourism departments in major hospitals and partnerships with international healthcare facilitators also contribute to the smooth coordination of patient care. These supportive policies enhance India’s global competitiveness in medical tourism, attracting a growing number of patients each year.

Growing Demand for Specialized and Alternative Treatments

The increasing prevalence of chronic diseases, long waiting periods for medical procedures in developed nations, and rising healthcare costs are driving patients to seek specialized treatments in India. The country has gained global recognition for complex procedures, including organ transplants, cardiac surgeries, fertility treatments, and cancer care. Additionally, India’s rich heritage in alternative medicine, particularly Ayurveda, naturopathy, and holistic wellness therapies, attracts patients looking for integrative healthcare solutions. The growing trend of medical tourists combining allopathic treatments with traditional wellness therapies has further boosted India’s appeal as a medical tourism hub. Moreover, the rise of digital health services, including telemedicine and AI-powered diagnostics, is enhancing patient convenience and pre-treatment consultations. As medical tourism continues to evolve, India’s ability to offer both cutting-edge medical treatments and holistic healthcare solutions ensures its strong position in the global medical tourism landscape.

Market Trends

Rising Demand for Specialized and Complex Treatments

India is witnessing a surge in demand for specialized medical procedures, particularly in cardiology, oncology, organ transplants, and orthopedic surgeries. International patients increasingly choose India for high-risk procedures due to its combination of advanced technology, experienced medical professionals, and cost-effective treatment plans. For instance, hospitals like AIIMS and Medanta have successfully performed complex organ transplants and cardiac surgeries, attracting patients from across the globe. The country’s hospitals are continuously expanding their capabilities to offer robotic surgeries, minimally invasive procedures, and regenerative medicine treatments, enhancing patient outcomes and recovery times. Additionally, India’s reputation in fertility treatments, including in-vitro fertilization (IVF) and surrogacy, attracts a significant number of medical tourists seeking affordable and high-success-rate procedures. This growing preference for specialized care is strengthening India’s position as a leading global medical tourism destination.

Integration of Digital Health and Telemedicine

The adoption of digital health technologies and telemedicine is transforming India’s medical tourism sector by improving patient engagement and pre-treatment consultations. International patients can now connect with Indian healthcare providers for virtual diagnoses, second opinions, and treatment planning before traveling for medical procedures. AI-powered diagnostic tools, remote patient monitoring, and electronic health records streamline the treatment journey, ensuring seamless communication between doctors and patients. Additionally, hospitals are leveraging telehealth platforms to provide post-operative care and follow-ups, reducing the need for repeat visits. These digital advancements enhance patient confidence and convenience, making India’s healthcare services more accessible and appealing to global medical travelers.

Expansion of Wellness and Holistic Health Tourism

Alongside conventional medical treatments, India is witnessing a rising demand for integrative healthcare solutions, including Ayurveda, naturopathy, and yoga-based therapies. Many international patients seek holistic healing experiences that combine modern medicine with traditional wellness practices to enhance recovery and overall well-being. The government and private healthcare providers are investing in wellness centers, medical resorts, and integrative health programs that cater to this growing trend. Destinations such as Kerala, Rishikesh, and Goa are becoming global wellness hubs, attracting patients looking for stress management, detoxification, and rehabilitation therapies. This fusion of medical and wellness tourism is strengthening India’s position as a comprehensive healthcare destination.

Strengthening of International Partnerships and Accreditation

India’s medical tourism industry is expanding its global presence through strategic collaborations with international healthcare providers, insurance companies, and travel agencies. For instance, partnerships between Indian hospitals like Fortis Healthcare and international insurance companies ensure seamless patient referrals and coverage for treatments. Additionally, the increasing number of Joint Commission International (JCI) and National Accreditation Board for Hospitals & Healthcare Providers (NABH) accreditations is reinforcing India’s credibility as a provider of world-class healthcare. These international affiliations improve medical tourism infrastructure, patient experience, and regulatory compliance, further positioning India as a preferred destination for high-quality and cost-effective medical treatments.

Market Challenges Analysis

Infrastructural and Regulatory Challenges

Despite India’s rapid growth in medical tourism, infrastructural and regulatory challenges hinder its full potential. Inconsistent healthcare standards across different hospitals and regions create disparities in patient experiences and treatment outcomes. For instance, while hospitals like Apollo and Fortis maintain global accreditations such as JCI and NABH, smaller healthcare facilities often lack standardized protocols, raising concerns about service quality. Additionally, the country faces limitations in medical tourism-specific infrastructure, such as dedicated international patient wings, streamlined immigration processes, and seamless transportation services. Bureaucratic hurdles, including complex visa policies and regulatory delays, can deter potential medical tourists. Ensuring uniform healthcare quality, improving hospital accreditation processes, and simplifying medical visa regulations are essential to overcoming these barriers and enhancing India’s global competitiveness in medical tourism.

Concerns Over Ethical Practices and Patient Safety

Ethical concerns and patient safety issues present significant challenges to India’s medical tourism sector. Instances of malpractice, misrepresentation of treatment success rates, and inadequate post-operative care in certain facilities raise doubts about credibility. The lack of a centralized regulatory authority to oversee medical tourism operations can lead to inconsistencies in pricing transparency and ethical standards. Additionally, unregulated intermediaries and medical tourism facilitators sometimes mislead patients with false promises, impacting trust in India’s healthcare system. Ensuring strict compliance with ethical guidelines, implementing standardized pricing structures, and strengthening legal frameworks for medical malpractice can help mitigate these challenges. Strengthening patient protection mechanisms and maintaining transparency in treatment outcomes will be crucial in sustaining India’s reputation as a trusted medical tourism destination.

Market Opportunities

India’s medical tourism sector presents immense growth opportunities, driven by increasing global demand for affordable, high-quality healthcare. The country can capitalize on its cost advantage by expanding specialized treatment offerings in areas such as oncology, neurology, organ transplants, and advanced cosmetic procedures. Strengthening medical infrastructure with more internationally accredited hospitals and state-of-the-art technology will enhance India’s credibility and attract a broader patient base. Additionally, the integration of telemedicine and AI-driven diagnostics allows healthcare providers to offer remote consultations, enabling patients to assess treatment options before traveling. Expanding medical tourism-specific infrastructure, such as dedicated international patient departments and streamlined visa policies, can further improve accessibility and patient experience. The development of strategic partnerships with global healthcare organizations, insurance providers, and travel agencies will also help boost India’s position as a preferred medical tourism destination.

Another significant opportunity lies in the growing interest in holistic and wellness tourism. India’s rich heritage in Ayurveda, naturopathy, and yoga provides a unique value proposition for international patients seeking integrative healthcare solutions. By establishing more wellness resorts and combining traditional healing therapies with modern medicine, India can attract a new segment of health-conscious travelers. Additionally, government initiatives aimed at promoting India as a global medical and wellness hub, such as the “Heal in India” campaign, further support market expansion. Enhancing international branding through targeted marketing efforts, participation in global healthcare summits, and leveraging digital platforms can increase India’s visibility among medical tourists. With continuous advancements in healthcare technology and increasing global patient awareness, India’s medical tourism industry is well-positioned for long-term growth and sustained competitiveness on the global stage.

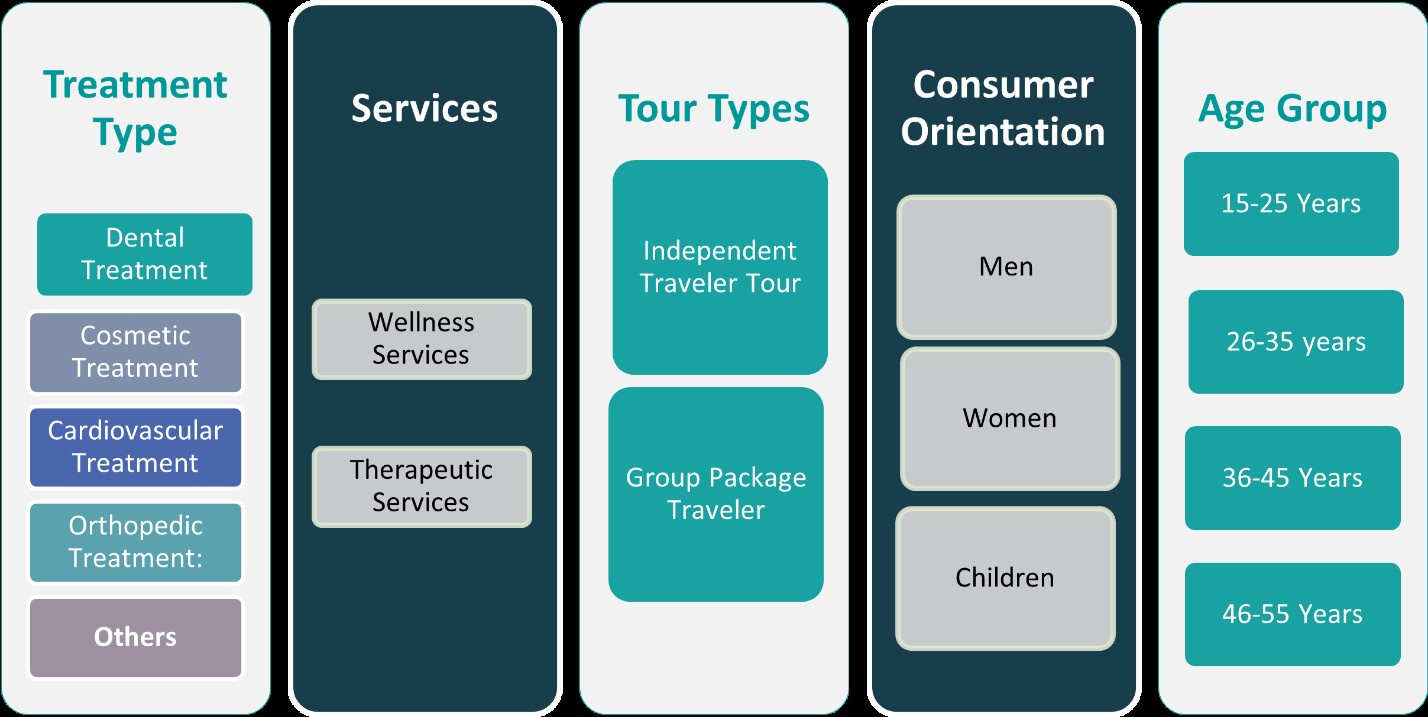

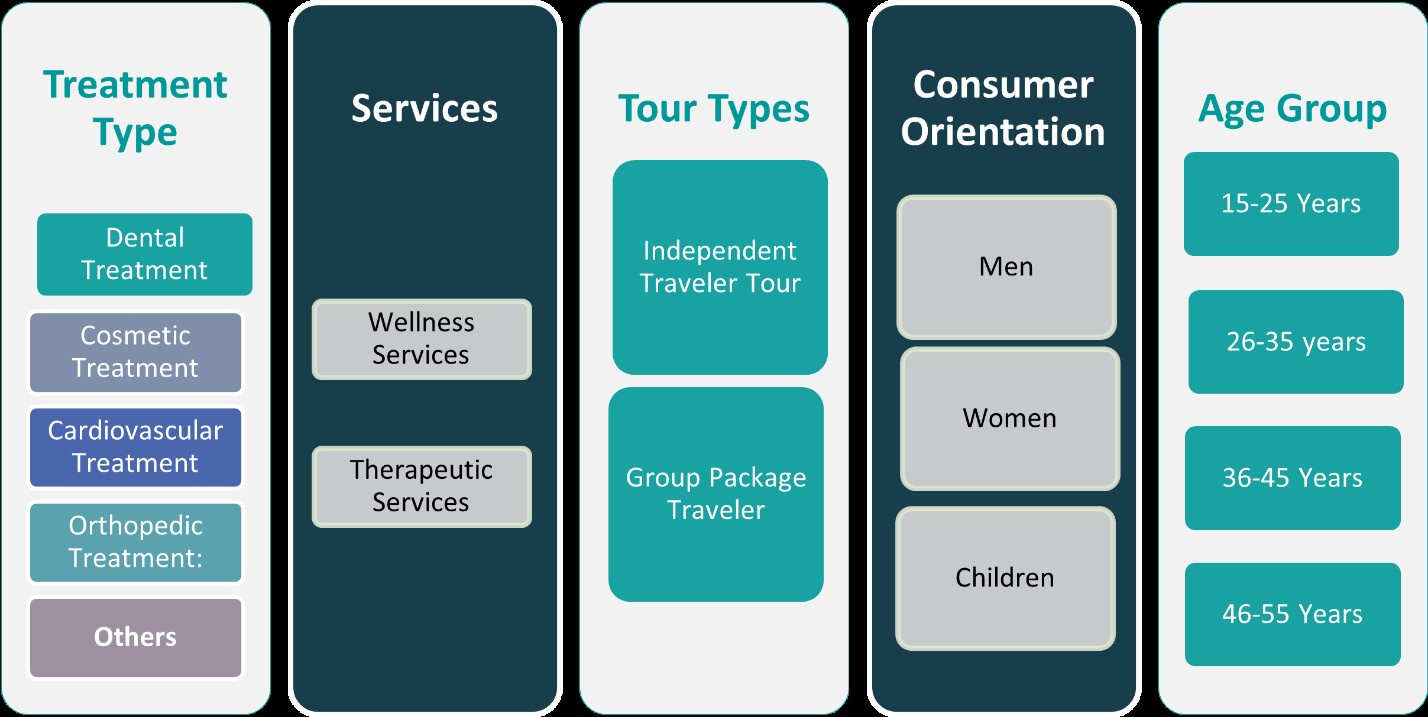

Market Segmentation Analysis:

By Treatment:

India’s medical tourism market is segmented based on treatment types, including dental, cosmetic, cardiovascular, orthopedic, and other specialized medical procedures. Dental treatments attract a significant number of international patients due to their affordability and availability of advanced procedures such as dental implants, root canals, and cosmetic dentistry. The cosmetic treatment segment is also witnessing robust growth, driven by the rising demand for aesthetic enhancements, including rhinoplasty, liposuction, and hair transplants. India’s competitive pricing, coupled with the expertise of board-certified plastic surgeons, has positioned the country as a top destination for cosmetic procedures. Cardiovascular treatments, such as bypass surgeries, valve replacements, and angioplasty, are among the most sought-after procedures due to the high prevalence of heart diseases globally and India’s reputation for world-class cardiac care at cost-effective rates. Orthopedic treatments, including joint replacement surgeries and spinal procedures, are also in high demand, especially among elderly patients and those seeking advanced, minimally invasive techniques. Other specialized treatments, such as fertility procedures, oncology care, and neurosurgery, further contribute to India’s growing medical tourism industry.

By Services:

India’s medical tourism market is further segmented based on services, primarily categorized into wellness services and therapeutic services. Wellness services encompass traditional healing systems such as Ayurveda, naturopathy, and yoga, which have gained immense popularity among international tourists seeking holistic health solutions. Many patients combine modern medical treatments with wellness therapies to aid in post-surgical recovery and overall well-being. India’s numerous wellness retreats and integrative healthcare centers cater to this demand by offering detoxification, stress management, and rejuvenation programs. On the other hand, therapeutic services include conventional medical treatments across specialties such as cardiology, oncology, orthopedics, and neurology, where patients receive evidence-based care from internationally accredited hospitals. The rising prevalence of chronic diseases, coupled with the high cost of medical care in developed countries, continues to drive international patients to India for therapeutic treatments. With the increasing adoption of personalized healthcare plans and digital health services, India remains a preferred destination for both wellness and therapeutic medical tourism.

Segments:

Based on Treatment:

- Dental Treatment

- Cosmetic Treatment

- Cardiovascular Treatment

- Orthopedic Treatment

- Others

Based on Services:

- Wellness Services

- Therapeutic Services

Based on Tour Type:

- Independent Traveler Tour

- Group Package Traveler

Based on Consumer Orientation:

Based on the Geography:

- Northern

- Western

- Southern

- Eastern

Regional Analysis

Northern Region

The northern region of India accounts for approximately 30% of the medical tourism market, driven by world-class healthcare facilities in cities like Delhi, Gurugram, and Chandigarh. These cities host internationally accredited hospitals offering specialized treatments in cardiology, oncology, neurology, and orthopedic surgeries. Delhi, in particular, has emerged as a key medical tourism hub, attracting patients from South Asia, the Middle East, and Africa due to its advanced infrastructure and cost-effective medical procedures. AIIMS, Medanta, Fortis, and Max Healthcare are among the leading institutions providing high-quality care to international patients. Additionally, the presence of government-supported medical initiatives and well-developed air connectivity further enhance the region’s appeal. The availability of premium wellness centers and integrative medicine facilities offering Ayurveda and naturopathy treatments also contribute to the region’s growth.

Western Region

The western region holds approximately 25% of India’s medical tourism market, with Maharashtra and Gujarat emerging as leading destinations. Mumbai, Pune, and Ahmedabad are at the forefront, offering a combination of cutting-edge medical technology, highly skilled specialists, and internationally accredited hospitals. Mumbai, known for its multi-specialty hospitals like Kokilaben Dhirubhai Ambani Hospital, Lilavati Hospital, and Jaslok Hospital, attracts a large number of foreign patients seeking complex treatments, including organ transplants and oncology care. Gujarat, particularly Ahmedabad, is recognized for advanced cardiac care and orthopedic procedures, making it a preferred destination for patients from Africa and the Middle East. Additionally, the region’s strong pharmaceutical industry ensures accessibility to high-quality medications at lower costs, further benefiting medical tourists. The presence of wellness resorts along the western coastline also contributes to the region’s appeal for patients seeking post-treatment rehabilitation and alternative healing therapies.

Southern Region

The southern region dominates India’s medical tourism market, holding a 35% share, making it the most preferred destination for international patients. Cities like Chennai, Bengaluru, Hyderabad, and Kochi are known for their high-quality medical infrastructure, affordable treatments, and renowned healthcare institutions such as Apollo Hospitals, Narayana Health, and Manipal Hospitals. Chennai, often referred to as the “Health Capital of India,” alone attracts a large percentage of foreign patients, particularly from Southeast Asia and the Middle East, seeking specialized treatments in cardiology, organ transplants, and orthopedics. The presence of top-tier wellness centers offering Ayurveda, Siddha, and yoga-based therapies further strengthens the region’s position in medical tourism. Southern India’s superior healthcare ecosystem, supported by government initiatives and seamless international connectivity, ensures continued dominance in the industry.

Eastern Region

The eastern region, while still developing as a medical tourism hub, holds 10% of the market, with Kolkata and Bhubaneswar leading in healthcare services. The region attracts patients primarily from Bangladesh, Nepal, Bhutan, and Southeast Asia due to its geographical proximity and affordable medical treatments. Kolkata, home to prominent hospitals such as AMRI Hospitals, Apollo Gleneagles, and Fortis, is recognized for its expertise in cardiac care, neurology, and gastrointestinal treatments. Bhubaneswar is emerging as a medical destination with investments in multi-specialty hospitals and government-supported healthcare initiatives. However, compared to other regions, the eastern market faces challenges related to infrastructure development and international connectivity. Despite these limitations, the region continues to witness steady growth due to its affordability and the increasing presence of well-equipped hospitals catering to foreign patients.

Key Player Analysis

- Fortis Healthcare

- Apollo Hospital

- Medanta

- Max Healthcare

- Manipal Hospitals

- Narayana Health

- Kokilaben Dhirubhai Ambani Hospital

- Artemis Hospitals

- Columbia Asia Hospitals

- Sri Ramachandra Medical Centre

Competitive Analysis

India’s medical tourism market is highly competitive, with leading healthcare providers offering world-class medical services at cost-effective rates. Fortis Healthcare, Apollo Hospitals, Medanta, Max Healthcare, Manipal Hospitals, Narayana Health, and Kokilaben Dhirubhai Ambani Hospital are key players driving market growth through advanced infrastructure, skilled medical professionals, and globally accredited facilities. These hospitals specialize in various treatments, including cardiology, oncology, orthopedics, neurology, and cosmetic procedures, attracting patients from across the globe. These players focus on enhancing patient experience by providing multilingual support, personalized care, and international patient departments to streamline treatment processes. Additionally, strategic collaborations with global insurance providers, digital healthcare platforms, and medical tourism facilitators strengthen their competitive edge. Many hospitals have adopted telemedicine and AI-based diagnostics, allowing patients to consult specialists before traveling. Despite strong market positioning, challenges such as regulatory constraints and competition from emerging medical tourism destinations require continuous innovation. By expanding service offerings and leveraging government support, these players aim to sustain their leadership in India’s growing medical tourism industry.

Recent Developments

- In March 2025, Raffles Medical Group signed a strategic collaboration agreement with Shanghai Renji Hospital to establish a “dual circulation” service system. This partnership aims to promote cross-border healthcare services and position Shanghai as a hub for international medical tourism.

- In March 2025, MOHW Hengchun Tourism Hospital was highlighted as a key player in the global medical tourism market in a report projecting significant growth for the industry. The hospital continues to play a pivotal role in expanding medical tourism opportunities, particularly in Asia.

- In February 2025, Apollo Hospitals emphasized the need for a liberal visa policy to enhance India’s medical tourism sector. The hospital is collaborating with the Indian government on the “Heal in India” initiative to attract international patients and streamline medical visa processes.

- In January 2025, Mount Elizabeth Hospitals unveiled new facilities under “Project Renaissance,” which included expanded wards, upgraded critical care units, and additional single-bedded and negative pressure rooms. This expansion added 62 beds to its capacity and enhanced patient care infrastructure.

Market Concentration & Characteristics

India’s medical tourism market exhibits a moderately high market concentration, with a few dominant healthcare providers catering to a significant share of international patients. Leading hospitals such as Fortis Healthcare, Apollo Hospitals, Medanta, Max Healthcare, Manipal Hospitals, Narayana Health, and Kokilaben Dhirubhai Ambani Hospital drive the sector through advanced medical expertise, globally accredited facilities, and competitive pricing. The market is characterized by a strong presence of multi-specialty hospitals, offering treatments across cardiology, oncology, orthopedics, neurology, and cosmetic procedures. Additionally, India’s cost-effective medical services, compared to Western nations, enhance its attractiveness to international patients. The industry also benefits from technological integration, telemedicine, and AI-based diagnostics, improving patient accessibility and service efficiency. Despite strong growth potential, entry barriers for new players remain high, as international accreditation, infrastructure investment, and regulatory compliance require significant resources. Overall, the market is evolving rapidly, with innovation and strategic expansions shaping its competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Treatment, Services, Tour Type, Consumer Orientation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- India’s medical tourism market will continue to grow, driven by affordability and advanced healthcare infrastructure.

- The adoption of AI, telemedicine, and robotic surgeries will enhance medical service efficiency and patient outcomes.

- Government initiatives such as the “Heal in India” campaign will further promote India as a global healthcare destination.

- More international collaborations with insurance providers will simplify the medical travel process for foreign patients.

- Expansion of wellness tourism, including Ayurveda, yoga, and naturopathy, will attract a broader international audience.

- Leading hospitals will continue to invest in specialized centers for oncology, cardiology, neurology, and organ transplants.

- Improved visa facilitation and medical travel policies will enhance patient inflow from Africa, the Middle East, and Southeast Asia.

- Infrastructure developments, including smart hospitals and digital health platforms, will improve patient experiences.

- Rising competition from emerging medical tourism destinations may push Indian hospitals to further innovate and enhance service quality.

- Strengthening of regulatory frameworks and international accreditations will boost trust and credibility in India’s healthcare system.