| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Plastic Welding Equipment Market Size 2024 |

USD 333.08 Million |

| India Plastic Welding Equipment Market, CAGR |

9.33% |

| India Plastic Welding Equipment Market Size 2032 |

USD 679.85 Million |

Market Overview

India Plastic Welding Equipment Market size was valued at USD 333.08 million in 2024 and is anticipated to reach USD 679.85 million by 2032, at a CAGR of 9.33% during the forecast period (2024-2032).

The India plastic welding equipment market is driven by several key factors, including rapid industrialization, increased demand for plastic components across industries like automotive, packaging, and construction, and advancements in welding technology. The growing trend of automation in manufacturing processes is boosting the adoption of plastic welding equipment, as it enhances production efficiency and reduces labor costs. Additionally, the shift toward sustainable and eco-friendly practices is encouraging the use of plastic welding techniques for recycling and reusing materials. The automotive sector, in particular, is a significant contributor, with rising demand for lightweight, durable plastic parts. Furthermore, the increasing focus on reducing plastic waste and promoting circular economy practices is expected to further fuel market growth. As these sectors evolve, the market for plastic welding equipment is poised for steady expansion, driven by innovations in technology and a heightened emphasis on sustainability.

The geographical analysis of the Indian plastic welding equipment market highlights the regional variation in demand driven by industrial activity and infrastructure development. Northern India, with its strong manufacturing base, is a key player in driving demand, particularly in automotive and packaging sectors. Western India, known for its industrialized economy and proximity to major ports, also sees high demand from the electronics and automotive industries. Southern India’s rapidly growing sectors such as automotive and consumer electronics further contribute to the market’s expansion, while Eastern India, though historically lagging, is catching up due to increasing investments in infrastructure and small-medium enterprises. The market is competitive with major players like Emerson Electric Co., Leister Technologies AG, and Dukane Corporation leading the way. Other notable companies include Herrmann Ultraschalltechnik GmbH & Co. KG, Branson Ultrasonics Corporation, and Frimo Group GmbH, all of which offer advanced plastic welding solutions across various industries in India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India plastic welding equipment market was valued at USD 333.08 million in 2024 and is expected to reach USD 679.85 million by 2032, growing at a CAGR of 9.33% during the forecast period (2024-2032).

- The global plastic welding equipment market was valued at USD 11,340.00 million in 2024 and is projected to reach USD 19,842.36 million by 2032, growing at a CAGR of 7.24% from 2024 to 2032.

- Increasing industrialization, particularly in sectors like automotive, packaging, and electronics, is driving the demand for advanced plastic welding solutions.

- Rising automation in manufacturing processes is a key market trend, leading to greater efficiency and precision in plastic welding.

- The market is highly competitive with key players such as Emerson Electric Co., Leister Technologies AG, and Dukane Corporation dominating the industry.

- Market restraints include high initial costs of equipment and the need for skilled labor for advanced welding processes.

- Northern and Western India are the largest contributors to the market, with industrial hubs like Delhi, Mumbai, and Pune leading demand.

- Eastern and Southern regions show promising growth due to increasing infrastructure development and industrial investments.

Report Scope

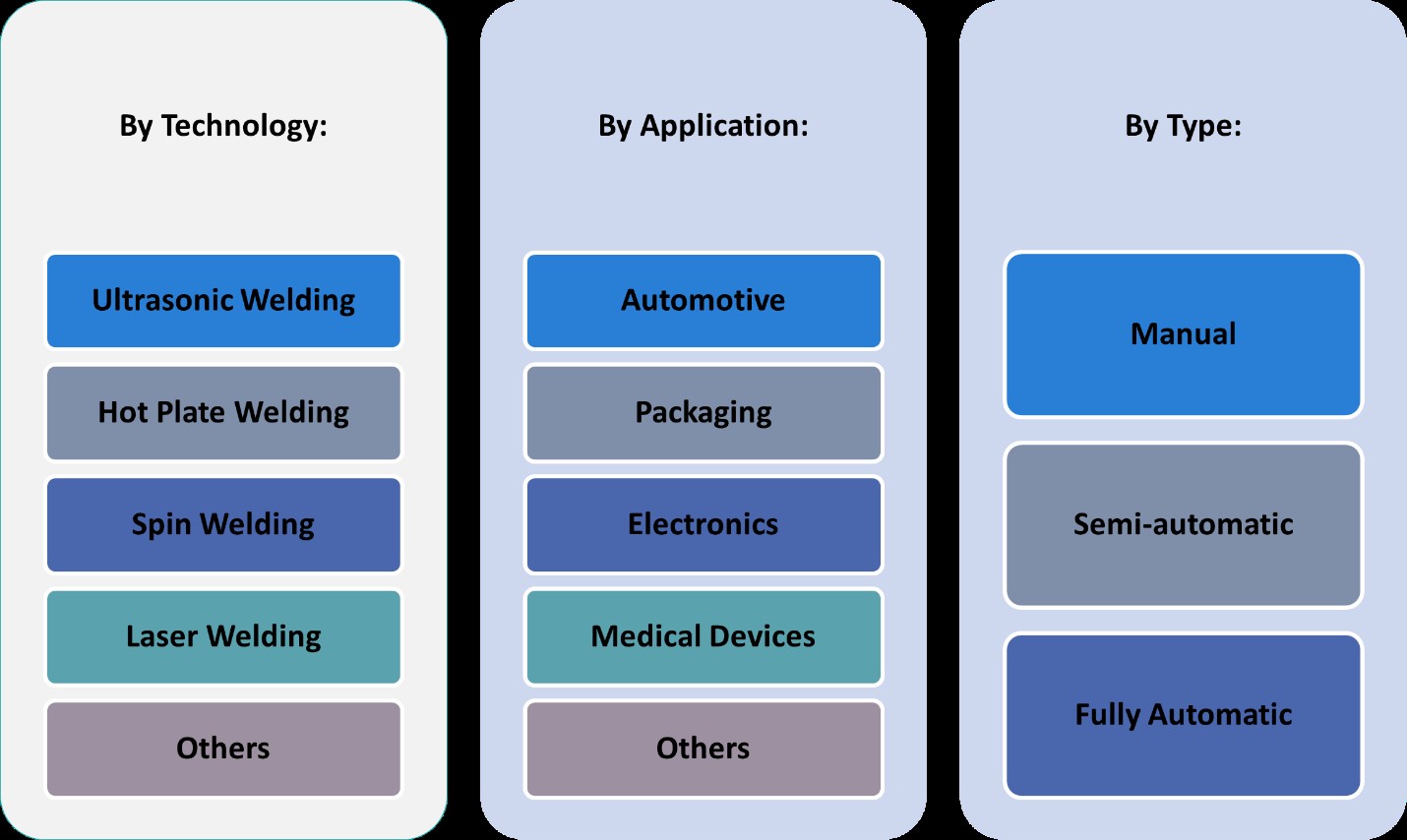

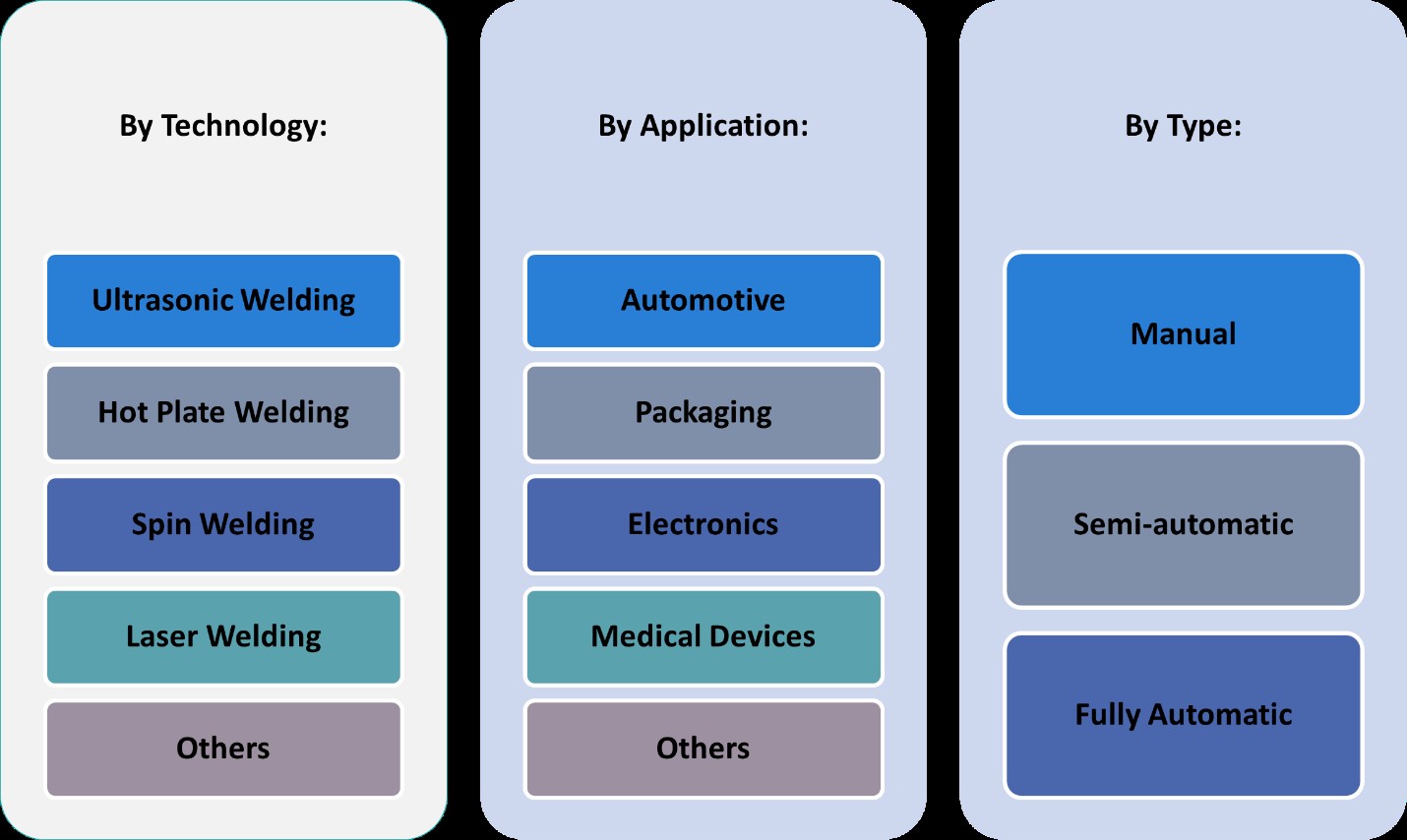

This report segments the India Plastic Welding Equipment Market as follows:

Market Drivers

Industrial Growth and Urbanization

The rapid industrialization and urbanization of India are primary drivers of the growth in the plastic welding equipment market. For instance, the Annual Survey of Industries (ASI) conducted by the Ministry of Statistics and Programme Implementation highlights the increasing industrial activities in urban areas, which fuel the demand for advanced manufacturing solutions. As industries such as automotive, construction, packaging, and consumer goods expand, the demand for plastic components continues to rise. The increasing industrial activities in urban areas fuel the need for advanced plastic welding solutions to meet manufacturing demands. With infrastructure development accelerating, particularly in sectors like construction and automotive, plastic welding equipment becomes crucial for fabricating components used in various machinery, vehicles, and building materials. Urbanization also leads to a rise in consumer goods manufacturing, further driving the need for plastic products and, consequently, the welding equipment required to produce them efficiently.

Growing Demand from the Automotive Sector

The automotive industry in India is experiencing significant growth, driven by a rising middle class, increased disposable incomes, and a greater demand for fuel-efficient, lightweight vehicles. For instance, the NITI Aayog report on the automotive sector highlights the growing reliance on lightweight plastic components to improve fuel efficiency and reduce emissions. As a result, the automotive sector is increasingly relying on plastic components for vehicle interiors, exteriors, and under-the-hood applications. Plastic welding technology is essential for manufacturing durable, cost-effective parts with minimal weight. With the growing emphasis on fuel efficiency and reducing vehicle weight for better performance and emissions control, the demand for plastic welding equipment is expected to rise. Additionally, the shift toward electric vehicles (EVs) further propels the need for innovative plastic welding solutions, as lightweight materials become crucial for battery enclosures, interiors, and other components.

Advancements in Welding Technology

Technological advancements in plastic welding equipment are transforming the manufacturing landscape in India. New innovations in welding technology, such as ultrasonic welding, hot plate welding, and laser welding, provide improved precision, efficiency, and strength in plastic joint formation. These advancements allow manufacturers to produce high-quality products with minimal defects, reducing costs and improving production timelines. Furthermore, the automation of plastic welding processes enables faster production rates, consistent quality, and reduced human intervention, which is especially important in large-scale manufacturing. As a result, companies are increasingly adopting advanced plastic welding technologies to stay competitive, boosting the demand for sophisticated equipment. The continuous evolution of these technologies also ensures that the market will remain dynamic, attracting investments and driving further growth.

Shift Toward Sustainable Practices and Circular Economy

As environmental concerns rise, industries in India are focusing more on sustainability and circular economy practices. The demand for eco-friendly manufacturing processes has spurred the adoption of plastic recycling technologies, and plastic welding plays a key role in enabling efficient reuse of plastic materials. Plastic welding techniques can be used for repairing and reusing plastic components, reducing the need for new plastic production and minimizing waste. The shift toward circular economies in sectors like packaging and automotive is driving the use of plastic welding equipment for reprocessing plastic parts and components. Government regulations and initiatives promoting recycling and sustainable production also influence this trend. As industries prioritize reducing their environmental impact, the demand for plastic welding solutions that support sustainability will continue to rise, further fueling market growth.

Market Trends

Automation and Industry 4.0 Integration

One of the prominent trends in the India plastic welding equipment market is the growing integration of automation and Industry 4.0 technologies. For instance, the SAMARTH Udyog Bharat 4.0 initiative by the Ministry of Heavy Industries promotes the adoption of smart manufacturing systems equipped with sensors, robotics, and AI to enhance operational efficiency. Manufacturers are increasingly adopting automated plastic welding systems that improve efficiency, consistency, and production speed. Automation also allows for better quality control, as the systems are capable of monitoring and adjusting welding parameters in real-time. The shift towards smart factories and digital manufacturing further accelerates the demand for automated plastic welding equipment, as industries seek to enhance their operational efficiency while minimizing downtime and waste.

Adoption of Advanced Welding Technologies

The adoption of advanced welding technologies is a significant trend in the Indian plastic welding equipment market. For instance, the White Paper on Advanced Welding Technologies by the Ministry of MSME highlights innovations such as ultrasonic and laser welding, which provide high-speed operation and precision in joining plastic materials. These advanced welding methods allow manufacturers to join plastic materials with greater accuracy and strength, resulting in high-quality, durable products. Additionally, these technologies reduce energy consumption and offer more efficient ways to handle different plastic materials. As industries seek to meet the increasing demand for high-performance and lightweight plastic components, the shift towards these advanced welding technologies is expected to continue, driving market growth and innovation in the sector.

Growth of Plastic Recycling Initiatives

Another notable trend is the rising focus on plastic recycling and sustainability, which is influencing the plastic welding equipment market in India. As environmental concerns intensify, there is a growing emphasis on the circular economy, with industries aiming to reduce plastic waste through recycling and reusing plastic materials. Plastic welding plays a critical role in these initiatives, enabling the repair and reuse of plastic components across sectors like automotive, packaging, and consumer goods. Manufacturers are increasingly investing in plastic welding technologies that support the recycling process, allowing for the creation of sustainable products and reducing the environmental footprint of production. This trend aligns with India’s government initiatives to promote sustainability and waste reduction, which in turn boosts demand for plastic welding equipment.

Demand for Lightweight and Durable Plastic Components

The increasing demand for lightweight and durable plastic components across various industries, particularly in the automotive and packaging sectors, is another key trend shaping the market. As the automotive industry focuses on fuel efficiency and reduced emissions, lightweight materials, such as plastic, are being used more extensively in vehicle construction. Plastic welding equipment is crucial for joining these materials to produce strong, lightweight parts, such as bumpers, dashboards, and exterior panels. Similarly, in the packaging sector, the need for strong yet lightweight packaging solutions is driving the demand for plastic welding technologies. As industries continue to prioritize durability and performance in their products, the demand for plastic welding equipment will increase to meet these evolving needs.

Market Challenges Analysis

High Initial Investment and Maintenance Costs

One of the primary challenges facing the India plastic welding equipment market is the high initial investment and maintenance costs associated with advanced welding systems. While automated and advanced welding technologies offer significant benefits in terms of efficiency and quality, they require substantial upfront capital for installation and integration into production lines. For small and medium-sized enterprises (SMEs), these costs can be a significant barrier to entry. Additionally, the maintenance and operational costs of advanced systems can add to the financial burden, especially if specialized components or frequent repairs are required. This challenge may hinder the widespread adoption of plastic welding equipment among cost-sensitive businesses, limiting market growth in certain segments.

Skill Gap and Lack of Trained Workforce

Another challenge is the shortage of skilled operators and technicians trained in advanced plastic welding technologies. For instance, the India Skills Report 2025 highlights the need for workforce development to address the skill gap in specialized fields like advanced welding techniques. However, there is a gap in the availability of skilled professionals, particularly in smaller cities or rural areas, where the adoption of advanced welding technologies is still in its nascent stages. This lack of a trained workforce can lead to inefficiencies, quality issues, and an increased risk of operational errors, which can hinder the effective utilization of plastic welding equipment. Bridging this skill gap through training and certification programs will be essential to overcoming this challenge and ensuring smooth market growth.

Market Opportunities

The India plastic welding equipment market presents significant growth opportunities driven by the increasing demand for lightweight, durable, and high-performance plastic components across various industries. The automotive sector, in particular, offers substantial potential, as manufacturers seek to reduce vehicle weight for improved fuel efficiency and emissions. Plastic welding is critical for producing lightweight parts, such as dashboards, bumpers, and interior components, which is driving the demand for advanced welding technologies. Additionally, the rapid growth of the electric vehicle (EV) market in India opens new avenues for plastic welding equipment, as EVs require specialized components, including battery enclosures and lightweight interiors. As the automotive industry moves towards more sustainable practices, the adoption of advanced plastic welding technologies is expected to rise, further boosting market prospects.

The growing emphasis on sustainability and plastic recycling also presents key opportunities for the Indian plastic welding equipment market. With increasing awareness of environmental concerns, industries are focusing on reducing plastic waste and promoting circular economies. Plastic welding plays an essential role in this process by enabling the repair and reuse of plastic products, which can be recycled into new materials or components. This trend is particularly prominent in the packaging, consumer goods, and electronics sectors, where the demand for eco-friendly manufacturing solutions is on the rise. As India continues to push for stricter environmental regulations and encourages the use of recycled materials, the adoption of plastic welding equipment that supports sustainability initiatives will see continued growth, providing substantial opportunities for manufacturers in this space.

Market Segmentation Analysis:

By Type:

The India plastic welding equipment market can be segmented by type into manual, semi-automatic, and fully automatic systems. Manual plastic welding equipment is primarily used in small-scale operations and for low-volume production, where precision and high-speed automation are not crucial. While manual systems are cost-effective and require less initial investment, they are limited in terms of efficiency and consistency. Semi-automatic systems offer a balanced approach, providing improved production efficiency compared to manual systems while still allowing for some operator intervention. These systems are commonly used in medium-sized operations where moderate automation is desired. The fully automatic segment is experiencing the most growth, driven by the demand for high-volume production and increased operational efficiency. Fully automatic plastic welding systems provide precision, speed, and minimal human intervention, making them ideal for large-scale manufacturing operations, particularly in industries like automotive and packaging. The increased focus on automation and smart factories further drives the adoption of fully automatic plastic welding equipment.

By Application:

The India plastic welding equipment market is also segmented based on application, including electronics, packaging, automotive, medical devices, and others. The automotive sector is one of the largest contributors to market growth, driven by the rising demand for lightweight, durable, and fuel-efficient vehicles. Plastic welding is used extensively in manufacturing parts like bumpers, dashboards, and interior components, which require precise and strong joining. The packaging industry is another significant segment, where plastic welding technologies are used for creating sealed, lightweight, and durable packaging materials. In the electronics sector, plastic welding plays a critical role in assembling components such as housings, enclosures, and connectors for devices like smartphones and laptops. The medical device sector also demands high-precision plastic welding for producing sterile, reliable components such as syringes, IV sets, and diagnostic equipment. Additionally, other sectors like consumer goods, construction, and aerospace are contributing to the growing demand for plastic welding equipment.

Segments:

Based on Type:

- Manual

- Semi-automatic

- Fully Automatic

Based on Application:

- Electronics

- Packaging

- Automotive

- Medical Devices

- Others

Based on Technology:

- Ultrasonic Welding

- Hot Plate Welding

- Spin Welding

- Laser Welding

- Others

Based on the Geography:

- Northern

- Western

- Southern

- Eastern

Regional Analysis

Northern India

Northern India holds a dominant position in the market, accounting for approximately 35% of the total market share. The region’s rapid industrialization, coupled with the presence of major manufacturing hubs, has spurred demand for plastic welding equipment across sectors such as automotive, packaging, and construction. The strong industrial base in cities like Delhi, Chandigarh, and Ludhiana has been a key factor in the region’s substantial market share.

Western India

Western India, contributing around 28% to the market share, is another important region for the plastic welding equipment industry. The region benefits from its well-established infrastructure, proximity to major ports such as Mumbai and Gujarat, and a thriving industrial ecosystem. Sectors such as textiles, automotive, and electronics in cities like Ahmedabad, Mumbai, and Pune are major drivers of demand for plastic welding equipment. The region’s robust industrial policies and focus on technological advancements further support the market’s growth.

Southern India

Southern India, which represents roughly 22% of the market share, is home to a significant portion of India’s manufacturing and IT industries. Key cities like Chennai, Bengaluru, and Hyderabad are experiencing substantial growth in the automotive, electronics, and consumer goods industries. This growth is directly influencing the demand for plastic welding equipment, as the need for durable and efficient plastic welding solutions rises in these industrial sectors. The region is also witnessing a shift towards automation and advanced welding techniques, which is positively impacting the market for these specialized tools.

Eastern India

Eastern India, accounting for approximately 15% of the total market share, has traditionally lagged behind the other regions in terms of industrial growth. However, with the increasing investments in infrastructure and the rise of sectors like mining, chemicals, and construction in cities like Kolkata, Bhubaneswar, and Jamshedpur, the demand for plastic welding equipment is gradually increasing. The region is witnessing growth in the small and medium-sized enterprise (SME) sector, contributing to the rise in demand for more affordable and reliable plastic welding solutions. While its market share is currently lower than that of the other regions, Eastern India shows promise for future growth.

Key Player Analysis

- Emerson Electric Co.

- Leister Technologies AG

- Dukane Corporation

- Herrmann Ultraschalltechnik GmbH & Co. KG

- Branson Ultrasonics Corporation

- Frimo Group GmbH

- Bielomatik Leuze GmbH & Co. KG

- CHN-TOP Machinery Group

- Haitian International Holdings Ltd.

- Xinpoint Corporation

Competitive Analysis

The competitive landscape of the Indian plastic welding equipment market is characterized by the presence of several leading global and local players, each offering advanced solutions for a variety of industries. Key players in the market include Emerson Electric Co., Leister Technologies AG, Dukane Corporation, Herrmann Ultraschalltechnik GmbH & Co. KG, Branson Ultrasonics Corporation, Frimo Group GmbH, Bielomatik Leuze GmbH & Co. KG, CHN-TOP Machinery Group, Haitian International Holdings Ltd., and Xinpoint Corporation. The dominant players typically focus on product innovation and offering specialized welding technologies such as ultrasonic, laser, and hot plate welding. Manufacturers are also adopting automation and digitalization to improve efficiency and reduce operational costs. The increasing industrialization across sectors such as automotive, packaging, and electronics is propelling competition, as companies strive to meet the growing demand for durable and high-quality plastic welding solutions. Competitive strategies also include forming strategic partnerships with local distributors, offering after-sales services, and customizing solutions to cater to specific industry needs. Moreover, the rise in domestic production and availability of cost-effective solutions are enabling new players to enter the market and gain a foothold, making it more competitive. Despite these competitive dynamics, challenges such as high initial costs and the need for skilled labor persist, pushing companies to innovate further in product offerings and manufacturing processes to stay ahead in the market.

Recent Developments

- In March 2025, Leister transferred its laser plastic welding business to Hymson Novolas AG, a subsidiary of Hymson Laser Technology Group Co. Ltd. The transition ensures continuity and further development of existing product lines, with a new Laser Technology Center established in Switzerland. Leister will now focus more on its core competencies: plastic welding (hot air, infrared) and industrial process heat.

- In February 2025, Herrmann continues to set industry standards with its ultrasonic welding solutions, particularly for medical devices and sensitive components. The company emphasizes individualized process development, intelligent process control, and digital quality monitoring for reproducible, high-strength welds. Herrmann will showcase new applications and integration options at K 2025, focusing on automation and sustainability in medical and packaging industries.

- In January 2025, Dukane highlighted its patented Q-Factor, Melt-Match®, Low Amplitude Preheat, and Ultra-High Frequency (260–400 Hz) vibration welding technologies, emphasizing their leadership in process control and diagnostics.

- In May 2024, Emerson launched the Branson™ GLX-1 Laser Welder, designed for the automated assembly of small, intricate plastic parts. The GLX-1 features a compact, modular design suitable for cleanroom environments, advanced servo-based actuation, and the ability to “un-weld” plastics for closed-loop recycling. It uses Simultaneous Through-Transmission Infrared® (STTlr) laser-welding technology for high efficiency, weld strength, and aesthetics. Enhanced connectivity, security, and data collection features support Industry 4.0 integration.

Market Concentration & Characteristics

The market concentration of the Indian plastic welding equipment industry is moderately fragmented, with a mix of global and local players contributing to its growth. While a few leading companies dominate the market through established brand recognition and advanced product offerings, there is ample room for smaller and emerging players to carve out market share by catering to specific regional needs or providing cost-effective solutions. The key characteristics of this market include a focus on technological innovation, with an increasing shift towards automation and advanced welding techniques such as ultrasonic, laser, and hot plate welding. As industries such as automotive, electronics, and packaging continue to expand, the demand for efficient, high-quality welding solutions grows, fostering competition. Additionally, there is a strong emphasis on customization and after-sales service, as companies look to differentiate themselves by offering tailored solutions to meet the specific requirements of various industrial applications. The overall market remains dynamic, with continuous innovation driving competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for plastic welding equipment in India is expected to grow due to increasing industrial automation.

- Rapid advancements in technology will drive the development of more efficient and eco-friendly plastic welding machines.

- Government regulations aimed at reducing plastic waste may push industries towards better recycling and welding solutions.

- Rising investment in the automotive, packaging, and construction sectors will expand the market for plastic welding equipment.

- Adoption of Industry 4.0 principles will lead to the integration of smart, automated plastic welding systems.

- The growing need for lightweight materials in various industries will boost the demand for plastic welding technologies.

- The shift toward sustainable practices will promote the use of welding techniques that minimize waste and energy consumption.

- Expanding manufacturing capabilities in India will increase the demand for high-performance plastic welding machines.

- The increasing presence of multinational companies in India will drive demand for advanced plastic welding solutions.

- Strategic partnerships between local and international manufacturers will enhance product availability and technical expertise.