Market Overview

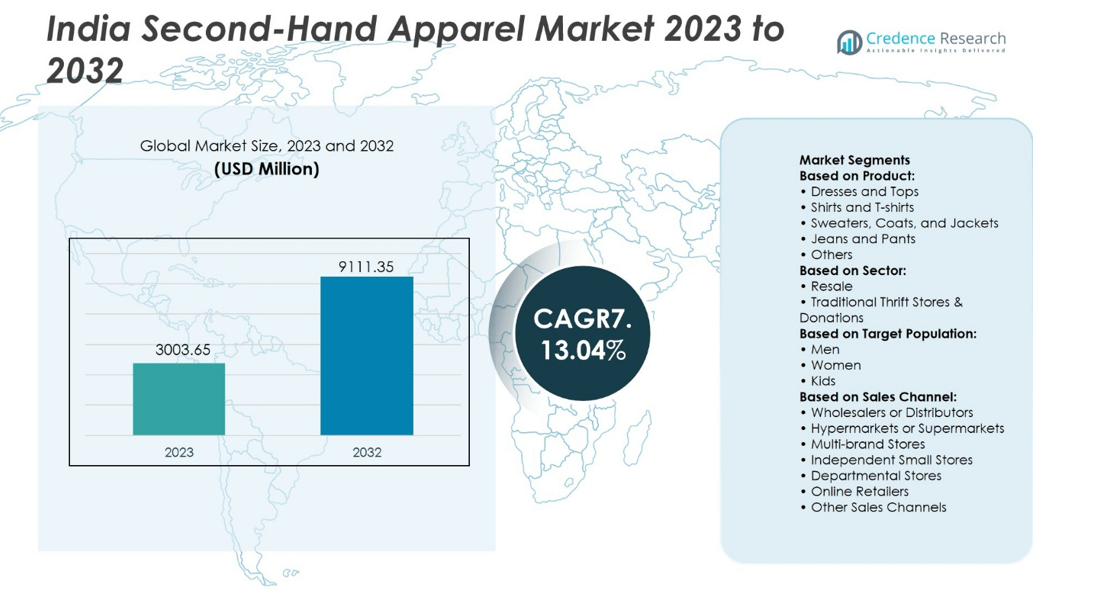

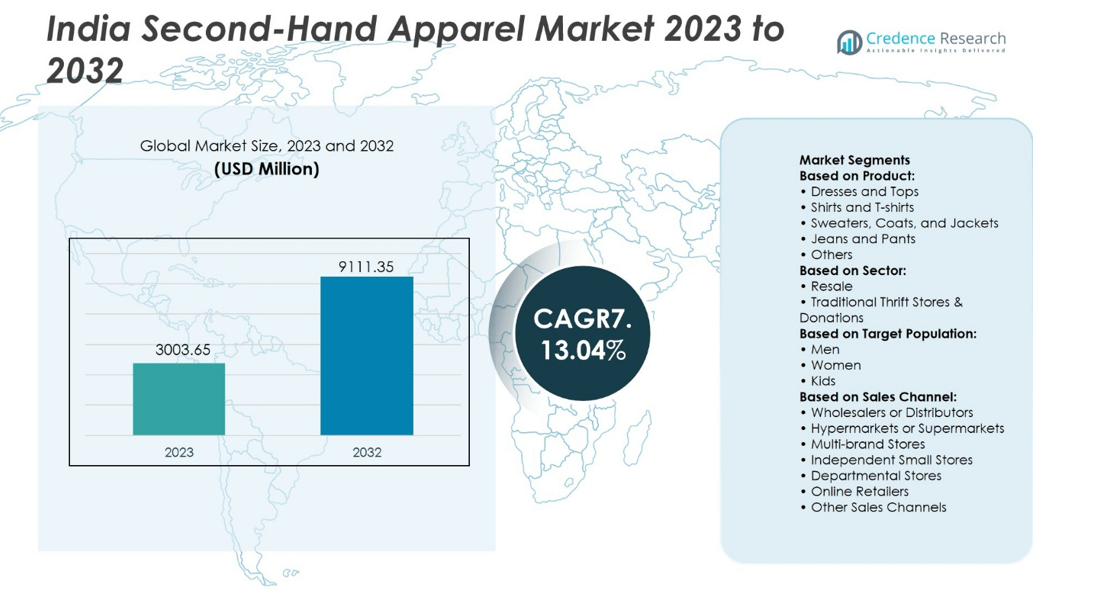

India Second-Hand Apparel Market size was valued at USD 3003.65 million in 2023 and is anticipated to reach USD 9111.35 million by 2032, at a CAGR of 13.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Second-Hand Apparel Market Size 2024 |

USD 3003.65 million |

| India Second-Hand Apparel Market, CAGR |

13.04% |

| India Second-Hand Apparel Market Size 2032 |

USD 9111.35 million |

The India Second-Hand Apparel Market grows steadily, driven by rising consumer awareness of sustainability, affordability, and circular fashion practices. It benefits from younger demographics seeking value-conscious choices and expanding digital platforms that simplify resale transactions. Strong demand for branded and luxury resale products supports market depth, while organized platforms enhance trust through authentication and quality checks. Key trends include the adoption of mobile-first shopping, growth of community-driven resale models, and integration of technology such as AI-based verification. It reflects a shift where both affordability and environmental responsibility influence long-term consumer behavior and retail strategies.

The India Second-Hand Apparel Market shows strong geographical presence across Delhi, Mumbai, and Bangalore, which together hold a major share due to urban demand, digital adoption, and established resale culture. Emerging Tier-II and Tier-III cities also contribute to expanding reach with rising internet penetration and affordability-focused consumers. Key players such as ThredUp Inc., The RealReal, Poshmark, Reebonz, Vinted, Micolet, Thrift+, Chikatex, and HunTex Recycling Kft drive competition through authentication, digital platforms, and sustainability-focused strategies to capture diverse consumer segments.

Market Insights

- India Second-Hand Apparel Market size was USD 3003.65 million in 2023 and is projected to reach USD 9111.35 million by 2032 at a CAGR of 13.04%.

- Rising awareness of sustainability and affordability drives strong demand, especially among younger demographics seeking value-conscious fashion.

- Expanding digital platforms and mobile-first shopping enhance accessibility, while AI-based verification boosts consumer trust.

- Branded and luxury resale segments grow steadily, supported by organized platforms that focus on authentication and quality checks.

- Competition intensifies with players innovating through digital engagement, sustainability-driven models, and localized strategies.

- Market faces restraints from consumer skepticism around hygiene, inconsistent quality standards, and dominance of informal thrift networks.

- Delhi, Mumbai, and Bangalore hold the largest regional share, while Tier-II and Tier-III cities contribute rising demand with internet penetration and affordability-focused consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Awareness of Sustainable Fashion and Circular Economy Models

The India Second-Hand Apparel Market gains strength from a rising consumer preference for sustainable fashion. Shoppers recognize the environmental benefits of extending garment life cycles through resale and reuse. It responds to increasing awareness of waste reduction and sustainable consumption, particularly among urban youth. Government campaigns promoting sustainable practices further support demand for pre-owned clothing. Retailers adopt circular economy models to align with these values. The market benefits from consumers linking affordability with ecological responsibility.

- For instance, ThredUp reported processing over 137 million pre-owned garments through its platform in 2023, diverting them from landfills and extending product lifespans across multiple resale cycles.

Expanding Digital Platforms and Online Resale Ecosystems

Growth accelerates with the rise of e-commerce and mobile platforms that simplify resale transactions. Dedicated apps and online marketplaces provide secure payment gateways and authentication systems. It allows consumers to access branded apparel at lower costs, making resale appealing to wider demographics. Influencers and fashion communities promote second-hand fashion through digital content. The seamless integration of logistics networks ensures timely delivery and efficient reverse supply chains. Increasing smartphone penetration and digital literacy further expand this customer base.

- For instance, Poshmark reported over 80 million registered users across its resale platform by 2023.

Rising Demand for Affordable Fashion and Value-Conscious Consumption

Price-sensitive consumers play a central role in shaping this market. The India Second-Hand Apparel Market benefits from individuals seeking high-quality clothing at significantly reduced prices. It creates access to premium and luxury brands for middle-income groups. Rapid urbanization and rising living costs strengthen the appeal of affordable apparel alternatives. Students and young professionals particularly drive adoption due to limited disposable income. The market grows steadily as consumers equate affordability with smarter fashion choices.

Influence of Global Fashion Trends and Cross-Border Resale Integration

International trends and cross-border trade influence growth momentum. Global fashion movements promoting thrift culture encourage Indian consumers to embrace pre-owned apparel. It gains credibility as luxury resale platforms enter partnerships with Indian startups and marketplaces. Imported second-hand clothing provides greater variety and style diversity. Exposure to Western fashion habits through digital media accelerates acceptance of pre-owned garments. The market develops faster when global players collaborate with local resellers for authentication and quality assurance. This integration strengthens trust and boosts market visibility.

Market Trends

Increasing Popularity of Thrift Culture and Lifestyle Shifts

The India Second-Hand Apparel Market reflects the growing influence of thrift culture among younger generations. Consumers view second-hand fashion as a sustainable and socially responsible choice. It creates a lifestyle statement where conscious purchasing aligns with personal values. College students and urban millennials promote resale culture through social media communities. Growing awareness of minimalism also drives preference for quality over quantity. This shift positions second-hand apparel as both a practical and aspirational category.

- For instance, Vinted reported reaching over 75 million members across 18 countries in 2023, with more than 105 million.

Integration of Technology and Resale Platform Innovations

Digital transformation shapes the way second-hand apparel reaches consumers. Online platforms integrate artificial intelligence to personalize recommendations and verify authenticity. It strengthens consumer trust by ensuring secure payment channels and transparent product details. Virtual try-on features and live-stream resale events enhance user engagement. Technology reduces traditional barriers of quality doubts and counterfeit risks. This trend makes resale shopping convenient and trustworthy for a broader audience.

- For instance, The RealReal reported that in 2022 it authenticated and sold over 5.4 million items, generating gross merchandise.

Expansion of Premium and Luxury Segments within Resale Market

Luxury resale emerges as a distinct growth driver in the market. The India Second-Hand Apparel Market attracts value-conscious buyers seeking branded products at affordable rates. It encourages luxury fashion houses to partner with authenticated resale platforms. Consumers perceive luxury resale as a way to access exclusivity without paying full retail prices. Increasing demand for designer wear and limited editions broadens this trend. The luxury resale niche gains traction across metropolitan cities with high fashion consciousness.

Evolving Retail Strategies and Omnichannel Approaches

Retailers adapt by combining physical and digital resale experiences. Pop-up thrift stores, in-store resale corners, and collaborations with established fashion chains strengthen visibility. It enables customers to explore second-hand apparel within mainstream retail environments. Brands promote buy-back schemes and loyalty programs to integrate resale into their business models. Consumers respond positively to these hybrid approaches that blend convenience with trust. The retail ecosystem evolves to position second-hand apparel as a normalized fashion segment.

Market Challenges Analysis

Concerns Over Quality, Hygiene, and Consumer Perceptions

The India Second-Hand Apparel Market faces persistent challenges in ensuring consistent quality and hygiene standards. Many consumers remain skeptical about the safety and cleanliness of pre-owned garments. It creates hesitation among first-time buyers, particularly in semi-urban and rural regions where resale culture is less established. Limited quality checks and inconsistent grading systems reduce confidence in product reliability. Retailers often struggle to communicate authenticity and proper sanitization measures effectively. Consumer reluctance continues to hinder wider acceptance despite growing awareness of sustainability.

Regulatory Gaps, Supply Chain Complexities, and Informal Market Pressure

Weak regulatory oversight creates hurdles for organized resale platforms. The India Second-Hand Apparel Market must navigate fragmented supply chains where sourcing, verification, and logistics remain inefficient. It encounters competition from informal street markets that offer cheaper but unregulated alternatives. Lack of uniform taxation and clear compliance guidelines adds uncertainty for businesses. Cross-border trade of second-hand garments also raises policy and import restriction issues. Organized players face difficulty scaling operations while maintaining transparency and competitive pricing in this environment.

Market Opportunities

Rising Consumer Awareness and Shifts Toward Sustainable Fashion

The India Second-Hand Apparel Market holds strong opportunities in the growing demand for eco-friendly consumption. Consumers increasingly recognize the environmental impact of fast fashion and turn to resale as a practical alternative. It benefits from the rising acceptance of thrift culture among younger generations, who view second-hand apparel as both affordable and responsible. Expanding urban populations and digital connectivity accelerate this trend, creating a wider customer base. Retailers that highlight quality assurance and sustainability credentials can strengthen their brand appeal. Market players gain long-term growth prospects by aligning with the values of environmentally conscious consumers.

Expansion of Digital Resale Platforms and Entry of Luxury Segments

Technology-driven resale ecosystems create new opportunities for scalability and innovation. The India Second-Hand Apparel Market can expand rapidly through mobile apps, AI-based product verification, and integrated logistics solutions. It gains momentum from the rising demand for affordable access to premium and luxury fashion. Partnerships between global resale platforms and Indian startups strengthen trust and enhance product diversity. Urban consumers, particularly professionals and students, drive adoption of authenticated branded apparel at reduced costs. This evolving digital infrastructure provides organized players the ability to capture higher market share and differentiate from informal competitors.

Market Segmentation Analysis:

By Product

The India Second-Hand Apparel Market divides into dresses and tops, shirts and t-shirts, sweaters, coats and jackets, jeans and pants, and other categories. Dresses and tops hold a strong share due to rising demand from women and younger consumers seeking affordable yet trendy options. It gains further traction from shirts and t-shirts, which remain popular for casual and professional use across genders. Jeans and pants record steady demand because of their durability and longer life cycle, making them suitable for resale. Sweaters, coats, and jackets attract buyers in colder regions and among urban populations exposed to global fashion trends. Other categories include ethnic wear and accessories, which cater to diverse cultural and seasonal preferences.

- For instance, ThredUp reported in its 2023 Resale Report that it listed over 5.2 million dresses and 7.1 million tops on its platform in a single year, demonstrating the scale of consumer preference for these categories in second-hand fashion.

By Sector

The market separates into resale platforms and traditional thrift stores with donation-driven models. Organized resale platforms lead growth by offering authentication, quality checks, and broader reach through online channels. It faces competition from traditional thrift stores that dominate in lower-income and semi-urban markets through low pricing. Donations play a key role in fueling supply chains for both organized and unorganized segments. Resale platforms gain stronger acceptance among urban millennials, while thrift stores remain critical in community-driven and rural contexts. The balance between formal resale and informal thrift activity defines the sector’s evolution.

- For instance, Goodwill Industries in the United States reported processing more than 107 million donations in 2022. These donations, comprised of items like clothing and household goods, are sold in their retail stores and online marketplace, with the revenue supporting job training and placement services.

By Target Population

Segmentation by population includes men, women, and kids. Women represent the largest customer group, driven by high fashion turnover and diverse style preferences. It finds growing demand among men, who increasingly adopt resale for both casual and workwear apparel. Kids’ apparel provides a promising segment, as parents seek affordable options for fast-growing age groups. Branded resale products, particularly for children, create opportunities for organized players. Gender and age preferences strongly shape product demand and resale strategies.

By Sales Channel

The market distributes through wholesalers or distributors, hypermarkets or supermarkets, multi-brand stores, independent small stores, departmental stores, online retailers, and other channels. Online retailers record the fastest growth due to convenience, variety, and secure payment systems. It also expands through independent small stores that attract price-sensitive customers in local markets. Departmental and multi-brand stores introduce in-store resale counters to appeal to mainstream shoppers. Wholesalers and distributors contribute by supplying bulk stock to both online and offline platforms. Hypermarkets and supermarkets offer limited resale presence but serve as potential expansion points in urban centers. The diversity of sales channels enables the market to reach different income groups and geographical segments effectively.

Segments:

Based on Product:

- Dresses and Tops

- Shirts and T-shirts

- Sweaters, Coats, and Jackets

- Jeans and Pants

- Others

Based on Sector:

- Resale

- Traditional Thrift Stores & Donations

Based on Target Population:

Based on Sales Channel:

- Wholesalers or Distributors

- Hypermarkets or Supermarkets

- Multi-brand Stores

- Independent Small Stores

- Departmental Stores

- Online Retailers

- Other Sales Channels

Based on the Geography:

Regional Analysis

Delhi (North India)

Delhi holds the largest share of the India Second-Hand Apparel Market, contributing around 25–30%. The city benefits from a large urban population, strong wholesale markets, and a culture that already accepts resale clothing. Students and young professionals drive demand as they look for affordable and trendy fashion. Online resale platforms and physical thrift stores both operate actively in Delhi, creating a balanced ecosystem. The city also acts as a key entry point for imported second-hand clothing, which increases supply and variety. Delhi’s position as a fashion and trade hub helps it remain the leading region in the market.

Mumbai (West India)

Mumbai contributes about 20–25% of the overall market. The city is a fashion capital and home to both luxury resale and traditional thrift markets. Luxury resale platforms such as Luxepolis attract buyers looking for branded products at lower prices, while Chor Bazaar continues to serve mass consumers with affordable options. This dual presence makes Mumbai an important hub for both premium and low-cost resale. High disposable incomes and exposure to global fashion trends also support demand. Mumbai’s diversity in consumer segments strengthens its strong share of the national market.

Bangalore (South India)

Bangalore makes up about 15–20% of the India Second-Hand Apparel Market. The city’s tech-savvy population is highly comfortable using resale apps and online platforms, making digital channels a strong driver. Professionals and students contribute significantly to demand, especially for branded apparel sold at lower prices. Traditional markets and local retailers also play a role in supplying affordable second-hand clothing. Bangalore’s younger demographic is more open to sustainability and reuse, which helps resale gain wider acceptance. This makes the city an important growth driver in South India.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The India Second-Hand Apparel Market features include ThredUp Inc., The RealReal, Poshmark, Reebonz, Vinted, Micolet, Thrift+, Chikatex, and HunTex Recycling Kft. The India Second-Hand Apparel Market demonstrates a highly competitive environment shaped by rapid digital adoption, evolving consumer preferences, and growing demand for sustainable fashion. Companies differentiate themselves through strategies such as advanced authentication systems, curated product collections, and strong resale platforms that ensure quality and trust. The rise of mobile-first shopping and social commerce enhances consumer engagement, while effective logistics and reverse supply chains strengthen operational efficiency. Competition intensifies with firms focusing on sustainability-driven narratives, influencer collaborations, and community-driven resale models to attract younger demographics. Pricing strategies, transparency, and brand positioning remain central to building consumer loyalty. The market continues to mature as both global and regional players refine their approaches to serve diverse income groups and regional demands.

Recent Developments

- In August 2025, ThredUp released its fourth annual impact report detailing environmental, social, and governance strategy and progress.

- In August 2024, ThredUp introduced AI-powered shopping tools to improve the shopping experience in its secondhand clothing marketplace.

- In February 2024, Thrift+ generated significant contribution towards overheads, setting a path to profitability.

- In January 2024, United Kingdom-based fashion brand HERA launched an integrated platform for secondhand clothing resale, promoting the quality and longevity of its products as part of its circularity journey rather than relying on pre-existing reselling sites.

Market Concentration & Characteristics

The India Second-Hand Apparel Market shows moderate concentration with a mix of global resale platforms, regional startups, and informal thrift networks influencing competition. It reflects fragmented characteristics where organized players focus on authentication, branding, and digital channels, while unorganized vendors dominate local markets through low-cost supply. It benefits from rising consumer awareness of sustainability and affordability, which creates opportunities for structured growth. Market characteristics highlight strong urban demand, high adoption among youth, and increasing online penetration supported by mobile-first shopping habits. It also demonstrates dual dynamics where premium resale platforms cater to affluent buyers seeking branded products, while community-driven thrift stores serve price-sensitive consumers. The market maintains a balance of organized and informal activity, shaping its diverse and adaptive nature.

Report Coverage

The research report offers an in-depth analysis based on Product, Sector, Target Population, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand through rising awareness of sustainable and circular fashion practices.

- Organized resale platforms will strengthen their position with authentication and quality assurance.

- Digital channels will drive growth through mobile-first platforms and social resale apps.

- Luxury resale will gain traction as consumers seek branded products at lower prices.

- Supply chain efficiency and reverse logistics will become critical competitive factors.

- Younger demographics will remain the largest adopters due to affordability and fashion-conscious behavior.

- Tier-II and Tier-III cities will emerge as new growth centers with improving digital access.

- Strategic collaborations between global resale firms and local startups will increase.

- Influencer-driven marketing and community engagement will shape consumer trust and loyalty.

- Sustainability-focused policies and consumer demand will further normalize second-hand apparel in mainstream retail.