| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Ultrafast CT Scan Devices Market Size 2024 |

USD 286.84 Million |

| India Ultrafast CT Scan Devices Market, CAGR |

8.31% |

| India Ultrafast CT Scan Devices Market Size 2032 |

USD 543.35 Million |

Market Overview

The India Ultrafast CT Scan Devices Market is projected to grow from USD 286.84 million in 2024 to an estimated USD 543.35 million by 2032, with a compound annual growth rate (CAGR) 8.31% from 2025 to 2032. This robust growth reflects increasing investments in diagnostic imaging infrastructure across the country, rising adoption of advanced imaging technologies in both public and private healthcare sectors, and the escalating demand for quicker and more accurate diagnostic solutions.

Key drivers contributing to market growth include the rising geriatric population, a surge in chronic disease cases, and an increasing focus on early disease detection and non-invasive imaging techniques. The Indian government’s initiatives to strengthen diagnostic capacity under national health programs and expanding private healthcare infrastructure are also driving demand. Trends such as AI-integrated CT platforms and low-dose radiation technology are gaining momentum, encouraging hospitals and diagnostic chains to upgrade to ultrafast systems.

Geographically, metropolitan cities like Delhi, Mumbai, Bengaluru, and Hyderabad are witnessing higher adoption due to well-developed healthcare infrastructure and the concentration of leading hospitals. Tier-II cities are also emerging as significant markets with growing investments in diagnostic centers. Prominent players operating in the India ultrafast CT scan devices market include GE HealthCare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, and Fujifilm India, each offering advanced imaging solutions tailored to the needs of Indian healthcare providers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India Ultrafast CT Scan Devices Market is expected to grow from USD286.84 million in 2024 to USD543.35 million by 2032, driven by increased healthcare investments and demand for faster, more accurate diagnostic imaging.

- The Global Ultrafast CT Scan Devices Market is projected to grow from USD 9,765.51 million in 2024 to an estimated USD 15,858.58 million by 2032, with a compound annual growth rate (CAGR) of 6.25% from 2025 to 2032.

- Key drivers include the rise in chronic diseases, an aging population, increased focus on early diagnosis, and government initiatives to enhance healthcare infrastructure across the country.

- AI-integrated platforms and low-dose radiation technology are gaining momentum, encouraging healthcare providers to adopt ultrafast CT systems for improved accuracy and efficiency in diagnostics.

- The high cost of ultrafast CT devices, including maintenance and operational costs, remains a barrier for smaller healthcare facilities, limiting their widespread adoption in underserved regions.

- Metropolitan cities such as Delhi, Mumbai, and Bengaluru are seeing the highest adoption due to well-developed healthcare infrastructure and the presence of advanced diagnostic centers.

- Tier-II cities are emerging as key markets as healthcare access improves, with growing investments in diagnostic infrastructure and increasing demand for advanced imaging solutions.

- Leading players such as GE HealthCare, Siemens Healthineers, and Philips Healthcare are at the forefront, offering advanced, high-speed CT scan devices tailored to the needs of the Indian healthcare sector.

Report Scope

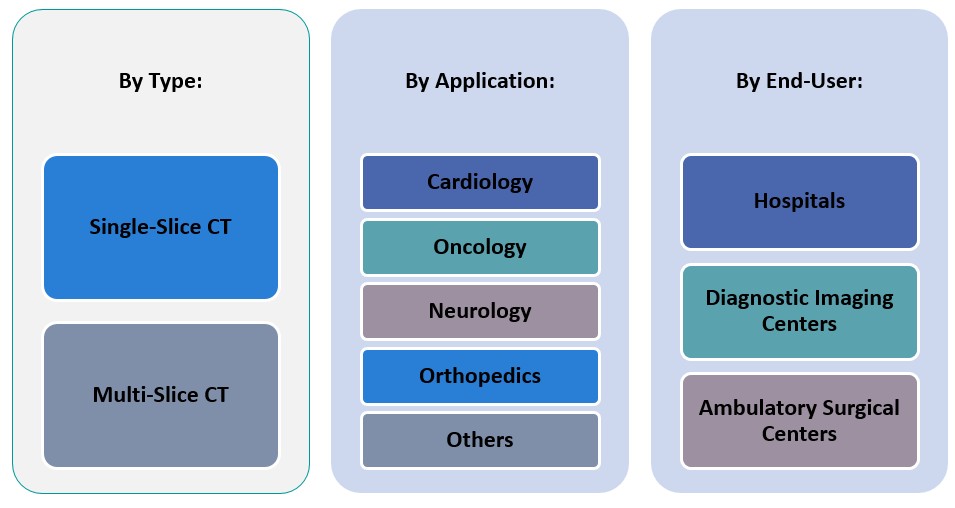

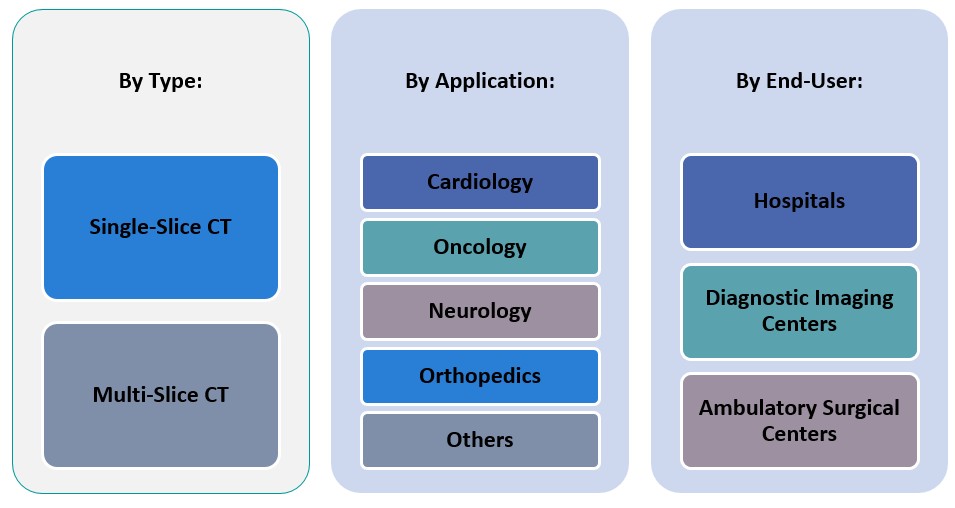

This report segments the India Ultrafast CT Scan Devices Market as follows:

Market Drivers

Rising Burden of Chronic Diseases and Aging Population

The growing incidence of chronic diseases such as cardiovascular conditions, cancer, and neurological disorders in India significantly drives the demand for advanced diagnostic imaging technologies like ultrafast CT scan devices. According to the Indian Council of Medical Research (ICMR), non-communicable diseases (NCDs) account for nearly 63% of total deaths in India. Cardiovascular diseases alone contribute to 27% of these deaths, followed by respiratory diseases, cancers, and diabetes. Ultrafast CT scanners enable quick and detailed imaging, allowing physicians to detect diseases at earlier stages, plan treatments efficiently, and monitor disease progression with greater precision. Moreover, India’s aging population further intensifies the need for improved diagnostic capabilities. For instance, the United Nations estimates that the proportion of India’s population aged 60 and above will increase from 10% in 2021 to nearly 19% by 2050. Since elderly individuals are more prone to chronic illnesses, the rising geriatric demographic boosts the need for sophisticated, non-invasive imaging solutions. Consequently, hospitals and diagnostic centers across India are investing heavily in high-speed CT technology to manage the growing patient load efficiently and enhance diagnostic accuracy.

Expanding Healthcare Infrastructure and Rising Medical Tourism

India’s healthcare infrastructure is undergoing significant expansion, supported by both government initiatives and private sector investments. Under programs such as Ayushman Bharat and the National Health Mission, substantial efforts are being made to enhance diagnostic services across urban and rural areas. Public-private partnerships have facilitated the establishment of advanced diagnostic centers equipped with ultrafast CT devices, ensuring improved accessibility to high-quality imaging solutions. India has also emerged as a major destination for medical tourism, attracting patients from Southeast Asia, Africa, and the Middle East. In 2024, India issued approximately 463,725 medical visas, reflecting its growing reputation for cost-effective and high-quality healthcare. Ultrafast CT scan devices, for instance, play a crucial role in maintaining diagnostic accuracy, offering rapid imaging with reduced scan times and lower radiation doses. To accommodate the increasing number of medical tourists seeking efficient diagnostics, hospitals and imaging centers are actively upgrading their radiology departments with cutting-edge ultrafast CT systems, further driving market growth.

Technological Advancements and Growing Preference for Non-Invasive Diagnostics

Continuous advancements in CT imaging technologies play a pivotal role in driving the India ultrafast CT scan devices market. Recent innovations such as dual-energy CT scanning, iterative reconstruction algorithms, AI-assisted image interpretation, and ultra-low-dose imaging techniques have enhanced the capabilities of ultrafast CT systems. These improvements have made CT imaging safer, faster, and more accurate, expanding its clinical applications across cardiology, oncology, neurology, and trauma care. The growing preference for non-invasive diagnostic methods among both patients and healthcare providers supports the adoption of ultrafast CT scan devices. Unlike traditional diagnostic procedures, ultrafast CT scans minimize patient discomfort, reduce procedural risks, and deliver immediate results, facilitating faster clinical decision-making. As awareness regarding the benefits of early disease detection and non-invasive imaging continues to spread, demand for ultrafast CT technology is expected to witness sustained momentum. Manufacturers are responding to this trend by launching new models that combine speed, precision, and patient comfort, further boosting market growth in India.

Rising Government Support and Favorable Regulatory Environment

The Indian government’s supportive policies and regulatory initiatives have significantly contributed to the development of the medical imaging sector, including ultrafast CT technologies. Programs like the Pradhan Mantri Swasthya Suraksha Yojana (PMSSY) focus on upgrading existing healthcare institutions with modern diagnostic infrastructure. The establishment of AIIMS-like institutions across different states under PMSSY and increased budget allocations for the health sector in Union Budgets highlight the government’s commitment to improving diagnostic access. Furthermore, the recent introduction of the Production Linked Incentive (PLI) Scheme for medical devices manufacturing is expected to enhance the domestic production of high-end diagnostic equipment, including CT scan devices, reducing dependency on imports and encouraging price competitiveness. Regulatory bodies like the Central Drugs Standard Control Organization (CDSCO) have also streamlined approval processes for importing and marketing advanced imaging devices, making it easier for global players to introduce newer technologies in the Indian market. The convergence of favorable policies, increased public health spending, and regulatory facilitation is creating a conducive environment for the widespread adoption of ultrafast CT scan devices, firmly positioning India as a high-growth market over the next decade.

Market Trends

Integration of Artificial Intelligence in CT Imaging

The integration of artificial intelligence (AI) into ultrafast CT scan devices is transforming diagnostic imaging practices across India. AI-powered algorithms now assist radiologists by automating image reconstruction, enhancing image clarity, and highlighting anomalies for quicker diagnosis. AI applications also reduce human error, standardize reporting, and optimize workflow efficiency, which is critical in high-volume diagnostic centers. For instance, AI-powered CT scanners introduced by Siemens Healthineers can process up to 1,500 images daily, significantly improving diagnostic efficiency. In India, where there is a shortage of radiologists relative to the growing patient base, AI-driven CT systems enable faster interpretation of scans, improving patient throughput without compromising diagnostic accuracy. Major players like GE HealthCare, Siemens Healthineers, and Philips Healthcare are actively introducing AI-enabled CT platforms tailored to the Indian healthcare environment. This trend is also encouraging hospitals and imaging centers to invest in ultrafast CT systems capable of integrating AI modules, thereby future-proofing their facilities against rising diagnostic demands. Furthermore, AI applications are contributing to dose optimization strategies, ensuring that patients are exposed to minimal radiation without sacrificing image quality. As AI becomes increasingly embedded in India’s healthcare digitalization roadmap, the adoption of AI-powered ultrafast CT scan devices is expected to accelerate significantly, reshaping the landscape of diagnostic imaging in the country.

Growing Demand for Low-Dose CT Scanning Technologies

The rising awareness regarding radiation safety among patients and healthcare providers is fueling the demand for low-dose CT scanning technologies in India. Ultrafast CT devices are increasingly being equipped with advanced dose-reduction features such as automated exposure control, iterative reconstruction techniques, and spectral imaging options. These innovations help minimize radiation exposure while maintaining high-resolution imaging quality, making ultrafast CT an attractive choice for both preventive health screenings and routine diagnostics. For instance, next-generation CT scanners with enhanced imaging intelligence and operational efficiency have been shown to offer up to 50% higher throughput, allowing healthcare facilities to serve more patients while maintaining high diagnostic accuracy. In India, as corporate wellness programs and preventive healthcare services gain traction, there is a growing preference for diagnostic methods that offer minimal radiation risk, especially among younger populations and health-conscious urban residents. Regulatory emphasis on radiation protection standards further strengthens the push towards adopting low-dose CT solutions. Equipment manufacturers are responding by designing ultrafast CT systems that not only deliver speed but also prioritize patient safety. Moreover, healthcare providers are promoting low-dose CT capabilities as a differentiator to attract more patients to their diagnostic centers. This trend of prioritizing low-dose imaging is poised to remain prominent as the Indian healthcare ecosystem continues to evolve towards more patient-centric, safer diagnostic protocols across clinical specialties.

Increasing Adoption of Cardiac and Emergency Imaging Applications

The demand for ultrafast CT scan devices in cardiac and emergency imaging applications is growing rapidly across India. Ultrafast CT systems, capable of scanning the entire heart within a single heartbeat, are becoming crucial for the early detection and management of cardiovascular diseases (CVDs). Given the high burden of CVDs in India, where heart disease accounts for one in four deaths, hospitals are increasingly investing in CT systems that offer fast, high-resolution cardiac imaging. In emergency care settings, ultrafast CT’s ability to deliver whole-body scans within seconds is revolutionizing trauma management, stroke diagnosis, and critical care evaluation. These devices enable physicians to make quicker, life-saving clinical decisions, significantly improving patient outcomes in acute care scenarios. Government-run tertiary care centers and private multispecialty hospitals are leading the way in adopting ultrafast CT technologies specifically for cardiac and emergency departments. As the Indian healthcare sector shifts towards more specialized and time-sensitive diagnostic services, the emphasis on acquiring ultrafast CT capabilities for cardiac and trauma imaging is expected to grow. This trend positions ultrafast CT scan devices as indispensable tools in modern emergency medicine and cardiac care pathways across the country.

Expansion of Tier-II and Tier-III Markets

A notable trend reshaping the India Ultrafast CT Scan Devices Market is the rapid expansion of diagnostic imaging infrastructure in Tier-II and Tier-III cities. While metropolitan areas like Delhi, Mumbai, and Bengaluru continue to dominate market share, healthcare providers are now actively investing in secondary and tertiary cities to meet rising healthcare demands. Increasing health awareness, improving income levels, and government schemes to strengthen rural healthcare delivery are fueling this shift. Diagnostic chains and hospital networks such as Apollo Diagnostics, Dr. Lal PathLabs, and SRL Diagnostics are expanding their presence in non-metro cities and equipping their new centers with advanced imaging modalities, including ultrafast CT systems. The availability of high-speed internet connectivity and telemedicine networks further supports remote diagnostics and teleradiology services, allowing ultrafast CT scan results to be interpreted by specialists located elsewhere. Moreover, manufacturers are introducing cost-effective, compact ultrafast CT models to cater to the budget constraints of healthcare facilities in smaller cities. As a result, patients in Tier-II and Tier-III regions increasingly have access to the same high-quality, rapid diagnostic services traditionally available only in metros. This decentralization trend is expected to significantly expand the addressable market for ultrafast CT devices in India over the coming years.

Market Challenges

High Cost of Acquisition and Maintenance

The substantial cost associated with acquiring and maintaining ultrafast CT scan devices presents a major challenge to market expansion in India. Ultrafast CT systems are technologically sophisticated, incorporating features such as high-speed detectors, AI-powered imaging software, and low-dose radiation modules, all of which significantly elevate the initial investment required. For example, healthcare reports indicate that diagnostic imaging equipment, including CT scanners, requires substantial infrastructural modifications, such as shielding, power supply upgrades, and specialized installation processes. In India, where healthcare expenditure as a percentage of GDP remains relatively low compared to developed economies, many small and mid-sized hospitals, particularly in Tier-II and Tier-III cities, find it difficult to justify such high capital investments. Additionally, the ongoing maintenance costs, including regular servicing, software updates, and consumable replacements, further strain operational budgets. Studies on India’s healthcare budget constraints highlight that public hospitals often prioritize essential medical services over high-end imaging technologies, limiting widespread adoption. Despite the long-term benefits offered by ultrafast CT devices in terms of patient throughput and diagnostic precision, the high upfront and operational costs limit accessibility predominantly to premium hospitals and large diagnostic chains. As a result, widespread adoption across the broader healthcare ecosystem remains constrained, slowing overall market penetration. To overcome this challenge, manufacturers and healthcare providers must explore innovative financing options, leasing models, and cost-sharing partnerships that can make ultrafast CT technologies more affordable and accessible across diverse healthcare settings.

Shortage of Skilled Radiologists and Technologists

Another significant challenge hindering the growth of the India ultrafast CT scan devices market is the shortage of skilled radiologists and trained CT technologists. Although the number of diagnostic imaging centers is increasing across India, the availability of qualified professionals capable of operating complex ultrafast CT systems and accurately interpreting results has not kept pace. Many rural and semi-urban areas lack access to specialized training programs, resulting in a regional disparity in the quality of diagnostic services. Even in urban centers, the growing patient load often exceeds the available diagnostic workforce, leading to potential delays in scan analysis and reporting. Ultrafast CT systems require precise calibration and expert handling to maximize image quality and minimize radiation exposure, emphasizing the need for ongoing training and education. Without sufficient investment in building a skilled workforce, healthcare providers risk underutilizing the advanced capabilities of ultrafast CT devices. To address this gap, collaborative efforts between equipment manufacturers, medical institutions, and government bodies are essential to establish comprehensive training initiatives that can prepare the next generation of diagnostic imaging professionals.

Market Opportunities

Government Initiatives and Health Infrastructure Development

The Indian government’s ongoing efforts to strengthen healthcare infrastructure present significant opportunities for the growth of the ultrafast CT scan devices market. Schemes like Ayushman Bharat and the National Health Mission (NHM) are focused on enhancing diagnostic services in both urban and rural areas. Increased funding for healthcare initiatives and the establishment of new medical institutions, particularly in underserved regions, are likely to create substantial demand for advanced diagnostic imaging technologies. With government push towards digital health and telemedicine, ultrafast CT devices are becoming integral to expanding diagnostic reach. Public hospitals and healthcare centers are increasingly investing in state-of-the-art imaging solutions to meet the rising demand for faster and more accurate diagnostic procedures. Additionally, the expansion of private healthcare networks into Tier-II and Tier-III cities, supported by government incentives, offers new growth avenues for ultrafast CT manufacturers. As these programs unfold, there will be an expanding need for cost-effective and efficient CT technologies, creating an opportunity for increased market penetration across a broader spectrum of healthcare providers.

Growth of Medical Tourism and Rising Health Awareness

India’s position as a growing hub for medical tourism offers significant market opportunities for ultrafast CT scan devices. The country’s reputation for high-quality, cost-effective healthcare services continues to attract international patients, especially from Southeast Asia, Africa, and the Middle East. Ultrafast CT systems, known for their rapid, high-quality imaging, play a crucial role in attracting medical tourists seeking efficient diagnostic procedures. Moreover, increasing health awareness among Indian citizens is driving demand for advanced diagnostic tools. As more people prioritize preventive healthcare and early diagnosis, the need for fast and accurate imaging solutions, such as ultrafast CT scans, will continue to rise, further contributing to market expansion.

Market Segmentation Analysis

By Type

The India Ultrafast CT Scan Devices Market can be segmented by type into Single-Slice CT and Multi-Slice CT devices. Single-Slice CT devices, though less commonly used in current practice, remain relevant in smaller healthcare settings due to their relatively lower cost and simpler technology. These systems offer efficient imaging for basic diagnostic purposes and are often found in rural or low-budget hospitals. However, the demand for Multi-Slice CT (MSCT) systems is increasing due to their ability to provide high-speed, high-resolution imaging with improved diagnostic accuracy. MSCT systems are particularly useful in applications requiring detailed anatomical imaging, such as cardiology, oncology, and neurology. The market for Multi-Slice CT devices is expanding rapidly in India due to their versatility, ability to capture detailed cross-sectional images quickly, and the increasing adoption of advanced imaging technologies in both public and private healthcare sectors.

By Application

The India Ultrafast CT Scan Devices Market is witnessing substantial growth across multiple application areas, including cardiology, oncology, neurology, orthopedics, and others. In cardiology, ultrafast CT devices are increasingly used for the rapid assessment of coronary arteries, detecting heart diseases like coronary artery disease and assessing cardiac morphology. With the rising prevalence of cardiovascular diseases in India, demand for advanced imaging solutions in this field is growing. In oncology, ultrafast CT devices play a critical role in detecting and monitoring various types of cancer, providing detailed images for precise tumor localization and treatment planning. Neurology is another key application area where ultrafast CT scans are used for brain imaging, helping to detect conditions like strokes, aneurysms, and brain tumors. In orthopedics, CT scans aid in the assessment of bone fractures, joint dislocations, and complex musculoskeletal disorders. The demand for ultrafast CT devices is increasing across these specialized applications due to the growing need for faster, non-invasive diagnostics and enhanced image quality for better clinical outcomes.

Segments

Based on Type

- Single-Slice CT

- Multi-Slice CT

Based on Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Others

Based on End User

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

Based on Region

Regional Analysis

South India (35%)

South India holds the largest market share in the India Ultrafast CT Scan Devices Market, accounting for approximately 35% of the total market. This region is home to several advanced healthcare hubs such as Bengaluru, Chennai, Hyderabad, and Kochi, which are equipped with state-of-the-art diagnostic facilities. The rapid growth of private healthcare facilities in these cities, coupled with increasing healthcare investments from both the government and private sector, fuels the demand for ultrafast CT scan systems. South India is also a major medical tourism destination, attracting patients from neighboring countries, which further boosts the need for advanced imaging technologies.

West India (30%)

West India, including cities like Mumbai, Pune, and Ahmedabad, follows closely behind with a market share of around 30%. The region is a significant healthcare and industrial hub, with numerous top-tier hospitals and diagnostic centers investing in ultrafast CT devices to cater to the growing demand for quick and accurate diagnostics. Mumbai, being the financial capital, has the highest concentration of private healthcare facilities, contributing heavily to the adoption of advanced imaging solutions. Additionally, the state of Gujarat is seeing rising investments in healthcare infrastructure, further supporting market growth in the West.

Key players

- Canon Medical Systems Corporation

- Siemens Healthineers

- GE HealthCare

- Philips Healthcare

- Samsung Medison

- Hitachi Healthcare

- Fujifilm Holdings Corporation

- United Imaging Healthcare

- Neusoft Medical Systems

- Mindray Medical International

Competitive Analysis

The India Ultrafast CT Scan Devices Market is highly competitive, with leading global players continuously innovating to maintain their market share. Companies such as Siemens Healthineers, GE HealthCare, and Philips Healthcare dominate the market with their advanced product offerings, leveraging strong brand presence and extensive distribution networks. Siemens, with its Somatom series, focuses on high-resolution imaging and speed, catering to high-demand healthcare facilities in urban areas. GE HealthCare and Philips Healthcare also lead in providing multi-slice CT scanners equipped with AI-driven features for enhanced diagnostics. Canon Medical Systems and Samsung Medison are gaining traction by offering cost-effective solutions without compromising on performance, making them attractive options for smaller healthcare facilities in Tier-II and Tier-III cities. Fujifilm Holdings and Mindray Medical International focus on expanding their presence in emerging markets with competitive pricing strategies and flexible service models. The competition is further intensified by regional players such as United Imaging Healthcare and Neusoft Medical Systems, which are focusing on offering advanced imaging systems tailored to local market needs.

Recent Developments

- In February 2024, Canon Medical Systems Corporation completed its second global installation of a photon-counting CT system at Radboud University Medical Center in the Netherlands, initiating clinical research led by Prof. Mathias Prokop.

- In December 2024, Samsung Medison showcased an enhanced portfolio at RSNA 2024, including the floor-mounted digital X-ray GF 85 and a pediatric cardiac-specific ultrasound probe.

- In December 2024, United Imaging Healthcare introduced the uMI Panvivo PET/CT system at RSNA 2024, featuring industry-leading NEMA PET spatial resolution and AI-driven 3D camera technology.

- In March 2025, Mindray Medical International introduced the Resona A20 at ECR 2025, featuring Acoustic Intelligence Technology to elevate ultrasound imaging capabilities.

- In March 2025, Shimadzu Corporation celebrated its 150th anniversary and opened a new R&D center in Boston, focusing on customer-oriented development to expand business in the pharmaceutical field.

- In February 2025, Esaote SpA presented integrated medical imaging solutions and unveiled innovations in ultrasound technology at ECR 2025, emphasizing AI integration to optimize workflows and improve image quality.

- In March 2025, Agfa HealthCare showcased the next generation of Enterprise Imaging at ECR 2025, focusing on innovations that support a more sustainable future for clinical teams.

Market Concentration and Characteristics

The India Ultrafast CT Scan Devices Market is moderately concentrated, with a mix of global and regional players competing for market share. Major multinational corporations like Siemens Healthineers, GE HealthCare, Philips Healthcare, and Canon Medical Systems dominate the high-end segment with advanced technology offerings, strong brand recognition, and extensive distribution networks. However, the market also features regional players such as Mindray Medical International, Samsung Medison, and United Imaging Healthcare, which focus on providing cost-effective solutions for emerging healthcare facilities in Tier-II and Tier-III cities. The market is characterized by rapid technological innovation, with a strong emphasis on improving image resolution, scan speed, and patient safety through AI integration and low-dose radiation. Additionally, the growing demand for ultrafast, high-resolution imaging systems, driven by increasing healthcare investments, rising disease prevalence, and medical tourism, is contributing to the overall market expansion. The competitive dynamics are shaped by the need for affordability, efficiency, and localized solutions across diverse healthcare settings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The India Ultrafast CT Scan Devices Market is expected to maintain strong growth, driven by increasing healthcare investments and technological advancements in imaging systems.

- AI-powered CT scan devices will gain prominence, enhancing diagnostic precision, improving image quality, and optimizing workflow efficiency across healthcare facilities.

- As patients and healthcare providers prioritize non-invasive diagnostic options, the demand for ultrafast CT scans will continue to rise due to their speed and accuracy.

- With continued government support for healthcare infrastructure development through schemes like Ayushman Bharat, ultrafast CT devices will become more accessible, especially in rural areas.

- India’s growing status as a medical tourism hub will drive demand for high-quality diagnostic services, including ultrafast CT scans, attracting international patients.

- Ongoing advancements such as spectral CT and low-dose imaging will make ultrafast CT systems more efficient and safer, expanding their application across various medical fields.

- As Tier-II and Tier-III cities experience infrastructure improvements, the adoption of ultrafast CT devices will increase, supporting broader healthcare access across India.

- To penetrate cost-sensitive markets, manufacturers will focus on offering affordable ultrafast CT solutions, leading to increased competition and lower prices, especially in non-metro areas.

- The growing prevalence of chronic diseases such as cardiovascular conditions and cancer will continue to push the demand for advanced imaging solutions like ultrafast CT devices.

- Collaborations between global manufacturers and local healthcare providers will accelerate the adoption of ultrafast CT devices, particularly in underserved regions, fostering market expansion.