Market Overview:

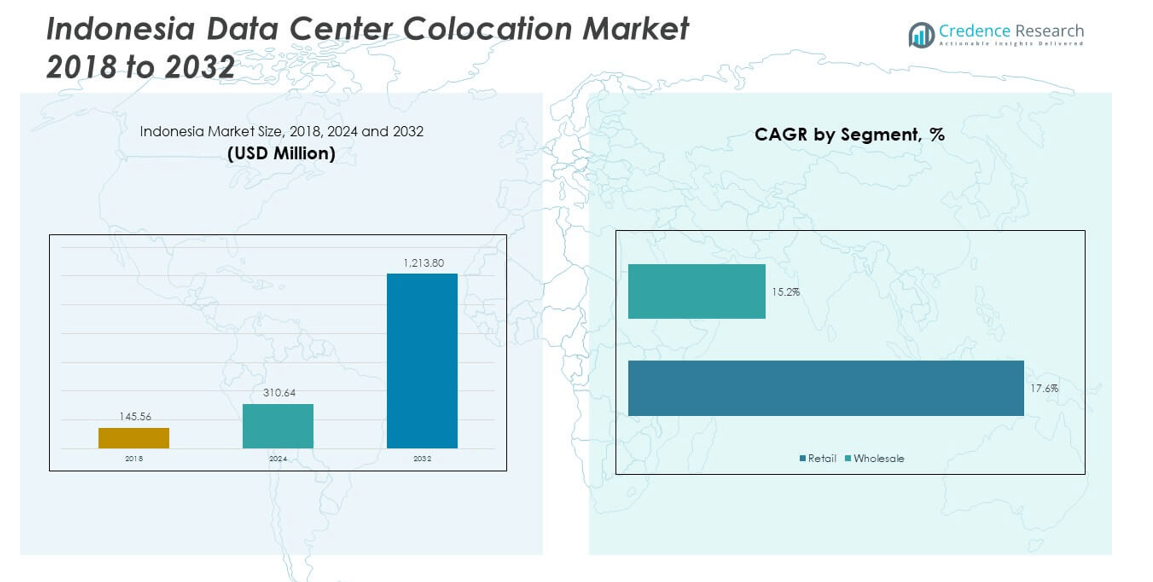

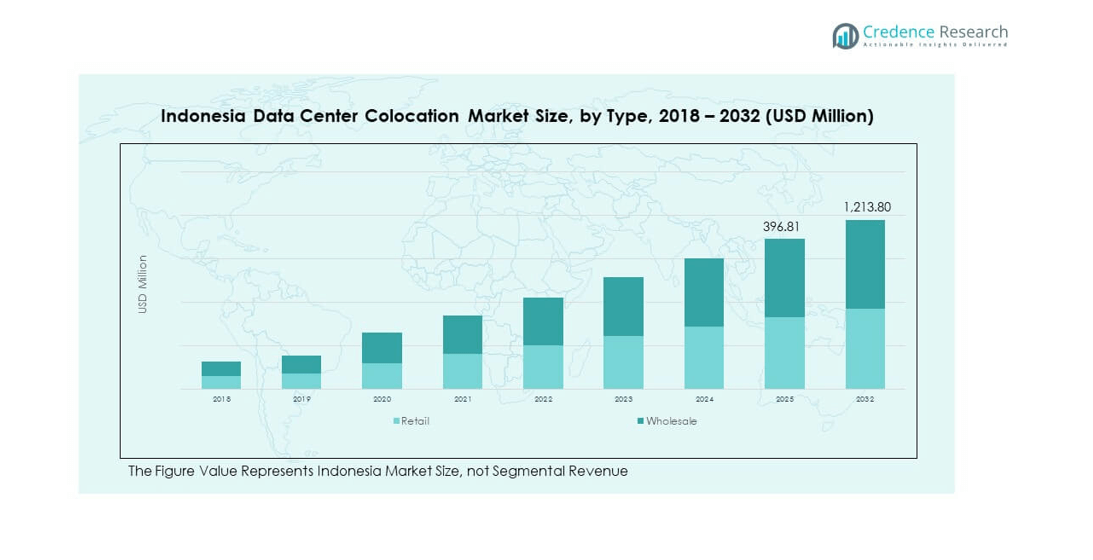

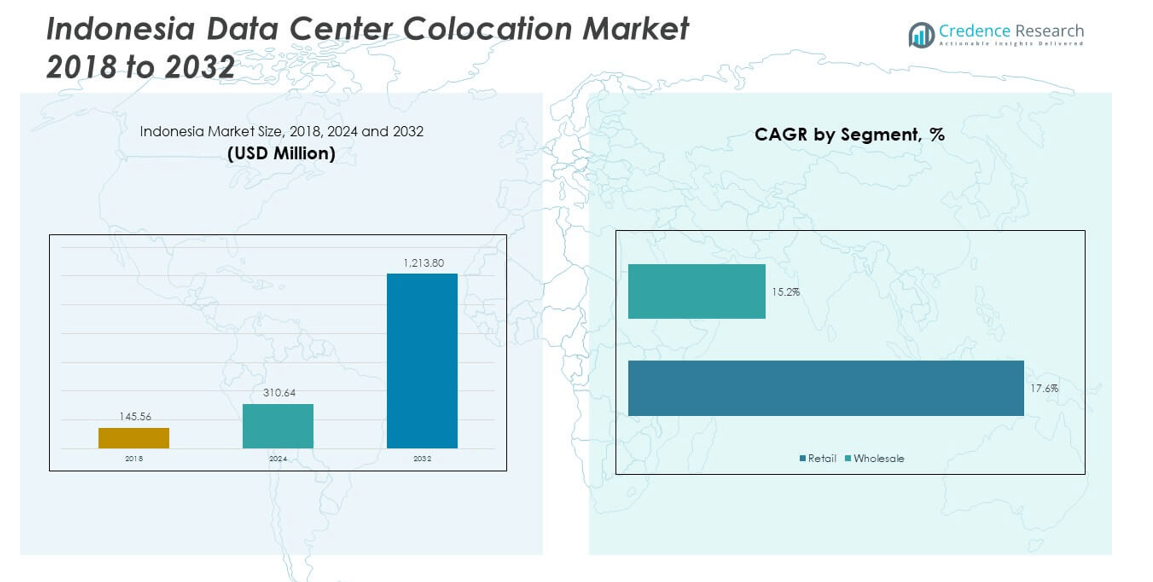

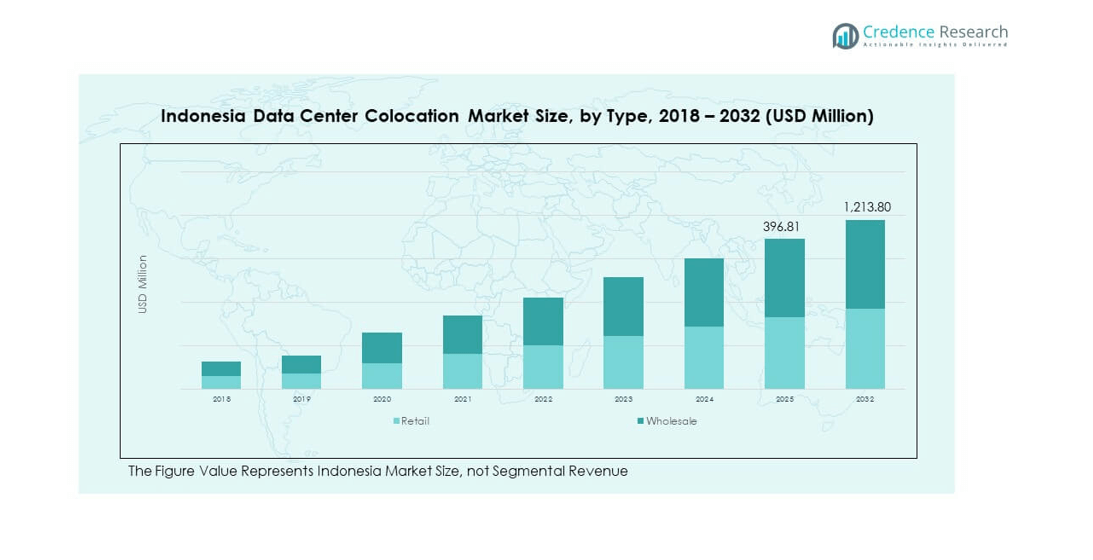

The Indonesia Data Center Colocation Market size was valued at USD 145.56 million in 2018 to USD 310.64 million in 2024 and is anticipated to reach USD 1,213.80 million by 2032, at a CAGR of 17.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Data Center Colocation Market Size 2024 |

USD 310.64 million |

| Indonesia Data Center Colocation Market, CAGR |

17.32% |

| Indonesia Data Center Colocation Market Size 2032 |

USD 1,213.80 million |

The market drivers include rapid digital transformation across industries, strong adoption of cloud computing, and the government’s supportive initiatives for digital economy growth. Rising smartphone penetration and high internet usage have accelerated data consumption, creating demand for reliable colocation services. Enterprises are outsourcing IT infrastructure to reduce costs and improve scalability, while the growth of fintech, e-commerce, and social media platforms is fueling capacity demand. Strategic partnerships between international operators and local firms further strengthen market growth opportunities.

Geographically, the market growth is concentrated in Jakarta, which leads due to its status as the primary financial and digital hub. Surrounding regions such as West Java and Banten are emerging as attractive colocation centers due to improved power infrastructure and proximity to demand hubs. International companies are investing heavily in Indonesia as a gateway to Southeast Asia’s digital economy. Regions outside Java are gradually attracting attention as enterprises and hyperscale providers look to diversify infrastructure, ensuring resilience and coverage across the country.

Market Insights:

- The Indonesia Data Center Colocation Market size was USD 145.56 million in 2018, reached USD 310.64 million in 2024, and is projected to hit USD 1,213.80 million by 2032, registering a CAGR of 17.32% during 2024–2032.

- Java commanded 65% share in 2024, followed by Sumatra with 15% share and Sulawesi with 10% share, supported by infrastructure development and rising internet penetration.

- Kalimantan and Eastern Indonesia together held 10% share in 2024 and represent the fastest-growing regions, driven by capital relocation projects and submarine cable investments.

- Wholesale colocation accounted for 62% share in 2024, supported by hyperscalers, telecom operators, and cloud service providers.

- Retail colocation held 38% share in 2024, driven by SMEs and enterprises seeking scalable and cost-effective solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rapid Digital Transformation Across Core Industries and Enterprises:

The Indonesia Data Center Colocation Market is growing on the back of fast digital transformation in banking, e-commerce, and telecom. Enterprises are shifting operations to digital platforms, which generates increasing demand for reliable data storage and connectivity. It supports business continuity and enhances agility, especially in customer-facing services. With more companies implementing advanced IT systems, the need for scalable colocation solutions continues to rise. Growing reliance on cloud services intensifies this momentum. Financial institutions, in particular, are investing heavily in data infrastructure. This trend reflects the strong need for secured and regulated environments. Enterprises prefer colocation to reduce infrastructure costs while gaining access to advanced facilities.

- For instance, DCI Indonesia launched its Tier IV data center, E1, in downtown Jakarta with an 18 MW capacity in March 2024, catering especially to secure, regulated environments for banking and financial services. Enterprises prefer colocation services to reduce infrastructure costs while gaining access to advanced facilities and expertise.

Expanding Cloud Computing Adoption by Domestic and Global Players:

Cloud adoption acts as a major driver, with hyperscalers investing in Indonesian infrastructure. The market is witnessing growth from domestic startups and established global players seeking local data storage capacity. Enterprises benefit from flexible deployment models, which enhance efficiency. It creates opportunities for colocation providers to partner with global firms and expand facilities. Growing demand for hybrid and multi-cloud strategies fuels the requirement for interconnected colocation environments. Cloud service providers find Indonesia’s market favorable due to its large internet user base. Rising competition among providers strengthens service quality and affordability. The market’s ability to support hybrid models positions it as a vital hub.

- For example, Amazon Web Services, with over three availability zones separated by 100 kilometers in Jakarta, supports enterprises like Tokopedia and Traveloka with improved redundancy and reduced latency. Microsoft announced in April 2024 an investment of USD 1.7 billion over the next four years to expand cloud infrastructure and AI capabilities in Indonesia, strengthening hybrid cloud adoption.

Government Support and Policy Initiatives for Digital Economy Growth:

Supportive government policies are helping accelerate infrastructure expansion and attract foreign investment. The digital economy roadmap emphasizes innovation and high-speed internet penetration. It encourages global firms to build local data centers to comply with data sovereignty requirements. Public sector digitization also contributes to demand, with e-governance initiatives creating new workloads. Strong regulatory backing instills confidence in enterprises adopting colocation solutions. The rise in public-private partnerships further supports expansion. This environment enables a predictable regulatory framework for investors. By promoting digital infrastructure development, the government ensures long-term market growth.

Growing Data Traffic Driven by Internet Penetration and Mobile Usage:

The surge in mobile internet use and social media platforms is fueling exponential data growth. Indonesia ranks among the largest internet economies in Southeast Asia. It is driving enterprises to seek reliable colocation services for high data volumes. Online gaming, fintech, and video streaming platforms require uninterrupted performance. Colocation facilities provide lower latency and robust connectivity, which is essential for user satisfaction. Increasing demand from SMEs and startups accelerates this trend. Expansion of 5G networks adds further data loads that require colocation solutions. Providers are upgrading infrastructure to meet these needs and capture market share.

Market Trends:

Shift Toward Edge Data Centers to Enhance Latency and Performance:

The Indonesia Data Center Colocation Market is witnessing an increasing focus on edge data centers. These smaller facilities are closer to end-users, reducing latency and improving service quality. It addresses the growing demand for real-time applications in gaming, video streaming, and IoT. Companies view edge infrastructure as critical for enhancing user experience. Providers are investing in regional locations beyond Jakarta to extend coverage. This trend improves resiliency while supporting decentralized networks. Enterprises benefit from faster response times, which support mission-critical operations. The shift marks a structural change in Indonesia’s colocation strategy.

- For instance, EDGE DC operates EDGE1 (6 MW) and EDGE2 (23 MW) in downtown Jakarta, with over 60 network providers connected to minimize latency and sustain high availability with a service uptime SLA of 99.999%. This trend improves resiliency while supporting decentralized networks. Enterprises benefit from faster response times, which support mission-critical operations. The shift marks a structural change in Indonesia’s colocation strategy.

Sustainability and Green Energy Adoption in Data Center Design:

Sustainability has emerged as a key trend shaping infrastructure development. The Indonesia Data Center Colocation Market is incorporating energy-efficient systems and renewable sources. It reflects global emphasis on lowering carbon footprints while supporting rapid data growth. Operators adopt advanced cooling technologies to reduce energy use. Green certifications are gaining importance among global enterprises. Colocation providers are investing in solar and hydro-based energy options to enhance sustainability. This move attracts environmentally conscious clients seeking compliant solutions. Sustainable practices also help providers align with future regulatory standards. The shift indicates a long-term commitment to clean energy.

- For instance, Climanusa, an Indonesian cooling distributor, states it offers liquid cooling solutions for data centers to support high-density AI and big data workloads. Industry-wide, liquid cooling can increase energy efficiency compared to traditional air cooling, allowing for higher rack densities, including those exceeding 50 kW. In the broader data center industry, enterprises are increasingly seeking green certifications, and colocation providers are investing in renewable energy sources like solar and hydro to enhance sustainability.

Integration of Artificial Intelligence and Automation in Operations:

Artificial intelligence and automation are becoming vital for efficient operations in colocation centers. The Indonesia Data Center Colocation Market uses AI-driven tools to improve monitoring and predictive maintenance. It helps operators optimize power usage and improve uptime reliability. Automated systems also enhance security by detecting anomalies in real time. Providers benefit from reduced operational costs and improved service delivery. AI-based analytics support better capacity planning and resource management. Enterprises adopting colocation services prefer AI-enhanced facilities for scalability. The trend demonstrates the alignment of infrastructure with advanced digital ecosystems. Such integration ensures higher performance standards.

Expansion of Hyperscale and Interconnection Ecosystems in the Region:

Hyperscale data centers are expanding their presence across Indonesia. The Indonesia Data Center Colocation Market benefits from partnerships with global players seeking regional expansion. It creates a stronger interconnection ecosystem linking enterprises, cloud providers, and telecom operators. This expansion accelerates digital adoption for businesses of all sizes. The development of submarine cable systems further enhances Indonesia’s connectivity to global networks. Colocation facilities become central hubs for these interconnections. Providers gain from high demand for scalable and secure infrastructure. The growing ecosystem fosters collaboration across multiple industries. It reinforces Indonesia’s role as a regional digital hub.

Market Challenges Analysis:

High Energy Costs and Limited Power Infrastructure Reliability:

Energy costs remain a pressing challenge for the Indonesia Data Center Colocation Market. The country faces limitations in power infrastructure reliability, especially outside major cities. It impacts operational expenses and raises concerns for investors. Frequent disruptions increase the cost of deploying backup systems. Colocation providers must allocate resources to maintain stable energy supply, which affects profitability. These challenges hinder expansion in emerging areas with weaker grids. The situation forces concentration of facilities in select regions like Jakarta. Providers continue to face pressure to adopt energy-efficient designs to balance high costs.

Regulatory Complexity and Talent Shortages in the Industry:

Complex regulatory requirements create obstacles for market players. The Indonesia Data Center Colocation Market must navigate data sovereignty laws, licensing issues, and foreign investment rules. It often slows entry for global operators aiming to set up facilities. The market also struggles with a shortage of skilled professionals. Expertise in cybersecurity, cloud management, and facility operations is limited. Providers face difficulty in meeting advanced service expectations. Talent scarcity increases dependency on international expertise, raising costs further. These combined regulatory and workforce challenges delay implementation timelines. It restricts smooth scalability of operations for both domestic and international players.

Market Opportunities:

Expansion Potential Beyond Jakarta with Regional Data Center Development:

The Indonesia Data Center Colocation Market presents strong opportunities beyond the Jakarta region. Enterprises in West Java, Sumatra, and Sulawesi are emerging demand hubs. It creates prospects for regional facilities to support local businesses and reduce latency. Providers that expand into these markets can capture new customer bases. Government support for regional infrastructure adds to the growth potential. By diversifying locations, operators reduce concentration risks and ensure resilience. Expansion in emerging regions positions Indonesia as a truly distributed colocation market.

Rising Demand From Fintech, E-commerce, and Digital Startups:

Fintech, e-commerce, and startups are fueling demand for advanced colocation solutions. The Indonesia Data Center Colocation Market is well-placed to serve these fast-growing sectors. It supports flexible scalability required by digital businesses with fluctuating data loads. Providers offering secure and compliant facilities gain significant advantage. Growing online transactions increase the importance of robust infrastructure. Local startups prefer colocation for cost savings over building in-house centers. International e-commerce firms also seek reliable Indonesian facilities for customer engagement. This demand offers providers strong long-term growth opportunities.

Market Segmentation Analysis:

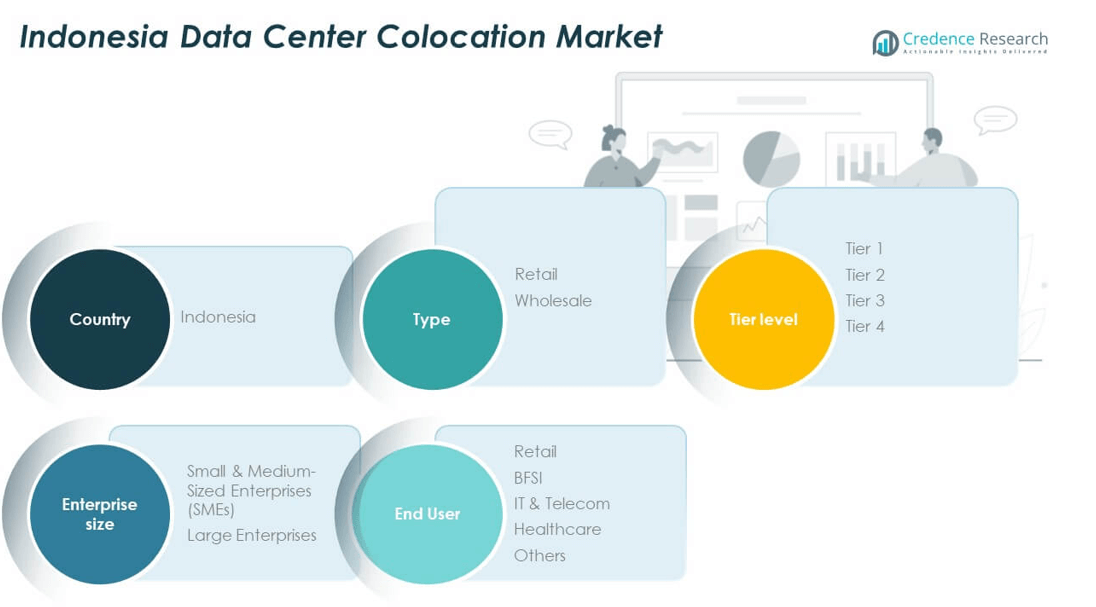

By Type

The Indonesia Data Center Colocation Market is segmented into retail and wholesale models. Retail colocation attracts enterprises seeking smaller, scalable space with strong security and connectivity. Wholesale dominates large-scale deployments, catering to hyperscalers and telecom operators requiring significant capacity. It allows long-term contracts and infrastructure flexibility.

- For instance, hyperscale operator NTT Communications has expanded its wholesale colocation capacity in key urban centers to meet the demands of telecom operators and other large enterprises.

By Tier Level

The market includes Tier 1, Tier 2, Tier 3, and Tier 4 facilities. Tier 3 data centers lead demand due to balanced uptime and cost efficiency. Tier 4 facilities are gaining traction among critical industries requiring high redundancy. Tier 1 and Tier 2 are limited to smaller enterprises with basic needs.

- For instance, EDGE DC’s Tier 3 EDGE2 center demonstrates balanced cost and uptime with a power usage effectiveness (PUE) of 1.24, ensuring reliable service for a mix of enterprise and hyperscale clients.

By Enterprise Size

Small and medium-sized enterprises (SMEs) form a growing segment, driven by digitalization and cost-saving needs. Large enterprises dominate market share, using colocation for scalability and compliance. It provides both groups with infrastructure that supports cloud adoption and digital expansion.

By End User

Key end users include retail, BFSI, IT & telecom, healthcare, and others. BFSI remains a strong contributor, requiring secure environments for financial transactions. IT & telecom demand is expanding with growing internet penetration and cloud adoption. Healthcare is increasing usage for patient data management. Retail and other sectors leverage colocation for operational efficiency and digital growth.

Segmentation:

- By Type

- By Tier Level

- Tier 1

- Tier 2

- Tier 3

- Tier 4

- By Enterprise Size

- Small & Medium-Sized Enterprises (SMEs)

- Large Enterprises

- By End User

- Retail

- BFSI (Banking, Financial Services & Insurance)

- IT & Telecom

- Healthcare

- Others

- By Country (within Indonesia context – for revenue footprint and mapping)

- Country-wise revenue share

- Type-based revenue split

- Tier-level revenue split

- Enterprise size-based revenue split

- End-user-based revenue split

Regional Analysis:

Java Region

Java dominates the Indonesia Data Center Colocation Market with a 65% share in 2024. Jakarta serves as the hub due to its role as the financial and digital center of the country. Strong presence of hyperscale providers and advanced connectivity infrastructure strengthens the region’s leadership. It benefits from government support, reliable power availability, and dense enterprise concentration. West Java and Banten are also emerging within the region due to land availability and expanding demand from technology-driven sectors. Enterprises prefer Java for low-latency services and diverse interconnection options. The concentration of global and local providers highlights Java’s central role.

Sumatra and Sulawesi

Sumatra holds a 15% share of the market, driven by industrial growth and rising internet penetration. The region attracts investment due to its strategic proximity to Singapore and growing demand for regional connectivity. It offers opportunities for colocation providers to serve manufacturing and resource-based industries. Sulawesi contributes around 10% share, supported by government initiatives to improve digital infrastructure outside Java. It is building momentum through improved submarine cable connections and data-driven projects. Providers view these regions as expansion grounds to diversify beyond Jakarta. The focus on infrastructure development ensures long-term growth prospects.

Kalimantan and Eastern Indonesia

Kalimantan and Eastern Indonesia together account for 10% of the market share. Growth is tied to planned infrastructure development and the relocation of Indonesia’s new capital to East Kalimantan. It creates significant opportunities for colocation providers to serve government, enterprise, and cloud operators. Eastern Indonesia is gaining importance as digital adoption rises in Papua, Maluku, and Nusa Tenggara. It faces challenges related to power reliability and limited connectivity, yet investments in undersea cables are addressing these gaps. It highlights strong potential for reducing regional disparities in digital access. Expansion in these regions is critical for balanced national growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Indonesia Data Center Colocation Market is highly competitive, with domestic and global players investing aggressively to expand capacity. Local firms such as Telkom Indonesia (NeutraDC), Biznet Data Center, and IDC Indonesia leverage strong market presence and local knowledge, while international operators including NTT Global Data Centers, Digital Edge, and EdgeConneX drive growth through advanced infrastructure and global connectivity. It reflects a balanced mix of established incumbents and new entrants focusing on hyperscale opportunities, regulatory compliance, and sustainability. Companies compete through expansion, strategic partnerships, and technological innovation to secure long-term clients across BFSI, IT & telecom, and e-commerce.

Recent Developments:

- In July 2025, NeutraDC, a part of Telkom Indonesia, partnered with renewable energy developer Medco Power to deploy solar power at its hyperscale data center facility in Batam, Indonesia. The project aims to deliver around 20MW of capacity powered through renewable energy, with the entire data center expected to have a capacity exceeding 60MW and operations commencing in the third quarter of 2025. This partnership demonstrates a long-term ESG commitment to building a greener AI-ready digital ecosystem.

- In October 2024, Telkom Indonesia launched its 25th data center, NeuCentrIX, in Yogyakarta, expanding its digital infrastructure footprint. The NeuCentrIX data center is designed as a neutral center to offer secure data storage solutions, serving various industries and supporting Indonesia’s digital economy. Telkom also has been developing the AI-powered NeutraDC data center in Batam, expected to start operations by Q3 2025.

- In August 2025, NTT DATA announced a global partnership with Google Cloud to accelerate AI-powered cloud innovations and digital transformation globally. While not Indonesia-specific, NTT DATA is a key player operating and expanding data center infrastructure in Indonesia and other strategic markets to support high-performance workloads.

- In February 2024, Bitera Data Center in Jakarta commenced operations with a 20MW capacity across nine stories, certified as Tier III by Uptime Institute. The facility runs on 100% renewable energy via certificates from Indonesia’s state electricity company. Bitera is an affiliate of MMS Group Indonesia and aims to support Indonesia’s digital economy and sustainable growth.

- Biznet Data Center, as of mid-2025, promotes its infrastructure as purpose-built, energy-efficient, and designed to support Indonesia’s digital growth with secure and scalable solutions. Their data centers are strategically located in Jakarta, West Java, and Bali, supporting cloud services and AI-ready environments.

- EdgeConneX expanded into Indonesia through the acquisition of GTN Data Center in Jakarta’s greater area, with an existing 7MW Tier 3 certified facility and plans for a large hyperscale data center campus. This move was part of EdgeConneX’s global expansion to meet growing demand for hyperscale data centers in Southeast Asia.

Report Coverage:

The research report offers an in-depth analysis based on type, tier level, enterprise size, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing reliance on colocation services from BFSI, IT, and healthcare industries.

- Expansion of hyperscale facilities by global providers to meet enterprise demand.

- Stronger adoption of hybrid and multi-cloud strategies supported by colocation centers.

- Rising interest in regional facilities beyond Jakarta to diversify market presence.

- Integration of AI and automation to improve operational efficiency and reliability.

- Investment in sustainable energy sources to address power costs and regulations.

- Development of interconnection ecosystems linking enterprises, cloud, and telecom.

- SMEs driving retail colocation growth with demand for cost-effective infrastructure.

- Government initiatives and capital relocation boosting regional digital infrastructure.

- Increasing competition fostering innovation in service delivery and customer support.