Market Overview

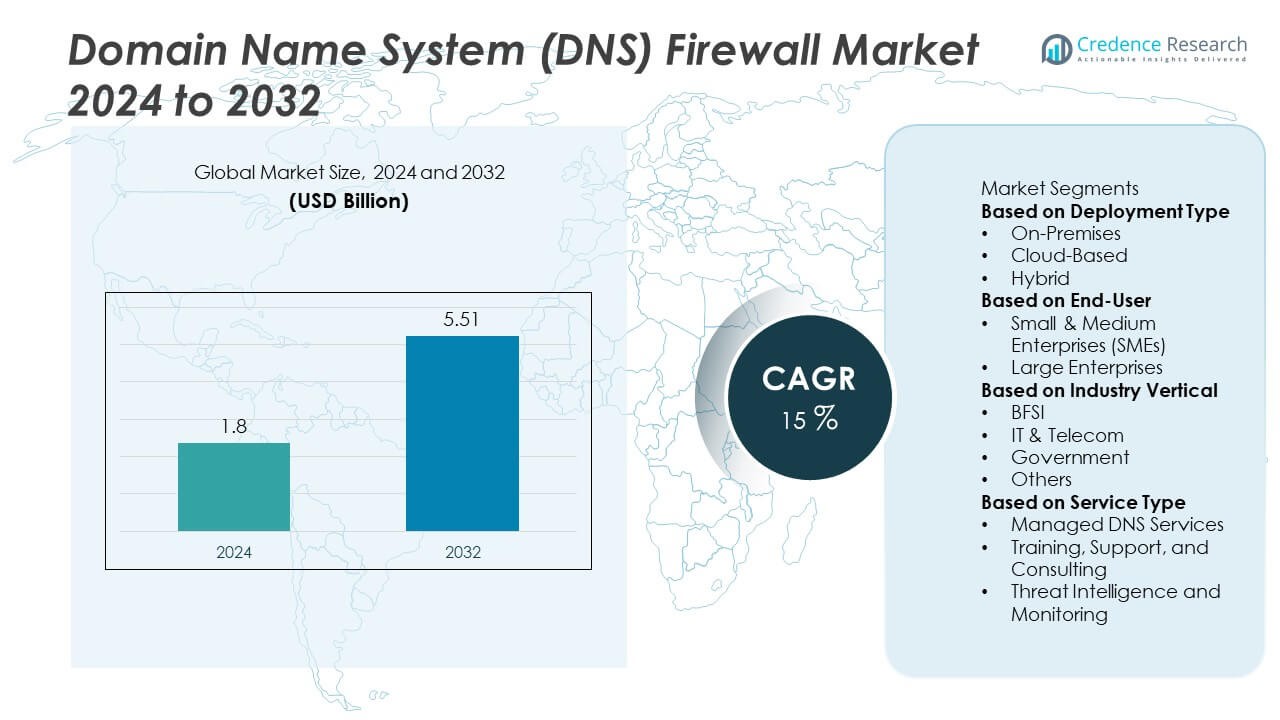

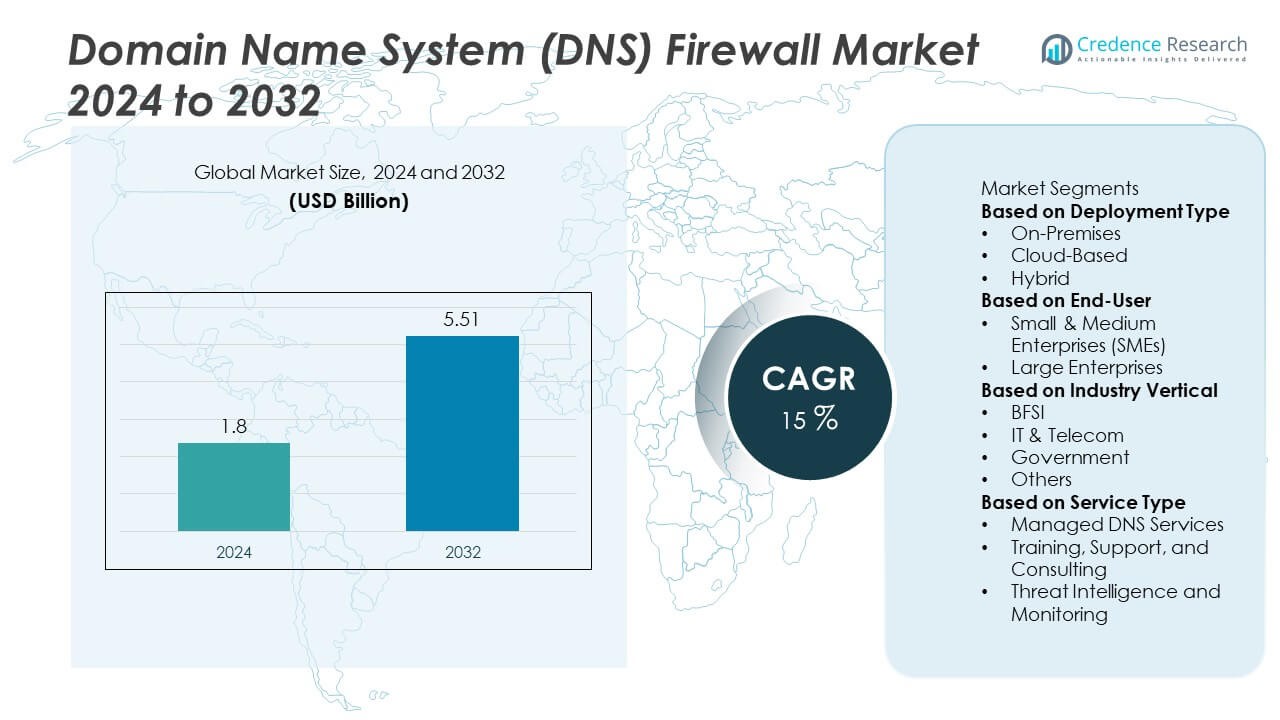

The Domain Name System (DNS) Firewall market was valued at USD 1.8 billion in 2024 and is projected to reach USD 5.51 billion by 2032, growing at a CAGR of 15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Domain Name System (DNS) Firewall Market Size 2024 |

USD 1.8 Billion |

| Domain Name System (DNS) Firewall Market, CAGR |

15% |

| Domain Name System (DNS) Firewall Market Size 2032 |

USD 5.51 Billion |

The Domain Name System (DNS) Firewall market is led by key players including Cisco Systems, Akamai Technologies (Nominum), Cloudflare, IBM Corporation, VeriSign, F5 Networks, BlueCat Networks, Comodo, EfficientIP, and EonScope. These companies dominate through innovations in DNS threat intelligence, cloud-based protection, and AI-driven network monitoring. Cisco and Akamai lead in enterprise adoption, while Cloudflare and IBM strengthen their presence through scalable, cloud-native security platforms. North America leads the market with a 38% share, supported by advanced cybersecurity infrastructure and regulatory compliance, followed by Asia-Pacific with 29% and Europe with 27%, reflecting expanding cloud adoption and DNS security integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Domain Name System (DNS) Firewall market was valued at USD 1.8 billion in 2024 and is projected to reach USD 5.51 billion by 2032, growing at a CAGR of 15%.

- Rising frequency of cyberattacks and DNS-based threats drives strong adoption of DNS firewalls across enterprises and government agencies.

- Key trends include integration of AI and machine learning in threat detection, adoption of cloud-based solutions, and alignment with zero-trust security models.

- Leading players such as Cisco Systems, Akamai Technologies, and Cloudflare focus on innovation, managed security services, and global expansion through strategic partnerships.

- North America leads with a 38% share, followed by Asia-Pacific with 29% and Europe with 27%, while the cloud-based deployment segment dominates with 54% share due to scalability and cost-efficiency advantages.

Market Segmentation Analysis:

By Deployment Type

The cloud-based segment dominated the Domain Name System (DNS) Firewall market with a 54% share in 2024. Its growth is driven by the rising adoption of cloud infrastructure across enterprises seeking scalability, flexibility, and real-time threat protection. Cloud-based DNS firewalls provide faster updates and easier integration with security platforms, making them ideal for distributed work environments. The increasing use of hybrid work models and cloud-hosted applications further boosts demand. Organizations prefer cloud deployment for its lower maintenance cost and enhanced visibility into DNS-layer attacks.

- For instance, Cloudflare reported handling over 1.7 trillion daily DNS queries through its global network of 320 data centers. The company’s cloud-managed firewall blocks around 140 billion cyber threats each day, providing rapid, automated defense across its DNS and Zero Trust security architecture.

By End-User

Large enterprises accounted for a leading 61% share of the DNS Firewall market in 2024. This dominance is due to their higher investment in cybersecurity infrastructure and complex network environments requiring advanced protection. These enterprises deploy DNS firewalls to prevent phishing, data breaches, and DNS tunneling attacks. The increasing frequency of targeted cyber threats across multinational organizations strengthens demand. Meanwhile, small and medium enterprises are gradually adopting cost-effective managed DNS security solutions to enhance protection without heavy infrastructure investments, contributing to market expansion.

- For instance, Cisco Umbrella protects over 30,000 enterprise customers and processes more than 620 billion internet requests daily. Its DNS-layer security infrastructure blocks approximately 20 million malicious domains every day, supporting large organizations in preventing data exfiltration and phishing-based intrusions.

By Industry Vertical

The BFSI segment held the largest 33% share of the DNS Firewall market in 2024. Financial institutions heavily rely on DNS firewalls to safeguard digital banking platforms, secure customer data, and prevent domain spoofing. The rise in online transactions and digital transformation in banking has amplified the need for multi-layered DNS security. IT and telecom sectors follow closely, supported by growing cloud service usage and network expansion. Government organizations also contribute significantly, adopting DNS firewalls to ensure data sovereignty and protect critical national infrastructure from evolving cyber threats.

Key Growth Drivers

Rising Incidence of Cyberattacks and DNS Exploits

The increasing frequency of phishing, ransomware, and botnet attacks is a major driver of DNS firewall adoption. Organizations are deploying DNS firewalls to block malicious domains, prevent data theft, and ensure network resilience. As attackers increasingly exploit DNS infrastructure for command-and-control activities, enterprises seek proactive defense mechanisms. The demand for DNS security solutions is rising across industries handling sensitive data, such as BFSI, healthcare, and government. This heightened awareness of DNS-level protection continues to strengthen global adoption and drive consistent market expansion.

- For instance, Akamai’s Edge DNS service and broader cloud network handle a massive volume of internet traffic and DNS queries daily. Using its extensive global threat intelligence, Akamai’s security products, such as Guardicore DNS Firewall and Brand Protector, detect and block millions of malicious requests, including those from botnets and phishing attempts, protecting enterprise networks.

Expansion of Cloud Infrastructure and Remote Work Environments

The shift toward cloud computing and hybrid work models is accelerating the need for DNS-based security. Cloud DNS firewalls offer scalable protection for distributed networks and remote employees without compromising performance. As organizations migrate workloads to public and hybrid clouds, ensuring DNS-level threat visibility has become critical. Cloud-native security providers are integrating intelligent DNS filtering and AI-based threat analytics to enhance detection speed. This evolution supports secure digital transformation initiatives and ensures consistent protection across multi-cloud environments, driving sustained market growth.

- For instance, BlueCat Networks offers the Integrity DNS Edge platform, which provides visibility and control over DNS traffic across multicloud and on-premise environments. The platform features AI-enabled anomaly detection capabilities, threat protection, and automated DNS management for enhanced security and operational efficiency.

Regulatory Compliance and Data Protection Mandates

Stringent data protection regulations such as GDPR, CCPA, and HIPAA are pushing enterprises to strengthen network-level defenses. DNS firewalls help ensure compliance by blocking unauthorized data transfers and restricting access to malicious or unverified domains. Governments and regulatory bodies are emphasizing secure DNS management as a key cybersecurity requirement. Industries such as finance, healthcare, and public services are prioritizing DNS security to mitigate compliance risks. The increasing global focus on cybersecurity governance and data sovereignty is fostering higher adoption of DNS firewall solutions.

Key Trends and Opportunities

Integration of AI and Machine Learning in Threat Detection

AI and machine learning are revolutionizing DNS firewall capabilities by enabling predictive and adaptive threat detection. These technologies enhance the ability to identify anomalies, detect zero-day threats, and block malicious domains in real time. Vendors are incorporating behavioral analytics and automated response systems to improve protection accuracy. The integration of AI-driven models also reduces false positives and accelerates incident response times. As cyber threats evolve, intelligent DNS filtering solutions are becoming essential, presenting strong opportunities for vendors offering advanced, automated threat detection platforms.

- For instance, IBM Security leverages its AI-powered security products, including the watsonx data and AI platform, to analyze vast amounts of security event data, such as the over 150 billion security events monitored per day for its X-Force Threat Intelligence Index.

Rising Adoption of Secure Access Service Edge (SASE) Frameworks

The growing implementation of SASE architectures is creating new opportunities for DNS firewall integration. DNS security serves as a foundational layer within SASE frameworks, ensuring secure access to cloud applications and distributed networks. Enterprises are adopting SASE to unify network and security management, enabling DNS firewalls to function alongside SD-WAN and zero-trust models. This convergence supports consistent protection across remote and hybrid environments. The increasing need for integrated, scalable cybersecurity architectures continues to fuel the incorporation of DNS firewalls within modern network infrastructures.

- For instance, Palo Alto Networks integrated its DNS Security service into the Prisma SASE platform, analyzing over 500 million DNS requests per day. The AI-driven threat engine automatically blocked more than 1.2 million malicious domains weekly, delivering real-time enforcement across enterprise networks and remote endpoints within a unified SASE framework.

Key Challenges

High Implementation and Maintenance Costs

Deploying DNS firewall solutions can be costly, especially for small and medium-sized enterprises. Advanced protection systems require continuous updates, threat intelligence subscriptions, and skilled cybersecurity personnel. The cost of integrating DNS firewalls with existing network infrastructure further raises the total ownership expense. This creates a barrier for organizations with limited budgets, particularly in developing regions. Vendors are addressing this challenge through cloud-based and subscription models, but affordability and ROI remain critical concerns for broader market penetration.

Complexity in Managing Hybrid and Multi-Cloud Networks

Managing DNS security across multi-cloud and hybrid environments presents operational challenges. As enterprises adopt diverse infrastructure providers, ensuring consistent DNS policy enforcement and visibility becomes difficult. Disparate network architectures often lead to security blind spots and configuration errors. Lack of centralized control complicates real-time monitoring and response to DNS-based threats. Companies are increasingly adopting unified management platforms, but integration complexities and interoperability limitations continue to hinder full implementation efficiency in large-scale, hybrid environments.

Regional Analysis

North America

North America held a 38% share of the Domain Name System (DNS) Firewall market in 2024, driven by the strong presence of cybersecurity vendors and widespread digital transformation across industries. The United States leads adoption due to strict regulatory compliance requirements and high cloud usage. Enterprises in sectors such as BFSI, government, and healthcare are deploying DNS firewalls to counter sophisticated cyber threats. Continuous innovation in AI-driven threat detection and the adoption of zero-trust security frameworks further support regional dominance. Rising investment in cloud-based DNS solutions continues to strengthen North America’s leadership position.

Europe

Europe accounted for a 27% share of the DNS Firewall market in 2024, supported by robust cybersecurity regulations and increasing digitalization of enterprises. The General Data Protection Regulation (GDPR) drives the adoption of DNS firewalls to enhance data security and compliance. Key markets including Germany, the United Kingdom, and France are witnessing growing deployment in finance, telecom, and public administration. The rise of hybrid IT infrastructures and demand for secure DNS filtering services reinforce market expansion. Investments in cross-border cyber defense initiatives and partnerships with global security providers strengthen Europe’s competitive position.

Asia-Pacific

Asia-Pacific captured a 29% share of the DNS Firewall market in 2024, fueled by rapid cloud adoption and increasing cyber threat incidents. Countries such as China, India, Japan, and South Korea are major contributors due to the growth of digital businesses and government-backed cybersecurity programs. The expanding telecom sector and rise of e-commerce platforms are increasing demand for DNS protection services. Enterprises are prioritizing DNS-layer security to protect distributed networks and cloud environments. Continuous investment in IT infrastructure modernization and regional data protection policies is further accelerating market growth across Asia-Pacific.

Latin America

Latin America held a 4% share of the DNS Firewall market in 2024, supported by growing awareness of DNS-based threats and expanding enterprise digitalization. Brazil and Mexico are the leading markets, driven by regulatory efforts to strengthen cybersecurity and rising adoption of managed DNS security services. The financial and telecom sectors are investing in DNS firewall solutions to protect against phishing and data exfiltration attacks. Limited cybersecurity infrastructure and budget constraints pose challenges; however, government initiatives promoting digital resilience are expected to support steady market growth in the coming years.

Middle East & Africa

The Middle East & Africa accounted for a 2% share of the DNS Firewall market in 2024. The United Arab Emirates and Saudi Arabia lead adoption, driven by increasing investments in national cybersecurity frameworks and smart city programs. The demand for DNS firewall solutions is growing in energy, finance, and government sectors as organizations strengthen data protection. Africa is witnessing gradual adoption supported by telecom expansion and growing digital inclusion initiatives. Rising awareness of DNS-layer threats and partnerships with global cybersecurity firms are expected to improve market penetration and regional network security.

Market Segmentations:

By Deployment Type

- On-Premises

- Cloud-Based

- Hybrid

By End-User

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- BFSI

- IT & Telecom

- Government

- Others

By Service Type

- Managed DNS Services

- Training, Support, and Consulting

- Threat Intelligence and Monitoring

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Domain Name System (DNS) Firewall market includes major players such as Cisco Systems, Akamai Technologies (Nominum), Cloudflare, IBM Corporation, VeriSign, F5 Networks, BlueCat Networks, Comodo, EfficientIP, and EonScope. These companies dominate through advanced threat intelligence, real-time DNS monitoring, and integrated cybersecurity platforms. Cisco and Akamai lead the market with strong enterprise adoption and cloud-based DNS protection capabilities, while Cloudflare focuses on scalable edge security solutions. IBM and F5 Networks are expanding their portfolios through AI-driven analytics and managed DNS security services. Strategic partnerships, product innovation, and mergers aimed at improving network visibility and response times are key competitive strategies. Continuous R&D in automated threat detection and hybrid DNS protection models further strengthens the competitive positioning of leading vendors in this rapidly evolving cybersecurity landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cisco Systems

- Akamai Technologies (Nominum)

- Cloudflare

- IBM Corporation

- VeriSign

- F5 Networks

- BlueCat Networks

- Comodo

- EfficientIP

- EonScope

Recent Developments

- In October 2025, F5 Networks disclosed a security incident affecting its BIG-IP platform, with stolen source-code and vulnerability data, and released patches addressing 44 vulnerabilities in its DNS/firewall infrastructure.

- In September 2025, Cloudflare launched “DNS Firewall Analytics” in its dashboard, offering customers access to 62 days of historical DNS query data, charts of cached vs uncached queries, and breakdowns by data-center.

- In June 2025, Akamai Technologies introduced “DNS Posture Management”—an agentless solution giving multicloud visibility of DNS assets and real-time monitoring of DNS-based attacks.

- In October 2023, IBM introduced its “NS1 Connect” premium DNS offering, delivering a global network with a 100% uptime SLA and advanced traffic-steering across 26 points of presence (PoPs).

Report Coverage

The research report offers an in-depth analysis based on Deployment Type, End-User, Industry Vertical, Service Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for DNS firewalls will increase as cyber threats targeting DNS infrastructure rise.

- Cloud-based DNS security solutions will dominate due to scalability and ease of integration.

- AI and machine learning will enhance real-time threat detection and automated response.

- Adoption of zero-trust network frameworks will strengthen the role of DNS firewalls.

- Enterprises will invest more in DNS-layer protection for remote and hybrid work environments.

- Regulatory compliance requirements will continue to drive implementation across critical industries.

- Partnerships between DNS firewall vendors and cloud providers will expand global coverage.

- SMEs will adopt managed DNS security services to reduce operational complexity.

- Integration with Secure Access Service Edge (SASE) platforms will create new deployment opportunities.

- Asia-Pacific and North America will remain the fastest-growing regions for DNS firewall adoption.