Market Overview:

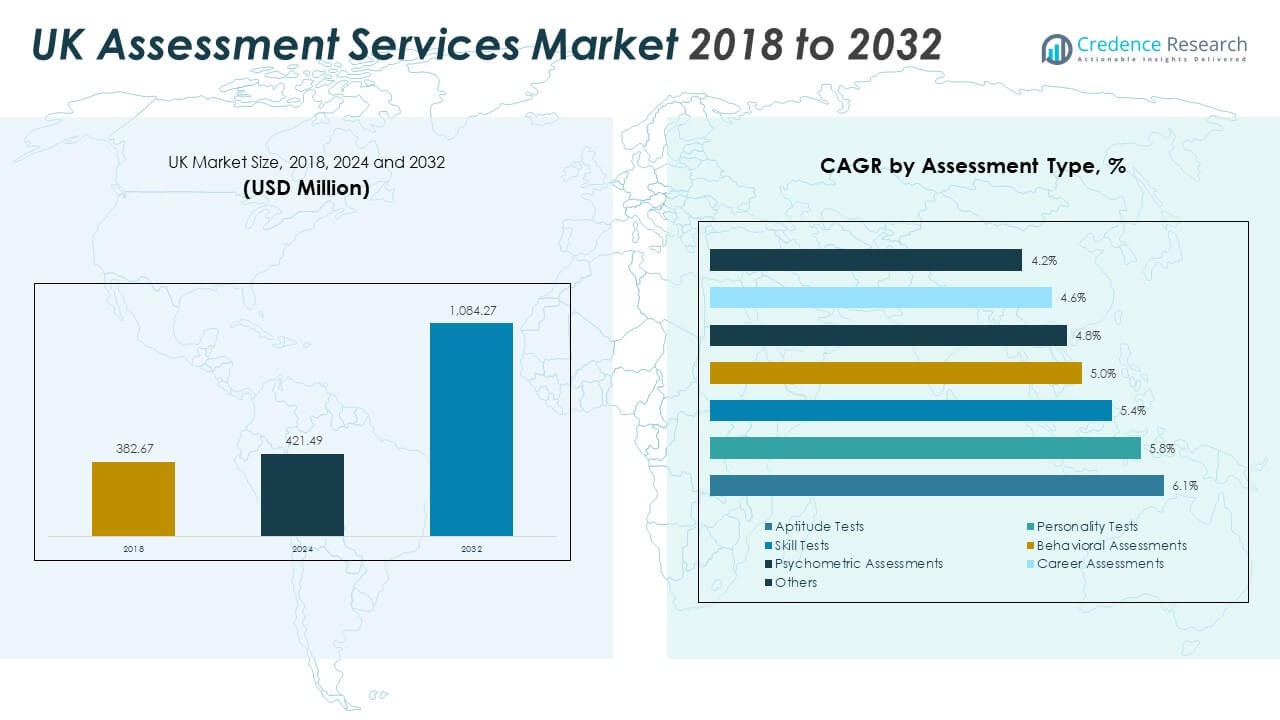

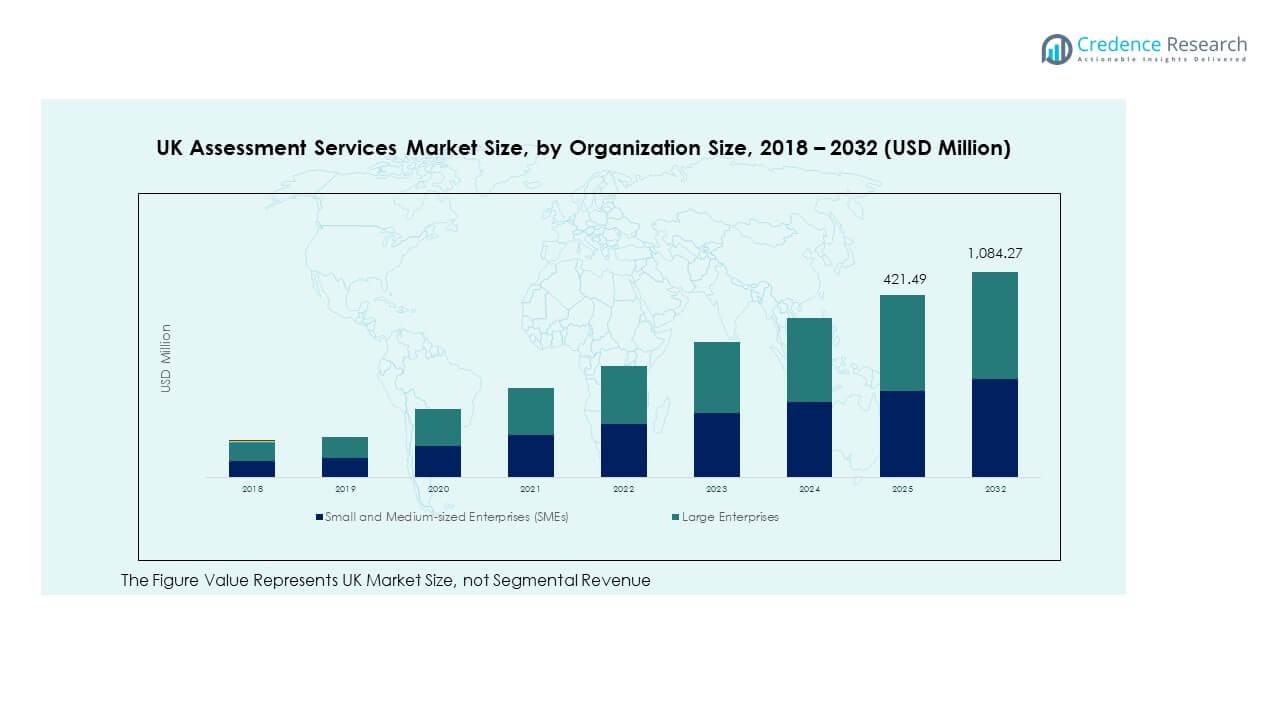

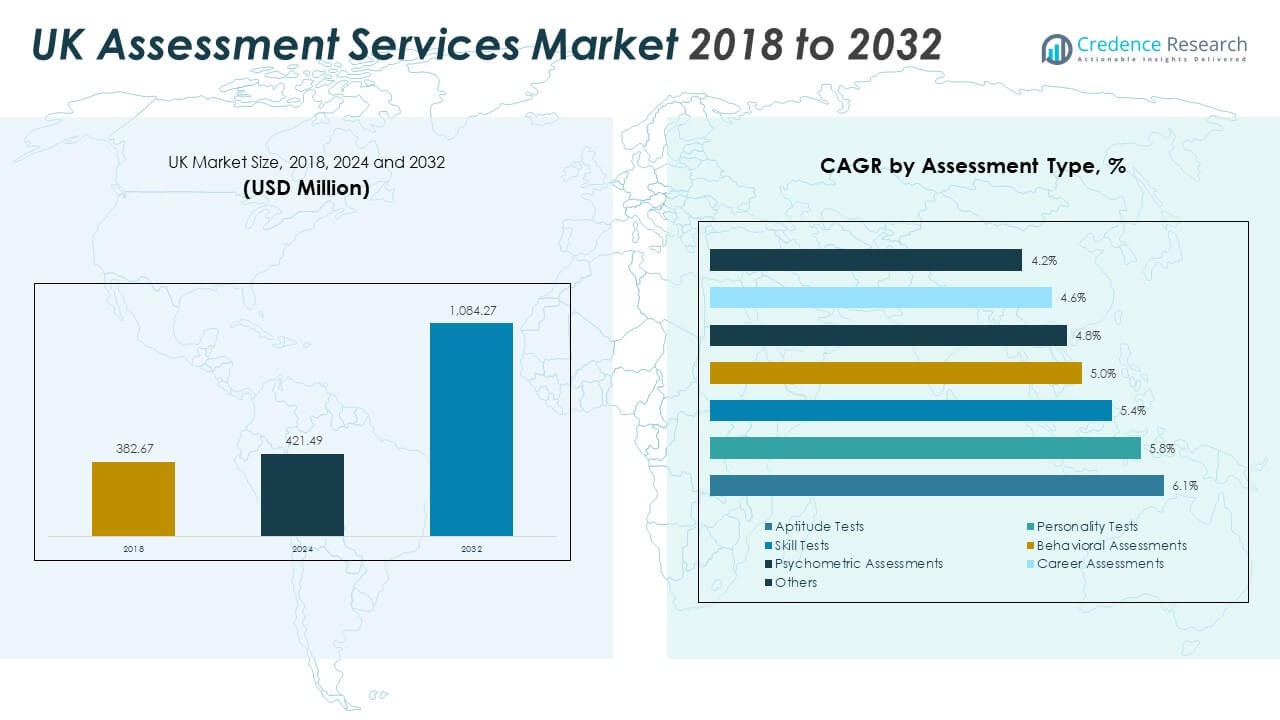

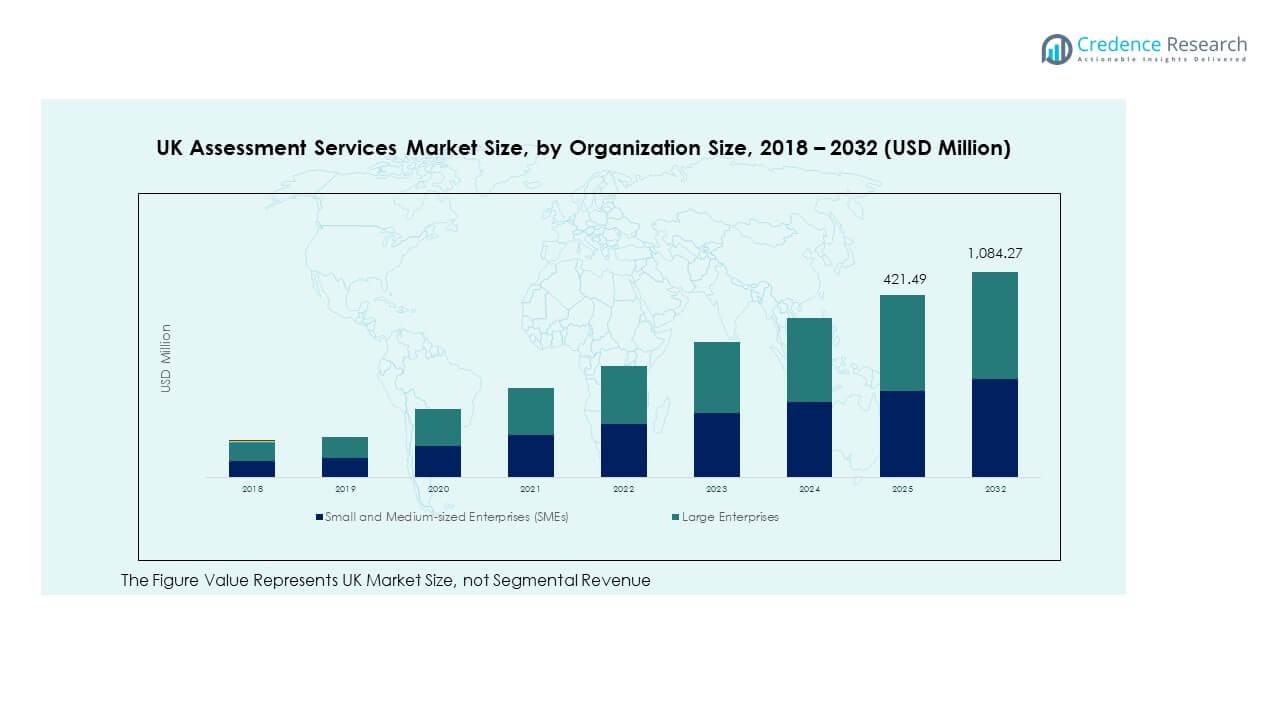

The UK Assessment Services Market size was valued at USD 382.67 million in 2018 to USD 421.49 million in 2024 and is anticipated to reach USD 1,084.27 million by 2032, at a CAGR of 12.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Assessment Services Market Size 2024 |

USD 421.49 Million |

| UK Assessment Services Market, CAGR |

12.54% |

| UK Assessment Services Market Size 2032 |

USD 1,084.27 Million |

The market growth is fueled by rising demand for skill-based assessments and workforce development programs. Organizations use adaptive and AI-integrated platforms to improve candidate selection, training effectiveness, and performance tracking. Government support for digital learning infrastructure is strengthening adoption across academic and professional segments. Secure cloud-based solutions are enabling seamless test delivery and scalability. The emphasis on upskilling and reskilling is reinforcing the role of assessment as a core tool in both education and employment ecosystems.

England leads the UK Assessment Services Market due to its strong education network, advanced digital infrastructure, and early technology adoption. Scotland is emerging as a key growth region supported by public sector investments and education-focused policies. Wales and Northern Ireland are experiencing steady growth through increased digital literacy programs and regional workforce development efforts. The presence of EdTech companies and supportive government initiatives is creating a balanced growth environment across all subregions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Assessment Services Market was valued at USD 382.67 million in 2018, USD 421.49 million in 2024, and is projected to reach USD 1,084.27 million by 2032, growing at a CAGR of 12.54%.

- England leads with 57% share due to its strong education infrastructure and digital maturity, followed by Scotland at 21% and Wales & Northern Ireland at 22%, supported by policy-driven digital adoption.

- Wales and Northern Ireland represent the fastest-growing regions with 22% share, driven by government-backed workforce development programs and rural digital testing expansion.

- Large enterprises contribute an estimated 58% of the market, reflecting higher investments in digital assessment platforms for recruitment and training.

- Small and medium-sized enterprises account for 42% of the market, showing steady adoption through cost-effective and scalable online testing solutions.

Market Drivers

Rising Demand for Skill-Based Assessments Across Education and Corporate Sectors

The UK Assessment Services Market is growing steadily due to a strong shift toward skill-based testing. Institutions are focusing on accurate measurement of knowledge, skills, and behavioral competencies. Companies use structured assessments to make informed hiring decisions and improve workforce productivity. Digital adoption has increased access to advanced testing platforms, supporting scalable evaluations. Governments and private bodies are investing in standardized testing frameworks to improve employability. EdTech firms are offering adaptive testing models that support personalized learning pathways. This focus is improving candidate engagement and completion rates. It is creating new opportunities for service providers to expand their offerings.

Increased Digital Transformation Driving Higher Adoption of Online Platforms

The ongoing digital transformation has accelerated the demand for online testing platforms. Companies and universities are using secure, AI-enabled systems to deliver large-scale assessments. Online proctoring ensures test integrity and builds trust among users. Cloud-based platforms simplify test delivery and allow seamless data management. This helps institutions achieve real-time evaluation and quick reporting. Employers benefit from automated skill evaluation, improving workforce planning. It is making the assessment process more efficient, transparent, and cost-effective. Growing integration with learning management systems is further expanding platform adoption.

- For instance, Proctortrack’s PEBble Browser is a secure, standalone lockdown solution designed to prevent cheating during online exams. It integrates OS-level protection and AI monitoring features to support live and hybrid proctoring for high-stakes assessments.

Rising Emphasis on Workforce Upskilling and Reskilling Initiatives

Workforce transformation initiatives are driving assessment adoption across industries. Employers prioritize testing tools that align with internal learning and development goals. Regular assessments help track employee progress and identify skill gaps. It improves workforce readiness for evolving roles in technology-driven environments. Government-funded programs are encouraging organizations to implement scalable assessments for training. EdTech companies are launching targeted solutions for professional certifications. Testing models with adaptive structures support both entry-level and advanced skill evaluation. This structured approach is driving sustained demand across public and private sectors.

- For instance, PwC’s “New World. New Skills.” program has reached more than 11 million people globally through upskilling initiatives focused on digital literacy and workforce readiness. The program aims to equip individuals and communities with practical skills to thrive in a digital economy.

Government Support and Standardization Policies Boosting Market Penetration

Strong government initiatives are promoting standardized assessment systems nationwide. Education policies emphasize structured testing frameworks to ensure quality assurance. This regulatory support builds confidence among academic and corporate stakeholders. Testing providers gain operational clarity, allowing wider platform expansion. Investment in digital education infrastructure has improved accessibility for remote learners. It is strengthening collaboration between EdTech firms and government bodies. Policies also encourage integration of testing tools with broader learning ecosystems. This ecosystem support is driving market penetration and long-term growth.

Market Trends:

Growing Adoption of AI-Powered and Adaptive Testing Technologies

The UK Assessment Services Market is witnessing a rapid shift toward AI-enabled testing platforms. Adaptive technologies personalize test difficulty levels based on user responses. These models improve accuracy and provide deeper insight into candidate performance. AI features help reduce bias and standardize evaluation outcomes. Test administrators gain real-time analytics that support better decision-making. EdTech providers integrate machine learning to refine assessments continuously. It is making digital testing smarter and more efficient. Growing acceptance of AI-backed assessments reflects a strong trend across sectors.

Expansion of Hybrid Assessment Models Supporting Flexibility and Reach

Hybrid delivery modes are becoming a preferred approach for many institutions. A blend of online and in-person formats ensures wider coverage and flexibility. Universities, corporate training centers, and public sector programs use hybrid methods to reach diverse learners. It helps reduce logistical barriers and supports large-scale testing initiatives. Employers rely on this model to assess distributed teams across regions. This structure also improves test security and scalability. Testing vendors are focusing on seamless integration between offline and online processes. This evolving model is reshaping how assessments are delivered and consumed.

- For instance, City St George’s University of London adopted hybrid teaching frameworks across its institution, offering synchronous online and in-person sessions simultaneously. Their mixed-methods study during the 2021-2022 academic year found that hybrid delivery improved accessibility and inclusivity for students facing time or access constraints, and supported more flexible engagement.

Integration of Assessment Tools with Learning and Talent Platforms

Integrated systems are creating end-to-end learning and assessment environments. Organizations link testing tools with learning platforms to streamline user journeys. It allows automated score transfers, personalized content delivery, and improved learner tracking. Institutions benefit from centralized reporting and real-time performance insights. EdTech platforms use APIs to integrate seamlessly with HR systems and LMS tools. It enhances testing efficiency and user experience. This integrated ecosystem supports adaptive learning strategies and talent development. Growing demand for interoperable platforms is shaping future assessment solutions.

- For instance, Moodle is one of the most widely used virtual learning environments in UK higher education, with thousands of registered institutional sites. The platform includes built-in assessment modules that support automated grading, analytics, and integration with third-party education and communication tools.

Increasing Focus on Credentialing and Certification Programs

Professional credentialing programs are gaining traction in multiple industries. Candidates pursue certifications to validate skills and enhance employability. Organizations rely on standardized assessments to support their certification frameworks. Testing platforms are evolving to meet the growing demand for verified credentials. It is increasing the relevance of assessment in career progression. Many providers offer secure digital badges and blockchain-enabled verification. This transparency boosts confidence among employers and candidates. The trend is reinforcing the role of assessment as a core element of professional development.

Market Challenges Analysis:

Ensuring Data Security, Compliance, and Integrity in Digital Assessment Systems

The UK Assessment Services Market faces challenges in maintaining data security and compliance. Institutions must protect sensitive student and employee information across cloud systems. Cybersecurity breaches can impact trust and disrupt operations. Strict regulations require providers to follow strong encryption and privacy standards. Test integrity issues, including cheating and identity fraud, remain significant concerns. Vendors invest in advanced authentication and monitoring technologies to address these risks. It requires constant system upgrades and compliance audits. Balancing ease of access with security remains a critical challenge.

High Implementation Costs and Limited Digital Infrastructure in Certain Regions

Cost barriers pose a challenge for organizations with limited budgets. Many small institutions struggle to invest in advanced testing platforms. Infrastructure gaps in remote or rural areas reduce digital adoption. Reliable internet and secure systems are necessary for online testing to work effectively. Training faculty and administrators adds extra financial pressure. It limits the scalability of programs, especially for public education sectors. Vendors must offer flexible pricing and support structures. Closing this gap is essential to ensure equitable access to modern assessments.

Market Opportunities:

Rising Scope for Global Expansion Through Online and Hybrid Platforms

The UK Assessment Services Market holds strong potential for international expansion. Online platforms can reach learners and professionals across borders with ease. Testing vendors can localize content while maintaining global standards. Hybrid delivery models enable institutions to scale without heavy infrastructure costs. It opens opportunities to collaborate with international universities and corporations. Flexible platforms also support multilingual assessments. These factors create a clear pathway for growth in exportable EdTech services. Global demand for English-based testing adds further momentum to expansion strategies.

Increased Demand for Industry-Specific and Customizable Testing Solutions

Industry-focused testing solutions present a key growth area for service providers. Companies seek tailored assessments aligned with sector-specific skill requirements. It enhances talent quality and accelerates hiring cycles. Vendors are investing in adaptive content engines to create specialized test formats. Sectors such as healthcare, IT, and BFSI show strong demand for skill validation. This customization improves candidate-job matching and retention rates. Providers offering flexible design frameworks can secure a competitive edge. The growing demand for specialized assessments supports sustained market growth.

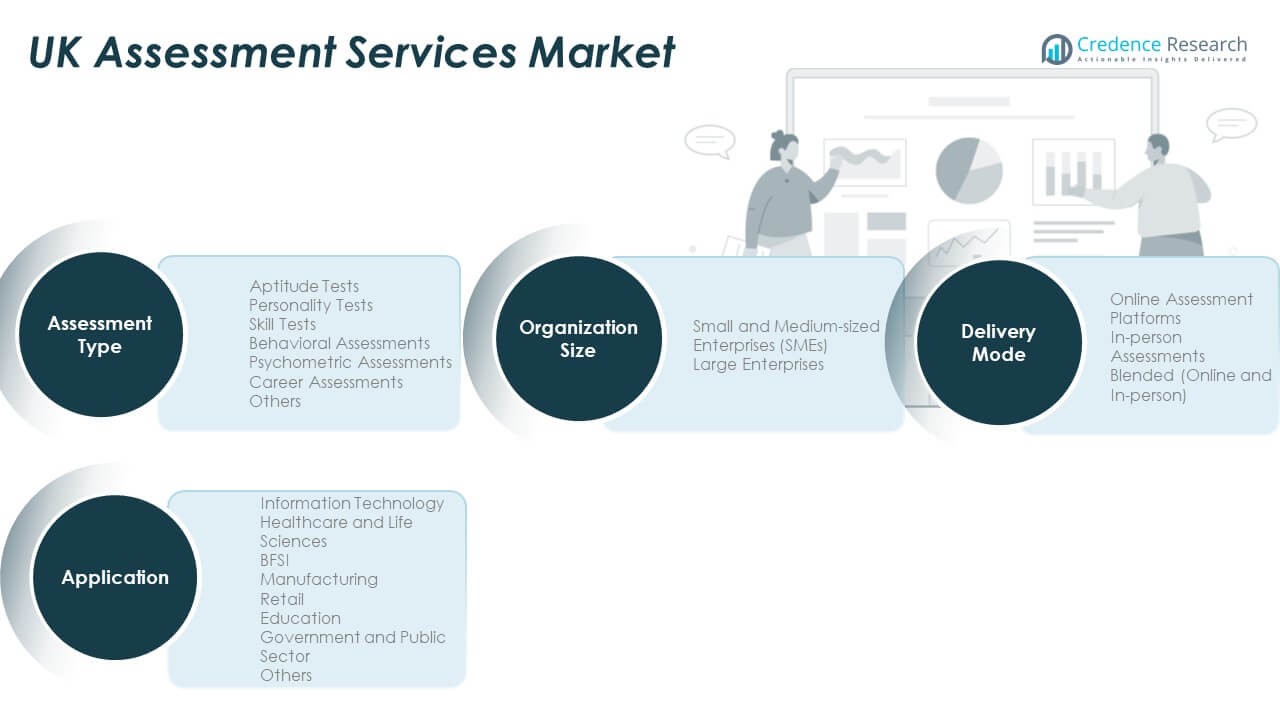

Market Segmentation Analysis:

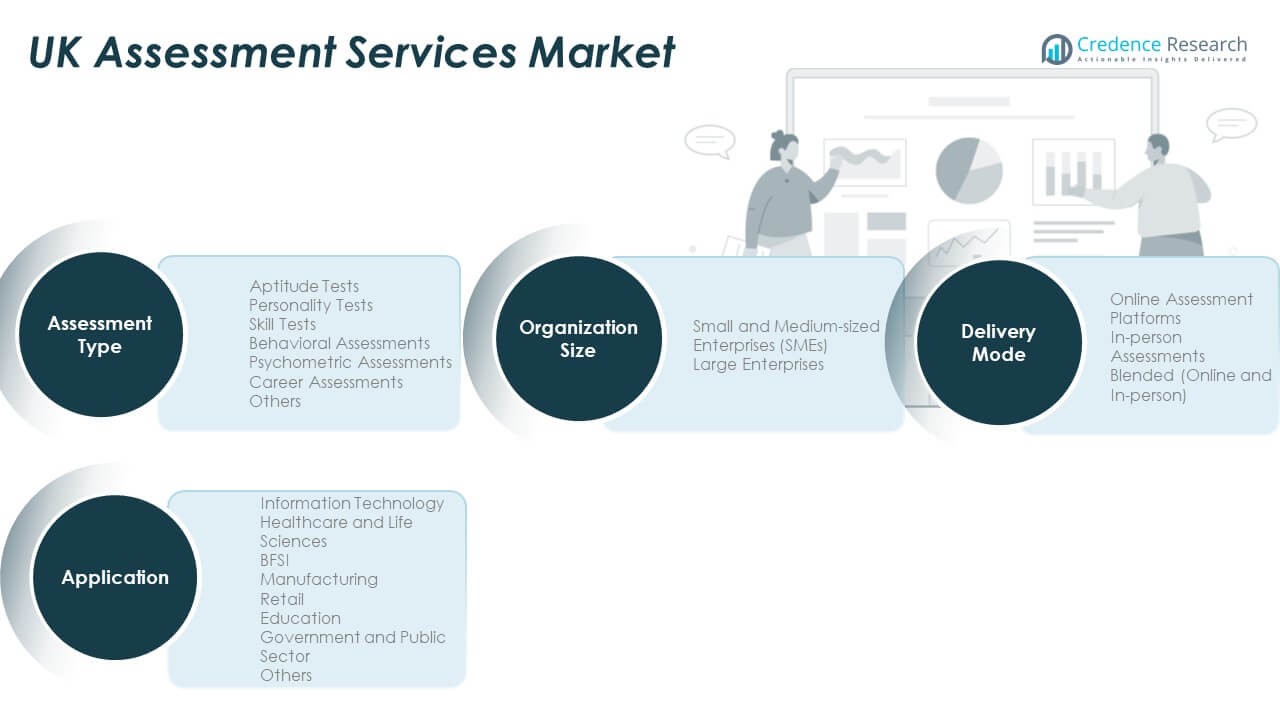

The UK Assessment Services Market is structured across multiple segment categories, allowing targeted adoption across industries and user groups.

By Assessment Type, the market includes aptitude tests, personality tests, skill tests, behavioural assessments, psychometric assessments, career assessments, and others. Aptitude and skill tests dominate due to strong use in academic admissions and corporate hiring. Personality and psychometric assessments support deeper candidate insights, driving demand in talent evaluation.

By Application, the market covers information organization size, healthcare and life sciences, BFSI, manufacturing, retail, education, government and public sector, and others. Education and government sectors lead adoption due to strong policy support and digital learning initiatives. Healthcare and BFSI are showing strong adoption for compliance and licensing needs.

- For instance, Coursera was recognised as a Leader in The Forrester Wave: Technology Skills Development Platforms, Q2 2025, earning the highest possible score in eight criteria including AI capabilities for skills acquisition, partner ecosystem breadth, and individual and team skills assessment.

By Organization Size, the market includes small and medium-sized enterprises (SMEs) and large enterprises. Large enterprises drive platform adoption with greater investment capacity, while SMEs adopt flexible, low-cost solutions to build digital capability.

By Delivery Mode, the market includes online assessment platforms, in-person assessments, and blended formats. Online platforms dominate due to flexibility and scalability. Hybrid solutions are gaining popularity, offering broader reach and improved security. It reflects a structured, multi-segmented market approach supporting diverse testing needs across sectors.

- For instance, Mercer | Mettl’s Proctoring as a Service (MPaaS) integrates smoothly with standard LMS platforms and reports AI-based flagging capabilities with over 95% accuracy in detecting suspicious behaviours during remote exams.

Segmentation

By Assessment Type

- Aptitude Tests

- Personality Tests

- Skill Tests

- Behavioural Assessments

- Psychometric Assessments

- Career Assessments

- Others

By Application

- Information Organization Size

- Healthcare and Life Sciences

- BFSI

- Manufacturing

- Retail

- Education

- Government and Public Sector

- Others

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Delivery Mode

- Online Assessment Platforms

- In-person Assessments

- Blended (Online and In-person)

Regional Analysis

England leads the UK Assessment Services Market with a market share of 57%. Strong digital infrastructure, a dense education network, and a mature corporate sector drive this leadership. London and the South East host major testing technology providers and EdTech innovators. Universities and enterprises in this region are early adopters of AI-enabled platforms, driving consistent growth. It benefits from strong regulatory support and large-scale workforce training programs. High investment levels allow rapid implementation of digital testing systems. This dominant position makes the region a key contributor to national market expansion.

Scotland holds a market share of 21% with steady growth supported by public sector investment and education-focused policies. The government emphasizes digital learning tools and standardized testing to improve learning outcomes. Universities and skill development institutions use hybrid and adaptive testing solutions to reach remote areas effectively. It is expanding its EdTech ecosystem through strategic collaborations with global testing providers. Growing interest in certification and vocational testing also supports demand. Educational reform efforts are creating a favorable environment for sustained platform adoption. This growth trajectory strengthens its position in the overall market structure.

Wales and Northern Ireland together account for 22% of the market share. Both regions are seeing rising investment in digital assessment platforms driven by workforce development initiatives. Regional governments focus on supporting SMEs, public education systems, and healthcare training programs. It benefits from increased funding aimed at improving access to digital testing in rural and semi-urban areas. Partnerships between universities and testing providers are improving adoption rates. Wales focuses on digital literacy programs, while Northern Ireland leverages public-private collaborations. This strategic growth across subregions is strengthening the market’s national footprint.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SHL

- Pearson PLC

- Thomas International

- Capp (Cappfinity)

- AON

- Cubiks (now part of Talogy)

- RM plc

- Synap

- Assessment Services Ltd

- Pearson VUE

Competitive Analysis

The UK Assessment Services Market features a mix of global and domestic providers competing for market leadership. Key players include Pearson VUE, SHL, Talogy, PSI Services LLC, Mercer | Mettl, Test Partnership, and Thomas International. These companies offer a broad portfolio of online testing solutions, proctoring systems, and adaptive testing platforms. It is characterized by strong investments in AI, automation, and secure delivery models. Many players focus on integrating their solutions with corporate HR systems and learning platforms. Partnerships with universities, government agencies, and private corporations are expanding market reach. Local EdTech firms compete through niche offerings, pricing flexibility, and service customization. This competitive landscape is fostering product innovation and strategic alliances to maintain market leadership.

Recent Developments

- In July 2025, Thomas International launched its new aptitude assessment on the upgraded Thomas Talent Assessment Platform. This enhanced platform, incorporating Thomas Perform and Thomas Profile applications, combines four decades of psychometric experience with advanced technology to improve predictive hiring and workforce development.

- In April 2025, AON launched its new People Insights talent assessment platform. This next-generation solution delivers data-driven insights to help organizations enhance talent acquisition, development, and engagement strategies. The platform integrates predictive analytics to improve workforce decision-making and leadership potential assessments.

Report Coverage

The research report offers an in-depth analysis based on Assessment Type, Application, Organization Size and Delivery Mode. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital transformation will strengthen the integration of AI-driven and adaptive testing technologies across education and corporate sectors.

- Online and hybrid assessment platforms will expand their reach, improving accessibility and operational efficiency nationwide.

- Strategic partnerships between EdTech firms and government agencies will accelerate platform adoption and infrastructure upgrades.

- Industry-specific and customizable assessments will see strong growth, especially in healthcare, BFSI, and technology sectors.

- Hybrid delivery models will dominate as institutions seek flexibility and scalability in testing formats.

- Workforce upskilling and professional certification programs will drive long-term demand for specialized assessments.

- Cybersecurity enhancements and compliance measures will shape future product development and service models.

- Integration of assessment platforms with HR, talent management, and LMS systems will become a key differentiator.

- Regional expansion efforts will bridge digital access gaps, supporting growth beyond major cities.

- Competitive innovation among leading vendors will foster rapid product evolution and market consolidation.