Market Overview:

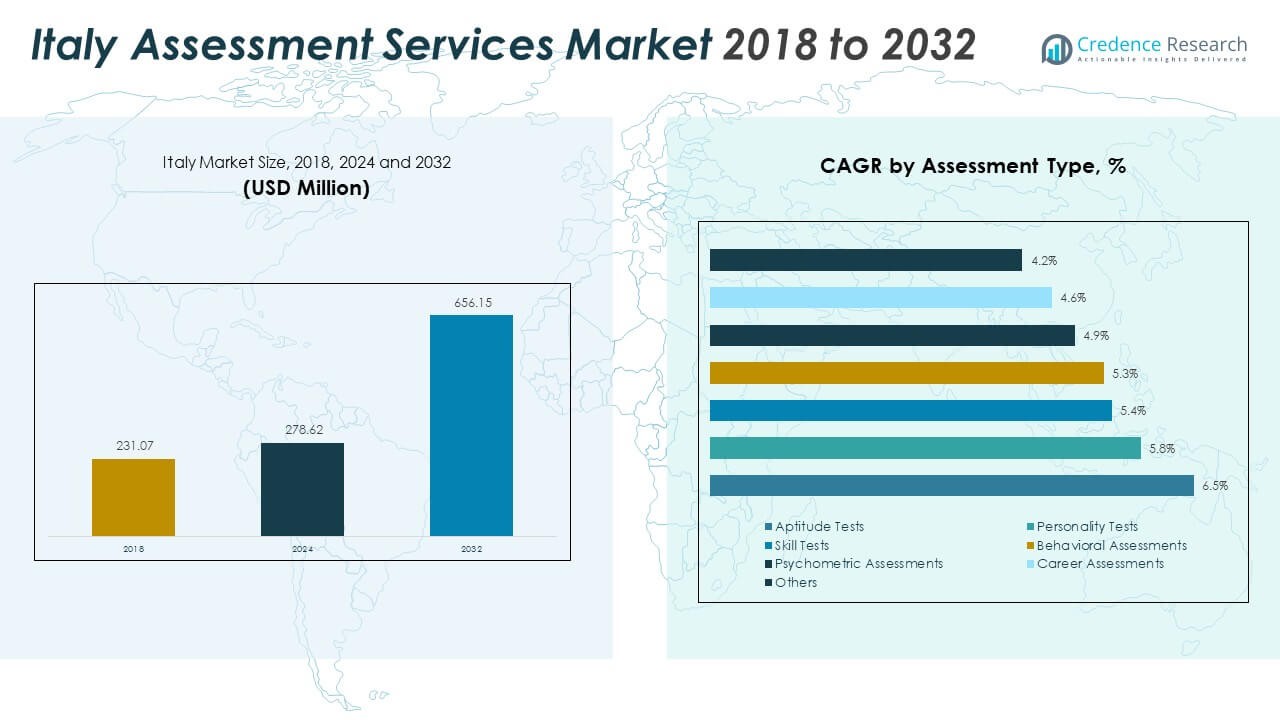

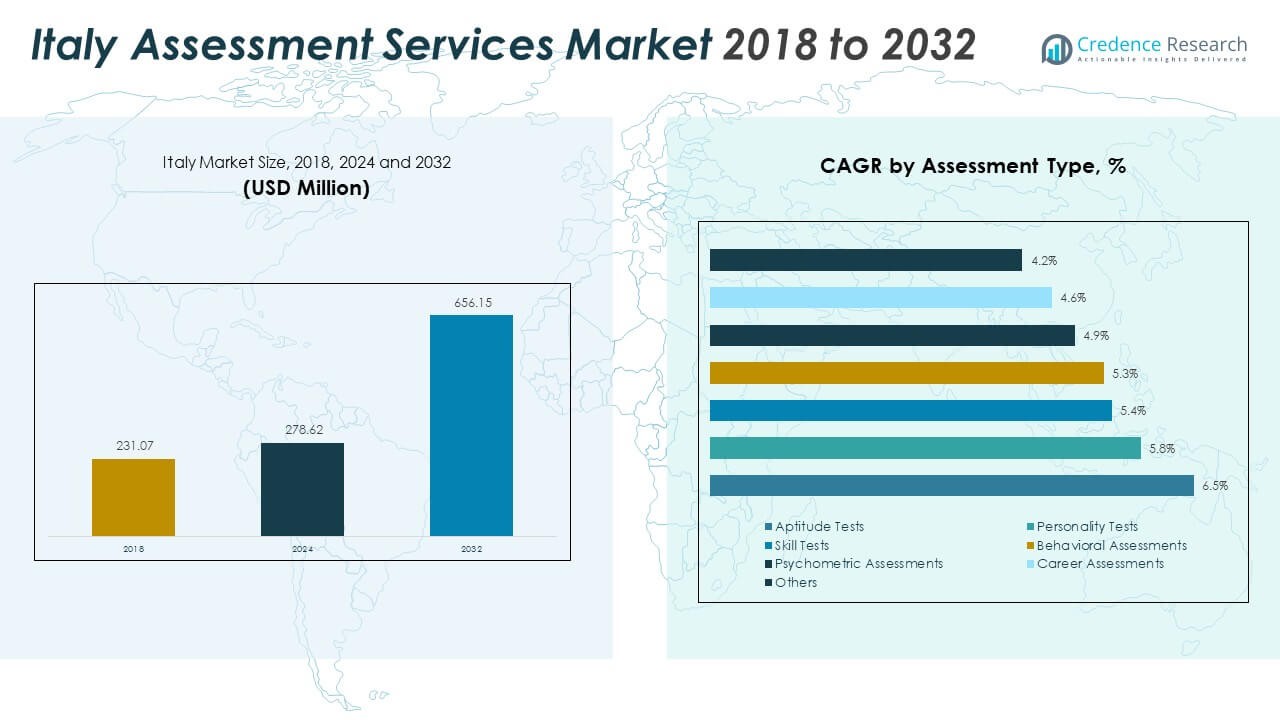

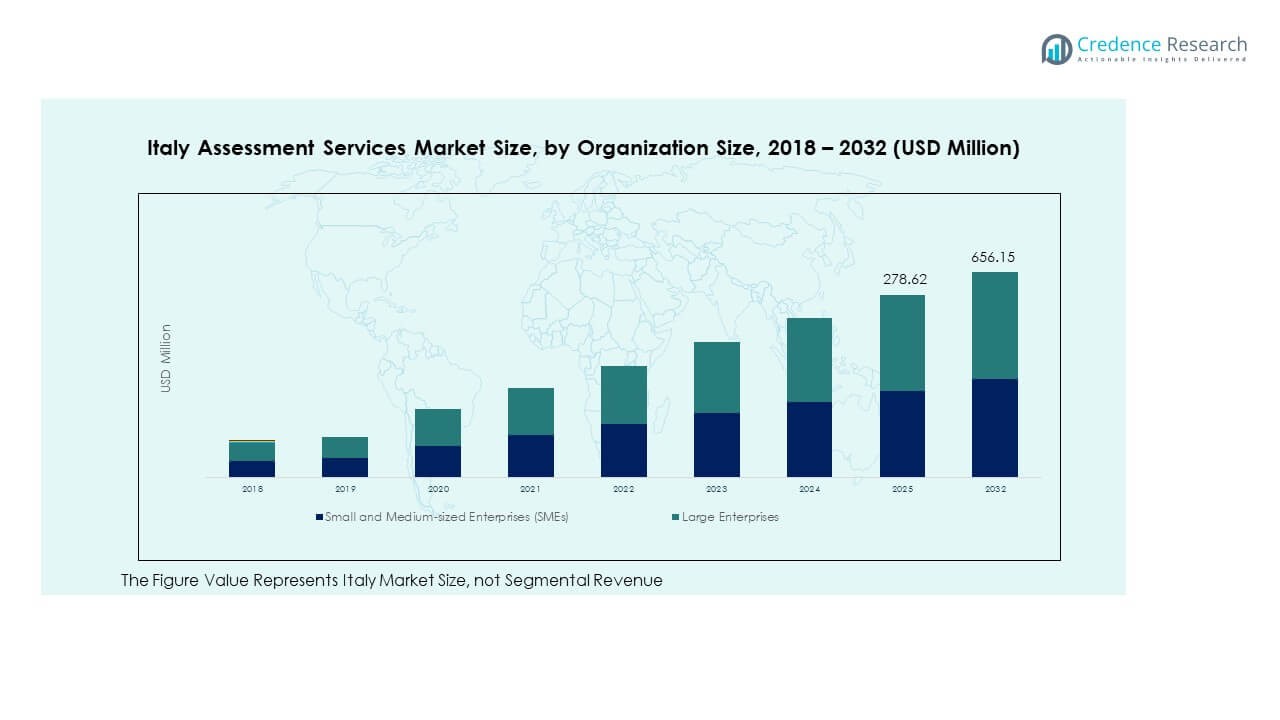

The Italy Assessment Services Market size was valued at USD 231.07 million in 2018 to USD 278.62 million in 2024 and is anticipated to reach USD 656.15 million by 2032, at a CAGR of 11.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Assessment Services Market Size 2024 |

USD 278.62 Million |

| Italy Assessment Services Market, CAGR |

11.30% |

| Italy Assessment Services Market Size 2032 |

USD 656.15 Million |

Growing demand for skill-based hiring and education quality improvement drives the market. Italian corporations and educational institutions are increasingly using digital and psychometric assessments to improve hiring accuracy and academic evaluation. Government efforts toward workforce upskilling and corporate digital transformation further support the adoption of online and AI-driven testing platforms, making assessment services vital in both education and professional sectors.

Northern Italy dominates the market due to strong corporate presence and educational infrastructure in regions like Lombardy, Emilia-Romagna, and Veneto. Central Italy shows steady growth supported by academic digitization and public service reforms. Southern regions are emerging, driven by EU-funded projects, growing private education networks, and increasing investment in e-learning technologies that enhance accessibility and assessment quality across diverse institutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Assessment Services Market was valued at USD 231.07 million in 2018, reached USD 278.62 million in 2024, and is expected to attain USD 656.15 million by 2032, registering a CAGR of 11.30% during 2024–2032.

- Northern Italy leads with 46% share, supported by strong corporate presence, advanced HR adoption, and established universities. Central Italy follows with 32%, driven by government digital programs and educational modernization. Southern Italy holds 22%, supported by skill-development and digital-inclusion projects.

- Southern Italy is the fastest-growing region, expanding through EU-funded training, e-learning initiatives, and investments in cloud-based assessment platforms improving accessibility and participation.

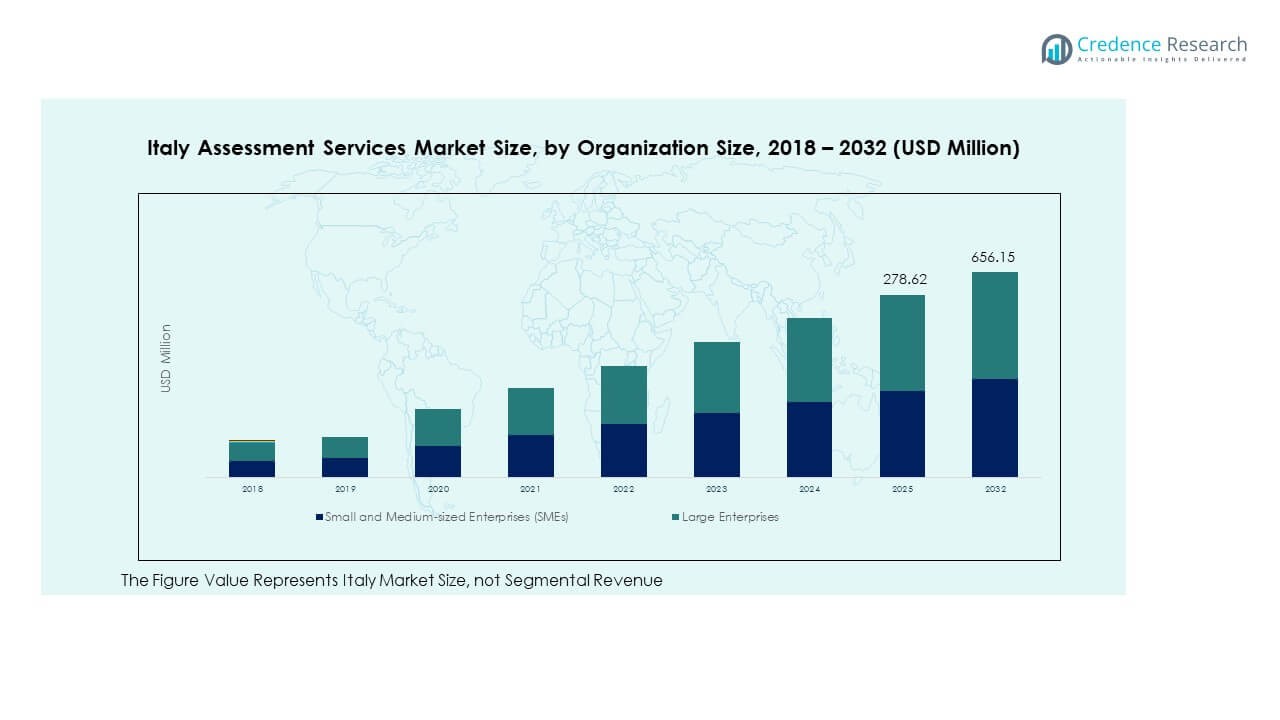

- In 2024, large enterprises accounted for about 60% of total revenue, reflecting their capacity for structured HR integration and adoption of analytics-based assessment systems.

- Small and medium-sized enterprises (SMEs) contributed roughly 40%, benefiting from cost-efficient digital platforms that streamline hiring, certification, and workforce evaluation processes.

Market Drivers:

Growing Demand from Corporate Talent Strategies and Workforce Assessment Initiatives

The Italy Assessment Services Market experiences strong momentum because firms emphasise data-driven hiring and performance evaluation. Organisations face increasing pressure to fill skills gaps, reduce turnover and align talent with business objectives. Enabling accurate measurement of employee competencies and behavioural traits fuels demand for advanced assessment tools. Many companies invest in solutions that deliver predictive insights, streamline candidate screening and support leadership development. Technology providers enhance platforms to include cloud-based delivery, real-time analytics and remote proctoring. This evolution boosts penetration of assessment services across sectors including finance, manufacturing and professional services. Firms seek partner-renowned providers offering validated psychometric tests and reporting capabilities. With talent competition intensifying in Italy’s evolving job market, the need for robust assessment frameworks supports sustained growth in the market.

- For instance, Microsoft and Pearson VUE jointly deliver online, proctored certification exams monitored through webcam and microphone to maintain integrity, supporting thousands of professional assessments globally across sectors such as finance and IT. Pearson’s secure cloud infrastructure operates under EU GDPR, hosting data in Frankfurt with 99.7% uptime to ensure fairness and reliability in assessment delivery.

Technology Integration and Digital Assessment Platform Adoption

The Italy Assessment Services Market benefits from rapid adoption of digital platforms, web-based testing and AI-powered analytics. Assessment providers deploy adaptive algorithms and automated scoring to increase efficiency, reduce bias and improve candidate experience. Educational institutions and professional certification bodies shift from paper-based tests to online formats, expanding reach and lowering cost. Secure remote proctoring enables large-scale administration of assessments across geographies, particularly important in Italy’s remote and regional locations. Cloud architecture supports scalability and flexibility for providers and clients. The convergence of learning management systems and assessment modules creates integrated ecosystems, further boosting uptake. These technology enhancements remove many logistical barriers and enable more frequent, flexible assessment cycles. As organisations prioritise agility and digital transformation, the expanded use of online assessment services strengthens the market.

- For instance, Pearson’s online proctoring platform integrates live and record-and-review monitoring modes supported by 24/7 candidate helpdesk service and multi-camera setups to ensure exam authenticity across thousands of remote users weekly.

Policy Emphasis on Skills Verification and Certification Frameworks

Regulatory and institutional initiatives in Italy drive demand for structured assessment services across education, vocational training and corporate certification programs. National strategies that emphasise lifelong learning, workforce upskilling and accreditation elevate the role of assessment as a quality-assurance mechanism. Certification bodies and training organisations require dependable assessment to validate competency, compliance and qualification standards. Employers increasingly rely on certified profiles to ensure workforce readiness for regulatory environments and industry standards. The interplay of policy mandates, public funding for upskilling and collaboration between educational institutions and industry supports market growth. Assessment services providers optimise their offerings to align with national frameworks and accreditation requirements. As Italy emphasises alignment with European Union skill-validation norms, this regulatory push amplifies the uptake of assessment solutions in diverse settings.

Expansion in Academic, Vocational and Continuing Education Settings

The Italy Assessment Services Market expands significantly because schools, universities and vocational training providers integrate assessments into curricula and certification pathways. These institutions implement formative and summative assessments to track learner progress, identify weaknesses and personalise instruction. The availability of digital learning platforms in Italy encourages deployment of assessment modules that provide immediate feedback and support adaptive learning. Training providers rely on assessments to certify competencies and monitor program effectiveness, which drives adoption of services that provide reliable measurement and benchmarking. Corporates collaborate with academic institutions to upskill employees, increasing demand for assessment frameworks that link education outcomes to workplace performance. As lifelong learning becomes a norm in Italy, the market for assessment services broadens across age groups and learning contexts. This diversification of end-user segments reinforces steady market expansion.

Market Trends:

Rise of Online and Remote Assessment Delivery Models in Italy

The Italy Assessment Services Market shifts toward online and remote delivery, enabling assessments to occur anytime and anywhere. Providers offer web-based testing platforms and remote proctoring to support scalability and accessibility. Candidates in different regions access the same assessments without travel or scheduling constraints. Corporations administer recruitment, promotion and certification tests virtually, reducing cost and speeding up timelines. Educational institutions adopt online assessments that integrate with digital learning environments and provide faster feedback. The transition from traditional in-person exams to digital formats enhances flexibility and opens opportunities in underserved Italian regions. This trend supports broader inclusion of assessment services across organisational types and geographic areas.

- For instance, Pearson’s Proctored by Pearson system uses Chrome-based monitoring plugins and human proctors stationed in Europe, India, and the United States to detect anomalies such as gaze deviations or unauthorized objects, ensuring reliable supervision of remote exams.

Integration of Artificial Intelligence and Analytics for Enhanced Insights

The Italy Assessment Services Market experiences a shift toward AI-enabled assessment tools that deliver deeper insights, predictive analytics and adaptive testing. Providers incorporate machine-learning algorithms to analyse response patterns, detect anomalies and personalise testing pathways. Employers use analytics to identify high-potential talent, forecast performance and inform development decisions. Training organisations employ data dashboards to track learner progress and refine curricula. These analytics capabilities differentiate service providers and raise client expectations for richer diagnostic output. Assessment platforms evolve into intelligence tools rather than mere question-and-answer systems. With Italian organisations seeking more actionable data, this trend strengthens the value proposition of assessment services.

Growth of Certification and Skills-Credentialing Assessments Across Sectors

The Italy Assessment Services Market observes heightened demand for certification assessments that validate skills and professional competencies. Industries subject to regulatory oversight or rapid technological change increasingly require credentialing of personnel. Employers rely on certified employees to comply with standards and demonstrate capability. Training providers include assessment components to award credentials to learners completing programmes. This shift increases growth of services oriented to certification, rather than only entrance or recruitment contexts. Market providers expand offerings to include sector-specific assessments in fields like IT, healthcare and manufacturing. As Italian organisations prioritise skills verification and public bodies endorse credentialing frameworks, demand for certification assessments rises.

Focus on Assessment Solutions Tailored to Corporate Talent Management and Employee Development

The Italy Assessment Services Market evolves toward solutions that integrate into corporate talent management workflows and development programmes rather than serve only recruitment endpoints. Organisations adopt assessments to map competencies, identify skill gaps, support leadership pipelines and link outcomes to development planning. Providers offer employee-lifecycle tools covering onboarding, performance review, promotion and succession planning. Firms in Italy seek scalable solutions that deliver consistent evaluation across divisions and geographies. The trend toward continuous assessment, rather than one-time testing, drives demand for platforms supporting periodic evaluation, micro-assessments and ongoing feedback. With talent development becoming a strategic priority, assessment services become embedded within broader HR and learning ecosystems.

Market Challenges Analysis:

Ensuring Validity, Fairness and Cultural Relevance of Assessments

The Italy Assessment Services Market faces the challenge of maintaining high validity and fairness in test design across diverse Italian populations. Assessment providers must ensure cultural and linguistic appropriateness for candidates from different regions and backgrounds within Italy. Bias in items or scoring may reduce organisational trust in results and hinder adoption. Validation studies and psychometric research incur cost and time which may deter smaller providers or users. Clients require transparent evidence of reliability and normative data specific to Italian samples. Translation and localisation add complexity to multinational assessment tools when used in Italian markets. Providers must keep pace with evolving norms for fairness, data protection and transparency to sustain credibility. Without addressing these issues, buyers may hesitate to invest in new assessment services.

Data Privacy, Security Risks and Regulatory Compliance Burdens

The Italy Assessment Services Market struggles with data privacy, security risks and regulatory compliance obligations affecting client confidence and provider adoption. Assessment platforms handle sensitive personal data and performance metrics, making them potential targets for breaches or misuse. Italian and European regulations such as GDPR impose stringent requirements on handling, storage and cross-border transfer of assessment data. Providers must implement robust encryption, secure hosting and auditing regimes which raise operational cost. Clients may hesitate if they doubt the assessment vendor’s ability to safeguard data or ensure user anonymity. Remote proctoring and online delivery introduce additional security concerns such as identity verification, cheating detection and system integrity. Managing these risks efficiently remains a barrier to broader uptake and slower adoption in conservative sectors that emphasise data protection and compliance.

Market Opportunities:

Expansion Into Regional Underserved Educational and Training Institutions

The Italy Assessment Services Market has opportunity in reaching regional education and training institutions that remain underserved. Many parts of Southern Italy and rural areas lack access to advanced assessment platforms and digital learning infrastructure. Providers can tailor offerings for smaller schools, local vocational centres and regional training networks. They can develop low-cost online assessment packages that support remote testing, learner tracking and competency benchmarking. Partnering with public initiatives or European funding programmes aimed at educational uplift presents another avenue. This outreach expands client base beyond major-city institutions and corporate hubs. With the push for digital inclusion and remote access, this underserved segment offers growth potential.

Development of Niche Sector Assessments and Specialised Certification Frameworks

The Italy Assessment Services Market finds opportunity in creating niche assessments and specialised certifications for emerging sectors and roles. Industries such as renewables, healthcare technology, advanced manufacturing and digital services require workforce with validated competencies. Service providers can develop sector-specific tests, credentials and development tools tailored to Italian regulatory and market needs. Offering bundled solutions—assessment plus training pathway—can attract firms seeking turnkey talent-development programmes. Collaboration with industry associations and certification bodies enhances credibility and adoption. This vertical-specific approach differentiates providers from generic test services and addresses evolving skill demands in the Italian economy. With organisations seeking to validate new competencies rapidly, this approach opens growth avenues.

Market Segmentation Analysis:

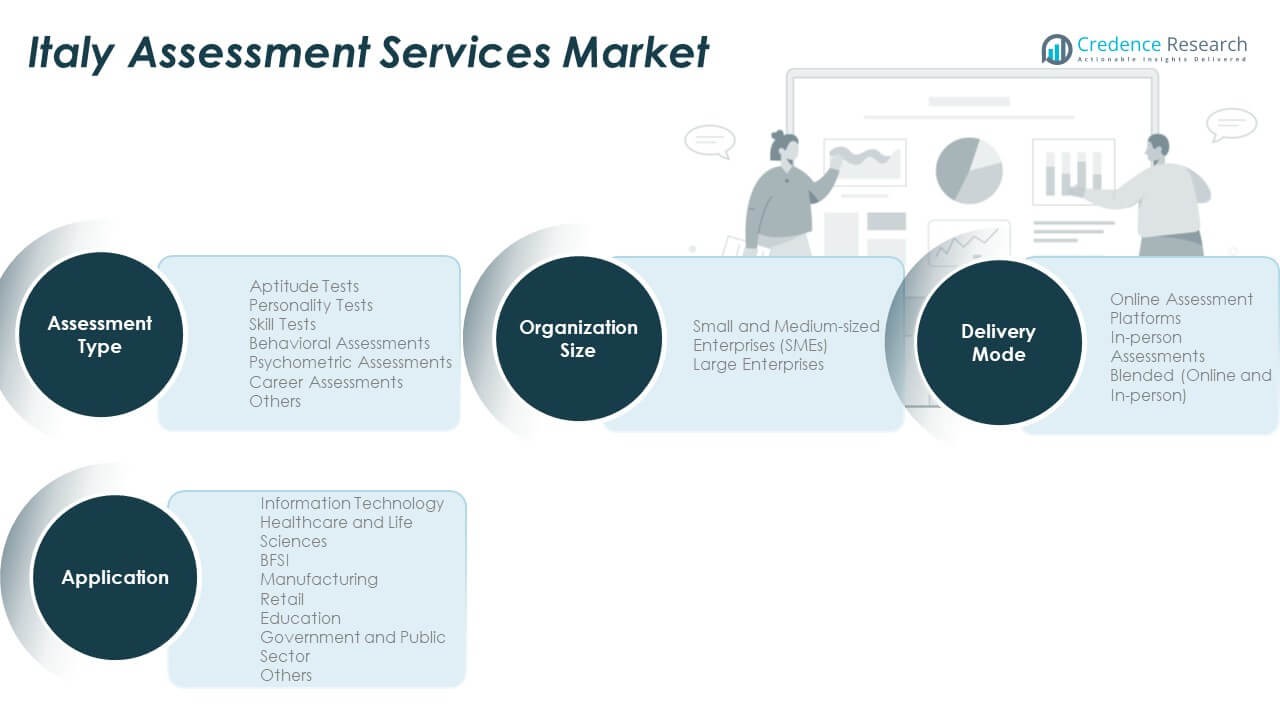

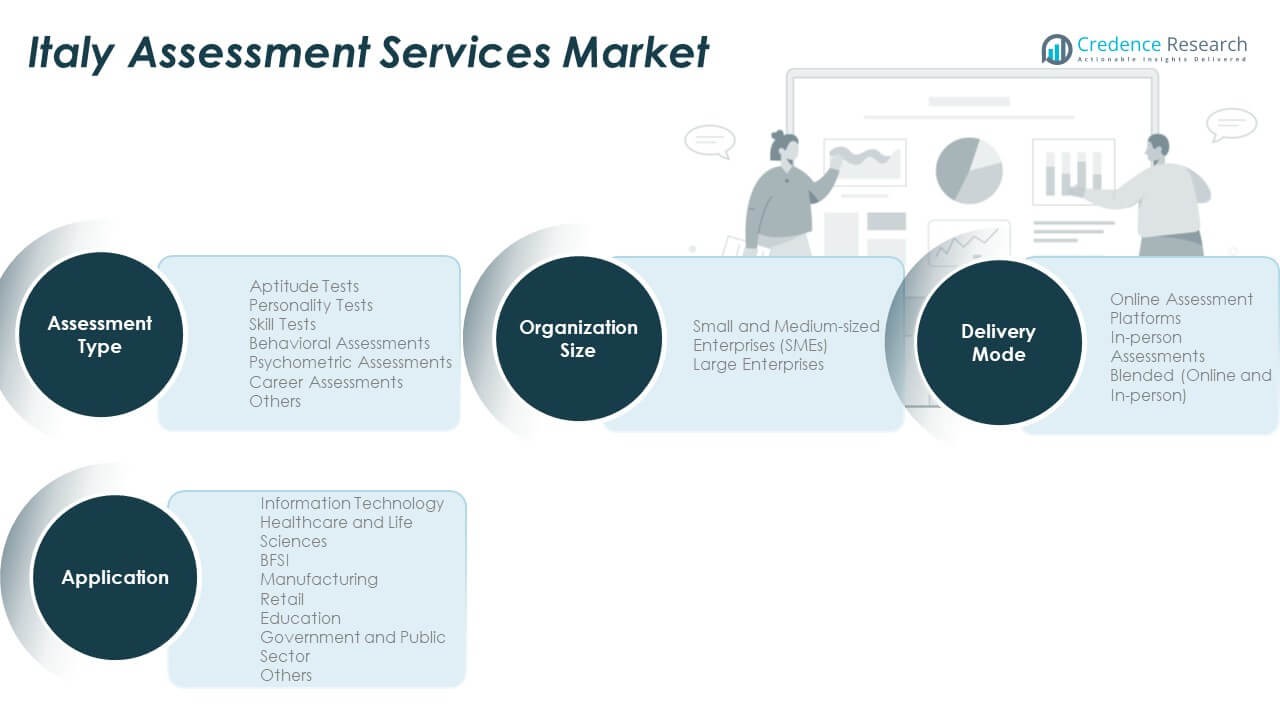

By Assessment Type

The Italy Assessment Services Market is segmented into aptitude tests, personality tests, skill tests, behavioural assessments, psychometric assessments, career assessments, and others. Aptitude and skill tests dominate due to strong demand from corporate recruitment and talent management processes. Personality and behavioural assessments gain traction for evaluating emotional intelligence and team compatibility. Psychometric and career assessments grow in education and counseling sectors, supporting student guidance and workforce development. The diverse use across industries ensures steady growth across all categories.

- For instance, Pearson VUE provides adaptive online exams across technical, professional, and corporate skills domains, processing hundreds of thousands of qualifications under strict digital supervision annually under Microsoft’s certification ecosystem.

By Application

Key application areas include information organization size, healthcare and life sciences, BFSI, manufacturing, retail, education, government and public sector, and others. Education and corporate segments remain the leading adopters, supported by digitization and focus on performance benchmarking. BFSI and manufacturing rely on assessments for regulatory compliance and workforce optimization. Public sector bodies use standardized testing for recruitment and civil service evaluation. Expanding adoption across healthcare and retail strengthens overall market penetration.

- For instance, Pearson VUE’s GDPR-compliant integration into educational LMS frameworks supports large-scale exam hosting across EU data centers from Frankfurt to Dublin, ensuring multilingual accessibility and full security compliance. Similarly, Microsoft’s online exam program expands corporate and IT certification pathways accessible from remote regions, reinforcing standardized skill evaluation used by organizations for credential verification.

By Organization Size

The market is divided into small and medium-sized enterprises (SMEs) and large enterprises. Large enterprises lead adoption due to structured HR systems and investment capacity in advanced platforms. SMEs show increasing participation driven by cost-effective digital assessments that support faster hiring and skill verification. The growing awareness of analytics-driven hiring strengthens adoption across both categories.

By Delivery Mode

Delivery modes include online assessment platforms, in-person assessments, and blended formats. Online platforms dominate due to scalability, flexibility, and accessibility. Blended formats combine digital and physical methods, offering balanced reliability and convenience. In-person testing remains relevant for specialized assessments requiring supervision or controlled environments. The shift toward digital delivery defines the sector’s future growth trajectory.

Segmentation:

- By Assessment Type

- Aptitude Tests

- Personality Tests

- Skill Tests

- Behavioural Assessments

- Psychometric Assessments

- Career Assessments

- Others

- By Application

- Information Organization Size

- Healthcare and Life Sciences

- BFSI

- Manufacturing

- Retail

- Education

- Government and Public Sector

- Others

- By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Delivery Mode

- Online Assessment Platforms

- In-person Assessments

- Blended (Online and In-person)

Regional Analysis:

Northern Italy – Industrial and Educational Core

Northern Italy holds the largest market share of 46% in the Italy Assessment Services Market, driven by its dense concentration of corporations, universities, and training institutions. Regions such as Lombardy, Emilia-Romagna, and Veneto serve as hubs for enterprise recruitment and higher education assessment demand. The strong presence of multinational firms and advanced HR technology adoption promotes extensive use of psychometric and aptitude tests. Major universities and research centers integrate digital assessments into academic programs and admissions. Companies in manufacturing, automotive, and financial sectors increasingly use AI-based evaluations for workforce selection and development. The high level of digital infrastructure and innovation funding keeps Northern Italy the dominant region in market expansion.

Central Italy – Expanding Digital and Public Sector Participation

Central Italy accounts for nearly 32% of the market share, supported by government-driven digital transformation and expanding educational modernization. Lazio and Tuscany lead in the adoption of online and blended assessment platforms across schools, universities, and public institutions. The region’s public sector actively uses assessments in civil service recruitment and performance management. Growing awareness of data-driven evaluation in healthcare and life sciences sectors supports demand for certified testing services. Startups and SMEs in Rome and Florence increasingly use online assessments to streamline hiring processes and reduce HR costs. With improving connectivity and institutional collaboration, Central Italy is becoming a significant contributor to market growth.

Southern Italy – Emerging Market with Growing Digital Adoption

Southern Italy represents around 22% of the market share and continues to grow steadily due to digital inclusion programs and EU-backed educational projects. Regions such as Campania, Puglia, and Sicily are investing in online learning and assessment technologies to bridge regional skill gaps. Training centers and vocational institutes adopt low-cost digital assessment solutions to support youth employment initiatives. The government’s focus on upskilling programs in partnership with private providers drives consistent adoption. Local enterprises begin using cloud-based assessments for recruitment and workforce evaluation. Despite slower infrastructure development, expanding access to e-learning and talent evaluation tools positions Southern Italy as a fast-growing regional segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Italy Assessment Services Market exhibits a moderately concentrated vendor landscape where a handful of international and local firms hold dominant positions. Global players with strong psychometric and digital capabilities lead the space, while regional firms focus on niche segments and tailored client services. It offers significant entry opportunities for technology-driven and specialization-oriented companies that deliver analytics, remote proctoring or vertical-specific assessments. Clients demand robust test validity, compliance with EU data laws and user-friendly digital platforms, which raises the barrier for smaller providers. Competitive differentiation depends on offering validated tools, seamless integration with HR systems and scalable delivery models. Partnerships with local universities, training institutions and professional bodies give firms leverage and credibility. Service providers that continuously update test content, align with Italian regulatory frameworks and offer flexible pricing models achieve stronger positioning within the market.

Recent Developments:

- In January 2024, Giunti Psychometrics acquired a majority stake in Vetor Editora, a strategic move to strengthen its presence in the Brazilian psychological assessment market and develop localized products while expanding access to its scientific platforms. The company also acquired psicologia.io in early 2025, one of the largest psychology training providers globally, to broaden its service offerings and reinforce its global visibility in the psychology market.

- Tazio released its 2025 Trends Report in June 2025, focusing on inclusive hiring strategies and neurodiverse assessment solutions, reinforcing its commitment to equitable recruitment practices through accessible design and bias-minimized evaluations. The company’s platform supports large-scale volume hiring with virtual assessment centers, realistic job previews, and personalized feedback mechanisms.

Report Coverage:

The research report offers an in-depth analysis based on assessment type, application, organization size, and delivery mode. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growth in digital and remote assessment delivery will accelerate across Italy’s corporate and educational sectors.

- AI-based analytics and adaptive testing models will become standard components in assessment service offerings.

- Blended delivery formats that combine online and in-person assessments will gain traction among hybrid workforces.

- Uptake of assessment services among SMEs will increase as digital platforms lower entry-barriers.

- Sector-specific credentialing and certification assessments will expand in industries with regulatory oversight.

- Regional expansion into Southern Italy and rural areas will pick up driven by digital inclusion programmes.

- Large enterprises will invest in employee-lifecycle assessments covering onboarding, performance, retention and succession.

- Data privacy and regulatory compliance solutions will become differentiators for assessment service providers.

- Strategic partnerships between assessment and HR-tech firms will multiply to deliver integrated talent-management solutions.

- Providers offering multilingual, culturally-adapted assessments will capture growing demand from diverse Italian workforce segments.