Market Overview

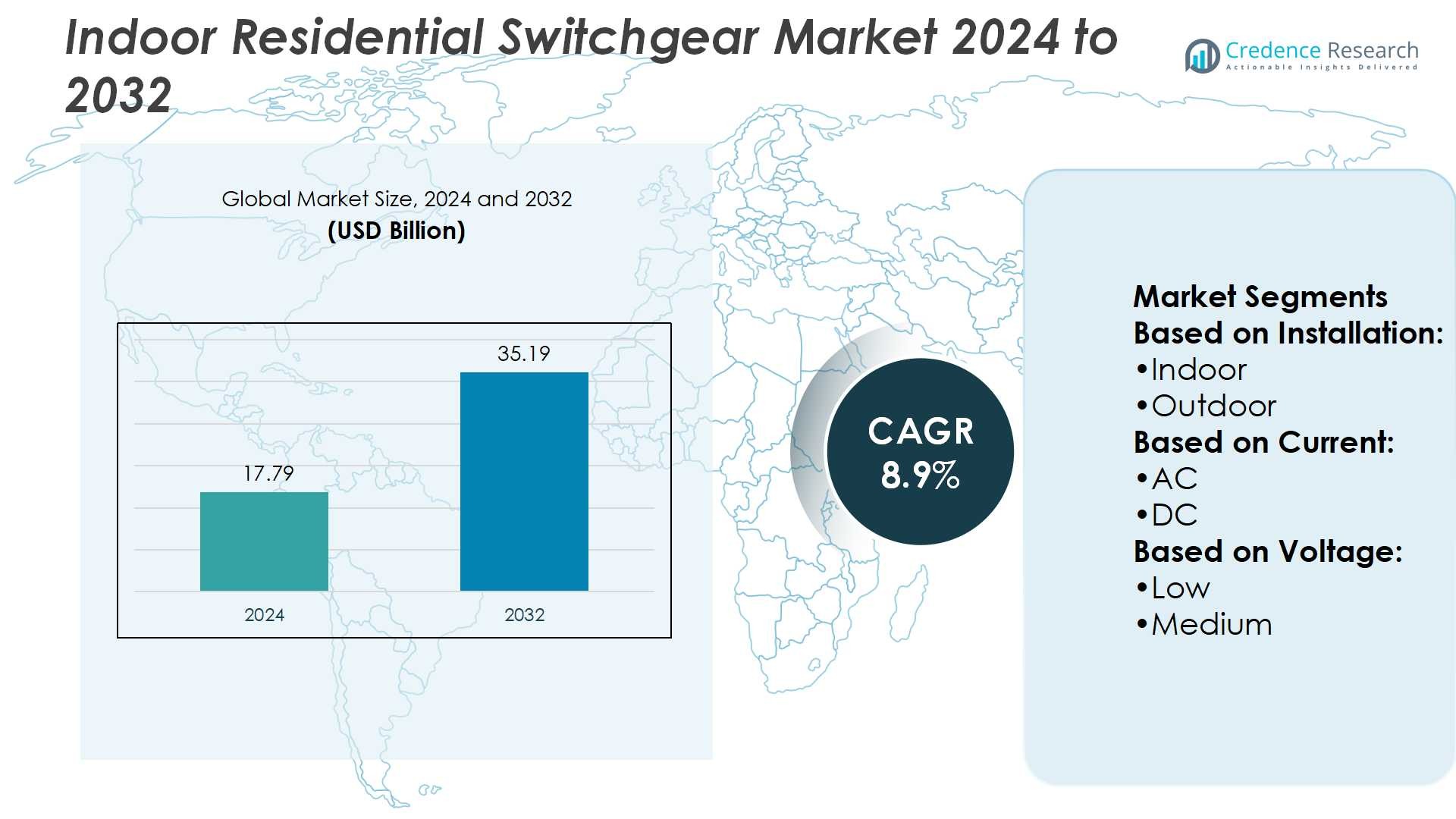

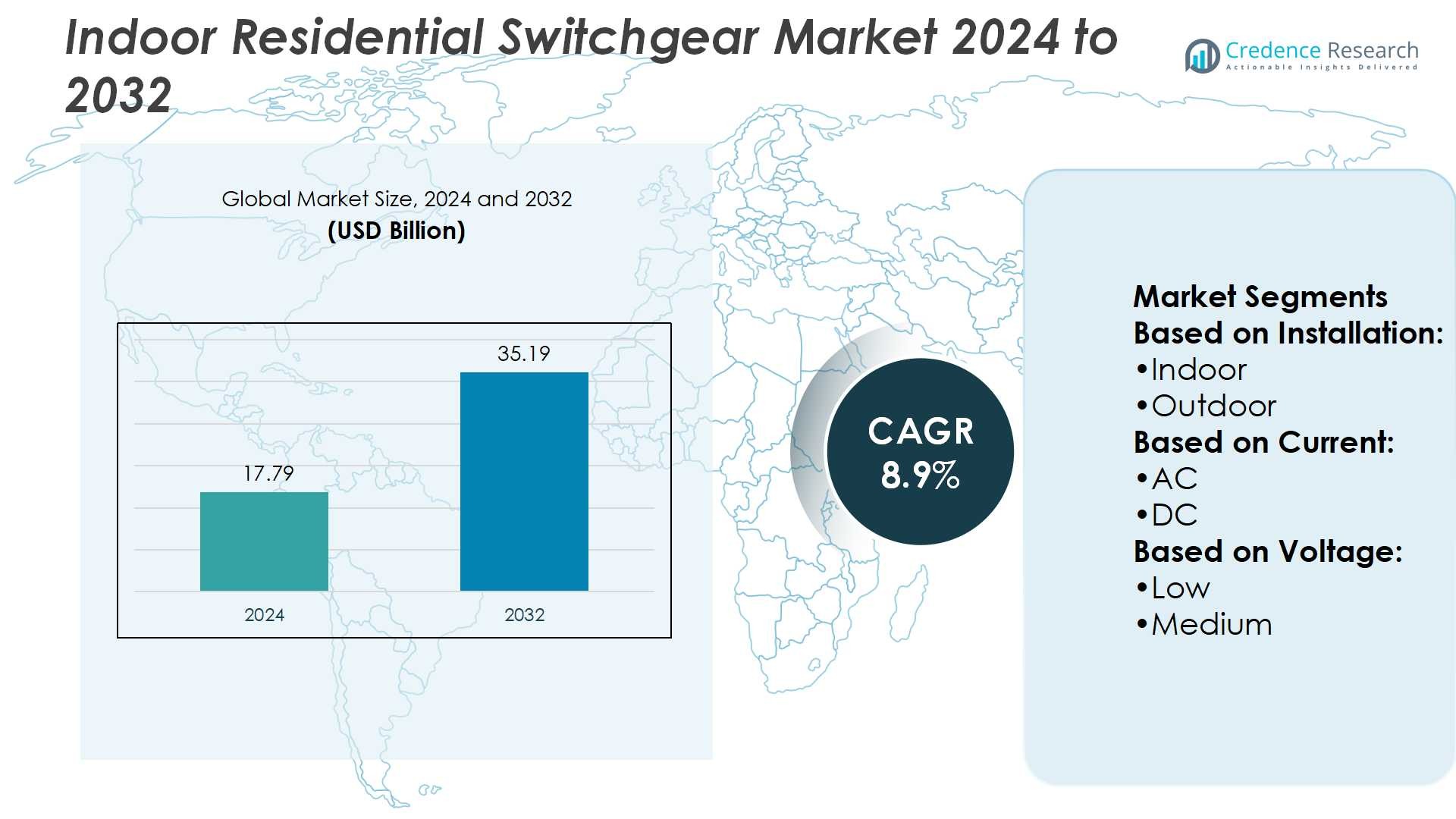

Indoor Residential Switchgear Market size was valued at USD 17.79 billion in 2024 and is anticipated to reach USD 35.19 billion by 2032, at a CAGR of 8.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indoor Residential Switchgear Market Size 2024 |

USD 17.79 Billion |

| Indoor Residential Switchgear Market, CAGR |

8.9% |

| Indoor Residential Switchgear Market Size 2032 |

USD 35.19 Billion |

The Indoor Residential Switchgear Market is driven by rising demand for safe and reliable power distribution, growing adoption of smart homes, and increasing focus on energy-efficient systems. It benefits from regulatory standards that enforce safety and sustainability in residential construction. Urbanization and expanding housing projects create further opportunities for advanced installations. Key trends include the integration of IoT-enabled solutions for remote monitoring, preference for compact and modular designs, and adoption of eco-friendly materials. The shift toward renewable energy integration in households strengthens the need for compatible switchgear, positioning the market for steady growth across developed and emerging regions.

North America leads the Indoor Residential Switchgear Market with advanced infrastructure, followed by Europe’s strong regulatory support and Asia Pacific’s rapid urban growth. Latin America and the Middle East & Africa show steady progress through housing projects and electrification programs. The market features strong competition from global and regional players focusing on innovation, sustainability, and smart solutions. Leading companies invest in compact, modular, and IoT-enabled designs to meet diverse residential needs and strengthen their presence across both developed and emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Indoor Residential Switchgear Market size was USD 17.79 billion in 2024 and will reach USD 35.19 billion by 2032, growing at a CAGR of 8.9%.

- Rising demand for safe and reliable power distribution and smart home adoption drives market growth.

- Energy-efficient systems and strict regulatory standards support sustainability and enhance consumer confidence.

- IoT-enabled solutions, compact modular designs, and eco-friendly materials define key market trends.

- Competitive landscape features strong global and regional players investing in innovation and smart technologies.

- High installation costs and complex regulatory compliance act as restraints to wider adoption.

- North America leads the market, Europe follows with regulatory support, Asia Pacific grows fastest, while Latin America and Middle East & Africa expand through urban housing and electrification programs.

Market Drivers

Rising Demand for Safe and Reliable Power Distribution in Modern Homes

The Indoor Residential Switchgear Market benefits from growing demand for safe and reliable electricity distribution. Rising adoption of modern appliances and electronic devices in households increases the need for efficient power management systems. Switchgear ensures protection against faults and electrical overloads, which strengthens consumer confidence. Governments emphasize safety standards and regulations that mandate advanced protection solutions in residential buildings. Builders and contractors prefer integrated systems that reduce maintenance and downtime risks. The market gains traction by offering safety-focused solutions for modern households.

- For instance, Fuji Electric produces medium-voltage and low-voltage switchgear units, and its eco-friendly vacuum circuit breakers are designed to handle voltages up to 24 kV with an interrupting current capacity of 25 kA.

Growing Urbanization and Smart Housing Projects Drive Market Expansion

Urbanization and the surge of smart housing projects create strong opportunities for the Indoor Residential Switchgear Market. Urban households require compact and efficient switchgear to support higher energy usage. Smart home ecosystems depend on switchgear capable of integrating with intelligent energy management platforms. Demand grows further with rising consumer preference for automation and energy efficiency in residential infrastructure. Construction of high-rise apartments and planned housing projects also accelerates adoption. It becomes essential to deliver compact designs that fit into limited residential spaces.

- For instance, HD Hyundai Electric has engineered its HMGS-G81 medium-voltage switchgear to handle up to 36 kV with a rated current of 4,000 A and a breaking capacity of 40 kA/3 s, which allows use in densified urban substations.

Increasing Focus on Energy Efficiency and Sustainable Power Systems

The Indoor Residential Switchgear Market advances with the emphasis on energy efficiency and sustainable energy use. Consumers seek products that lower electricity losses and improve system performance. Manufacturers develop switchgear with eco-friendly designs and materials to align with sustainability goals. The shift toward renewable energy integration requires residential systems that handle distributed energy sources safely. Energy-efficient solutions help homeowners reduce utility costs while enhancing safety. It creates steady adoption among environmentally conscious households and builders.

Continuous Technological Advancements and Product Innovations Shape Growth

Technological advancements play a key role in strengthening the Indoor Residential Switchgear Market. Companies focus on smart monitoring systems that offer real-time fault detection and predictive maintenance features. Innovations in modular and compact switchgear improve installation flexibility and reduce space requirements. Connectivity with IoT and digital platforms further enhances household energy management. Manufacturers prioritize designs that meet international safety and performance standards. Product innovations create differentiation in a competitive market, encouraging wider adoption among residential customers.

Market Trends

Integration of Smart and Connected Technologies in Residential Power Systems

The Indoor Residential Switchgear Market shows a clear trend toward smart and connected solutions. Homeowners demand systems that integrate with home automation and energy management platforms. Smart switchgear enables remote monitoring and fault detection through IoT connectivity. It supports predictive maintenance, which reduces risks of power interruptions. Builders and contractors increasingly adopt intelligent switchgear to align with modern housing standards. This shift makes connected technologies a defining feature of residential power systems.

- For instance, Eaton’s Xiria medium-voltage switchgear is rated up to 24 kV and 630 A, with vacuum interrupters certified for 30,000 operating cycles, enabling SF₆-free, low-maintenance operation.

Rising Popularity of Compact and Modular Switchgear Designs

Compact and modular designs represent a strong trend in the Indoor Residential Switchgear Market. Urban housing projects often face space constraints, requiring equipment that fits into limited areas. Modular switchgear provides flexibility, allowing customization for varied residential layouts. It reduces installation time and simplifies maintenance processes for electricians and contractors. Growing consumer preference for sleek and space-saving electrical systems supports this trend. Manufacturers respond by introducing compact solutions that ensure performance without occupying excessive space.

- For instance, BHEL’s 500 kVA Compact Substation / Packaged Substation coupled with 11 kV Ring Main Unit (RMU) supports a fault level of 21 kA for 1 second, includes two manual SF₆ insulated 630 A load-break switches and one fixed manual SF₆-insulated Vacuum Circuit Breaker for the RMU.

Increasing Adoption of Sustainable and Eco-Friendly Switchgear Solutions

Sustainability drives product development in the Indoor Residential Switchgear Market. Consumers prefer eco-friendly designs that use recyclable materials and reduce energy losses. Green building certifications further influence the adoption of energy-efficient switchgear in residential projects. Manufacturers introduce solutions that minimize environmental impact while maintaining safety and reliability. The use of non-toxic insulation materials and efficient conductors gains traction. It strengthens alignment with regulatory frameworks promoting sustainable construction practices.

Expansion of Renewable Energy Integration within Residential Power Infrastructure

Renewable energy integration emerges as a prominent trend in the Indoor Residential Switchgear Market. Households adopting solar panels and small-scale wind systems require compatible switchgear solutions. It enables safe handling of distributed power sources within residential networks. Advanced switchgear ensures smooth transfer between grid supply and renewable generation. Manufacturers focus on designing products that optimize energy flow from hybrid power systems. This trend expands as renewable adoption becomes a standard part of modern residential development.

Market Challenges Analysis

High Installation Costs and Complexity in Residential Applications

The Indoor Residential Switchgear Market faces challenges from high installation costs and technical complexity. Advanced switchgear requires skilled professionals for proper setup, which increases project expenses. Smaller residential developers often hesitate to invest in premium solutions due to budget constraints. Maintenance costs can also rise when specialized parts or services are required. It creates barriers for widespread adoption, especially in cost-sensitive housing markets. Balancing advanced functionality with affordable pricing remains a critical hurdle for manufacturers.

Regulatory Compliance and Safety Concerns Across Diverse Markets

Meeting stringent safety standards presents another major challenge for the Indoor Residential Switchgear Market. Different regions enforce varying regulations on electrical safety, material use, and energy efficiency. Manufacturers must adapt designs to comply with local requirements, which increases production costs. Faulty or non-compliant switchgear can expose households to risks such as fire hazards and system failures. It also raises reputational risks for suppliers unable to maintain consistent quality. Ensuring regulatory compliance while managing costs remains a persistent obstacle for industry players.

Market Opportunities

Growing Demand for Smart Homes and Energy Management Solutions

The Indoor Residential Switchgear Market holds strong opportunities through the expansion of smart homes and energy management systems. Consumers increasingly seek devices that integrate with automation platforms for efficient power usage. Smart switchgear supports remote monitoring, load control, and predictive fault detection, which align with evolving residential needs. Builders and developers focus on premium housing projects that include intelligent power infrastructure. It creates opportunities for manufacturers to design advanced solutions with digital connectivity. The growing awareness of efficient energy use strengthens this opportunity across both developed and emerging regions.

Rising Adoption of Renewable Energy and Sustainable Construction Practices

Sustainable construction and renewable integration open significant growth avenues for the Indoor Residential Switchgear Market. Residential solar panels and hybrid energy systems require switchgear capable of managing distributed power safely. Manufacturers offering eco-friendly materials and low-loss designs position themselves strongly in regulatory-driven markets. Green building certifications further encourage adoption of energy-efficient switchgear in residential projects. It supports alignment with environmental goals while meeting consumer expectations for sustainable living. This opportunity continues to expand with increasing investments in renewable-powered residential infrastructure.

Market Segmentation Analysis:

By Installation

The Indoor Residential Switchgear Market is segmented into indoor and outdoor installations. Indoor switchgear dominates due to its widespread use in apartments, residential complexes, and smart homes where protection from weather is essential. It offers compact design, easy accessibility, and lower maintenance compared to outdoor systems. Outdoor switchgear finds relevance in villas, gated communities, and independent houses with larger energy demands. It provides durability against environmental stress and supports higher load capacity. Manufacturers focus on enhancing both categories to ensure safety, performance, and compliance with residential infrastructure needs.

- For instance, Hyosung Heavy Industries has developed its eco-friendly Dry Air Insulated Switchgear (DAIS) with rated voltage up to 38 kV and rated short-circuit breaking current up to 40 kA for 3 seconds, and a normal current rating up to 3,150 A, matching performance of conventional SF₆ GIS while enabling indoor installation in buildings.

By Current

The market is divided into alternating current (AC) and direct current (DC) systems. AC switchgear holds the largest share, driven by its dominance in traditional residential power distribution. It supports household appliances, HVAC systems, and lighting, making it indispensable in urban and suburban homes. DC switchgear, though smaller in share, gains traction with the adoption of solar systems, battery storage, and electric vehicle charging infrastructure. It enables efficient integration of renewable power sources into household networks. Growing demand for hybrid systems boosts opportunities for manufacturers to optimize both AC and DC applications in residential use.

- For instance, ABB’s recent innovations include its SACE Infinitus solid-state circuit breaker, certified as the first fully IEC 60947-2 compliant of its kind, which switches DC currents more than 1250 V and interrupts fault currents above 80 kA within microseconds, offering more than 100 times faster switching compared to traditional mechanical breakers.

By Voltage

The Indoor Residential Switchgear Market by voltage is segmented into low and medium categories. Low-voltage switchgear leads the segment due to its suitability for standard residential applications such as appliance protection and load distribution. It provides cost-effective and reliable solutions for most housing projects. Medium-voltage switchgear plays a vital role in larger residential communities, high-rise buildings, and premium housing projects with higher energy demands. It ensures safety in managing heavy loads and supports integration with distributed energy systems. The growing focus on energy-efficient housing expands the demand for both low and medium voltage systems, creating balanced opportunities for manufacturers.

Segments:

Based on Installation:

Based on Current:

Based on Voltage:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest market share of 34% in the Indoor Residential Switchgear Market. The region benefits from advanced residential infrastructure and high consumer adoption of modern electrical systems. Growing demand for smart homes strengthens the use of intelligent switchgear with IoT and automation features. Strict regulatory standards in the United States and Canada enforce safety and energy efficiency, driving replacement demand for outdated systems. Builders prioritize compact and energy-efficient designs that align with urban housing needs. Rising integration of renewable power, particularly solar, also supports adoption of advanced switchgear in residential projects across the region.

Europe

Europe accounts for 27% of the market share, supported by its strong regulatory framework and established housing sector. Countries such as Germany, France, and the United Kingdom emphasize energy efficiency and sustainability in residential construction. The adoption of eco-friendly and recyclable switchgear solutions aligns with the European Green Deal objectives. Smart city initiatives and the rapid expansion of green housing projects increase the demand for compact and modular designs. The region also experiences growing consumer preference for systems that integrate renewable energy sources with household power distribution. This trend ensures steady growth for both low and medium voltage switchgear across European markets.

Asia Pacific

The Asia Pacific region represents 24% of the Indoor Residential Switchgear Market share and demonstrates the fastest growth rate. Rapid urbanization in China, India, and Southeast Asia fuels demand for reliable power distribution systems. Expanding middle-class populations invest in modern housing equipped with smart and energy-efficient switchgear. Governments encourage the use of advanced electrical safety systems in new residential projects, further driving adoption. Renewable energy integration, particularly rooftop solar, accelerates the use of both AC and DC switchgear. Local manufacturers compete with global players by offering cost-effective and durable solutions, supporting market expansion across diverse residential segments.

Latin America

Latin America captures 8% of the market share, led by Brazil and Mexico with growing housing development and infrastructure projects. The market benefits from increasing investments in urban housing, where reliable and affordable switchgear is essential. Rising demand for safety features in residential electrical systems strengthens adoption in middle-income households. The region also sees gradual integration of renewable energy systems that require compatible residential switchgear. Economic challenges create pressure on affordability, but government housing initiatives support continued demand. Manufacturers targeting cost-efficient and compact designs gain a competitive advantage in this region.

Middle East and Africa

The Middle East and Africa collectively hold 7% of the Indoor Residential Switchgear Market share. Rapid urban development in Gulf countries such as Saudi Arabia and the UAE drives demand for modern residential infrastructure. High-end housing projects and smart city investments create opportunities for intelligent and compact switchgear systems. In Africa, electrification programs and expanding residential projects increase demand for basic low-voltage solutions. Harsh climatic conditions encourage the adoption of durable and weather-resistant designs, particularly in outdoor applications. The region faces challenges in affordability and access, but long-term government initiatives to expand residential infrastructure support future market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fuji Electric

- HD Hyundai Electric

- General Electric

- Eaton

- Bharat Heavy Electricals

- Hyosung Heavy Industries

- ABB

- E + I Engineering

- Hitachi

- CG Power and Industrial Solutions

Competitive Analysis

The Indoor Residential Switchgear Market companies including Fuji Electric, HD Hyundai Electric, General Electric, Eaton, Bharat Heavy Electricals, Hyosung Heavy Industries, ABB, E + I Engineering, Hitachi, and CG Power and Industrial Solutions. The Indoor Residential Switchgear Market is highly competitive, with companies focusing on innovation, digital integration, and safety-driven designs to secure market presence. Manufacturers emphasize compact and modular solutions that address space limitations in modern housing while meeting strict regulatory standards. Growing demand for smart homes drives investment in IoT-enabled switchgear that supports remote monitoring and predictive maintenance. Companies also prioritize eco-friendly materials and energy-efficient technologies to align with sustainable construction practices. Strategic partnerships, expansion into emerging markets, and continuous product development strengthen competitiveness. The focus on balancing affordability with advanced performance remains central to sustaining long-term growth in the residential segment.

Recent Developments

- In April 2025, ABB introduced a complete switchgear solution for wind turbines to support the deployment of larger wind turbines with higher yields. The solution offers the industry’s highest power rating for a complete switchgear solution, integrating a 7200A Emax 2 air circuit breaker and a 3200A AF

- In April 2025, Siemens Ltd. invested to expand its manufacturing operations in Goa, India. The company expressed interest in collaborating with local MSMEs to incorporate them into its supply chain. The firm already operated five factories in Goa and was actively working to increase its capacities.

- In March 2025, nVent Electric plc announced to enter into a definitive agreement to acquire the enclosures, switchgear, and bus systems businesses of Avail Infrastructure Solutions for an acquisition.

- In May 2024, L&T Switchgear, one of India’s leading electrical and automation brands and a pioneer in energy management, unveiled its new brand identity, Lauritz Knudsen Electrical and Automation.

Report Coverage

The research report offers an in-depth analysis based on Installation, Current, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for smart and automated residential infrastructure.

- Adoption of IoT-enabled switchgear will grow to support real-time monitoring and fault detection.

- Compact and modular designs will gain preference in urban housing with limited space.

- Renewable energy integration in homes will drive demand for compatible AC and DC switchgear.

- Energy-efficient and eco-friendly designs will align with sustainable construction practices.

- Regulations on electrical safety will continue to push demand for advanced protective systems.

- Emerging economies will offer growth opportunities through rapid urbanization and housing projects.

- Premium residential projects will increase adoption of intelligent and digitally connected systems.

- Local manufacturers will compete with global players by offering cost-effective solutions.

- Continuous product innovation and strategic partnerships will define long-term competitive advantage.