Market Overview

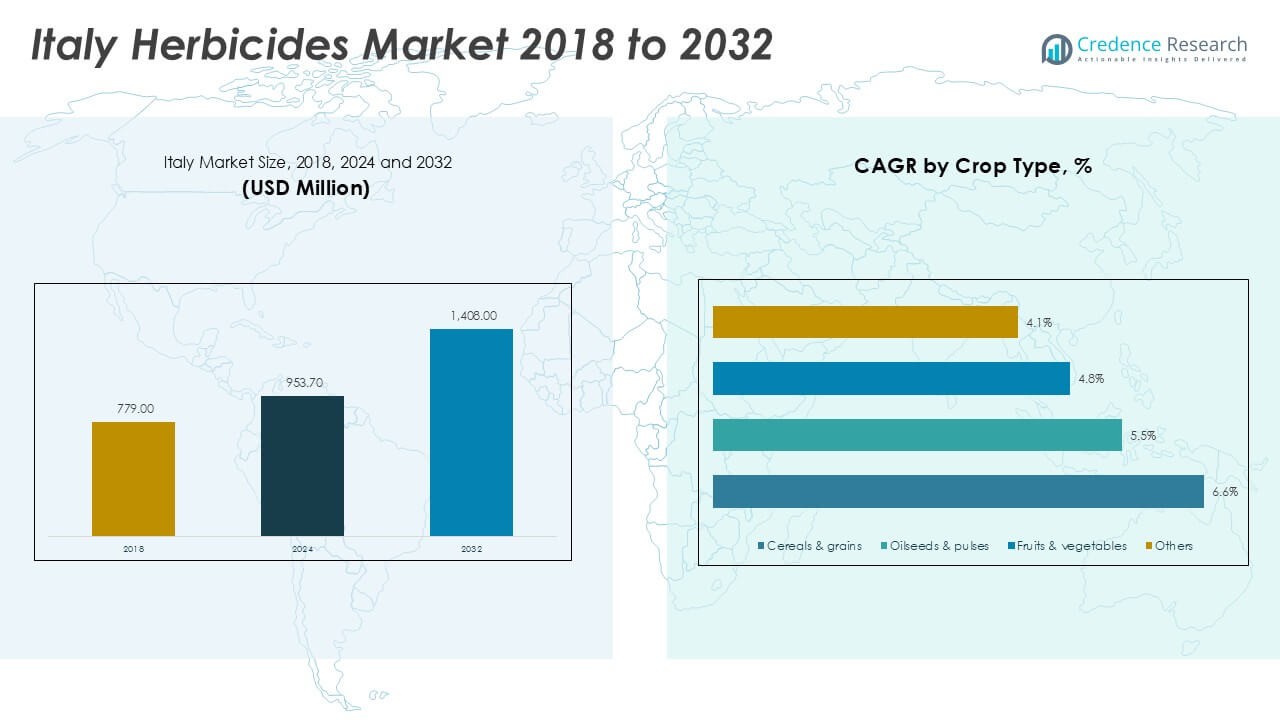

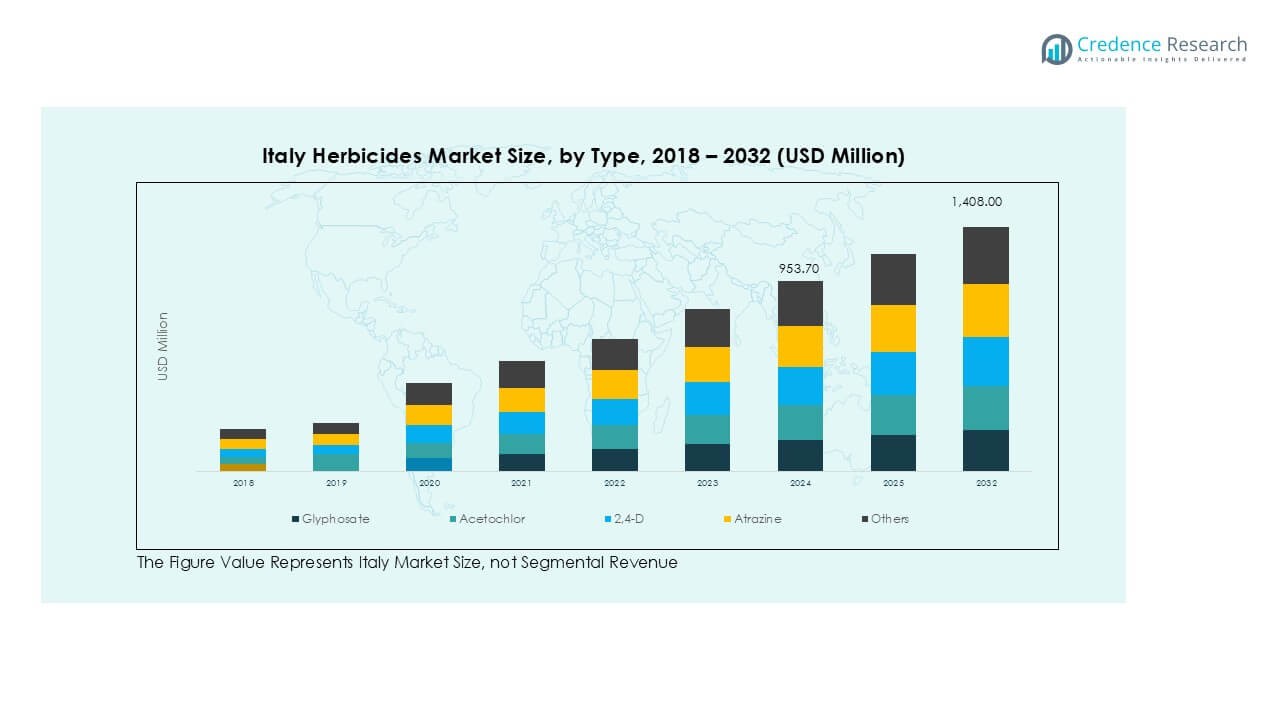

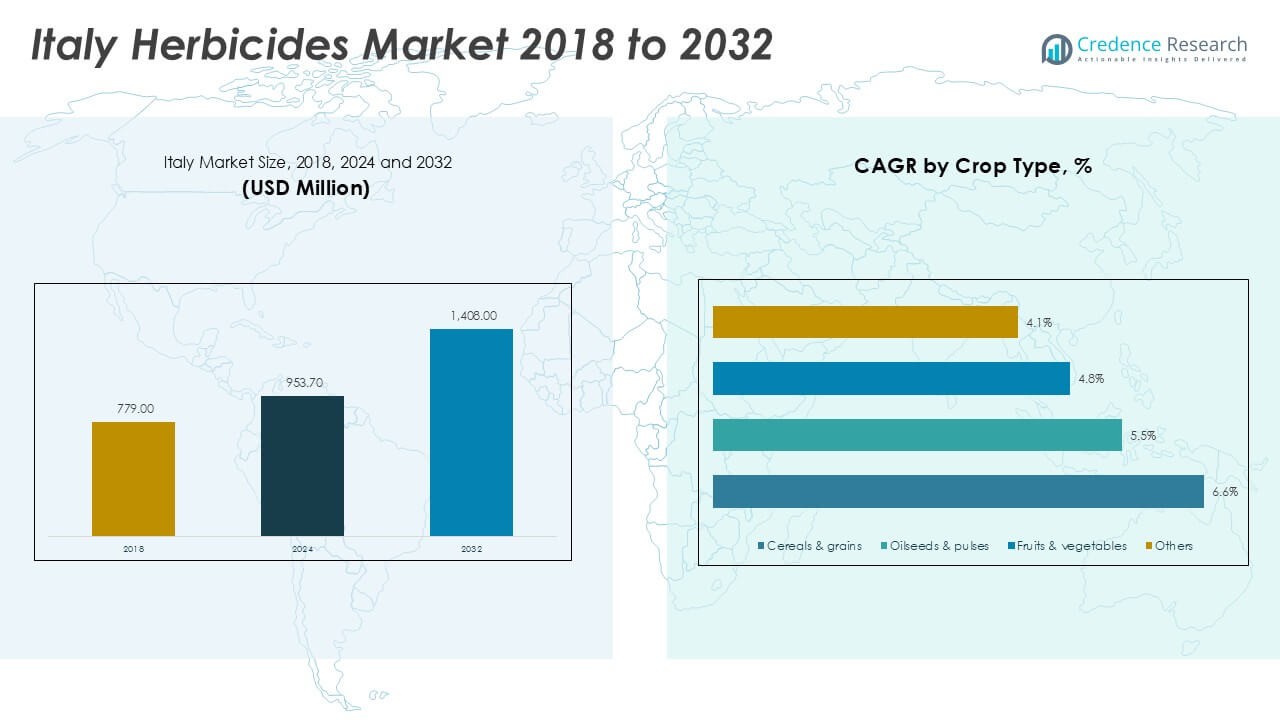

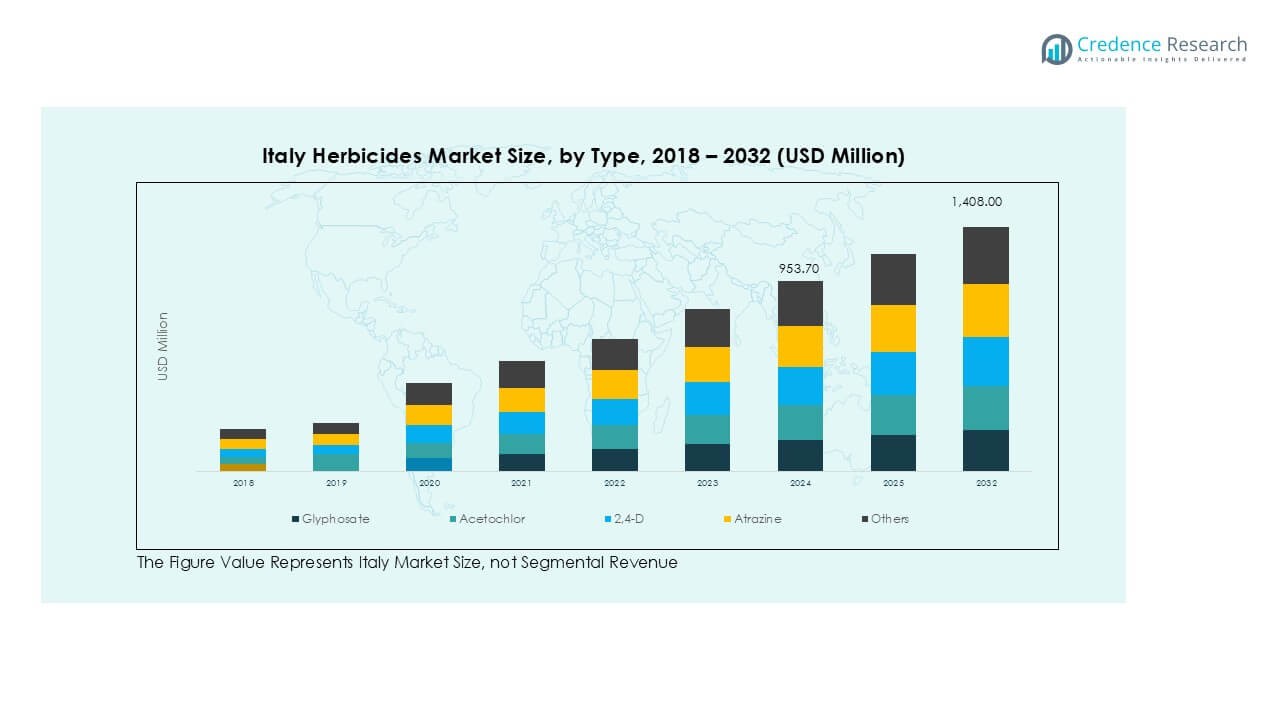

Italy Herbicides market size was valued at USD 779.00 million in 2018 and increased to USD 953.70 million in 2024. The market is anticipated to reach USD 1,408.00 million by 2032, growing at a CAGR of 4.99% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Herbicides Market Size 2024 |

USD 953.70 Million |

| Italy Herbicides Market, CAGR |

4.99% |

| Italy Herbicides Market Size 2032 |

USD 1,408.00 Million |

The Italy herbicides market is led by BASF SE, Bayer AG, Corteva Agriscience, and Syngenta Group, supported by key players such as FMC Corporation, UPL Limited, ADAMA Agricultural Solutions, and Sumitomo Chemical Co. Ltd. These companies focus on broad-spectrum herbicide solutions, eco-friendly formulations, and precision application technologies to meet EU regulatory standards and farmer demand. Northern Italy holds the largest regional share at over 40%, driven by extensive cereal and maize cultivation supported by mechanized farming practices. Southern Italy follows with about 35% share, led by strong horticultural crop production and fertigation-based herbicide adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Italy herbicides market was valued at USD 953.70 million in 2024 and is projected to reach USD 1,408.00 million by 2032, growing at a CAGR of 4.99%.

- Rising demand for cereals and grains, coupled with adoption of precision agriculture technologies, is driving herbicide usage to enhance crop yield and reduce labor costs.

- Key trends include growing preference for post-emergent and bio-based herbicides, along with increasing integration of herbicide applications with drip and micro-irrigation systems.

- BASF SE, Bayer AG, Corteva Agriscience, and Syngenta Group dominate the market, focusing on innovative formulations and partnerships, while regional players compete with cost-effective solutions.

- Northern Italy leads with over 40% share due to large-scale cereal cultivation, followed by Southern Italy with nearly 35% driven by fruit and vegetable production; glyphosate remains the leading herbicide type with more than 35% share, and foliar application holds the largest share among application methods.

Market Segmentation Analysis:

By Type

Glyphosate dominated the Italy herbicides market in 2024, accounting for over 35% share. Its broad-spectrum weed control, cost-effectiveness, and compatibility with no-till farming drive demand. Farmers prefer glyphosate for managing annual and perennial weeds across cereals and grains, reducing labor costs and improving yield efficiency. Acetochlor and 2,4-D follow, mainly used for selective pre-emergent weed control in corn and soybean production. Atrazine remains significant for maize farming but faces regulatory scrutiny. Growing adoption of integrated weed management practices supports steady use across other herbicide categories in niche applications.

- For instance, Italy cultivated nearly 1.2 million hectares of durum wheat in 2024. The claim of widespread use of glyphosate for pre-sowing and stubble management is inaccurate, as Italy has strict restrictions on its use in agriculture.

By Application

Foliar application led the market with nearly 50% share in 2024, favored for its direct and rapid weed-kill action. Farmers prefer foliar sprays for their precision, effectiveness at lower doses, and ability to target specific weed growth stages. Fertigation is gaining traction with the expansion of drip irrigation systems, allowing uniform distribution of herbicides and reduced wastage. Soil applications remain important for pre-emergence control, ensuring weed-free crop establishment. Growing adoption of precision agriculture technologies is enhancing application efficiency and encouraging farmers to use targeted herbicide delivery methods.

- For instance, Italian field trials conducted by CREA showed that optimized foliar herbicide programs improved wheat yields by 8–12% compared to untreated control plots.

By Crop Type

Cereals and grains were the dominant crop segment, holding over 40% market share in 2024. High demand for wheat, corn, and barley production in Italy drives herbicide consumption to maintain yield quality and control invasive weed species. Oilseeds and pulses follow as significant consumers, especially in soybean and sunflower cultivation. Fruits and vegetables also contribute notably due to the need for weed-free fields in high-value horticultural crops. Rising food demand and government support for sustainable crop protection practices continue to drive herbicide adoption across all major crop categories.

Key Growth Drivers

Expansion of Cereal and Grain Production

Rising demand for wheat, corn, and barley is boosting herbicide use across Italy. Farmers rely on glyphosate and selective herbicides to manage resistant weeds and improve crop yields. Expanding acreage under cereals, supported by government incentives for sustainable farming, further drives adoption. Efficient weed control ensures higher productivity and protects profitability for growers. Integration of herbicides with advanced crop management practices is encouraging consistent product demand. This growth is expected to remain steady as Italy strengthens its domestic grain production to reduce import dependence.

- For instance, Italy harvested approximately 6.1 million metric tons of wheat in 2024, with durum wheat production estimated at less than 3.5 million metric tons and soft wheat around 2.6 million metric tons. The cultivated area for durum wheat was less than 1.2 million hectares. While glyphosate is used in Italian agriculture, its use for pre-harvest desiccation has been banned since 2016.

Adoption of Precision Agriculture

Precision agriculture technologies are increasing herbicide efficiency through targeted application. Italian farmers are adopting GPS-guided sprayers, drones, and variable rate technology to reduce wastage and improve crop protection. These innovations minimize costs and environmental impact, supporting EU sustainability goals. Foliar sprays and fertigation systems benefit most from precision methods, enhancing coverage and reducing chemical runoff. Growing awareness about precision farming’s economic benefits is accelerating technology adoption across large and mid-sized farms. This shift toward smarter farming practices is driving continuous herbicide demand growth in the country.

- For example, farms using precision spraying have reported up to 20% savings in herbicide volumes while maintaining effective weed control.

Shift Toward Sustainable Weed Control

There is growing emphasis on eco-friendly herbicide solutions in Italy. Farmers are gradually adopting low-residue, bio-based, and selective herbicides that align with EU regulations. Integrated weed management practices combining chemical and mechanical methods are gaining popularity. These approaches support biodiversity protection while maintaining effective weed control. Regulatory bodies are promoting sustainable herbicide use, encouraging companies to develop safer formulations. This transition is driving product innovation and expanding opportunities for herbicide manufacturers focused on green chemistry and environment-friendly solutions in the Italian agricultural market.

Key Trends & Opportunities

Rising Demand for Post-Emergent Herbicides

The post-emergent herbicides are gaining traction due to their ability to control weeds during active crop growth stages. Italian farmers prefer them for their flexibility and effectiveness against late-season weed infestations. Glyphosate and 2,4-D dominate this category, helping maintain crop health and yield. Increased adoption of minimum-tillage practices further supports demand for post-emergent solutions. Manufacturers are introducing advanced formulations that reduce application frequency and improve coverage, creating new opportunities. This trend aligns with farmers’ need for cost-effective and timely weed management strategies across cereals and horticultural crops.

- For instance, Italy applies post-emergent herbicides on more than 1.5 million hectares of cereals annually, ensuring effective control of broadleaf and grassy weeds.

Growth of Drip and Micro-Irrigation Systems

Expansion of drip irrigation is creating opportunities for fertigation-based herbicide applications. Fertigation allows precise delivery of herbicides, reducing overuse and ensuring uniform coverage. Adoption is growing in fruit, vegetable, and vineyard cultivation where water efficiency is crucial. Government subsidies for micro-irrigation infrastructure are accelerating this shift. Integration of soluble herbicide formulations with fertigation systems improves weed control efficiency while saving time and labor. This trend is expected to expand further, particularly in southern Italy, where water scarcity is a persistent challenge for farmers.

- For instance, Italy has more than 1.1 million hectares under micro- and drip-irrigation, making it one of Europe’s largest adopters of fertigation systems.

Key Challenges

Regulatory Restrictions on Herbicides

Stringent EU regulations on active ingredients are impacting herbicide availability in Italy. Bans on certain formulations, including restrictions on atrazine use, limit options for farmers. Compliance with residue limits and environmental safety requirements raises costs for manufacturers and distributors. Farmers face higher input costs as they shift to alternative solutions, which may be less effective or more expensive. Continuous regulatory changes create uncertainty for market participants, discouraging long-term investments. This challenge is pushing companies to invest in safer and compliant formulations to maintain market share.

Rising Herbicide Resistance

Weed resistance to commonly used herbicides, particularly glyphosate, is becoming a major issue. Resistant weed species reduce control efficiency and force farmers to increase application rates or switch to costly alternatives. This escalates production costs and can harm soil health over time. Integrated weed management approaches are necessary but require higher technical knowledge and additional labor. Herbicide resistance is driving research into novel active ingredients and mixtures. Addressing resistance effectively will be crucial for ensuring sustainable weed control and maintaining farm productivity in Italy.

Regional Analysis

Northern Italy

Northern Italy dominated the herbicides market with over 40% share in 2024, driven by its extensive agricultural activities and advanced farming infrastructure. Regions like Milan, Turin, and Venice lead in cereals, maize, and industrial crop cultivation, creating strong demand for glyphosate and selective herbicides. Farmers in this region are early adopters of precision agriculture tools, which enhance herbicide efficiency and reduce wastage. Favorable climate conditions and high mechanization rates support consistent herbicide use throughout the growing seasons. Strong agribusiness presence and proximity to chemical manufacturing hubs further contribute to the region’s leadership in herbicide consumption.

Southern Italy

Southern Italy accounted for nearly 35% of the herbicides market share in 2024, supported by large-scale production of fruits, vegetables, and oilseeds. Key cities such as Naples, Palermo, and Bari drive demand due to their focus on horticultural crops that require effective weed management. Farmers rely heavily on foliar and fertigation-based herbicide applications to maximize yield under water-scarce conditions. Government incentives for irrigation system upgrades are boosting herbicide integration with drip systems. Rising adoption of sustainable herbicides and integrated weed management practices is further driving market growth in this region, particularly in vineyard and olive grove cultivation.

Central Italy

Central Italy held around 25% share of the herbicides market in 2024, with Rome, Florence, and Bologna serving as major agricultural centers. The region is known for producing cereals, pulses, and specialty crops, driving consistent demand for pre- and post-emergent herbicides. Adoption of bio-based herbicides is gaining traction due to the region’s strong focus on organic farming and environmental protection. Farmers are increasingly adopting soil-applied herbicides to ensure weed-free crop establishment in key growing areas. Investments in precision farming and EU-backed programs promoting sustainable crop protection are expected to support steady herbicide demand in Central Italy.

Market Segmentations:

By Type

- Glyphosate

- Acetochlor

- 2,4-D

- Atrazine

- Others

By Application

- Fertigation

- Foliar

- Soil

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Geography

Competitive Landscape

The Italy herbicides market is moderately consolidated, with global and regional players competing on product innovation, pricing, and distribution reach. BASF SE, Bayer AG, Corteva Agriscience, and Syngenta Group lead the market, collectively accounting for a significant share through their broad portfolios of glyphosate, selective herbicides, and bio-based solutions. Companies such as FMC Corporation, UPL Limited, and ADAMA Agricultural Solutions focus on expanding their presence through partnerships with local distributors and precision agriculture initiatives. Recent developments include launches of low-residue and eco-friendly herbicides to meet EU sustainability regulations. Strategic mergers, acquisitions, and R&D investments are common as players aim to enhance competitiveness and manage herbicide resistance challenges. Regional companies also compete by offering cost-effective solutions tailored to Italian crop types and climatic conditions, increasing pressure on multinational corporations to localize their offerings. This competitive environment fosters continuous innovation and supports market growth across cereals, grains, fruits, and vegetables.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Bayer AG

- Corteva Agriscience

- Syngenta Group

- Nufarm Ltd

- FMC Corporation

- UPL Limited

- ADAMA Agricultural Solutions Ltd

- Sumitomo Chemical Co. Ltd

- Belchim Crop Protection

Recent Developments

- In December 2023, ADAMA introduced its most advanced cross-spectrum herbicide called Kampai for the grain business. The new product provides the broadest application window for broadleaf and narrow-leaf weed control for cereal crops.

- In September 2023, American Water Chemicals (AWC) announced the launch of its European division, named Amaya Solutions Europe, SL. This strategic move marks a significant milestone in AWC’s global expansion efforts, aimed at enhancing its presence in the European market.

- In July 2023, ADAMA introduced new products, Davai A Plus and Clearfield Broad-Spectrum Herbicide Solutions, for imidazolinone-tolerant legumes like lentils, peas, and soybeans.

- In March 2023, BASF announced the launch of a novel corn herbicide named Surtain, which is set to be available for use in the United States in 2024. This innovative herbicide features solid encapsulation technology, marking it as the first of its kind in the industry.

- In January 2023, Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Crop Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by rising demand for cereals and grains.

- Adoption of precision agriculture will increase targeted herbicide applications across farms.

- Bio-based and low-residue herbicides will see higher demand due to EU sustainability goals.

- Farmers will increasingly adopt integrated weed management to combat herbicide resistance.

- Foliar applications will continue dominating as farmers prefer quick and efficient weed control.

- Technological advances like GPS-guided sprayers and drones will improve application efficiency.

- Government incentives for irrigation upgrades will boost fertigation-based herbicide use.

- Companies will invest more in R&D to develop innovative and compliant formulations.

- Northern Italy will maintain its leading share due to advanced mechanized farming systems.

- Strategic collaborations and local partnerships will expand market presence of global players.