Market Overview

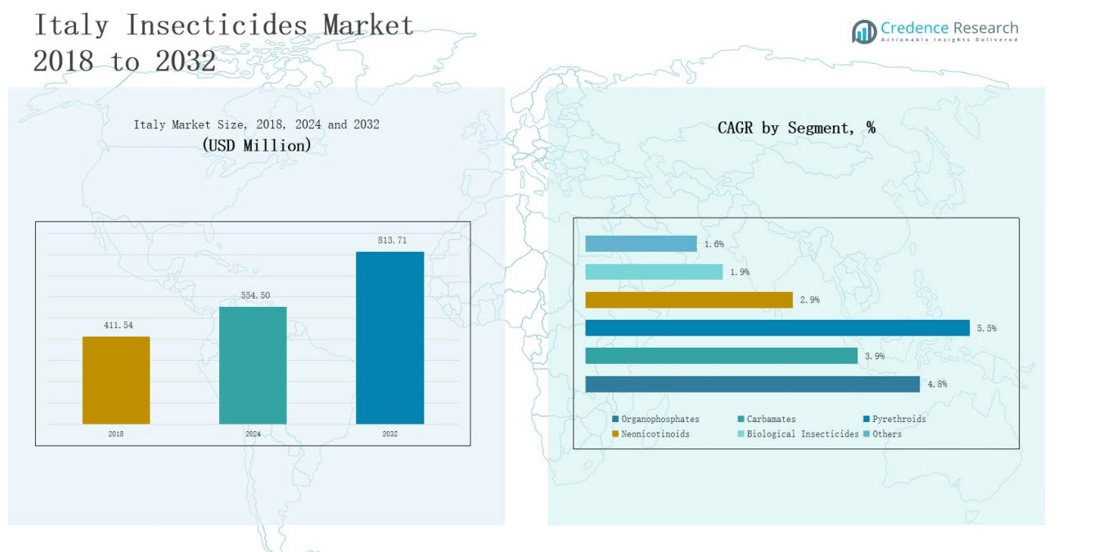

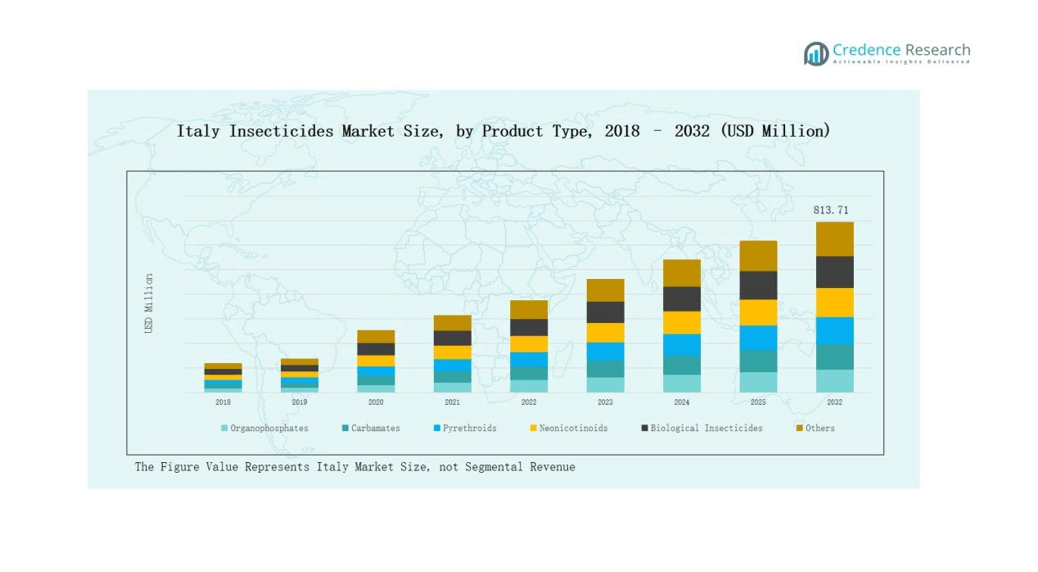

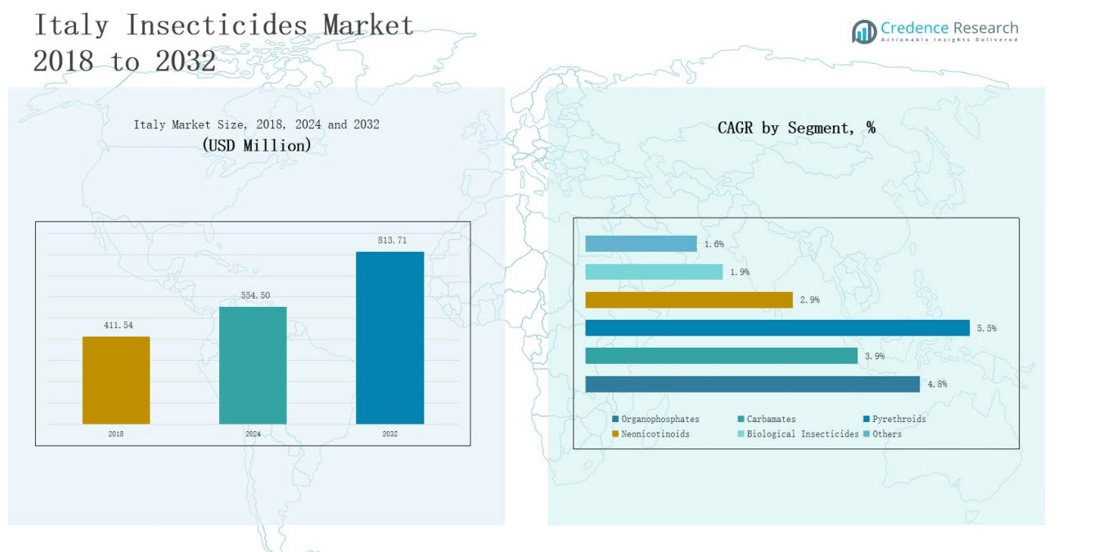

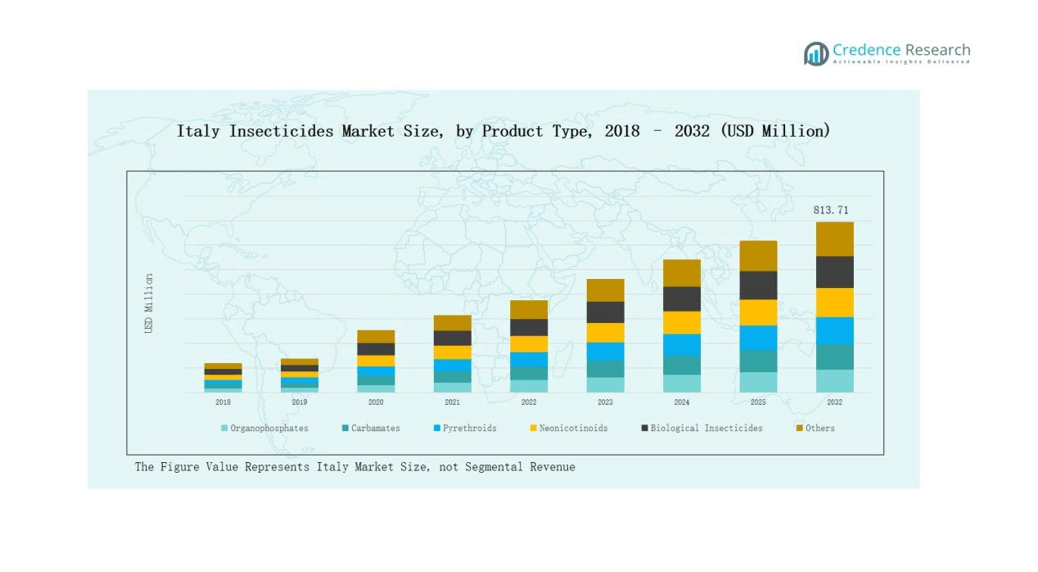

Italy Insecticides Market size was valued at USD 411.54 million in 2018 to USD 554.50 million in 2024 and is anticipated to reach USD 813.71 million by 2032, at a CAGR of 4.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Insecticides Market Size 2024 |

USD 554.50 million |

| Italy Insecticides Market, CAGR |

4.82% |

| Italy Insecticides Market Size 2032 |

USD 813.71 million |

The Italy Insecticides Market is shaped by leading companies such as BASF SE, Bayer CropScience, Corteva Agriscience, Syngenta, ADAMA Agricultural Solutions, UPL Limited, Nufarm, Sipcam Italia, Sumitomo Chemical, and XEDA Italia. These players maintain strong positions through extensive product portfolios, innovation in eco-friendly formulations, and compliance with EU regulatory frameworks. They focus on supporting both conventional and organic farming, aligning with Italy’s demand for sustainable crop protection. Northern Italy led the market with 42% share in 2024, driven by intensive agriculture in Lombardy, Emilia-Romagna, and Veneto, where vineyards and high-value crops dominate insecticide consumption.

Market Insights

- The Italy Insecticides Market grew from USD 411.54 million in 2018 to USD 554.50 million in 2024 and is expected to reach USD 813.71 million by 2032, expanding at 4.82% CAGR.

- Organophosphates led by product type with 34% share in 2024, followed by pyrethroids at 22% and carbamates at 18%, while biological insecticides recorded the fastest growth at 8%.

- Agriculture dominated applications with 63% share in 2024, while public health accounted for 12%, forestry for 9%, turf and landscape for 8%, and other uses for 8%.

- Northern Italy held the largest regional share at 42%, followed by Central Italy at 27%, Southern Italy at 23%, and the islands of Sicily and Sardinia at 8%.

- Leading companies include BASF SE, Bayer CropScience, Corteva Agriscience, Syngenta, ADAMA Agricultural Solutions, UPL Limited, Nufarm, Sipcam Italia, Sumitomo Chemical, and XEDA Italia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

In 2024, organophosphates led the Italy insecticides market with 34% share, supported by their broad-spectrum effectiveness in cereals and vegetables. Pyrethroids followed with 22% share, driven by their strong adoption in vineyards and horticulture for export-quality crops. Carbamates held 18% share, preferred for selective pest control in fruits and vegetables. Neonicotinoids captured 12% share, with usage limited by EU restrictions but maintained in greenhouse farming. Biological insecticides represented 8% share, recording the fastest growth due to Italy’s large organic farming base and consumer demand for residue-free food. Other categories, including fumigants and newer chemistries, accounted for 6% share, used in niche applications.

- For instance, in March 2024, BASF launched its biological insecticide Velifer in Italy, designed for greenhouse vegetables and ornamentals, supporting the country’s shift toward organic production.

By Application

Agriculture dominated the application segment with 63% share, supported by high-value crops such as grapes, olives, and vegetables that demand intensive pest control. Public health followed with 12% share, where demand is shaped by mosquito control programs and rising urban populations. Forestry applications accounted for 9% share, sustained by government initiatives to protect timber resources and biodiversity. Turf and landscape held 8% share, driven by expanding urban green spaces, parks, and golf courses. The remaining 8% share came from household, storage, and industrial pest management, reflecting growing awareness about hygiene and protection in food facilities.

- For instance, Bayer and M2i Group expanded their partnership in 2023 to distribute the Vynyty Press range of pheromone-based biological pest control products in Europe, with solutions developed for grapes and other crops.

Market Overview

High-Value Crop Cultivation

Italy’s strong focus on high-value crops such as grapes, olives, and vegetables drives consistent insecticide demand. Farmers depend on effective solutions to ensure quality for domestic use and exports, particularly in the EU market. The premium nature of these crops increases sensitivity to pest damage, encouraging adoption of advanced insecticides. The need to maintain production levels under changing climatic conditions further fuels reliance on crop protection. This factor makes agriculture the dominant driver of insecticide consumption in Italy.

- For instance, Corteva Agriscience introduced its biological insecticide Qalcova™ active, which Italian olive producers have adopted to manage olive fruit fly infestations.

Shift Toward Biological Solutions

Italy is among Europe’s largest organic farming markets, where biological insecticides are rapidly gaining traction. Rising consumer preference for residue-free food and stringent EU restrictions on chemical pesticides accelerate the move toward sustainable solutions. Italian farmers and cooperatives are investing in eco-friendly products to protect crops while meeting certification standards. This trend supports the rapid expansion of biopesticides across orchards, vineyards, and vegetables. With government and EU incentives for sustainable agriculture, biological insecticides are poised to capture greater market share.

- For instance, Koppert Biological Systems expanded its Italian portfolio by introducing beneficial insects like Trichogramma brassicae for integrated pest management in vegetables, helping growers reduce pesticide residues while protecting yields.

Government and EU Policy Support

Regulatory frameworks and agricultural policies at both national and EU levels support insecticide adoption. Italy’s compliance with the EU Green Deal and integrated pest management practices has intensified the need for modern pest control products. Funding for sustainable agriculture and incentives for innovation encourage farmers to balance productivity with environmental safety. Public health programs, particularly mosquito control, also enhance government-driven demand. These supportive policies ensure steady market growth while guiding a transition toward safer, regulated solutions.

Key Trends & Opportunities

Adoption of Precision Agriculture

The integration of digital tools and precision farming practices is reshaping pest management in Italy. Farmers increasingly rely on data-driven approaches to optimize insecticide application, reduce waste, and improve efficiency. Sensors, drones, and smart spraying equipment help monitor pest outbreaks and apply solutions only where needed. This trend lowers costs and supports environmental goals, creating strong opportunities for companies offering precision-compatible insecticides. It also aligns with EU sustainability targets, boosting long-term adoption in Italy’s modern farms.

- For instance, Farmonaut offers real-time carbon footprinting and traceability solutions vital for complying with EU sustainability standards and enhancing pest control efficiency.

Innovation in Eco-Friendly Formulations

Growing environmental concerns and regulatory pressure are creating opportunities for next-generation eco-friendly formulations. Companies are developing insecticides with low toxicity, biodegradable properties, and targeted action against specific pests. Demand is rising in vineyards, olive farms, and horticulture where export standards require reduced pesticide residues. Italian manufacturers and global players are focusing on biological blends and novel delivery systems to meet this demand. The opportunity to innovate in sustainable formulations presents a key pathway for differentiation and market growth.

- For instance, Indian company UPL Limited has developed a biodegradable insecticide blend that targets specific vineyard pests while minimizing residue, aligning with export standards.

Key Challenges

Stringent EU Regulatory Restrictions

The Italian insecticides market faces hurdles due to strict EU pesticide regulations. Bans on several neonicotinoids and tighter residue limits limit product portfolios and increase compliance costs. Farmers often struggle to replace restricted products with equally effective alternatives. Regulatory delays in product approvals further challenge market expansion. These restrictions push companies to invest heavily in R&D and adapt to evolving compliance frameworks. Balancing pest control needs with regulatory demands remains a persistent challenge for both producers and users.

Pest Resistance Issues

Continuous use of certain insecticides, such as organophosphates and pyrethroids, has led to pest resistance. This reduces product effectiveness and forces farmers to rotate or combine solutions, raising input costs. Resistance is particularly evident in vineyards and horticulture where repeated pest pressure is common. Managing resistance requires investment in integrated pest management practices and innovative formulations. Without addressing this challenge, both crop productivity and market growth could face serious constraints in the long term.

Rising Costs and Farmer Affordability

The high cost of advanced insecticides, combined with increasing production expenses, creates affordability concerns for Italian farmers. Small-scale producers, who form a large share of the sector, are most affected. Transitioning to biological and precision-based solutions often requires significant investment, limiting adoption. Price-sensitive farmers may delay product use or opt for older chemistries despite their limitations. Ensuring affordable access to effective insecticides remains a major challenge that could slow market modernization in Italy.

Regional Analysis

Northern Italy

Northern Italy accounted for 42% share of the Italy Insecticides Market in 2024, making it the leading region. The dominance is supported by intensive agriculture in Lombardy, Emilia-Romagna, and Veneto, where high-value crops such as grapes, maize, and vegetables require strong pest protection. Vineyards in this region drive heavy reliance on pyrethroids and biological insecticides to meet export standards. Farmers benefit from advanced agricultural practices and early adoption of precision farming solutions. It continues to be the hub for innovation and adoption of sustainable crop protection methods. Strong cooperative networks further enhance product penetration in this region.

Central Italy

Central Italy captured 27% share of the Italy Insecticides Market in 2024. Tuscany, Lazio, and Marche are major contributors, with olive and vineyard cultivation shaping insecticide demand. Organophosphates and carbamates remain widely used, although biological alternatives are steadily growing in share. Farmers prioritize pest management to protect traditional crops linked to Italy’s agri-food heritage and tourism-driven exports. It remains a region balancing conventional and sustainable practices, where both small and medium-scale farmers play a strong role. Regional policies supporting organic farming add momentum to biological insecticide adoption.

Southern Italy

Southern Italy held 23% share of the Italy Insecticides Market in 2024. Crops such as citrus, tomatoes, and olives dominate the demand, requiring consistent insecticide application to prevent yield losses. Pyrethroids and neonicotinoids remain relevant due to their effectiveness against pests common in warmer climates. Farmers in Puglia, Calabria, and Campania continue to invest in pest control despite cost pressures. It faces challenges with small-scale farming structures, yet government subsidies support modernization. Expanding organic citrus production also creates scope for greater use of biological insecticides.

Islands (Sicily and Sardinia)

The islands of Sicily and Sardinia accounted for 8% share of the Italy Insecticides Market in 2024. These regions are recognized for citrus, grapes, and horticultural crops, where insecticides are essential for export compliance. Biological insecticides are expanding quickly due to rising demand for residue-free produce in export markets. Farmers rely on both traditional chemical insecticides and sustainable options, often influenced by cooperative and export consortium policies. It remains a smaller but strategically important market segment for companies targeting high-quality niche crops. Government support for sustainable farming on islands continues to enhance future growth prospects.

Market Segmentations:

By Product Type

- Organophosphates

- Carbamates

- Pyrethroids

- Neonicotinoids

- Biological Insecticides

- Others

By Application

- Agriculture

- Forestry

- Turf & Landscape

- Public Health

- Others

By Region

- Northern Itay

- Central Italy

- Southern Italy

- Islands (Sicily and Sardinia)

Competitive Landscape

The competitive landscape of the Italy insecticides market is characterized by the strong presence of multinational corporations and regional players that balance innovation with regulatory compliance. Leading companies such as BASF SE, Bayer CropScience, Corteva Agriscience, Syngenta, ADAMA Agricultural Solutions, and UPL Limited maintain dominance through extensive product portfolios that include both chemical and biological formulations. These firms focus heavily on research and development to introduce eco-friendly solutions, aligning with EU regulations and Italy’s growing demand for sustainable farming practices. Local firms like Sipcam Italia and XEDA Italia complement the market by offering tailored solutions for regional crops, particularly in horticulture and viticulture. Competitive strategies revolve around product diversification, partnerships with cooperatives, and expansion into biological insecticides to meet rising consumer preferences for residue-free produce. The combination of global expertise and local adaptability ensures a dynamic market structure, fostering both innovation and compliance in Italy’s agriculture sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- BASF SE

- Bayer CropScience

- Corteva Agriscience

- Syngenta

- ADAMA Agricultural Solutions

- UPL Limited

- Nufarm

- Sipcam Italia

- Sumitomo Chemical

- XEDA Italia

Recent Developments

- In May 2025, Sumitomo Chemical launched Sumifly, a biological insecticide, during the Macfrut 2025 fair in Italy.

- In May 2024, Vestaron’s bioinsecticide SPEAR LEP received emergency use authorization in Italy for tomato crops, enabling control of invasive pests such as the tomato leafminer.

- In May 2025, Altinco introduced its eco-friendly pesticide Grinward®, containing just 20% paraffin oil, targeting aphids, whiteflies, and psylla across various crops.

- In May 2025, Altinco introduced its eco-friendly pesticide Grinward®, containing just 20% paraffin oil, targeting aphids, whiteflies, and psylla across various crops.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biological insecticides will expand with Italy’s leadership in organic farming.

- Precision agriculture adoption will increase targeted use of insecticides across high-value crops.

- Public health programs will strengthen demand for safe vector control solutions.

- Regulatory frameworks will continue to drive innovation in eco-friendly formulations.

- Resistance management strategies will shape product development and farmer training programs.

- Vineyards and olive cultivation will remain core sectors supporting insecticide usage.

- Export-driven quality standards will sustain demand for effective pest management solutions.

- Digital platforms will enhance farmer access to advanced crop protection products.

- Government incentives will encourage a gradual shift from synthetic to biological solutions.

- Regional cooperatives will play a growing role in distributing sustainable insecticide products.