Market Overview:

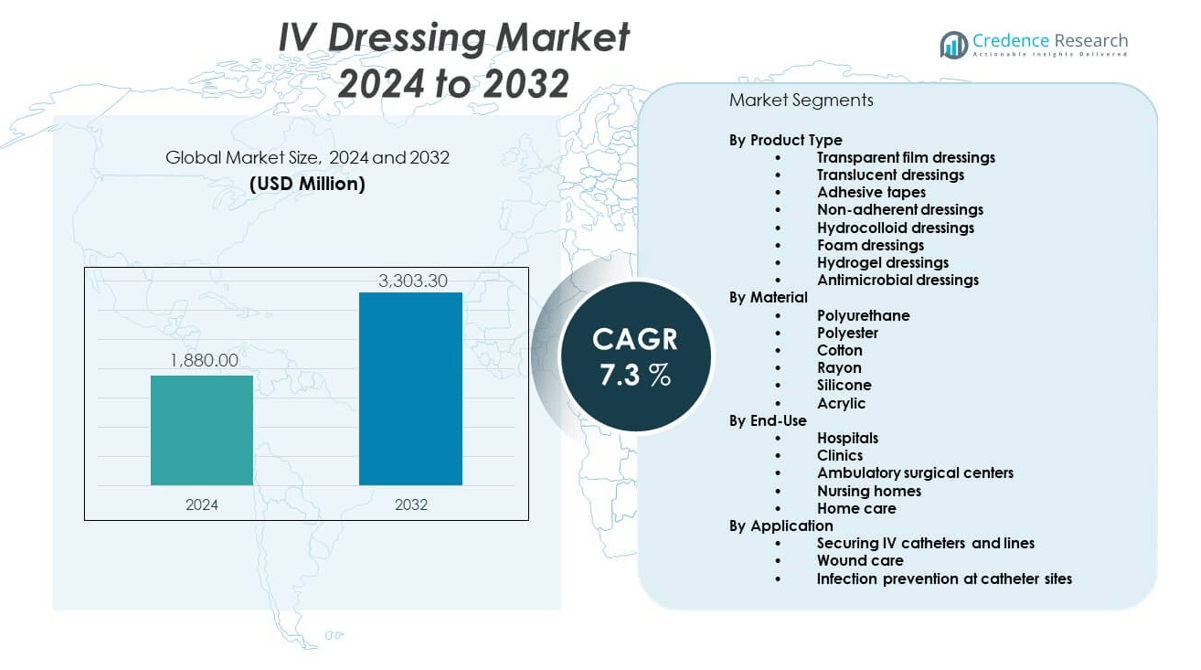

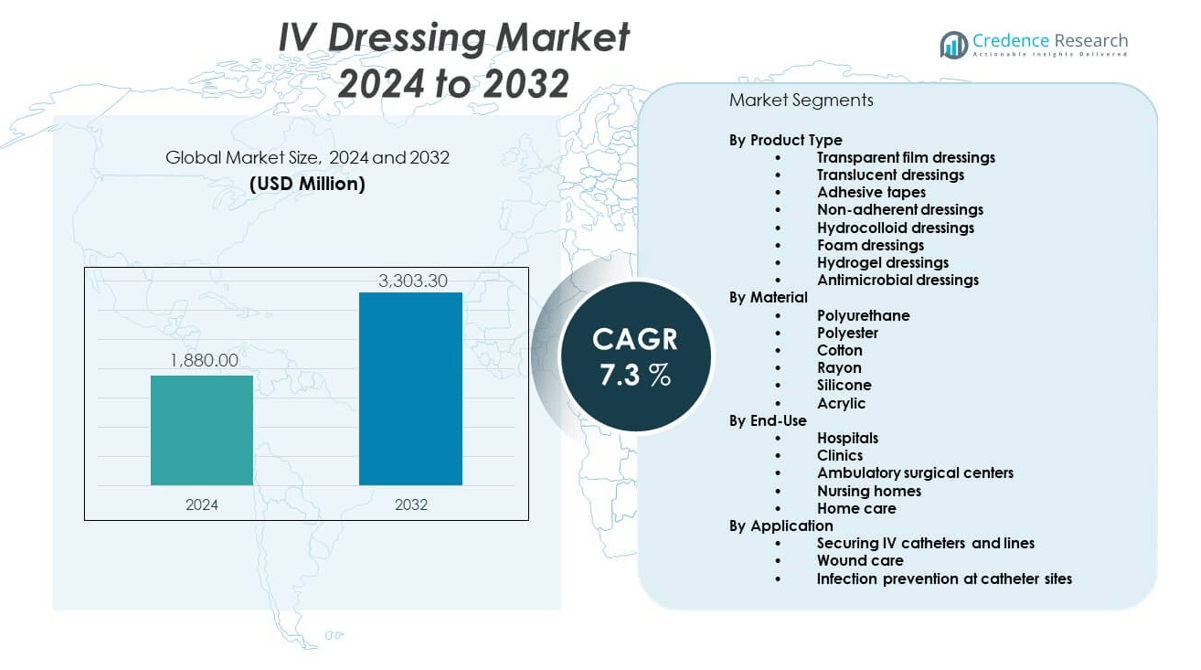

The IV dressing market is projected to grow from USD 1880 million in 2024 to an estimated USD 3303.3 million by 2032, with a compound annual growth rate (CAGR) of 7.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| IV Dressing Market Size 2024 |

USD 1880 million |

| IV Dressing Market, CAGR |

7.3% |

| IV Dressing Market Size 2032 |

USD 3303.3 million |

The market growth is driven by the rising number of hospital admissions, surgical procedures, and the increasing prevalence of chronic illnesses requiring intravenous therapy. As healthcare systems emphasize infection prevention and patient safety, demand for advanced IV dressings with antimicrobial and transparent properties has surged. Additionally, innovations in dressing materials and adhesive technologies enhance comfort, reduce skin irritation, and extend wear time, making them preferable for both acute and long-term care settings.

North America currently leads the IV dressing market due to its advanced healthcare infrastructure, high awareness of infection control protocols, and strong presence of key medical device manufacturers. Europe follows, supported by favorable healthcare regulations and increasing investments in patient safety. Meanwhile, Asia-Pacific is emerging rapidly, fueled by expanding hospital networks, improving access to healthcare in rural areas, and growing awareness about hospital-acquired infections. Countries like India and China are witnessing increased adoption due to rising healthcare spending and government initiatives promoting quality care.

Market Insights:

- The IV dressing market was valued at USD 1,880 million in 2024 and is projected to reach USD 3,303.3 million by 2032, growing at a CAGR of 3% during the forecast period.

- Increasing hospital admissions, surgical procedures, and demand for infection control drive consistent use of IV dressings across clinical settings.

- Rising adoption of antimicrobial and transparent dressings enhances patient safety and aligns with evolving healthcare protocols.

- High costs of advanced dressings and limited access in low-resource settings restrain broader adoption, especially in developing regions.

- North America leads the market with a 7% share, driven by advanced healthcare infrastructure and strong infection prevention practices.

- Europe holds a 4% market share, supported by centralized procurement systems and growing elderly population requiring long-term IV care.

- Asia-Pacific emerges as the fastest-growing region with a 8% share, fueled by expanding healthcare access, infrastructure development, and rising public awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Hospitalization and Surgical Procedures Increase Demand for Intravenous Access Management:

Rising global hospitalization rates have created consistent demand for intravenous access, directly impacting the IV dressing market. Hospitals increasingly rely on IV therapy for fluid administration, blood transfusions, and medications. The growing number of surgeries and emergency treatments has led to a surge in catheter insertions. Patients in intensive care units often require long-term IV access, prompting regular dressing changes. The market benefits from healthcare providers prioritizing securement and infection prevention. Clinicians now select dressings with stronger adhesives and barrier properties to maintain line integrity. Regulatory bodies also emphasize the use of approved, sterile dressings. These combined factors accelerate the adoption of IV dressings in both developed and emerging healthcare systems.

- For instance, 3M Health Care reported that their Tegaderm IV dressings have been applied in over 250 million procedures worldwide, benefiting from enhanced adhesive technology that increased dressing retention time by 20%, thereby reducing the frequency of dressing changes in hospitals.

Focus on Preventing Catheter-Related Bloodstream Infections Drives Product Adoption:

Hospitals worldwide focus on reducing catheter-related bloodstream infections (CRBSIs), leading to stronger infection control protocols. The IV dressing market gains traction as healthcare providers invest in antimicrobial and transparent dressing solutions. These dressings provide both visibility and barrier protection, reducing risks of contamination at insertion sites. Hospitals implement care bundles that include regular dressing changes and use of specialized materials. Clinical studies show that advanced dressings reduce infection rates compared to traditional gauze. It creates a strong value proposition for both public and private healthcare providers. The demand for evidence-backed, cost-effective solutions supports continued procurement. Governments and accreditation bodies further pressure facilities to comply with infection control standards.

- For instance, the clinical trial conducted by Smith & Nephew demonstrated that their BioPatch antimicrobial dressing reduced CRBSI rates by up to 40% in ICU patients, helping hospitals meet stringent infection prevention mandates.

Rising Chronic Illnesses and Home Healthcare Adoption Drive Long-Term IV Therapy Needs:

The global burden of chronic illnesses such as cancer, diabetes, and renal failure has increased the need for long-term intravenous therapy. Patients undergoing chemotherapy or dialysis often require indwelling catheters, maintained with secure and breathable dressings. The IV dressing market responds with solutions designed for frequent access and longer wear time. Home healthcare adoption has surged due to hospital overcrowding and patient preference. It has pushed manufacturers to develop user-friendly, easy-to-apply dressings that patients or caregivers can manage independently. Demand also rises for hypoallergenic options to prevent skin damage over repeated use. Pharmacies and e-commerce platforms help meet growing demand outside traditional settings. These shifts support consistent growth across age groups and care environments.

Healthcare Digitalization Supports Protocol Adherence and Dressing Compliance:

Digital transformation across healthcare systems reinforces structured IV therapy protocols. Hospitals deploy electronic health records that trigger dressing change alerts, improving compliance. The IV dressing market benefits from technology integration that supports timely intervention and infection monitoring. Smart labeling and tracking systems reduce human error in dressing management. It enables caregivers to standardize application and removal practices. Training programs integrated into hospital software guide nurses on best practices. Data from compliance audits highlight the importance of consistent dressing performance. These digital enablers enhance overall patient safety and support broader product utilization across health networks.

Market Trends:

Integration of Antimicrobial Technologies Into IV Dressings Gains Market Traction:

The IV dressing market has seen a strong shift toward dressings that incorporate antimicrobial agents directly into the material. Manufacturers use silver, chlorhexidine, or iodine to prevent microbial colonization on the skin and catheter site. This trend aligns with rising infection control requirements and increasing microbial resistance. Hospitals adopt these dressings to reduce the need for separate antiseptic steps. It simplifies clinical workflows and minimizes touchpoints that risk contamination. Antimicrobial dressings also support extended wear time, which reduces dressing changes and labor costs. Research continues to validate their effectiveness in diverse care environments. These innovations attract attention from procurement teams focused on reducing hospital-acquired infections.

- For instance, Derma Sciences’ silver-impregnated dressing technology has been shown through independent studies to extend dressing wear time by 30%, contributing to a reduction of dressing-related infections by nearly 35% in acute care settings.

Rise of Transparent and Breathable Dressings for Visual Monitoring and Skin Protection:

Clinicians prioritize dressings that allow continuous monitoring of the catheter insertion site without removal. Transparent film dressings dominate due to their ability to detect early signs of inflammation or leakage. The IV dressing market reflects growing demand for breathable materials that allow moisture evaporation while blocking contaminants. These dressings support skin integrity, especially in long-term use scenarios. Their thin profile improves comfort, encouraging patient compliance. Hospitals deploy them across oncology, pediatrics, and geriatric care where skin sensitivity is high. Manufacturers refine adhesive technology to balance adhesion with painless removal. This shift supports better patient outcomes and reduces nursing workload.

- For instance Medline Industries transparent film dressing IV300 achieves a moisture vapor transmission rate exceeding 2000 g m² 24hr which enhanced breathability and decreased skin irritation by 25 in elderly patients improving patient comfort

Expansion of Disposable, Single-Use IV Dressing Kits Among Healthcare Providers:

Hospitals seek efficiency in IV site preparation and maintenance, leading to the adoption of single-use dressing kits. These pre-assembled kits include all required components such as dressing, antiseptic swab, tape, and gloves. The IV dressing market incorporates this trend to streamline clinical workflow and reduce contamination risk. It reduces variability between clinicians and ensures protocol adherence. Emergency and field hospitals benefit from portable, standardized kits. It improves infection control in resource-limited settings. The demand for disposable options aligns with global sustainability regulations focusing on safe waste disposal. Vendors position kits as cost-efficient alternatives to bulk packaging models. Procurement teams increasingly prioritize bundled solutions for consistent care delivery.

Demand for Pediatric-Specific and Neonatal Dressings Fuels Customization Efforts:

The growing pediatric and neonatal patient base has generated need for tailored IV dressing solutions. Infants and children have fragile skin and lower tolerance for adhesive materials. The IV dressing market addresses this with products designed for smaller catheter sizes and gentler materials. These dressings also incorporate playful designs or colors to reduce pediatric anxiety. Healthcare providers rely on these products in neonatal intensive care units and outpatient pediatric clinics. It improves care quality while supporting emotional comfort. Design refinements focus on flexibility, skin breathability, and minimal residue. Customization helps differentiate offerings in a competitive landscape. Manufacturers use pediatric insights to guide future product development strategies.

Market Challenges Analysis:

High Cost of Advanced IV Dressings Limits Access in Budget-Constrained Settings:

Many healthcare institutions operate under strict financial constraints, especially in low- and middle-income countries. The IV dressing market faces resistance from providers who prioritize basic, low-cost solutions over advanced options. Antimicrobial and extended-wear dressings offer superior performance but come at higher upfront costs. Hospitals must balance infection control needs against tight procurement budgets. It reduces adoption outside of specialized units or high-risk departments. Smaller clinics and rural facilities often lack the funding to upgrade standard care protocols. Without reimbursement incentives or subsidy programs, decision-makers hesitate to invest. This limits product penetration and slows down innovation diffusion across the global market.

Adverse Skin Reactions and User Variability Impact Dressing Outcomes and Patient Comfort:

Despite technological improvements, dressings still cause skin irritation in some patients, especially those with allergies or compromised skin. The IV dressing market experiences pushback when patients report discomfort, itching, or dermatitis. Caregivers sometimes apply dressings incorrectly, which undermines their effectiveness. Hospitals must invest in staff training to ensure proper usage. It adds indirect cost and operational complexity. Variability in patient anatomy, skin type, and mobility further complicates consistent outcomes. Negative patient experiences discourage repeat use and reduce trust in new products. Manufacturers face the challenge of balancing adhesion strength with gentleness. These issues affect long-term adoption and brand reputation.

Market Opportunities:

Expanding Home Healthcare Sector Offers New Avenues for Dressing Innovation and Access:

The growth of home-based medical care opens opportunities for companies to design self-application-friendly dressing products. The IV dressing market can expand by offering user-centric, low-training dressings that support long-term IV use in non-clinical settings. It creates potential for partnerships with home healthcare providers and remote care platforms. Manufacturers can tap into growing demand for consumer-packaged sterile kits. These innovations support patient autonomy and reduce hospital burden.

Rising Awareness of Infection Control Drives Policy-Backed Adoption Across Developing Regions:

Government health campaigns and global health initiatives now focus on reducing hospital-acquired infections. The IV dressing market benefits from increased policy support and procurement reforms across Asia, Africa, and Latin America. It encourages local hospitals to adopt higher-quality dressings. It enables distributors to offer region-specific product lines with regulatory alignment. These developments create room for new entrants and scaled adoption in emerging economies.

Market Segmentation Analysis:

By Product Type

The IV dressing market includes a wide range of product types, each tailored to specific clinical requirements. Transparent film dressings lead the segment due to their ability to allow visual inspection of insertion sites. Antimicrobial dressings see growing demand in infection-prone environments. Foam and hydrocolloid dressings provide moisture management and comfort, ideal for long-term wear. Hydrogel dressings are used for healing support in complex wounds. Adhesive tapes and non-adherent dressings offer basic securement and skin-friendly alternatives. Translucent dressings remain viable for general-purpose, cost-sensitive applications.

- For instance, Hollister Incorporated reported that their hydrocolloid IV dressings improved patient comfort scores by 18% while maintaining securement for up to 7 days, supporting longer wear times in post-operative care units.

By Material

Polyurethane is the preferred material in the IV dressing market due to its breathability and adaptability to skin contours. Polyester and cotton continue to support basic applications in low-risk care. Rayon and acrylic materials are used for lightweight and durable dressing construction. Silicone is increasingly favored for its gentle adhesion, especially in pediatric and elderly populations. It enables manufacturers to balance secure fixation with minimal skin trauma.

- For instance, Smith & Nephew’s use of silicone-based adhesives in their Allevyn dressing line demonstrated a 40% reduction in skin stripping incidents among geriatric patients, significantly improving patient comfort while maintaining dressing integrity.

By End-Use

Hospitals dominate end-use adoption due to high IV line usage across intensive care, surgery, and emergency units. Clinics and ambulatory surgical centers require efficient dressings for outpatient procedures. Nursing homes and home care providers represent a growing segment, driven by rising chronic disease burdens and a shift toward decentralized care. It supports ongoing product demand across settings.

By Application

Securing IV catheters and lines remains the most common application, ensuring line stability and site cleanliness. Wound care and infection prevention follow as critical uses, particularly in high-risk patients. The IV dressing market continues to innovate in response to these evolving clinical priorities.

Segmentation:

By Product Type

- Transparent film dressings

- Translucent dressings

- Adhesive tapes

- Non-adherent dressings

- Hydrocolloid dressings

- Foam dressings

- Hydrogel dressings

- Antimicrobial dressings

By Material

- Polyurethane

- Polyester

- Cotton

- Rayon

- Silicone

- Acrylic

By End-Use

- Hospitals

- Clinics

- Ambulatory surgical centers

- Nursing homes

- Home care

By Application

- Securing IV catheters and lines

- Wound care

- Infection prevention at catheter sites

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Strong Clinical Infrastructure and High Adoption Rates

North America holds the largest share in the IV dressing market, accounting for approximately 37.7% of the global revenue. This dominance is driven by high volumes of surgical procedures, widespread use of intravenous therapies, and stringent infection control standards. The United States remains the key contributor, supported by a robust hospital network and favorable reimbursement frameworks. Leading manufacturers such as 3M and Cardinal Health maintain strong distribution across the region. The region’s early adoption of advanced antimicrobial and transparent dressings strengthens market leadership. It continues to invest in healthcare digitalization, supporting protocol adherence and dressing compliance.

Europe Maintains Strong Position Through Regulatory Focus and Aging Demographics

Europe represents the second-largest market with a share of approximately 27.4%. Countries like Germany, France, and the United Kingdom drive demand through high-quality care standards and centralized procurement systems. The IV dressing market in Europe benefits from a large elderly population requiring chronic IV access and post-operative care. Regulatory mandates across the European Union promote the use of advanced dressing materials to reduce hospital-acquired infections. Strong public healthcare funding supports the replacement of traditional gauze with transparent and antimicrobial dressings. It enables consistent adoption across hospitals, outpatient clinics, and long-term care facilities.

Asia-Pacific Emerges as the Fastest-Growing Market with Expanding Healthcare Access

Asia-Pacific accounts for approximately 23.8% of the global IV dressing market and shows the fastest growth rate. Rising healthcare expenditure, growing hospital infrastructure, and increased awareness of infection control practices drive demand. China, India, Japan, and South Korea lead regional expansion, supported by national programs aimed at improving patient safety. Local players and global companies invest in affordable dressing solutions tailored to public and private healthcare segments. The region sees increasing home care and ambulatory care penetration. It positions Asia-Pacific as a major growth engine for IV dressing manufacturers targeting high-volume markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3M

- Smith+Nephew

- Cardinal Health

- McKesson Corporation

- Covalon Technologies Ltd

- Richardson Healthcare, Inc.

- Medline Industries

- Paul Hartmann AG

- Lohmann & Rauscher (L&R)

- Mölnlycke Health Care AB

- DermaRite Industries, LLC

- BSN Medical

- DeRoyal Industries, Inc.

- Dynarex Corporation

- Komal Health Care Pvt. Ltd.

- Sentry Medical

- Shandong Dermcosy Medical Co., Ltd.

Competitive Analysis:

The IV dressing market is highly competitive, with both multinational corporations and regional players striving for market share through innovation, pricing, and distribution reach. Companies such as 3M, Smith+Nephew, Cardinal Health, and Mölnlycke dominate with comprehensive product portfolios and strong clinical partnerships. It favors firms offering antimicrobial features, extended wear time, and patient-friendly materials. Smaller players target niche segments like pediatric dressings or low-cost solutions for emerging markets. Strategic collaborations with hospitals and distributors strengthen competitive positions. Brands differentiate based on dressing durability, infection prevention performance, and regulatory compliance. The competitive intensity drives continuous R&D investment, especially in breathable and transparent designs.

Recent Developments:

- In 2025, 3M launched new advanced IV dressings featuring highly breathable polyurethane films with waterproof and antibacterial properties, aimed at improving patient comfort and reducing infection risks in intravenous catheter fixation applications. This product expansion aligns with the growing transparent IV dressing market.

Market Concentration & Characteristics:

The IV dressing market demonstrates moderate concentration, with a few global leaders holding significant revenue share across premium product segments. It includes a mix of established healthcare brands and regional players offering specialized or cost-effective solutions. The market favors companies with strong distribution capabilities and product innovation pipelines. It is characterized by high regulatory compliance, product performance differentiation, and demand across acute and long-term care. Barriers to entry remain moderate due to certification requirements and hospital procurement standards.

Report Coverage:

The research report offers an in-depth analysis based on type, material, end-use, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise for antimicrobial dressings across hospital and home care settings

- Transparent dressings will remain preferred for catheter site visibility

- Asia-Pacific will emerge as the fastest-growing regional market

- Integration of sensor-based smart dressings will gain commercial traction

- Customized pediatric and geriatric dressings will address niche care needs

- E-commerce channels will support growth in decentralized care delivery

- Polyurethane and silicone materials will dominate due to superior performance

- Regulatory approvals will shape product availability and regional competitiveness

- Public health initiatives will support wider adoption in developing economies

- Competitive innovation will focus on infection prevention and wear-time optimization