Market Overview:

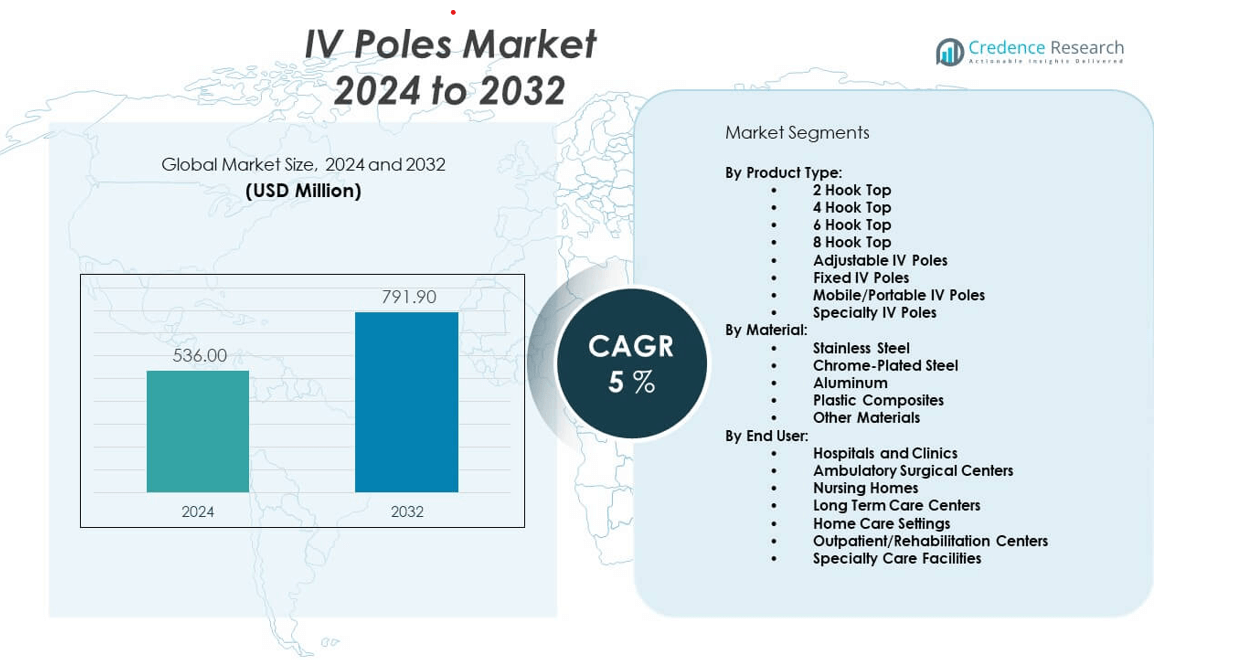

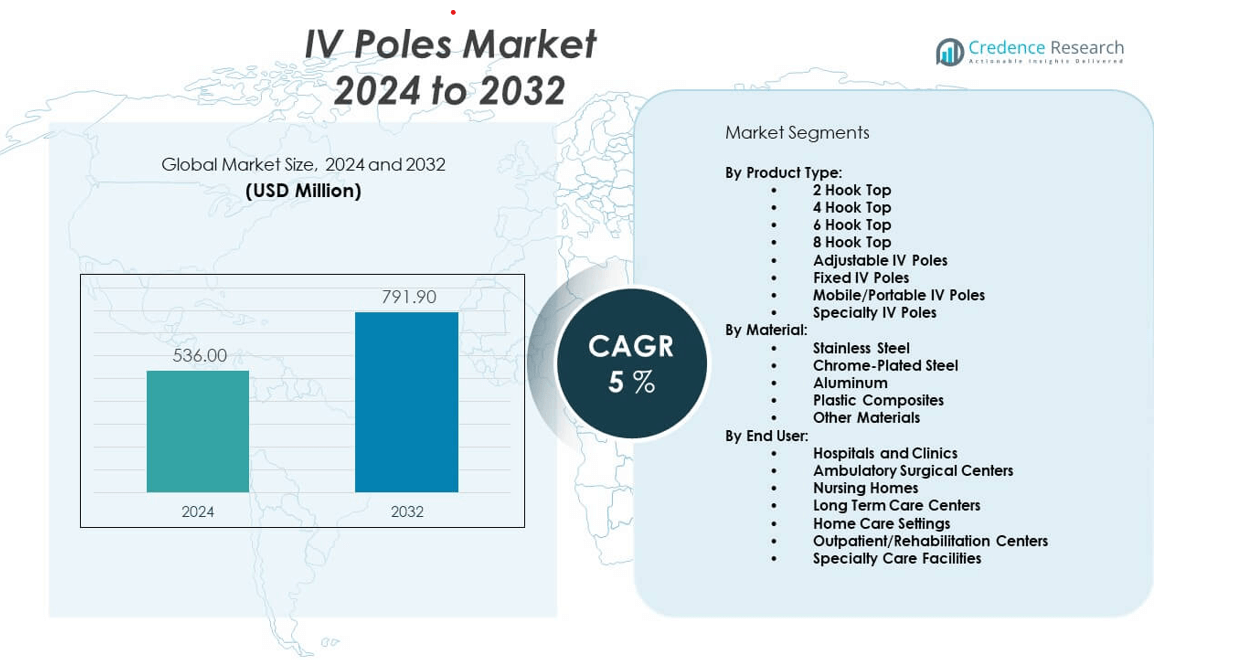

The IV poles market is projected to grow from USD 536 million in 2024 to an estimated USD 791.9 million by 2032, with a compound annual growth rate (CAGR) of 5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| IV Poles Market Size 2024 |

USD 536 million |

| IV Poles Market , CAGR |

5% |

| IV Poles Market Size 2032 |

USD 791.9 million |

The growth of the IV poles market is driven by the rising number of hospital admissions, increasing surgical procedures, and the growing elderly population requiring long-term intravenous therapies. Healthcare facilities are expanding their infrastructure to support better patient care, leading to higher demand for essential medical equipment like IV poles. Moreover, the focus on patient mobility and convenience in both hospital and homecare settings is driving innovation in IV pole designs, including foldable and adjustable variants. Manufacturers are also enhancing durability and integrating antimicrobial materials to align with infection control protocols, boosting adoption.

Regionally, North America leads the IV poles market due to its advanced healthcare infrastructure, higher healthcare spending, and strong presence of key manufacturers. Europe follows closely, benefiting from a growing elderly population and rising demand for home healthcare solutions. Meanwhile, the Asia-Pacific region is emerging as a high-growth market, driven by expanding healthcare facilities, increasing government healthcare investments, and a growing awareness of infection control standards in countries like India, China, and Southeast Asian nations.

Market Insights:

- The IV poles market was valued at USD 536 million in 2024 and is projected to reach USD 791.9 million by 2032, growing at a CAGR of 5% during the forecast period.

- Rising surgical volumes, longer hospital stays, and increased chronic disease prevalence drive demand for infusion support systems across care settings.

- Expansion of home healthcare and outpatient care models boosts the need for portable, lightweight, and adjustable IV poles.

- Cost constraints in public hospitals and inconsistent product quality in low-income regions hinder widespread adoption of advanced pole designs.

- North America holds the largest share of the IV poles market, supported by high healthcare expenditure and advanced infrastructure.

- Asia-Pacific emerges as the fastest-growing region due to healthcare facility expansion and rising patient volumes in countries like China and India.

- Market fragmentation and lack of global product standardization present challenges for cross-border supply and procurement efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Hospitalization Rates and Expanding Patient Care Infrastructure:

The steady increase in global hospitalization rates directly drives the need for essential patient care equipment. Hospitals require IV poles for fluid and medication administration across all departments, including ICUs and emergency rooms. The growing burden of chronic illnesses pushes healthcare systems to expand infrastructure, reinforcing the demand for IV poles. It plays a vital role in improving efficiency during inpatient care and emergency interventions. Healthcare facilities now prioritize mobility, hygiene, and safety, prompting continuous procurement of modern, user-friendly IV poles. The surge in surgical procedures and recovery ward requirements sustains this demand. Home healthcare growth also contributes to market expansion, with patients needing durable, transportable solutions. Public and private sector investments in hospital construction amplify procurement volume. The IV poles market benefits from these combined drivers.

- For instance, Drive DeVilbiss Healthcare’s latest mobile IV poles feature a lightweight aluminum alloy frame weighing under 4.5 kg, enhancing portability for clinical and home use. The surge in surgical procedures and recovery ward requirements sustains this demand. Home healthcare growth also contributes to market expansion, with patients needing durable, transportable solutions. Public and private sector investments in hospital construction amplify procurement volume. The IV poles market benefits from these combined drivers.

Aging Population Creating Persistent Demand for Infusion Support Devices:

The aging global population base has increased the demand for long-term and chronic care services. Elderly patients often require frequent IV infusions for nutrition, hydration, and medication management. Hospitals, nursing homes, and assisted living centers rely on IV poles to deliver consistent treatment to geriatric patients. It remains an indispensable support tool during rehabilitation and prolonged therapies. Governments worldwide are increasing geriatric care spending, boosting equipment acquisition rates. The IV poles market finds strong relevance in eldercare infrastructure expansion. Patients with reduced mobility need devices that can easily be maneuvered, prompting demand for lightweight and adjustable pole designs. Innovations in base stability and height flexibility respond to this demographic trend. It continues to gain from rising attention toward quality eldercare.

- For instance, AliMed Inc. offers an IV pole that includes a telescoping height adjustment range from 85 cm to 160 cm with a weighted base stability rating supporting up to 25 kg of mounted equipment, specifically targeting geriatric care facilities. Innovations in base stability and height flexibility respond to this demographic trend. It continues to gain from rising attention toward quality eldercare.

Increasing Preference for Home-Based Healthcare and Remote Monitoring:

Healthcare providers are shifting treatment protocols toward home-based care to reduce hospitalization costs. This transition fuels demand for portable and reliable IV poles that can be used outside clinical settings. It supports long-term treatment plans that involve IV therapy administered at home by caregivers or professionals. Patients recovering from surgeries or managing chronic conditions find value in home-use poles. Insurers now cover more at-home procedures, encouraging use of outpatient IV equipment. Lightweight, collapsible poles with adjustable features meet these growing residential care needs. The IV poles market captures share through innovations that suit compact, non-clinical environments. Manufacturers now emphasize easy assembly, antimicrobial coating, and patient-friendly designs. It aligns with the evolution of decentralized care models.

Public and Private Healthcare Investments Driving Medical Equipment Procurement:

Global health authorities and private entities are investing in modernizing healthcare facilities and expanding critical care infrastructure. These investments include large-scale procurement of medical devices such as IV poles for use in both public hospitals and private clinics. It directly links with budget allocations for surgical equipment and patient treatment kits. Emergency preparedness strategies demand high inventory levels of infusion support tools. Bulk tenders from government health programs secure consistent demand over multiple fiscal cycles. The IV poles market grows alongside national healthcare capacity building programs. Modern hospital design now integrates specialized units that require varying pole configurations. Procurement departments seek suppliers offering customization, durability, and hygiene compliance. It responds positively to rising demand for scalable and compliant product portfolios.

Market Trends:

Adoption of Antimicrobial Coatings and Hygiene-Compliant Designs:

Manufacturers increasingly integrate antimicrobial surface treatments into IV poles to prevent hospital-acquired infections. The IV poles market responds to stringent hygiene regulations by enhancing material safety and reducing bacterial retention. Facilities prioritize equipment that minimizes contamination risks. Stainless steel and powder-coated finishes remain popular due to their durability and easy cleaning. Hospitals now standardize infection-control-compliant accessories, including poles, to meet regulatory audits. Manufacturers develop smooth surface finishes to eliminate bacterial hiding points. It encourages use in high-risk departments such as oncology, surgery, and ICUs. Demand is rising for pre-assembled, sealed designs to minimize exposure. These features align with global infection prevention strategies.

- For instance, 3M Healthcare, through its spun-off entity Solventum, applies advanced antimicrobial coatings reducing surface bacterial load by over 99.9% within two hours, validated in independent lab testing, targeting use in high-risk units such as oncology and ICU

Integration of Smart Technologies and Device Compatibility Features:

Healthcare providers seek IV poles that can support not only infusion pumps but also compatible electronic monitoring equipment. It now includes utility trays, power ports, and modular attachments for broader functionality. The IV poles market is seeing design shifts that incorporate smart technology mounts and flexible arm holders. These poles facilitate multi-device management at patient bedsides, improving workflow. Hospitals require standardized poles that integrate seamlessly with electronic medical devices. It allows efficient data access and device recharging at the point of care. Height calibration mechanisms and weight sensors improve safety in handling. Smart compatibility drives procurement decisions in tech-forward facilities. It creates differentiation among premium product lines.

- For instance, Hill-Rom’s recent IV pole models incorporate embedded weight sensors accurate to within 0.1 kg to prevent equipment overload and feature integrated USB power hubs supplying up to 60W, enabling simultaneous charging of multiple infusion pumps. Smart compatibility drives procurement decisions in tech-forward facilities. It creates differentiation among premium product lines.

Focus on Ergonomic Designs and Patient Mobility Enhancement:

Manufacturers continue redesigning IV poles for ergonomic handling, reduced physical strain, and enhanced stability. Facilities increasingly seek poles with five-wheel bases, silent castors, and adjustable locking systems. The IV poles market responds to user feedback by incorporating lightweight materials and intuitive height adjustment features. Nurses and caregivers demand effortless maneuverability through crowded hospital corridors. Ergonomic grips and handle-friendly contours improve transport efficiency. It helps minimize physical fatigue during frequent repositioning. Pediatric and bariatric-specific designs also gain popularity. Mobility support drives procurement preferences in rehabilitation and recovery wards. This ergonomic trend reinforces user comfort and patient safety.

Customization of IV Poles for Specialized Clinical Applications:

Hospitals and specialty clinics now require IV poles tailored for specific departments and procedures. It includes dual-hook, four-hook, and pump-compatible configurations designed for intensive or neonatal care. The IV poles market benefits from rising demand for department-specific solutions. Oncology, emergency care, and dialysis units require poles that accommodate higher infusion volumes. Adjustable arms, IV bag organizers, and load-bearing enhancements meet those operational needs. Manufacturers offer color-coded options for easy department identification. It supports faster workflows and reduces cross-departmental errors. Custom-built designs contribute to long-term vendor partnerships. This trend drives repeat procurement and brand loyalty in large healthcare networks.

Market Challenges Analysis:

Inconsistent Product Quality and Lack of Standardization Across Regions:

The IV poles market faces challenges due to inconsistent manufacturing quality and varying product standards, especially across emerging economies. Procurement decisions often depend on cost over quality, leading to usage of suboptimal poles in critical care settings. It impacts patient safety and equipment longevity. The absence of universal standards for durability, load-bearing capacity, and hygiene compliance creates variability. This limits interoperability across hospitals and hinders scalability for global suppliers. Small manufacturers dominate regional markets, making it difficult to enforce uniform safety benchmarks. Health institutions struggle with non-compatible pole accessories that slow down workflows. Regulatory oversight remains weak in certain regions, adding to procurement inefficiencies. Market fragmentation dilutes brand trust and supplier accountability. These challenges stall uniform adoption of best-in-class designs.

Cost Sensitivity in Budget-Constrained Healthcare Facilities:

Many hospitals, especially in developing countries, operate under tight capital expenditure budgets, limiting their ability to procure advanced IV poles. The IV poles market finds it difficult to scale premium variants in price-sensitive regions. Facilities often opt for basic, low-cost poles without advanced features or safety enhancements. It restricts market penetration for high-margin, innovative products. Public hospitals face lengthy tender cycles, delaying procurement of urgently needed equipment. Repair and maintenance budgets also remain constrained, increasing the risk of continued use of worn-out poles. Vendors face resistance when introducing upgrades or accessories priced above standard models. Price-driven purchasing limits demand for ergonomic, antimicrobial, or technology-integrated variants. The imbalance between functionality and affordability remains a critical barrier.

Market Opportunities:

Growing Demand for Pediatric and Geriatric Care-Centric IV Pole Designs:

Demand is rising for specialized IV poles designed specifically for pediatric and geriatric use cases. These segments require height-adjustable, safe, and lightweight poles with added stability. It opens new product innovation and marketing avenues for manufacturers. Healthcare facilities seek poles with specific features like toy mounts for children or extended reach handles for elderly caregivers. This unmet demand allows manufacturers to build differentiated portfolios that cater to evolving care environments. The IV poles market stands to gain from customized, age-appropriate product lines.

Expansion of Outpatient Clinics and Daycare Surgery Centers:

The increasing number of outpatient clinics and daycare surgery centers globally supports new procurement channels. These facilities require compact, easy-to-clean IV poles optimized for short-term use. It encourages vendors to develop transportable, foldable models that balance quality with portability. Private sector investment in decentralized care infrastructure enhances purchasing capacity. This shift creates a niche market for manufacturers focused on space-saving designs. The IV poles market can scale by aligning products with these expanding low-acuity care settings.

Market Segmentation Analysis:

By Product Type

The IV poles market features a diverse range of configurations designed for different clinical needs. 2 Hook Top and 4 Hook Top poles remain standard in general medical and emergency settings due to their simplicity and reliability. 6 Hook Top and 8 Hook Top models are preferred in intensive care units and oncology wards, where multiple IV lines are required simultaneously. Adjustable IV poles offer height flexibility and are increasingly used in multi-specialty hospitals. Fixed IV poles serve well in settings requiring maximum stability. Mobile/Portable IV poles are gaining traction in home care, outpatient, and day surgery centers due to their lightweight and maneuverable design. Specialty IV poles meet the needs of niche areas such as pediatric, neonatal, or dialysis care, often featuring added attachments or safety features.

- For instance, Medline Industries’ adjustable poles provide hook configurations up to 8 hooks and a height adjustment range spanning 70 cm to 180 cm, designed to meet ICU demands in over 300 hospitals globally. Specialty IV poles meet the needs of niche areas such as pediatric, neonatal, or dialysis care, often featuring added attachments or safety features.

By Material

Material selection in the IV poles market determines strength, hygiene, and portability. Stainless steel remains the dominant choice due to its durability, corrosion resistance, and ease of sterilization. Chrome-plated steel is used for cost-sensitive applications with moderate durability requirements. Aluminum offers lightweight performance ideal for mobile and home use. Plastic composites are emerging in disposable or infection-sensitive environments. Other materials like carbon steel and coated lightweight alloys support innovation in structural performance and ergonomic handling.

- For instance, Provita Medical GmbH & Co. KG’s newly launched aluminum IV poles reduce total pole weight by 30% without compromising strength, improving user ergonomics in mobile care units.

By End User

Demand varies across end users. Hospitals and clinics lead in procurement, requiring high-volume, multi-use models. Ambulatory surgical centers and rehabilitation units prefer compact, versatile designs. Nursing homes and long-term care centers seek poles with stability and patient-friendly features. Home care and specialty care facilities prioritize mobility and ease of use. The IV poles market adapts its offerings to align with each segment’s operational needs.

Segmentation:

By Product Type:

- 2 Hook Top

- 4 Hook Top

- 6 Hook Top

- 8 Hook Top

- Adjustable IV Poles

- Fixed IV Poles

- Mobile/Portable IV Poles

- Specialty IV Poles

By Material:

- Stainless Steel

- Chrome-Plated Steel

- Aluminum

- Plastic Composites

- Other Materials

By End User:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Nursing Homes

- Long Term Care Centers

- Home Care Settings

- Outpatient/Rehabilitation Centers

- Specialty Care Facilities

By Geography/Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Strong Infrastructure and High Institutional Spending

North America holds the largest share in the IV poles market, accounting for approximately 35.5% of the global revenue. The region benefits from well-established healthcare infrastructure, high hospitalization rates, and consistent capital expenditure on medical equipment. Hospitals, clinics, and outpatient centers across the U.S. and Canada frequently update equipment, driving strong replacement demand. The rise in home healthcare and long-term care facilities has further increased the need for mobile and ergonomic IV pole designs. Market players benefit from centralized procurement models and strict compliance standards, which favor durable and hygienic materials. The IV poles market continues to expand in North America due to innovation and premium product adoption.

Asia-Pacific Emerges as the Fastest-Growing Region with Expanding Healthcare Access

Asia-Pacific holds a market share of approximately 27.8%, driven by rapid healthcare infrastructure development and population growth. Countries like China, India, Japan, and South Korea invest heavily in hospitals, ambulatory centers, and public health initiatives. Demand for basic and mid-range IV poles remains high due to budget-conscious procurement policies and rising patient volumes. It gains further traction from government efforts to expand rural healthcare access and elderly care infrastructure. Manufacturers in the region are increasingly offering low-cost, locally produced poles, making them accessible to tier-2 and tier-3 cities. The IV poles market in Asia-Pacific grows steadily through both volume-driven demand and improving care standards.

Europe, Latin America, and Middle East & Africa Show Stable and Niche Growth

Europe represents about 21.3% of the global IV poles market, supported by universal healthcare systems and a growing elderly population. Countries such as Germany, France, and the UK prioritize infection control and product compliance, favoring stainless steel and antimicrobial-coated variants. Latin America holds around 8.7% share, with Brazil and Mexico leading due to expanding private healthcare facilities and medical tourism. The Middle East & Africa region contributes approximately 6.7%, driven by gradual improvements in hospital infrastructure and public health investments. It continues to see growing demand in urban hospitals, although overall adoption remains lower due to economic constraints. Regional suppliers focus on meeting baseline quality and cost expectations in these emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cardinal Health

- 3M Healthcare (including Solventum)

- Medline Industries Inc.

- AliMed Inc.

- Drive DeVilbiss Healthcare

- Hill-Rom

- Invacare Corporation

- Provita Medical GmbH & Co. KG

- Promotal SAS

- medifa-hesse GmbH & Co. KG

Competitive Analysis:

The IV poles market is moderately fragmented, with a mix of global medical device leaders and specialized regional manufacturers. Key players such as Cardinal Health, Medline Industries, and 3M Healthcare maintain strong market positions through broad product portfolios and well-established distribution networks. Companies like Hill-Rom and Invacare Corporation emphasize ergonomic and specialty product lines tailored for acute and long-term care settings. It continues to see competition centered on material durability, design versatility, and compliance with hygiene standards. Emerging players compete by offering cost-effective and customizable solutions for mid-tier hospitals and outpatient facilities. Manufacturers invest in product innovation, targeting mobile and multi-functional designs to capture growing demand from home care and ambulatory sectors. Strategic partnerships with healthcare providers and bulk procurement contracts further shape competitive dynamics.

Recent Developments:

- In November 2024, Cardinal Health announced two strategic acquisitions to enhance its portfolio and growth in specialty and at-home solutions. The company acquired a majority stake (71%) in GI Alliance, a leading gastroenterology management services organization, for approximately $2.8 billion in cash. Additionally, Cardinal Health acquired Advanced Diabetes Supply Group (ADSG), a prominent diabetic medical supplies provider, for about $1.1 billion in cash, merging ADSG with its at-Home Solutions business to grow that segment.

- In April 2024, 3M completed the spin-off of its healthcare business, launching the independent company Solventum Corporation, which trades on the New York Stock Exchange under the ticker SOLV. This spinoff positioned Solventum to pursue dedicated growth and innovation in healthcare products, including those relevant to clinical safety and wound care.The announcement of the Solventum name and spin-off plan was initially made in late 2023, with the official launch in early 2024.

- Medline Industries expanded its health plans business by acquiring United Medco, a national provider of supplemental benefits and member engagement solutions. This acquisition, announced in January 2024, aims to strengthen Medline’s distribution capabilities and broaden its offerings in the evolving post-acute care space

Market Concentration & Characteristics:

The IV poles market exhibits moderate concentration, with a few dominant players holding significant global shares. It is characterized by product standardization in hospitals, growing customization in home and specialty care, and rising demand for infection-control features. Competitive differentiation centers around material innovation, mobility enhancements, and design versatility. Regulatory compliance and bulk purchasing patterns influence supplier selection, particularly in institutional settings. Smaller firms gain foothold by addressing localized procurement needs and offering lower-cost variants without compromising basic standards.

Report Coverage:

The research report offers an in-depth analysis based on type, material, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will grow across outpatient, ambulatory, and home care settings.

- Hospitals will prioritize ergonomic, mobile, and infection-resistant designs.

- Technological integration will support smart accessory compatibility.

- Antimicrobial coatings will become a product standard in acute care.

- Asia-Pacific will lead volume growth due to expanding infrastructure.

- Customization will rise for pediatric, bariatric, and specialty care poles.

- Procurement models will favor long-term supplier partnerships.

- Product durability and ease of disinfection will drive design changes.

- Regional manufacturers will expand with cost-competitive offerings.

- Sustainability in materials will influence new product development.