Market Overview:

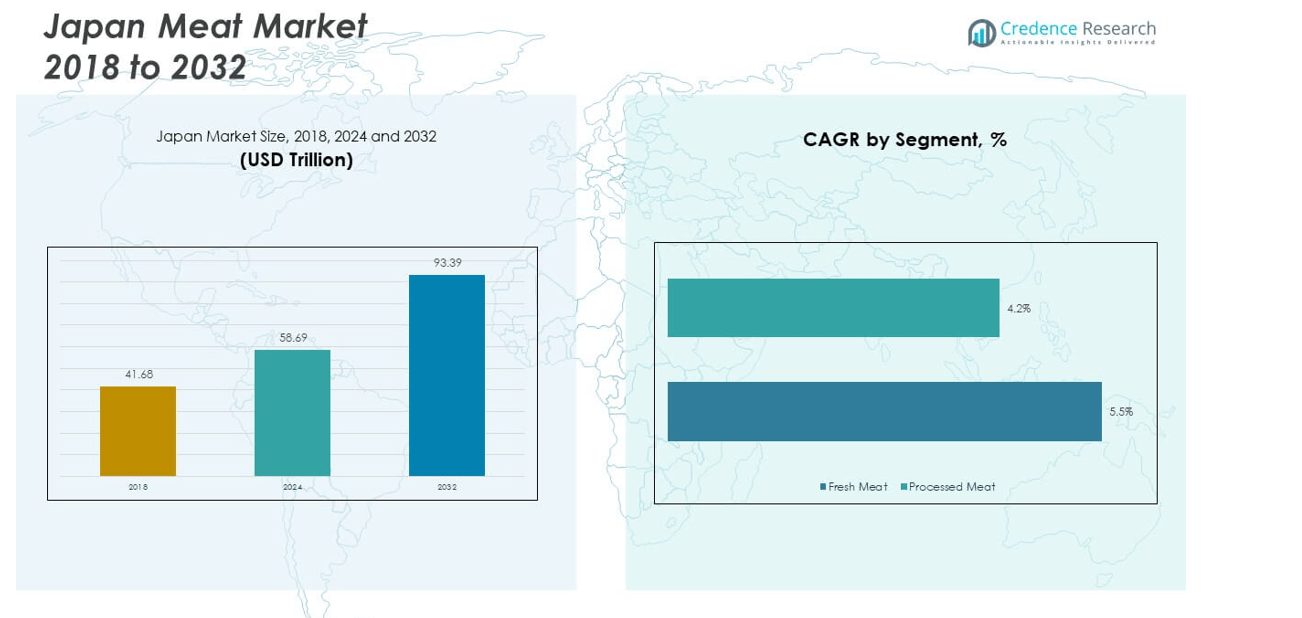

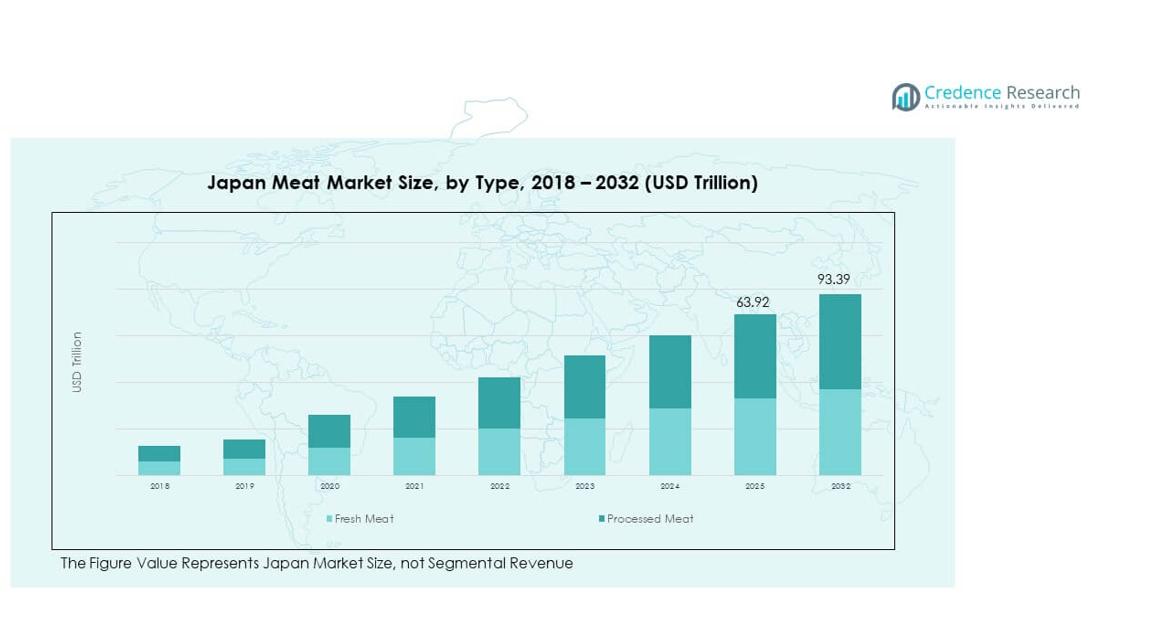

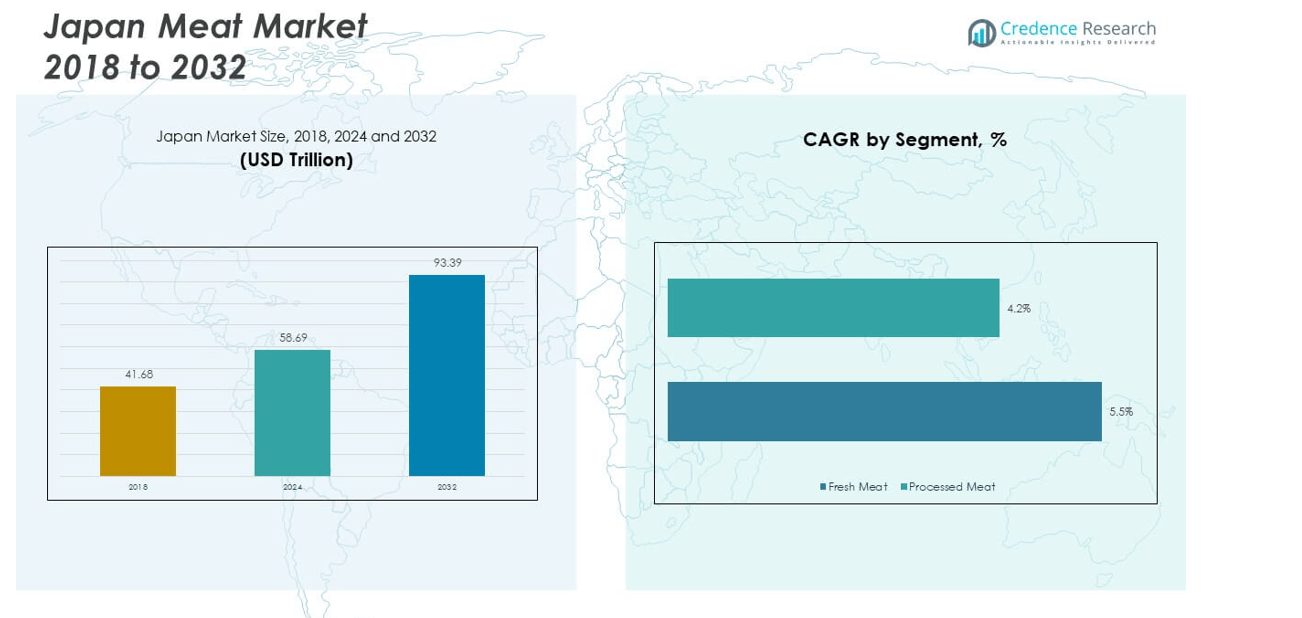

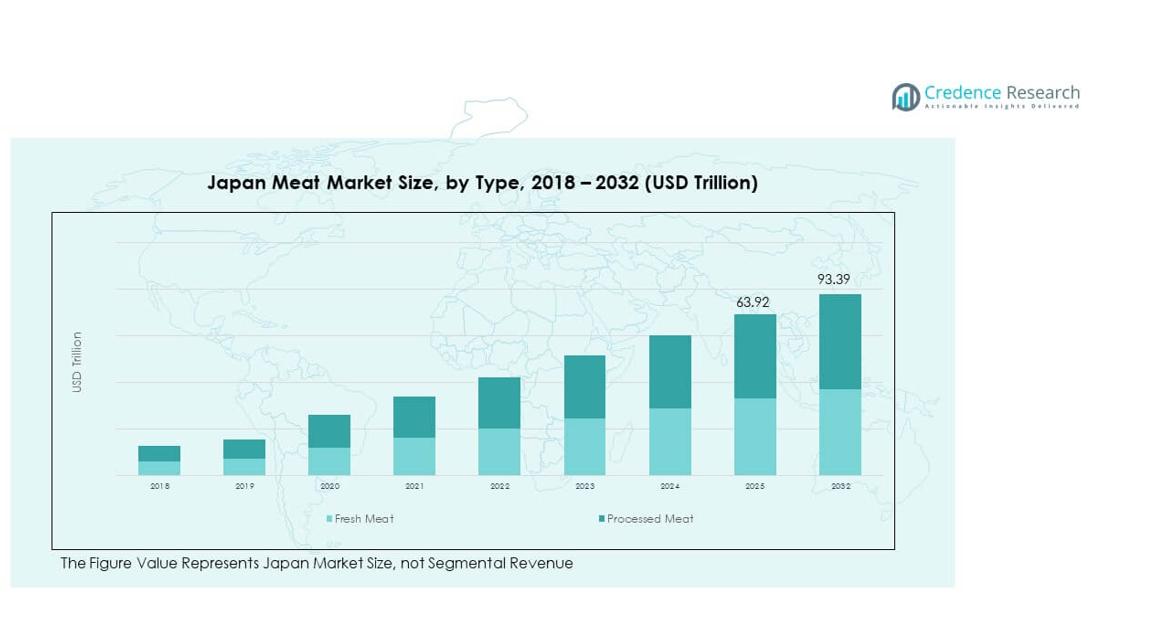

The Japan Meat Market size was valued at USD 41.68 million in 2018 to USD 58.69 million in 2024 and is anticipated to reach USD 93.39 million by 2032, at a CAGR of 5.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Meat Market Size 2024 |

USD 58.69 million |

| Japan Meat Market, CAGR |

5.56% |

| Japan Meat Market Size 2032 |

USD 93.39 million |

Growth in the Japan Meat Market is supported by rising demand for protein-rich diets, premiumization of meat categories, and technological advancements in processing. Consumers are showing stronger preference for high-quality beef, pork, and poultry products, while convenience-driven lifestyles boost adoption of processed and ready-to-cook meat. It also benefits from government support for food safety regulations, strict quality checks, and traceability systems that increase consumer trust. Expanding retail networks, including supermarkets and online platforms, further drive accessibility and availability across demographics.

Regionally, the market reflects strong dominance of urban hubs with higher consumption patterns and advanced retail penetration. Kanto leads with its dense population and metropolitan demand, while Kansai gains strength through premium beef offerings such as Kobe beef, which hold global recognition. Kyushu and surrounding regions serve as important production bases for poultry and pork, ensuring domestic supply stability. Emerging cities across Japan are witnessing stronger adoption of processed and convenience-based meat formats. It highlights a balance between traditional dietary preferences and modern consumption trends across regions.

Market Insights

- The Japan Meat Market size was valued at USD 41.68 million in 2018, grew to USD 58.69 million in 2024, and is projected to reach USD 93.39 million by 2032, expanding at a CAGR of 5.56%.

- Kanto holds 38%, Kansai 27%, and Kyushu 35% of the market, with Kanto leading due to metropolitan demand, Kansai supported by premium beef brands, and Kyushu driven by pork and poultry production hubs.

- Kyushu emerges as the fastest-growing subregion with its 35% share, supported by domestic farming strength, pork exports, and strong government support for supply chain resilience.

- Fresh meat accounts for 62% of the market, reflecting strong consumer preference for authenticity, natural taste, and traditional culinary use.

- Processed meat contributes 38%, showing momentum in urban markets where convenience, ready-to-cook meals, and packaging innovation drive demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand For High Quality And Protein-Rich Meat Products Among Health-Conscious Consumers

The Japan Meat Market benefits from increasing demand for high-protein diets driven by urban lifestyles. Consumers prefer lean cuts and premium categories such as wagyu beef, supported by rising income levels. It reflects strong consumer focus on health, nutrition, and food safety. Awareness campaigns about protein benefits accelerate product adoption across different demographics. Modern retail formats and specialty stores expand access to diverse meat products. Foodservice operators strengthen this growth by offering premium meat dishes in restaurants and hotels. The shift toward functional foods and balanced nutrition further strengthens the role of meat. Continuous product innovation by suppliers sustains consumer confidence.

- For example, in April 2025, IntegriCulture unveiled seven prototypes of cultivated duck liver at a Tokyo event, including restaurant dishes and packaged products, supported by Japan’s Ministry of Agriculture, Forestry and Fisheries. This milestone showcased Japan’s progress in premium alternative meats for foodservice and retail.

Government Support And Strict Food Safety Regulations Enhancing Consumer Trust

The Japan Meat Market gains momentum from strict government regulations that ensure product safety and traceability. Authorities emphasize monitoring systems covering slaughtering, packaging, and retail operations. It builds higher trust among consumers who are conscious of food origins. Advanced inspection frameworks improve quality consistency and market transparency. Certification programs increase appeal for premium and organic meat categories. Retailers benefit from clear compliance standards that help reassure customers. Food processors align with government norms to expand market credibility. Industry collaborations on safety practices reinforce long-term growth stability.

Technological Advancements In Processing And Packaging Improving Shelf Life And Efficiency

Technological innovation plays a major role in driving expansion across the Japan Meat Market. Advanced processing machinery enhances yield while reducing manual intervention. It ensures consistent quality across large-scale production units. Modified atmosphere packaging and vacuum sealing improve product shelf life. Automated storage and cold-chain logistics enhance supply reliability. These developments support the growth of ready-to-eat and convenience-based meat categories. Manufacturers use smart labeling for transparency on nutrition and sourcing. Continuous R&D investment creates sustainable and efficient processing solutions. Integration of robotics further optimizes hygiene and throughput levels.

Expansion Of Retail Networks And Changing Consumer Preferences Toward Convenient Formats

The Japan Meat Market benefits from retail modernization and expansion of supermarkets and online channels. Consumers increasingly prefer convenient formats such as pre-cut, marinated, and ready-to-cook meat. It reflects lifestyle changes influenced by urbanization and smaller household sizes. E-commerce platforms create new growth avenues by offering doorstep delivery. Food delivery services expand access to premium meat products for busy consumers. Modern packaging ensures safety and convenience during transport. Retailers adapt assortments to meet varied consumer preferences in different cities. These developments strengthen market penetration across traditional and modern channels.

- For instance, in April 2025, AEON launched three new “TOPVALU Best Price” frozen one-plate meals featuring ready-to-eat Japanese and Western dishes, available at approximately 2,900 stores nationwide including AEON, AEON Style, and MaxValu outlets. The line was specifically designed for household convenience and immediate microwave preparation, reflecting the retailer’s response to changing lifestyles and demand for accessible premium meat meal options.

Market Trends

Growth In Plant-Based Alternatives Complementing Traditional Meat Consumption Patterns

The Japan Meat Market observes a rise in demand for plant-based meat alternatives alongside traditional categories. Urban consumers seek balance between sustainability and taste preferences. It reflects the influence of global dietary trends within domestic markets. Major retailers introduce hybrid products that mix plant proteins with meat. Foodservice operators innovate with plant-based menus appealing to younger demographics. This trend complements rather than replaces core meat demand. Investments in R&D enhance taste and texture of substitutes. The dual growth path strengthens overall protein market development.

Increasing Focus On Premiumization And Niche Meat Segments Across Foodservice Sector

Premiumization strongly influences the Japan Meat Market, with demand for wagyu beef and heritage pork rising. Consumers value authenticity, traceability, and regional branding. It strengthens local farmers who highlight specialty breeds and unique flavors. High-end restaurants use storytelling to create stronger connections with diners. Specialty meat imports diversify offerings beyond domestic supply. This trend supports higher margins for suppliers catering to premium customers. Chefs experiment with niche meats to expand menu creativity. Long-term focus remains on quality over quantity in consumer decision-making.

- For instance, in July 2025, Starzen Co., Ltd. launched the AOMORI GOLD Japanese wagyu beef brand, graded A4 or higher and processed at the Sannohe Beef Center in Aomori Prefecture, for export. This brand maintains rigorous artisanal and hygiene standards, and represents a new addition to Starzen’s export offerings. The brand launch is verified through Starzen’s own press documentation.

E-Commerce Expansion Creating New Sales Channels For Fresh And Frozen Meat Products

The Japan Meat Market experiences strong momentum from online grocery platforms and digital delivery models. Consumers embrace subscription services offering regular meat deliveries. It reduces dependence on traditional wet markets and small shops. Cold-chain improvements enable secure transport of fresh and frozen products. It provides flexibility for households in urban areas with limited time. Online reviews and ratings influence consumer choice of meat brands. Retailers expand into regional markets through online sales channels. This trend accelerates convenience-driven consumption across the country.

- For example, in August 2024, Rakuten Group, Inc. announced the rebranding of its online grocery service to “Rakuten Mart,” offering fresh, frozen, and refrigerated foods. Its temperature-controlled fulfillment centers in the Tokyo metropolitan and Kansai regions can process up to 70,000 orders per day, as confirmed in the company’s official press release.

Innovation In Ready-To-Eat And Convenience-Based Meat Products For Busy Urban Consumers

Ready-to-eat innovations reshape the Japan Meat Market by meeting demand from working professionals. Packaged meals include grilled meats, skewers, and high-protein snacks. It reflects the strong influence of urban lifestyle and long working hours. Food manufacturers expand product ranges for lunchbox-friendly portions. Convenience stores stock innovative meat options for quick purchases. Packaging technology ensures freshness while enhancing portability. This trend drives strong loyalty among young and middle-aged consumers. Suppliers use product differentiation to target niche groups like fitness enthusiasts.

Market Challenges Analysis

Rising Import Dependence And Vulnerability To Global Supply Chain Disruptions

The Japan Meat Market faces structural challenges due to its reliance on imported beef, pork, and poultry. It exposes the sector to risks linked with currency fluctuations and global trade disputes. Import disruptions from key suppliers such as the U.S. and Australia create instability. It pressures local processors and retailers to manage volatile pricing. Domestic production cannot fully meet growing demand. Rising transportation costs also strain profitability across the value chain. Dependence on external sources limits flexibility in market strategy. Maintaining balance between imports and domestic supply remains complex.

High Production Costs And Labor Shortages Affecting Local Meat Industry Competitiveness

The Japan Meat Market encounters difficulties linked with rising production costs and limited workforce availability. It challenges small and medium-scale farmers operating under tight margins. Feed costs, energy prices, and compliance requirements increase overall expenses. Modernization requires large capital investment that not all producers can manage. Labor shortages impact efficiency in processing plants and farms. It restricts growth capacity despite rising consumer demand. Rural depopulation reduces available workforce for agriculture and meat production. This structural challenge demands long-term solutions for industry resilience.

Expanding Export Potential For Specialty And Premium Meat Categories In Global Markets

The Japan Meat Market holds strong opportunities through export of wagyu beef and premium cuts. International demand for Japanese meat products continues to rise in Asia, Europe, and North America. It benefits from the reputation of quality, taste, and traceability associated with Japanese farming practices. Trade agreements enhance access to global buyers. Suppliers position wagyu as a luxury product appealing to high-income groups. Expanding certifications build trust among overseas consumers. Tourism promotion also enhances brand image for Japanese meat abroad. Export growth diversifies revenue streams for local farmers.

Integration Of Digital Platforms And Smart Supply Chains To Enhance Efficiency And Reach

The Japan Meat Market has opportunities in adopting digital tools and advanced logistics for greater efficiency. E-commerce integration expands market access for both domestic and global consumers. It enables better customer engagement through data-driven insights. Smart cold-chain systems reduce waste and ensure consistent quality. Automation within warehouses supports faster deliveries. Cloud-based platforms connect farmers, processors, and retailers seamlessly. These developments support scalable operations for future growth. It helps the industry align with changing consumer expectations in an increasingly digital economy.

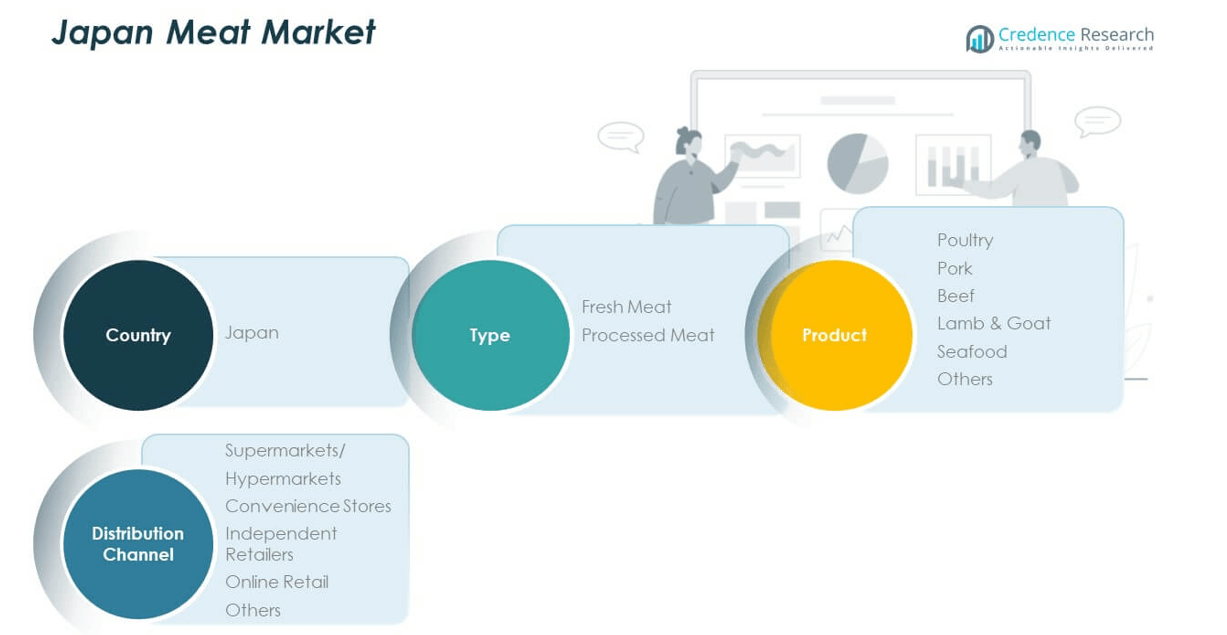

Market Segmentation Analysis

By type, the Japan Meat Market is divided into fresh meat and processed meat. Fresh meat dominates household consumption due to cultural preference for authenticity and natural taste, while processed meat shows strong growth in urban centers where ready-to-cook and convenience categories align with fast-paced lifestyles. It benefits from continuous innovation in packaging that extends shelf life and ensures quality.

- For instance, NH Foods the largest supplier of fresh and processed meat in Japan—reported that its business profit increased to ¥44.9 billion in fiscal 2023 (ending March 2024), up from ¥25.6 billion the previous year, credited in part to product mix enhancement and investments in processing and packaging technologies.

By product, poultry holds a leading position, supported by affordability and consistent demand across foodservice and retail. Pork remains a traditional favorite, particularly in dishes unique to Japanese cuisine, while beef, especially wagyu, drives premiumization trends across domestic and international markets. Seafood retains a vital role in balanced diets, reflecting Japan’s deep culinary heritage, while lamb, goat, and other proteins appeal to niche consumer groups. It showcases a diverse product structure catering to multiple demographics and consumption occasions.

- For instance, Jukuho Farm won the Gold Medal at the World Steak Challenge 2024 in Europe for its Japanese beef, signifying international recognition for technological achievement in meat processing and freshness standards that meet rigorous export criteria.

By distribution channel, supermarkets and hypermarkets remain dominant due to extensive availability and strong trust in branded supply chains. Convenience stores capture significant share by offering ready-to-eat and pre-packed options for urban consumers. Independent retailers maintain presence in regional markets where personalized service attracts loyal customers. Online retail grows rapidly, supported by cold-chain expansion and rising consumer comfort with digital platforms. It reflects the market’s shift toward hybrid distribution models that balance tradition and technology.

Segmentation

By Type

- Fresh Meat

- Processed Meat

By Product

- Poultry

- Pork

- Beef

- Lamb & Goat

- Seafood

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Independent Retailers

- Online Retail

- Others

By Country

Regional Analysis

Kanto Region

The Kanto region dominates the Japan Meat Market, holding 38% share due to its large population base and concentration of urban centers such as Tokyo and Yokohama. Consumer demand is driven by diverse culinary preferences, with strong traction for premium beef, pork, and poultry. It benefits from advanced cold-chain logistics and the presence of major supermarkets and convenience stores. Restaurants and foodservice operators in metropolitan areas heavily influence meat consumption trends. High disposable incomes support growing demand for imported premium meat varieties. Retail and e-commerce channels play a crucial role in expanding reach within this subregion.

Kansai Region

he Kansai region contributes 27% share of the Japan Meat Market, supported by cities such as Osaka, Kyoto, and Kobe. Local preferences highlight beef, particularly Kobe beef, which holds global recognition for quality and authenticity. It reflects strong consumer attachment to heritage meat products. Modern retail formats are well established, enhancing access to fresh and processed meat categories. Regional branding initiatives support premium positioning, particularly for wagyu. Food tourism also strengthens demand, with Kansai’s cuisine culture influencing both domestic and international consumption patterns.

Kyushu and Other Regions

Kyushu and other regions collectively account for 35% share of the Japan Meat Market, with Kyushu recognized as a key production hub for pork and poultry. It benefits from proximity to domestic farming clusters, ensuring a reliable supply base. Consumer demand in these regions is shaped by a mix of traditional diets and modern convenience-oriented meat products. Regional exporters play a growing role in supplying international markets, particularly wagyu and pork. Online retail penetration is expanding across smaller cities, creating fresh demand opportunities. Strong domestic farming support policies sustain regional competitiveness against imports.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Prima Meat Packers Group

- Japanmeat Co., Ltd.

- Nippon Ham Co., Ltd.

- Itoham Foods Inc.

- NH Foods Ltd.

- Mitsubishi Shokuhin Co., Ltd.

- Kanematsu Corporation

- Marudai Food Co., Ltd.

- Nishi-Nippon Best Packer Co., Ltd.

- Kamifurano Farm Ltd.

Competitive Analysis

The Japan Meat Market is characterized by a mix of established domestic companies and diversified conglomerates. Leading players such as NH Foods Ltd., Nippon Ham Co., Ltd., and Itoham Foods Inc. dominate market share with extensive distribution networks and broad product portfolios. It reflects strong competition across fresh, processed, and premium meat categories. Companies focus on maintaining brand loyalty through quality assurance, product innovation, and traceability programs. International trade agreements create opportunities for expansion of premium exports like wagyu beef. Key players also invest in digital platforms and automation to strengthen supply chains. Competition intensifies as regional processors and niche producers highlight specialty meats, reinforcing a dynamic and evolving market landscape.

Recent Developments

- In August 2025, Itoham Yonekyu Holdings demonstrated significant momentum in Japan’s processed meat sector, reporting powerful first-quarter fiscal 2026 results with revenue of JP¥297.1 billion and a net income of JP¥6.38 billion, strengthening its position in both fresh and processed meats for supermarket and retailer distribution channels.

- In August 2025, Japanese beef bowl chain Sukiya announced its first price cuts in 11 years, reducing the price of beef bowls and related dishes starting September 4, 2025, across all its convenience and independent retail outlets, in response to changing market conditions and consumer demand.

Report Coverage

The research report offers an in-depth analysis based on Type, Product and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan Meat Market will experience strong growth driven by rising demand for premium categories such as wagyu beef.

- It will see wider adoption of processed meat supported by evolving consumer lifestyles and convenience-driven diets.

- E-commerce and digital retail platforms will expand distribution reach and reshape consumer purchasing behavior.

- Technological advancements in cold-chain logistics and packaging will strengthen product safety and freshness.

- Export opportunities will increase, especially for high-value segments like wagyu, boosting international presence.

- Sustainability and traceability programs will gain importance, reinforcing consumer trust and brand loyalty.

- Urbanization and smaller household structures will expand demand for ready-to-eat and portioned meat products.

- Rising food tourism will enhance visibility for regional specialties and further elevate premium branding.

- Strategic investments in automation and robotics will improve processing efficiency and reduce labor dependency.

- Collaborations between domestic producers and global players will create new growth channels across the market.