Market Overview:

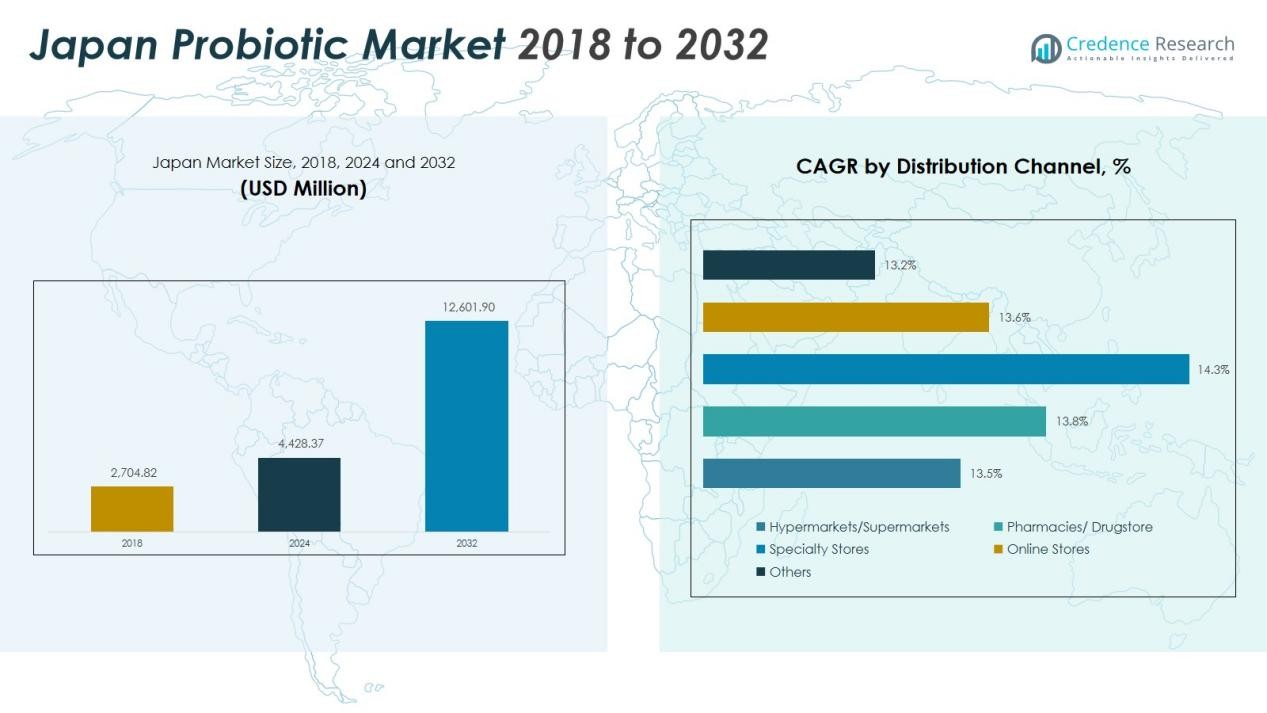

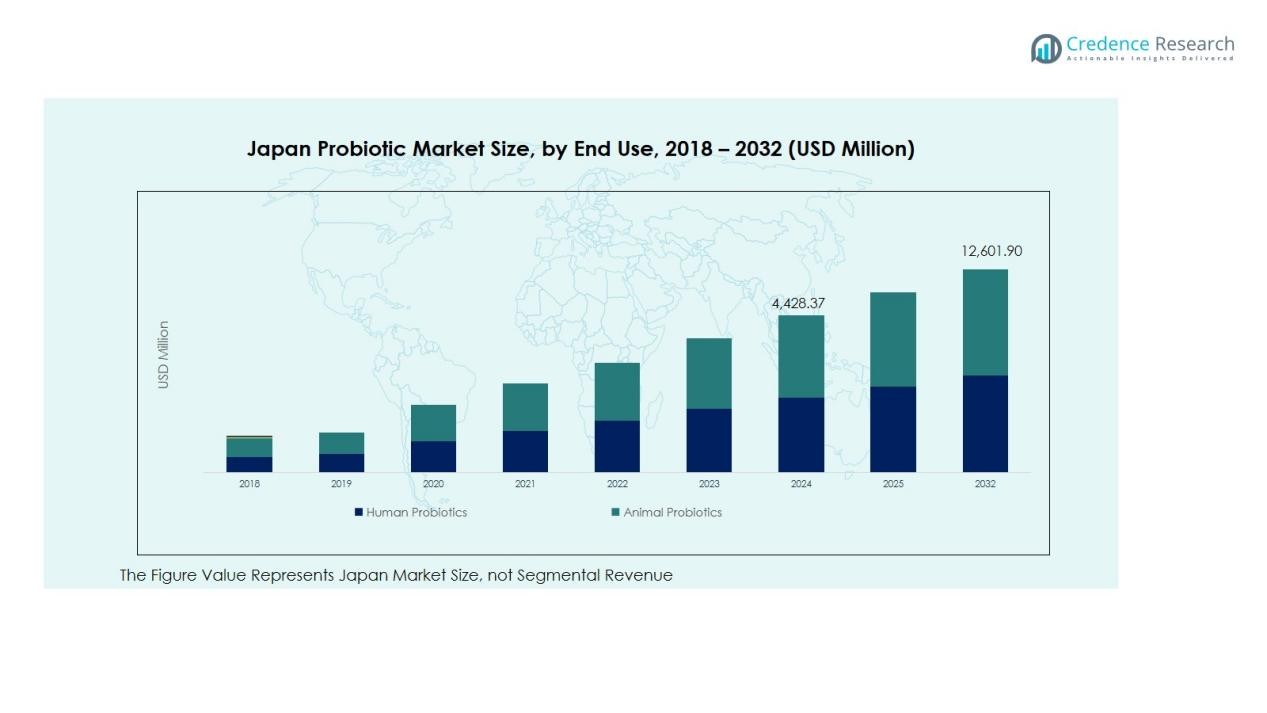

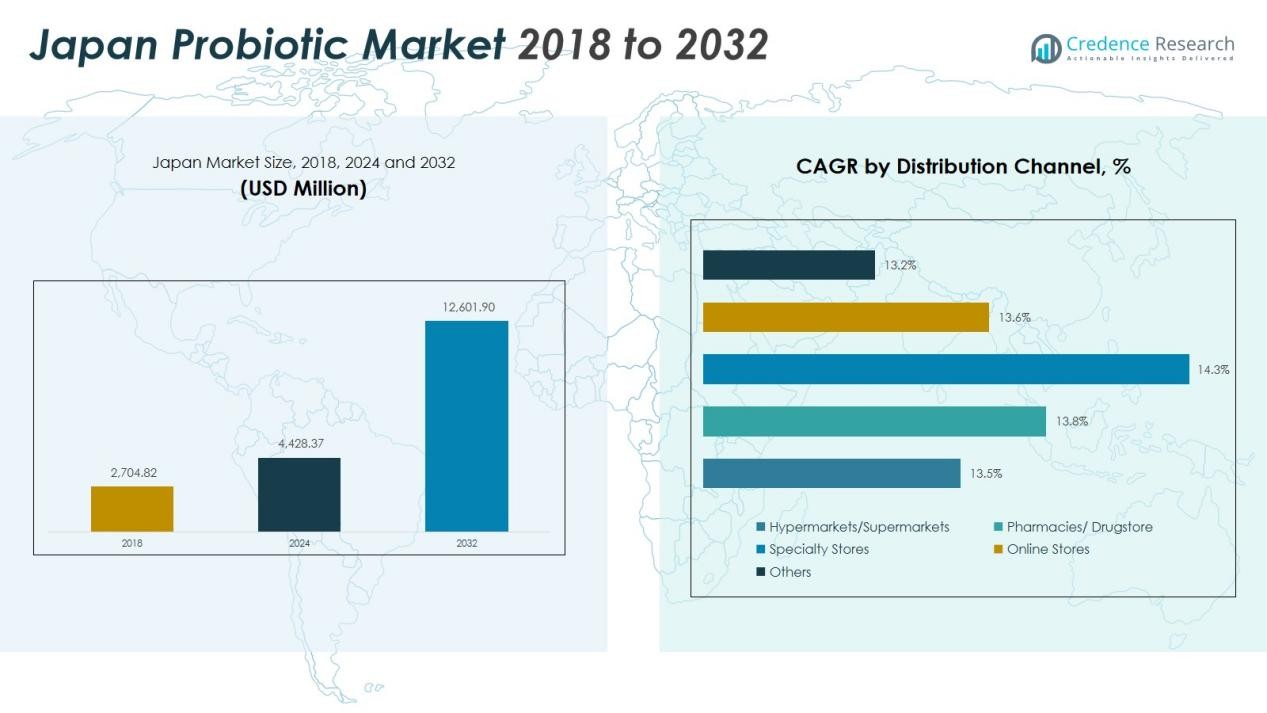

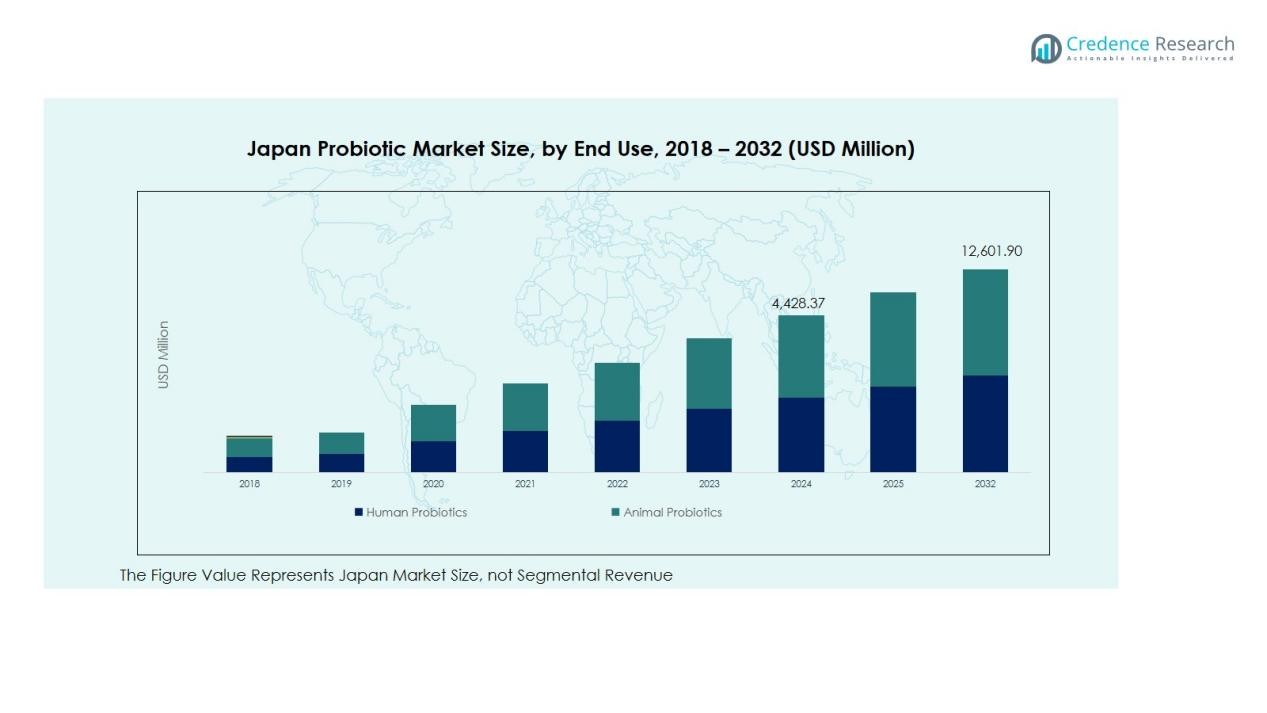

The Japan Probiotic Market size was valued at USD 2,704.82 million in 2018 to USD 4,428.37 million in 2024 and is anticipated to reach USD 12,601.90 million by 2032, at a CAGR of 13.97%during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Probiotic Market Size 2024 |

USD 4,428.37 Million |

| Japan Probiotic Market , CAGR |

13.97% |

| Japan Probiotic Market Size 2032 |

USD 12,601.90 Million |

The market is driven by growing awareness of gut and immune health, the aging population, and innovation in strain technology. Manufacturers are focusing on developing multi-strain formulations with improved stability and shelf life. Demand is also supported by increased clinical research, supportive government health policies, and rising popularity of probiotic-infused dairy and non-dairy alternatives among health-conscious consumers.

Regionally, Kanto dominates the Japan Probiotic Market due to high urbanization, advanced retail infrastructure, and strong presence of key food manufacturers. Kansai follows, driven by a large health-oriented population and wide product availability. Kyushu and Hokkaido are emerging as high-growth regions, supported by expanding distribution channels, online retail penetration, and growing adoption of probiotic supplements in rural and semi-urban areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Probiotic Market was valued at USD 2,704.82 million in 2018, reached USD 4,428.37 million in 2024, and is projected to attain USD 12,601.90 million by 2032, growing at a CAGR of 13.97%.

- Kanto holds the largest share of 42% in 2024, supported by high urbanization, advanced retail infrastructure, and a strong presence of food manufacturers. Kansai follows with a 27% share, driven by health-conscious consumers and product diversification.

- Kyushu and Hokkaido together account for 19% of the market, showing rising demand supported by growing online retail and regional health initiatives.

- Probiotic food and beverages dominate the market with a 63% share, fueled by strong consumer preference for yogurt drinks and fermented dairy products.

- Probiotic dietary supplements represent 25% of the market, gaining traction among adults seeking convenient, clinically validated digestive and immune health solutions.

Market Drivers:

Rising Focus on Digestive and Immune Health

Growing consumer awareness of digestive wellness and immunity is driving strong demand for probiotics. The aging population and lifestyle-related disorders have increased interest in gut microbiome health. Probiotic-based supplements and fortified foods are gaining preference due to their proven clinical benefits in improving digestion and immunity. The Japan Probiotic Market benefits from this shift toward functional nutrition, supported by both healthcare professionals and consumer education programs.

- For Instance, In Japan, Yakult Honsha offers the non-carbonated probiotic drink Y1000, which contains 110 billion Lacticaseibacillus paracasei strain Shirota per bottle.

Technological Advancements in Strain Development and Delivery

Innovation in strain engineering and encapsulation technology is improving probiotic stability and bioavailability. Manufacturers are developing multi-strain and shelf-stable formulations that can withstand varying temperature and storage conditions. It enables broader product use across beverages, snacks, and dairy alternatives without compromising efficacy. These advancements enhance consumer confidence and expand market applications in Japan’s competitive health food industry.

- For instance, in 2023, Morinaga Milk Industry developed a high-concentration bifidobacteria powder that maintained live bacterial stability for over 12 months at room temperature and is now supplied to more than 150 neonatal intensive care units (NICUs) in Japan and overseas, marking a major leap in probiotic shelf-life technology.

Strong Influence of Preventive Healthcare and Functional Foods

The Japanese population’s preference for preventive healthcare supports continuous probiotic adoption. Consumers are prioritizing nutrition-based solutions over medication, creating opportunities for fortified food and beverage products. Functional dairy products, probiotic drinks, and capsules are witnessing rapid growth in both retail and e-commerce channels. It strengthens the market’s position in Japan’s evolving healthcare and wellness ecosystem.

Expanding Retail and E-Commerce Distribution Networks

The growing reach of modern retail and digital platforms has significantly improved probiotic accessibility. Supermarkets, convenience stores, and online marketplaces are increasing visibility and consumer engagement. E-commerce platforms promote awareness and enable easy comparison of product efficacy and ingredients. The Japan Probiotic Market gains momentum from these distribution improvements, ensuring strong sales penetration across both urban and regional markets.

Market Trends:

Growing Adoption of Functional and Fortified Food Products

Japanese consumers are increasingly integrating probiotics into everyday diets through functional and fortified foods. Yogurt, fermented beverages, and snack bars enriched with probiotic strains are becoming daily health staples. It reflects the country’s strong emphasis on preventive health and convenience-based nutrition. Food manufacturers are introducing products with targeted benefits such as improved digestion, skin health, and mental well-being. Demand is further supported by product labeling transparency and endorsements from healthcare professionals. The Japan Probiotic Market continues to expand within the food segment, driven by innovation, premiumization, and diversification of probiotic-enriched formulations.

- For instance, in May 2025, Nomura Dairy Products, in collaboration with Probi AB, launched Japan’s first fermented carrot juice drink fortified with the Lactiplantibacillus plantarum LP299V® strain, delivering over 100 billion live probiotics per serving to support digestive wellness and gut balance.

Rising Popularity of Non-Dairy and Plant-Based Probiotics

Shifting dietary preferences toward lactose-free and vegan alternatives are shaping new growth areas for probiotics. Consumers are seeking non-dairy probiotic beverages made from soy, oats, and coconut bases. It aligns with the country’s focus on sustainability and digestive comfort among lactose-intolerant populations. Brands are expanding portfolios with plant-derived formulations that maintain strain stability and taste appeal. Collaborations between biotechnology firms and food producers are accelerating the development of next-generation probiotics. The Japan Probiotic Market is witnessing a strong move toward inclusive and eco-friendly products that cater to both health and ethical consumer values.

- For instance, Silk’s Cherry Plant-based Probiotic Yogurt contains more than 1 billion CFU (\(>10^{9}\)) of Bifidobacterium lactis per serving, offering a smooth coconut-base texture in a refrigerated format.

Market Challenges Analysis:

High Product Costs and Regulatory Complexity

The Japan Probiotic Market faces challenges from high production and regulatory compliance costs. Advanced strain development, encapsulation technologies, and clinical testing increase overall product pricing. Strict labeling and approval standards from health authorities make product registration time-consuming. It limits entry for smaller manufacturers and slows innovation cycles. Price-sensitive consumers may prefer traditional fermented foods over premium probiotic supplements. The need for continuous validation of health claims also adds to the financial burden on producers.

Limited Awareness Beyond Urban Centers

Consumer understanding of probiotics remains concentrated in urban regions such as Tokyo and Osaka. Rural populations show slower adoption due to limited awareness of specific health benefits. It restricts nationwide market penetration and reduces sales potential in less-developed areas. Distribution infrastructure gaps and fewer retail partnerships further weaken accessibility. Companies are investing in education campaigns and online marketing to address this imbalance. Sustained outreach and regional marketing are critical to overcoming this awareness divide.

Market Opportunities:

Expansion into Personalized and Clinical Nutrition

The growing focus on personalized healthcare creates strong potential for tailored probiotic solutions. Advances in microbiome research allow manufacturers to design products that target specific age groups and health conditions. It supports the development of probiotics for gut health, immunity, skin care, and cognitive well-being. Collaborations between nutraceutical companies and medical institutions are strengthening clinical validation. Consumers in Japan are increasingly open to science-driven, customized supplements that reflect individual health needs. The Japan Probiotic Market can capitalize on this demand by integrating AI-driven formulation and DNA-based microbiome testing into product innovation.

Growth in E-Commerce and International Collaboration

E-commerce expansion presents major growth prospects for probiotic brands in Japan. Online platforms enable wider reach, product education, and subscription-based wellness programs. It enhances visibility and allows direct consumer engagement through digital health communities. Strategic partnerships with global biotech firms can introduce advanced strains and patented technologies. Increasing exports of probiotic supplements and beverages also support regional leadership in Asia-Pacific. The Japan Probiotic Market can strengthen its global presence by leveraging digital transformation and international collaboration in product research and commercialization.

Market Segmentation Analysis:

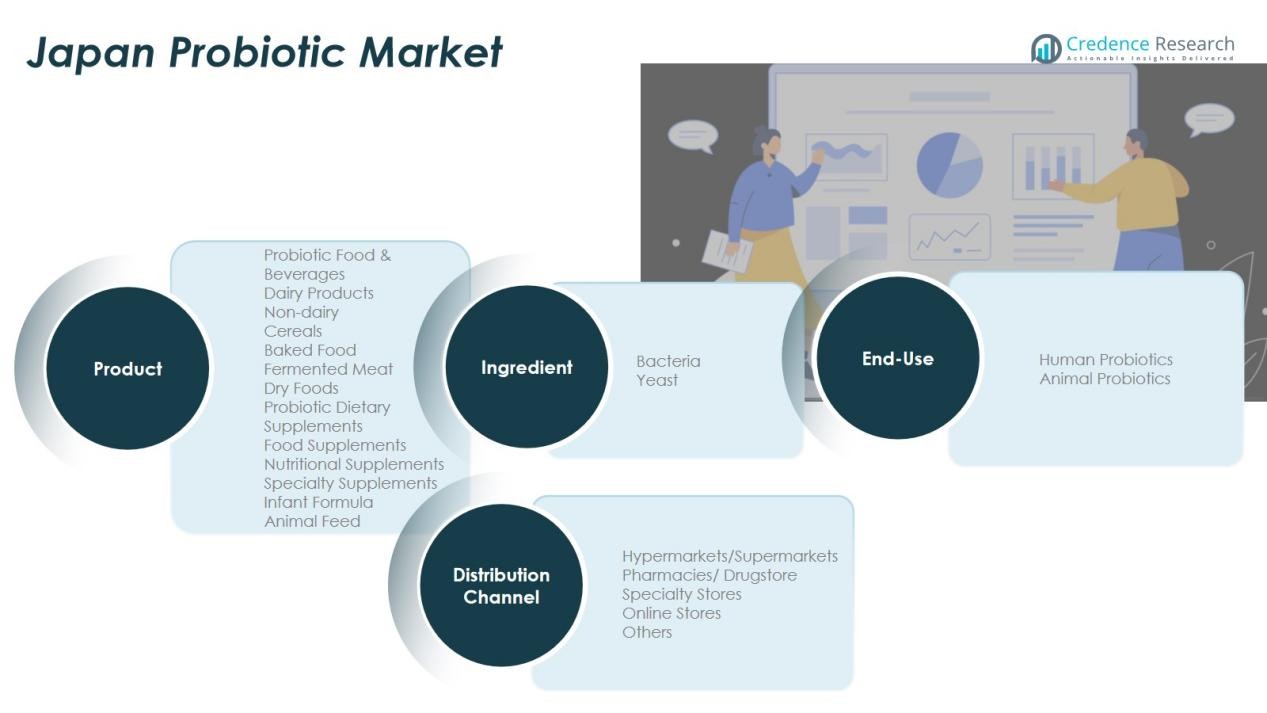

By Type

Probiotic food and beverages dominate the Japan Probiotic Market, driven by strong consumer preference for functional dairy and fermented drinks. Yogurt, cultured milk, and probiotic beverages lead sales due to their proven digestive benefits and taste familiarity. It gains momentum through the integration of science-backed strains and expansion of plant-based alternatives. Probiotic dietary supplements, including capsules, powders, and gummies, are growing rapidly among adults seeking immune and gut health support. The animal feed segment shows steady development supported by improved livestock health awareness and the need for antibiotic-free solutions.

- For instance, in May 2025, Nomura Dairy Products partnered with Probi AB to launch My Flora, Japan’s first probiotic-enhanced carrot juice fortified with over 100 billion live Lactiplantibacillus plantarum LP299V® cells per bottle, marking a breakthrough in the country’s plant-based probiotic drink segment.

By Ingredient

Bacterial strains hold the largest market share due to their extensive clinical validation and established use in food and supplement products. Lactobacillus and Bifidobacterium dominate due to their digestive and immune support benefits. It continues to attract investment in R&D for enhanced strain stability and targeted formulations. Yeast-based probiotics are gaining popularity for their heat resistance and suitability in varied applications such as functional foods and pharmaceuticals. Their growing adoption reflects expanding product diversification in Japan’s health and nutrition sector.

- For instance, Yakult Honsha’s Lactobacillus casei strain Shirota achieved a mean fecal viability of 7.5 log CFU/g after an 8-week intervention in 23 healthy subjects.

By End-Use

Human probiotics account for the majority share due to rising health awareness and preference for preventive nutrition. It benefits from aging demographics and the popularity of fortified dairy and beverage options. Animal probiotics are emerging steadily with applications in pet care and livestock feed efficiency. The increasing focus on overall well-being and nutritional innovation supports balanced growth across both end-use segments.

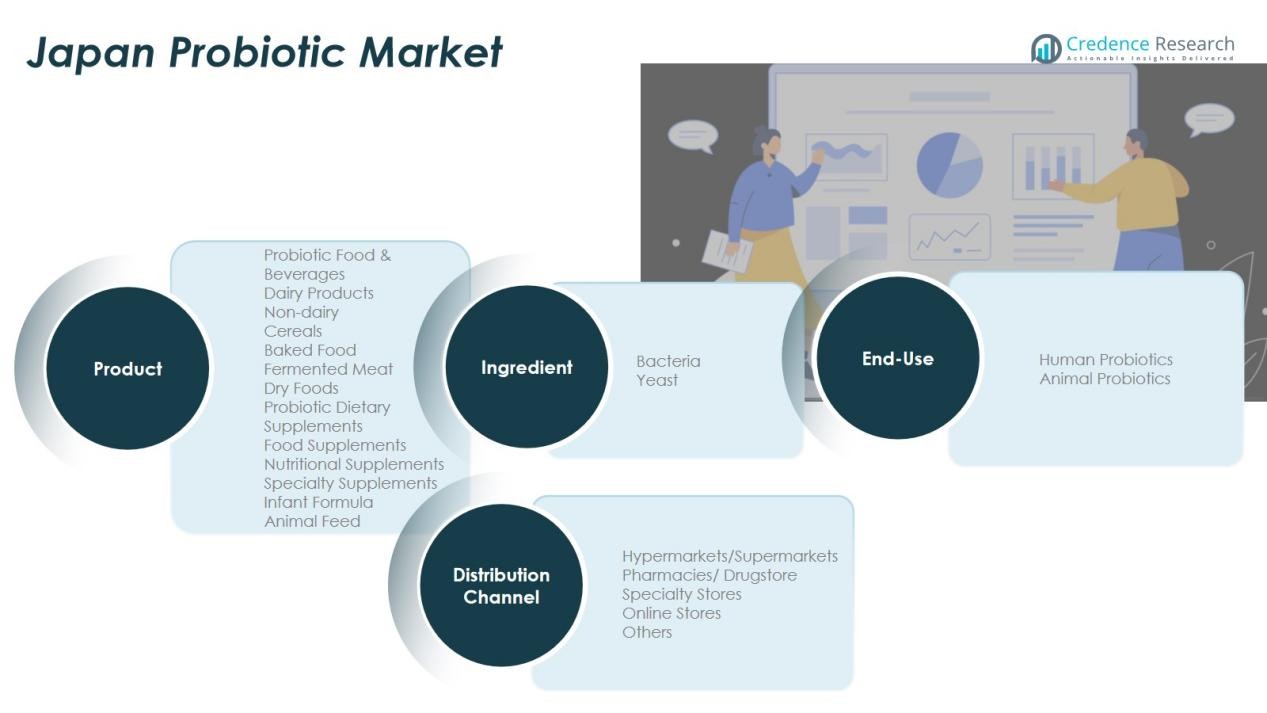

Segmentations:

By Type:

Probiotic Food & Beverages

- Dairy Products

- Non-Dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

By Ingredient:

By End-Use:

- Human Probiotics

- Animal Probiotics

By Distribution Channel:

- Hypermarkets/Supermarkets

- Pharmacies/Drugstores

- Specialty Stores

- Online Stores

- Others

Regional Analysis:

Kanto Region Leading with Strong Consumer Base and Retail Network

The Kanto region dominates the Japan Probiotic Market due to its dense population, urban lifestyle, and advanced retail infrastructure. Tokyo and surrounding prefectures drive high demand for probiotic supplements and functional foods. Consumers here show strong interest in preventive health and prefer products backed by clinical evidence. It benefits from the presence of major food manufacturers, pharmaceutical companies, and research institutes. The concentration of premium supermarkets and convenience stores further supports product accessibility. Continuous innovation in ready-to-drink probiotic beverages sustains the region’s leadership position.

Kansai Region Showing Steady Demand and Product Diversification

The Kansai region ranks second, supported by its balanced mix of urban and suburban consumers. Cities such as Osaka and Kyoto demonstrate high awareness of digestive and immune health benefits. It shows strong adoption of probiotic-infused dairy, yogurt, and nutraceutical supplements. Local manufacturers are expanding portfolios with functional formulations that address elderly health and dietary preferences. Distribution through convenience stores and e-commerce platforms enhances product reach. The region’s health-conscious population and focus on product quality continue to attract new investments.

Emerging Growth Across Kyushu and Hokkaido Regions

Kyushu and Hokkaido are emerging as high-growth areas due to rising health awareness and improved logistics. Consumers in these regions are increasingly adopting probiotic drinks and capsules supported by digital marketing campaigns. It benefits from expanding retail infrastructure and growing online shopping penetration. Local dairies and beverage companies are introducing affordable probiotic formulations to appeal to broader audiences. Government support for rural healthcare and nutrition initiatives further encourages probiotic consumption. These developments position regional markets for strong future expansion within Japan’s overall probiotic landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Japan Probiotic Market is highly competitive, with companies focusing on innovation, clinical validation, and brand differentiation. Key players include Yakult Honsha Co., Ltd., Danone, Asahi Group Holdings, Ltd., Morinaga Milk Industry Co., Ltd., Nestlé Japan Ltd., and Lonza Group Ltd. It features strong domestic dominance alongside international brand presence, supported by robust distribution networks and advanced research capabilities. Firms are investing in next-generation probiotic strains, plant-based alternatives, and fortified functional foods to capture growing consumer interest. Strategic collaborations between food and biotech companies are expanding product portfolios and strengthening regulatory compliance. Continuous marketing, premiumization, and diversification across supplements and beverages sustain competition intensity in this evolving market.

Recent Developments:

- In September 2025, Yakult Honsha established the Yakult European R&D Center B.V. in the Netherlands to expand global probiotic research and innovation activities.

- In August 2025, Danone overhauled its leadership structure, transitioning from five geographic regions to three (EMEA, Americas, and Asia-Pacific) to enhance organizational agility under its “Renew Danone” transformation.

Report Coverage:

The research report offers an in-depth analysis based on Type, Ingredient, End-Use and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing consumer preference for preventive health will continue to strengthen probiotic product adoption across Japan.

- Innovation in strain technology and encapsulation will enhance stability and expand application in food and supplements.

- Rising interest in microbiome science will drive collaborations between research institutions and probiotic manufacturers.

- E-commerce growth will enable greater access to personalized probiotic solutions and subscription-based health programs.

- Demand for plant-based and lactose-free probiotic alternatives will rise due to dietary diversification and sustainability awareness.

- Clinical validation and transparent labeling will become key differentiators influencing consumer trust and purchase behavior.

- Integration of probiotics into beauty and skin health products will create new cross-sector opportunities.

- Partnerships between local firms and global biotech companies will accelerate advanced strain development.

- Increasing awareness among rural populations will support broader market penetration beyond urban regions.

- The Japan Probiotic Market will evolve toward a science-driven, digitally connected ecosystem focused on personalized wellness and long-term digestive health.