| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Water Pump Market Size 2023 |

USD 3,400.80 Million |

| Japan Water Pump Market, CAGR |

4.56% |

| Japan Water Pump Market Size 2032 |

USD 5,085.74 Million |

Market Overview:

Japan Water Pump Market size was valued at USD 3,400.80 million in 2023 and is anticipated to reach USD 5,085.74 million by 2032, at a CAGR of 4.56% during the forecast period (2023-2032).

Several factors are propelling the growth of the water pump market in Japan. The nation’s commitment to sustainable water management practices is a significant driver, as industries and municipalities seek efficient solutions for water distribution and wastewater treatment. Japan’s focus on reducing environmental impact and conserving water resources is prompting investments in high-performance pumps that minimize energy usage and optimize operational efficiency. Advancements in pump technology, particularly in energy efficiency and durability, are also contributing to market expansion. These innovations help industries comply with increasingly stringent regulations on energy consumption and environmental protection. Additionally, the growing emphasis on infrastructure development, especially in urban areas, is increasing the demand for reliable water pumping systems to support expanding populations and industries in major cities.

Japan’s water pump market is influenced by its unique geographical and industrial landscape. The country’s advanced manufacturing sector, including industries such as automotive, chemical processing, and power generation, drives the demand for specialized pumping solutions that meet the unique needs of these sectors. Additionally, the government’s ongoing investments in infrastructure projects, such as urban expansion, wastewater treatment plants, and flood prevention systems, contribute significantly to market growth. Furthermore, Japan’s vulnerability to natural disasters, such as earthquakes, tsunamis, and floods, necessitates robust water management systems, further fueling the market for reliable and efficient water pumps. The need for effective flood control and water supply management in disaster-prone regions is increasing demand for advanced pump solutions that can ensure the safety and resilience of infrastructure during emergencies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan water pump market was valued at USD 3,400.80 million in 2023 and is expected to reach USD 5,085.74 million by 2032, growing at a CAGR of 4.56% during the forecast period.

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Japan’s commitment to sustainable water management practices is driving the demand for high-performance, energy-efficient water pumps across industries and municipalities.

- Technological advancements in pump efficiency, such as IoT-enabled systems, are enhancing operational efficiency, reducing energy consumption, and driving market growth.

- Government investments in urban expansion, wastewater treatment, and flood control systems are increasing the demand for reliable water pumps in both residential and industrial sectors.

- Japan’s vulnerability to natural disasters, including earthquakes and floods, is prompting increased demand for resilient and reliable water pumps to ensure disaster preparedness and water supply management.

- High initial capital investment requirements for advanced pump systems present a barrier to market adoption, particularly for smaller businesses and municipalities with limited budgets.

- The competition from low-cost water pumps offers affordable alternatives but often compromises on energy efficiency and reliability, intensifying market pressure, particularly in cost-sensitive segments.

Market Drivers:

Increasing Demand for Efficient Water Management Solutions

The Japan water pump market is experiencing significant growth due to the rising demand for efficient water management solutions. For example, Ebara Corporation, a leading Japanese pump manufacturer, launched an IoT-enabled centrifugal pump in March 2023 specifically optimized for desalination plants, which are critical for addressing water scarcity and supporting sustainable water use. As industries and municipalities work to address challenges related to water scarcity and waste management, the need for reliable, energy-efficient water pumps has become a priority. In both residential and industrial sectors, Japan’s commitment to sustainable water use and wastewater treatment systems is propelling the market forward. Advanced water pumping technologies, which minimize energy consumption and enhance operational efficiency, are at the forefront of this trend. The increased focus on optimizing water systems to reduce environmental impact is driving investments in modern pump technologies that meet Japan’s stringent environmental regulations.

Technological Advancements in Pump Efficiency

Technological innovations in pump efficiency are another key driver in the Japanese water pump market. Manufacturers are continuously developing more advanced pump solutions that incorporate smart features, energy-saving technologies, and improved durability. These pumps are designed to reduce energy consumption, which is particularly important in a country that emphasizes sustainability and carbon footprint reduction. Enhanced pump efficiency directly impacts cost savings and operational effectiveness across industries such as agriculture, construction, and municipal services. The integration of sensors, automation, and IoT capabilities into water pumps is also enabling real-time monitoring, predictive maintenance, and optimization of system performance, making these technologies highly attractive to businesses looking to streamline operations and reduce downtime.

Government Initiatives and Infrastructure Development

Government policies and infrastructure development are key drivers of growth in the Japan water pump market. With ongoing initiatives to improve water infrastructure and manage water resources more effectively, the demand for reliable and high-performance water pumps continues to rise. Japan’s government is investing heavily in projects that focus on urban water supply systems, wastewater treatment plants, and flood control systems. For instance, the Japanese government’s “Water Resource Management Act” promotes the adoption of innovative technologies for sustainable water resource management, while the “Energy Conservation Law” encourages the use of energy-saving equipment, including pumps, to reduce carbon emissions. The nation’s urbanization and industrial expansion, particularly in large cities like Tokyo and Osaka, have increased the need for advanced water management systems. As the government continues to prioritize water conservation, environmental protection, and disaster resilience, it is fueling further adoption of modern water pumps for municipal and industrial applications.

Resilience to Natural Disasters

Japan’s vulnerability to natural disasters such as earthquakes, tsunamis, and floods is another critical driver of the water pump market. The need for robust and reliable water management systems that can withstand these events has led to a surge in demand for specialized water pumps. Following devastating natural disasters, the country has focused on improving flood management and disaster preparedness infrastructure. Water pumps play an essential role in ensuring the functionality of these systems during emergencies, as they are crucial for draining floodwaters, maintaining water supply during disasters, and restoring normal operations in affected areas. As Japan continues to face the effects of climate change, with increased frequency and intensity of extreme weather events, the demand for water pumps that offer resilience and reliability during such crises is expected to remain strong.

Market Trends:

Adoption of Smart Water Pumping Solutions

A notable trend in the Japan water pump market is the increasing adoption of smart water pumping solutions. For instance, companies such as Ebara Corporation and Hitachi Industrial Equipment Systems are integrating advanced technologies like sensors, Internet of Things (IoT), and artificial intelligence (AI) into their pump systems to enhance functionality and efficiency. By incorporating these technologies, water pumps are able to monitor real-time performance, predict maintenance needs, and optimize energy usage. This trend is especially relevant for industrial and municipal water management, where operational costs and efficiency are critical factors. With smart water pumping systems, Japan is advancing its water management capabilities by improving operational visibility, reducing downtime, and extending the lifespan of equipment.

Sustainability and Energy-Efficient Pumps

As sustainability becomes a top priority across various sectors, there is a marked shift towards energy-efficient and environmentally friendly water pumps in Japan. These pumps are designed to minimize power consumption, which aligns with Japan’s commitment to reducing carbon emissions and promoting greener technologies. For example, Torishima Pump Mfg. Co., Ltd. has introduced high-efficiency pumps for district heating and cooling systems in urban developments, which have demonstrated a reduction in electricity consumption by up to 30% compared to conventional models. The growing trend toward energy-efficient solutions is particularly prominent in industries such as agriculture, manufacturing, and municipal services, where large volumes of water are frequently pumped. Pumps that utilize renewable energy sources, such as solar power, are also gaining traction, particularly in rural and remote areas. This trend is expected to continue as Japan seeks to balance industrial growth with environmental responsibility.

Growing Demand for Customized Pump Solutions

The demand for customized water pumping solutions is another trend shaping the Japanese market. Industrial sectors, including construction, agriculture, and power generation, are increasingly seeking tailored pump systems that meet their specific operational requirements. Customization allows for more precise control over water flow, pressure, and energy consumption, which is essential in industries with high-volume water needs. As each industry faces unique challenges, water pumps that can be specifically designed to meet these demands are becoming a preferred choice. In response, manufacturers are offering more diverse product portfolios, allowing companies to select pumps that offer optimal performance for their applications.

Focus on Maintenance and Aftermarket Services

There is a growing emphasis on maintenance and aftermarket services in the Japan water pump market. As the complexity of water pumps increases with the adoption of advanced technologies, maintaining optimal performance becomes crucial to ensuring longevity and efficiency. This trend has led to the rise of companies offering specialized maintenance services, including real-time monitoring, predictive maintenance, and repair solutions. These services are particularly important in preventing costly breakdowns and minimizing operational disruptions, especially in critical infrastructure projects. The trend is expected to grow as industries and municipalities continue to invest in high-performance, technologically advanced water pumps that require ongoing support and care to function at their best.

Market Challenges Analysis:

High Initial Capital Investment

One of the key market restraints in the Japan water pump market is the high initial capital investment required for advanced water pumping systems. For instance, the Japan International Cooperation Agency (JICA) notes that investment in distribution infrastructure such as service reservoirs, pump stations, and pipelines accounts for two-thirds of the total capital cost of all water supply facilities in Japan, making the initial outlay for advanced water pumping systems a significant financial burden. While these systems offer long-term operational savings and efficiency, the upfront costs for purchasing and installing high-tech water pumps, particularly those incorporating smart technologies, can be prohibitive for some industries and municipalities. Smaller businesses and local governments may struggle to allocate the necessary budgets for these investments, which can slow the adoption of state-of-the-art water management solutions. This financial barrier poses a challenge, particularly in sectors where cost efficiency is crucial.

Complexity of Maintenance and Repair

Another challenge faced by the Japan water pump market is the complexity associated with maintaining and repairing advanced water pumps. As pumps become more sophisticated, especially with the integration of smart features and automation, the technical expertise required for maintenance increases. Many companies and local authorities may lack the necessary skills and resources to manage these systems effectively, which can result in longer downtimes and reduced operational efficiency. The complexity of maintenance can also drive up service costs, creating an additional financial burden for businesses that rely on water pumps for critical operations.

Stringent Regulatory Compliance

Japan’s stringent environmental and safety regulations can also act as a restraint on the water pump market. While these regulations are designed to promote sustainability and public safety, they can impose challenges on manufacturers and end-users. Compliance with these regulations often requires additional investments in R&D to develop products that meet the required standards, increasing product costs and lengthening development timelines. Additionally, changing regulations can create uncertainty in the market, making it difficult for companies to plan long-term investments in water pump systems and technologies.

Competition from Low-Cost Alternatives

The increasing availability of low-cost water pumps from international manufacturers presents another challenge to the Japan water pump market. These cheaper alternatives may not offer the same level of efficiency or reliability as higher-end models, but they provide a more affordable option for price-sensitive customers. This intensifies competition within the market, especially for smaller businesses and local municipalities that may opt for budget-friendly solutions, even if they come with limitations in terms of energy efficiency and durability.

Market Opportunities:

The Japan water pump market presents significant opportunities due to the increasing demand for water infrastructure projects. As Japan continues to focus on modernizing its urban water supply systems, wastewater treatment plants, and flood management infrastructure, the need for advanced and efficient water pumps is expected to rise. This trend is particularly evident in major metropolitan areas where urbanization is accelerating, and the need for reliable water management systems is more critical than ever. Additionally, Japan’s commitment to addressing climate change and improving resilience to natural disasters creates opportunities for innovative water pump solutions that support disaster preparedness, water conservation, and sustainable management of water resources. Companies that can offer advanced, energy-efficient, and smart water pumps are well-positioned to capitalize on this growing market demand.

Another notable market opportunity is the integration of renewable energy sources into water pumping systems. With Japan’s increasing focus on reducing its carbon footprint and transitioning to cleaner energy, there is a growing demand for water pumps powered by renewable energy sources such as solar and wind power. This presents an opportunity for manufacturers to develop water pumps that not only provide high performance but also align with the country’s sustainability goals. In rural and remote areas where the electrical grid may be unreliable or inaccessible, solar-powered pumps offer a sustainable and cost-effective alternative, further expanding the market potential. Manufacturers who can develop innovative, energy-efficient, and environmentally friendly pumping systems will likely see increased demand as Japan pursues a greener future.

Market Segmentation Analysis:

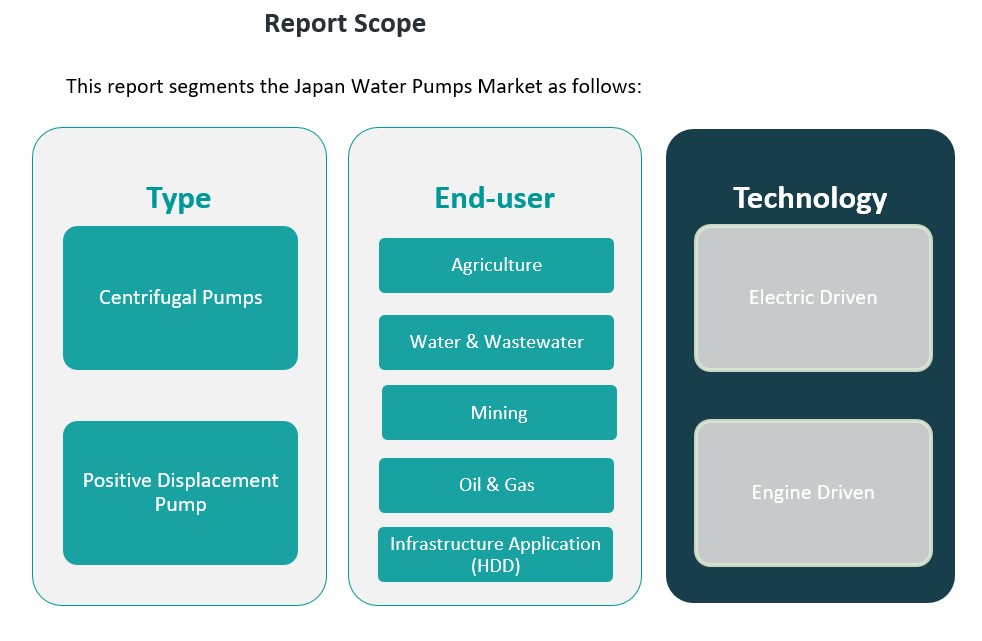

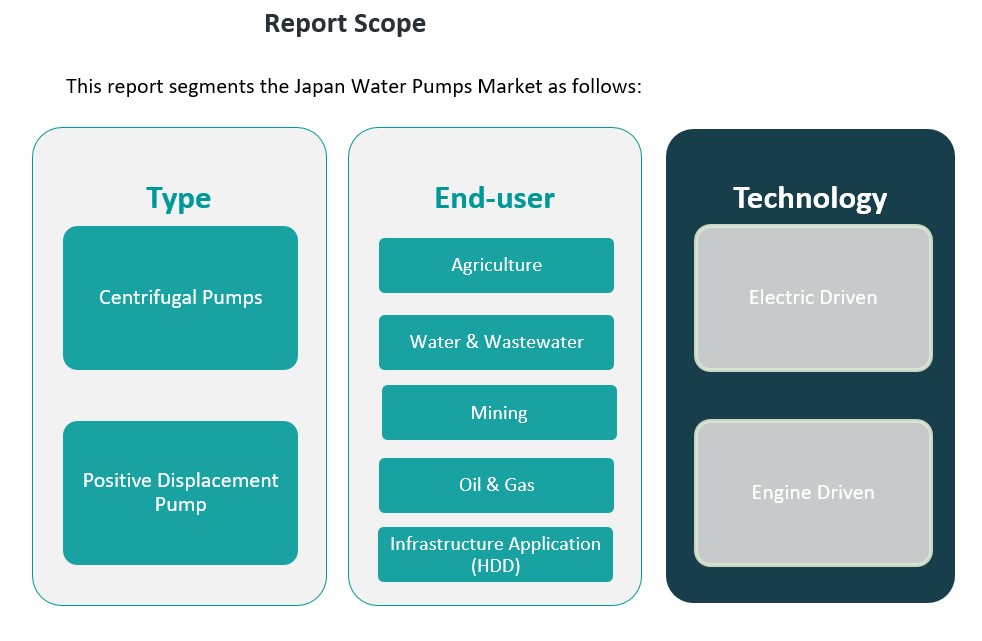

The Japan water pump market is segmented based on type, end-user, and technology, each contributing to the overall growth of the market.

By Type Segment

The water pump market in Japan is dominated by two key types: centrifugal pumps and positive displacement pumps. Centrifugal pumps hold the largest market share due to their widespread use in industries requiring high flow rates and moderate pressure, such as water distribution and wastewater treatment. They are favored for their simple design, ease of maintenance, and cost-effectiveness. Positive displacement pumps, on the other hand, are used in applications requiring precise flow control and high pressure, such as in the oil & gas and chemical industries. Their ability to handle viscous liquids and maintain consistent pressure makes them essential for specific industrial applications.

By End-User Segment

The end-user segment of the Japan water pump market is diverse, with key industries including agriculture, water and wastewater, mining, oil & gas, and infrastructure applications. The agriculture sector is a significant contributor to the demand for water pumps, driven by the need for efficient irrigation systems. The water and wastewater segment is another major consumer, as Japan continues to modernize its infrastructure for both urban and rural areas. The mining and oil & gas sectors rely on water pumps for fluid handling and other operational processes, while infrastructure applications, particularly Horizontal Directional Drilling (HDD), use pumps for fluid circulation during construction.

By Technology Segment

In terms of technology, electric-driven pumps are more commonly used in urban and industrial settings due to their efficiency and ease of use. Engine-driven pumps are preferred in remote or off-grid locations, offering greater mobility and flexibility for applications such as construction and emergency services. Both technologies play a vital role in ensuring Japan’s water management systems operate efficiently across various industries.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

The Japan water pump market is influenced by regional variations in industrial activities, infrastructure development, and environmental challenges. As one of the most technologically advanced nations, Japan’s water pump market sees a higher demand in specific regions driven by diverse applications such as water supply, wastewater treatment, agriculture, and industrial processes.

Kanto Region (Tokyo Area)

The Kanto region, encompassing Tokyo and its surrounding areas, holds the largest market share in Japan. This region is the country’s economic hub, where significant urbanization, population growth, and industrial development have led to a high demand for water pumps. The need for efficient water supply systems, wastewater management, and flood control infrastructure in the metropolitan area drives the demand for reliable and advanced pumping solutions. Additionally, the large manufacturing sector in this region, including the chemical, automotive, and power generation industries, further increases the demand for water pumps. The Kanto region accounts for approximately 35-40% of Japan’s total water pump market share.

Kinki Region (Osaka Area)

The Kinki region, which includes Osaka and other industrial cities, also represents a substantial portion of the market. This area is home to Japan’s manufacturing sector, including industries such as metalworking, food processing, and electronics. The region’s need for water management in industrial applications, such as cooling systems, wastewater treatment, and irrigation, drives the demand for various types of water pumps. Additionally, the ongoing expansion of infrastructure projects in urban and rural areas continues to contribute to the market’s growth. The Kinki region holds approximately 25-30% of the market share.

Chubu Region

The Chubu region, centered around Nagoya, is known for its heavy manufacturing base, including industries like automotive, steel production, and chemicals. These sectors require a wide range of water pumps for cooling, fluid transfer, and wastewater management. With the region’s focus on industrial growth and environmental sustainability, the demand for energy-efficient and high-performance pumps is on the rise. The Chubu region contributes to around 15-20% of Japan’s water pump market share.

Other Regions (Hokkaido, Kyushu, Shikoku)

Other regions such as Hokkaido, Kyushu, and Shikoku are less industrialized compared to Kanto and Kinki, but they still present opportunities for growth in the water pump market. These regions have significant agricultural activities that drive demand for irrigation systems. Additionally, rural areas are increasingly investing in water supply infrastructure and flood control systems to mitigate the effects of natural disasters. Combined, these regions hold the remaining 20-25% of the market share, with Kyushu leading the way in terms of agricultural demand for water pumps.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT INC.

- EBARA CORPORATION

- Torishima Pump Mfg. Co

- Ebara Corporation

Competitive Analysis:

The Japan water pump market is highly competitive, with several key players dominating the landscape. Leading global and local manufacturers such as Grundfos, KSB, Pentair, and Fuji Electric offer a wide range of water pumps, catering to diverse industries like agriculture, water treatment, and industrial applications. These companies emphasize product innovation, particularly in the development of energy-efficient, durable, and smart water pumping systems. Local players such as Kirloskar and Tsurumi Manufacturing Co. also maintain a strong presence, focusing on meeting specific regional demands and regulations. Competition is intensifying as companies invest in advanced technologies like IoT-enabled pumps for real-time monitoring and maintenance. Furthermore, collaborations with municipal authorities and large industrial projects, especially in urban infrastructure and flood management systems, are becoming essential for market growth. The market’s competitive dynamics are shaped by product differentiation, technological advancements, and the ability to provide cost-effective, reliable solutions.

Recent Developments:

- In January 2024, Grundfos Pumps KK, a leading player in the Japanese hydraulic and water pump market, announced the launch of its new SP 6-inch hydraulic pump specifically designed for groundwater pumping. This product sets a new standard for durability and reliability in groundwater pumps, catering to a wide range of applications and reinforcing Grundfos’s commitment to energy efficiency and robust performance in the Japanese market.

- In March 2023, Ebara Corporation, a major domestic innovator in Japan’s water pump sector, introduced an IoT-enabled centrifugal pump optimized for desalination plants. This launch reflects Ebara’s focus on integrating smart technologies and precision engineering to enhance operational efficiency and support Japan’s sustainable water management goals.

Market Concentration & Characteristics:

The Japan water pump market exhibits moderate concentration, with several leading global and regional players dominating the market share. Large multinational companies like Grundfos, KSB, and Pentair command a significant portion due to their advanced product offerings and strong brand presence. These players focus on technological innovation, offering energy-efficient, durable, and smart water pump solutions. Additionally, local manufacturers such as Tsurumi Manufacturing Co. and Fuji Electric maintain a strong foothold by catering to specific regional needs and aligning with Japan’s stringent environmental standards. The market is characterized by a high degree of product differentiation, with companies investing heavily in R&D to provide tailored solutions for various industrial, municipal, and agricultural applications. This competitive landscape is also marked by a growing emphasis on sustainable, energy-efficient technologies, and integrated smart systems that enable real-time monitoring and predictive maintenance, which are driving innovation within the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japan water pump market will continue to grow, driven by increasing urbanization and infrastructure development.

- Demand for energy-efficient and eco-friendly water pumps will rise as Japan focuses on sustainability and carbon reduction goals.

- Advancements in smart water pumping technologies, including IoT and AI integration, will enhance operational efficiency and predictive maintenance.

- The agriculture sector will see increased adoption of water pumps for advanced irrigation systems, particularly in rural areas.

- Rising industrialization in sectors like chemicals and power generation will continue to drive the need for high-performance water pumps.

- Water scarcity concerns will accelerate investments in water recycling and wastewater treatment systems, boosting market demand.

- The oil and gas industry will seek specialized pumps for fluid handling and pipeline transportation.

- Government initiatives aimed at modernizing water infrastructure will create new opportunities for water pump manufacturers.

- Integration of renewable energy sources, such as solar-powered pumps, will become more prevalent in off-grid areas.

- Increased focus on disaster preparedness and flood control will drive demand for reliable and resilient water pumping solutions.