Market Overview:

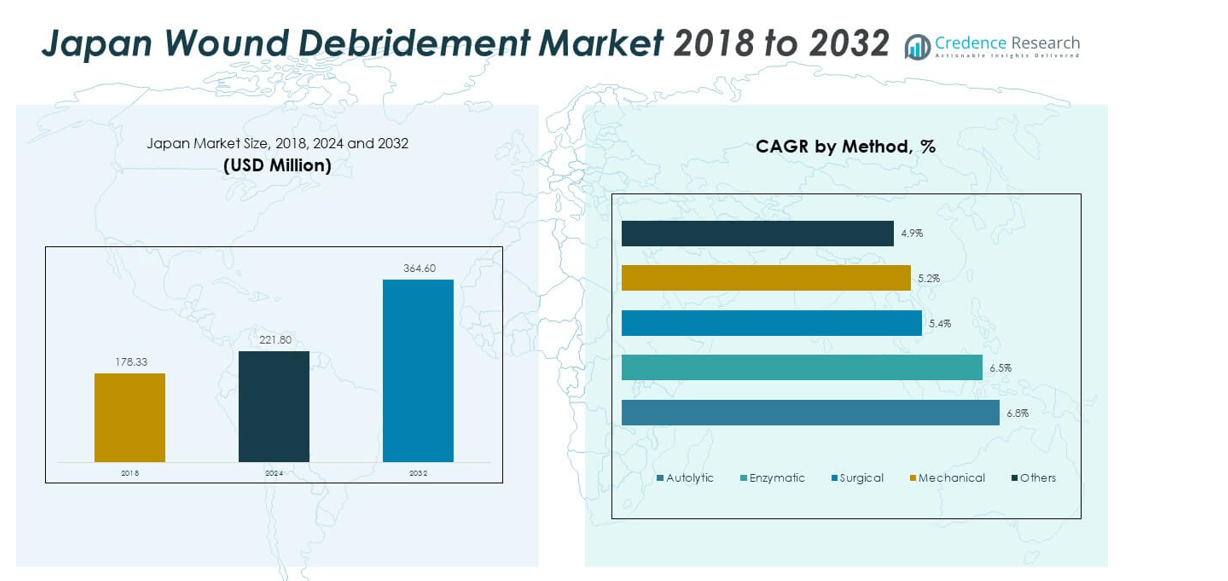

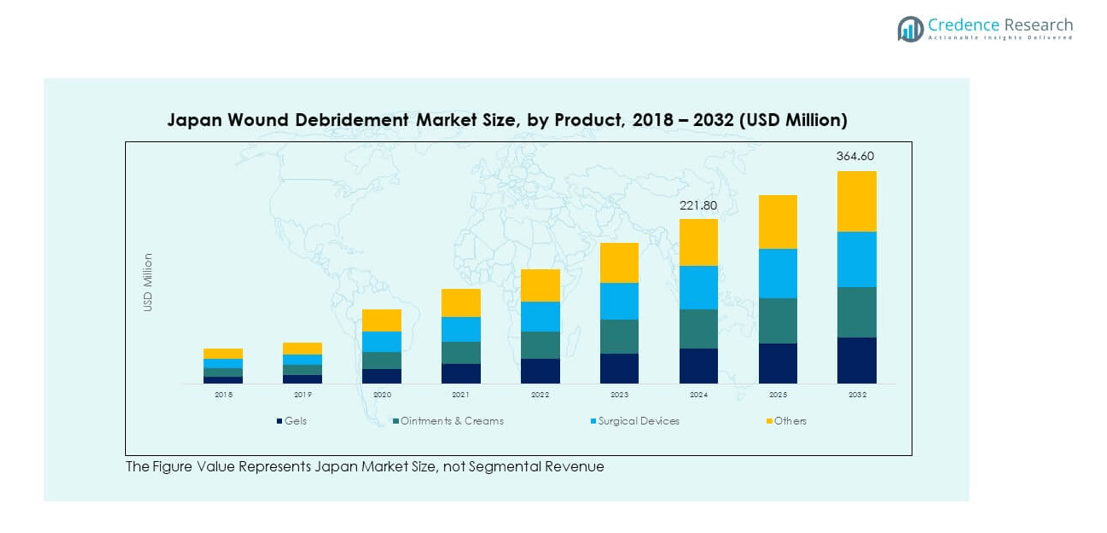

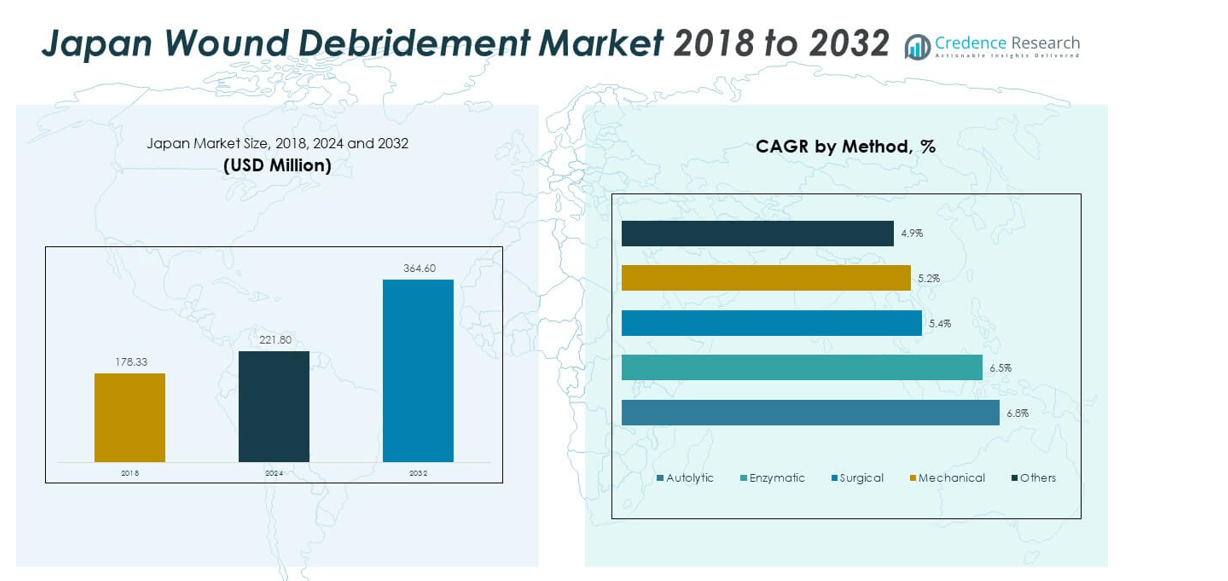

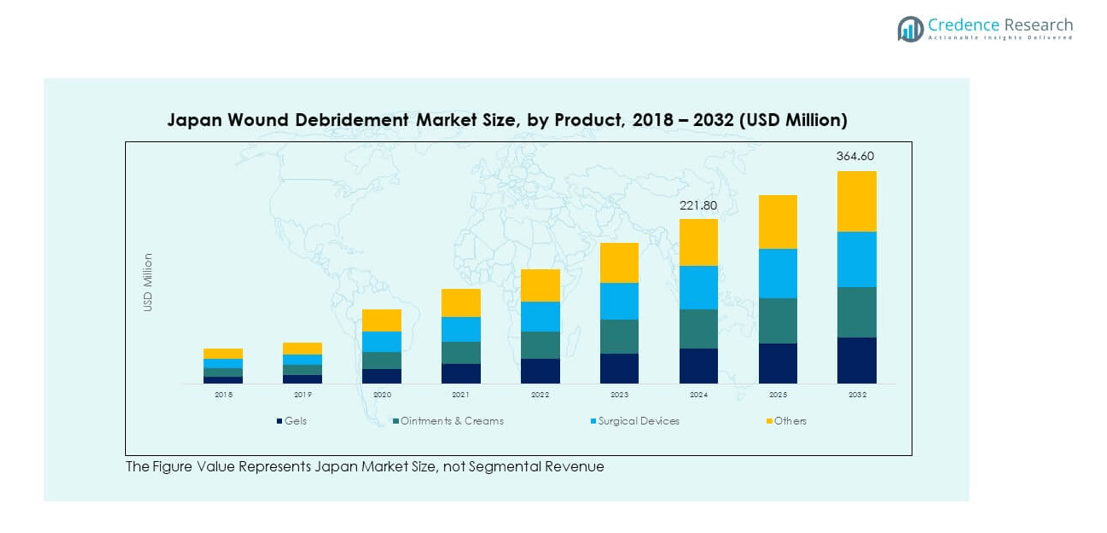

The Japan Wound Debridement Market size was valued at USD 178.33 million in 2018 to USD 221.80 million in 2024 and is anticipated to reach USD 364.60 million by 2032, at a CAGR of 6.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Wound Debridement Market Size 2024 |

USD 221.80 million |

| Japan Wound Debridement Market, CAGR |

6.41% |

| Japan Wound Debridement Market Size 2032 |

USD 364.60 million |

Rising cases of chronic wounds, diabetic ulcers, and surgical injuries are driving the market in Japan. Increasing healthcare expenditure and growing awareness about advanced wound care techniques are fueling demand for effective debridement products. Government initiatives supporting better patient outcomes and the introduction of innovative solutions by local and global manufacturers further strengthen market expansion.

Geographically, major urban regions such as Tokyo, Osaka, and Nagoya lead the market due to advanced healthcare infrastructure and higher patient awareness. Rural areas are emerging markets, supported by improving healthcare accessibility and growing adoption of modern wound care practices. The country’s aging population and focus on reducing hospital stays continue to push demand for efficient debridement therapies nationwide.

Market Insights:

- The Japan Wound Debridement Market was valued at USD 178.33 million in 2018, reached USD 221.80 million in 2024, and is projected to attain USD 364.60 million by 2032, growing at a CAGR of 6.41%.

- The Kanto region leads with a 38% share, driven by superior healthcare infrastructure and high adoption of advanced wound care technologies. Kansai follows with 27% due to expanding clinical facilities, while Chubu holds 20% supported by growing hospital networks.

- Kyushu and Hokkaido collectively represent the fastest-growing regional cluster with 15% share, fueled by rising investments in telemedicine, home healthcare, and rural medical outreach.

- Among product segments, gels account for about 32% of total market share in 2024, favored for their affordability and ease of application in both hospitals and homes.

- Surgical devices hold nearly 26% share, supported by their vital role in chronic and severe wound management, with adoption increasing across specialized wound care centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Incidence of Chronic Wounds and Diabetes-Related Complications

The growing prevalence of diabetes and obesity in Japan has led to a surge in chronic wounds such as diabetic foot ulcers and pressure ulcers. The Japan Wound Debridement Market benefits from increased hospital admissions and home care treatments for these conditions. Healthcare professionals emphasize early wound management to reduce complications, increasing the need for debridement products. The aging population contributes to more chronic wound cases, further boosting product demand. Hospitals and clinics are expanding wound care departments to handle higher patient inflows. Innovative therapies are being introduced to address slow-healing wounds more effectively. It continues to see rising adoption of both mechanical and autolytic debridement techniques in clinical settings.

- For instance, Smith & Nephew’s PICO Single Use Negative Pressure Wound Therapy system was reviewed and accepted in 2024 by NICE guidelines, demonstrating clinically significant reduction in surgical site infections among high-risk patients such as those with diabetes and obesity.

Government Initiatives Promoting Advanced Wound Care Technologies

Japan’s healthcare authorities are investing in improving wound management infrastructure through funding and regulatory support. The country’s focus on patient safety and faster recovery encourages the use of modern wound debridement tools. Reimbursement policies for chronic wound treatments help hospitals and patients adopt advanced care methods. Local companies are collaborating with research institutions to develop more efficient products. It supports the adoption of advanced wound care devices across hospitals and long-term care centers. Rising training programs for clinicians enhance treatment efficiency and wound healing outcomes. The government’s continued focus on digital healthcare and remote wound monitoring also supports sustained market growth.

- For instance, In April 2024, Anaut Inc. received Japanese regulatory approval for its new AI-powered system, Eureka α, which is designed to provide surgeons with real-time visual assistance during endoscopic, laparoscopic, and robotic surgery. The system helps improve surgical safety and precision by highlighting connective tissues and nerves.

Increasing Healthcare Expenditure and Hospital Infrastructure Development

Rising healthcare spending is driving the expansion of hospital and home care facilities across Japan. Improved access to advanced medical devices supports the growth of debridement treatment adoption. Private healthcare institutions are increasing investments in wound management centers. The Japan Wound Debridement Market gains from higher awareness among healthcare providers about cost-effective wound solutions. Rising availability of imported debridement products enhances clinical outcomes. Medical technology suppliers are partnering with hospitals to expand product accessibility. It is becoming a key area of focus for Japan’s long-term healthcare modernization strategy.

R&D Investments and Technological Innovation in Debridement Products

Manufacturers are focusing on developing next-generation enzymatic and ultrasonic debridement tools for faster healing. Research funding from both government and private investors is stimulating product innovation. The shift toward painless, minimally invasive procedures is encouraging product adoption. The Japan Wound Debridement Market benefits from active R&D by domestic firms targeting chronic wound therapies. Companies are integrating smart wound monitoring systems to optimize debridement procedures. Collaborations between local manufacturers and global players foster new device launches. It continues to evolve through innovation aimed at improving healing efficiency and patient comfort.

Market Trends:

Growing Adoption of Enzymatic and Autolytic Debridement Methods

Clinicians are increasingly preferring enzymatic and autolytic techniques for their precision and lower pain levels. The Japan Wound Debridement Market experiences higher acceptance of these methods in hospitals and clinics. These techniques reduce the risk of infection and support faster recovery compared to traditional surgical methods. Rising awareness among healthcare workers is enhancing procedural outcomes. Companies are introducing new formulations that act selectively on necrotic tissue. Demand for patient-friendly wound care methods is influencing product development. It is promoting a gradual transition toward advanced biological and chemical debridement technologies.

- For instance, MediWound’s NexoBrid enzymatic product was launched in Japan through Kaken Pharmaceuticals in 2023, representing a key milestone in the introduction of biological wound debridement technologies in Japanese hospitals.

Shift Toward Home-Based and Outpatient Wound Care Services

The trend of decentralized healthcare delivery is creating opportunities for at-home wound care solutions. Patients prefer home-based debridement kits to minimize hospital visits and costs. The Japan Wound Debridement Market is adapting to this trend through portable and user-friendly devices. Hospitals are partnering with telemedicine platforms to guide patients remotely. The expansion of home healthcare services is improving treatment continuity. Portable wound management tools with easy handling are gaining popularity. It is helping healthcare providers extend care access to remote and aging populations.

- For instance, ConvaTec showcased the Flexi-Seal™ PROTECT PLUS Fecal Management System at the 2024 Japanese Society of Wound, Ostomy, and Continence Management Conference, highlighting its dual medication/irrigation port and a unique self-closing catheter designed to improve outcomes in outpatient and home care settings.

Integration of Artificial Intelligence and Digital Monitoring Tools

AI-driven wound assessment systems are being integrated into clinical workflows for accurate diagnosis. Digital imaging and data analytics assist clinicians in selecting suitable debridement procedures. The Japan Wound Debridement Market is witnessing collaborations for AI-based wound analysis tools. These systems reduce manual error and speed up treatment planning. Smart sensors are being embedded into dressings to track healing progress. Hospitals are leveraging data platforms for personalized patient monitoring. It is transforming wound management into a data-informed and predictive healthcare practice.

Growing Presence of Global Companies and Strategic Collaborations

International firms are strengthening their presence through partnerships with Japanese healthcare providers. Local distributors are expanding their portfolios with imported wound care technologies. The Japan Wound Debridement Market benefits from global companies introducing advanced debridement systems. These collaborations ensure technology transfer and enhance training among local clinicians. Partnerships also promote faster regulatory approval for innovative products. Companies are adopting strategies to align with Japan’s strict healthcare standards. It continues to attract foreign investments in wound management and medical device development.

Market Challenges Analysis:

High Cost of Advanced Wound Debridement Devices and Limited Reimbursement Coverage

The cost of advanced wound debridement systems remains a major barrier for smaller hospitals and clinics. Despite government support, reimbursement for high-end devices is limited, affecting affordability. Many healthcare facilities rely on conventional methods due to budget constraints. The Japan Wound Debridement Market faces challenges in balancing innovation with cost efficiency. Import duties and regulatory expenses increase product prices further. Patients in rural regions often cannot access modern debridement tools. It must address these cost-related barriers to ensure equitable access across the country.

Shortage of Skilled Professionals and Uneven Healthcare Access Across Regions

A lack of trained wound care specialists limits the adoption of advanced debridement techniques. Many healthcare providers struggle to manage chronic wounds effectively due to skill gaps. The Japan Wound Debridement Market is also affected by uneven healthcare distribution. Urban hospitals are well-equipped, while rural clinics lack the infrastructure for advanced treatments. This disparity slows down national-level adoption of new technologies. The shortage of dedicated wound care units affects patient recovery times. It requires stronger training programs and resource distribution to improve healthcare equality.

Market Opportunities:

Rising Demand for Minimally Invasive and Patient-Centric Debridement Solutions

Growing patient preference for less painful and faster recovery procedures is expanding market potential. The Japan Wound Debridement Market can leverage innovation in enzymatic and ultrasonic methods. Increasing awareness about self-care and home treatment options supports product diversification. Companies can design compact and affordable solutions for elderly users. Collaborations with digital health startups offer personalized care plans. Hospitals are open to adopting smart, data-based devices that enhance healing outcomes. It will likely benefit from continuous demand for safe, user-friendly debridement technologies.

Expansion Opportunities in Rural Healthcare and Telemedicine Integration

Improving rural healthcare infrastructure presents untapped opportunities for market players. The government’s focus on digitalization supports telemedicine integration for wound management. The Japan Wound Debridement Market can expand by offering remote care and training programs. Companies can collaborate with healthcare networks to reach underserved populations. Introducing low-cost devices with remote monitoring functions can increase adoption. Hospitals are willing to explore mobile wound care units for chronic cases. It holds strong potential for growth through nationwide digital and infrastructure advancement.

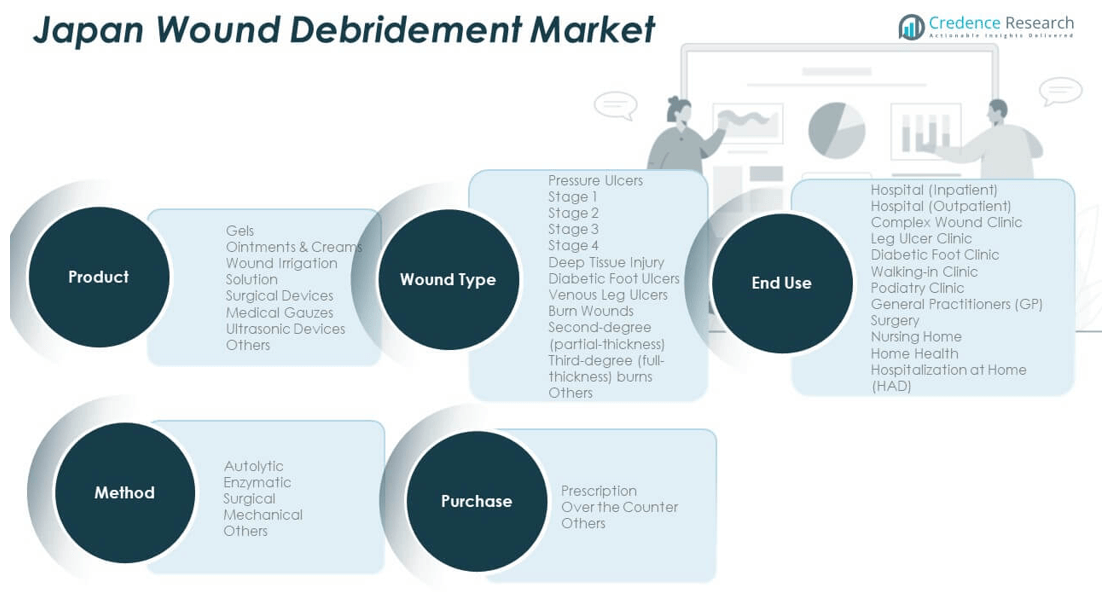

Market Segmentation Analysis:

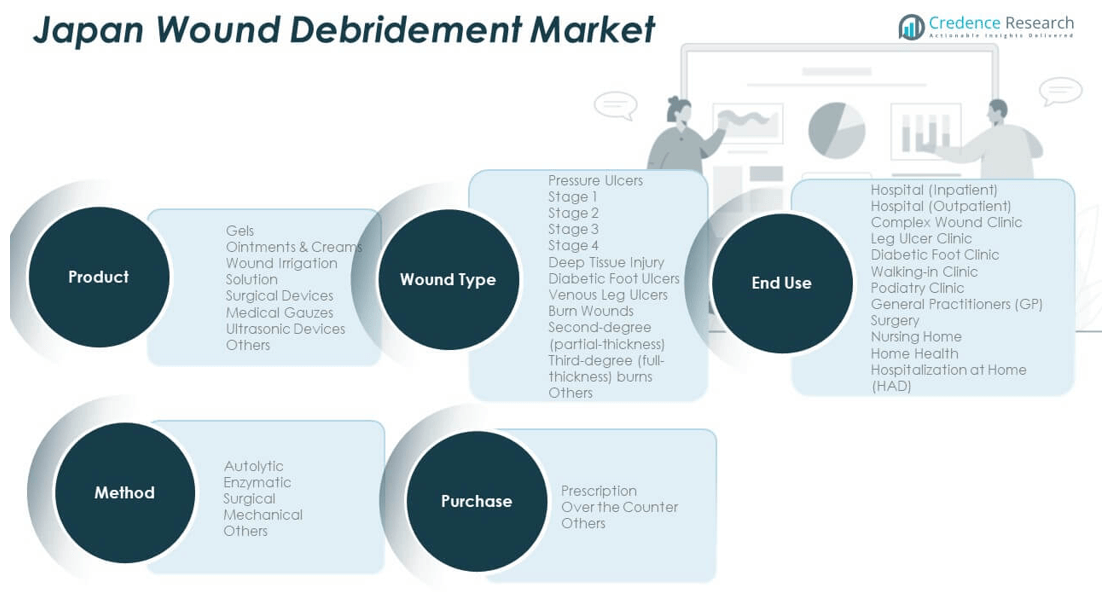

By Product Segment

The Japan Wound Debridement Market is segmented into gels, ointments and creams, wound irrigation solutions, surgical devices, medical gauzes, ultrasonic devices, and others. Gels and ointments lead the market due to their ease of use, cost-effectiveness, and high patient compliance. Surgical and ultrasonic devices are gaining traction in hospitals for chronic wound management. Wound irrigation solutions are increasingly used in outpatient care for infection control. It continues to see rising innovation across bioactive and enzyme-based formulations designed for faster healing.

By Method Segment

Key methods include autolytic, enzymatic, surgical, mechanical, and others. Autolytic debridement holds a significant share due to its non-invasive nature and safety for sensitive wounds. Enzymatic methods are expanding in usage with improved formulations for selective tissue removal. Surgical debridement remains dominant in severe or infected wounds requiring fast tissue clearance. Mechanical methods find steady use in clinics for cost-conscious treatment. It benefits from the growing adoption of combination techniques in complex cases.

- For instance, a December 2023 retrospective study in The International Journal of Lower Extremity Woundsat a Japanese medical center found that single-use incisional negative pressure wound therapy was associated with a reduction in surgical site infections (SSI) and wound dehiscence within 15 days post-lower extremity amputation, when compared to standard care.

By Wound Type, End-Use, and Purchase Segment

Pressure ulcers and diabetic foot ulcers form the largest wound type segments due to Japan’s aging population and diabetes prevalence. Hospitals, both inpatient and outpatient, dominate end-use due to advanced infrastructure and skilled professionals. Home health and nursing care segments are expanding with the rise of remote and elderly care services. By purchase type, prescription-based products account for major revenue, while over-the-counter products are expanding through pharmacies and online platforms. It shows balanced demand across institutional and home-based treatment settings.

Segmentation:

By Product Segment

- Gels

- Ointments & Creams

- Wound Irrigation Solution

- Surgical Devices

- Medical Gauzes

- Ultrasonic Devices

- Others

By Method Segment

- Autolytic

- Enzymatic

- Surgical

- Mechanical

- Others

By Wound Type Segment

- Pressure Ulcers

- Stage 1

- Stage 2

- Stage 3

- Stage 4

- Deep Tissue Injury

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Burn Wounds

- Second-degree (Partial-thickness)

- Third-degree (Full-thickness)

- Others

By End-Use Segment

- Hospital (Inpatient)

- Hospital (Outpatient)

- Complex Wound Clinic

- Leg Ulcer Clinic

- Diabetic Foot Clinic

- Walk-in Clinic

- Podiatry Clinic

- General Practitioners (GP) Surgery

- Nursing Home

- Home Health

- Hospitalization at Home (HAD)

By Purchase Segment

- Prescription

- Over the Counter

- Others

Regional Analysis:

Kanto Region – Dominant Healthcare and Technological Hub

The Kanto region holds the largest share of the Japan Wound Debridement Market, accounting for nearly 38% of the total revenue. Tokyo, Kanagawa, and Saitama lead due to their advanced medical infrastructure and high concentration of specialized hospitals. The region’s dense elderly population drives consistent demand for chronic wound care and debridement services. Leading healthcare providers are investing in advanced enzymatic and ultrasonic devices to improve patient recovery outcomes. Government initiatives supporting smart hospital systems and digital health platforms further enhance regional growth. It benefits from strong collaboration between research institutions, global medical device firms, and local distributors that ensure faster technology adoption.

Kansai Region – Expanding Clinical Adoption and Manufacturing Presence

The Kansai region represents about 27% of the Japan Wound Debridement Market share, supported by major cities such as Osaka, Kyoto, and Hyogo. Hospitals in the region are increasingly integrating advanced wound care protocols into routine clinical practice. Local manufacturers are contributing to innovation by developing cost-effective surgical and autolytic debridement solutions. The region’s growing medical tourism sector also strengthens the demand for wound management products. Rising collaborations between pharmaceutical and biomedical companies support regional competitiveness. It continues to expand through government-backed healthcare modernization programs and strong local production capabilities.

Chubu and Other Regions – Emerging Growth Frontiers

The Chubu region accounts for nearly 20% of the market share, driven by industrial development and a growing network of regional hospitals. Prefectures such as Aichi and Shizuoka are witnessing steady improvements in healthcare accessibility and service quality. The remaining regions, including Kyushu and Hokkaido, collectively hold around 15% of the Japan Wound Debridement Market. These areas are emerging as potential growth zones due to the expansion of home healthcare and government support for rural medical services. Increasing adoption of telemedicine and portable debridement devices improves access to treatment in remote areas. It is expected to see long-term growth through continuous investment in infrastructure and nationwide standardization of wound care protocols.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nippon Medical & Chemical Instruments Co., Ltd.

- Kaken Pharmaceutical Co., Ltd.

- Nipro Corporation

- Torii Pharmaceutical Co., Ltd.

- Fujifilm Wako Pure Chemical Corporation

- 3M Japan Ltd.

- Smith & Nephew

- Coloplast

- ConvaTec Japan

- Braun Medical Japan Co., Ltd.

- Mölnlycke Health Care Japan

- BD Japan

Competitive Analysis:

The Japan Wound Debridement Market is moderately consolidated, featuring a mix of domestic and international players competing on product quality, innovation, and distribution strength. Leading companies such as Nippon Medical & Chemical Instruments, 3M Japan Ltd., and Mölnlycke Health Care Japan dominate through strong brand presence and diversified portfolios. Local firms like Kaken Pharmaceutical and Nipro Corporation enhance competitiveness through cost-effective wound care solutions. Global brands including Smith & Nephew, Coloplast, and ConvaTec Japan focus on advanced enzymatic and surgical devices. It maintains intense competition driven by continuous product upgrades and clinical collaborations aimed at improving wound healing outcomes.

Recent Developments:

- In Nipro Corporation, August 2025 saw the company expand its business internationally by rebranding its American subsidiaries as Nipro Americas Group Companies, Inc. and investing in a new US-based medical device facility—demonstrating its growing manufacturing capacity and focus on wound care and chronic disease device innovation, relevant to its market leadership in Japan.

- In Nipro Corporation, the company further strengthened its international footprint in August 2025 by rebranding its American operations as Nipro Americas Group Companies, Inc., and investing in a new medical device facility in North Carolina, USA. While the latter is a US-market move, it underscores Nipro’s growth and innovation capacity that also supports advancement of wound care and debridement technology lines in the Japanese and global markets.

- In Kaken Pharmaceutical Co., Ltd., another notable partnership was unveiled in August 2025 when the company entered into a licensing agreement with Astria Therapeutics to develop and commercialize navenibart, a Phase III-stage hereditary angioedema (HAE) drug, in Japan. Kaken paid $16 million upfront for the Japanese rights, reinforcing its late-stage rare disease portfolio and strategy for innovative therapies addressing unmet medical needs in Japan.

Report Coverage:

The research report offers an in-depth analysis based on product, method, wound type, end-use, and purchase segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of advanced enzymatic and autolytic debridement methods across hospitals and clinics.

- Increasing government support for digital wound management platforms and smart healthcare systems.

- Expansion of home-based wound care and telemedicine services for elderly and chronic patients.

- Growing focus on localized product manufacturing to reduce import dependency.

- Integration of AI-driven diagnostic tools to enhance wound assessment accuracy.

- Continuous product innovation targeting faster recovery and patient comfort.

- Strengthening collaborations between domestic companies and global medical device leaders.

- Development of cost-efficient products to improve accessibility in rural regions.

- Steady demand growth driven by an aging population and rising chronic disease incidence.

- Enhanced clinical training and public awareness programs promoting better wound care outcomes.