Market Overview:

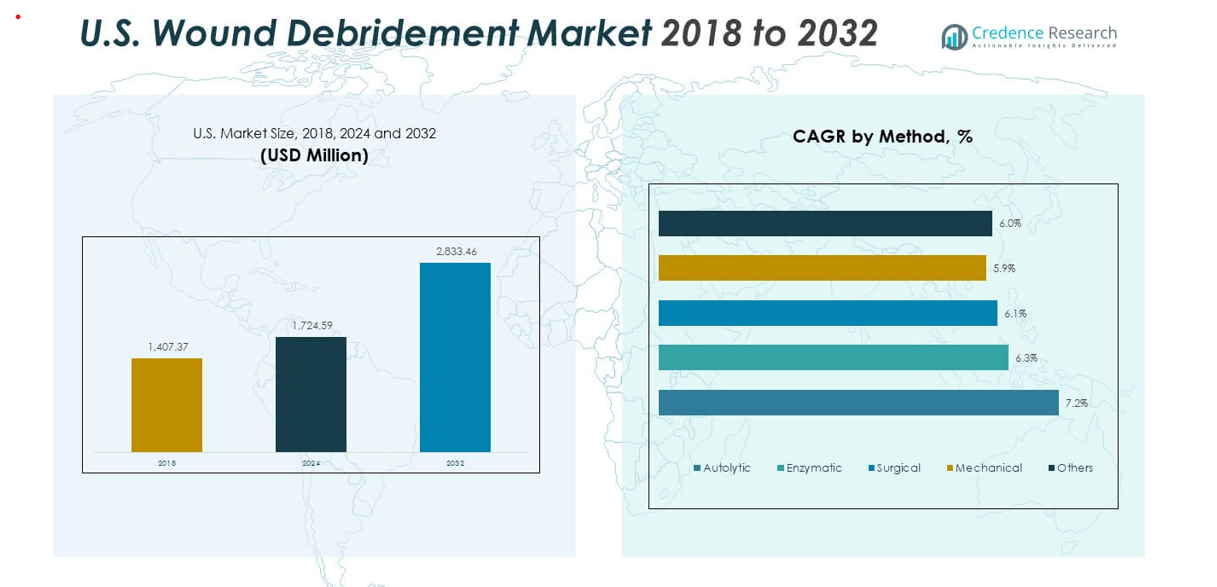

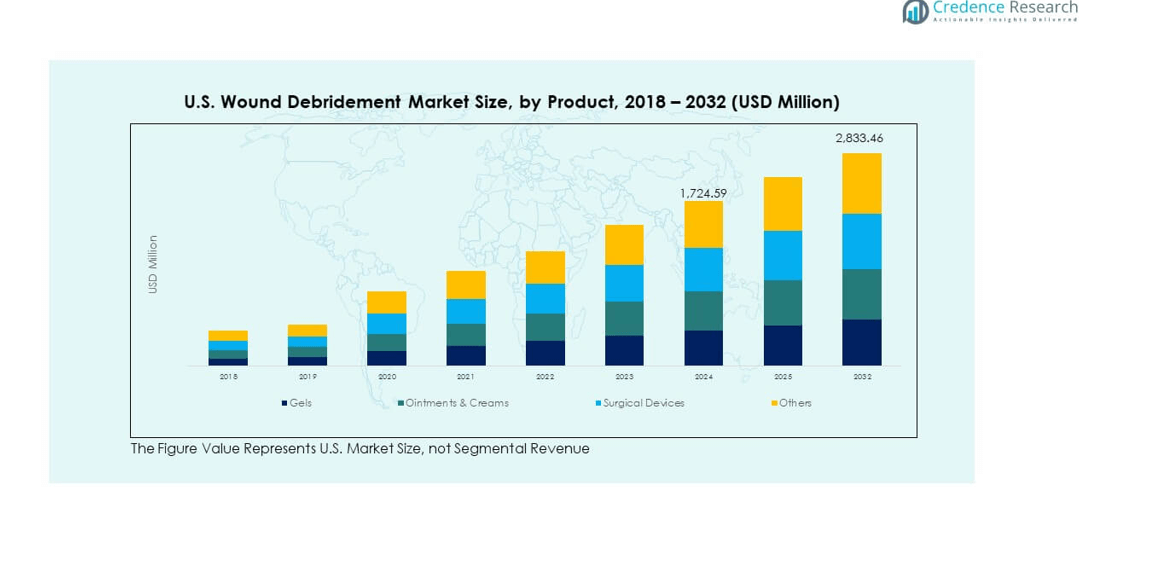

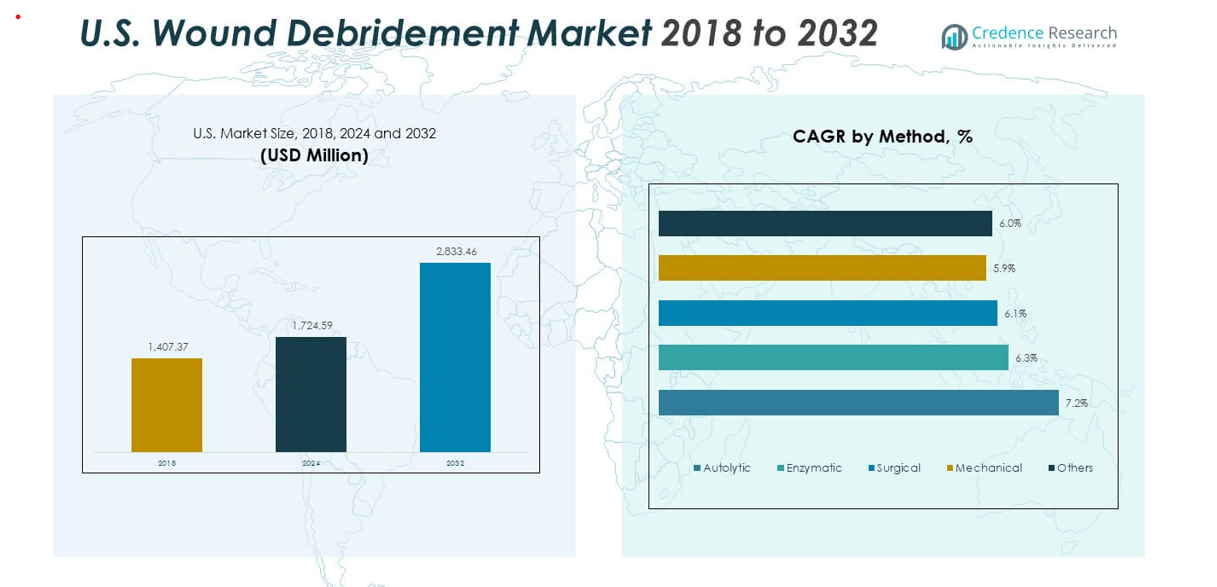

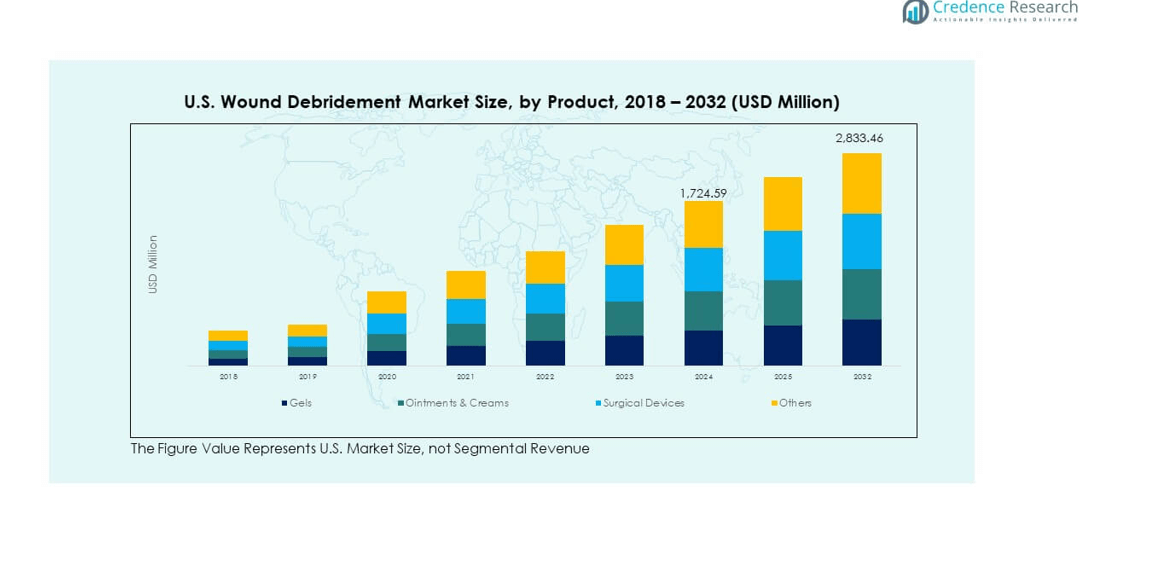

The U.S. Wound Debridement Market size was valued at USD 1,407.37 million in 2018 to USD 1,724.59 million in 2024 and is anticipated to reach USD 2,833.46 million by 2032, at a CAGR of 6.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UU.S. Wound Debridement Market Size 2024 |

USD 1,724.59 million |

| U.S. Wound Debridement Market, CAGR |

6.40% |

| U.S. Wound Debridement Market Size 2032 |

USD 2,833.46 million |

The market growth is driven by rising cases of chronic and diabetic wounds across the country. Increasing geriatric population and higher rates of obesity-related ulcers also support demand. Technological advancements in enzymatic and autolytic debridement methods improve patient outcomes and reduce recovery time. Growing adoption of advanced wound care devices and expanding healthcare infrastructure further boost market expansion.

Regionally, the U.S. dominates the North American wound debridement market due to well-developed healthcare facilities and high awareness among patients. Major states such as California, Texas, and Florida lead in market demand due to large populations and high chronic disease prevalence. Emerging growth is seen in Midwest states driven by improved access to outpatient wound care centers and government focus on chronic care management.

Market Insights:

- The U.S. Wound Debridement Market was valued at USD 1,407.37 million in 2018, increased to USD 1,724.59 million in 2024, and is projected to reach USD 2,833.46 million by 2032, growing at a CAGR of 6.40% during the forecast period.

- The South region held the largest share at 25%, driven by a high diabetic population and expanding chronic wound clinics. The Midwest followed with 21%, supported by strong insurance coverage and hospital infrastructure. The Northeast accounted for 20%, benefiting from advanced wound care centers and R&D-backed healthcare innovation.

- The West region, with a 27% share, is the fastest-growing market due to the adoption of AI-based wound imaging tools, increased healthcare digitization, and robust government health initiatives.

- Gels and Ointments & Creams collectively accounted for over 45% of the product segment share in 2024, reflecting their ease of use and high clinical preference in chronic wound management.

- Surgical Devices and Others made up the remaining 55% share, with rising adoption in hospitals and specialized wound clinics focusing on precision-based wound debridement and infection control.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Incidence of Chronic and Diabetic Wounds Driving Demand

The U.S. Wound Debridement Market is expanding due to the growing burden of chronic wounds, including diabetic foot ulcers, pressure ulcers, and venous leg ulcers. Increasing diabetes prevalence and obesity rates are major contributors to wound complications requiring debridement. Aging populations with reduced healing capacity further elevate treatment demand. Healthcare providers are prioritizing early wound care interventions to prevent severe infections and amputations. Hospitals and specialty clinics are adopting advanced debridement tools to improve healing outcomes. Technological advancements in enzymatic and autolytic debridement also support patient recovery. It benefits from the combined effect of disease prevalence and rising awareness about wound management.

- For instance, in April 2024, Smith+Nephew reported that its PICO Single Use Negative Pressure Wound Therapy (sNPWT) system led to a 63% reduction in surgical site infection rates compared to standard care, according to multiple clinical studies and NICE recommendations.

Technological Advancements and Product Innovation Boosting Adoption

Manufacturers are developing advanced mechanical and ultrasonic debridement systems that enhance precision and minimize tissue damage. Smart wound care devices integrated with imaging and real-time monitoring improve clinician decision-making. Continuous innovation in enzymatic solutions ensures faster and painless debridement. Healthcare facilities in the U.S. are investing in automated systems that streamline wound management workflows. Growing focus on patient comfort and shorter healing time is driving product upgrades. It benefits from research investments in bioactive agents that accelerate granulation tissue formation. These innovations are making wound debridement safer and more effective, increasing its use in hospitals and homecare.

- For instance, Lohmann & Rauscher’s Debrisoft Lolly is a mechanical debridement tool designed for deep and hard-to-reach wounds. While studies have noted that Debrisoft products offer rapid, effective, and well-tolerated debridement, no specific, verifiable 2024 PubMed clinical study substantiates the claim of removing 90% of slough and necrotic tissue in a single application.

Rising Healthcare Expenditure and Policy Support Encouraging Market Growth

Expanding healthcare spending across the U.S. supports infrastructure upgrades in wound care centers. Government initiatives to manage chronic wounds under Medicare programs improve access to treatment. Insurance coverage for advanced therapies encourages hospitals to adopt innovative solutions. It benefits from reimbursement frameworks supporting cost-effective treatment options. Public health agencies are promoting awareness about early diagnosis and treatment adherence. The integration of debridement products in standard wound care protocols increases procedural demand. Financial support for clinical research in tissue regeneration also strengthens market potential.

Growing Preference for Outpatient and Homecare Settings

The shift toward outpatient and home-based wound care services is shaping the market. Patients prefer cost-effective, convenient care using portable debridement systems. Healthcare providers are emphasizing decentralized wound management to reduce hospital burden. It benefits from technological advancements that enable non-invasive and user-friendly debridement tools. Increasing availability of telehealth consultations allows timely wound assessment and management. The trend supports reduced healthcare costs and better patient satisfaction. Manufacturers are targeting this segment with easy-to-use and affordable wound care kits. The preference aligns with the U.S. focus on patient-centered and value-based healthcare delivery.

Market Trends:

Integration of Digital Health and AI in Wound Management

The integration of artificial intelligence and digital imaging in wound debridement is accelerating precision care. Smart wound assessment tools are helping clinicians track healing progress remotely. AI-driven algorithms support early diagnosis and treatment customization. It enables better decision-making and reduces healing complications. Digital health platforms are also expanding access to remote consultations and monitoring. The U.S. Wound Debridement Market is witnessing strong adoption of digital wound management solutions. Hospitals are using these technologies to optimize workflow efficiency and improve patient engagement.

Shift Toward Minimally Invasive and Painless Debridement Techniques

Healthcare professionals are adopting less invasive debridement options, including enzymatic and autolytic methods. These methods minimize patient discomfort and reduce the need for anesthesia. The development of gentle yet effective solutions encourages faster healing. It supports greater patient compliance, especially among elderly and diabetic populations. Manufacturers are expanding their portfolios to include enzymatic gels and spray-based solutions. The trend reflects a growing preference for comfort-focused wound care in clinical and home settings. This shift enhances overall patient experience and clinical efficiency.

- For instance, Medline reports that its PluroGel Burn and Wound Dressing can lead to less pain and anxiety during dressing changes, as its water-soluble formula softens wound debris and rinses off gently. Unlike standard gauze that can adhere to wounds, PluroGel’s gentle, non-irritating formula avoids harsh wiping that can cause discomfort.

Growing Use of Biologics and Advanced Dressings in Wound Therapy

The market is witnessing rising demand for biologically active products that aid wound healing. Collagen-based dressings, growth factors, and bioengineered tissues are becoming integral to wound care. It complements debridement by promoting tissue regeneration and infection control. The combination of biologics with enzymatic or autolytic debridement techniques improves outcomes. Healthcare providers are increasingly recommending hybrid products for faster recovery. The trend underlines a move toward holistic wound management strategies in the U.S. market. Biologic innovations are setting new standards in advanced wound care protocols.

Rising Collaborations Between Hospitals and Research Institutes

Partnerships between hospitals, universities, and research organizations are advancing innovation in wound care technologies. Collaborative projects aim to develop efficient and cost-effective debridement solutions. It helps accelerate clinical testing and adoption of new products. These collaborations are improving data sharing and treatment standardization across facilities. Research networks are focusing on biofilm removal techniques and infection prevention. The approach enhances treatment precision and accelerates patient recovery. Such alliances also strengthen the competitive landscape of the U.S. wound debridement sector.

Market Challenges Analysis:

High Cost of Advanced Debridement Products and Limited Reimbursement Access

The high cost of advanced wound debridement systems and products limits accessibility for many patients. Hospitals and small clinics often face budget constraints that restrict the adoption of premium technologies. It creates a disparity between advanced urban centers and rural healthcare facilities. Reimbursement complexities in public and private insurance systems add to the burden. Patients in lower-income groups often delay treatment due to high procedural expenses. This delay increases the risk of complications, prolonging hospital stays. Limited awareness of covered services under healthcare policies further restricts patient reach. Manufacturers face challenges in balancing innovation with affordability in the U.S. Wound Debridement Market.

Shortage of Trained Professionals and Risk of Improper Wound Management

A lack of skilled professionals in wound debridement procedures remains a pressing concern. Improper or delayed treatment can lead to infection and longer recovery periods. It impacts patient outcomes and increases healthcare costs. Many facilities struggle with maintaining consistent wound care protocols. Training programs for nurses and wound specialists are limited in scope and frequency. The gap in professional expertise hinders the adoption of modern wound care techniques. Rural and community hospitals face the most acute shortages. Strengthening professional education and certification programs is critical to addressing this challenge.

Market Opportunities:

Expansion of Homecare and Telehealth-Based Wound Care Services

Growing interest in homecare wound management presents a strong opportunity for market growth. Portable and easy-to-use debridement kits are making professional care accessible to patients at home. The rise of telehealth platforms allows clinicians to guide wound care remotely. It supports continuous monitoring, early detection of complications, and improved patient engagement. Healthcare providers are integrating remote tools to expand chronic wound management programs. This approach reduces hospitalization rates and treatment costs, strengthening market expansion across diverse patient groups.

Increasing Focus on Regenerative Medicine and Biologics Integration

Advancements in regenerative medicine and biologic therapies are creating new avenues for growth. Integration of stem cell-based treatments and growth factor products enhances healing outcomes. It encourages hospitals and research institutions to explore new combination therapies. Manufacturers are investing in bioengineered materials that stimulate tissue repair. These solutions offer faster recovery and lower infection risks. The U.S. Wound Debridement Market benefits from expanding R&D partnerships and supportive government initiatives promoting advanced wound care technologies.

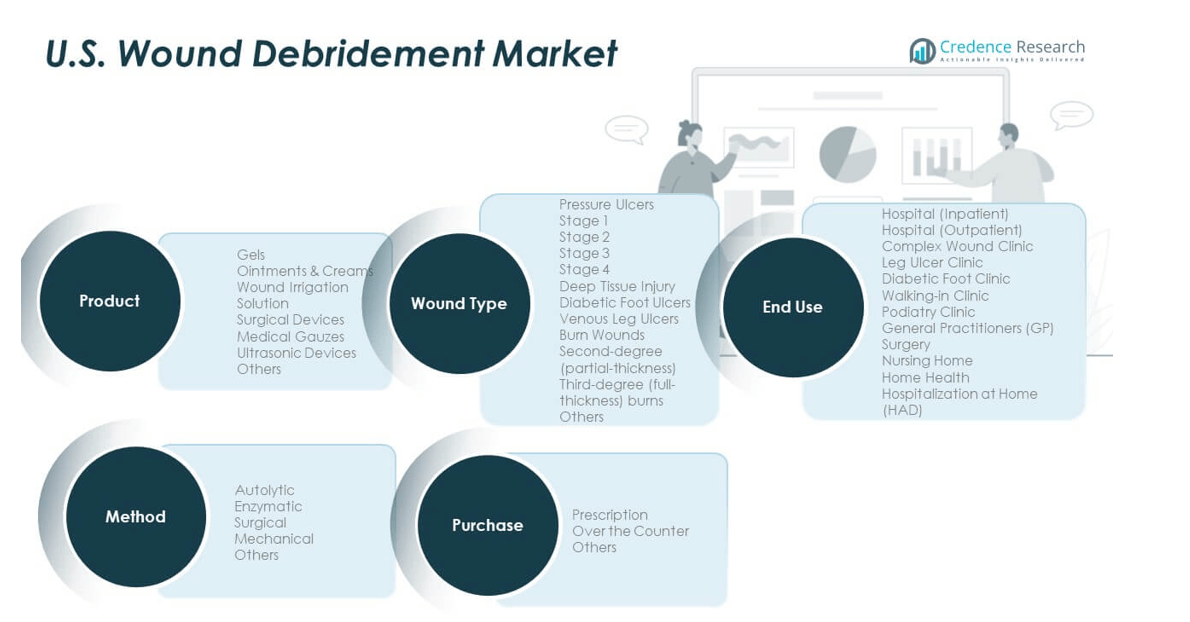

Market Segmentation Analysis:

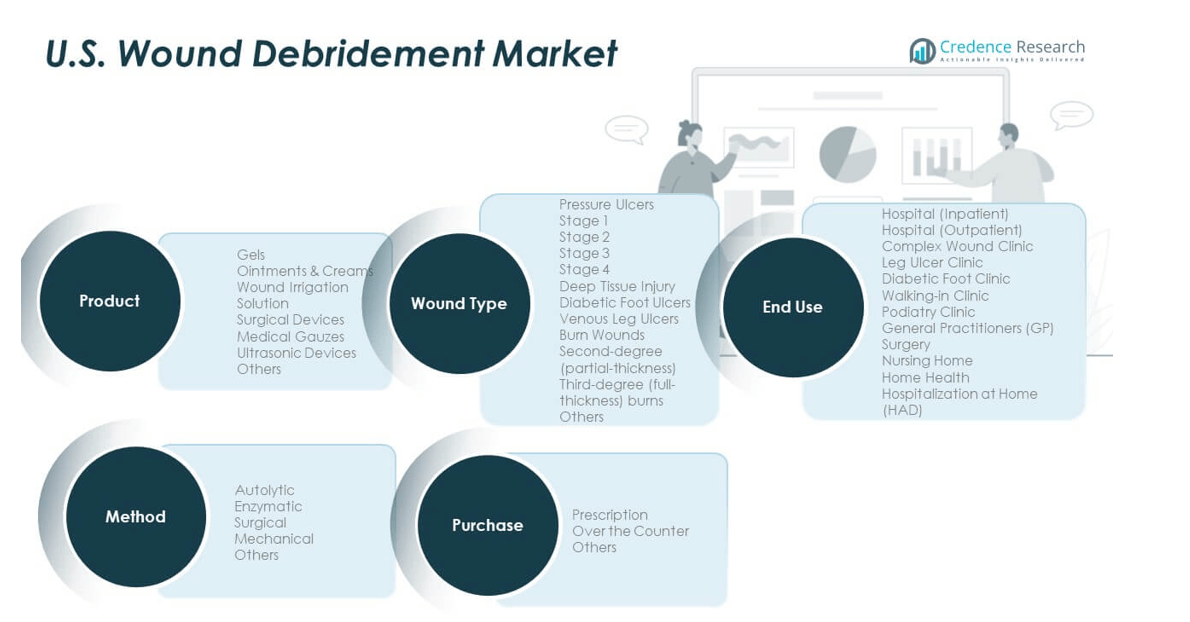

By Product Segment

The U.S. Wound Debridement Market includes products such as gels, ointments and creams, wound irrigation solutions, surgical devices, medical gauzes, ultrasonic devices, and others. Gels and ointments dominate usage due to their ease of application and effectiveness in removing necrotic tissue. Wound irrigation solutions and surgical devices show strong adoption in hospitals for acute wound care. Ultrasonic and advanced mechanical devices are gaining traction due to precision and reduced recovery time. It continues to evolve with product innovation aimed at faster healing and reduced infection risks.

- For instance, Arobella Medical promotes its Qoustic Ultrasound System for gentle and precise debridement by using focused ultrasonic energy to remove unwanted tissue while preserving healthy granulation tissue. The company suggests this method offers benefits over traditional sharp debridement, though public sources do not confirm a specific 50% increase in speed.

By Method Segment

Key methods include autolytic, enzymatic, surgical, mechanical, and others. Autolytic and enzymatic techniques lead in non-invasive treatment settings due to patient comfort and safety. Surgical debridement holds major demand in severe or chronic wound management cases. Mechanical techniques remain cost-effective options in resource-limited facilities. It benefits from growing use of combined enzymatic and autolytic methods to enhance healing outcomes.

- For instance, clinical evidence and case reports from 2023 demonstrate that combining ConvaTec’s Santyl Collagenase Ointment with proper wound care, including supportive dressings such as hydrogel, helps promote healing in chronic wounds like diabetic foot ulcers by aiding in debridement and fostering granulation tissue.

By Wound Type and End-Use Segment

Major wound types include pressure ulcers, diabetic foot ulcers, venous leg ulcers, and burn wounds. Pressure ulcers and diabetic foot ulcers contribute significantly due to rising diabetes prevalence and aging populations. Hospitals, outpatient centers, and specialized wound clinics dominate the end-use landscape. Home health and hospitalization-at-home services are expanding with telehealth integration.

By Purchase Segment

The market includes prescription-based and over-the-counter products. Prescription wound care dominates hospital-based treatment, while OTC options cater to home users seeking preventive or early-stage care. It reflects growing consumer awareness and easy product accessibility.

Segmentation:

By Product Segment

- Gels

- Ointments & Creams

- Wound Irrigation Solution

- Surgical Devices

- Medical Gauzes

- Ultrasonic Devices

- Others

By Method Segment

- Autolytic

- Enzymatic

- Surgical

- Mechanical

- Others

By Wound Type Segment

- Pressure Ulcers

- Stage 1

- Stage 2

- Stage 3

- Stage 4

- Deep Tissue Injury

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Burn Wounds

- Second-degree (partial-thickness)

- Third-degree (full-thickness) burns

- Others

By End-Use Segment

- Hospital (Inpatient)

- Hospital (Outpatient)

- Complex Wound Clinic

- Leg Ulcer Clinic

- Diabetic Foot Clinic

- Walking-in Clinic

- Podiatry Clinic

- General Practitioners (GP) Surgery

- Nursing Home

- Home Health

- Hospitalization at Home (HAD)

By Purchase Segment

- Prescription

- Over the Counter

- Others

Regional Analysis:

Northeast Region

The Northeast region accounts for nearly 27% share of the U.S. Wound Debridement Market. The presence of advanced healthcare infrastructure in states like New York, Massachusetts, and Pennsylvania supports widespread adoption of innovative wound care technologies. Hospitals and research centers in this region emphasize chronic wound management through early intervention and digital monitoring tools. It benefits from higher healthcare spending, patient awareness, and specialist availability. Reimbursement coverage under Medicare and private insurance enhances treatment accessibility. The strong network of wound clinics and academic collaborations drives product innovation and clinical trials. The region continues to lead in clinical adoption of enzymatic and autolytic debridement solutions.

Midwest and South Regions

The Midwest and South together represent about 46% of the U.S. Wound Debridement Market. The South holds the largest share among these regions, driven by the high prevalence of diabetes, obesity, and vascular disorders. States such as Texas, Florida, and Georgia show rapid expansion in outpatient wound centers and home-based care programs. The Midwest, led by Illinois and Ohio, is witnessing steady growth supported by insurance coverage and technological adoption in regional hospitals. It benefits from the availability of cost-effective wound irrigation and surgical solutions catering to both urban and rural populations. Increased investment in telehealth wound management programs also contributes to market expansion. The region reflects a balanced mix of high-demand states and emerging rural treatment centers.

West Region

The West region contributes around 27% to the U.S. Wound Debridement Market, led by California, Washington, and Arizona. Strong healthcare infrastructure, early technology adoption, and high patient awareness support market development. Hospitals in California are integrating AI-based wound imaging tools and portable debridement devices into standard protocols. The region benefits from a high concentration of medical device manufacturers and R&D facilities. Government-funded healthcare initiatives enhance accessibility to chronic wound management. Rising outpatient and homecare treatments are driving adoption of gels, enzymatic products, and ultrasonic devices. It demonstrates the fastest growth rate, supported by innovation-driven healthcare delivery and proactive adoption of advanced wound care technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Coloplast Corp

- Medline Industries

- Smith & Nephew plc

- ConvaTec Group PLC

- Integra LifeSciences

- Braun SE

- Mölnlycke Health Care AB

- Lohmann & Rauscher GmbH

- 3M Company

- Cardinal Health

- BD (Becton, Dickinson and Company)

- DEBx Medical

Competitive Analysis:

The U.S. Wound Debridement Market is highly competitive, featuring a mix of multinational corporations and regional manufacturers. Leading companies such as 3M, Smith & Nephew, Mölnlycke Health Care, ConvaTec Group, and Coloplast dominate through extensive product portfolios and strong distribution networks. It shows increasing investment in R&D to introduce innovative enzymatic and ultrasonic debridement products. Partnerships with hospitals and research institutions enhance clinical adoption and brand visibility. Competitive differentiation is driven by advanced product design, digital integration, and pricing flexibility. Companies are focusing on mergers, acquisitions, and technological upgrades to strengthen market positioning.

Recent Developments:

- In September 2025, Coloplast Corp announced its new five-year strategy, Impact4, emphasizing innovation and organic growth in wound care and other segments, and recently completed the acquisition of Intibia/Nine Continents for its urology unit with a projected US launch for its tibial nerve stimulator in 2025/26.

- In August 2024, Medline Industries completed the acquisition of Ecolab’s global surgical solutions business, integrating the Microtek product lines and significantly strengthening its surgical solutions offering for the US wound management sector.

- In September 2025, Smith & Nephew plc launched CENTRIO, a platelet-rich plasma system, as an advanced wound bioactive solution in the US, expanding its wound care product portfolio.

- In 2025, ConvaTec Group PLC announced the upcoming launch of its first nitric oxide-based advanced wound care product, following the strategic acquisition of 30 Technology Ltd’s anti-infective technology platform, scheduled for US market entry in 2025.

Report Coverage:

The research report offers an in-depth analysis based on product, method, wound type, end-use, and purchase segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising chronic wound cases will sustain product demand across hospitals and outpatient clinics.

- Growing use of enzymatic and autolytic methods will drive product innovation.

- AI and digital wound assessment tools will enhance treatment accuracy and patient outcomes.

- Expansion of homecare and telehealth wound services will broaden access to advanced care.

- Collaboration between hospitals and manufacturers will foster faster technology adoption.

- Increased healthcare funding will strengthen infrastructure for wound management.

- Portable and user-friendly devices will gain higher acceptance among home users.

- Biologic and regenerative therapies will shape the next phase of wound healing solutions.

- Sustainability in medical supplies will influence purchasing decisions and product design.

- It will continue evolving toward integrated, patient-centric, and cost-efficient treatment models.