Market Overview:

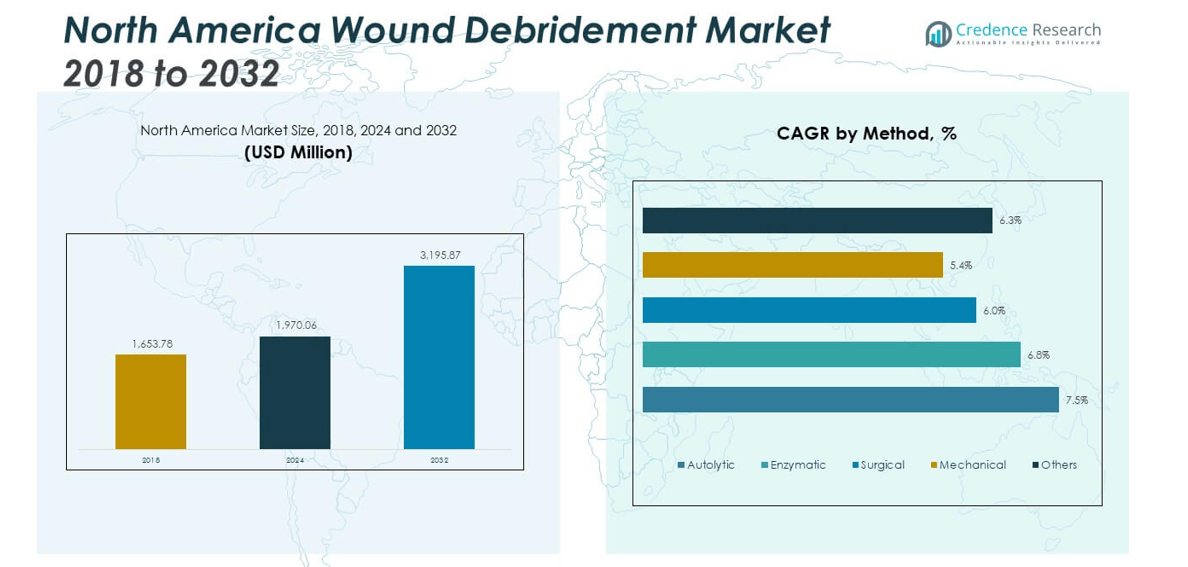

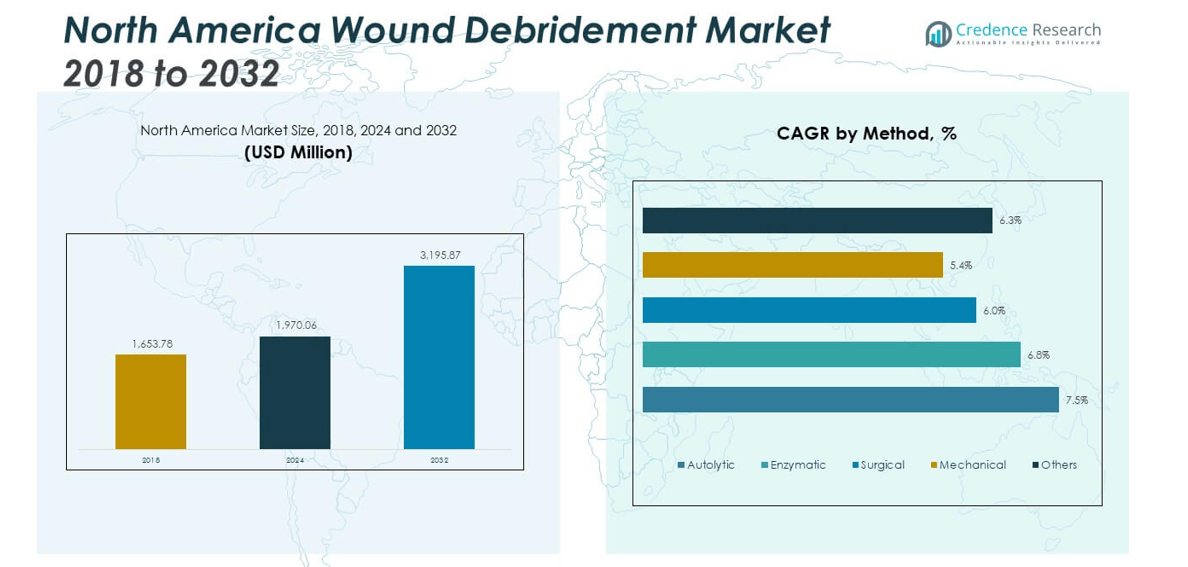

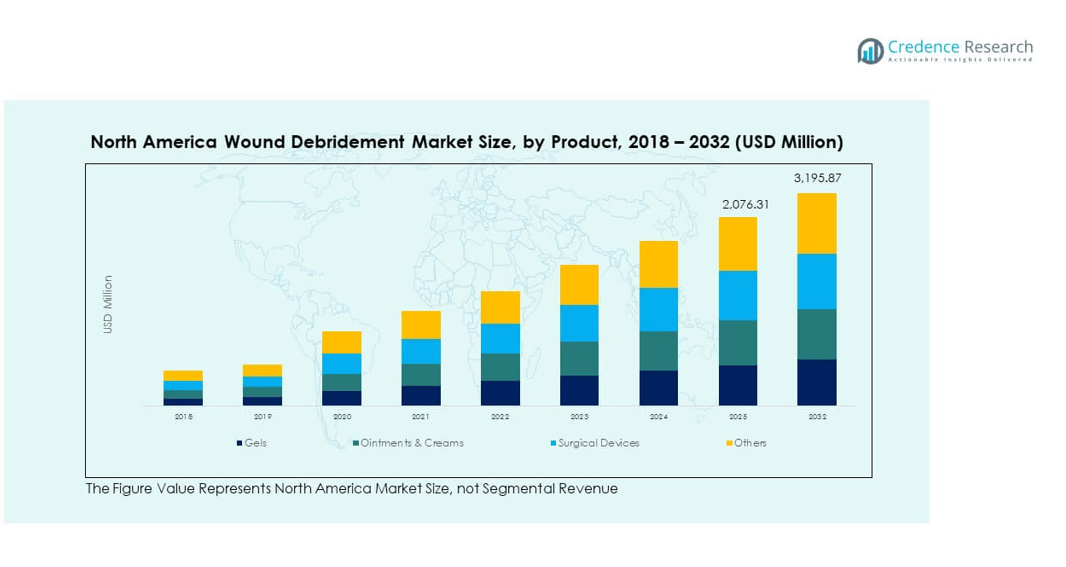

The North America Wound Debridement Market size was valued at USD 1,653.78 million in 2018 to USD 1,970.06 million in 2024 and is anticipated to reach USD 3,195.87 million by 2032, at a CAGR of 6.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Wound Debridement Market Size 2024 |

USD 1,970.06 million |

| North America Wound Debridement Market, CAGR |

6.23% |

| North America Wound Debridement Market Size 2032 |

USD 3,195.87 million |

The market growth is driven by rising cases of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers. Increasing geriatric population, growing diabetes prevalence, and demand for advanced wound care technologies are supporting adoption. Strong healthcare infrastructure and higher patient awareness across the region are further accelerating product penetration and innovation in wound debridement solutions.

The United States leads the North America Wound Debridement Market due to advanced healthcare facilities, higher healthcare spending, and early adoption of modern wound management techniques. Canada follows with growing investments in medical technology and expanding chronic wound care programs. Mexico is emerging rapidly, supported by improving healthcare access and rising government initiatives to enhance wound management outcomes across public hospitals.

Market Insights:

- The North America Wound Debridement Market was valued at USD 1,653.78 million in 2018, reached USD 1,970.06 million in 2024, and is projected to hit USD 3,195.87 million by 2032, growing at a CAGR of 6.23%.

- The United States dominates with 78% share, driven by advanced healthcare infrastructure, high chronic wound prevalence, and rapid adoption of modern wound care technologies. Canada follows with 14%, supported by strong medical training programs and government initiatives, while Mexico holds 8%, fueled by growing healthcare access.

- Mexico represents the fastest-growing region, supported by expanding hospital infrastructure, government healthcare reforms, and rising adoption of affordable wound care solutions.

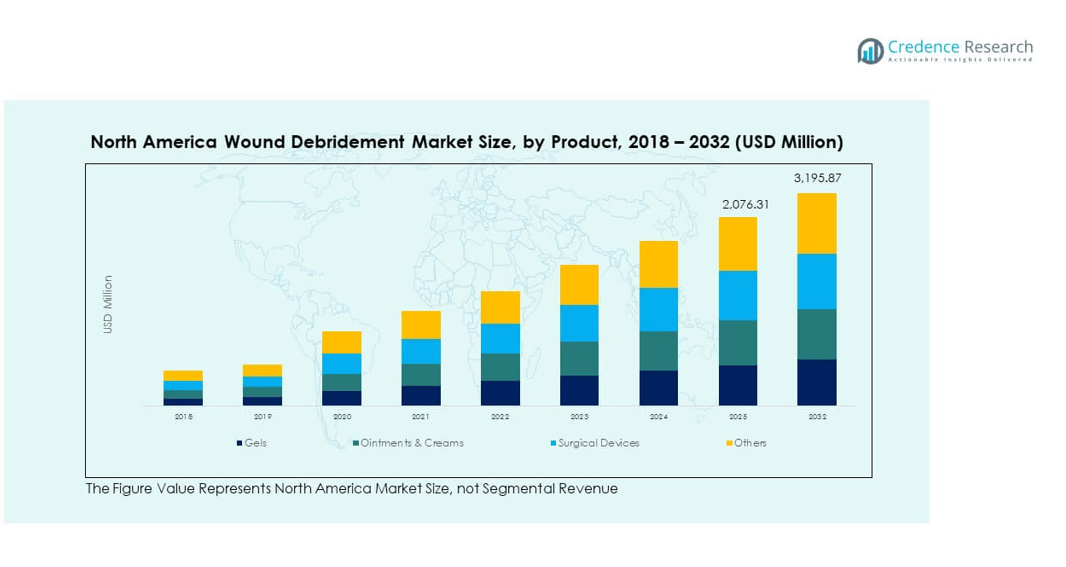

- By product, gels account for the largest segment share at around 32%, due to their ease of application and effectiveness in chronic wound treatment.

- Surgical devices hold nearly 27% share, reflecting increased use in complex wound cases across hospitals and specialized wound care centers in the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Incidence of Chronic and Surgical Wounds Driving Adoption of Advanced Debridement Solutions

The growing prevalence of chronic conditions such as diabetes, vascular diseases, and obesity is expanding the demand for effective wound management. The North America Wound Debridement Market benefits from a high number of surgical procedures and trauma cases requiring precise wound care. It experiences increasing use of enzymatic and autolytic products for efficient tissue removal. Strong clinical emphasis on faster healing and infection prevention is accelerating adoption. Healthcare professionals are increasingly favoring minimally invasive and automated debridement systems. Government initiatives promoting better chronic wound care are enhancing product accessibility. Increasing patient awareness and hospital investments in advanced wound care infrastructure further support the market’s expansion.

- For instance, A December 2023 study published in the International Journal of Lower Extremity Wounds at a Japanese medical center found that single-use incisional negative pressure wound therapy was associated with a reduction in surgical site infections (SSI) and wound dehiscence within 15 days post-lower extremity amputation, when compared to standard care.

Advancements in Debridement Technology Enhancing Clinical Outcomes and Efficiency

Technological innovation is transforming wound debridement practices across the region. The introduction of ultrasonic, hydrosurgical, and laser-assisted systems improves healing outcomes and reduces patient discomfort. The North America Wound Debridement Market is benefiting from device integration with digital wound monitoring platforms. It supports precise treatment planning and early detection of complications. Research collaborations between healthcare providers and device manufacturers are encouraging innovation. Regulatory support for advanced wound care products is improving market penetration. The rising preference for outpatient and home-based wound care solutions further drives the demand for efficient and safe debridement tools.

- For instance, studies published in peer-reviewed journals highlight that ultrasonic debridement devices, such as those from Misonix, have demonstrated superior wound healing outcomes and efficient tissue removal compared to conventional mechanical methods.

Growing Aging Population and Rising Healthcare Expenditure Supporting Market Growth

The aging population across North America significantly contributes to higher wound prevalence, including pressure ulcers and diabetic foot ulcers. The North America Wound Debridement Market benefits from increased healthcare funding focused on elderly care. It experiences rising product demand across hospitals, clinics, and long-term care facilities. Advancements in reimbursement policies for wound care procedures are improving access to modern products. Healthcare organizations are expanding specialized wound care centers to meet growing patient needs. Increased spending on advanced therapies such as enzymatic and mechanical debridement supports clinical outcomes. Enhanced focus on patient comfort and faster recovery further strengthens the regional market’s trajectory.

Rising Awareness and Training Programs Driving Professional Adoption Across Care Settings

Rising education initiatives and training programs are strengthening professional awareness of wound debridement techniques. The North America Wound Debridement Market gains traction through clinical workshops promoting best practices. It witnesses active involvement from wound care associations that improve product adoption rates. The rise of accredited wound care certification programs ensures skilled practitioners deliver optimal patient outcomes. Hospitals and home-care providers are integrating evidence-based wound management protocols. Increasing collaboration between academic institutions and medical device firms enhances knowledge transfer. Expanding access to online training tools and clinical resources continues to improve professional expertise and regional market performance.

Market Trends:

Integration of Smart Wound Care Technologies Improving Monitoring and Debridement Precision

Smart wound monitoring technologies are reshaping clinical approaches to wound debridement. The North America Wound Debridement Market is witnessing a rise in connected devices that track wound healing progress. It includes sensors and imaging systems that measure moisture, temperature, and infection levels. The data-driven approach supports real-time clinical decisions and early intervention. The use of AI-based analysis is improving diagnosis accuracy and reducing treatment time. Integration with telemedicine platforms enhances patient follow-up and remote care delivery. This trend promotes personalized wound treatment and boosts efficiency across healthcare facilities.

- For instance, MolecuLight’s i:X fluorescence imaging device is widely used in wound clinics and hospitals in North America, providing advanced infection visualization and supporting clinicians with objective, real-time wound assessment, as verified in published clinical studies and company documentation.

Shift Toward Outpatient and Home-Based Wound Care Solutions Expanding Access

The preference for home-based and outpatient wound management is gaining momentum in the region. The North America Wound Debridement Market benefits from portable and user-friendly debridement devices. It allows patients to receive consistent care outside hospital environments. The rise of telehealth and e-consultation services further supports this transition. Hospitals are partnering with home-care agencies to improve post-surgical wound care. This approach reduces costs and hospital readmissions while maintaining care quality. Increasing insurance support for home-based wound care solutions strengthens the trend’s adoption.

- For instance, Convatec’s InnovaMatrix product line has experienced rapid adoption across multiple U.S. health systems for advanced wound care solutions, with sales performance and product expansion verified in investor communications and external market news.

Rising Adoption of Biological and Enzymatic Debridement Methods Enhancing Healing Efficiency

The growing shift toward biological and enzymatic debridement is changing wound treatment preferences. The North America Wound Debridement Market is focusing on methods that minimize tissue trauma. It aligns with the clinical goal of promoting natural healing while ensuring precision. Enzymatic products offer controlled necrotic tissue removal, improving recovery time. Increasing research on bioactive agents and microbial enzymes enhances product innovation. Hospitals are integrating hybrid debridement techniques for better patient outcomes. Growing clinical validation and safety profiles continue to expand their acceptance in advanced wound care.

Sustainability and Cost Optimization Becoming Central to Wound Care Innovation

Healthcare providers are emphasizing sustainable practices in wound care management. The North America Wound Debridement Market is seeing higher demand for reusable and eco-friendly medical devices. It reflects a growing focus on cost reduction and environmental responsibility. Manufacturers are developing biodegradable dressing materials and low-waste packaging. Value-based healthcare models are promoting efficient treatment strategies that reduce hospital stays. Adoption of automated systems is improving resource efficiency in clinics. The alignment between clinical outcomes and sustainability goals is redefining innovation strategies for the region.

Market Challenges Analysis:

High Cost of Advanced Debridement Procedures and Limited Reimbursement Coverage

The high cost of advanced wound debridement products poses a barrier to widespread adoption. The North America Wound Debridement Market faces challenges from limited reimbursement for new devices and technologies. It restricts usage among smaller hospitals and outpatient centers. Many healthcare facilities struggle to justify the investment without consistent insurance coverage. Patients in rural areas experience limited access to advanced treatments due to cost constraints. Procurement budgets in public hospitals often prioritize essential supplies over innovative solutions. This imbalance slows down the overall market expansion despite strong clinical advantages.

Shortage of Trained Professionals and Lack of Standardized Clinical Protocols

The shortage of skilled wound care specialists affects treatment consistency and patient outcomes. The North America Wound Debridement Market encounters operational inefficiencies due to varying skill levels among healthcare workers. It also lacks unified guidelines for wound assessment and debridement techniques. Training programs are unevenly distributed across states, limiting knowledge transfer. Smaller clinics face difficulty implementing advanced systems without expert supervision. The absence of standardization in clinical practices delays regulatory approvals. Continued education and certification are needed to strengthen the professional base and ensure consistent quality of care.

Market Opportunities:

Emerging Role of AI and Robotics Creating Next-Generation Wound Debridement Solutions

Artificial intelligence and robotic assistance are creating major opportunities in wound management. The North America Wound Debridement Market is evolving through AI-driven tools that assess wound depth, size, and infection risk. It enables precision-based tissue removal and predictive healing analytics. Robotics are improving surgical accuracy and minimizing manual errors. Hospitals adopting smart systems benefit from improved efficiency and patient satisfaction. Growing research funding for AI-integrated wound care further enhances technological innovation across the region.

Expansion in Outpatient Clinics and Homecare Settings Enhancing Market Reach

Outpatient centers and homecare facilities are becoming vital growth areas for manufacturers. The North America Wound Debridement Market is expanding its reach through compact, affordable, and easy-to-use devices. It supports continuity of care beyond hospital settings. Strategic partnerships with telehealth providers are strengthening accessibility. Insurance coverage for home-based care is increasing patient affordability. Rising focus on community healthcare models ensures long-term sustainability for the market.

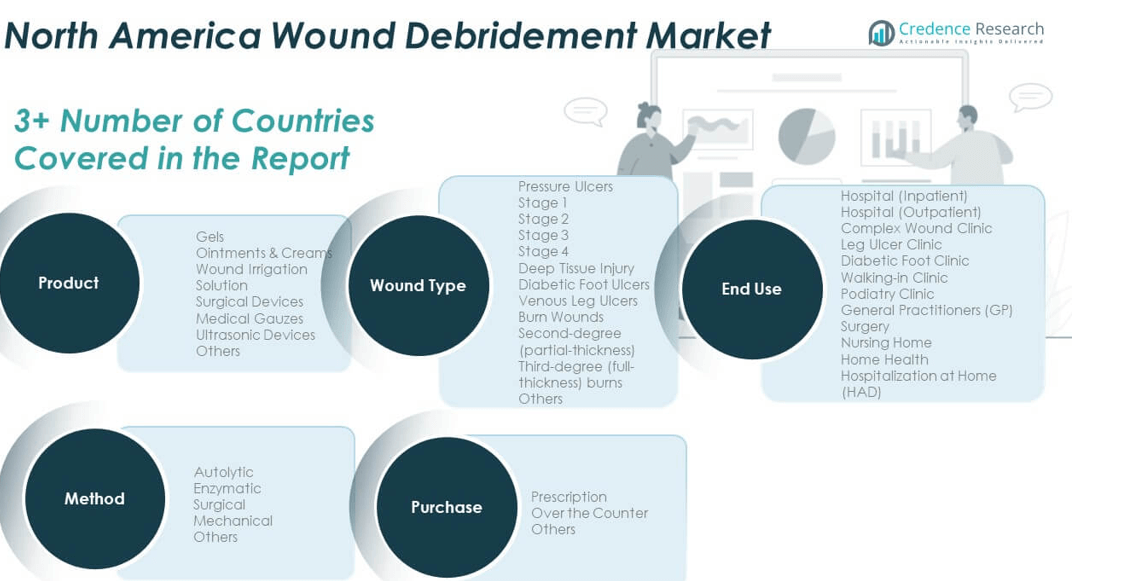

Market Segmentation Analysis:

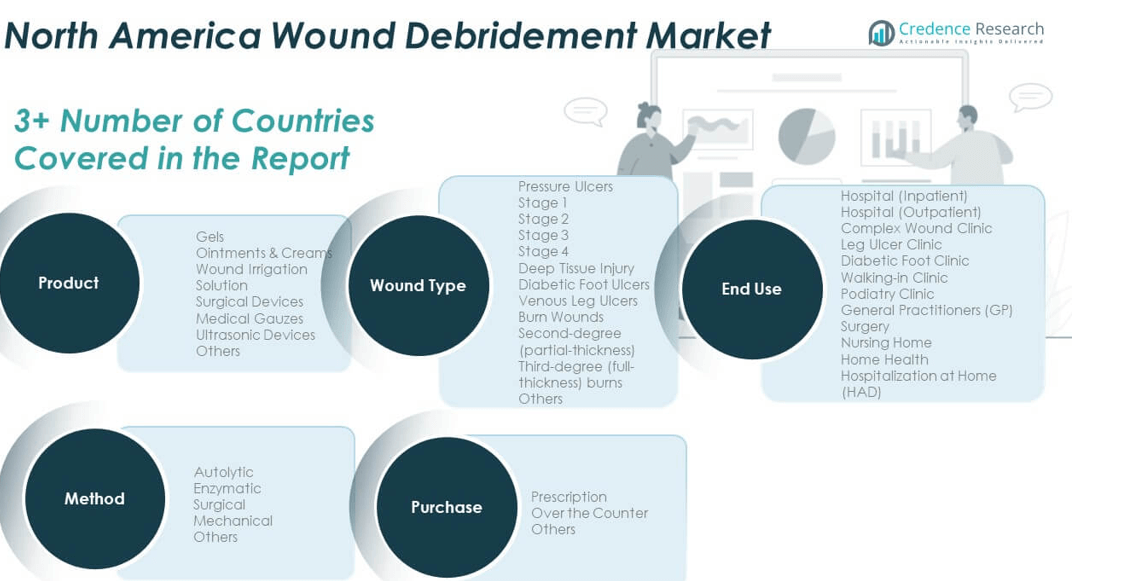

By Product

The North America Wound Debridement Market is segmented into gels, ointments & creams, wound irrigation solutions, surgical devices, medical gauzes, ultrasonic devices, and others. Gels and ointments lead the segment due to their ease of use and faster wound healing. Wound irrigation solutions are gaining traction for reducing infection risks. Surgical and ultrasonic devices are increasingly used in chronic and complex wound cases, enhancing treatment precision. Medical gauzes maintain strong demand for basic wound care needs in hospitals and clinics.

- For instance, Solventum’s Silvercel Hydro-Alginate dressing is widely utilized for managing infected wounds and has been recognized for its antimicrobial benefits and ease of use in product documentation and wound care resources.

By Method

The market includes autolytic, enzymatic, surgical, mechanical, and other methods. Autolytic and enzymatic debridement are witnessing strong adoption due to their minimally invasive nature and tissue preservation. Surgical methods remain essential for severe or infected wounds. Mechanical techniques are common in routine and homecare applications. It benefits from growing clinical preference for controlled, effective, and pain-minimized wound management approaches.

- For instance, Solventum’s Silvercel Hydro-Alginate dressing is widely utilized for managing infected wounds and has been recognized for its antimicrobial benefits and ease of use in product documentation and wound care resources.

By Wound Type

Pressure ulcers, diabetic foot ulcers, venous leg ulcers, and burn wounds dominate this category. Pressure ulcers and diabetic foot ulcers represent a large share due to aging populations and increasing diabetes prevalence. Venous leg ulcers show growing treatment demand from vascular disorders. Burn wounds continue to require advanced debridement solutions to minimize tissue loss and scarring.

By End-use and Purchase

Hospitals, both inpatient and outpatient, account for major revenue share due to higher procedure volumes. Specialized wound clinics, nursing homes, and home healthcare are expanding rapidly. Prescription-based purchases dominate the market, while over-the-counter and home-use solutions are gaining popularity due to convenience and affordability.

Segmentation:

- By Product

- Gels

- Ointments & Creams

- Wound Irrigation Solutions

- Surgical Devices

- Medical Gauzes

- Ultrasonic Devices

- Others

- By Method

- Autolytic

- Enzymatic

- Surgical

- Mechanical

- Others

- By Wound Type

- Pressure Ulcers (Stage 1, Stage 2, Stage 3, Stage 4, Deep Tissue Injury)

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Burn Wounds (Second-degree, Third-degree, Others)

- By End-use

- Hospital (Inpatient)

- Hospital (Outpatient)

- Complex Wound Clinic

- Leg Ulcer Clinic

- Diabetic Foot Clinic

- Walk-in Clinic

- Podiatry Clinic

- General Practitioners (GP) Surgery

- Nursing Home

- Home Health

- Hospitalization at Home (HAD)

- By Purchase

- Prescription

- Over the Counter

- Others

- By Country

Regional Analysis:

United States: Leading Regional Market with Strong Healthcare Infrastructure

The United States dominates the North America Wound Debridement Market, accounting for nearly 78% of the regional share. Its leadership is supported by a well-established healthcare system, strong reimbursement policies, and a high prevalence of chronic wounds. The country shows significant adoption of advanced wound care devices such as ultrasonic and enzymatic debridement systems. It benefits from continuous innovation driven by domestic manufacturers and research institutions. Increasing cases of diabetes and obesity are contributing to higher treatment volumes. Hospitals and specialty wound clinics continue to drive product demand through advanced treatment procedures and post-surgical care programs.

Canada: Expanding Market Supported by Healthcare Modernization and Training

Canada holds around 14% of the North America Wound Debridement Market, with growth driven by healthcare modernization and rising chronic wound awareness. It is witnessing strong government support for improving wound care training and clinical standards. Growing adoption of autolytic and enzymatic products in hospitals and long-term care centers enhances the market scope. The shift toward outpatient and home-based wound management supports demand for portable debridement devices. Increasing partnerships between hospitals and technology providers are helping to strengthen access to advanced wound solutions. The country’s focus on value-based healthcare and aging population continues to create long-term growth opportunities.

Mexico: Emerging Market Driven by Expanding Healthcare Access

Mexico contributes nearly 8% of the North America Wound Debridement Market and is rapidly evolving due to expanding healthcare access and infrastructure development. It benefits from a growing focus on chronic disease management and government initiatives to improve wound care availability. The market is witnessing higher demand for affordable surgical and mechanical debridement products. Local clinics and public hospitals are increasingly adopting advanced wound irrigation solutions. Rising medical tourism and awareness campaigns are improving patient access to specialized treatments. It continues to attract foreign investment and partnerships that enhance distribution networks and support the adoption of cost-effective wound care technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis:

- Coloplast Corp

- Medline Industries

- Smith & Nephew

- ConvaTec Group PLC

- Integra LifeSciences

- Braun SE

- Mölnlycke Health Care AB

- Lohmann & Rauscher

- 3M

- Schülke & Mayr GmbH (via distributors)

- Cardinal Health

- URGO Medical

- BD (Becton, Dickinson and Company)

- DEBx Medical

Competitive Analysis:

The North America Wound Debridement Market is moderately consolidated, with a mix of global leaders and regional players competing on technology, product efficacy, and distribution strength. It features strong participation from key companies such as Smith & Nephew, 3M, Coloplast, and ConvaTec Group PLC. These firms invest heavily in R&D to introduce advanced enzymatic and ultrasonic wound care solutions. It maintains competition through innovation in minimally invasive products and home-care compatible devices. Local players focus on affordable options to capture cost-sensitive segments. Strategic partnerships and clinical collaborations are shaping the market’s growth direction and strengthening product reach across hospitals and clinics.

Recent Developments:

- In September 2025, Smith & Nephew announced the US launch of the CENTRIO Platelet-Rich-Plasma (PRP) System, which is designed to assist in the healing process by providing a biodynamic hematogel derived from a patient’s own platelets and plasma for chronic exuding wounds.

- In September 2025, Coloplast Corp introduced its new five-year strategy, “Impact4,” aiming to drive innovative customer offerings, embrace technology, and unlock efficiency.

Report Coverage:

The research report offers an in-depth analysis based on product, method, wound type, end-use, and purchase segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will continue expanding due to the rising prevalence of chronic wounds and diabetes.

- Technological advances in enzymatic and ultrasonic devices will enhance clinical efficiency.

- Home healthcare adoption will increase, driving demand for compact and easy-to-use systems.

- Hospitals will remain the key revenue contributor, supported by a strong patient base.

- Artificial intelligence will enable faster wound assessment and personalized care protocols.

- Growing collaborations between medical device firms and hospitals will accelerate innovation.

- Training programs will boost professional adoption of advanced wound debridement tools.

- Sustainable product development will gain traction in regulatory and purchasing frameworks.

- Mexico will emerge as a competitive hub for affordable wound care solutions in North America.

- Rising healthcare investments and reimbursement support will sustain long-term market growth.