Market Overview:

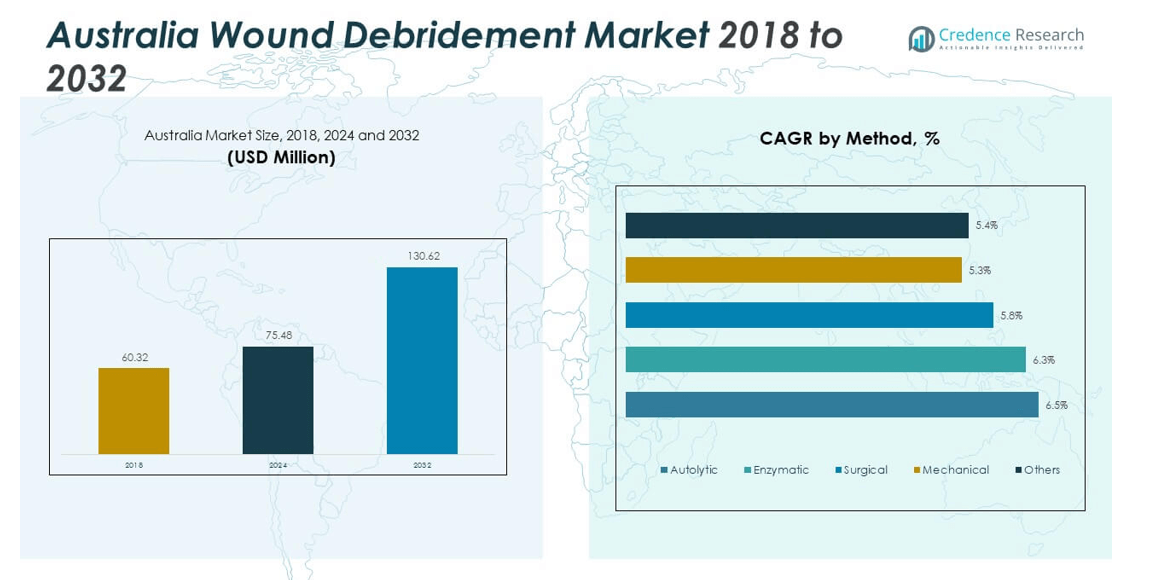

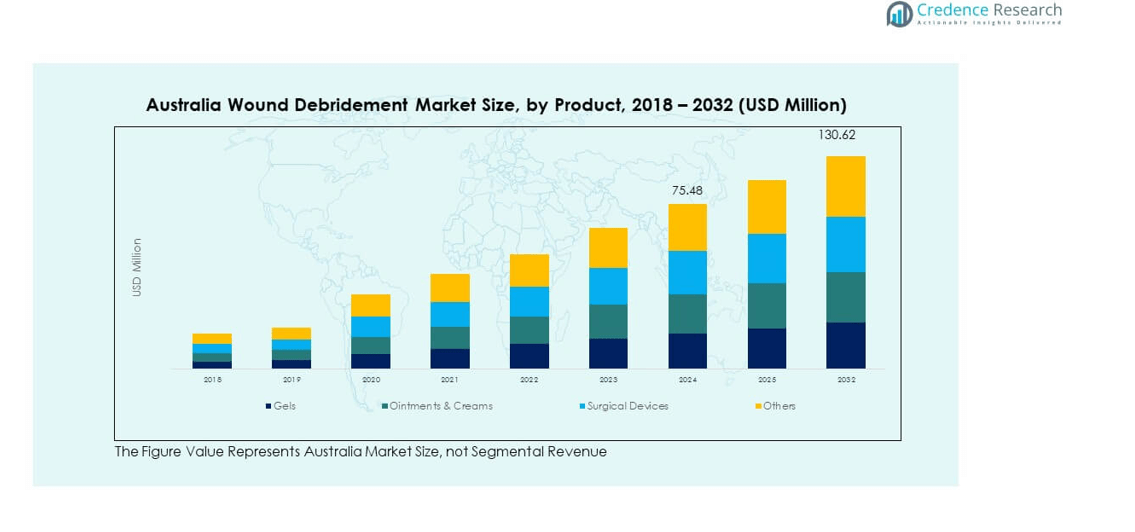

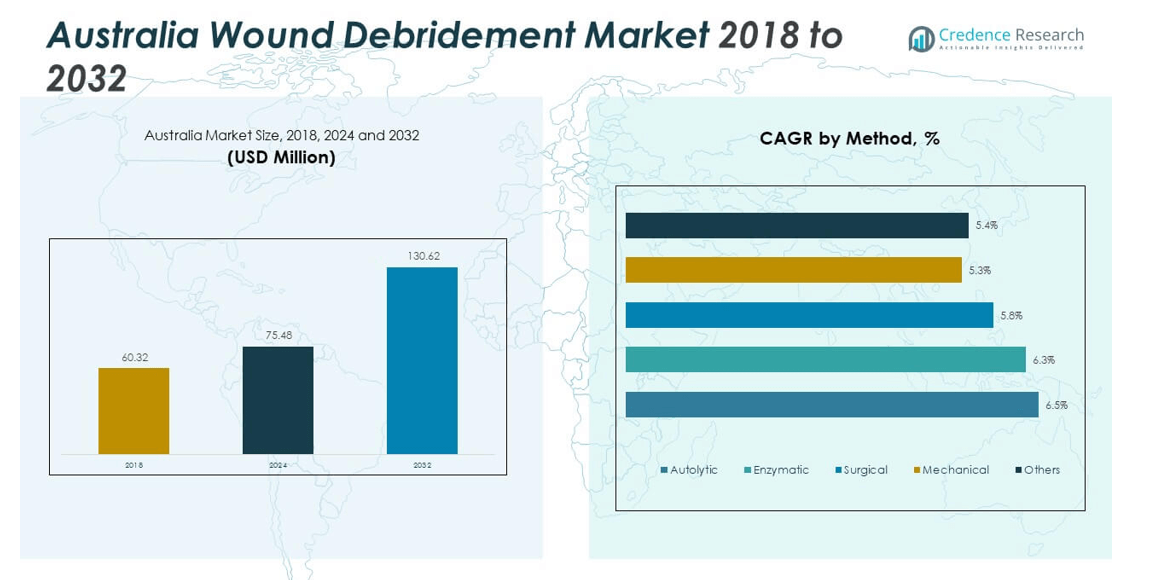

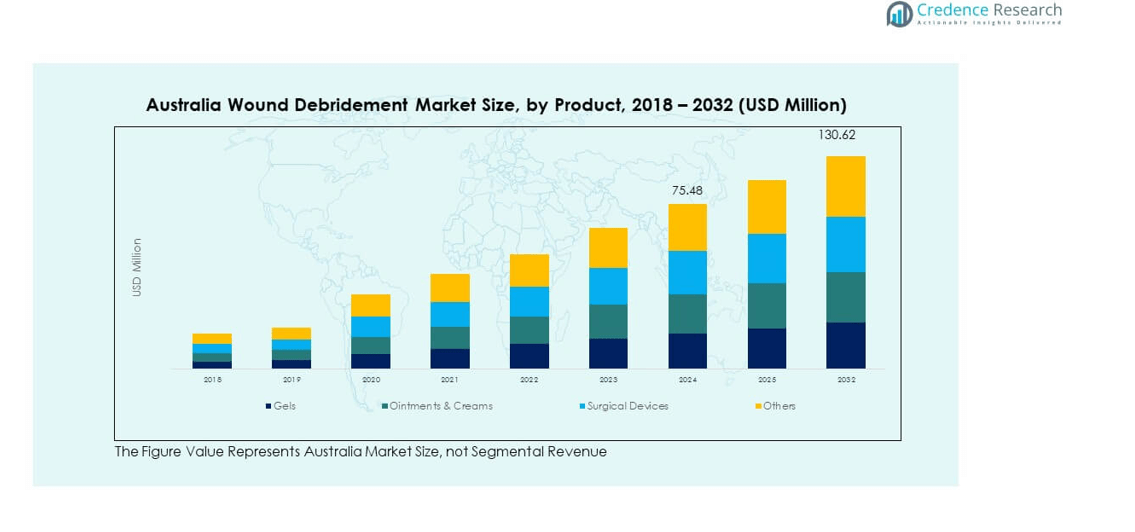

The Australia Wound Debridement Market size was valued at USD 60.32 million in 2018, increased to USD 75.48 million in 2024, and is anticipated to reach USD 130.62 million by 2032, at a CAGR of 7.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Wound Debridement Market Size 2024 |

USD 75.48 million |

| Australia Wound Debridement Market, CAGR |

7.09% |

| Australia Wound Debridement Market Size 2032 |

USD 130.62 million |

The market is expanding due to the increasing prevalence of chronic wounds, diabetic ulcers, and pressure sores among the aging population. Advancements in wound care technologies, including enzymatic and autolytic debridement methods, are improving patient outcomes and treatment efficiency. Rising healthcare spending, better hospital infrastructure, and growing awareness of early wound management further drive market growth across Australia.

Geographically, New South Wales and Victoria dominate due to their strong healthcare networks, skilled professionals, and high patient volumes. Queensland and Western Australia are emerging markets, supported by rising investments in hospital infrastructure and medical device distribution. The rural and remote regions are also gaining attention, with government-led initiatives aimed at improving wound care accessibility through telemedicine and community healthcare programs.

Market Insights:

- The Australia Wound Debridement Market was valued at USD 60.32 million in 2018, reached USD 75.48 million in 2024, and is projected to attain USD 130.62 million by 2032, growing at a CAGR of 7.09% during the forecast period.

- New South Wales (36%), Victoria (27%), and Queensland (18%) hold the top regional shares due to their strong healthcare systems, large patient populations, and widespread access to advanced wound care facilities.

- Western Australia, with an 11% share, is the fastest-growing region, supported by rising investment in rural healthcare infrastructure and expanding adoption of telehealth wound care services.

- Among product segments, Surgical Devices account for about 33% of the total share in 2024, driven by hospital preference for precise and rapid wound cleaning procedures.

- Gels and Ointments & Creams collectively represent nearly 42% of the market, attributed to their affordability, ease of application, and effectiveness in managing chronic and diabetic wounds.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Burden of Chronic and Diabetic Wounds Across the Population

The Australia Wound Debridement Market is expanding due to rising cases of chronic wounds, diabetic ulcers, and pressure injuries. The aging population faces a higher risk of slow-healing wounds caused by vascular diseases and diabetes. Hospitals are adopting advanced debridement methods to improve recovery time and reduce infection risks. The growing number of diabetic patients and post-surgical wound cases strengthens market demand. Government-led programs promoting wound awareness support early diagnosis and treatment adoption. Healthcare professionals increasingly prefer advanced enzymatic and autolytic debridement over traditional methods. These trends collectively boost the adoption of specialized wound care solutions in Australia.

- For instance, Smith & Nephew’s collagenase-based enzymatic debriding ointment, SANTYL®, showed wound area reductions of up to 68% in chronic wounds, including diabetic foot ulcers, and led to earlier granulation tissue formation in several clinical evaluations. The growing number of diabetic patients and post-surgical wound cases strengthens market demand. Government-led programs promoting wound awareness support early diagnosis and treatment adoption.

Strong Adoption of Technological Innovations in Debridement Procedures

Technological advancements drive steady growth across healthcare settings in Australia. Manufacturers are developing precision instruments, enzymatic formulations, and ultrasonic devices that enhance treatment outcomes. Hospitals and clinics increasingly integrate smart dressing systems and portable wound care tools for better patient management. It benefits clinicians by enabling accurate tissue removal with minimal discomfort. The Australia Wound Debridement Market benefits from a shift toward non-invasive and automated technologies. Medical professionals are receiving continuous training for safe use of these modern techniques. This progress accelerates patient recovery and ensures consistent care standards nationwide.

- For instance, 3M’s Prevena™ Incision Management System, a negative pressure wound therapy platform, has been documented in over 200 clinical studies, providing evidence-based support for reducing surgical site infections and improving postoperative healing in patients with high-risk wounds.

Expanding Healthcare Infrastructure and Access to Advanced Treatments

Australia’s healthcare infrastructure supports high-quality wound management across public and private facilities. Investments in hospital expansions and community health programs ensure access to specialized wound care. The government prioritizes funding for advanced wound treatment and research initiatives. Rural health networks are receiving attention through telemedicine and mobile wound care clinics. It helps bridge accessibility gaps and promotes consistent treatment standards across regions. Demand for high-efficiency debridement products increases in surgical and home-care settings. The overall expansion of care infrastructure sustains long-term market growth momentum.

Rising Awareness and Education Among Healthcare Professionals and Patients

Educational programs focusing on wound management strengthen treatment adoption and reduce complications. Healthcare organizations are promoting best practices for early detection and proper wound maintenance. The Australia Wound Debridement Market benefits from awareness campaigns targeting clinicians and caregivers. Training initiatives improve diagnostic accuracy and promote evidence-based wound care approaches. Patients are becoming more aware of preventive care and post-surgery wound management. Pharmaceutical companies are conducting educational workshops to support product familiarity. The widespread emphasis on education fosters professional competency and enhances patient recovery outcomes.

Market Trends:

Integration of Digital Wound Management and Remote Monitoring Solutions

Digital transformation shapes the future of wound debridement practices in Australia. Hospitals adopt digital wound imaging systems and AI-based monitoring tools to track healing progress. These platforms enable clinicians to analyze wound size, infection status, and healing rates remotely. The Australia Wound Debridement Market experiences growth due to rising telehealth integration. Remote monitoring systems reduce hospital visits and improve treatment continuity for rural patients. Health startups are investing in app-based platforms that support personalized wound care. Digitalization enhances data-driven treatment and optimizes patient engagement in wound management.

Increasing Demand for Biologically Derived and Enzymatic Debridement Products

Biological and enzymatic debridement products gain traction due to their precision and safety. These products offer selective removal of necrotic tissue without harming surrounding healthy cells. The Australia Wound Debridement Market benefits from innovation in bioactive dressings and enzyme-based gels. Patients prefer enzymatic solutions for their minimal pain and faster healing properties. Manufacturers focus on improving product formulations to enhance stability and efficacy. Healthcare providers value these products for reducing infection risks and recovery time. The rising shift toward biologically derived agents promotes sustainable and patient-friendly wound care solutions.

- For instance, SANTYL® ointment by Smith & Nephew led to median wound closure times of 6 weeks for chronic wounds in randomized controlled studies versus 8 weeks with standard hydrogel treatments. Healthcare providers value these products for reducing infection risks and recovery time. The rising shift toward biologically derived agents promotes sustainable and patient-friendly wound care solutions.

Growing Collaboration Between Public Health Agencies and Private Enterprises

Collaborations between hospitals, medical device firms, and government agencies strengthen the wound care ecosystem. Public-private partnerships improve product availability and promote cost-effective solutions. The Australia Wound Debridement Market grows through joint initiatives for clinical research and innovation. These alliances focus on creating localized manufacturing hubs to reduce import reliance. Hospitals benefit from advanced tools developed through shared research and pilot studies. Government funding accelerates innovation pipelines and product commercialization. Strong collaboration fosters long-term growth and enhances national wound care efficiency.

Increased Focus on Personalized and Patient-Centric Wound Treatment Approaches

Personalized wound care gains importance in clinical and home-based environments. Healthcare providers tailor treatment based on wound type, depth, and infection status. The Australia Wound Debridement Market embraces a patient-centric framework to enhance treatment outcomes. Smart dressing systems now include feedback sensors to track healing response. The rise in customized care pathways ensures targeted healing for complex wounds. Hospitals are integrating data analytics to predict healing times and prevent recurrence. This transition toward personalized treatment enhances patient satisfaction and long-term recovery rates.

Market Challenges Analysis:

High Treatment Costs and Uneven Access to Specialized Wound Care Services

The cost of advanced debridement products and equipment remains a barrier for many healthcare facilities. Smaller hospitals and regional clinics face financial challenges in adopting premium technologies. The Australia Wound Debridement Market encounters disparities in service availability across rural areas. Limited reimbursement options restrict patient access to high-end treatment procedures. Healthcare providers often prioritize cost-efficiency over innovation when budgets are constrained. Import dependence increases product pricing and delays equipment availability. It affects long-term market adoption, especially in low-income and remote communities.

Shortage of Skilled Professionals and Lack of Standardized Clinical Protocols

A shortage of trained wound care specialists limits consistent treatment outcomes in many facilities. Hospitals experience gaps in advanced wound debridement knowledge among nursing staff. The Australia Wound Debridement Market faces challenges from inconsistent clinical protocols and training standards. Variation in treatment procedures leads to differences in healing outcomes across regions. Continuous education and certification programs are needed to bridge this skill gap. Some public healthcare institutions struggle to implement uniform wound management guidelines. These issues collectively restrict the scalability of advanced debridement practices nationwide.

Market Opportunities:

Rising Investment in Research and Expansion of Local Manufacturing Capabilities

Expanding R&D initiatives and government support create new business prospects for manufacturers. The Australia Wound Debridement Market benefits from funding aimed at developing locally produced wound care solutions. Domestic manufacturing reduces import costs and ensures faster supply chain response. Startups and global firms collaborate to build regional production hubs for wound dressings and debridement tools. These investments enhance innovation and improve product availability for hospitals and clinics. The initiative also supports long-term sustainability in the national healthcare supply network.

Emerging Role of Telehealth and Home-Based Wound Management Programs

Telehealth platforms are expanding wound care accessibility in rural and remote regions. Patients can now receive debridement consultations and follow-ups without frequent hospital visits. The Australia Wound Debridement Market leverages digital platforms for remote wound assessment and guided treatment. Home-based care programs lower costs while maintaining quality outcomes. These advancements increase convenience and encourage early intervention. The growing use of remote technologies creates strong opportunities for scalable and inclusive wound care delivery.

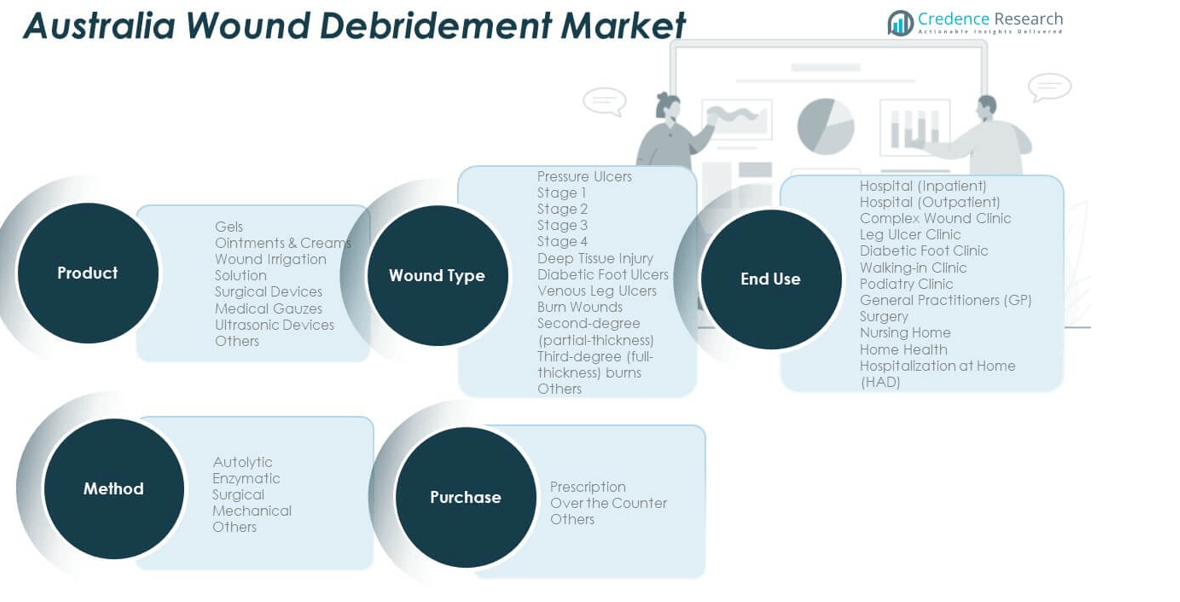

Market Segmentation Analysis:

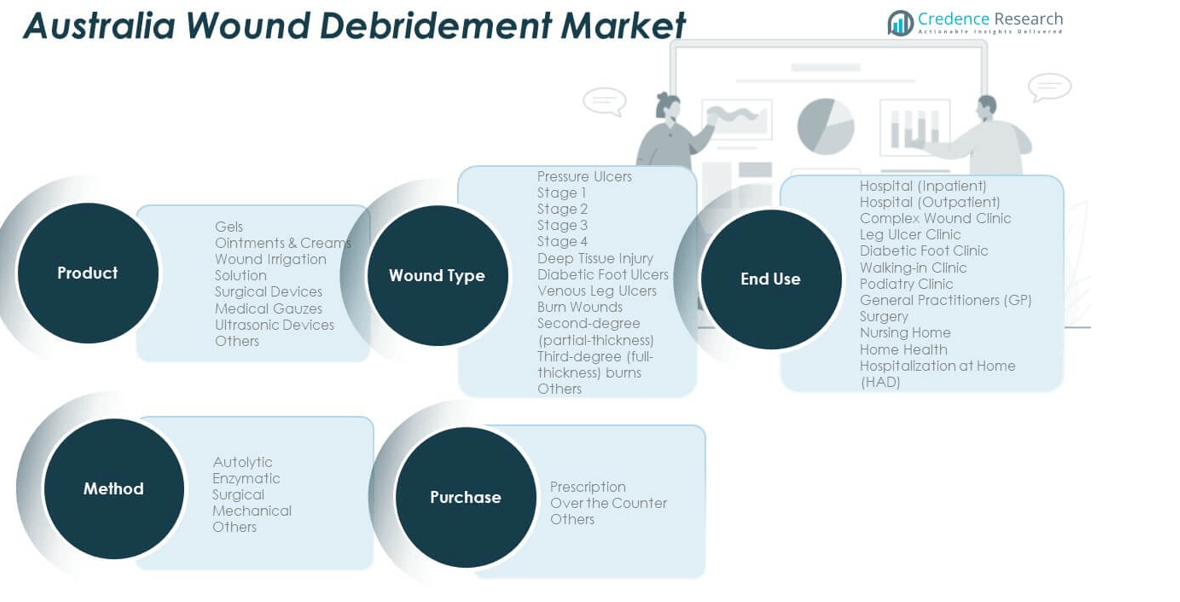

By Product Segment

The Australia Wound Debridement Market includes products such as gels, ointments and creams, wound irrigation solutions, surgical devices, medical gauzes, ultrasonic devices, and others. Gels and ointments hold significant demand due to their easy application and effectiveness in maintaining a moist healing environment. Surgical and ultrasonic devices are gaining traction in hospitals for precise debridement procedures. Medical gauzes continue to be widely used in outpatient and home care settings for cost-effective wound coverage. The combination of innovative formulations and advanced devices strengthens product diversity and improves treatment outcomes.

- For instance, Medical gauzes continue to be widely used in outpatient and home care settings for cost-effective wound coverage. The combination of innovative formulations and advanced devices, like the ART system, strengthens product diversity and improves treatment outcomes.

By Method Segment

The market is categorized into autolytic, enzymatic, surgical, mechanical, and other debridement methods. Enzymatic and autolytic methods are widely adopted due to their non-invasive nature and minimal pain during use. Surgical techniques dominate in complex or deep wound cases requiring rapid tissue removal. Mechanical debridement retains utility in moderate wounds, supported by cost benefits. The growing preference for less invasive methods and improved formulations continues to shape procedural advancements.

- For instance, a recent comparative study demonstrated full healing rates of 65% for enzymatic (collagenase-based) debridement compared to 50% for autolytic hydrogels in chronic wounds, along with faster development of granulation tissue. Mechanical debridement retains utility in moderate wounds, supported by cost benefits.

By Wound Type, End-Use, and Purchase Segment

Pressure ulcers, diabetic foot ulcers, venous leg ulcers, and burn wounds are major wound categories influencing product demand. Hospitals and specialized wound clinics account for the largest end-use share due to advanced infrastructure and skilled personnel. Home health and nursing facilities show rising adoption for chronic wound care. Prescription-based sales dominate, while over-the-counter products expand among patients managing minor wounds. The Australia Wound Debridement Market continues to diversify through personalized treatment options across these evolving segments.

Segmentation:

By Product Segment

- Gels

- Ointments & Creams

- Wound Irrigation Solution

- Surgical Devices

- Medical Gauzes

- Ultrasonic Devices

- Others

By Method Segment

- Autolytic

- Enzymatic

- Surgical

- Mechanical

- Others

By Wound Type Segment

- Pressure Ulcers

- Stage 1

- Stage 2

- Stage 3

- Stage 4

- Deep Tissue Injury

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Burn Wounds

- Second-degree (partial-thickness)

- Third-degree (full-thickness) burns

- Others

By End-Use Segment

- Hospital (Inpatient)

- Hospital (Outpatient)

- Complex Wound Clinic

- Leg Ulcer Clinic

- Diabetic Foot Clinic

- Walking-in Clinic

- Podiatry Clinic

- General Practitioners (GP) Surgery

- Nursing Home

- Home Health

- Hospitalization at Home (HAD)

By Purchase Segment

- Prescription

- Over the Counter

- Others

Regional Analysis:

Dominance of New South Wales and Victoria in Market Contribution

New South Wales holds the largest share of the Australia Wound Debridement Market, accounting for nearly 36% in 2024. The region’s dominance is driven by its well-established healthcare infrastructure, high patient volume, and advanced wound care facilities. Major hospitals and specialized wound management centers in Sydney and surrounding cities promote the adoption of enzymatic and surgical debridement solutions. Victoria follows with a 27% market share, supported by its growing aged population and strong clinical research base in Melbourne. The presence of skilled medical professionals and access to advanced wound care technologies sustain its leadership position. These two regions collectively represent the core hubs for innovation, clinical trials, and advanced wound care delivery across Australia.

Emerging Growth in Queensland and Western Australia

Queensland contributes around 18% of the national share, benefiting from expanding hospital networks and improved access to wound care in both metropolitan and rural settings. Government-led healthcare reforms and higher investments in outpatient care have accelerated the adoption of autolytic and enzymatic debridement methods. The Australia Wound Debridement Market in this region is strengthened by a growing focus on telehealth and home-based care, particularly in remote communities. Western Australia holds nearly 11% of the market, supported by its regional healthcare infrastructure and rising awareness among healthcare practitioners. Perth serves as a key hub for advanced wound clinics and academic collaboration in wound management. The growing emphasis on localized product distribution supports consistent supply across both urban and remote areas.

Opportunities in South Australia and Other Territories

South Australia represents around 6% of the market, reflecting steady growth driven by hospital modernization and specialist wound centers in Adelaide. The remaining 2% share is distributed among Tasmania, the Northern Territory, and the Australian Capital Territory. These areas are witnessing gradual improvements in healthcare access through mobile wound care units and community-based programs. The Australia Wound Debridement Market continues to expand in these regions due to government initiatives focusing on preventive wound management. Partnerships between local clinics and national healthcare providers enhance training, diagnosis, and treatment capabilities. These territories offer untapped potential for manufacturers investing in affordable and accessible wound care technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Smith & Nephew Pty Ltd

- 3M Australia Pty Ltd

- Mölnlycke Health Care Australia

- Coloplast Pty Ltd

- ConvaTec (Australia) Pty Ltd

- Medline

- Cardinal Health

- BD Australia (Becton, Dickinson and Company)

- URGO Medical

- Paul Hartmann Pty Ltd

Competitive Analysis:

Major global and domestic players compete strongly in the Australia Wound Debridement Market. Companies such as Smith & Nephew, 3M Australia, Mölnlycke, Coloplast, and ConvaTec dominate through broad product portfolios and established distribution networks. These players leverage clinical collaborations, R&D investments, and regulatory compliance to strengthen market positions. It faces pressure from niche firms that develop novel enzymatic or digital debridement solutions. Competitive dynamics emphasize innovation, cost control, and regional reach. The key challenge for new entrants lies in navigating reimbursement, regulatory approval, and gaining clinical acceptance. Leading firms maintain their advantage by continuously updating product lines and expanding service support.

Recent Developments:

- In Australia, Smith & Nephew Pty Ltd launched the CENTRIO Platelet-Rich-Plasma (PRP) System in September 2025, a biodynamic hematogel designed to manage chronic exuding wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers by maintaining a moist wound environment. This system enhances healing by using the patient’s own platelets and plasma and is tailored for point-of-care use in both hospital and physician office settings.

- Coloplast Pty Ltd unveiled its new five-year strategy called Impact4 in September 2025, which focuses on customer-centric growth through innovative offerings, efficiency improvements, leveraging technology including AI, and sustainability. The company reorganized into two business units—Chronic Care and Acute Care—to better align with market dynamics and customer needs.

- Cardinal Health announced in June 2025 the U.S. launch of the Kendall DL™ Multi System, a medical device for continuous monitoring of cardiac activity, blood oxygen level, and temperature with one connection. The company is also expanding its powder-free gloves product line in Asia to improve patient and clinician safety.

Report Coverage:

The research report offers an in-depth analysis based on Product Segment, Method Segment, Wound Type Segment, End-Use Segment, and Purchase Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for advanced enzymatic and ultrasonic debridement solutions will increase.

- AI-driven wound analysis will transform early detection and treatment precision.

- Home-care adoption will expand across regional and remote communities.

- Domestic production will strengthen supply stability and reduce dependence on imports.

- Hospitals will adopt value-based wound care systems with outcome monitoring.

- R&D investment will target bioactive and sustainable product innovations.

- Government funding will promote training programs for specialized wound care professionals.

- Digital wound management tools will integrate with national healthcare systems.

- Partnerships between hospitals and technology providers will accelerate innovation.

- Growing awareness of chronic wound prevention will sustain long-term demand.